India Writing Instruments Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD2476

December 2024

90

About the Report

India Writing Instruments Market Overview

- The India Writing Instruments market is valued at USD 600 million, driven by the growing literacy rates and the increasing emphasis on education across the nation. This growth is supported by government initiatives promoting education and literacy, along with increasing demand from corporate offices and institutions for stationery supplies. Additionally, the expansion of organized retail and e-commerce channels has significantly facilitated consumer access to a wide range of writing instruments, contributing to the market's steady growth.

- Urban centers like Mumbai, Delhi, and Bangalore dominate the India Writing Instruments market. This dominance is due to higher literacy rates, a dense concentration of educational institutions, and a large corporate workforce, which consistently drives demand for writing tools. Additionally, cities with a well-established retail and e-commerce infrastructure play a crucial role in supporting the availability and accessibility of writing instruments, making these regions key contributors to the market.

- Indias regulations on recycling and waste management have become stringent, impacting the writing instruments industry. Under the Plastic Waste Management Rules 2022, manufacturers must incorporate recycling in product design and use recyclable materials, ensuring compliance with the mandated recycling targets. This regulation encourages producers to focus on recyclability, reducing the environmental footprint of writing instruments.

India Writing Instruments Market Segmentation

Indias writing instruments market is segmented by product type and by Distribution channels.

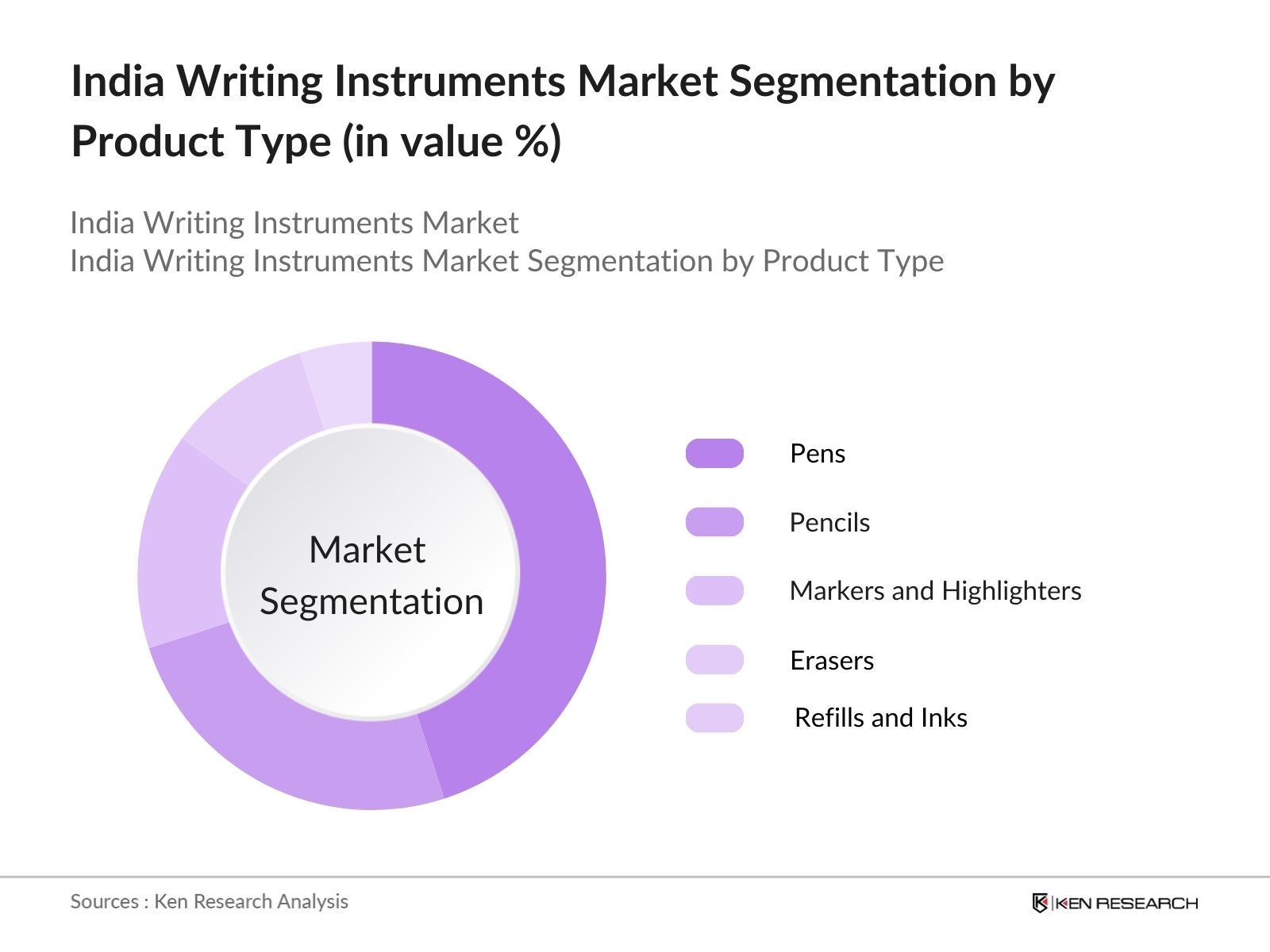

- By Product Type: Indias writing instruments market is segmented by product type into pens, pencils, markers and highlighters, erasers, and refills and inks. Recently, pens hold a dominant market share due to their widespread use in both educational institutions and offices. Brands like Cello and Linc have cemented their presence through affordable pricing, durable product offerings, and diverse styles catering to all age groups, which has kept them in high demand.

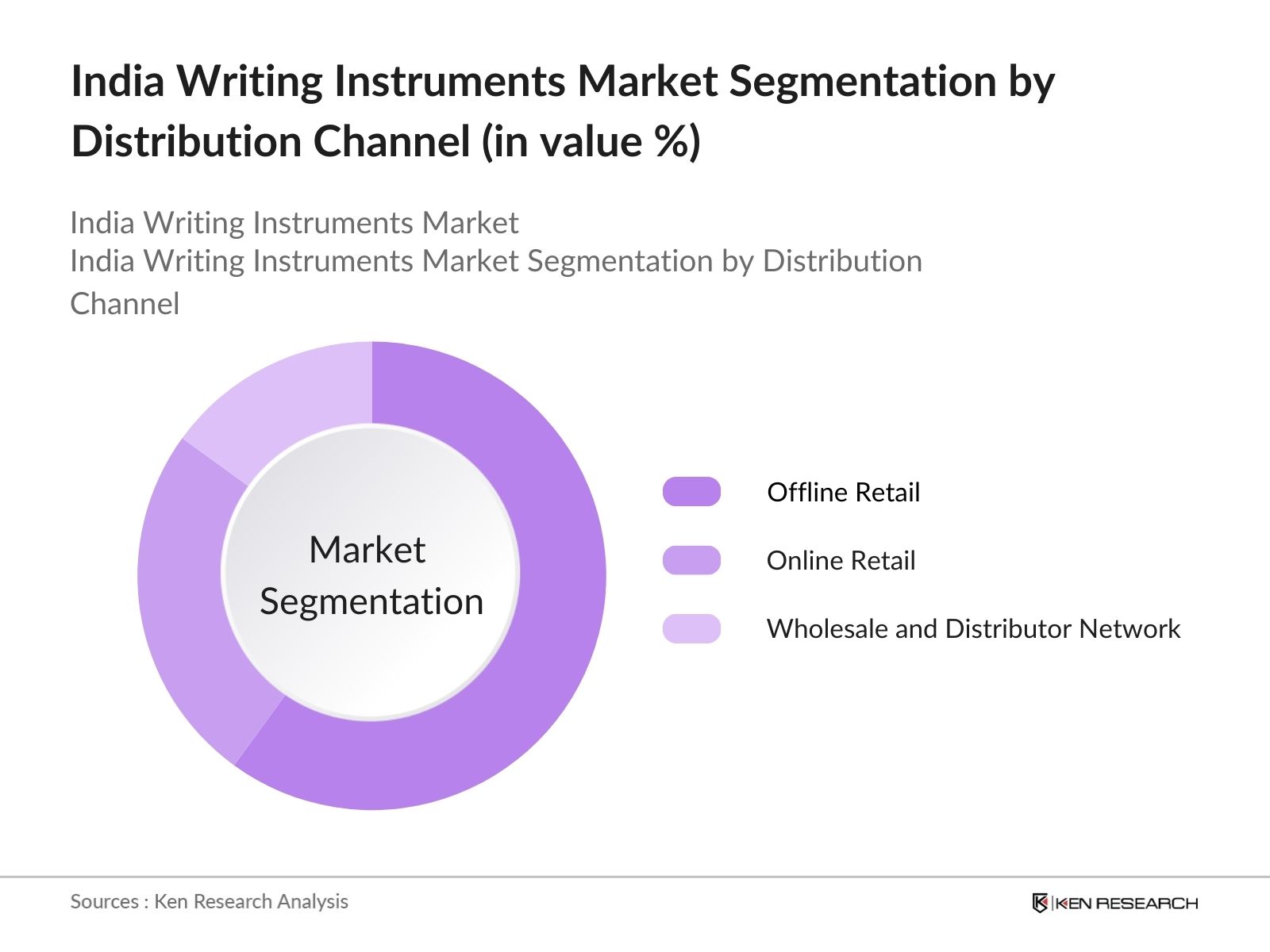

- By Distribution Channel: Distribution channels for writing instruments in India include online retail, offline retail (stationery shops, supermarkets, and hypermarkets), and wholesale and distributor networks. Offline retail has a dominant market share due to its extensive reach and the consumer preference for physically examining products before purchase. Traditional brick-and-mortar outlets have been key in building customer trust, especially in smaller towns and cities where e-commerce penetration is still evolving.

India Writing Instruments Market Competitive Landscape

The India Writing Instruments market is dominated by a few major players, including both local and global brands that have established strong brand recognition. These companies offer a variety of products, catering to both budget-conscious and premium consumers, leveraging extensive distribution networks and innovative product designs to capture a broad customer base.

India Writing Instruments Market Analysis

Growth Drivers

- Literacy Rate Improvement: The rising literacy rate in India has been a key driver for the writing instruments market, as the nation's literacy rate reached 77% in 2022, increasing by over 8% in the past decade. The Indian governments initiatives, including the National Education Policy (NEP) 2020, aim to expand quality education access, supporting over 300 million school and college students. Increased budget allocations, with 1.04 lakh crore earmarked for education in 2023, underpin this shift toward educational accessibility, fueling demand for writing instruments.

- Expanding Organized Retail: Organized retail expansion is boosting writing instrument accessibility, especially in urban regions. Indias organized retail sector accounted for 12% of total retail in 2022, with growing shopping mall developments increasing retail penetration for school and office supplies. Notably, the Indian government approved 100% FDI in single-brand retailing, further enhancing the organized retail footprint. With a shift from traditional to modern retail formats, writing instruments are more widely available and efficiently distributed across India.

- Demand from Corporate Sector: Corporate usage of writing instruments is bolstered by India's expanding corporate sector, with over 1.5 million new companies registered as of 2023. The professional environment demands high-quality office supplies for regular use and promotional activities, with corporate gifting alone estimated to include millions of pens annually. Initiatives like "Make in India" also encourage local sourcing, driving demand for branded and premium writing instruments among corporate clients.

Market Challenges

- Rising Digitalization: With the Digital India initiative, the adoption of digital devices is impacting traditional writing instrument usage. In 2022, India recorded over 1.1 billion mobile phone connections and 800 million internet users, reducing dependency on paper and pens. Educational institutions and workplaces increasingly integrate digital tools, which has led to a shift in preference, creating a decline in demand for traditional writing supplies.

- Environmental Concerns: Environmental sustainability has become crucial, with increased regulations around plastic use and waste management affecting the writing instruments sector. India generated over 3.5 million metric tons of plastic waste in 2022, prompting the government to enforce single-use plastic bans and promote biodegradable alternatives. This shift pressures manufacturers to adopt sustainable materials and recyclable packaging, addressing consumer and regulatory demands. Source: Central Pollution Control Board.

India Writing Instruments Market Future Outlook

The India Writing Instruments market is expected to continue expanding in the upcoming years, driven by the steady rise in literacy rates and the consistent demand from both educational and corporate sectors. The growing trend towards eco-friendly and sustainable writing tools, supported by various government and non-government initiatives, also indicates a promising future for companies focusing on green innovations. Furthermore, the rise of online shopping is expected to increase market accessibility, especially in rural and semi-urban areas, expanding the customer base for writing instruments.

Market Opportunities

- Growth in E-commerce: E-commerce growth has significantly benefited the writing instruments market, as Indias online retail sector grew to serve over 300 million online shoppers by 2023. With improved logistics infrastructure, rural penetration is increasing, broadening access to a diverse array of writing tools and brands. The government's Digital India mission has also facilitated digital payments, making it easier for consumers across regions to access and purchase writing instruments online.

- Increasing Demand for Premium Products: Urbanization and disposable income growth are driving demand for premium writing instruments in India. As of 2023, Indias urban population reached approximately 488 million, with significant adoption of premium stationery products in urban centers. Consumer preference for personalized, higher-quality materials for gifting and corporate use highlights a shift towards premiumization in writing instruments.

Scope of the Report

|

Pens Pencils Markers and Highlighters Erasers Refills and Inks |

|

|

By Distribution Channel |

Online Retail Offline Retail (Stationery Shops, Supermarkets, Hypermarkets) Wholesale and Distributor Network |

|

By End-User |

Educational Institutions Corporate and Government Households |

|

By Material |

Plastic Metal Recycled and Eco-friendly Materials |

|

By Region |

North East West South |

Products

Key Target Audience

Investors and Venture Capital Firms

Corporate Offices and Institutions

Government and Regulatory Bodies (Ministry of Education, Bureau of Indian Standards)

E-commerce Platforms and Retailers

Stationery and Office Supply Chains

Educational Institutions

Manufacturers and Suppliers of Writing Instruments

Environment and Sustainability Advocacy Groups

Companies

Players Mention in the Report:

Cello (BIC)

Linc Pen & Plastics Ltd.

Kokuyo Camlin Ltd.

ITC Classmate

Flair Group

Reynolds (Newell Brands)

Parker (Luxor)

Staedtler Mars GmbH & Co. KG

Faber-Castell

Hindustan Pencils Pvt Ltd

Doms Industries Pvt Ltd

Pentel Co., Ltd.

Bismi Pens

Kokuyo

Pilot Corporation of India

Table of Contents

1. India Writing Instruments Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Writing Instruments Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-on-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Writing Instruments Market Analysis

3.1 Growth Drivers

3.1.1 Literacy Rate Improvement (literacy level, educational policies)

3.1.2 Expanding Organized Retail (retail penetration, organized sector share)

3.1.3 Demand from Corporate Sector (corporate usage rate, promotional activities)

3.2 Market Challenges

3.2.1 Rising Digitalization (digital adoption rate, impact on stationery)

3.2.2 Environmental Concerns (material sustainability, waste management regulations)

3.3 Opportunities

3.3.1 Growth in E-commerce (online market share, consumer purchasing behavior)

3.3.2 Increasing Demand for Premium Products (premium product CAGR, urban preference)

3.4 Trends

3.4.1 Customization and Personalization (customization demand, product variants)

3.4.2 Sustainable Materials Adoption (bio-degradable materials, eco-friendly packaging)

3.5 Government Regulations

3.5.1 Recycling Standards (recycling targets, compliance requirements)

3.5.2 Manufacturing Standards (quality control, BIS certification)

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem

4. India Writing Instruments Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Pens (ballpoint, gel, fountain, rollerball)

4.1.2 Pencils (graphite, colored, mechanical)

4.1.3 Markers and Highlighters

4.1.4 Erasers

4.1.5 Refills and Inks

4.2 By Distribution Channel (In Value %)

4.2.1 Online Retail

4.2.2 Offline Retail (stationery shops, supermarkets, hypermarkets)

4.2.3 Wholesale and Distributor Network

4.3 By End-User (In Value %)

4.3.1 Educational Institutions

4.3.2 Corporate and Government

4.3.3 Households

4.4 By Material (In Value %)

4.4.1 Plastic

4.4.2 Metal

4.4.3 Recycled and Eco-friendly Materials

4.5 By Region (In Value %)

4.5.1 North

4.5.2 South

4.5.3 East

4.5.4 West

5. India Writing Instruments Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Cello (BIC)

5.1.2 Linc Pen & Plastics Ltd.

5.1.3 Kokuyo Camlin Ltd.

5.1.4 Flair Group

5.1.5 ITC Classmate

5.1.6 Reynolds (Newell Brands)

5.1.7 Parker (Luxor)

5.1.8 Staedtler Mars GmbH & Co. KG

5.1.9 Faber-Castell

5.1.10 Hindustan Pencils Pvt Ltd

5.1.11 Doms Industries Pvt Ltd

5.1.12 Pentel Co., Ltd.

5.1.13 Bismi Pens

5.1.14 Kokuyo

5.1.15 Pilot Corporation of India

5.2 Cross-Comparison Parameters (Number of employees, headquarters, inception year, revenue, R&D expenditure, regional dominance, product innovation rate, eco-friendly initiatives)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity Funding

5.8 Government Support Programs

6. India Writing Instruments Market Regulatory Framework

6.1 Quality and Safety Standards (BIS Standards, eco-labeling criteria)

6.2 Environmental Regulations (packaging requirements, waste disposal guidelines)

6.3 Import and Export Policies (customs duties, import standards)

6.4 Compliance and Certification Processes

7. India Writing Instruments Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Influencing Future Market Growth

8. India Writing Instruments Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Cohort Analysis

8.3 Marketing and Promotion Initiatives

8.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with the identification of crucial variables influencing the India Writing Instruments Market. This involves a comprehensive ecosystem mapping of major stakeholders, utilizing secondary databases and proprietary sources to capture industry-level information and pinpoint factors that affect market trends and dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data on market trends, revenue generation, and product demand are gathered. This includes analyzing the market penetration of different product types and distribution channels to determine their impact on overall market performance, supported by detailed data assessments to ensure reliable estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed are validated through expert consultations with industry professionals across leading writing instrument manufacturers. These interviews provide practical insights into production trends, consumer preferences, and industry challenges, adding depth to our analysis and ensuring data accuracy.

Step 4: Research Synthesis and Final Output

The last step involves synthesizing research findings and consolidating insights from direct industry engagement. Through this process, we validate the reliability of our bottom-up approach to derive a comprehensive analysis of the India Writing Instruments market.

Frequently Asked Questions

01. How big is the India Writing Instruments Market?

The India Writing Instruments market is valued at USD 600 million, driven by increasing educational enrollments and corporate demand.

02. What are the challenges in the India Writing Instruments Market?

The primary challenges in India Writing Instruments market include growing competition from digital technology, high dependency on raw materials, and sustainability concerns related to plastic-based products.

03. Who are the major players in the India Writing Instruments Market?

Key players in India Writing Instruments market include Cello (BIC), Linc Pen & Plastics, Kokuyo Camlin, ITC Classmate, and Flair Group, each with strong distribution networks and brand loyalty.

04. What are the growth drivers for the India Writing Instruments Market?

Growth drivers in India Writing Instruments market include expanding educational initiatives, an increase in corporate usage, and a rise in online shopping, which enhances consumer accessibility.

05. Which distribution channel dominates the India Writing Instruments Market?

Offline retail channels dominate, thanks to a well-established presence in urban and rural areas, offering easy accessibility for consumers across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.