India Zinc Oxide Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD8422

December 2024

85

About the Report

India Zinc Oxide Market Overview

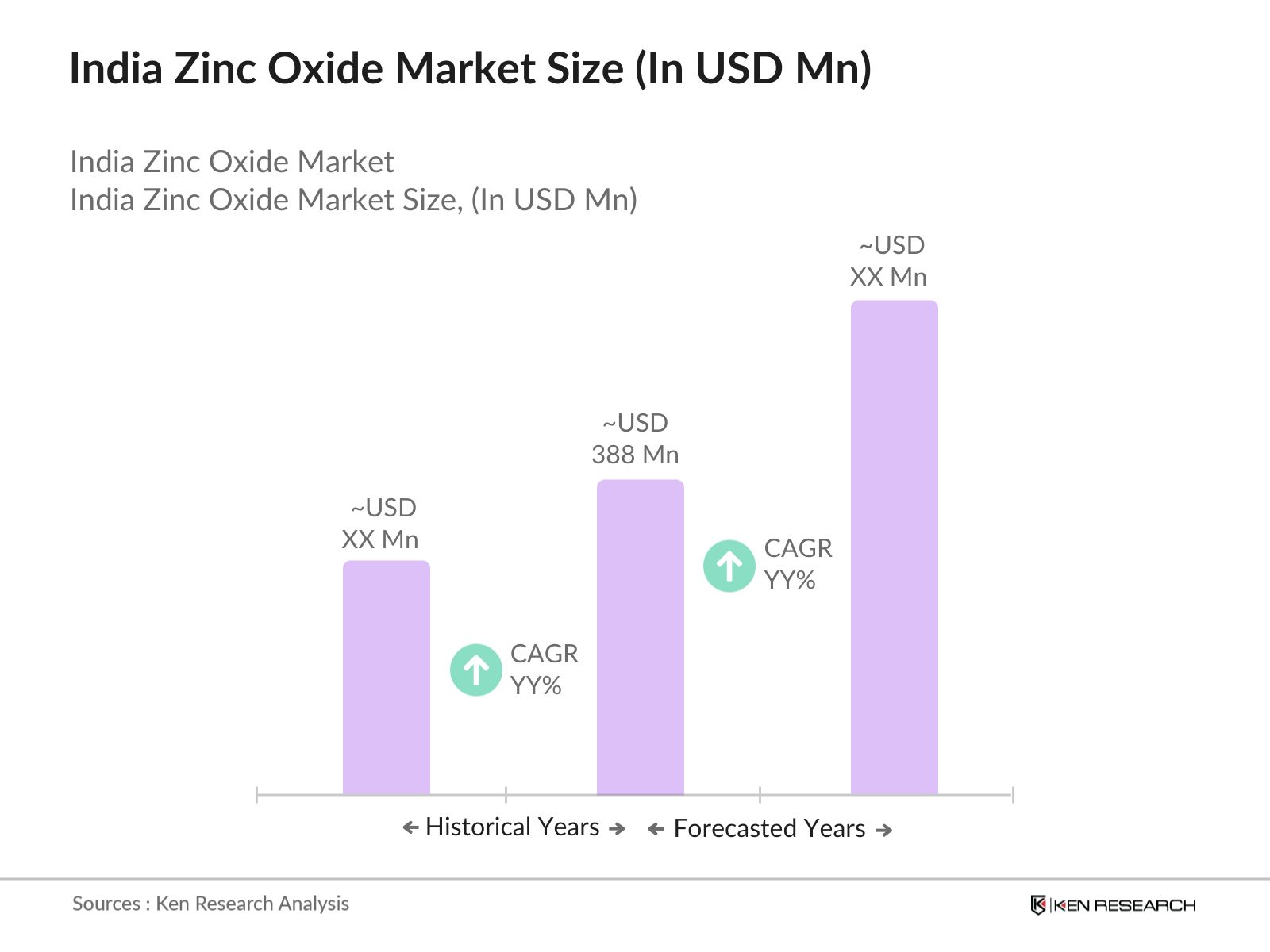

- The India Zinc Oxide market is valued at USD 388 million based on a five-year historical analysis. The market is driven by several industries, including rubber manufacturing, which is crucial for the automotive sector, and the increasing use of zinc oxide in agriculture and cosmetics. The demand for zinc oxide in rubber compounding, particularly in tire production, plays a pivotal role in its growth. Other applications such as pharmaceuticals and cosmetics further enhance the demand due to zinc oxides antibacterial and UV-blocking properties.

- The dominance of specific regions in the market is attributed to their industrial infrastructure and resource availability. Northern and Western India dominate the market due to their large-scale automotive and construction industries. Cities such as Mumbai, Pune, and Delhi serve as industrial hubs for automotive manufacturing, rubber production, and construction, making them key players in zinc oxide consumption.

- The Indian governments "Make in India" initiative continues to encourage the domestic production of key materials, including zinc oxide. In 2024, the government has allocated more than 12,000 crore for the promotion of domestic manufacturing and reducing import dependence. This initiative is expected to boost investments in zinc oxide manufacturing facilities, especially as part of the development of industrial corridors and special economic zones.

India Zinc Oxide Market Segmentation

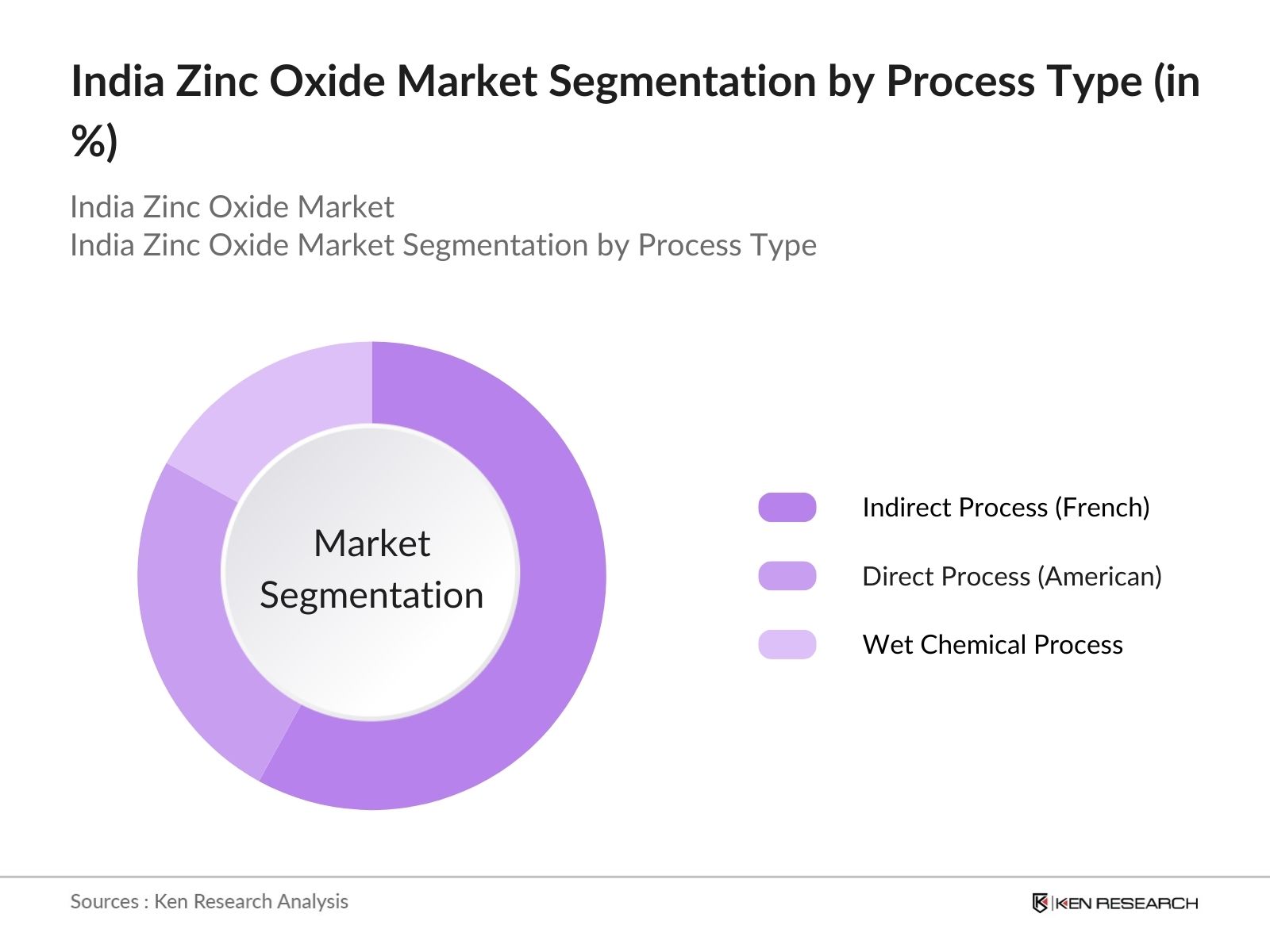

By Process Type: The market is segmented by process type into Indirect (French) Process, Direct (American) Process, and Wet Chemical Process. The Indirect Process currently holds a dominant market share due to its ability to produce higher purity zinc oxide, which is essential for high-end applications such as cosmetics and pharmaceuticals. The Indirect Process is also preferred in rubber and ceramics industries, where quality consistency is crucial.

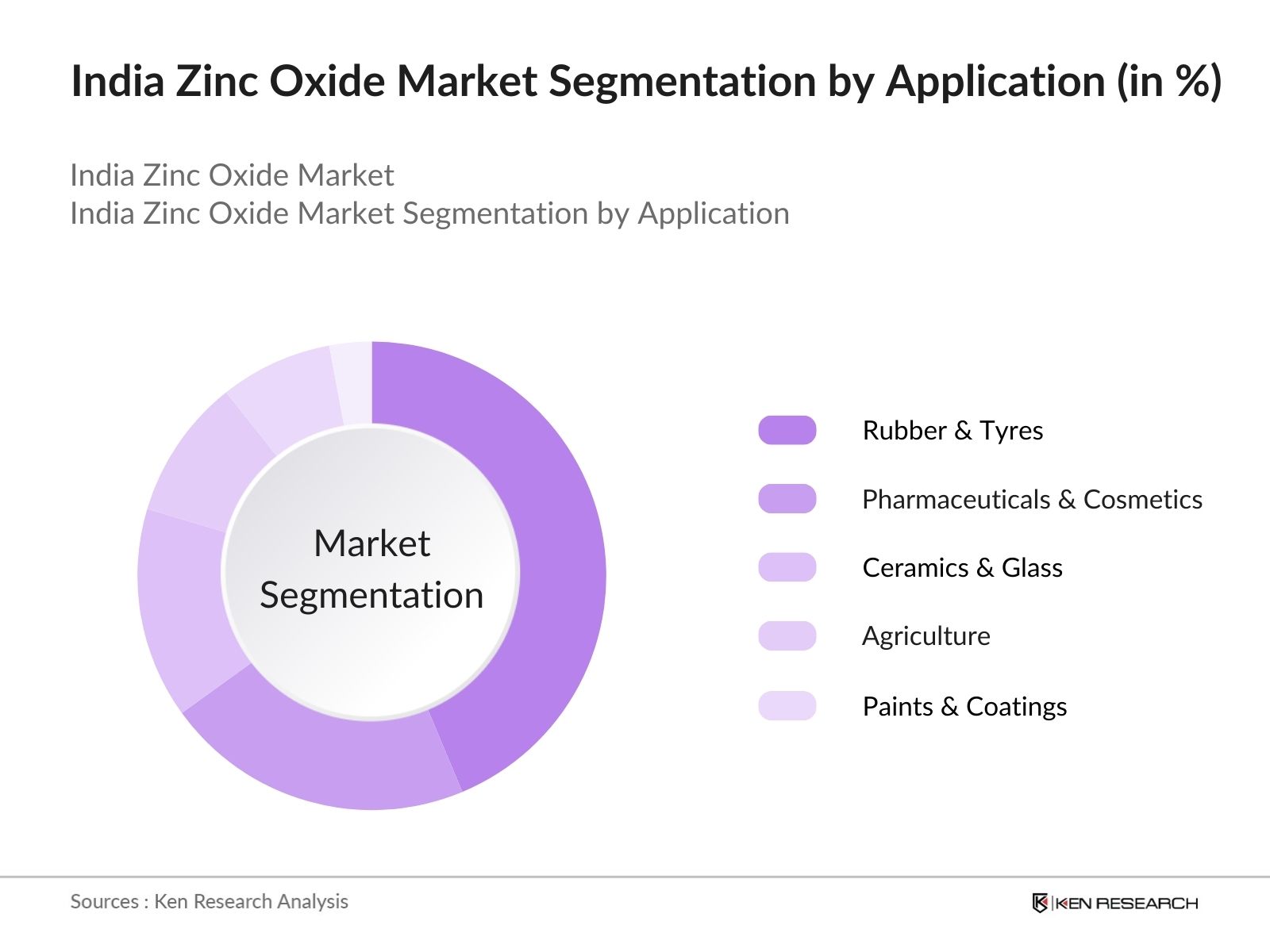

By Application: The market is segmented by application into Rubber & Tyres, Ceramics & Glass, Pharmaceuticals & Cosmetics, Agriculture, and Paints & Coatings. The Rubber & Tyres segment leads the market due to its extensive use in automotive tire manufacturing. Zinc oxide plays a critical role in the vulcanization process of rubber, enhancing the durability and heat resistance of tires. The increasing demand for electric vehicles (EVs) and advancements in tire technology further fuel this segment.

India Zinc Oxide Market Competitive Landscape

The market is highly competitive, with several domestic and international players. This consolidation is largely driven by the demand from multiple industries, particularly rubber and pharmaceuticals. Key companies leverage innovations in zinc oxide processing and invest in R&D to gain a competitive edge.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investments |

Process Types |

Key Markets |

Strategic Partnerships |

Revenue (2023) |

|

Rubamin Ltd |

1985 |

Vadodara, India |

||||||

|

H. Chemicals |

1995 |

Mumbai, India |

||||||

|

Zochem Inc. |

1933 |

USA |

||||||

|

SILOX SA |

1927 |

Belgium |

||||||

|

Tata Chemicals |

1939 |

India |

India Zinc Oxide Market Analysis

Market Growth Drivers

- Increasing Demand from the Rubber Industry: Indias expanding rubber industry, which consumed over 800,000 metric tons of rubber in 2023, is a key driver for zinc oxide demand. Zinc oxide is essential in vulcanization, making rubber more durable, particularly for automobile tires and industrial products. With the Indian automotive industry expected to manufacture more than 32 million vehicles in 2024, the demand for rubber-based products is anticipated to grow further, directly increasing zinc oxide consumption for tire production.

- Growth in the Pharmaceutical and Cosmetic Industries: The Indian pharmaceutical industry is forecasted to surpass $65 billion by 2024, creating a substantial market for zinc oxide, which is widely used as an ingredient in skin ointments and sunscreens due to its antibacterial properties. Similarly, the Indian cosmetic industry, expected to reach over $20 billion by 2025, increasingly uses zinc oxide in sunscreen lotions and skincare products.

- Expanding Paints and Coatings Sector: The paints and coatings industry in India is estimated to grow by approximately 15 million tons in 2024 due to rising infrastructure projects, housing developments, and industrial activities. Zinc oxide is used as an additive to enhance the durability and weather resistance of paints. The booming real estate sector, with the governments push for affordable housing, is expected to propel further growth in the paints market.

Market Challenges

- Environmental Regulations on Mining Activities: Indias zinc oxide production relies heavily on the mining of zinc ores. However, stringent government regulations on mining activities, including new emissions norms and environmental clearances, have led to a slowdown in zinc mining. In 2024, the Indian government rejected more than 100 mining applications due to non-compliance with environmental laws.

- Volatile Raw Material Prices: The price of zinc ore, which is the primary raw material for zinc oxide production, has been volatile due to international market fluctuations. In 2023, India imported over $3 billion worth of zinc ore, and any disruption in global supply chains, such as political instability or supply shortages, can drastically affect the pricing.

India Zinc Oxide Market Future Outlook

Over the next five years, the India Zinc Oxide industry is expected to exhibit steady growth, driven by increasing demand from the automotive and agricultural sectors.

Future Market Opportunities

- Sustainability and Green Manufacturing: The next five years will see Indian zinc oxide manufacturers increasingly shift toward sustainable production practices. With the government incentivizing green manufacturing, companies are expected to invest more in renewable energy sources for production, and this will lead to the development of eco-friendly zinc oxide products aimed at the global market.

- Increased Application in Agriculture for Crop Enhancement: The demand for zinc oxide as a micronutrient in fertilizers is forecasted to increase by 2028, driven by the governments push to enhance agricultural productivity. Zinc deficiency affects nearly 50% of Indias arable land, and initiatives to address this will drive up zinc oxide consumption in the agriculture sector.

Scope of the Report

|

Process |

Indirect Process Direct Process Wet Process |

|

Application |

Rubber & Tyres Ceramics & Glass Pharmaceuticals & Cosmetics Agriculture Paints & Coatings |

|

End-Use Industry |

Automotive Electronics Construction |

|

Distribution Channel |

Direct Sales Distributors E-commerce |

|

Region |

North India South India East India West India |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Automotive Manufacturers

Rubber Compounders

Cosmetic & Pharmaceutical Companies

Agriculture Companies (Fertilizer and Animal Feed Manufacturers)

Paint & Coating Manufacturers

Government and Regulatory Bodies (Ministry of Agriculture, Ministry of Chemicals and Fertilizers)

Investor and Venture Capitalist Firms

OEM Tire Manufacturers

Companies

Players Mentioned in the Report:

Rubamin Ltd

H. Chemicals

Zochem Inc.

SILOX SA

Grillo Zinkoxid GmbH

American Chemet Corporation

Pan-Continental Chemical Co., Ltd

Mario Pilato Blat

EverZinc

Tata Chemicals

Table of Contents

1. India Zinc Oxide Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. India Zinc Oxide Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. India Zinc Oxide Market Analysis

3.1 Growth Drivers (Application in Rubber, Cosmetics, and Agriculture)

3.1.1 Demand in Rubber Compounding (Vulcanization)

3.1.2 Agricultural Micronutrient Applications (Zinc Fertilizers, Animal Feed)

3.1.3 Increasing Demand from the Paints & Coatings Industry

3.1.4 Rising Use in Pharmaceuticals & Cosmetics (Wound Healing, UV Protection)

3.2 Market Challenges (Raw Material Volatility, Regulatory Hurdles)

3.2.1 Fluctuating Zinc Prices

3.2.2 Environmental Regulations on Zinc Mining

3.2.3 Competition from Substitute Compounds

3.3 Opportunities (Eco-Friendly Manufacturing, Nanotechnology)

3.3.1 Innovation in Sustainable Manufacturing Processes

3.3.2 Expansion in Electronics & Ceramics with Nano ZnO

3.4 Market Trends

3.4.1 Adoption of Zinc Oxide Nanoparticles in Healthcare

3.4.2 Shift Towards Sustainable Production Methods

3.4.3 Expansion in Electric Vehicle (EV) Tire Applications

3.5 Government Regulations (Supportive Policies, Zinc Utilization Schemes)

3.5.1 Government Focus on Zinc in Agriculture (Rashtriya Krishi Vikas Yojana)

3.5.2 Standards for Zinc Oxide Usage in Cosmetics

3.6 SWOT Analysis

3.7 Porters Five Forces

3.8 Stake Ecosystem

3.9 Competition Ecosystem

4. India Zinc Oxide Market Segmentation

4.1 By Process (In Value %)

4.1.1 Indirect Process (French Process)

4.1.2 Direct Process (American Process)

4.1.3 Wet Chemical Process

4.2 By Application (In Value %)

4.2.1 Rubber & Tyres

4.2.2 Ceramics & Glass

4.2.3 Agriculture (Fertilizers, Animal Feed)

4.2.4 Pharmaceuticals & Cosmetics

4.2.5 Paints & Coatings

4.3 By End-Use Industry (In Value %)

4.3.1 Automotive (Tires, Anti-Corrosion Coatings)

4.3.2 Electronics (Semiconductors, Wide-Band Gap Devices)

4.3.3 Construction (Glass, Tiles, Cement)

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Distributors

4.4.3 E-commerce

4.5 By Region (In Value %)

4.5.1 North India

4.5.2 South India

4.5.3 East India

4.5.4 West India

5. India Zinc Oxide Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Rubamin Ltd (India)

5.1.2 H. Chemicals (India)

5.1.3 Zochem Inc. (US)

5.1.4 Grillo Zinkoxid GmbH (Germany)

5.1.5 SILOX SA (Belgium)

5.1.6 American Chemet Corporation (US)

5.1.7 Pan-Continental Chemical Co., Ltd (Taiwan)

5.1.8 Mario Pilato Blat (Spain)

5.1.9 EverZinc (Belgium)

5.1.10 Upper India Smelting & Refinery Works

5.1.11 Tata Chemicals (India)

5.1.12 Advance Nanotek Ltd. (Australia)

5.1.13 Hindustan Zinc (India)

5.1.14 Lanxess (Germany)

5.1.15 Zinc Nacional (Mexico)

5.2 Cross Comparison Parameters (Revenue, Process Efficiency, Regional Presence, R&D Capabilities, Environmental Compliance, Strategic Initiatives, Product Innovation, Operational Capacity)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Partnerships, Product Expansions)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

6. India Zinc Oxide Market Regulatory Framework

6.1 Environmental Standards for Zinc Oxide Production

6.2 Compliance Requirements (Indian Environmental Laws)

6.3 Certification Processes (Quality Standards, Product Approvals)

7. India Zinc Oxide Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. India Zinc Oxide Future Market Segmentation

8.1 By Process (In Value %)

8.2 By Application (In Value %)

8.3 By End-Use Industry (In Value %)

8.4 By Region (In Value %)

9. India Zinc Oxide Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The first step involved identifying and mapping the key stakeholders and their respective roles in the India Zinc Oxide market. Extensive desk research was conducted to collect secondary data from proprietary databases and trusted sources like government reports and industry publications.

Step 2: Market Analysis and Construction

Historical data from the past five years was compiled, focusing on production volumes, pricing trends, and consumption across various segments. Special emphasis was placed on high-demand sectors like automotive and pharmaceuticals to ensure an accurate forecast model.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through telephone interviews to validate the initial market hypotheses. This provided valuable insights into future trends, challenges, and opportunities in the India Zinc Oxide market, particularly from rubber manufacturers and agricultural stakeholders.

Step 4: Research Synthesis and Final Output

The data gathered was synthesized into comprehensive reports that included market segmentation, competitive analysis, and future outlook. These reports were cross-referenced with top-down and bottom-up approaches to ensure accuracy and reliability.

Frequently Asked Questions

How big is the India Zinc Oxide Market?

The India Zinc Oxide market is valued at USD 388 million, with significant demand coming from the rubber and automotive industries. Its critical role in tire manufacturing drives much of this growth.

What are the challenges in the India Zinc Oxide Market?

Challenges in the India Zinc Oxide market include fluctuating raw material prices and environmental regulations on zinc mining. Additionally, geopolitical tensions and trade restrictions could affect the supply chain dynamics of zinc oxide production.

Who are the major players in the India Zinc Oxide Market?

Key players in the India Zinc Oxide market include Rubamin Ltd, H. Chemicals, Zochem Inc., and Tata Chemicals, dominating through their strong market presence and production capacities in both rubber and pharmaceuticals.

What are the growth drivers of the India Zinc Oxide Market?

Growth in the India Zinc Oxide market is driven by the increasing use of zinc oxide in the agriculture sector for micronutrient-rich fertilizers and animal feed, as well as its application in the automotive sector, especially for tire manufacturing.

Which application segments dominate the India Zinc Oxide Market?

The rubber and tire manufacturing segment dominates the market due to the essential role zinc oxide plays in the vulcanization process, ensuring higher durability and performance of automotive tires.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.