Indonesia Beauty Supplements Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD10224

December 2024

96

About the Report

Indonesia Beauty Supplements Market Overview

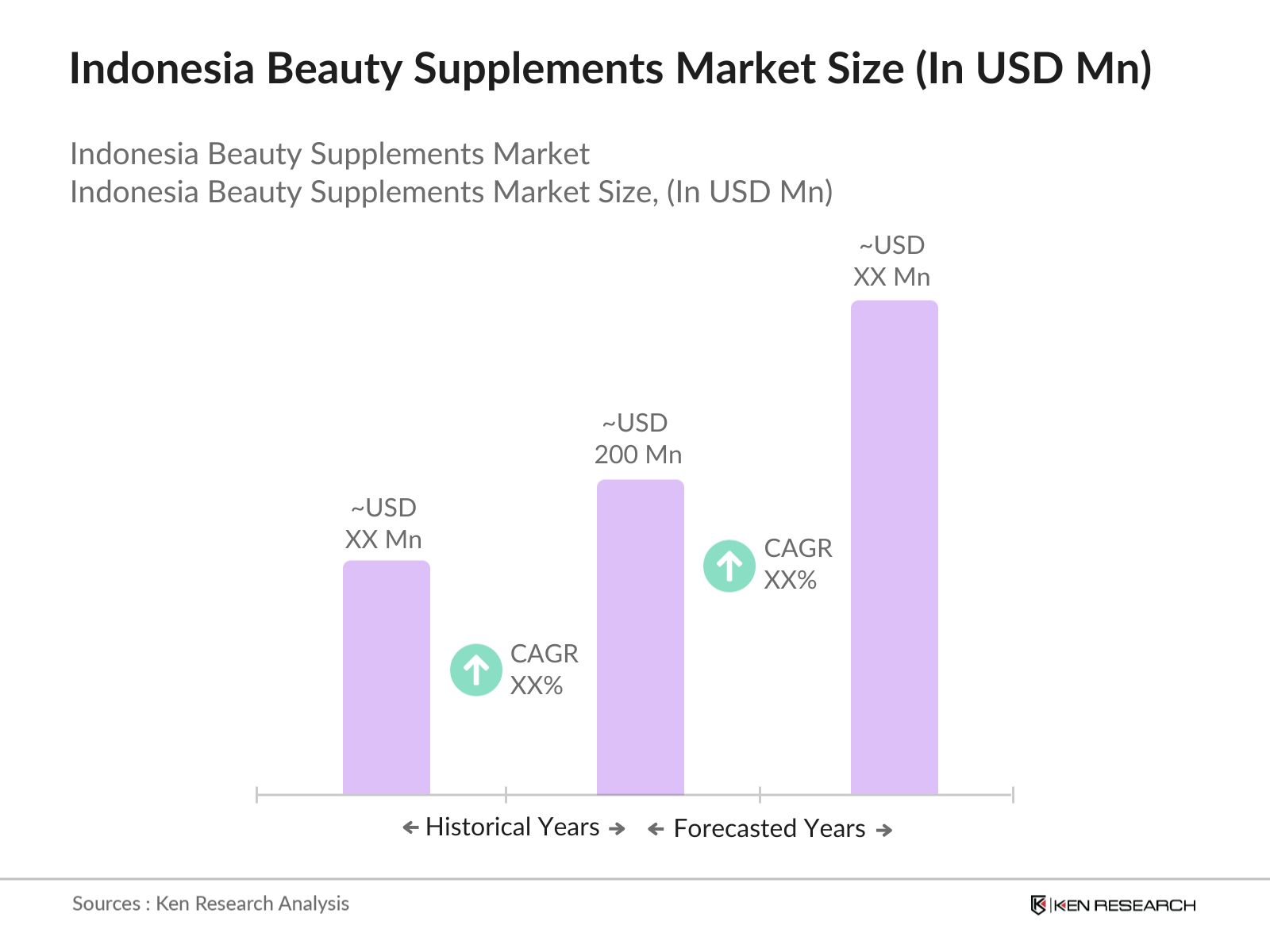

- The Indonesia beauty supplements market is valued at USD 200 million, reflecting a robust growth trajectory fueled by an increasing focus on health and wellness among consumers. This market's expansion is largely driven by the rising consumer awareness regarding the benefits of beauty supplements, such as collagen and vitamins, which are associated with enhancing skin health, reducing signs of aging, and promoting overall well-being. The ongoing shift towards preventive health measures and the popularity of natural and organic products are significant contributors to this growth.

- Major urban centers like Jakarta, Surabaya, and Bandung dominate the Indonesian beauty supplements market due to their high population density, economic activity, and consumer spending power. Jakarta, being the capital, is a hub for product launches and marketing campaigns, while Surabaya and Bandung are emerging markets with increasing demand for beauty products. The presence of a young, health-conscious population in these cities, combined with extensive distribution networks, propels their dominance in the beauty supplements sector.

- Government health policies significantly influence the beauty supplements market in Indonesia. The National Health System aims to improve public health by promoting the consumption of supplements that support overall wellness. In 2022, the government allocated IDR 50 trillion towards health initiatives, including nutritional programs that emphasize the importance of dietary supplements. This proactive approach is expected to create a favorable environment for the beauty supplements market by encouraging consumers to consider supplements as part of a healthy lifestyle.

Indonesia Beauty Supplements Market Segmentation

The Indonesia beauty supplements market is segmented by product type and by distribution channel.

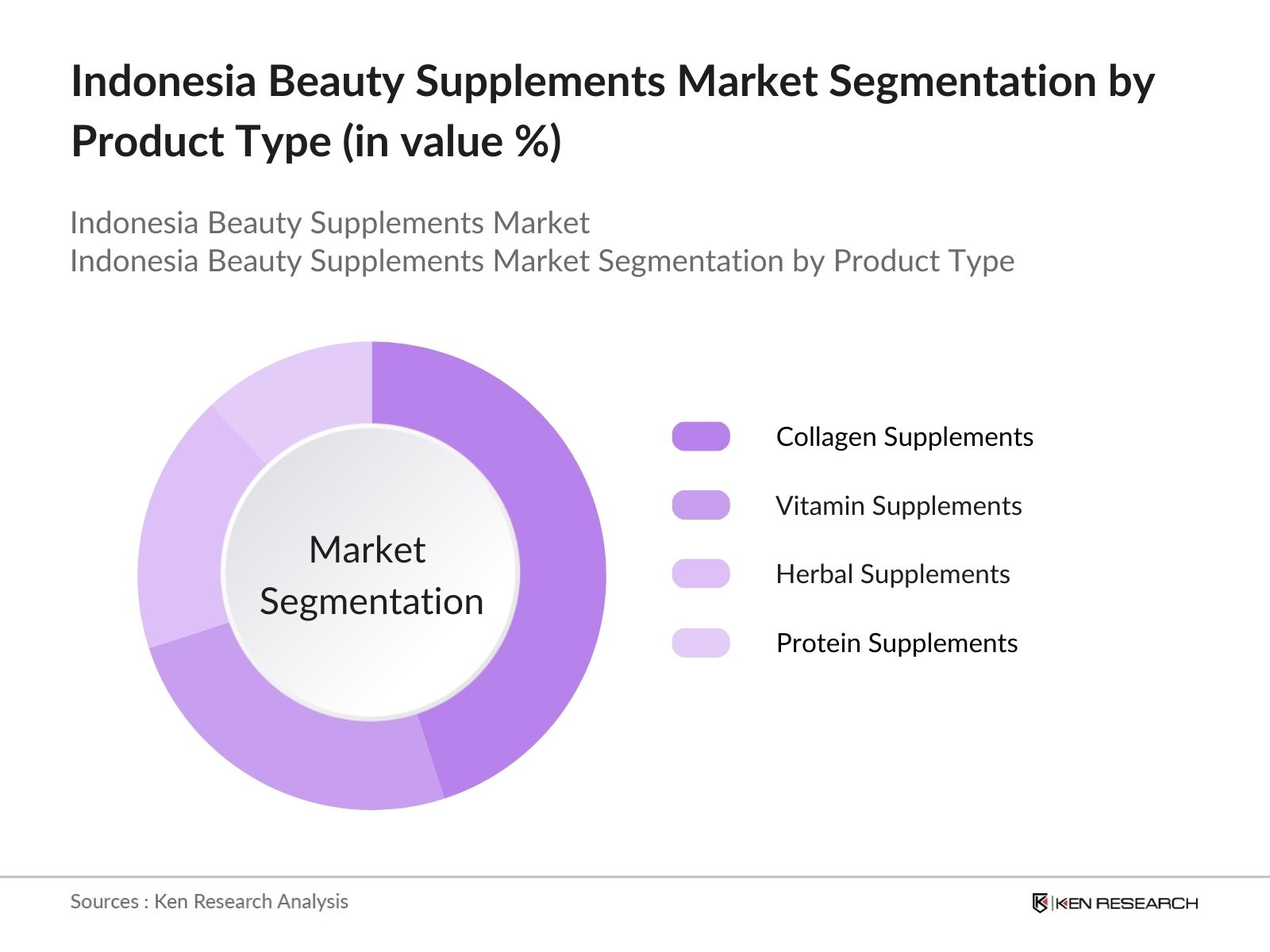

- By Product Type: The Indonesia beauty supplements market is segmented by product type into collagen supplements, vitamin supplements, herbal supplements, protein supplements, and others. Among these, collagen supplements have emerged as the leading segment, capturing a significant market share due to their growing popularity among consumers seeking anti-aging solutions. The effectiveness of collagen in improving skin elasticity, hydration, and overall appearance resonates well with the rising beauty consciousness in the population. Brands like Vital Proteins and Natures Way have established a strong presence, driving consumer loyalty and further growth in this segment.

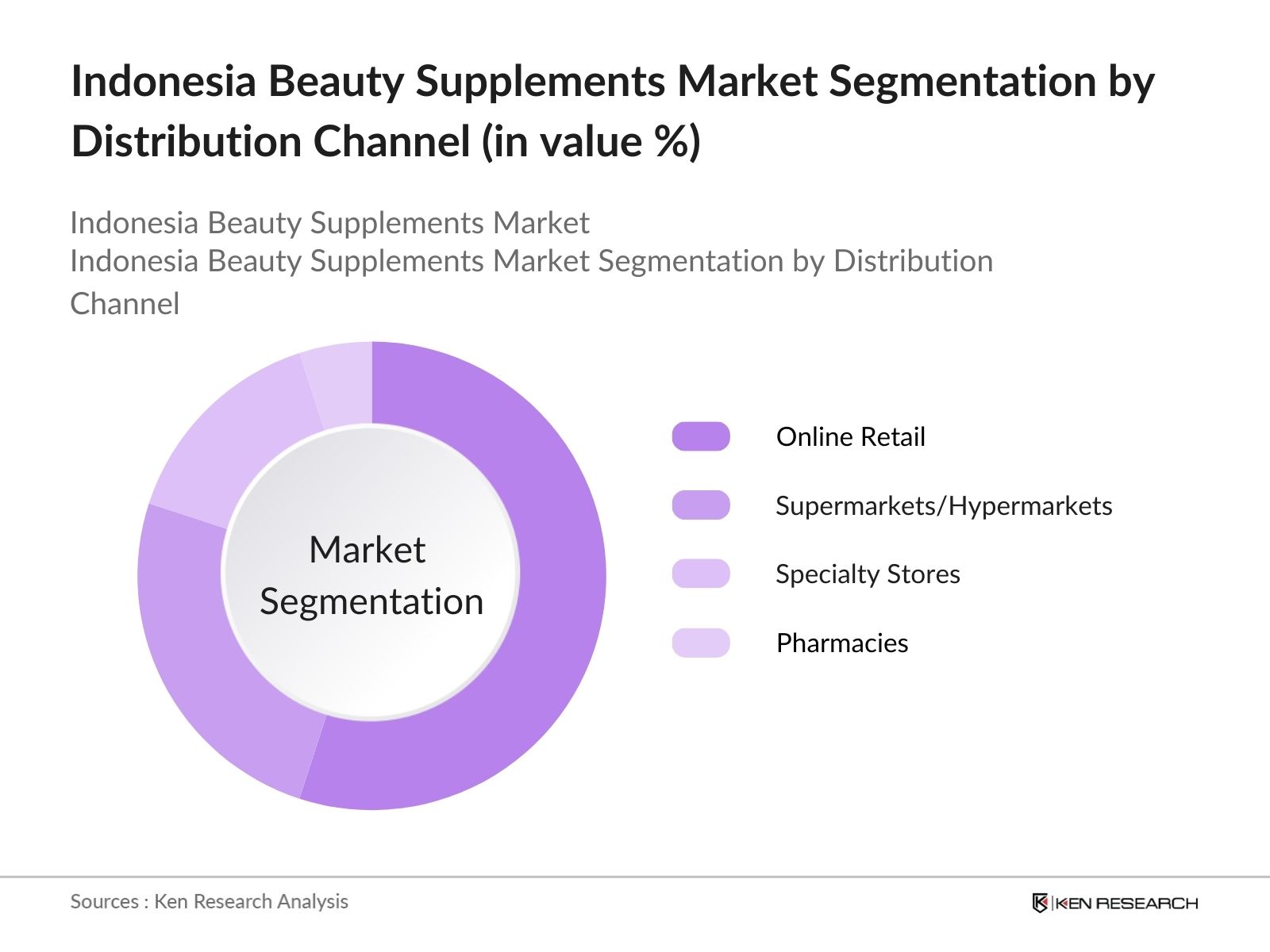

- By Distribution Channel: The market is also segmented by distribution channel into online retail, supermarkets/hypermarkets, specialty stores, and pharmacies. Online retail has taken the lead in this segment, reflecting the rapid growth of e-commerce in Indonesia. The convenience of online shopping, coupled with targeted marketing strategies and promotional offers, has attracted a larger consumer base. Additionally, the pandemic accelerated the shift towards online purchases, with platforms like Tokopedia and Shopee becoming go-to destinations for beauty supplement shoppers.

Indonesia Beauty Supplements Market Competitive Landscape

The Indonesian beauty supplements market is dominated by several key players, including both local and international brands. The competitive landscape is characterized by a mixture of established companies and emerging startups that offer innovative products tailored to consumer preferences. Major players such as Herbalife and Amway leverage their extensive distribution networks and brand recognition to maintain their market position. New entrants are focusing on natural and organic formulations, catering to the increasing consumer demand for health-conscious options.

Indonesia Beauty Supplements Industry Analysis

Growth Drivers

- Increasing Health Awareness: The rising health consciousness among Indonesians significantly drives the beauty supplements market. A study by the Indonesian Ministry of Health revealed that 60% of the population is prioritizing preventive healthcare measures, leading to an increased interest in products that promote beauty from within. The consumption of vitamins and dietary supplements is steadily rising, with reports indicating that the supplement industry in Indonesia grew to IDR 15 trillion in 2022, highlighting a growing trend in health-focused purchasing behavior. This increasing awareness is expected to continue fueling demand for beauty supplements as consumers seek healthier lifestyles. Source

- Rising Demand for Natural Ingredients: There is a notable shift towards natural and organic ingredients in the beauty supplements market in Indonesia. The World Health Organization reported that 80% of Indonesians prefer products containing natural components, reflecting a global trend towards clean and sustainable beauty. In 2022, the sales of beauty supplements featuring natural ingredients rose to IDR 10 trillion, showcasing consumers willingness to invest in products perceived as healthier and safer. This demand aligns with Indonesia's biodiversity, which offers numerous natural resources that can be harnessed in supplement formulations.

- Influencer Marketing Trends: Influencer marketing has emerged as a powerful tool in shaping consumer preferences for beauty supplements in Indonesia. According to a report by Statista, the number of social media users in Indonesia reached 205 million in 2023, making it one of the largest social media markets globally. This vast audience creates opportunities for brands to leverage influencers to promote their products effectively. In 2022, it was reported that campaigns using influencers led to a 60% increase in brand engagement and awareness, driving more consumers to consider beauty supplements as part of their daily routines.

Market Challenges

- Regulatory Hurdles: Navigating regulatory frameworks poses challenges for beauty supplement brands in Indonesia. The National Agency of Drug and Food Control (BPOM) enforces stringent regulations on dietary supplements, including registration requirements and safety standards. In 2022, over 1,000 products were rejected or recalled due to non-compliance with these regulations, underscoring the need for companies to invest in compliance efforts. These regulatory hurdles can delay product launches and increase operational costs, impacting market entry strategies for new and existing brands. Source

- Quality Control Issues: Quality control remains a significant concern in the beauty supplements market. The Indonesian Consumer Protection Foundation reported that nearly 30% of beauty supplement products in the market failed to meet safety and quality standards in 2022. Issues such as contamination and inaccurate labeling have raised alarms among consumers, leading to a loss of trust in the industry. To mitigate these challenges, companies are urged to enhance their quality assurance processes and obtain certifications to improve consumer confidence and ensure product safety.

Indonesia Beauty Supplements Market Future Outlook

Over the next few years, the Indonesia beauty supplements market is expected to witness substantial growth, driven by increasing consumer demand for health and wellness products, particularly those that promote beauty from within. The shift towards preventative health measures, coupled with innovative product formulations and aggressive marketing strategies, will significantly contribute to market expansion. Additionally, advancements in technology and e-commerce will further enhance accessibility and consumer engagement, solidifying the growth trajectory of this sector.

Market Opportunities

- Expansion into Untapped Markets: There is significant potential for beauty supplement brands to expand into untapped markets within Indonesia. Regions such as East Nusa Tenggara and West Papua, with limited access to beauty products, represent a growth opportunity. According to the Central Statistics Agency, these regions have seen a population growth of 15% between 2020 and 2022, indicating an increasing consumer base. Brands can explore local partnerships and distribution channels to penetrate these markets, catering to a growing demand for beauty supplements among underserved populations. Source

- Product Innovation: Innovation in product formulations offers a pathway for growth in the beauty supplements market. With 52% of consumers expressing interest in new and unique supplement offerings, brands can invest in research and development to create innovative products that meet specific beauty needs, such as skin health and anti-aging. The increasing consumer preference for personalized beauty solutions is driving brands to explore advanced technologies in ingredient sourcing and formulation, positioning them to capture a larger market share.

Scope of the Report

|

Collagen Supplements Vitamin Supplements Herbal Supplements Protein Supplements |

|

|

By Distribution Channel |

Online Retail Supermarkets/Hypermarkets Specialty Stores Pharmacies |

|

By Consumer Demographics |

Age Groups Gender |

|

By Ingredient Type |

Plant-Based Ingredients Animal-Derived Ingredients |

|

By Region |

North East West South |

Products

Key Target Audience

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, National Agency of Drug and Food Control)

Retailers and Distributors

Health and Wellness Brands

E-commerce Platforms

Pharmaceutical Companies

Health Practitioners and Nutritionists

Beauty and Personal Care Product Manufacturers

Companies

Players Mention in the Report:

Herbalife

Amway

Blackmores

Nature's Way

Usana Health Sciences

GNC Holdings

NeoCell Corporation

Swisse Wellness

Garden of Life

Youtheory

Revive Active

Solgar

Natures Bounty

NutraBlast

Bioglan

Table of Contents

1. Indonesia Beauty Supplements Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Beauty Supplements Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Beauty Supplements Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Health Awareness

3.1.2. Rising Demand for Natural Ingredients

3.1.3. Influencer Marketing Trends

3.1.4. Growth in E-commerce

3.2. Market Challenges

3.2.1. Regulatory Hurdles

3.2.2. Quality Control Issues

3.2.3. Consumer Misconceptions

3.3. Opportunities

3.3.1. Expansion into Untapped Markets

3.3.2. Product Innovation

3.3.3. Collaborations with Beauty Brands

3.4. Trends

3.4.1. Rise of Clean Beauty

3.4.2. Personalized Supplement Solutions

3.4.3. Increased Use of Social Media for Marketing

3.5. Government Regulation

3.5.1. National Health Policies

3.5.2. Labeling and Advertising Standards

3.5.3. Safety and Efficacy Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Beauty Supplements Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Collagen Supplements

4.1.2. Vitamin Supplements

4.1.3. Herbal Supplements

4.1.4. Protein Supplements

4.1.5. Others

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Specialty Stores

4.2.4. Pharmacies

4.3. By Consumer Demographics (In Value %)

4.3.1. Age Groups

4.3.2. Gender

4.4. By Ingredient Type (In Value %)

4.4.1. Plant-Based Ingredients

4.4.2. Animal-Derived Ingredients

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Beauty Supplements Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Herbalife International

5.1.2. Amway Corporation

5.1.3. Usana Health Sciences

5.1.4. Blackmores

5.1.5. GNC Holdings

5.1.6. Garden of Life

5.1.7. NeoCell Corporation

5.1.8. Swisse Wellness

5.1.9. Nature's Way

5.1.10. Solgar

5.1.11. Optimum Nutrition

5.1.12. Youtheory

5.1.13. Bioglan

5.1.14. NutraBlast

5.1.15. Revive Active

5.2. Cross Comparison Parameters (Market Share, Revenue, Distribution Reach, Brand Recognition, Product Range, R&D Investments, Customer Loyalty, Market Entry Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Beauty Supplements Market Regulatory Framework

6.1. Health and Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Beauty Supplements Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Beauty Supplements Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Demographics (In Value %)

8.4. By Ingredient Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Beauty Supplements Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

This initial phase involves mapping out all significant stakeholders within the Indonesian beauty supplements market. Extensive desk research is utilized, combining secondary and proprietary databases to gather comprehensive industry-level information. The primary aim is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, historical data relevant to the beauty supplements market in Indonesia will be compiled and analyzed. This includes assessing market penetration rates and the revenue generated by different product categories. Quality control statistics will also be reviewed to ensure reliable and accurate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and validated through interviews with industry experts representing a variety of companies. These consultations provide valuable operational and financial insights, crucial for refining and corroborating the gathered market data.

Step 4: Research Synthesis and Final Output

The final phase entails direct engagement with multiple beauty supplement manufacturers to gather detailed insights regarding product segments, sales performance, and consumer preferences. This interaction will validate and complement the data derived from the bottom-up approach, ensuring a thorough and accurate analysis of the Indonesian beauty supplements market.

Frequently Asked Questions

01. How big is the Indonesia Beauty Supplements Market?

The Indonesia beauty supplements market is valued at USD 200 million, driven by an increasing focus on health and wellness, alongside a growing demand for natural ingredients.

02. What are the challenges in the Indonesia Beauty Supplements Market?

Indonesia beauty supplements market Challenges include regulatory hurdles, market saturation, and the rising prevalence of counterfeit products, which affect consumer trust and brand integrity.

03. Who are the major players in the Indonesia Beauty Supplements Market?

Indonesia beauty supplements market Key players include Herbalife, Amway, Blackmores, and Nature's Way, which dominate due to their strong brand presence and extensive distribution channels.

04. What are the growth drivers of the Indonesia Beauty Supplements Market?

The Indonesia beauty supplements market is propelled by heightened consumer awareness of health benefits, the influence of social media marketing, and the increasing adoption of online retail platforms.

05. What are the major trends in the Indonesia Beauty Supplements Market?

Current trends in Indonesia beauty supplements market include the rise of clean beauty products, personalized supplement solutions, and the growing popularity of e-commerce for beauty product purchases.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.