Indonesia Application Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD2623

November 2024

82

About the Report

Indonesia Application Market Overview

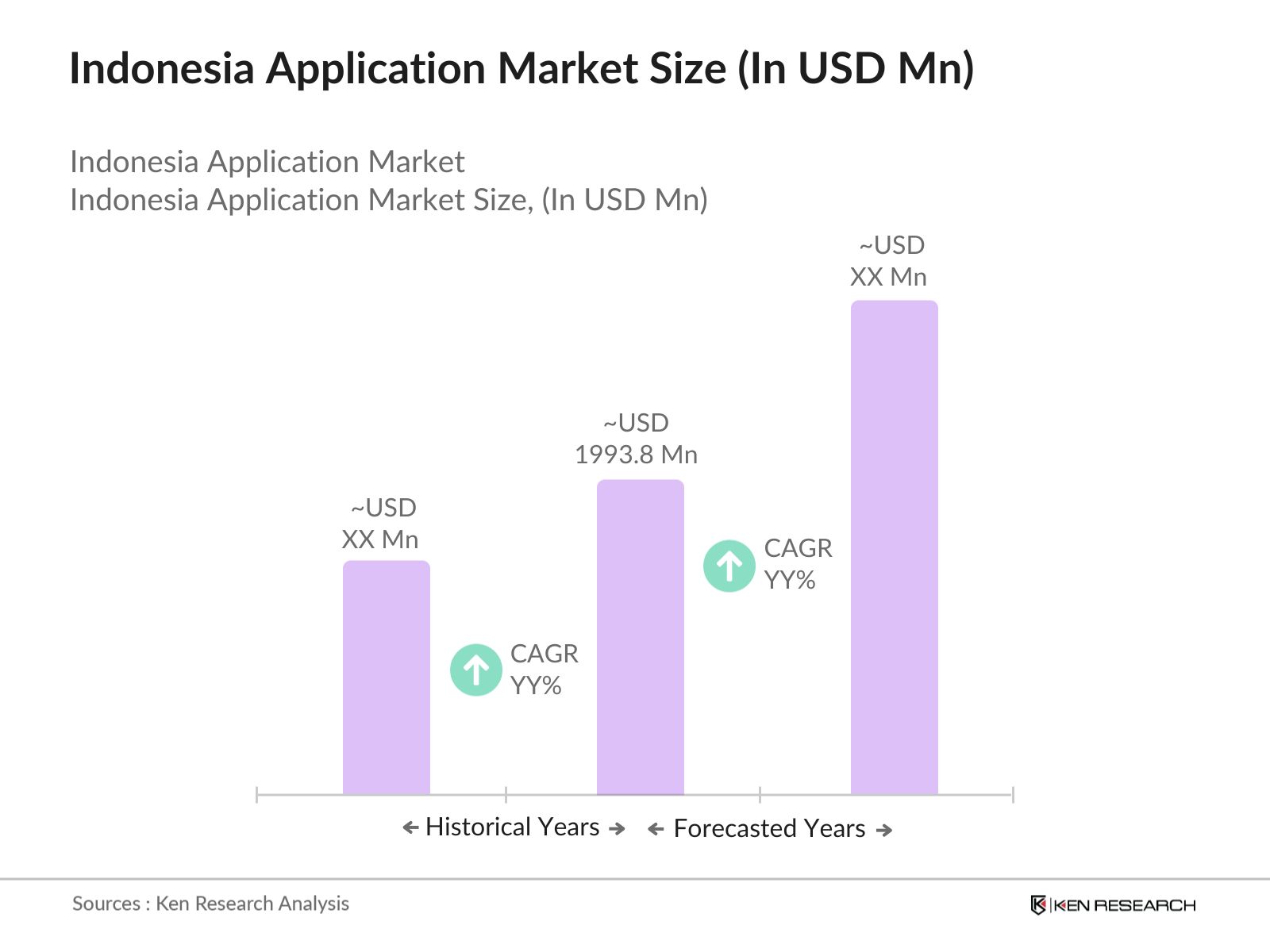

- The Indonesia Application Market is valued at USD 1993.8 million, driven by the increasing penetration of smartphones, growing demand for mobile-based services, and government-backed initiatives for digital transformation. This market is further supported by the growth of e-commerce, fintech applications, and the adoption of cloud-based services across industries.

- Key players in the Indonesia Application Market include GoTo, Telkom Indonesia, XL Axiata, Gojek, and Traveloka. These companies are capitalizing on the growing consumer preference for mobile applications in sectors such as banking, retail, and entertainment.

- Telkom Indonesia has partnered with F5 to enhance its cybersecurity services amid rising cyber threats. This collaboration aims to protect digital applications as Indonesia's digital transactions, valued at $77 billion in 2022, are projected to double by 2025.

- Jakarta leads the market, driven by the high concentration of tech companies, infrastructure, and consumer demand for mobile services.

Indonesia Application Market Segmentation

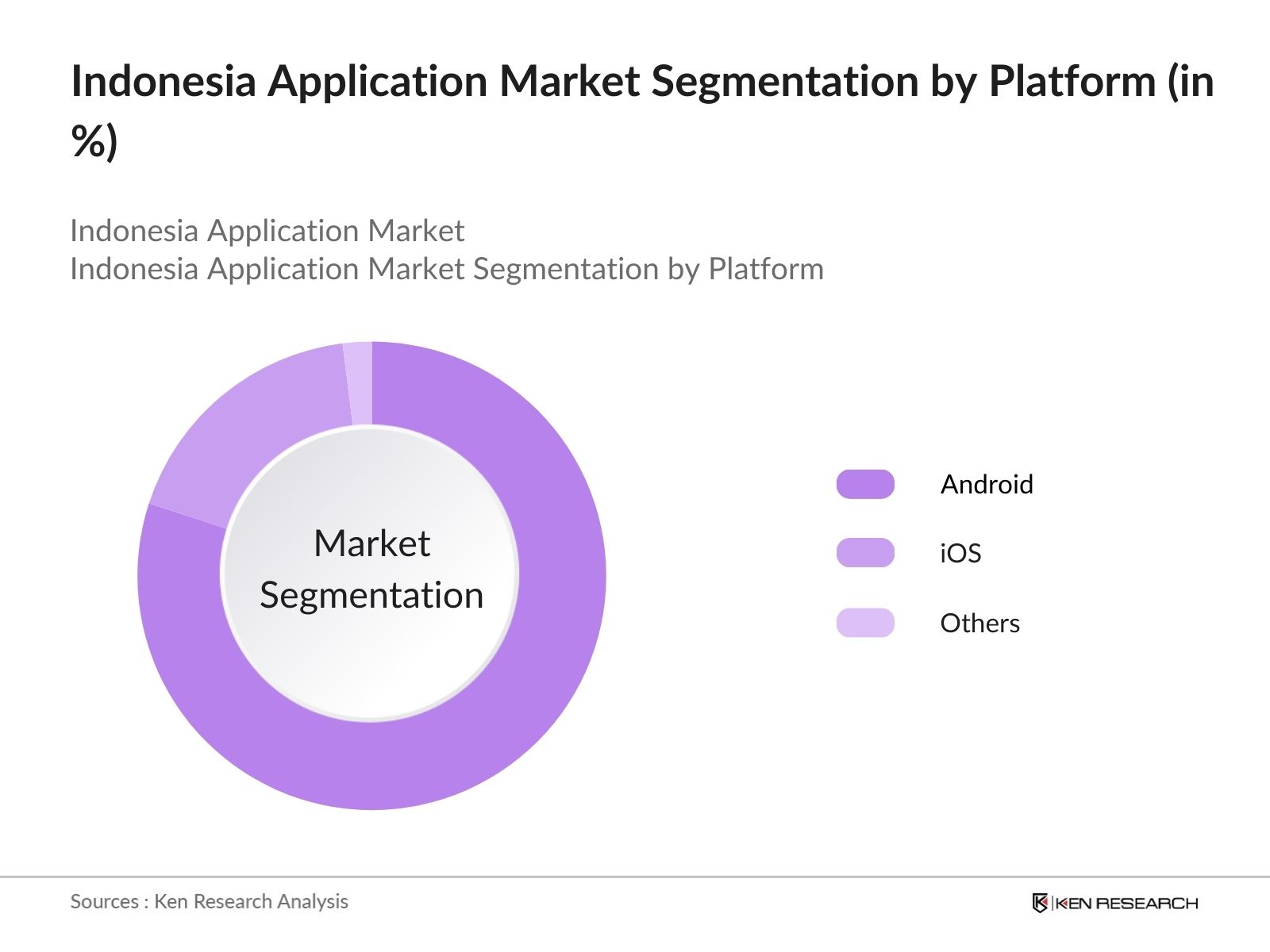

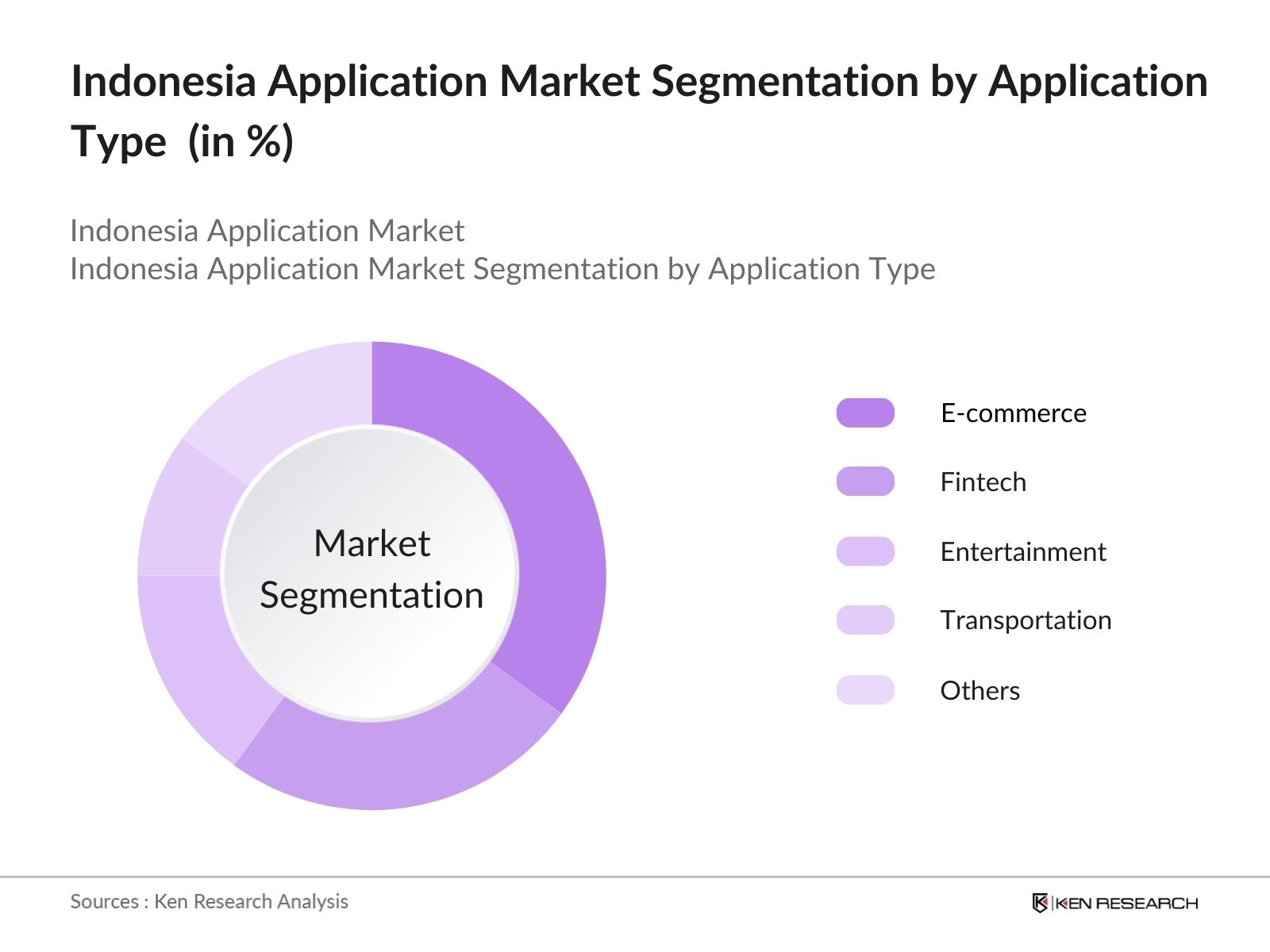

The Indonesia Application Market is segmented by platform, application type, and region.

- By Platform: The market is segmented into Android, iOS, and others. Android dominated the market in 2023 due to its widespread adoption among Indonesia's large and diverse population.

- By Application Type: The market is segmented into e-commerce, fintech, entertainment, transportation, and others (education, healthcare). E-commerce applications held the largest market share, driven by the shift toward online shopping and digital payments.

- By Region: The market is segmented into North, South, East, and West Indonesia. West Indonesia, especially Jakarta, led the market due to its advanced digital infrastructure and urban concentration.

Indonesia Application Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

GoTo |

2021 |

Jakarta, Indonesia |

|

Telkom Indonesia |

1965 |

Jakarta, Indonesia |

|

XL Axiata |

1989 |

Jakarta, Indonesia |

|

Gojek |

2010 |

Jakarta, Indonesia |

|

Traveloka |

2012 |

Jakarta, Indonesia |

- GoTo: PT GoTo Gojek Tokopedia Tbk has launched "Dira by GoTo AI," an AI voice assistant on the GoPay app, enhancing user experience by enabling voice commands in Bahasa Indonesia. This innovation aims to simplify tasks for Indonesia's 97 million unbanked adults, ensuring accessibility across all mobile devices.

- Gojek: Gojek has expanded its services to Binh Duong and Dong Nai provinces, allowing residents access to transportation (GoRide, GoCar), food delivery (GoFood), and courier services (GoSend). This growth connects over 200,000 driver partners and thousands of merchants, enhancing local economic opportunities.

Indonesia Application Market Analysis

Indonesia Application Market Growth Drivers:

- Smartphone Penetration: In 2022, 80% of Indonesia's population owned smartphones, translating to over 212 million users accessing the internet via mobile devices. This accessibility fosters a growing demand for mobile services, with users spending an average of 5.7 hours daily on mobile applications.

- E-commerce Growth: Online shopping platforms in Indonesia saw over 7.7 billion app downloads in 2022, reflecting the increasing reliance on mobile shopping apps. The surge in mobile transactions is evidenced by US$1.7 billion in revenue generated from mobile apps, highlighting robust consumer engagement.

- Digital Payments Expansion: Digital payment adoption in Indonesia is evident, with 93.17% of millennials using Internet services and a rise in e-wallet transactions. E-wallets like OVO and GoPay have become integral, supported by government initiatives that promote cashless transactions among the tech-savvy youth demographic.

Indonesia Application Market Challenges:

- Fragmented Infrastructure: Around 50% of Indonesia's rural population lacks reliable internet access, substantially hindering mobile app adoption outside urban centres. In contrast, urban areas have a projected internet penetration rate of 82.2% in 2024, highlighting the stark disparity in digital connectivity across regions.

- Data Privacy Concerns: Data privacy concerns are substantial in Indonesia, especially with the increasing use of apps. In 2022, over 21,000 companies experienced data breaches, highlighting vulnerabilities in data protection. Additionally, 78% of Indonesians expressed concern about the security and privacy of their data, reflecting widespread anxiety as regulations evolve.

Indonesia Application Market Government Initiatives:

- Making Indonesia 4.0: Making Indonesia 4.0" is a comprehensive initiative aimed at transforming the country's industrial landscape. The roadmap includes investments in digital infrastructure, intending to improve connectivity for 10 million+ small and medium businesses. The initiative is expected to boost Indonesia's GDP by 1-2% annually and create 7-19 million jobs by 2030.

- National Payment Gateway (GPN): The National Payment Gateway (GPN) was launched to enhance the fintech landscape in Indonesia. This initiative aims to unify payment systems, facilitating cashless transactions. In 2022, over 93% of millennials used digital payment services, demonstrating the growing reliance on fintech solutions and the need for a cohesive payment infrastructure.

Indonesia Application Future Market Outlook

The Indonesia Application Market is expected to grow over the next five years, driven by the increasing use of mobile devices, growth in fintech and e-commerce apps, and the adoption of cloud-based services.

Future Market Trends

- Fintech App Dominance: In the coming years, fintech applications will continue to dominate the Indonesian market, with a growing number of users adopting mobile wallets and payment services. As digital payment adoption becomes increasingly integrated into daily life, reliance on fintech solutions will strengthen among Indonesians.

- AI-Integrated Apps: In the coming years, the rise of AI-driven personalization in entertainment and e-commerce apps will enhance user experiences substantially. By leveraging user data for tailored content and recommendations, businesses will drive higher engagement and adoption rates, positioning AI integration as a key growth strategy.

Scope of the Report

|

By Platform |

Android iOS Others |

|

By Application Type |

E-commerce Fintech Entertainment Transportation Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Mobile Application Developers

Fintech Companies

E-commerce Platforms

Education Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Table of Contents

1. Indonesia Application Market Overview

1.1 Definition and Scope of the Indonesia Application Market

1.2 Market Taxonomy (Platform, Application Type, Region)

1.3 Market Growth Rate and Trends

1.4 Market Drivers (Smartphone Penetration, E-commerce Growth, Fintech Expansion)

1.5 Market Restraints (Fragmented Infrastructure, Data Privacy Concerns)

2. Indonesia Application Market Size (in USD Million)

2.1 Historical Market Size Analysis (2018-2023)

2.2 Year-on-Year Growth Analysis

2.3 Forecast Market Size and Growth Projections (2023-2028)

2.4 Key Market Milestones and Developments

3. Indonesia Application Market Analysis

3.1 Growth Drivers

3.1.1 Increasing Smartphone Penetration

3.1.2 E-commerce and Fintech Growth

3.1.3 Government Initiatives for Digital Transformation

3.2 Market Challenges

3.2.1 Fragmented Infrastructure in Rural Regions

3.2.2 Data Privacy and Cybersecurity Concerns

3.2.3 Regulatory Framework for Digital Payments and Data Protection

3.3 Opportunities

3.3.1 Growth in AI-Integrated Apps

3.3.2 Expansion of Fintech Services

3.4 Market Trends

3.4.1 Dominance of Android-Based Applications

3.4.2 Rise in Digital Payments and E-commerce Transactions

4. Indonesia Application Market Segmentation

4.1 By Platform (in Value %)

4.1.1 Android

4.1.2 iOS

4.1.3 Others

4.2 By Application Type (in Value %)

4.2.1 E-commerce

4.2.2 Fintech

4.2.3 Entertainment

4.2.4 Transportation

4.2.5 Others (Education, Healthcare)

4.3 By Region (in Value %)

4.3.1 North Indonesia

4.3.2 South Indonesia

4.3.3 East Indonesia

4.3.4 West Indonesia

5. Indonesia Application Competitive Landscape

5.1 Competitive Market Share Analysis

5.2 Company Profiles

5.2.1 GoTo (Established 2021, Headquarters: Jakarta, Indonesia)

5.2.2 Telkom Indonesia (Established 1965, Headquarters: Jakarta, Indonesia)

5.2.3 XL Axiata (Established 1989, Headquarters: Jakarta, Indonesia)

5.2.4 Gojek (Established 2010, Headquarters: Jakarta, Indonesia)

5.2.5 Traveloka (Established 2012, Headquarters: Jakarta, Indonesia)

5.2.6 Shopee (Established 2015, Headquarters: Singapore)

5.2.7 Bukalapak (Established 2010, Headquarters: Jakarta, Indonesia)

5.2.8 OVO (Established 2017, Headquarters: Jakarta, Indonesia)

5.2.9 Tokopedia (Established 2009, Headquarters: Jakarta, Indonesia)

5.2.10 Dana (Established 2018, Headquarters: Jakarta, Indonesia)

5.2.11 LinkAja (Established 2019, Headquarters: Jakarta, Indonesia)

5.2.12 Indosat Ooredoo (Established 1967, Headquarters: Jakarta, Indonesia)

5.2.13 Huawei Technologies (Established 1987, Headquarters: Shenzhen, China)

5.2.14 ZTE Corporation (Established 1985, Headquarters: Shenzhen, China)

5.2.15 Apple Inc. (Established 1976, Headquarters: Cupertino, California, USA)

5.3 Strategic Initiatives and Investments

5.4 Recent Mergers and Acquisitions

5.5 Technological Innovations and R&D Investments

6. Indonesia Application Market Government Regulations and Initiatives

6.1 "Making Indonesia 4.0" Initiative

6.2 National Payment Gateway (GPN) for Digital Payments

6.3 Government Support for Digital Infrastructure Development

7. Indonesia Application Market Future Market Size and Segmentation

7.1 Market Segmentation by Platform (2023-2028)

7.2 Market Segmentation by Application Type (2023-2028)

7.3 Market Segmentation by Region (2023-2028)

7.4 Future Market Trends (AI-Integrated Apps, Fintech App Growth)

8. Indonesia Application Market Technological Advancements

8.1 AI and Machine Learning in Mobile Applications

8.2 Cloud-Based Solutions for Application Development

8.3 Innovations in Digital Payment Systems

9. Indonesia Application Market Investment and Funding Landscape

9.1 Key Investments in Mobile Applications and Fintech

9.2 Mergers and Acquisitions in Indonesia's Application Market

9.3 Government Grants and Incentives for Digital Innovation

9.4 Private Equity and Venture Capital Funding in Application Development

10. Indonesia Application Market SWOT Analysis

10.1 Strengths (High Smartphone Penetration, Growing E-commerce and Fintech Sectors)

10.2 Weaknesses (Infrastructure Gaps, Data Privacy Concerns)

10.3 Opportunities (Growth in AI-Integrated Apps, Expansion of Fintech)

10.4 Threats (Data Privacy Issues, Competition in App Development)

11. Analysts Recommendations

11.1 Strategic Market Entry and Expansion Opportunities

11.2 Collaboration with Fintech and E-commerce Platforms

11.3 Innovative Product Development (AI-Integrated Apps, Cloud Solutions)

11.4 Market Positioning Strategies for Key Players

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Indonesia Application market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek opeApplicationtional and financial information from company representatives.

Step: 4 Research Output

Our research team approaches multiple mobile application developers to understand product segments, sales trends, consumer preferences, and other parameters. This approach supports us in validating the statistics derived from the bottom-up approach of these mobile application developers.

Frequently Asked Questions

01. How big is the Indonesia Application Market?

The Indonesia Application Market was valued at USD 2.5 billion in 2023, driven by increased smartphone usage and digital services adoption across various sectors like fintech and e-commerce.

02. Who are the major players in the Indonesia Application market?

Key players in the Indonesia Application Market include GoTo, Telkom Indonesia, XL Axiata, Gojek, Traveloka, and Shopee, which dominate various segments such as e-commerce, fintech, and entertainment.

03. What are the growth drivers of the Indonesia Application market?

Growth drivers in the Indonesia Application Market include rapid smartphone penetration, government initiatives for digital transformation, and the expansion of fintech and e-commerce applications across Indonesia.

04. What are the Indonesia Application market challenges?

Challenges in the Indonesia Application Market include fragmented infrastructure in rural regions, data privacy concerns, and the need for more robust digital regulations to safeguard user data.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.