Indonesia Amino Acid Fertilizer Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3937

December 2024

93

About the Report

Indonesia Amino Acid Fertilizer Market Overview

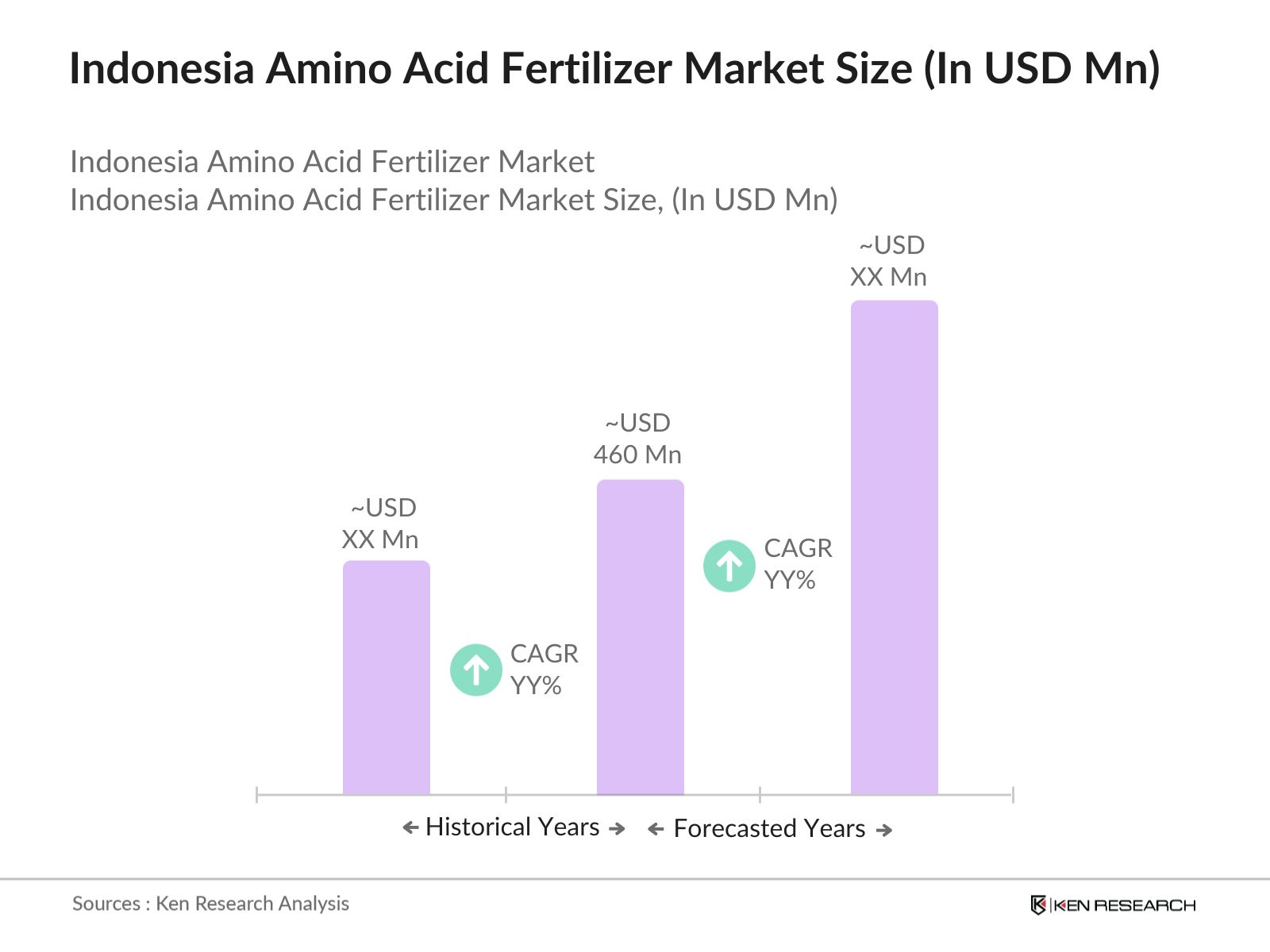

- The Indonesia Amino Acid Fertilizer market is valued at USD 460 million, driven by a growing emphasis on sustainable farming practices and the increasing demand for organic crop solutions. The market benefits from Indonesia's vast agricultural sector, with high demand from rice, corn, and palm oil farmers who seek enhanced productivity and soil health.

- Cities like Jakarta and Surabaya dominate due to their strategic locations, established agricultural trade networks, and advanced infrastructure, which support distribution and access to fertilizers. Additionally, regions like Java and Sumatra benefit from their fertile lands and government initiatives promoting sustainable agriculture, making these areas consumers within the market.

- The Indonesian government allocated IDR 45 trillion to the National Fertilizer Subsidy Program in 2024, supporting fertilizers that enhance crop yields. Although this program primarily covers conventional fertilizers, there is a gradual shift toward expanding subsidies to include amino acid fertilizers to promote sustainable agriculture. This inclusion, expected by 2025, aims to make amino acid fertilizers more accessible to a larger segment of the farming population.

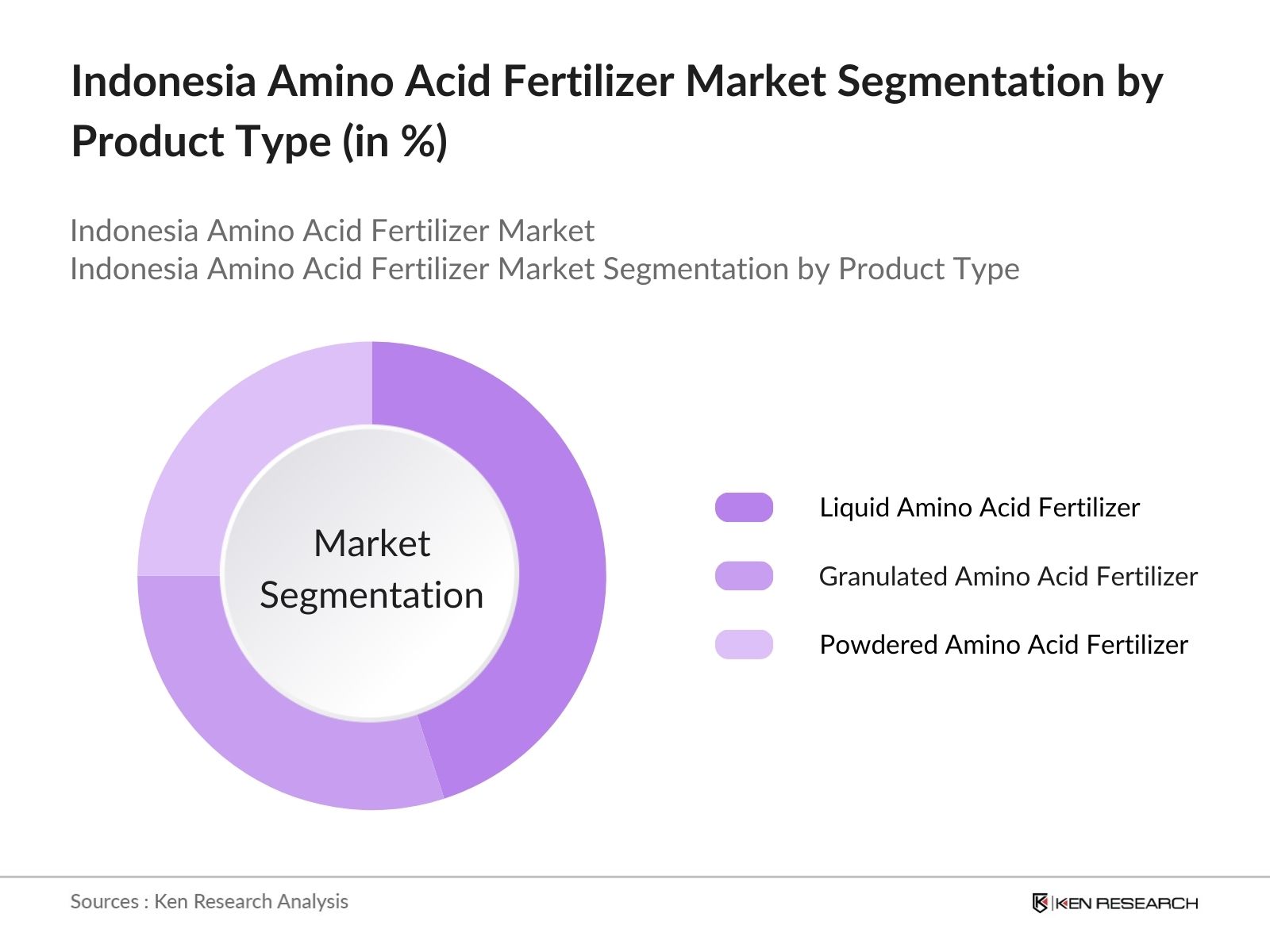

Indonesia Amino Acid Fertilizer Market Segmentation

By Product Type: The market is segmented by product type into Liquid Amino Acid Fertilizer, Granulated Amino Acid Fertilizer, and Powdered Amino Acid Fertilizer. Liquid Amino Acid Fertilizer holds a dominant market share, as it offers easy application and quick absorption by crops, making it highly preferred by farmers seeking immediate results. This format is especially advantageous for high-value crops, where nutrient absorption efficiency is crucial.

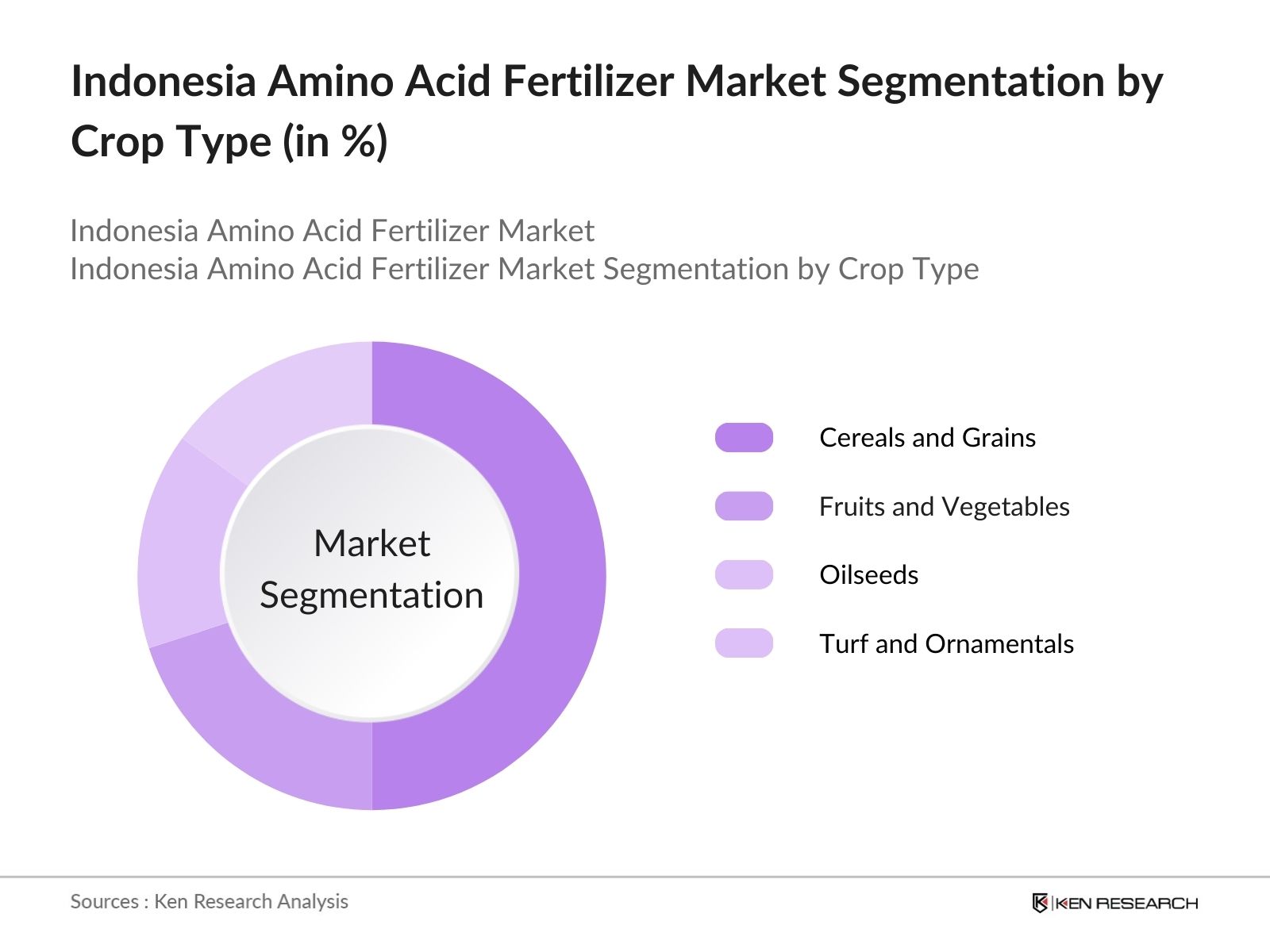

By Crop Type: The market is segmented by crop type into Cereals and Grains, Fruits and Vegetables, Oilseeds, and Turf and Ornamentals. Cereals and Grains dominate this segment, as they are staple crops in Indonesia and require nutrient supplementation to meet high productivity demands. Amino acid fertilizers play a crucial role in supporting consistent growth, yield, and resilience of these crops, especially in nutrient-depleted soils.

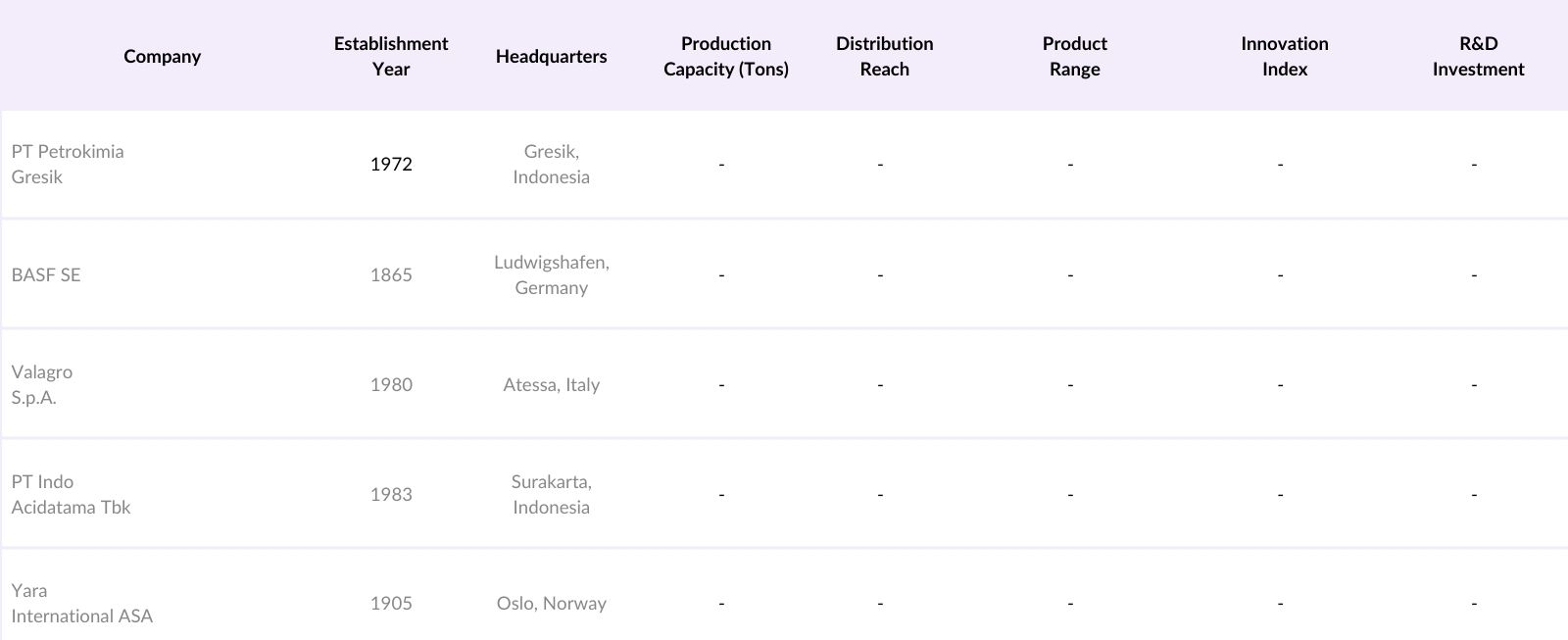

Indonesia Amino Acid Fertilizer Market Competitive Landscape

The market is dominated by a mix of domestic and international players who have established themselves through strategic investments, partnerships, and product innovations. Key companies leverage their extensive distribution networks and technical expertise to gain a competitive edge in the market.

Indonesia Amino Acid Fertilizer Market Analysis

Market Growth Drivers

- Increased Agricultural Production Demand: The demand for amino acid fertilizers in Indonesia is primarily driven by the rising agricultural production, particularly in high-demand crops such as rice and palm oil. In 2024, Indonesia's rice production exceeded 54 million metric tons, while palm oil production reached around 47 million metric tons, requiring high nutrient inputs to meet quality standards. Amino acid fertilizers, rich in essential nutrients, have proven to improve yield and quality.

- Shift Towards Organic Farming: With Indonesia's organic farming sector expanding by over 250,000 hectares in 2024, the demand for organic-compatible amino acid fertilizers has surged. The Indonesian Ministry of Agriculture supports this growth with funding programs for farmers transitioning to organic practices. Amino acid fertilizers, derived from natural sources and free from synthetic additives, meet the organic standards necessary for certification, aligning with consumer demand for sustainably produced food.

- Increase in Crop-Specific Fertilizer Use: Farmers are shifting towards crop-specific fertilizers to maximize crop yield and quality, boosting amino acid fertilizer usage. In 2024, the Indonesian government allocated IDR 5 trillion for subsidies encouraging crop-specific fertilization methods in high-value crops like coffee, cocoa, and spices. This targeted approach supports amino acid fertilizers as they deliver specialized nutrition tailored to each crops requirements, enhancing production outcomes for diverse agricultural products in Indonesia.

Market Challenges

- Limited Awareness Among Farmers: Despite their benefits, awareness about amino acid fertilizers is low among small-scale farmers in rural areas. In 2024, over 60% of Indonesian farmers reported limited knowledge about nutrient-specific fertilizers, which hampers widespread adoption. The Ministry of Agriculture has been running educational programs, but coverage is limited to urban and semi-urban areas, leaving a large portion of the rural farming community underinformed.

- Climate-Related Supply Chain Disruptions: Indonesias frequent natural disasters, including floods and landslides, disrupt the supply chain for agricultural inputs. In 2024, supply chain delays increased fertilizer costs by 15% across affected regions, limiting timely access to amino acid fertilizers, which are essential for crop productivity during critical growing periods. Such disruptions can lead to yield losses and discourage farmers from investing in high-quality fertilizers.

Indonesia Amino Acid Fertilizer Market Future Outlook

Over the next five years, the Indonesia Amino Acid Fertilizer industry is projected to experience substantial growth, driven by increasing governmental support for sustainable agriculture, innovations in amino acid technology, and growing awareness among farmers regarding organic alternatives.

Future Market Opportunities

- Increased Adoption of Precision Agriculture: Over the next five years, precision agriculture technology is projected to expand, with an expected investment growth of IDR 15 trillion by 2028. Amino acid fertilizers will see a rise in usage as precision agriculture adoption grows, providing farmers with accurate nutrient recommendations that improve crop yield and efficiency.

- Rise in Demand for Sustainable Fertilizers: With an estimated 30% of Indonesian consumers actively seeking organic products by 2028, the demand for amino acid fertilizers will increase as farmers shift toward organic and sustainable practices. The Indonesian governments policies promoting organic farming will further support this trend, encouraging higher adoption of amino acid fertilizers that meet organic standards.

Scope of the Report

|

Product Type |

Liquid Amino Acid Fertilizer Granulated Amino Acid Fertilizer Powdered Amino Acid Fertilizer |

|

Crop Type |

Cereals and Grains Fruits and Vegetables Oilseeds Turf and Ornamentals |

|

Application |

Foliar Application Soil Application Seed Treatment |

|

Distribution Channel |

Direct Sales Retail Distributors Online Sales |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Large Agricultural Corporations

Amino Acid Fertilizer Distributors

Government and Regulatory Bodies (e.g., Ministry of Agriculture, Indonesia)

Local Farmers' Associations

Agricultural Biotech Companies

Investor and Venture Capitalist Firms

Environmental NGOs

Fertilizer Manufacturers

Companies

Players Mentioned in the Report:

PT Petrokimia Gresik

BASF SE

Valagro S.p.A.

PT Indo Acidatama Tbk

Yara International ASA

Grow More Inc.

Shandong Lvfeng Fertilizer Co., Ltd.

Amino Chem Co. Ltd.

Haifa Group

Qingdao Sonef Chemical Co., Ltd.

Table of Contents

1. Indonesia Amino Acid Fertilizer Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Amino Acid Fertilizer Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Amino Acid Fertilizer Market Analysis

3.1 Growth Drivers

3.1.1 Agricultural Sector Expansion

3.1.2 Government Support for Sustainable Farming

3.1.3 Rising Demand for Organic Crop Enhancement

3.1.4 Consumer Shift Toward Organic Products

3.2 Market Challenges

3.2.1 High Production Costs

3.2.2 Limited Awareness in Small-Scale Farms

3.2.3 Challenges in Raw Material Procurement

3.3 Opportunities

3.3.1 Adoption of Precision Agriculture

3.3.2 Partnerships with Agro-Biotech Firms

3.3.3 Expansion in Untapped Rural Regions

3.4 Trends

3.4.1 Increasing Use of Bio-Based Fertilizers

3.4.2 Integration of Digital Farming Solutions

3.4.3 Customized Fertilizer Formulations

3.5 Government Regulations

3.5.1 National Organic Farming Standards

3.5.2 Import and Export Compliance for Fertilizers

3.5.3 Sustainable Agriculture Programs

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Analysis

4. Indonesia Amino Acid Fertilizer Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Liquid Amino Acid Fertilizer

4.1.2 Granulated Amino Acid Fertilizer

4.1.3 Powdered Amino Acid Fertilizer

4.2 By Crop Type (In Value %)

4.2.1 Cereals and Grains

4.2.2 Fruits and Vegetables

4.2.3 Oilseeds

4.2.4 Turf and Ornamentals

4.3 By Application (In Value %)

4.3.1 Foliar Application

4.3.2 Soil Application

4.3.3 Seed Treatment

4.4 By Distribution Channel (In Value %)

4.4.1 Direct Sales

4.4.2 Retail Distributors

4.4.3 Online Sales

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Amino Acid Fertilizer Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 PT Petrokimia Gresik

5.1.2 PT Pupuk Indonesia

5.1.3 Gavita Fertilizer Industries

5.1.4 Shandong Lvfeng Fertilizer Co., Ltd.

5.1.5 Grow More Inc.

5.1.6 PT Indo Acidatama Tbk

5.1.7 BASF SE

5.1.8 Valagro S.p.A.

5.1.9 Yara International ASA

5.1.10 Amino Chem Co. Ltd.

5.1.11 Haifa Group

5.1.12 Qingdao Sonef Chemical Co., Ltd.

5.1.13 Nutra Green Biotechnology Co., Ltd.

5.1.14 ICL Fertilizers

5.1.15 Omnia Specialities Ltd.

5.2 Cross Comparison Parameters (Market Share, Revenue, Product Portfolio, Global Presence, Innovation Index, Sales Channel, Customer Base, Strategic Partnerships)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Private Equity and Venture Capital Funding

6. Indonesia Amino Acid Fertilizer Market Regulatory Framework

6.1 Agricultural Standards for Fertilizers

6.2 Compliance with National Organic Certification

6.3 Import Tariffs and Restrictions

6.4 Labeling and Safety Requirements

7. Indonesia Amino Acid Fertilizer Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Amino Acid Fertilizer Future Market Segmentation

8.1 By Product Type (In Value %)

8.2 By Crop Type (In Value %)

8.3 By Application (In Value %)

8.4 By Distribution Channel (In Value %)

8.5 By Region (In Value %)

9. Indonesia Amino Acid Fertilizer Market Analysts Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Customer Segmentation and Demand Analysis

9.3 Strategic Marketing Insights

9.4 White Space Identification in Product Lines

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involves mapping out the industry ecosystem in Indonesia, identifying primary stakeholders and influencers in the amino acid fertilizer market. This process includes thorough desk research across secondary data sources to pinpoint key variables impacting market growth.

Step 2: Market Analysis and Construction

In this phase, historical data on the amino acid fertilizer market is compiled, focusing on sales volume, geographic distribution, and application types. Analysis includes comparing regional sales to estimate market penetration and developing a model to estimate revenue generation across segments.

Step 3: Hypothesis Validation and Expert Consultation

To validate assumptions, interviews with industry experts are conducted to verify the collected data, refine market insights, and corroborate key trends. These insights provide operational perspectives and allow us to adjust estimates as needed.

Step 4: Research Synthesis and Final Output

The final phase synthesizes data from direct company consultations, market analytics, and additional field data to ensure accuracy. The data undergoes further validation through a combination of top-down and bottom-up approaches, yielding a comprehensive view of the Indonesia Amino Acid Fertilizer market.

Frequently Asked Questions

01. How big is the Indonesia Amino Acid Fertilizer Market?

The Indonesia Amino Acid Fertilizer market is valued at USD 460 million, driven by the country's robust agricultural sector and rising adoption of organic farming practices.

02. What are the main challenges in the Indonesia Amino Acid Fertilizer Market?

Challenges in the Indonesia Amino Acid Fertilizer market include high production costs and limited awareness among small-scale farmers, which restrict market growth, especially in rural regions with less access to premium fertilizers.

03. Who are the major players in the Indonesia Amino Acid Fertilizer Market?

Key players in the Indonesia Amino Acid Fertilizer market include PT Petrokimia Gresik, BASF SE, Valagro S.p.A., PT Indo Acidatama Tbk, and Yara International ASA, who dominate through extensive networks and technical expertise.

04. What drives the Indonesia Amino Acid Fertilizer Market growth?

Growth in the Indonesia Amino Acid Fertilizer market is fueled by an increasing preference for sustainable and organic farming methods, government incentives, and technological advancements in bio-based fertilizer formulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.