Indonesia Adhesives Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD1090

November 2024

97

About the Report

Indonesia Adhesives Market Overview

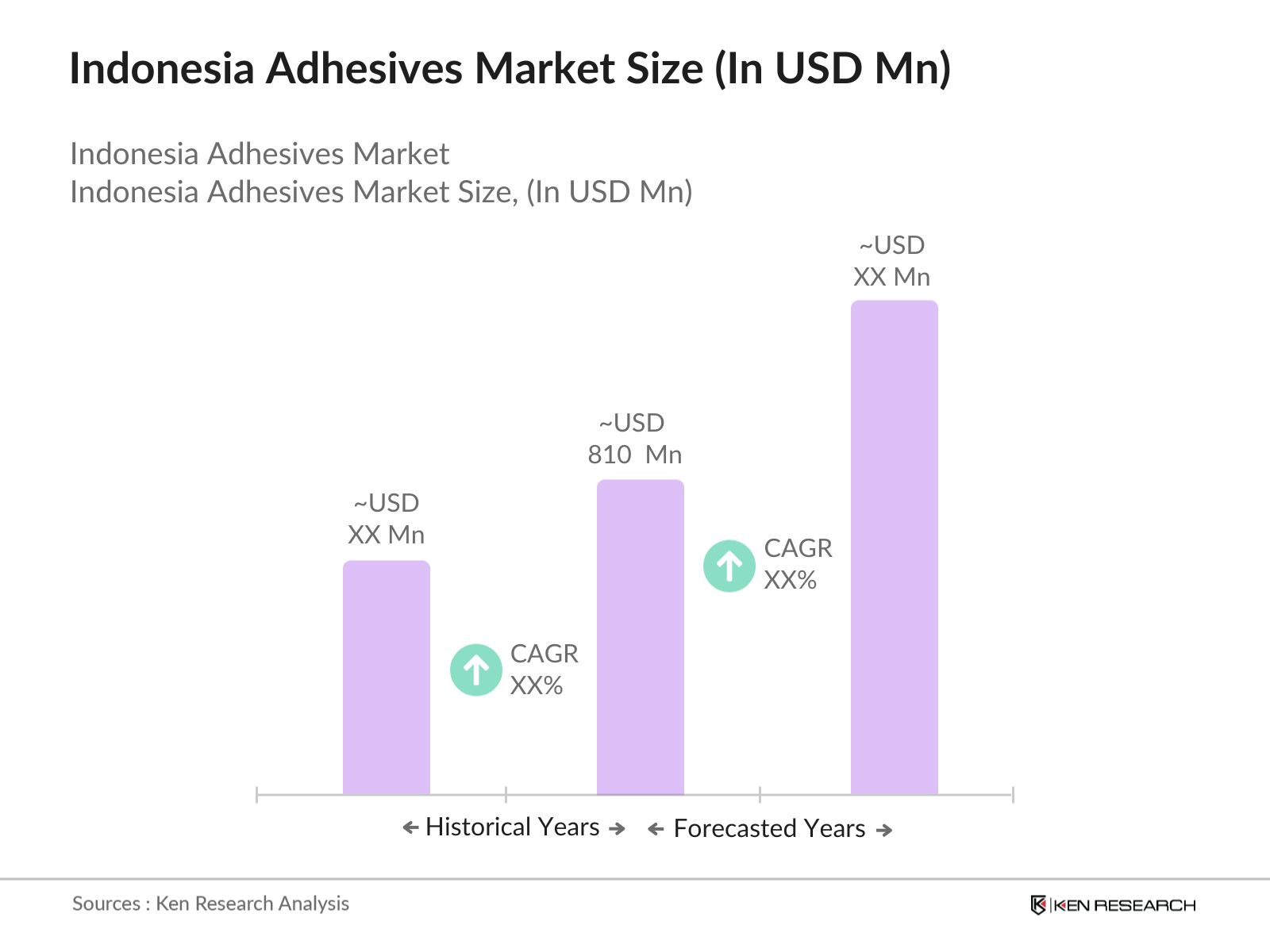

- The Indonesia adhesives market is valued at USD 810 million. The growth of this market is largely driven by the rapid industrialization and urbanization within the country, especially in key sectors such as construction, automotive, and packaging. The increasing demand for eco-friendly and bio-based adhesives, coupled with advancements in adhesive technologies, has further fueled market expansion. Moreover, rising infrastructure projects and the governments push for sustainable building practices are also major contributing factors.

- Cities such as Jakarta, Surabaya, and Bandung dominate the adhesives market due to their high concentration of industries, including automotive manufacturing, construction, and consumer goods production. These urban hubs benefit from well-established supply chains, a growing population base, and the presence of multinational companies, leading to higher demand for adhesives across multiple sectors. Additionally, Indonesia's strategic location in Southeast Asia enables it to serve as a key manufacturing and export hub for regional markets.

- Indonesia has implemented strict regulations to limit VOC emissions in industrial applications, including adhesives. In 2024, the government enforced updated VOC limits for industrial adhesives under the Ministry of Environment and Forestrys guidelines. These regulations are aimed at reducing air pollution and promoting the use of water-based or low-VOC adhesives in the construction, automotive, and packaging sectors. Companies failing to meet these standards face penalties, incentivizing the adoption of eco-friendly adhesive technologies.

Indonesia Adhesives Market Segmentation

Indonesias adhesive market is segmented by product type and by application.

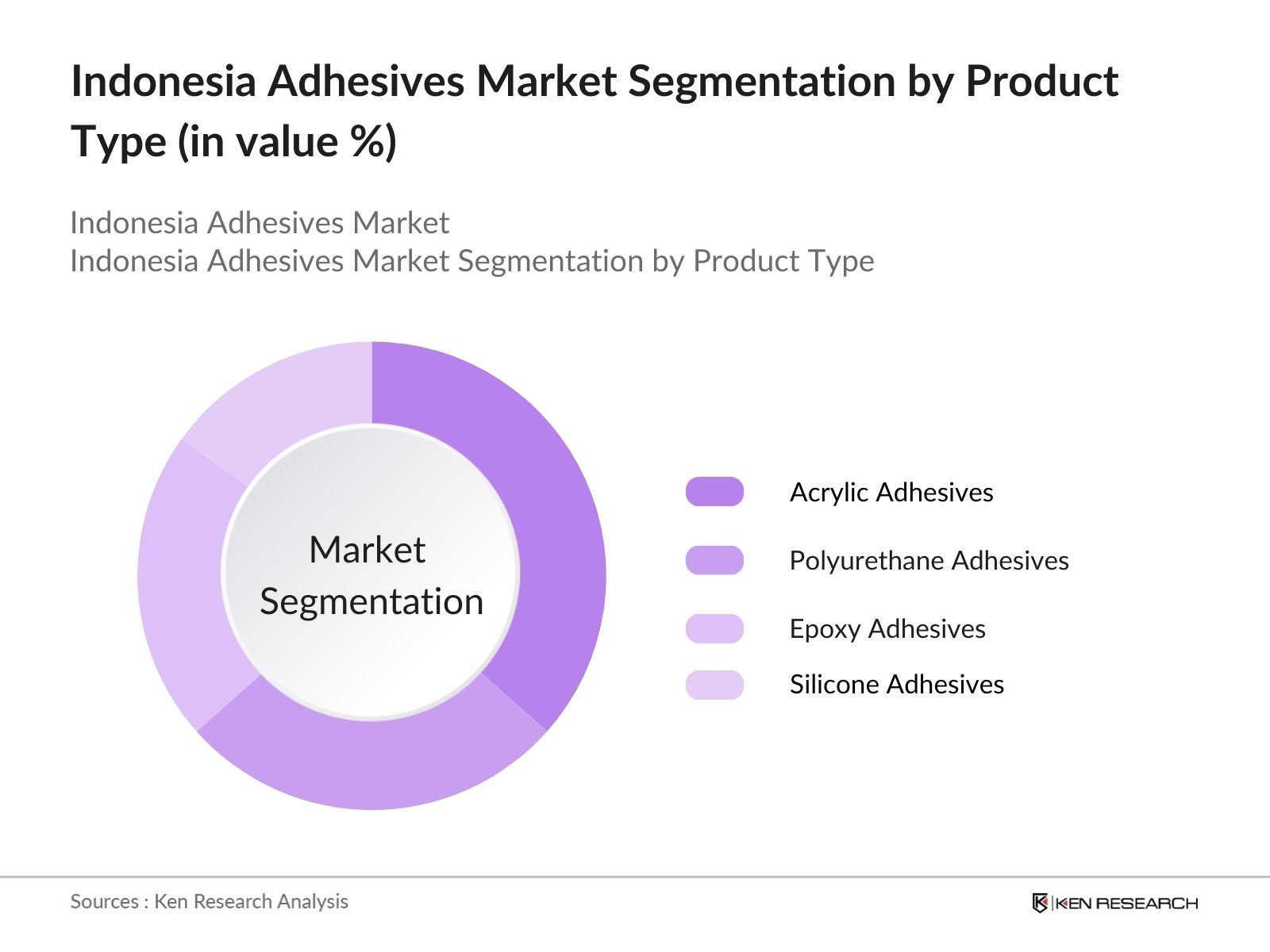

- By Product Type: The market is segmented by product type into acrylic adhesives, polyurethane adhesives, epoxy adhesives, and silicone adhesives. Acrylic adhesives dominate the market due to their versatility, high-performance characteristics, and cost-effectiveness. These adhesives are widely used in industries such as construction and packaging due to their excellent bonding capabilities and resistance to environmental factors such as heat and chemicals. Moreover, the increasing adoption of lightweight materials in the automotive sector has further boosted the demand for acrylic adhesives.

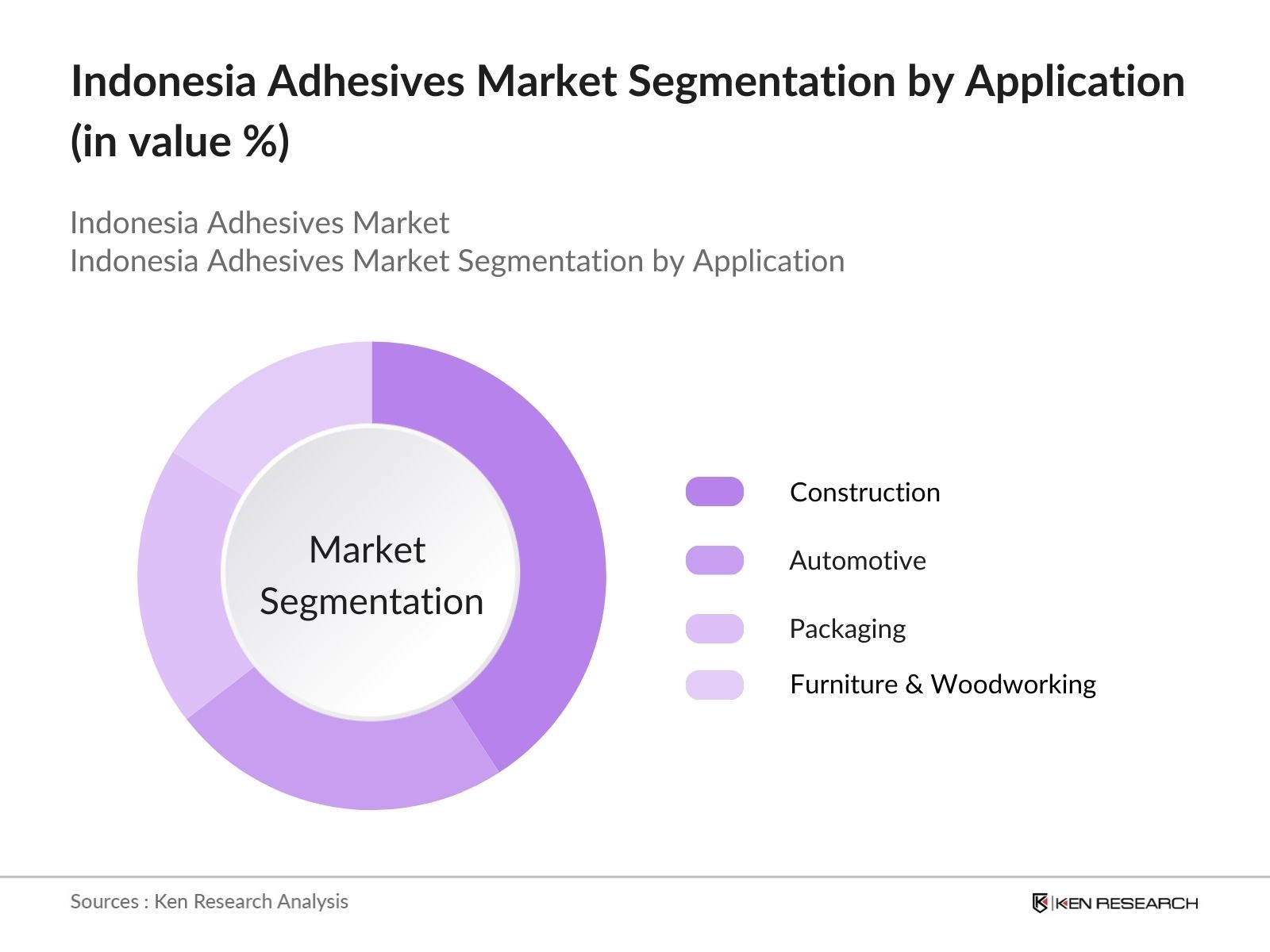

- By Application: The market is segmented by application into construction, automotive, packaging, furniture & woodworking. The construction sector holds the largest share in the market due to the ongoing infrastructure development projects across Indonesia. Adhesives are preferred over traditional fastening methods due to their superior bonding properties, which enhance the durability of buildings and reduce construction time. The demand for high-performance adhesives in applications like flooring, tiling, and insulation further reinforces the dominance of the construction segment.

Indonesia Adhesives Market Competitive Landscape

The Indonesia adhesives market is characterized by the presence of both global players and local manufacturers. These companies are engaged in strategic partnerships, product innovations, and mergers and acquisitions to maintain their market position. The competitive landscape reflects the dominance of multinational players such as Henkel, H.B. Fuller, and 3M, who leverage their global reach and extensive product portfolios to maintain a strong market position in Indonesia. Local companies also play a vital role, benefiting from proximity to the market and local expertise.

|

Company Name |

Establishment Year |

Headquarters |

R&D Investment |

Sustainability Initiatives |

Product Innovation |

Global Reach |

Local Partnerships |

|

Henkel AG & Co. KGaA |

1876 |

Dsseldorf, Germany |

|||||

|

H.B. Fuller |

1887 |

St. Paul, USA |

|||||

|

3M |

1902 |

St. Paul, USA |

|||||

|

Sika AG |

1910 |

Baar, Switzerland |

|||||

|

BASF SE |

1865 |

Ludwigshafen, Germany |

Indonesia Adhesives Industry Analysis

Market Growth Drivers

- Rising Industrialization and Urbanization: Indonesia has been undergoing rapid urbanization and industrial expansion, contributing to the adhesives market. In 2024, 58.8% of the population resides in urban areas, reflecting a strong demand for construction materials, including adhesives used in housing, infrastructure, and industrial applications. According to the World Bank, Indonesia's GDP reached USD 1.4 trillion in 2023, with industrial production contributing around 38% of the total GDP. This urban and industrial growth directly drives the demand for adhesives in various sectors such as manufacturing, packaging, and construction.

- Growth in Automotive Sector (Demand for Lightweight Materials): Indonesias automotive sector is a key driver of adhesives demand, especially as the focus on lightweight materials intensifies. The country produced 1.5 million vehicles in 2023, according to the International Organization of Motor Vehicle Manufacturers (OICA). Lightweight materials, essential for fuel efficiency, rely heavily on advanced adhesive technologies. Indonesias automotive industry, valued at around USD 20 billion in 2023, utilizes adhesives for bonding components in place of traditional fasteners, reducing vehicle weight and improving energy efficiency.

- Increasing Construction Projects (Housing and Infrastructure Development): The construction sector in Indonesia is expanding, driven by ongoing government initiatives and housing demands. In 2023, the Indonesian government allocated USD 26 billion for infrastructure projects, including new roads, bridges, and public housing under its "National Medium-Term Development Plan." This construction boom has created a surge in demand for adhesives used in building materials, including tiling, flooring, and insulation applications. With urban housing needs expected to grow by 1.2 million units annually, adhesives play a vital role in meeting construction standards.

Market Challenges

- Volatile Raw Material Prices (Petrochemical-based raw materials): The Indonesian adhesives market faces challenges due to the volatility of petrochemical-based raw material prices. Adhesives often rely on petrochemical derivatives, which are subject to price fluctuations driven by global oil prices. In 2024, the global oil market remains unstable, with crude oil prices ranging between USD 80-90 per barrel, according to the International Energy Agency (IEA). These fluctuations impact the production costs for adhesives manufacturers in Indonesia, leading to pricing pressures and profitability concerns.

- Environmental and Regulatory Challenges (VOC Emissions and Eco-friendly Mandates): Adhesive manufacturers in Indonesia face stringent environmental regulations regarding volatile organic compounds (VOC) emissions. In response to growing environmental concerns, the Indonesian government has implemented regulations to limit the VOC content in adhesives, aligning with international environmental standards. In 2023, Indonesias Ministry of Environment and Forestry imposed new limits on VOC emissions in industrial processes, pushing manufacturers toward greener, water-based, or low-VOC adhesives.

Indonesia Adhesives Market Future Outlook

Over the next five years, the Indonesia adhesives market is expected to witness steady growth, driven by factors such as increasing industrial activity, urbanization, and the growing demand for eco-friendly and sustainable adhesives. The rise of bio-based and water-based adhesives is anticipated to be a key trend as government regulations concerning environmental sustainability become stricter. Additionally, sectors such as automotive and construction will continue to dominate the market, as innovations in lightweight and high-performance adhesives offer new opportunities for growth.

Market Opportunities

- Growing Demand for Bio-based Adhesives: The demand for bio-based adhesives in Indonesia is on the rise, driven by increasing environmental awareness and regulatory pressures. In 2023, the global bio-based chemicals market, including adhesives, reached USD 90 billion, with a growing share attributed to Southeast Asia. Indonesias adhesives market stands to benefit from this trend as local manufacturers explore alternatives to petrochemical-derived adhesives. Bio-based adhesives derived from natural polymers such as starch, lignin, and cellulose are gaining traction, particularly in the packaging and construction sectors.

- Increasing Investment in Research and Development: Indonesias adhesive sector is seeing increased investment in research and development (R&D), particularly in the areas of sustainable and high-performance adhesives. In 2023, the Indonesian government allocated over USD 600 million for industrial R&D projects, which includes innovations in adhesive technologies. Local manufacturers are leveraging these investments to develop adhesives that meet both performance and environmental standards. This focus on R&D is expected to boost the competitiveness of Indonesian adhesives in global markets.

Scope of the Report

Products

Key Target Audience

Adhesive Manufacturers

Automotive Companies

Construction Firms

Packaging Companies

Electronics Manufacturers

Furniture Manufacturers

Banks and Financial Institutes

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Indonesian Ministry of Industry, Indonesian Ministry of Environment and Forestry)

Companies

Players Mention in the Report:

Henkel AG & Co. KGaA

H.B. Fuller Company

3M

Sika AG

BASF SE

Arkema Group (Bostik SA)

Ashland Global Holdings Inc.

Dow Chemical Company

Avery Dennison Corporation

Permabond LLC

ITW Performance Polymers

Jowat SE

Adhesive Technologies, Inc.

Parson Adhesives

Wacker Chemie AG

Table of Contents

1. Indonesia Adhesives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (CAGR, market share growth)

1.4. Market Segmentation Overview (Product type, Technology, Application, End-user, Region)

2. Indonesia Adhesives Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Adhesives Market Analysis

3.1. Growth Drivers

3.1.1. Rising Industrialization and Urbanization

3.1.2. Growth in Automotive Sector (Demand for lightweight materials)

3.1.3. Increasing Construction Projects (Housing and infrastructure development)

3.1.4. Expansion of Packaging and Consumer Goods Sectors

3.2. Market Challenges

3.2.1. Volatile Raw Material Prices (Petrochemical-based raw materials)

3.2.2. Environmental and Regulatory Challenges (VOC emissions and eco-friendly mandates)

3.2.3. Technological Barriers in Developing Sustainable Adhesives

3.3. Opportunities

3.3.1. Growing Demand for Bio-based Adhesives

3.3.2. Increasing Investment in Research and Development

3.3.3. Advancements in Adhesive Technologies (Pressure-sensitive, Hot-melt adhesives)

3.4. Trends

3.4.1. Shift Toward Water-based Adhesives (Regulations on solvent-based adhesives)

3.4.2. Adoption of Smart Adhesive Systems (Self-healing, Temperature-sensitive adhesives)

3.4.3. Increased Use of Adhesives in Automotive Light-Weighting

3.5. Government Regulation

3.5.1. Regulations on VOC Emissions

3.5.2. Implementation of Green Building Codes

3.5.3. Trade and Import Tariffs on Adhesive Raw Materials

3.5.4. Incentives for Eco-friendly Adhesive Technologies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.8.1. Threat of New Entrants

3.8.2. Bargaining Power of Suppliers

3.8.3. Bargaining Power of Buyers

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Indonesia Adhesives Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Acrylic Adhesives

4.1.2. Polyurethane Adhesives

4.1.3. Epoxy Adhesives

4.1.4. Silicone Adhesives

4.1.5. Others

4.2. By Technology (In Value %)

4.2.1. Water-Based Adhesives

4.2.2. Solvent-Based Adhesives

4.2.3. Hot-Melt Adhesives

4.2.4. Reactive Adhesives

4.2.5. Others

4.3. By Application (In Value %)

4.3.1. Construction

4.3.2. Automotive

4.3.3. Packaging

4.3.4. Furniture & Woodworking

4.3.5. Others

4.4. By End-User (In Value %)

4.4.1. Industrial Adhesives

4.4.2. Consumer Adhesives

4.4.3. Medical Adhesives

4.4.4. Electronics Adhesives

4.4.5. Others

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. West

4.5.4. East

5. Indonesia Adhesives Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Henkel AG & Co. KGaA

5.1.2. 3M Company

5.1.3. H.B. Fuller Company

5.1.4. Sika AG

5.1.5. Arkema Group (Bostik SA)

5.1.6. Ashland Global Holdings Inc.

5.1.7. Dow Chemical Company

5.1.8. Avery Dennison Corporation

5.1.9. BASF SE

5.1.10. Permabond LLC

5.1.11. ITW Performance Polymers

5.1.12. Jowat SE

5.1.13. Adhesive Technologies, Inc.

5.1.14. Parson Adhesives

5.1.15. Wacker Chemie AG

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share

5.2.6. Product Innovation

5.2.7. R&D Investment

5.2.8. Sustainability Initiatives

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Adhesives Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Adhesives Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Adhesives Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Indonesia Adhesives Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step focuses on identifying key variables within the Indonesia Adhesives Market ecosystem. Through extensive desk research, we mapped out major stakeholders, including manufacturers, suppliers, and distributors. This step relied heavily on secondary data and proprietary databases to gather critical information regarding market dynamics and competitive pressures.

Step 2: Market Analysis and Construction

This phase involved analyzing historical data of the Indonesia Adhesives Market, including sales trends, production volumes, and demand dynamics. The analysis extended to evaluating key segments such as product types and applications to assess their contribution to overall market revenue.

Step 3: Hypothesis Validation and Expert Consultation

Our research hypotheses were validated through consultations with industry experts from adhesive manufacturers, automotive companies, and the construction sector. These consultations helped fine-tune our market estimates and provided on-the-ground insights into market conditions.

Step 4: Research Synthesis and Final Output

The final phase involved synthesizing all collected data into actionable insights. This step included verifying market statistics with industry players and refining our analysis of future market trends. The final output offers a comprehensive view of the Indonesia Adhesives Market, addressing all market dynamics and key drivers of growth.

Frequently Asked Questions

01. How big is Indonesia Adhesives Market?

The Indonesia adhesives market is valued at USD 810 million, driven by industrial growth in construction, automotive, and packaging sectors. The rising demand for eco-friendly and high-performance adhesives is contributing to market expansion.

02. What are the challenges in Indonesia Adhesives Market?

Challenges in the Indonesia adhesives market include fluctuating raw material prices, especially petrochemical-based inputs, and stringent environmental regulations concerning VOC emissions. The market also faces technological hurdles in developing sustainable adhesives.

03. Who are the major players in the Indonesia Adhesives Market?

Key players in the Indonesia adhesives market include Henkel AG & Co. KGaA, H.B. Fuller, 3M, Sika AG, and BASF SE. These companies dominate the market due to their global reach, strong R&D capabilities, and product innovations.

04. What are the growth drivers of Indonesia Adhesives Market?

The Indonesia adhesives market is primarily driven by rapid industrialization, urbanization, and growth in key sectors such as construction, automotive, and packaging. The demand for eco-friendly and bio-based adhesives is also a key driver of market growth.

05. What are the trends in Indonesia Adhesives Market?

Key trends in the Indonesia adhesives market include the increasing adoption of bio-based and water-based adhesives, advancements in adhesive technologies, and the rising use of adhesives in automotive lightweighting and sustainable building practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.