Indonesia Automation Testing Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD335

July 2024

93

About the Report

Indonesia Automation Testing Market Overview

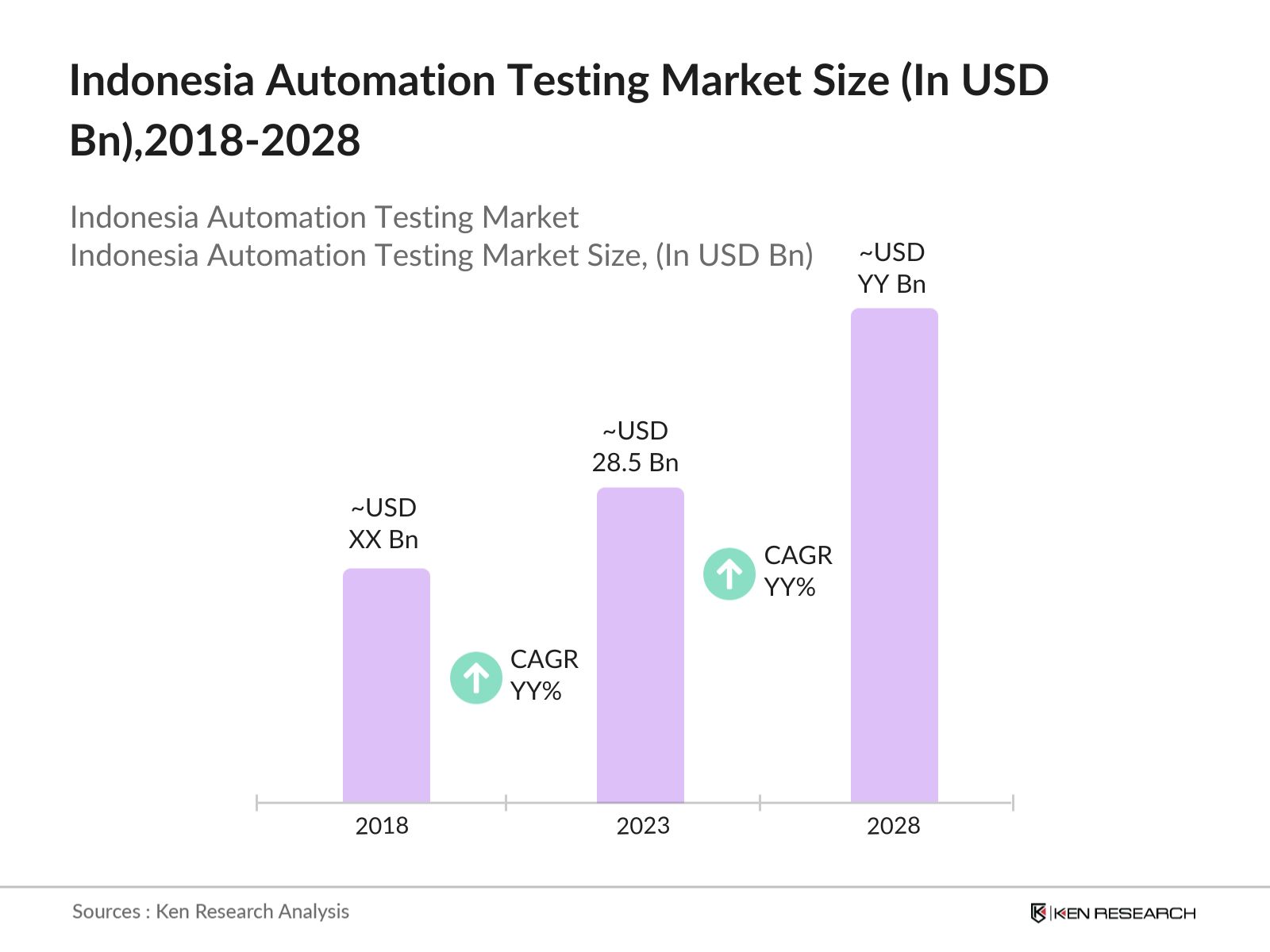

- The Indonesia automation testing market has experienced significant growth in recent years. In 2023, the global market was valued at USD 28.5 billion, driven by widespread digital transformation initiatives across various industries and the increasing need for efficient software testing solutions.

- Key players in the market include IBM Corporation, CA Technologies, Hewlett Packard Enterprise (HPE), Capgemini, Cognizant Technology Solutions, and Infosys Limited. These companies lead through continuous innovation, strategic acquisitions, and extensive service portfolios.

- IBM acquired Red Hat for USD 34 billion in 2019, significantly enhancing its hybrid cloud and AI capabilities. This acquisition has redefined the cloud market for business by combining Red Hat's open hybrid cloud technologies with IBM's scale and innovation, providing more robust and scalable testing solutions.

Indonesia Automation Testing Current Market Analysis

- In 2023, IBM Corporation launched an AI-driven testing tool designed to enhance the efficiency and accuracy of automated testing processes. This new tool leverages artificial intelligence to identify patterns, predict potential issues, and optimize testing strategies, showcasing IBM's commitment to continuous improvement and innovation in the automation testing market.

- The Indonesia automation testing market significantly boosts various industries by automating software testing processes, reducing errors, and improving product quality and release times. This innovation drives growth in sectors like finance, healthcare, and e-commerce by ensuring faster deployment of reliable software solutions, enhancing customer satisfaction, and optimizing operational efficiency.

- The West region, including Jakarta and its surrounding areas, dominates the Indonesia Automation Testing market. This dominance is driven by its advanced healthcare infrastructure, higher concentration of top-tier hospitals and research institutions, and significant investments in medical technology. The presence of leading medical universities and a skilled workforce further enhances the adoption of digital pathology solutions in this region.

Indonesia Automation Testing Market Segmentation

The Indonesia Automation testing market is segmented into the following:

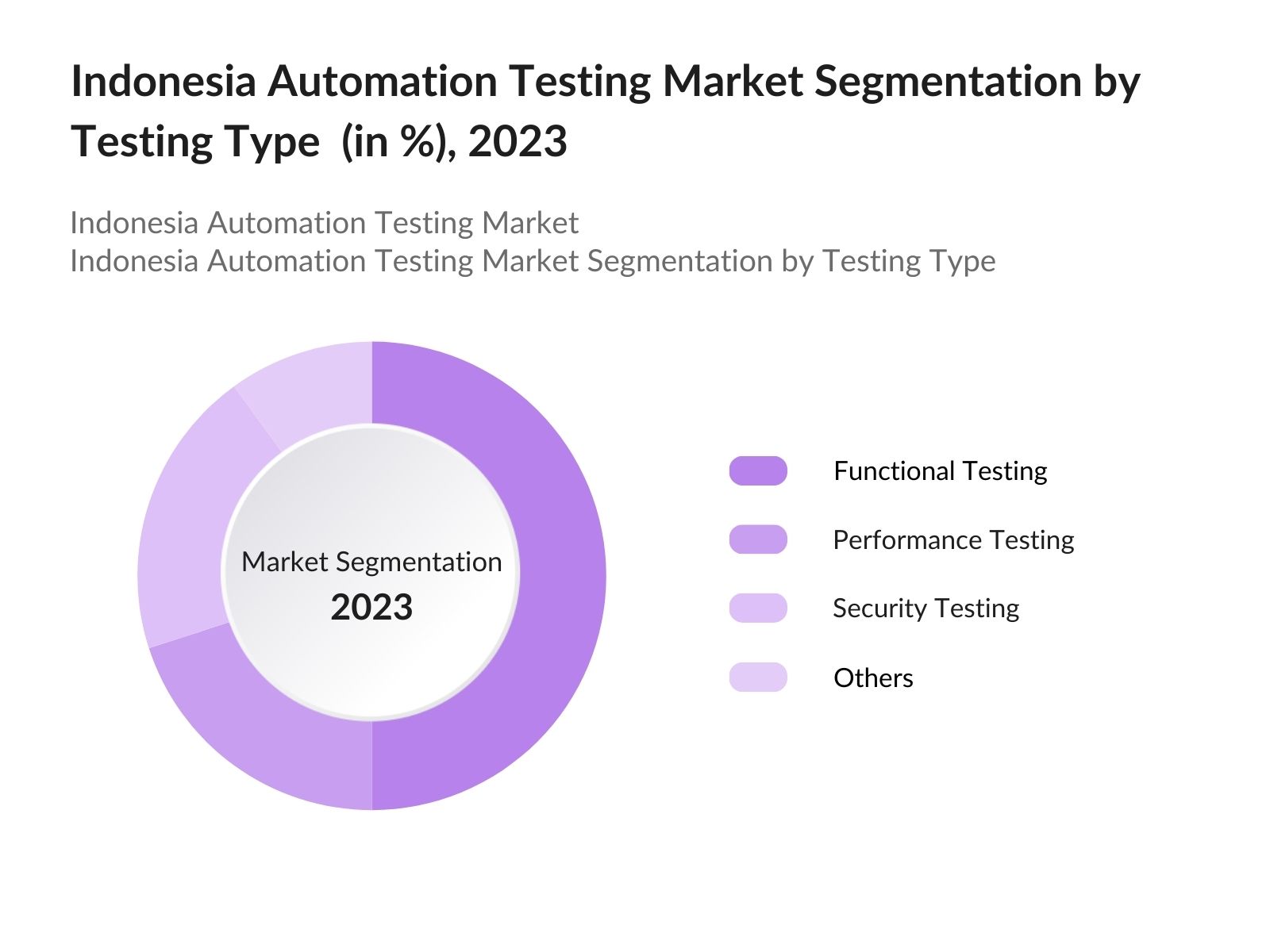

BY Testing Type: In Indonesia Automation Testing market is segmented into Functional Testing, Performance Testing, Security Testing and Others. In 2023, Functional Testing was the dominating segment, due to its critical role in verifying software functionalities, ensuring the software meets specified requirements. Its widespread adoption is driven by the necessity to ensure high-quality applications.

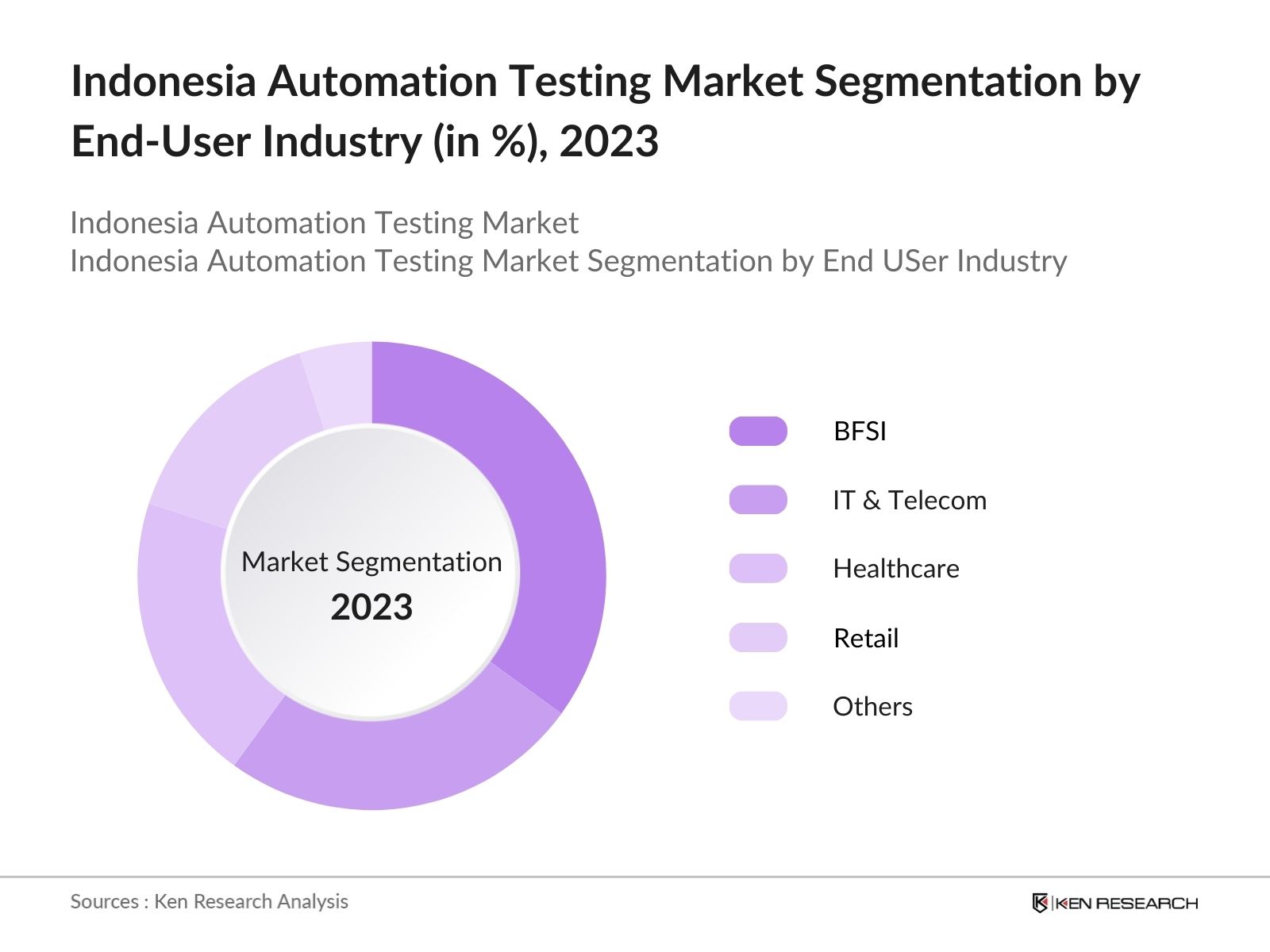

By End User Industry: The Indonesia Automation Testing market is segmented into BFSI, IT & Telecom, healthcare, retail and others. In 2023, BFSI was the dominating segment due to stringent regulatory requirements and the critical need for secure and reliable software applications. The sector's focus on digital transformation and customer experience drives the demand for comprehensive testing solutions.

By Region: The Indonesia Automation Testing market is segmented into North, south, East and West. In 2023, the West region dominated, as most developed in terms of healthcare infrastructure. It hosts the majority of the country's top hospitals, research centers, and medical universities, making it the leading region for adopting digital pathology solutions.

Indonesia Automation Testing Market Competitive Landscape

Indonesia Automation Testing Market Major Players

|

Company |

Establishment Year |

Headquarters |

|

IBM Corporation |

1911 |

Armonk, New York, USA |

|

Hewlett Packard Enterprise |

2015 |

San Jose, California, USA |

|

Capgemini |

1967 |

Paris, France |

|

Cognizant Technology Solutions |

1994 |

Teaneck, New Jersey, USA |

|

Infosys Limited |

1981 |

Bengaluru, India |

- HPE's Cloud-Based Testing Tool Launch (2023): Hewlett Packard Enterprise introduced a new cloud-based performance testing tool, catering to the growing demand for scalable testing solutions. This tool allows organizations to manage testing environments and resources more efficiently, aligning with the trend of shifting towards cloud-based testing.

- Capgemini's Acquisition of Altran (2022): Capgemini acquired Altran to strengthen its engineering and R&D services, including automation testing capabilities. This acquisition enhances Capgemini's ability to provide comprehensive testing solutions, reflecting the consolidation trend in the market. In 2023, accretion is expected to exceed 25% post synergies. The agreement has been unanimously approved by the Boards of Directors of Capgemini and Altran.

- Infosys' Partnership with AWS (2022): Infosys partnered with AWS in 2022 to develop cloud-based testing solutions, enhancing its service offerings in the automation testing market. This partnership leverages AWS's cloud infrastructure to provide scalable and flexible testing solutions, meeting the growing demand for cloud-based testing.

Indonesia Automation Testing Industry Analysis

Indonesia Automation Testing Market Growth Drivers:

- Digital Transformation Initiatives: Indonesia's drive towards digital transformation across various sectors has led to a surge in the adoption of automation testing solutions. According to the Indonesian Ministry of Communication and Information Technology, the country's digital economy is projected to contribute USD 130 billion to the GDP by 2025. This significant push towards digitalization necessitates efficient and reliable software testing to ensure the quality and performance of digital services and applications.

- Increasing Adoption of Agile and DevOps Methodologies: The shift towards Agile and DevOps methodologies in software development has created a robust demand for automation testing tools. A survey by the Indonesian Software Association reveals that 65% of software development companies in Indonesia have adopted Agile practices. This methodology emphasizes continuous testing and integration, which are best supported by automated testing solutions, driving their adoption in the market.

- Complexity of Software Applications: The growing complexity of software applications, especially with the integration of advanced technologies such as AI and IoT, requires more sophisticated testing solutions. The World Bank's report on Indonesia's technology sector indicates that the country is experiencing a rapid increase in tech startups and innovative projects, leading to a higher demand for comprehensive automation testing to manage the intricate software development processes.

Indonesia Automation Testing Market Challenges:

- High Initial Costs: The significant upfront investment required for automation testing tools is a major barrier, especially for small and medium-sized enterprises (SMEs) in Indonesia. According to the Indonesian Chamber of Commerce and Industry, over 70% of the SMEs find the cost of adopting advanced automation testing tools prohibitive, limiting their ability to implement these solutions and hindering market growth.

- Skilled Workforce Shortage: There is a notable shortage of skilled professionals proficient in automation testing tools and methodologies in Indonesia. A report by the Ministry of Manpower highlights that only 20% of IT professionals currently in the country have the necessary skills for advanced automation testing, creating a significant gap between the demand and supply of qualified personnel.

Indonesia Automation Testing Market Government Initiatives

- National ICT Policy (2022): The National ICT Policy focuses on enhancing the country's information and communication technology capabilities. It includes measures to support the adoption of advanced technologies in software development, including automation testing. The policy has allocated significant funding for tech education and infrastructure development, encouraging companies to invest in modern testing tools.

- Tech Education Programs (2022): The Indonesian government has launched several tech education programs to address the skilled workforce shortage in the IT sector. These programs aim to enhance skills in automation testing and software development. According to the Ministry of Education and Culture, these initiatives have resulted in a 25% increase in the number of professionals trained in automation testing techniques.

- Startup Incentives (2023): To foster innovation and growth in the tech sector, the government has introduced various incentives for startups, including tax breaks and grants for those investing in advanced testing tools and technologies. The Ministry of Industry reports that these incentives have led to a 35% increase in tech startup formations, driving demand for automation testing solutions.

Indonesia Automation Testing Market Future Outlook

The Indonesia automation testing market is expected to continue its growth trajectory. This growth is driven by continuous technological advancements, increasing demand for high-quality software applications, and the integration of AI and ML in testing tools.

Future Trends

- Shift to Cloud-Based Testing: There is a noticeable shift towards cloud-based testing solutions due to their scalability and cost-effectiveness. The Indonesia Cloud Computing Association states that by 2025, it is anticipated that the adoption rate of cloud-based testing in Indonesia will have increased by 50%. This growth will be driven by the enhanced scalability, cost-effectiveness, and remote management capabilities these solutions offer.

- Open-Source Testing Tools: The adoption of open-source automation testing tools in Indonesia is forecasted to expand significantly. By 2026, it is estimated that 60% of software development companies will be utilizing open-source testing tools. These tools will become integral to the software development lifecycle due to their cost-effectiveness, flexibility, and extensive community support. Companies will leverage the vast libraries and capabilities of open-source tools to enhance their testing processes, leading to improved software quality and reduced testing costs.

Scope of the Report

|

BY Testing Type |

Functional Testing Performance Testing Security Testing Others |

|

By End User Industry |

BFSI IT & Telecom Healthcare Retail others |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities who can benefit by subscribing this report:

IT and Software Development Companies

Financial Institutions (BFSI)

Healthcare Organizations

Retail Companies

Telecommunications Companies

Government Agencies (Financial Services Authority, Ministry of Communication and Information Technology)

Educational Institutions

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

- IBM Corporation

- Hewlett Packard Enterprise

- Capgemini

- Cognizant Technology Solutions

- Infosys Limited

- Wipro Limited

- Tricentis

- SmartBear Software

- CA Technologies

- Micro Focus

- TestPlant

- Parasoft

- Cigniti Technologies

- QualiTest

- TCS

- Amdocs

- Atos

- SQS Software Quality Systems

- Ranorex

- Applitools

Table of Contents

1. Indonesia Automation Testing Market Overview

1.1 Indonesia Automation Testing Market Taxonomy Â

2. Indonesia Automation Testing Market Size (in USD Bn), 2018-2023

3. Indonesia Automation Testing Market Analysis

3.1 Indonesia Automation Testing Market Growth Drivers Â

3.2 Indonesia Automation Testing Market Challenges and Issues Â

3.3 Indonesia Automation Testing Market Trends and Development Â

3.4 Indonesia Automation Testing Market Government Regulation Â

3.5 Indonesia Automation Testing Market SWOT Analysis Â

3.6 Indonesia Automation Testing Market Stake Ecosystem Â

3.7 Indonesia Automation Testing Market Competition Ecosystem Â

4. Indonesia Automation Testing Market Segmentation, 2023

4.1 Indonesia Automation Testing Market Segmentation by Testing Type (in value %), 2023 Â

4.2 Indonesia Automation Testing Market Segmentation by End User Industry (in value %), 2023 Â

4.3 Indonesia Automation Testing Market Segmentation by Region (in value %), 2023 Â

5. Indonesia Automation Testing Market Competition Benchmarking

5.1 Indonesia Automation Testing Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics) Â

6. Indonesia Automation Testing Future Market Size (in USD Bn), 2023-2028

7. Indonesia Automation Testing Future Market Segmentation, 2028

7.1 Indonesia Automation Testing Market Segmentation by Testing Type (in value %), 2028 Â

7.2 Indonesia Automation Testing Market Segmentation by End User Industry (in value %), 2028 Â

7.3 Indonesia Automation Testing Market Segmentation by Region (in value %), 2028 Â

8. Indonesia Automation Testing Market Analysts’ Recommendations

8.1 Indonesia Automation Testing Market TAM/SAM/SOM Analysis Â

8.2 Indonesia Automation Testing Market Customer Cohort Analysis Â

8.3 Indonesia Automation Testing Market Marketing Initiatives Â

8.4 Indonesia Automation Testing Market White Space Opportunity Analysis Â

Disclaimer Â

Contact Us Â

Research Methodology

Step 1: Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building

Collating statistics on Indonesia Digital Pathology Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Digital Pathology Industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output

Our team will approach multiple retail companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such industry specific companies.

Frequently Asked Questions

01 What is the Indonesia automation testing market size?Â

The Indonesia automation testing market is valued at USD 28.5 billion in 2023. This substantial market size is driven by digital transformation initiatives, increasing complexity of software applications, adoption of CI/CD practices, and significant government support for IT infrastructure enhancements

02 What factors are driving the growth of Indonesia automation testing market?Â

Key growth drivers of Indonesia automation testing market include digital transformation, adoption of Agile and DevOps methodologies, and increasing complexity of software applications.

03 Which segment dominates the Indonesia automation testing market?

In Indonesia automation testing market, the functional testing segment dominates the market due to its critical role in verifying software functionalities.

04 What are the major challenges in the Indonesia automation testing market?

Challenges in Indonesia automation testing market include high initial costs, skilled workforce shortage, continuous tool upgrades, integration issues, and data security concerns.

05 Who are the major players in the Indonesia automation testing market?

Major players in Indonesia automation testing market include IBM Corporation, Hewlett Packard Enterprise, Capgemini, and Cognizant Technology Solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.