Indonesia Agriculture Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD9521

November 2024

88

About the Report

Indonesia Agriculture Market Overview

- The Indonesia Agriculture Market is valued at USD 161 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for sustainable and organic food products, supported by technological advancements in precision farming and favorable government policies. With a growing emphasis on food security and export potential, the sector is also benefiting from increased investments in agritech and digital platforms. These advancements enable Indonesian farmers to optimize crop yields, particularly in key regions like Java and Sumatra, which are central to the country's rice and palm oil production.

- Java and Sumatra are among the most prominent regions in Indonesia's agriculture market. Java dominates due to its favorable climatic conditions, fertile soil, and access to advanced infrastructure, enabling efficient production and distribution. Sumatra, known for its extensive plantation crops, particularly palm oil and rubber, benefits from a conducive environment for cash crops, boosting its prominence in the market.

- Indonesias National Agricultural Policy emphasizes food self-sufficiency and resource conservation. The Ministry of Agriculture introduced incentives for sustainable practices, aiming to reduce reliance on imports. The policy encourages local production of staples like rice and corn, essential for reducing Indonesias trade imbalance.

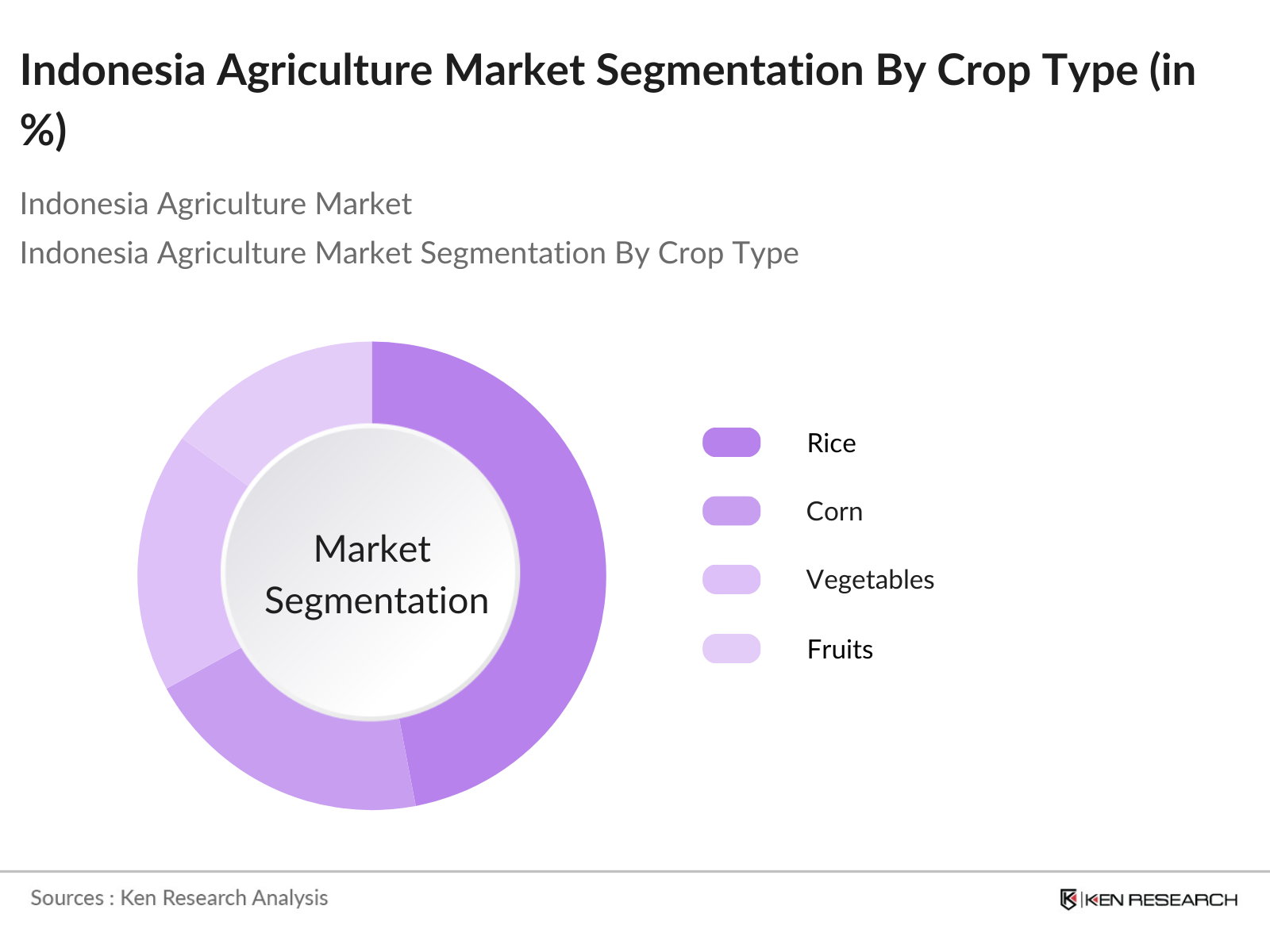

Indonesia Agriculture Market Segmentation

By Crop Type: The Indonesia Agriculture Market is segmented by crop type into rice, corn, vegetables, fruits, and cash crops. In recent years, rice has held a dominant market share within this segment due to its role as a staple food in Indonesian households. Government initiatives aimed at achieving rice self-sufficiency have driven extensive production. Furthermore, infrastructure for irrigation and support services for rice farming has been well-developed, solidifying its dominance in this segment.

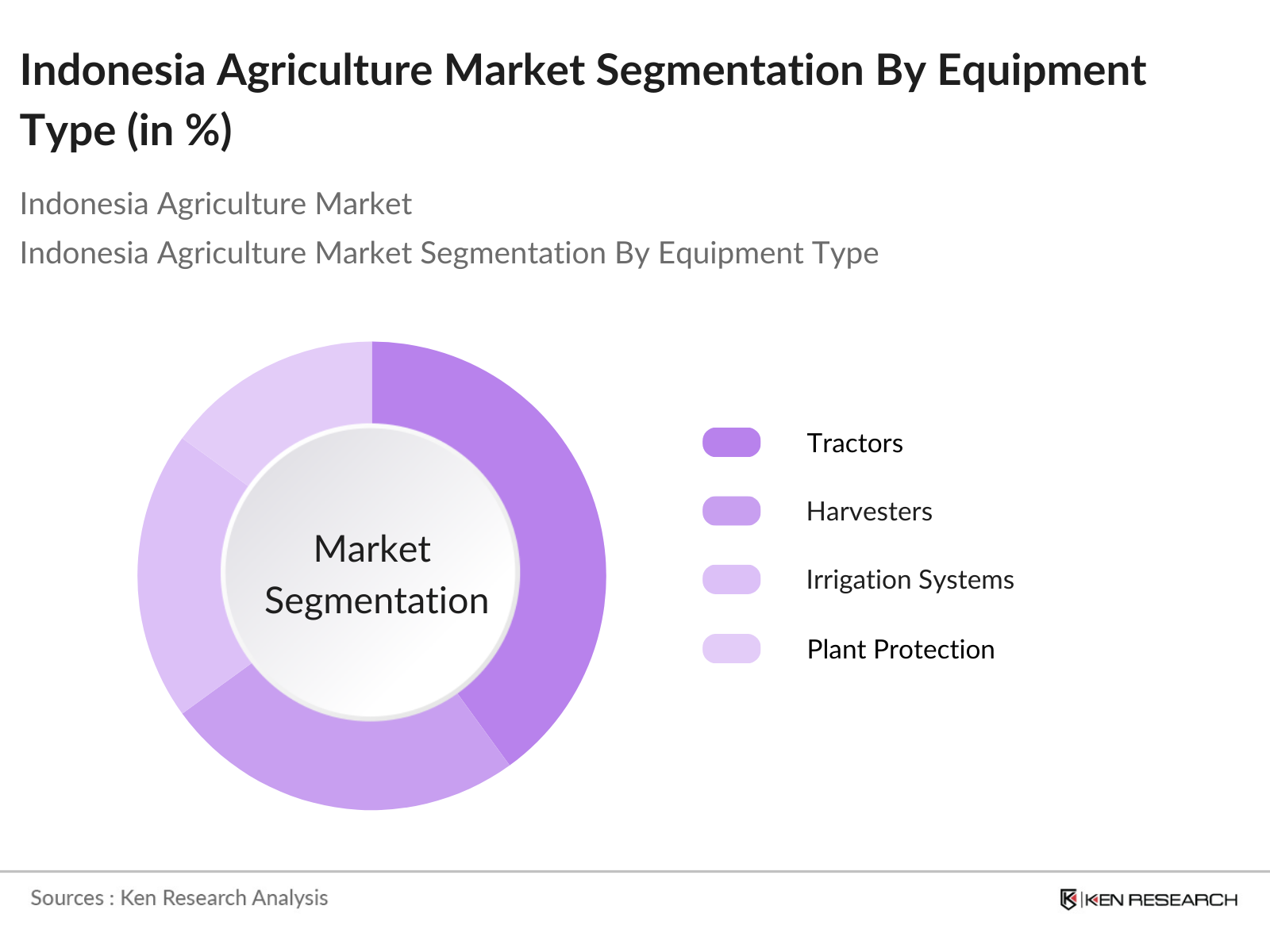

By Equipment Type: The market is also segmented by equipment type, including tractors, harvesters, irrigation systems, and plant protection equipment. Tractors hold a significant market share due to their essential role in land preparation and high utilization across various crops. Increased mechanization efforts and subsidies for agricultural equipment from the Indonesian government contribute to their widespread use and dominance in this segment.

Indonesia Agriculture Market Competitive Landscape

The Indonesia Agriculture Market is dominated by both local and international players who bring diverse expertise and technological capabilities. A handful of major companies, including PT Astra Agro Lestari and PT Indofood Sukses Makmur, have a substantial presence, supported by extensive distribution networks and technological advancements in precision farming. This consolidation allows key players to influence market trends and develop innovative solutions aligned with Indonesias unique agricultural landscape.

Indonesia Agriculture Industry Analysis

Growth Drivers

- Rising Demand for Organic Produce (Organic Agriculture Demand): Indonesia has increased its focus on organic agriculture due to rising health consciousness and international demand. The government allocated $150,000 in 2024 to enhance organic agriculture policies and strengthen statistical data for sustainable agriculture. Additionally, demand for organic produce in both domestic and export markets aligns with Indonesias National E-Agriculture Strategy, which envisions an integrated agricultural database by 2027.

- Technological Advancements in Farming (Precision Farming): Indonesias adoption of digital agriculture technologies, such as the Digital Collection Platform, is driving efficiency gains for smallholders. The AWR initiative, along with the National E-Agriculture Strategy, is modernizing agricultural operations through IoT and AI technologies, creating a national database to aid disaster management and climate resilience. Indonesias AgriTech ecosystem is rapidly growing, with digital platforms expanding to over 100,000 smallholders by 2023, focusing on advisory, financial access, and mechanization.

- Export Opportunities in Cash Crops (Export Demand): Indonesia ranks 11th globally in agricultural exports, primarily palm oil, rubber, and coffee, accounting for approximately 60% of its export earnings. In 2023, the Indonesia Maps of Agricultural Commodities Export (IMACE) app was launched to streamline international trading, which helped improve trade access for smallholders. The U.S., China, and Japan remain significant importers, supporting Indonesias goal of achieving a $50 billion agricultural export value by 2030, bolstered by digital platforms that connect farmers to global buyers.

Market Challenges

- Climate Change Impact (Weather Dependency): Climate change poses a critical challenge, with over 83% of agricultural land in Indonesia dependent on rain. In recent years, irregular weather patterns have caused major losses, especially in key crops like rice and coffee. Indonesia's deforestation rate also exacerbates climate vulnerability; between 2001-2018, 9.3 million hectares of forest cover were lost, impacting soil quality and water availability for farming

- Limited Access to Financing (Rural Credit Constraints): Access to credit remains restricted for smallholders, with less than 10% having access to formal financial services. Despite government initiatives, the majority of funding in the agricultural sector is directed toward large agribusinesses. Smallholder farmers often rely on informal loans, which can have interest rates as high as 20%. Expanding financial access through AgriTech could alleviate constraints, though current digital credit penetration remains low.

Indonesia Agriculture Market Future Outlook

The Indonesia Agriculture Market is poised for continued growth, driven by factors such as increased investment in agritech, supportive government policies, and rising consumer demand for organic products. Innovations in precision farming, combined with expanded digital platforms for farmers, are expected to enhance productivity and enable efficient resource management, driving the sector forward over the next five years.

Market Opportunities

- Expansion in Smart Farming (Smart Farming Initiatives): The Indonesian governments push for smart farming initiatives, including smart greenhouses and precision farming, has opened up opportunities for advanced crop monitoring and yield optimization. The Agricultural War Rooms integration with satellite data allows real-time monitoring, which has already shown a 15% improvement in productivity among early adopters in Java.

- Growth in Agritech Investments (Venture Capital Interest): AgriTech in Indonesia has witnessed significant growth, attracting venture capital investments targeting smallholder productivity. In 2023, more than 25 AgriTech startups operated within Indonesia, leveraging digital platforms to facilitate lending and farm management. Investments in AgriTech solutions, focusing on crop monitoring and market linkages, aim to increase efficiency and reduce dependency on middlemen.

Scope of the Report

|

Crop Type |

Rice Corn Vegetables Fruits Cash Crops (Palm Oil, Coffee, Rubber) |

|

Equipment Type |

Tractors Harvesters Irrigation Systems Plant Protection Equipment |

|

Application |

Crop Farming Livestock Aquaculture Horticulture |

|

Distribution Channel |

Retail Online Direct Sales |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Agricultural Equipment Manufacturers

Government and Regulatory Bodies (Indonesian Ministry of Agriculture)

Agrochemical Companies

Food and Beverage Producers

Agricultural Technology Providers

Investment and Venture Capitalist Firms

Crop Protection Solution Providers

Financial Institutions (e.g., banks offering agricultural loans)

Companies

Players Mentioned in the Report

PT Astra Agro Lestari Tbk

PT Sampoerna Agro Tbk

PT BISI International Tbk

PT SMART Tbk

PT Indofood Sukses Makmur Tbk

PT PP London Sumatra Indonesia Tbk

Japfa Comfeed Indonesia Tbk

PT Sawit Sumbermas Sarana Tbk

PT Charoen Pokphand Indonesia Tbk

Wilmar International Ltd

Table of Contents

1. Indonesia Agriculture Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Agriculture Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Agriculture Market Analysis

3.1. Growth Drivers

3.1.1. Rising Demand for Organic Produce (Organic Agriculture Demand)

3.1.2. Government Subsidies and Support (Policy and Support Initiatives)

3.1.3. Technological Advancements in Farming (Precision Farming)

3.1.4. Export Opportunities in Cash Crops (Export Demand)

3.2. Market Challenges

3.2.1. Climate Change Impact (Weather Dependency)

3.2.2. Limited Access to Financing (Rural Credit Constraints)

3.2.3. Land Ownership and Policy Barriers (Land Reforms)

3.3. Opportunities

3.3.1. Expansion in Smart Farming (Smart Farming Initiatives)

3.3.2. Growth in Agritech Investments (Venture Capital Interest)

3.3.3. Increased Focus on Sustainable Practices (Sustainability Focus)

3.4. Trends

3.4.1. Rise of Vertical and Urban Farming (Urban Agriculture)

3.4.2. Digitalization of Agricultural Processes (Digital Platforms in Farming)

3.4.3. Adoption of IoT in Agriculture (IoT-Enabled Agriculture)

3.5. Government Regulation

3.5.1. National Agricultural Policies (Policy Framework)

3.5.2. Subsidy and Grant Programs (Financial Support)

3.5.3. Crop Insurance Schemes (Risk Management Programs)

3.5.4. Trade and Export Regulations (Export Restrictions)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Agriculture Market Segmentation

4.1. By Crop Type (In Value %)

4.1.1. Rice

4.1.2. Corn

4.1.3. Vegetables

4.1.4. Fruits

4.1.5. Cash Crops (Palm Oil, Coffee, Rubber)

4.2. By Equipment Type (In Value %)

4.2.1. Tractors

4.2.2. Harvesters

4.2.3. Irrigation Systems

4.2.4. Plant Protection Equipment

4.3. By Application (In Value %)

4.3.1. Crop Farming

4.3.2. Livestock

4.3.3. Aquaculture

4.3.4. Horticulture

4.4. By Distribution Channel (In Value %)

4.4.1. Retail

4.4.2. Online

4.4.3. Direct Sales

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Agriculture Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Astra Agro Lestari Tbk

5.1.2. PT Sampoerna Agro Tbk

5.1.3. PT BISI International Tbk

5.1.4. PT SMART Tbk

5.1.5. PT Indofood Sukses Makmur Tbk

5.1.6. PT PP London Sumatra Indonesia Tbk

5.1.7. Japfa Comfeed Indonesia Tbk

5.1.8. PT Sawit Sumbermas Sarana Tbk

5.1.9. PT Charoen Pokphand Indonesia Tbk

5.1.10. Wilmar International Ltd

5.1.11. Musim Mas Group

5.1.12. Syngenta AG (Indonesia Division)

5.1.13. BASF SE (Indonesia Division)

5.1.14. Bayer CropScience (Indonesia Division)

5.1.15. DuPont de Nemours Inc. (Indonesia Division)

5.2. Cross Comparison Parameters (Revenue, Market Presence, Product Range, Distribution Network, R&D Investment, Customer Base, Sustainability Initiatives, Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Agriculture Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Agriculture Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Agriculture Market Segmentation

8.1. By Crop Type (In Value %)

8.2. By Equipment Type (In Value %)

8.3. By Application (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

9. Indonesia Agriculture Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with mapping all stakeholders in the Indonesia Agriculture Market ecosystem. This step includes comprehensive desk research and data extraction from secondary and proprietary databases to identify critical variables affecting the market.

Step 2: Market Analysis and Construction

In this phase, historical data is gathered to analyze the market penetration of agricultural equipment, crop production rates, and the revenue flow generated within the sector. This step is essential for constructing a detailed overview of the market dynamics and understanding the factors affecting revenue generation.

Step 3: Hypothesis Validation and Expert Consultation

Research hypotheses are developed and validated through consultations with industry experts. These interviews provide operational insights and key financial indicators, contributing to a more accurate and realistic understanding of the market.

Step 4: Research Synthesis and Final Output

This phase involves finalizing insights through direct engagement with top agricultural producers, aiming to verify statistical findings and strengthen market projections. This ensures a well-rounded and validated report output, beneficial for stakeholders.

Frequently Asked Questions

1. How big is the Indonesia Agriculture Market?

The Indonesia Agriculture Market is valued at USD 161 billion, based on a five-year historical analysis. This market is primarily driven by the rising demand for sustainable and organic food products, supported by technological advancements in precision farming and favorable government policies.

2. What are the main challenges in the Indonesia Agriculture Market?

The primary challenges include climate dependency, limited access to financing for smallholders, and infrastructure limitations in remote regions, which collectively restrict the sector's potential.

3. Who are the major players in the Indonesia Agriculture Market?

Key players include PT Astra Agro Lestari, PT Indofood Sukses Makmur, and Wilmar International, with each company holding significant market influence due to their robust infrastructure, technological investment, and market reach.

4. What are the growth drivers of the Indonesia Agriculture Market?

Major growth drivers are government subsidies, advancements in precision farming, and increasing export demand for commodities like palm oil and coffee, which collectively boost the agricultural sector's performance.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.