Indian Wearable Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2304

December 2024

89

About the Report

Indian Wearable Market Overview

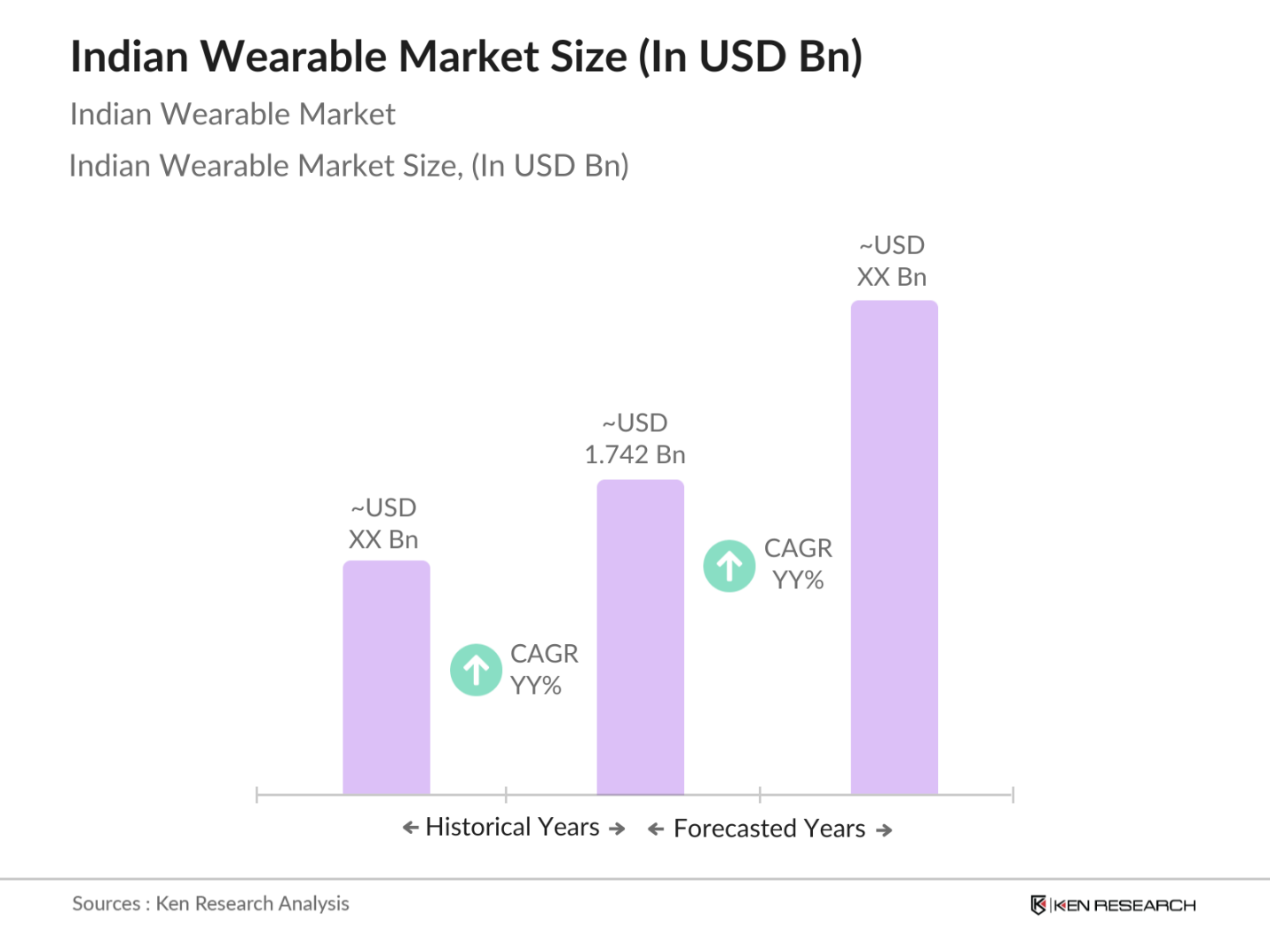

- The Indian wearable market is valued at USD 1.742 billion, reflecting a robust growth trajectory fueled by a surge in health consciousness and technological advancements. The demand for wearables, including fitness trackers and smartwatches, has significantly increased as consumers seek to monitor their health and fitness levels. This market's growth is supported by a shift towards health management solutions and the proliferation of smartphone usage, leading to more integrated wearable technologies that appeal to health-conscious consumers.

- The dominant players in the Indian wearable market include major urban centers like Delhi, Bangalore, and Mumbai, primarily due to their technological infrastructure, high-income population, and early adoption of wearable technologies. These cities serve as hubs for innovation and are home to a tech-savvy demographic that is more inclined to invest in fitness and health monitoring devices. Additionally, the presence of global brands and local startups in these regions further enhances market growth and competition.

- The Indian government has established stringent healthcare compliance standards to regulate wearable devices, ensuring safety and efficacy. As of 2023, a significant number of wearable manufacturers have obtained the necessary certifications to comply with regulatory requirements. The Bureau of Indian Standards (BIS) has introduced guidelines for health monitoring devices, promoting consumer trust and safety in the market. These regulatory measures are designed to enhance the quality of wearable devices and foster a safer environment for consumers, ultimately supporting the growth of the wearable technology sector in India.

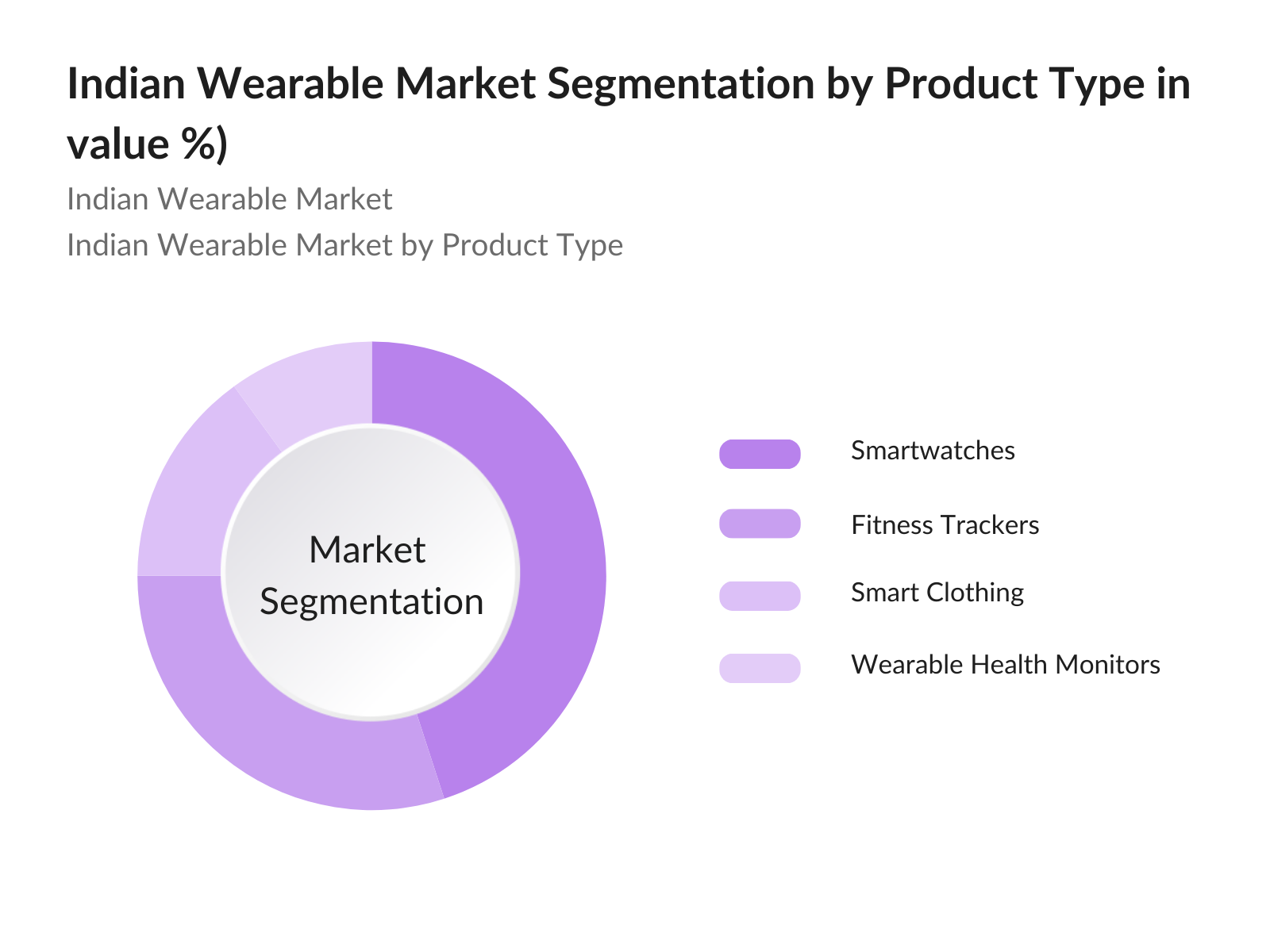

Indian Wearable Market Segmentation

By Product Type: The Indian wearable market is segmented by product type into smartwatches, fitness trackers, smart clothing, and wearable health monitors. Among these, smartwatches hold the dominant market share, driven by their multifunctionality and integration with smartphones. The increasing demand for health monitoring features, such as heart rate tracking and ECG capabilities, has made smartwatches particularly appealing. Their ability to provide notifications, track fitness metrics, and support third-party applications contributes to their widespread acceptance among consumers, especially among tech-savvy youth and health-conscious individuals.

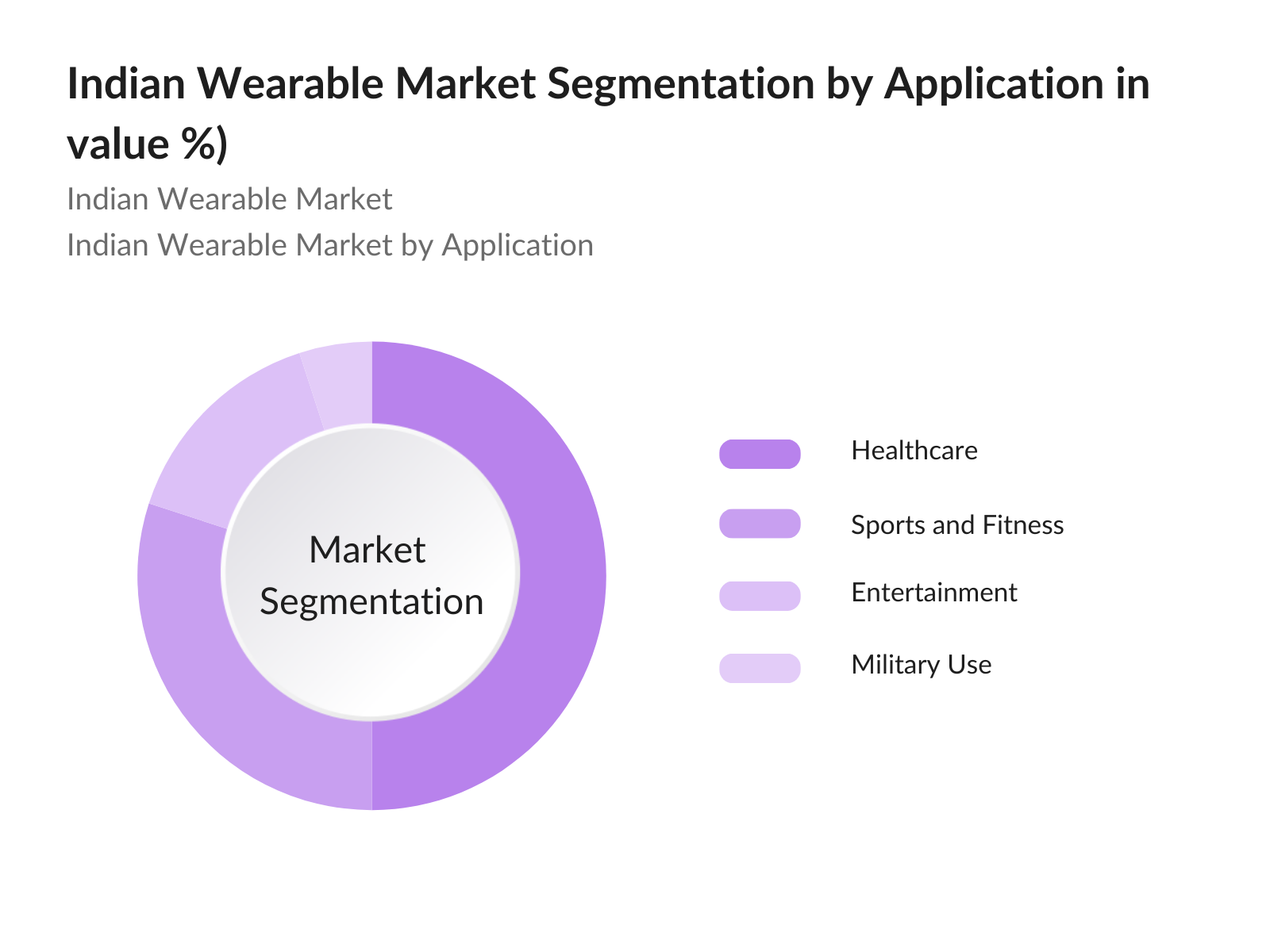

By Application: The market is also segmented by application into healthcare, sports and fitness, entertainment, and military use. The healthcare application segment is currently the largest due to the increasing emphasis on preventive healthcare and remote patient monitoring. Wearables in this segment enable real-time health data tracking, facilitating timely interventions and personalized care plans. This has become increasingly important in light of the growing prevalence of chronic diseases, where continuous health monitoring can lead to improved patient outcomes and reduced healthcare costs.

Indian Wearable Market Competitive Landscape

The Indian wearable market is characterized by a competitive landscape with several major players leading the market. The competition is primarily driven by innovation, pricing strategies, and brand loyalty. Key players in the market include:

|

Company |

Establishment Year |

Headquarters |

Market Share (%) |

Product Portfolio |

Target Market |

Distribution Channels |

Technological Innovation |

|

Apple Inc. |

1976 |

Cupertino, USA |

- |

- |

- |

- |

- |

|

Samsung Electronics |

1938 |

Suwon, South Korea |

- |

- |

- |

- |

- |

|

Fitbit Inc. |

2007 |

San Francisco, USA |

- |

- |

- |

- |

- |

|

Xiaomi Corporation |

2010 |

Beijing, China |

- |

- |

- |

- |

- |

|

Garmin Ltd. |

1989 |

Olathe, Kansas, USA |

- |

- |

- |

- |

- |

Indian Wearable Market Analysis

Market Growth Drivers

- Increasing Health Awareness: The Indian population is increasingly prioritizing health, evidenced by a rise in health-related mobile app downloads, which reached over 550 million in 2023, indicating a growing trend towards health consciousness. Furthermore, as of 2023, the Indian healthcare expenditure per capita was approximately $71, reflecting the population's willingness to invest in health and wellness solutions. This heightened awareness has prompted more consumers to adopt wearables for fitness tracking and health monitoring. Reports from the Ministry of Health and Family Welfare suggest a significant increase in preventive healthcare measures, further promoting the growth of the wearable market.

- Rise of Fitness Trends: Fitness trends have seen substantial growth in India, with over 90 million fitness app users as of 2023. This is coupled with the popularity of gym memberships, which rose to approximately 12 million in urban areas, indicating a lifestyle shift towards fitness. Furthermore, the Indian fitness industry was valued at around $2 billion in 2023, reflecting an increased consumer focus on health and wellness. Wearables are now integral to this trend, providing real-time health metrics and fitness tracking features that resonate with the health-conscious demographic.

- Government Initiatives: The Indian government has launched several initiatives to promote health and wellness, which indirectly support the wearable market. Programs like Ayushman Bharat aim to improve healthcare accessibility, resulting in increased health monitoring needs. As of 2023, the government allocated approximately $1 billion to enhance healthcare infrastructure, further encouraging the adoption of digital health solutions, including wearables. Additionally, the Digital India initiative has facilitated technological advancements in health monitoring, making wearables more accessible to the masses. This supportive regulatory environment fosters growth in the wearable segment.

Market Challenges:

- High Price Sensitivity: Price sensitivity remains a significant barrier to the widespread adoption of wearables in India. The per capita income is approximately $2,300 as of 2023, leading many consumers to be reluctant to invest heavily in wearable technology. A substantial portion of the population is classified as low to middle income, which impacts their purchasing decisions. Additionally, potential consumers often cite price as a primary concern when considering wearable devices. This sensitivity to price influences market growth, as manufacturers need to balance quality with affordability to attract a broader audience. Addressing these concerns is crucial for expanding the market reach of wearable devices in India.

- Market Saturation: As the wearable market in India matures, market saturation poses a challenge for growth. With a large number of wearable brands competing for market share as of 2023, differentiation becomes increasingly difficult. Many consumers own multiple wearable devices, leading to dissatisfaction with their devices, often due to redundancy in features. This saturation affects brand loyalty and consumer willingness to upgrade. Companies must innovate and offer unique functionalities to capture market attention and retain existing customers in a crowded marketplace. Addressing these challenges is essential for sustained growth and engagement in the Indian wearable market.

Indian Wearable Market Future Outlook

Over the next five years, the Indian wearable market is expected to show significant growth driven by continuous government support, advancements in wearable technology, and increasing consumer demand for eco-friendly and health-oriented solutions. The government's initiatives to promote digital health and wellness will further bolster market expansion. Moreover, the integration of artificial intelligence and machine learning in wearables is set to enhance user experience, making devices more intuitive and effective in health monitoring. The rise of the Internet of Things (IoT) will also pave the way for smarter and more connected wearable devices.

Market Opportunities:

- Adoption of Smart Clothing: The adoption of smart clothing in India is gaining traction, with sales of smart textiles reaching approximately 5 million units in 2023. This trend is fueled by the increasing interest in fitness and wellness among consumers, as smart clothing offers integrated health monitoring features. Additionally, the Indian textile market, valued at around $100 billion, provides a strong foundation for the growth of smart clothing.

- Growth of AR/VR Wearables: The growth of augmented reality (AR) and virtual reality (VR) wearables in India is on the rise, with the market expected to exceed $2 billion by 2025. This trend is driven by the increasing applications of AR/VR in various sectors, including healthcare, education, and gaming. As of 2023, approximately 5 million AR/VR devices were sold in India, demonstrating the growing consumer interest in immersive experiences.

Scope of the Report

|

By Product Type |

Fitness Trackers Smartwatches Smart Glasses Wearable Health Monitors Smart Clothing |

|

By Application |

Healthcare Sports and Fitness Entertainment Military |

|

By Technology |

Bluetooth NFC Wi-Fi |

|

By End-User |

Individual Consumers Corporate |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Fitness Enthusiasts

Health-conscious Individuals

Corporate Wellness Programs

Hospitals and Healthcare Providers

Sports Organizations

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health and Family Welfare)

Retailers and Distributors

Companies

Players Mention in the Report

Apple Inc.

Samsung Electronics

Fitbit Inc.

Xiaomi Corporation

Garmin Ltd.

Huawei Technologies

Realme

Noise

Fossil Group

Amazfit

Lenovo

Sony Corporation

Oppo

Micromax

Honor

Table of Contents

01. Indian Wearable Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR)

1.4. Market Segmentation Overview

02. Indian Wearable Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indian Wearable Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Rise of Fitness Trends

3.1.3. Technological Advancements

3.1.4. Government Initiatives

3.2. Market Challenges

3.2.1. High Price Sensitivity

3.2.2. Data Privacy Concerns

3.2.3. Market Saturation

3.3. Opportunities

3.3.1. Integration with IoT Devices

3.3.2. Expansion in Rural Markets

3.3.3. Development of Customized Wearables

3.4. Trends

3.4.1. Adoption of Smart Clothing

3.4.2. Increase in Remote Health Monitoring

3.4.3. Growth of AR/VR Wearables

3.5. Government Regulation

3.5.1. Healthcare Compliance Standards

3.5.2. Electronics and IT Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Indian Wearable Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Fitness Trackers

4.1.2. Smartwatches

4.1.3. Smart Glasses

4.1.4. Wearable Health Monitors

4.1.5. Smart Clothing

4.2. By Application (In Value %)

4.2.1. Healthcare

4.2.2. Sports and Fitness

4.2.3. Entertainment

4.2.4. Military

4.3. By Technology (In Value %)

4.3.1. Bluetooth

4.3.2. NFC

4.3.3. Wi-Fi

4.4. By End-User (In Value %)

4.4.1. Individual Consumers

4.4.2. Corporate

4.5. By Distribution Channel (In Value %)

4.5.1. Online

4.5.2. Offline

05. Indian Wearable Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Apple Inc.

5.1.2. Samsung Electronics

5.1.3. Fitbit Inc.

5.1.4. Garmin Ltd.

5.1.5. Huawei Technologies Co., Ltd.

5.1.6. Xiaomi Corporation

5.1.7. Sony Corporation

5.1.8. LG Electronics

5.1.9. Fossil Group, Inc.

5.1.10. Misfit Wearables Corp.

5.1.11. Amazfit (Zepp Health)

5.1.12. Realme

5.1.13. Noise

5.1.14. OnePlus

5.1.15. Oppo

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Share, Customer Demographics, Geographic Reach)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Indian Wearable Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Data Protection Regulations

6.3. Compliance Requirements

07. Indian Wearable Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Indian Wearable Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User (In Value %)

8.5. By Distribution Channel (In Value %)

09. Indian Wearable Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indian wearable market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Indian wearable market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple wearable manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indian wearable market.

Frequently Asked Questions

01. How big is the Indian Wearable Market?

The Indian wearable market is valued at USD 1.742 billion, driven by technological advancements and a growing awareness of health and fitness among consumers.

02. What are the challenges in the Indian Wearable Market?

Challenges include high competition among brands, concerns over data privacy, and the need for continuous innovation to meet consumer expectations.

03. Who are the major players in the Indian Wearable Market?

Key players in the market include Apple, Samsung, Fitbit, and Xiaomi, which dominate due to their strong brand presence and innovative product offerings.

04. What are the growth drivers of the Indian Wearable Market?

The market is propelled by increasing health consciousness, advancements in technology, and a shift towards integrated health solutions among consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.