Indonesia Automotive Adhesives Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD1373

November 2024

96

About the Report

Indonesia Automotive Adhesives Market Overview

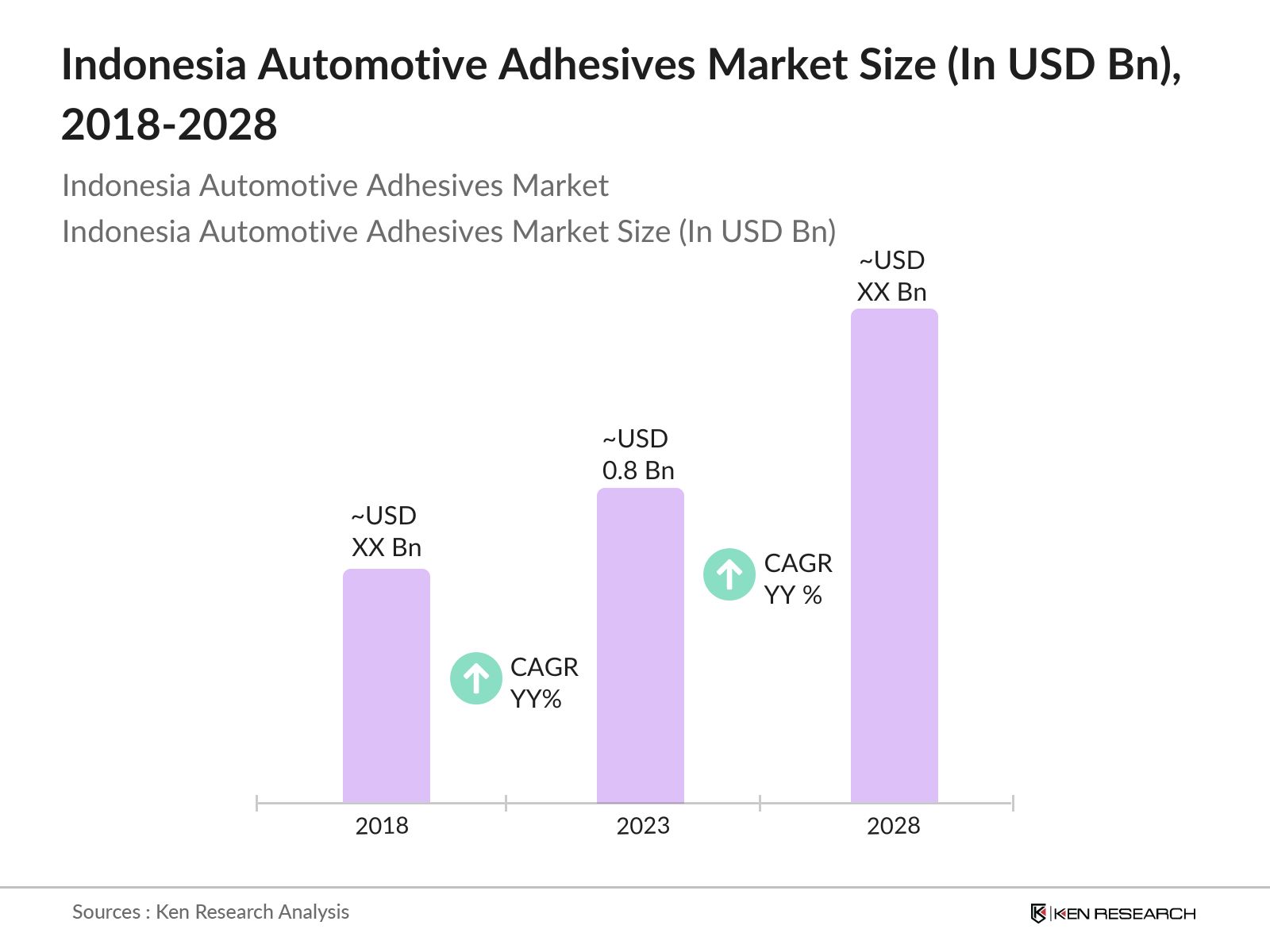

- The Indonesia Automotive Adhesives Market size was valued at USD 0.8 billion in 2023. The growth of this market is primarily driven by the rapid expansion of the automotive sector in Indonesia, with increasing demand for lightweight and fuel-efficient vehicles.

- The major players in the Indonesia Automotive Adhesives market include 3M Company, Henkel AG & Co. KGaA, Sika AG, and local players such as PT. Intanwijaya Internasional Tbk and PT. Fajar Chemical. These companies offer a wide range of adhesive solutions, including structural adhesives, sealants, and tapes, catering to the diverse needs of automotive manufacturers in Indonesia.

- In July 2024, Henkel AG & Co. KGaA reported strong business performance in the first half of the year, achieving sales of 10.8 billion and an organic sales growth of 2.9%. The company raised its earnings outlook 2024, driven by higher profit expectations in the Consumer Brands unit and increased marketing investments.

- The Java region, particularly Jakarta and Surabaya, dominated the Indonesia Automotive Adhesives Market in 2023. This dominance can be attributed to the regions status as the manufacturing hub of Indonesia, with a high concentration of automotive assembly plants and suppliers.

Indonesia Automotive Adhesives Market Segmentation

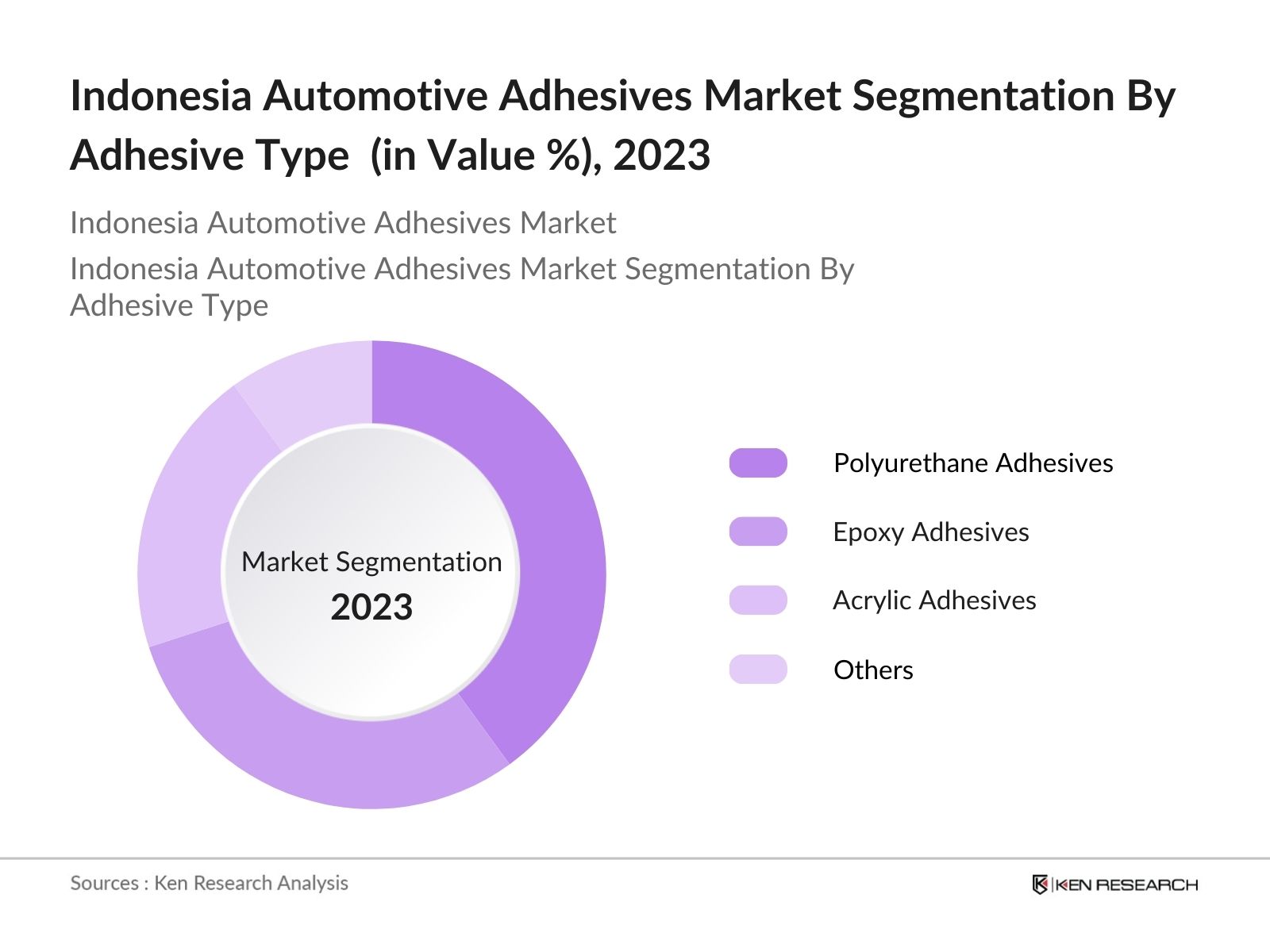

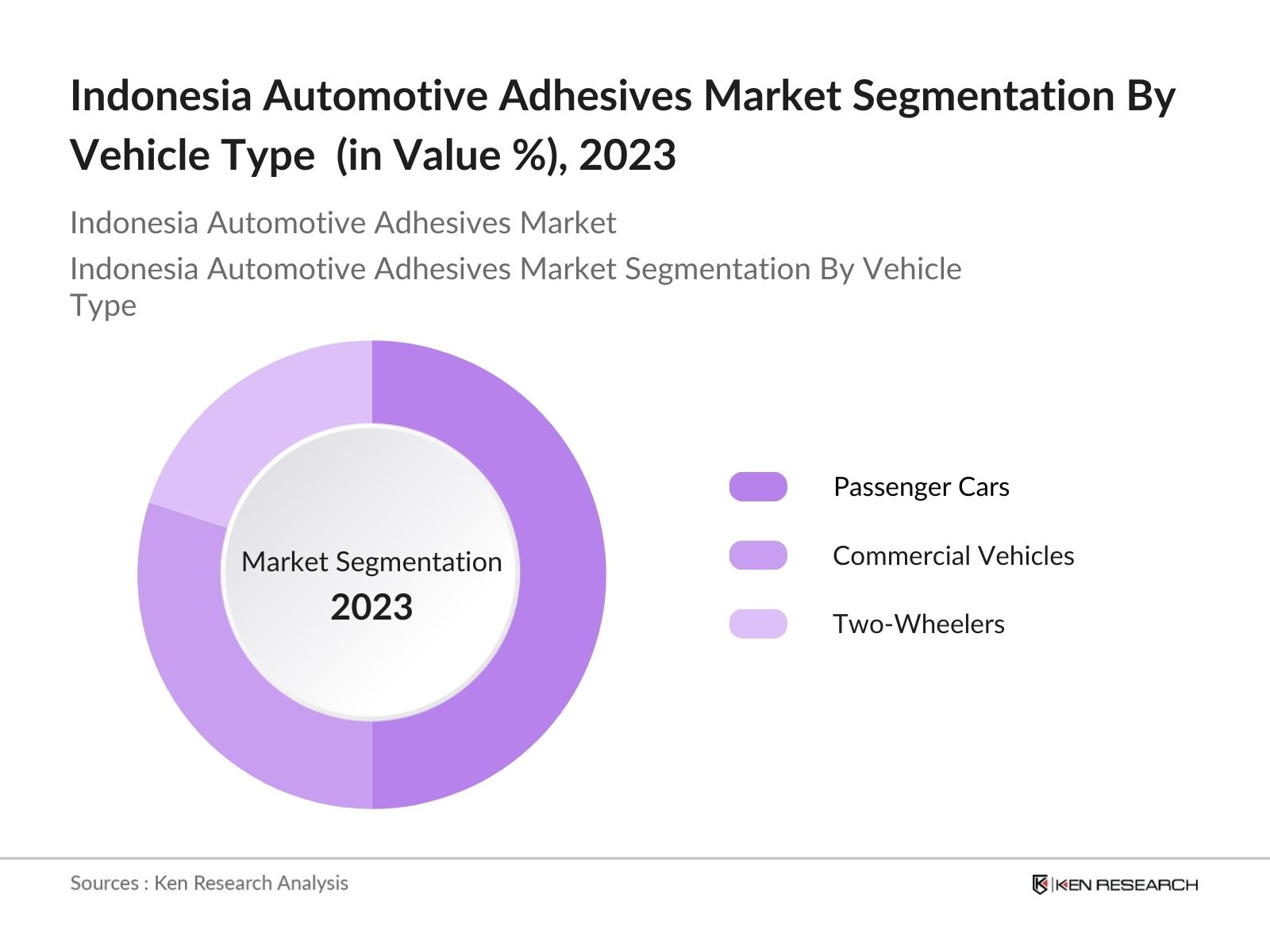

The Indonesia Automotive Adhesives Market is segmented into adhesive type, vehicle type, and region.

- By Adhesive Type: The market is segmented by adhesive type into epoxy adhesives, polyurethane adhesives, acrylic adhesives, and others. Polyurethane adhesives hold the dominant market share in 2023, driven by their versatility and high bonding strength.

- By Vehicle Type: The market is segmented by vehicle type into passenger cars, commercial vehicles, and two-wheelers. Passenger cars hold the largest market share in 2023, attributed to the increasing production and sales of cars in Indonesia.

- By Region: The market is segmented by region into North, South, East, and West. The Western region dominated the market in 2023 due to its well-developed infrastructure and concentration of automotive manufacturing plants. The Northern region is expected to see growth by 2028, driven by new investments in automotive production facilities.

Indonesia Automotive Adhesives Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

3M Company |

1902 |

St. Paul, Minnesota, USA |

|

Henkel AG & Co. KGaA |

1876 |

Dsseldorf, Germany |

|

Sika AG |

1910 |

Baar, Switzerland |

|

PT. Intanwijaya Internasional Tbk |

1982 |

Jakarta, Indonesia |

|

PT. Fajar Chemical |

1995 |

Surabaya, Indonesia |

- 3M Company: In July 2024, 3M Company announced strong second-quarter results, reporting sales of $6.3 billion. The company raised its full-year adjusted earnings outlook to $7.00 to $7.30 per share, reflecting improved operational execution. 3M continues to focus on innovation and sustainability, aiming to make some impacts on various markets.

- Sika AG: In July 2024, Sika reported record sales of CHF 5.83 billion in the first half of the year, reflecting a 12.8% increase in local currencies. The company successfully integrated the MBCC acquisition, enhancing its product offerings and aiming for sales growth of 6-9% in 2024, while also achieving Science Based Targets initiative validation for its net-zero emissions goals.

Indonesia Automotive Adhesives Market Analysis

Indonesia Automotive Adhesives Market Growth Drivers:

- Rising Automotive Production: Rising automotive production in Indonesia is a major growth driver, with vehicle production reaching 1.34 million units in 2022, marking a 17% increase from the previous year. Supported by government policies promoting foreign investment, Indonesia is positioned as the second-largest car producer in Southeast Asia, attracting substantial investment and enhancing market potential.

- Increasing Demand for Lightweight Vehicles: The global push for sustainability is driving demand for lightweight vehicles in Indonesia. Automotive adhesives are crucial for achieving weight reduction, which enhances fuel efficiency and reduces carbon emissions. As the market shifts towards more environmentally friendly vehicles, manufacturers are increasingly utilizing lightweight materials, making adhesives essential in vehicle design and production.

- Expansion of Electric Vehicle (EV) Market: The expansion of the electric vehicle (EV) market in Indonesia is a key growth driver, with projections indicating sales could reach 50,000 units by 2024, an substantial increase from 17,000 units in 2023. Government incentives, including tax breaks and infrastructure development, are fostering a favourable environment for EV adoption and production in the country.

Indonesia Automotive Adhesives Market Challenges:

- Fluctuating Raw Material Prices: The automotive adhesives market in Indonesia faces challenges from fluctuating raw material prices, particularly for resins and polymers. For example, crude oil prices have risen from around $40 per barrel in early 2021 to over $90 in 2023, impacting manufacturers' profitability and leading to higher product costs.

- Regulatory Compliance: Compliance with stringent environmental regulations poses challenges for market players in Indonesia. Adhering to local and international standards requires continuous investment in research and development to innovate eco-friendly adhesive solutions. The Indonesian National Standards (SNI) mandate specific testing processes, increasing operational costs for manufacturers striving to meet regulatory requirements.

Indonesia Automotive Adhesives Market Government Initiatives:

- Electric Vehicle Subsidy Scheme (2023): Indonesia introduced a subsidy scheme to promote electric vehicle (EV) purchases, offering consumers incentives ranging from IDR 8 million to IDR 80 million (USD 525 to USD 5,250) based on vehicle type. This aims to stimulate EV adoption and support the government's target of 2.2 million electric cars by 2030.

- Infrastructure Development for EV Charging Stations: The state-owned electricity company, PLN, is constructing 1,401 electric vehicle charging stations by 2025. This initiative enhances EV infrastructure, facilitating the transition to electric mobility and aligning with Indonesia's commitment to achieving net-zero emissions by 2060.

Indonesia Automotive Adhesives Market Future Market Outlook

The Indonesia Automotive Adhesives Market is expected to grow in the coming years. The market is likely to see a shift towards more organized players with a focus on sustainability and eco-friendly adhesive solutions.

Indonesia Automotive Adhesives Market Future Market Trends:

- Increased Adoption of Eco-friendly Adhesives: Over the next five years, the adoption of eco-friendly adhesives in Indonesia is expected to rise substantially, driven by increased awareness of environmental sustainability. Many automotive manufacturers are projected to use water-based and bio-based adhesives by 2028, reflecting a shift towards sustainable manufacturing practices and compliance with global environmental standards.

- Integration of Advanced Materials in Vehicle Manufacturing: The integration of advanced materials, such as composites and lightweight metals, is anticipated to be a major trend in Indonesia's automotive adhesives market. By 2028, most new vehicle models are expected to incorporate these materials, necessitating specialized adhesives that enhance fuel efficiency and meet the evolving demands of the automotive industry.

Scope of the Report

|

By Adhesive Type |

Epoxy Adhesives Polyurethane Adhesives Acrylic Adhesives Others |

|

By Vehicle Type |

Passenger Cars Commercial Vehicles Two-Wheelers |

|

By Application |

Body-in-White (BIW) Interior Exterior Powertrain Others |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Automotive Manufacturers

Adhesive Manufacturers

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

3M Company

Henkel AG & Co. KGaA

Sika AG

PT. Intanwijaya Internasional Tbk

PT. Fajar Chemical

H.B. Fuller

Bostik Indonesia

Dow Chemical Company

Arkema S.A.

Ashland Inc.

Toyo Ink SC Holdings Co., Ltd.

Lord Corporation

Permabond LLC

Soudal N.V.

Huntsman Corporation

Table of Contents

1. Indonesia Automotive Adhesives Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Automotive Adhesives Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Automotive Adhesives Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Automotive Industry

3.1.2. Rising Demand for Lightweight Vehicles

3.1.3. Government Incentives

3.1.4. Technological Advancements

3.2. Restraints

3.2.1. Volatility in Raw Material Prices

3.2.2. High Competition

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Adoption of Electric Vehicles (EVs)

3.3.2. Expansion into Emerging Markets

3.3.3. Increasing Demand for Eco-friendly Adhesives

3.4. Trends

3.4.1. Adoption of Sustainable Adhesives

3.4.2. Integration with Advanced Manufacturing Techniques

3.4.3. Increased Use of Automation in Production

3.5. Government Regulation

3.5.1. Automotive Industry Policies

3.5.2. Environmental Regulations

3.5.3. Incentives for Local Manufacturing

3.5.4. Support for R&D Activities

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Indonesia Automotive Adhesives Market Segmentation, 2023

4.1. By Adhesive Type (in Value %)

4.1.1. Polyurethane Adhesives

4.1.2. Epoxy Adhesives

4.1.3. Acrylic Adhesives

4.1.4. Others

4.2. By Vehicle Type (in Value %)

4.2.1. Passenger Cars

4.2.2. Commercial Vehicles

4.2.3. Two-Wheelers

4.3. By Application (in Value %)

4.3.1. Body-in-White (BIW)

4.3.2. Interior

4.3.3. Exterior

4.3.4. Powertrain

4.3.5. Others

4.4. By Region (in Value %)

4.4.1. North (Sumatra)

4.4.2. South (Java)

4.4.3. East (Sulawesi, East Java)

4.4.4. West (Kalimantan, Bali & Nusa Tenggara)

5. Indonesia Automotive Adhesives Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. 3M Company

5.1.2. Henkel AG & Co. KGaA

5.1.3. Sika AG

5.1.4. PT. Intanwijaya Internasional Tbk

5.1.5. PT. Fajar Chemical

5.1.6. H.B. Fuller

5.1.7. Bostik Indonesia

5.1.8. Dow Chemical Company

5.1.9. Arkema S.A.

5.1.10. Ashland Inc.

5.1.11. Toyo Ink SC Holdings Co., Ltd.

5.1.12. Lord Corporation

5.1.13. Permabond LLC

5.1.14. Soudal N.V.

5.1.15. Huntsman Corporation

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Indonesia Automotive Adhesives Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Indonesia Automotive Adhesives Market Regulatory Framework

7.1. Environmental Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Indonesia Automotive Adhesives Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Indonesia Automotive Adhesives Future Market Segmentation, 2028

9.1. By Adhesive Type (in Value %)

9.2. By Vehicle Type (in Value %)

9.3. By Application (in Value %)

9.4. By Region (in Value %)

10. Indonesia Automotive Adhesives Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the market to collate market-level information.

Step: 2 Market Building

Collating statistics on the Indonesia Automotive Adhesives market over the years and analyzing the penetration of products as well as the ratio of suppliers to compute the revenue generated for the market. We will also review product quality statistics to ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building market hypotheses and conducting CATIs with market experts from different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple automotive adhesive companies and understand the nature of product segments and sales, consumer preference, and other parameters, which will support us in validating statistics derived through the bottom-to-top approach from the automotive adhesive companies.

Frequently Asked Questions

01. How big is the Indonesia Automotive Adhesives Market?

The Indonesia Automotive Adhesives Market was valued at USD 0.8 billion in 2023, driven by rising automotive production and the increasing demand for lightweight vehicles in Indonesia.

02. Who are the major players in the Indonesia Automotive Adhesives market?

The major players in Indonesia Automotive Adhesives include 3M Company, Henkel AG & Co. KGaA, Sika AG, PT. Arindo Pacific Chemical, and PT. Dow Indonesia.

03. What are the growth drivers of the Indonesia Automotive Adhesives market?

The growth drivers of the Indonesia Automotive Adhesives market include rising automotive production, increasing demand for lightweight vehicles, and the expansion of the electric vehicle market in Indonesia.

04. What are the challenges in the Indonesia Automotive Adhesives market?

The Indonesia Automotive Adhesives market faces challenges such as fluctuating raw material prices and compliance with stringent environmental regulations.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.