Indonesia App Industry Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD2172

December 2024

87

About the Report

Indonesia App Industry Market Overview

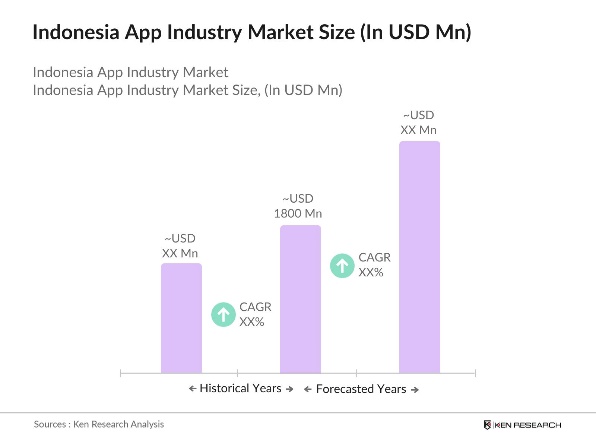

- In 2023, the Indonesia app industry was valued at USD 1,800 million, driven primarily by the increasing penetration of smartphones and affordable data services. The country has experienced rapid app development, particularly in e-commerce, gaming, and fintech sectors. The surge in the digital economy, paired with a young, tech-savvy population, has pushed demand for various mobile applications.

- The Indonesian app market is dominated by key players such as Gojek, Tokopedia, Bukalapak, and Traveloka. These companies have achieved significant user bases, leveraging local market knowledge to address consumer needs. Gojek, for instance, with over 190 million users, continues to lead the super-app market, while Tokopedia is a leader in the e-commerce app space. Other prominent players include international giants like Grab, which has made significant inroads in the region through localized offerings.

- Indonesia government has planned to launch nine superapps by 2024. These superapps aim to integrate public services like healthcare, education, and social assistance under a unified platform. The initiative is part of Indonesia's digital transformation strategy, which seeks to improve accessibility to public services and streamline government operations through digital means. The move is designed to enhance efficiency and ensure citizens have easier access to essential services via mobile platforms.

- Jakarta, Bandung, and Surabaya dominate the app market due to their high population density and advanced digital infrastructure. Jakarta, the capital city, is a hub for tech startups and digital innovation in 2023. The city's tech ecosystem is bolstered by strong venture capital investment, government support, and a growing user base, making it the prime market for app development and usage.

Indonesia App Industry Market Segmentation

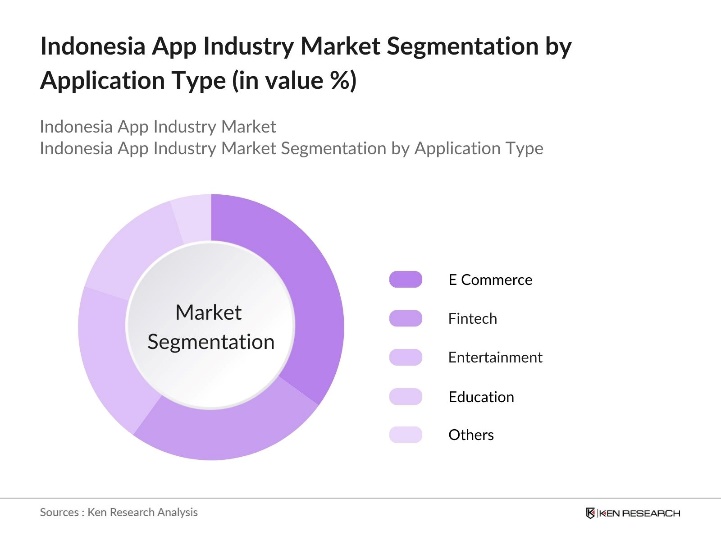

By Application Type: The Indonesian app industry is segmented by application type into e-commerce, fintech, entertainment, and education. In 2023, e-commerce apps held a dominant share due to Indonesia's rapidly growing digital retail space, with platforms like Tokopedia and Bukalapak leading the market. The surge in online shopping, coupled with improved logistics and payment solutions, has solidified the dominance of e-commerce apps. This growth is further amplified by consumer demand for convenience and the rise of small businesses going online post-pandemic.

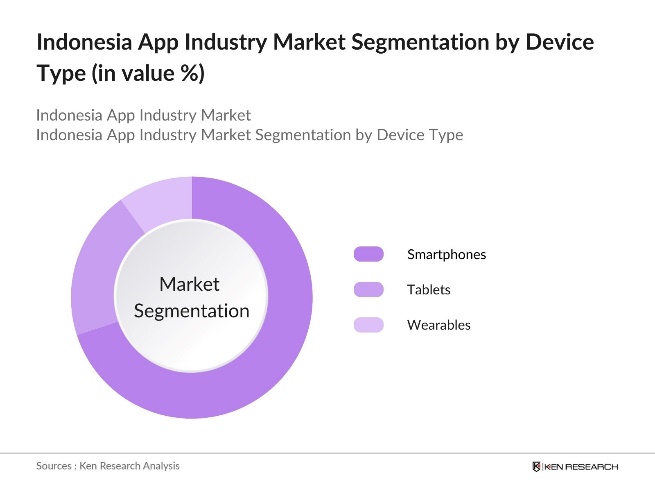

By Device Type: The market is also segmented by device type, including smartphones, tablets, and wearable devices. Smartphones dominated the market with a share in 2023, driven by the widespread use of affordable Android devices. The high smartphone penetration, combined with Indonesias mobile-first culture, encourages app developers to focus on optimizing for mobile platforms.

By Region: The market is segmented by region into North, South, East, and West Indonesia. In 2023, West Indonesia led the market share, driven by its advanced infrastructure and high population density. The region is the country's economic center and home to a large percentage of internet users, making it the key hub for app development and adoption. Additionally, the availability of better ICT infrastructure in these regions facilitates faster growth compared to other areas.

Indonesia App Industry Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|---|---|---|

|

Gojek |

2010 |

Jakarta |

|

Tokopedia |

2009 |

Jakarta |

|

Traveloka |

2012 |

Jakarta |

|

Bukalapak |

2010 |

Jakarta |

|

Grab Indonesia |

2012 |

Jakarta |

- Grab Indonesia: Grab's commitment to invest USD 700 million through its "Grab 4 Indonesia" master plan. This initiative aims to accelerate Indonesia's digital economy by focusing on developing local technology talent, investing in technopreneurship for social good, and expanding mobile payment services. The plan includes the establishment of an R&D center in Jakarta and support for financial inclusion through GrabPay and other digital services.

- Bukalapak: Bukalapak's partnership with YouAppi has driven user acquisition and purchase rates. In the first six months of their campaign, Bukalapak achieved a 205% increase in purchase rates and a top ranking in the Indonesian Google Play Store. This collaboration helped Bukalapak to expand its global reach while maintaining customer acquisition costs within target levels.

Indonesia App Industry Market Analysis

Growth Drivers

- Increased Smartphone Penetration: With smartphone usage surpassing 80% of Indonesia's population, app usage across various sectors like e-commerce, fintech, and entertainment has seen rapid growth. The widespread adoption of affordable smartphones and internet access is driving increased demand for mobile applications, transforming how Indonesians interact with businesses and services. This expansion is reshaping the digital economy by fueling the development of innovative mobile apps tailored to the diverse needs of consumers across the nation.

- Booming Digital Payment Ecosystem: A significant growth driver for the Indonesia app industry market is the rapid rise in digital payments, facilitated by the widespread adoption of the Quick Response Indonesian Standard (QRIS). By 2023, QR payments had surged, with 22.4 million registered merchants and further expansion expected. This growth in digital payments, driven by government-backed interoperability of payment systems, is enabling broader app usage in sectors like e-commerce and financial services across the country.

- Rising Middle-Class Consumption: Indonesias growing middle class, expected to exceed 150 million by 2024, has driven significant demand for consumer apps, particularly in retail, entertainment, and food delivery sectors. This demographic has increasingly turned to mobile apps for shopping, entertainment, and services. The expanding purchasing power of this segment is encouraging businesses to develop apps targeting convenience and luxury consumption, further propelling the growth of Indonesia's app industry.

Challenges

- Infrastructure Gaps in Rural Areas: Despite Indonesia's rapid digitalization, uneven internet infrastructure remains a critical challenge. This digital divide hampers growth opportunities for developers targeting rural consumers, where internet penetration lags behind urban centers. Government efforts, such as the Palapa Ring project aimed at connecting underserved regions, are in progress, but the slow pace of infrastructure deployment remains a key barrier.

- Data Privacy and Cybersecurity Concerns: With the increasing use of apps handling sensitive data, cybersecurity and data privacy have become major concerns in Indonesias app market. Indonesias Personal Data Protection Act (PDP) passed in 2022 mandates stricter data privacy regulations, but compliance challenges remain for many app developers. The rising frequency of cyber threats poses a growing challenge for the industry, necessitating investment in secure infrastructure and compliance mechanisms.

Government Initiatives

- Government to integrate government apps: Indonesian Government has planned to integrate 27,000 government apps into a unified platform, INA Digital. This consolidation aims to streamline public services and improve digital governance by reducing redundancy and enhancing service delivery. Launched in 2024, the initiative is expected to bring together services from at least 15 ministries, with significant cost savings and operational efficiency benefits for citizens and government agencies.

- 100 Smart Cities Program: A recent government initiative in the Indonesia app industry is the launch of the "100 Smart Cities" program, which aims to accelerate digitalization across the country. The initiative focuses on integrating digital public services, enhancing app-based solutions for transportation, healthcare, and governance, and improving ICT infrastructure to support mobile app development and usage in urban areas.

Indonesia Apps Industry Future Outlook

The Indonesia Apps Industry is projected to grow exponentially in the next 5 years. This growth will be driven by increased smartphone penetration, booming digital payment ecosystem and rising middle-class consumption.

Market Trends

- Growth of AI-Powered Apps: Indonesian app developers are increasingly leveraging AI and machine learning to enhance user experiences, personalize content, and optimize app functionalities. This shift towards AI-driven solutions is expected to drive innovation, improve competitiveness, and open new opportunities in sectors like finance, e-commerce, and healthcare within the app market.

- Expansion of 5G Networks: A future trend in Indonesias app industry will be driven by the rollout of 5G technology, which is expected to greatly improve mobile connectivity and app efficiency. By 2028, the region, including Southeast Asia and Oceania, is projected to have 620 million 5G subscriptions. This will spur growth in sectors such as gaming, fintech, and e-commerce, offering faster data speeds and lower latency for app-based services.

Scope of the Report

|

By Application |

E-commerce Fintech Entertainment Education Others |

|

By Device Type |

Smartphones Tablets Wearables |

|

By Region |

North South East West |

Products

Key Target Audience

App Developers and Software Companies

E-commerce Companies

Fintech Companies

Mobile Device Manufacturers

Digital Payment Providers

Telecommunication Companies

Cloud Service Providers

Healthcare Service Providers

Logistics and Delivery Companies

Advertising and Marketing Agencies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Indonesian Ministry of Communication and Information Technology)

Companies

Players Mentioned in the Report:

Gojek

Tokopedia

Bukalapak

Traveloka

Grab Indonesia

OVO

Dana

LinkAja

Shopee

Lazada

Blibli

Halodoc

Zenius

Ruangguru

Akulaku

Table of Contents

1. Indonesia App Industry Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Size (In USD)

1.4. Market Growth Rate (CAGR)

1.5. Key Market Developments and Milestones

2. Indonesia App Industry Market Size Analysis

2.1. Historical Market Size (In USD)

2.2. Year-on-Year Growth Analysis

2.3. App Download and Usage Trends

3. Indonesia App Industry Market Dynamics

3.1. Growth Drivers

3.1.1. Increased smartphone and internet penetration

3.1.2. Booming digital payment ecosystem

3.1.3. Growing e-commerce and m-commerce sectors

3.2. Challenges

3.2.1. Data privacy and cybersecurity concerns

3.2.2. Fragmented market with local vs international competition

3.2.3. Regulatory hurdles related to foreign investment and data localization

3.3. Opportunities

3.3.1. Expansion into underbanked regions with fintech apps

3.3.2. Increasing adoption of EdTech apps

3.3.3. Development of super apps integrating multiple services (ride-hailing, e-wallets, etc.)

3.4. Trends

3.4.1. Rise of artificial intelligence (AI) and machine learning (ML) in app development

3.4.2. Growing adoption of fintech apps in micro-lending and peer-to-peer payments

3.4.3. Surge in digital health and telemedicine apps post-pandemic

4. Indonesia App Industry Market Segmentation

4.1. By Application Type (In Value %)

4.1.1. E-commerce

4.1.2. Fintech

4.1.3. Gaming

4.1.4. Education

4.1.5. Others (healthcare, fitness, etc.)

4.2. By Device Type (In Value %)

4.2.1. Smartphones

4.2.2. Tablets

4.2.3. Wearables

4.3. By Revenue Model (In Value %)

4.3.1. Freemium apps

4.3.2. Subscription-based apps

4.3.3. Ad-supported apps

4.3.4. In-app purchases

4.4. By Platform Type (In Value %)

4.4.1. Android

4.4.2. iOS

4.4.3. Hybrid and web apps

4.5. By Region (In Value %)

4.5.1. West Indonesia (Jakarta, Java, etc.)

4.5.2. East Indonesia

4.5.3. North Indonesia

4.5.4. South Indonesia

5. Indonesia App Industry Competitive Landscape

5.1. Competitive Analysis

5.2. Detailed Profiles of Major Competitors

5.3. Cross Comparison Parameters

5.4. Strategic Initiatives by Key Players

6. Government Regulations and Policies

6.1. Digital Payment and Data Privacy Regulations

6.2. Foreign Investment Restrictions in Digital Services

6.3. Government Initiatives Promoting Digitalization

6.3.1. 100 Smart Cities Initiative

6.3.2. National Payment Gateway

6.3.3. Digital Talent Scholarship Program

7. Indonesia App Industry Market Growth Forecast

7.1. Market Size Forecast (In USD)

7.2. Key Growth Drivers in Forecast Period

7.2.1 Proliferation of 5G networks

7.2.2 Expansion of mobile broadband to rural areas

7.2.3 Rising adoption of AI and blockchain technology in app development

7.3. Future Market Trends

7.3.1. Growth of decentralized apps (dApps)

7.3.2. Integration of AI-powered personalization in consumer apps

7.3.3. Expansion of super apps beyond ride-hailing and food delivery

8. Indonesia App Industry Financial Analysis

8.1. Revenue Breakdown by App Category

8.2. Operational KPIs

8.3. Financial Performance of Key Players

9. Investment Landscape and M&A Activity

9.1. Venture Capital and Private Equity Investments

9.2. Mergers and Acquisitions

9.3. Government and Private Sector Funding Programs

10. SWOT Analysis for Indonesia App Industry

10.1. Strengths

10.2. Weaknesses

10.3. Opportunities

10.4. Threats

11. Indonesia App Industry Future Segmentation (2028)

11.1. By Application Type

11.2. By Device Type

11.3. By Revenue Model

11.4. By Platform Type

11.5. By Region

12. Analyst Recommendations

12.1. Key Success Factors

12.2. TAM/SAM/SOM Analysis

12.3. Recommendations for New Entrants

12.4. Marketing and Expansion Strategies

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase focuses on mapping key stakeholders and identifying influential variables within the Indonesia app industry. This step utilizes desk research, drawing from proprietary and secondary databases to establish a comprehensive understanding of market dynamics.

Step 2: Market Analysis and Construction

This phase involves compiling and analyzing historical data on the Indonesia app industry, including assessing app usage across various end-use industries. Additionally, service quality metrics are reviewed to ensure reliable revenue estimations.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are developed and validated through industry expert interviews, which provide insights into operational and technological trends. These consultations reinforce market data accuracy and align findings with real-world applications.

Step 4: Research Synthesis and Final Output

The concluding phase engages directly with industry stakeholders to verify and supplement bottom-up data, ensuring a validated, comprehensive analysis of the Indonesia app industry. This step synthesizes data from all phases, resulting in a precise market report.

Frequently Asked Questions

1. How big is Indonesia app industry market?

The Indonesia app industry market was valued at USD 1,800 million in 2023. This growth is driven by the increasing penetration of smartphones, widespread internet access, and the rise of digital payment systems, which have boosted app usage across multiple sectors.

2. What are the challenges in Indonesia app industry market?

Challenges in the Indonesia app industry market include fragmented digital infrastructure in rural areas, data privacy concerns, and regulatory hurdles related to foreign investment. Cybersecurity threats also remain a critical issue for app developers and users alike.

3. Who are the major players in the Indonesia app industry market?

Key players in the Indonesia app industry market include Gojek, Tokopedia, Bukalapak, Traveloka, and Grab Indonesia. These companies lead the market with their extensive user bases, innovative app ecosystems, and diverse service offerings.

4. What are the growth drivers of Indonesia app industry market?

The growth of the Indonesia app industry market is driven by increased smartphone penetration, booming digital payment ecosystem and rising middle-Class consumption. Government initiatives promoting digitalization are also contributing to the markets expansion.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.