Indonesia Box Truck Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4428

December 2024

93

About the Report

Indonesia Box Truck Market Overview

- The Indonesia box truck market is valued at USD 1.9 billion, based on a five-year historical analysis. This growth is primarily driven by the expansion of the logistics and transportation sector, which continues to thrive due to the growing e-commerce industry. Increasing urbanization has also boosted the demand for efficient transportation, which in turn fuels the demand for box trucks. Additionally, government-led infrastructure development projects, including the expansion of road networks and logistics hubs, play a pivotal role in driving market growth.

- Java is the dominant region in the Indonesia box truck market. This is attributed to its dense population and industrial concentration, leading to a high demand for transportation services. The region's advanced infrastructure and strong industrial base make it a key hub for logistics. Other regions like Sumatra and Kalimantan are also emerging due to increasing investments in road development and industrial growth. However, Java remains at the forefront due to its strategic position as a central node in Indonesia's logistics network.

- Customization in box truck design is becoming increasingly popular, as logistics companies seek vehicles tailored to specific needs. In 2023, manufacturers began offering modular box truck designs, allowing for the addition of refrigeration units, increased storage capacity, or other custom features based on client requirements. This trend reflects the growing demand for flexible solutions in Indonesias logistics industry, with companies prioritizing vehicle adaptability to meet diverse transportation needs.

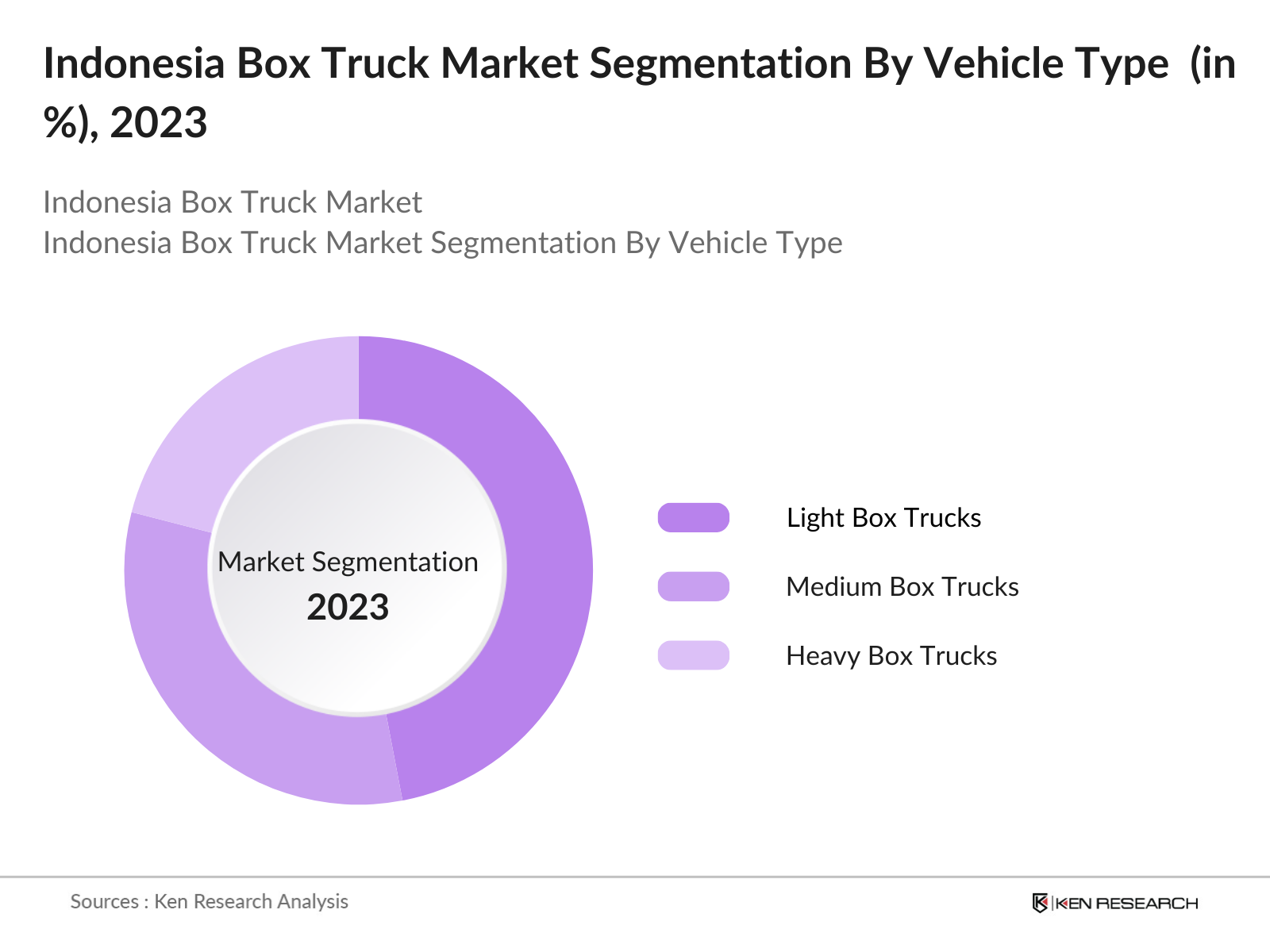

Indonesia Box Truck Market Segmentation

By Vehicle Type: Indonesias box truck market is segmented by vehicle type into light box trucks, medium box trucks, and heavy box trucks. Recently, light box trucks have maintained a dominant market share within this segment due to their versatility and widespread use in urban delivery services. The demand for efficient last-mile delivery solutions, especially in congested urban areas, has boosted the adoption of light box trucks. Their lower cost, ease of navigation in narrow city streets, and the boom of e-commerce have solidified their leading position in the market.

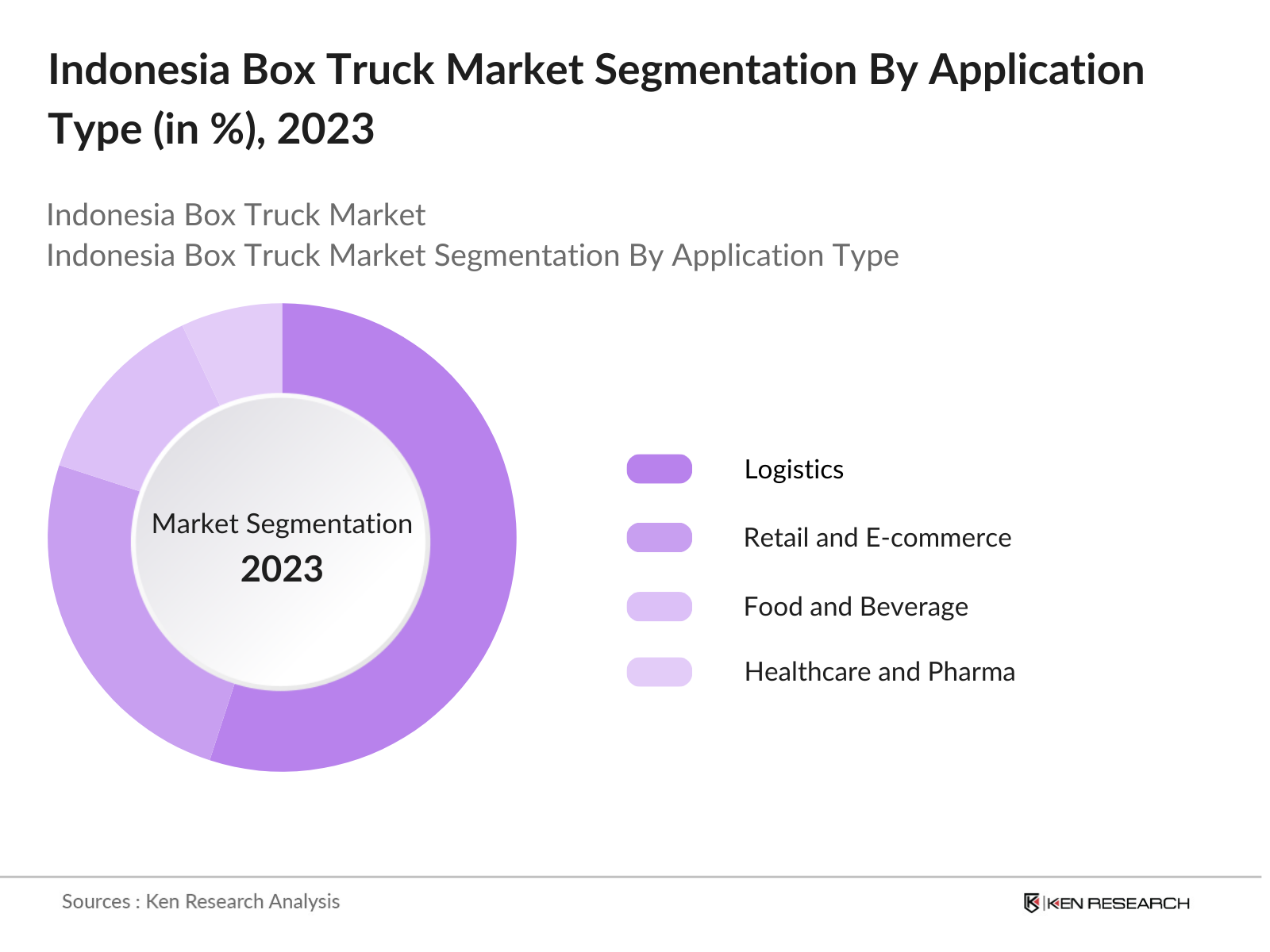

By Application: The box truck market in Indonesia is also segmented by application into logistics, retail and e-commerce, food and beverage transport, and healthcare and pharmaceuticals. The logistics application leads the market in terms of share due to the expansion of domestic and international trade. The rise of e-commerce platforms, along with Indonesias vast archipelago, necessitates the use of reliable box trucks for transporting goods between ports, cities, and rural areas. Logistics companies also rely heavily on box trucks for their versatility in handling different types of cargo efficiently.

Indonesia Box Truck Market Competitive Landscape

The Indonesia box truck market is characterized by a few dominant players, with both local and international manufacturers competing for market share. The market's consolidation is primarily driven by strong brands with extensive distribution networks and innovative product offerings. Companies like Mitsubishi Fuso, Hino Motors, and Isuzu have established themselves as market leaders due to their reliable product range, strong after-sales service, and widespread dealership networks across the country.

Indonesia Box Truck Industry Analysis

Growth Drivers

- Logistics Industry Expansion: Indonesia's logistics industry has seen substantial growth due to increased domestic demand and trade activities, driven by the rise in manufacturing and agricultural output. In 2023, the countrys logistics sector was valued at over IDR 2,500 trillion, contributing significantly to GDP. The governments focus on improving logistics efficiency, with investments in over 500 km of new toll roads under its infrastructure development plan, supports the expansion of the box truck market. Furthermore, the sector provides over 10 million jobs, emphasizing the need for transportation solutions such as box trucks to meet rising logistical demand.

- E-commerce Growth: The rapid growth of Indonesias e-commerce market, which exceeded IDR 500 trillion in 2023, has created strong demand for transportation services, including box trucks for last-mile delivery. The rise in online shopping, especially across urban and rural areas, has led to a surge in delivery volumes. Box trucks, with their ability to carry large volumes of goods, have become essential in facilitating efficient deliveries across the archipelago, a market now comprising over 200 million online users. This shift further accelerates the need for optimized transport vehicles.

- Government Infrastructure Investments: Indonesias government has committed over IDR 400 trillion to infrastructure development in 2024, prioritizing the construction of highways, ports, and transportation hubs. This investment improves connectivity across the countrys vast regions, directly impacting the demand for box trucks to transport goods efficiently. The governments initiative to improve over 2,500 km of national roads by 2025 is expected to enhance freight transportation across key logistical routes, thus boosting the box truck market.

Market Challenges

- High Fuel Prices: Indonesias fuel costs have been a consistent challenge for the transportation sector, with the price of diesel reaching IDR 15,000 per liter in 2023 due to global oil market fluctuations. High operational costs for box trucks, which depend heavily on fuel, have led to increasing financial pressure on logistics companies. This has prompted fleet operators to seek more fuel-efficient alternatives or look into fleet electrification as a long-term solution to reduce expenses.

- Stringent Emission Norms: Indonesias government has introduced stricter vehicle emission standards, aligning with Euro IV standards as of 2022. Compliance with these regulations requires logistics companies to adopt newer, more fuel-efficient and less polluting box trucks. This shift is expensive for smaller fleet operators, who face significant costs in upgrading their vehicles to meet emission requirements. Enforcement of these standards is expected to intensify, pushing for cleaner technologies across commercial vehicle fleets

Indonesia Box Truck Market Future Outlook

Over the next five years, the Indonesia box truck market is expected to witness steady growth driven by continued government investment in infrastructure, increased demand for last-mile delivery solutions, and advancements in electric and hybrid truck technology. The growing emphasis on sustainability and environmental regulations will likely spur the adoption of electric box trucks in urban areas, while logistics companies will continue to expand their fleets to accommodate the rise in e-commerce and retail demand. The market will also benefit from the introduction of smart logistics solutions, such as telematics and fleet management systems, which enhance operational efficiency and reduce costs for logistics providers. Furthermore, international collaborations and partnerships with local assemblers are expected to strengthen the manufacturing base in Indonesia, creating new opportunities for market players.

Opportunities

- Growth of Cold Chain Logistics: Cold chain logistics is becoming increasingly important in Indonesia, particularly in the food and pharmaceutical industries. As of 2023, the countrys cold storage capacity exceeded 3 million cubic meters, necessitating specialized box trucks equipped with refrigeration units to transport perishable goods. The demand for cold chain solutions is further driven by the expansion of the food delivery and healthcare sectors, offering significant growth potential for fleet operators focusing on refrigerated box truck.

- Technological Advancements in Vehicle Efficiency: Technological advancements in vehicle design, particularly in terms of fuel efficiency and load capacity, are transforming Indonesias box truck market. Innovations such as hybrid powertrains and lightweight materials are helping reduce operational costs while enhancing performance. For instance, newer box trucks introduced in 2023 can achieve up to 30% more fuel efficiency compared to their predecessors, which is crucial for logistics companies looking to optimize their fleet operations amidst high fuel costs

Scope of the Report

|

Vehicle Type |

Light Box Trucks Medium Box Trucks Heavy Box Trucks |

|

Fuel Type |

Diesel Electric Hybrid |

|

Application |

Logistics Retail and E-commerce Food and Beverage Transport Healthcare and Pharmaceuticals |

|

End-User |

Small and Medium Enterprises Large Enterprises Government and Public Sector |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Logistics Companies

E-commerce Companies

Food and Beverage Transport Companies

Healthcare and Pharmaceutical Industries

Vehicle Leasing Companies

Government and Regulatory Bodies (Ministry of Transportation, National Development Planning Agency)

Investor and Venture Capitalist Firms

Cold Chain Logistics Industries

Companies

Major Players

Mitsubishi Fuso Truck and Bus Corporation

Hino Motors, Ltd.

Isuzu Motors Ltd.

Toyota Motor Corporation

Tata Motors Limited

UD Trucks Corporation

Hyundai Motor Company

Daihatsu Motor Co., Ltd.

Ford Motor Company

MAN Truck & Bus SE

Scania AB

Daimler Truck AG

General Motors Company

Volvo Group

PT Astra International Tbk

Table of Contents

1. Indonesia Box Truck Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Box Truck Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Box Truck Market Analysis

3.1. Growth Drivers

3.1.1. Logistics Industry Expansion

3.1.2. E-commerce Growth

3.1.3. Government Infrastructure Investments

3.1.4. Urbanization and Population Growth

3.2. Market Challenges

3.2.1. High Fuel Prices

3.2.2. Stringent Emission Norms

3.2.3. Road Infrastructure Limitations

3.2.4. Competition from Other Transport Modes

3.3. Opportunities

3.3.1. Growth of Cold Chain Logistics

3.3.2. Technological Advancements in Vehicle Efficiency

3.3.3. Fleet Electrification

3.3.4. Strategic Partnerships for Supply Chain Optimization

3.4. Trends

3.4.1. Adoption of Telematics and Fleet Management Systems

3.4.2. Transition to Electric Box Trucks

3.4.3. Rising Demand for Last-Mile Delivery Solutions

3.4.4. Customization in Box Truck Design

3.5. Government Regulations

3.5.1. Emission Standards and Policies

3.5.2. Tax Incentives for Electric Vehicles

3.5.3. Infrastructure Development Projects

3.5.4. Logistics Industry Reforms

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Indonesia Box Truck Market Segmentation

4.1. By Vehicle Type (In Value %) 4.1.1. Light Box Trucks

4.1.2. Medium Box Trucks

4.1.3. Heavy Box Trucks

4.2. By Fuel Type (In Value %) 4.2.1. Diesel

4.2.2. Electric

4.2.3. Hybrid

4.3. By Application (In Value %) 4.3.1. Logistics

4.3.2. Retail and E-commerce

4.3.3. Food and Beverage Transport

4.3.4. Healthcare and Pharmaceuticals

4.4. By End-User (In Value %) 4.4.1. Small and Medium Enterprises

4.4.2. Large Enterprises

4.4.3. Government and Public Sector

4.5. By Region (In Value %) 4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Box Truck Market Competitive Analysis

5.1. Detailed Profiles of Major Companies 5.1.1. Mitsubishi Fuso Truck and Bus Corporation

5.1.2. Hino Motors, Ltd.

5.1.3. Isuzu Motors Ltd.

5.1.4. Toyota Motor Corporation

5.1.5. UD Trucks Corporation

5.1.6. PT Astra International Tbk

5.1.7. Tata Motors Limited

5.1.8. Hyundai Motor Company

5.1.9. Daihatsu Motor Co., Ltd.

5.1.10. Ford Motor Company

5.1.11. MAN Truck & Bus SE

5.1.12. Scania AB

5.1.13. Daimler Truck AG

5.1.14. General Motors Company

5.1.15. Volvo Group

5.2. Cross Comparison Parameters

(Number of Employees, Headquarters, Year of Establishment, Revenue, Fleet Size, Market Share, Key Contracts, Innovation Focus)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Box Truck Market Regulatory Framework

6.1. Vehicle Emission Standards

6.2. Safety Regulations for Commercial Vehicles

6.3. Compliance and Certification Processes

6.4. Government Incentives for Electric Vehicles

7. Indonesia Box Truck Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Box Truck Future Market Segmentation

8.1. By Vehicle Type (In Value %) 8.2. By Fuel Type (In Value %) 8.3. By Application (In Value %) 8.4. By End-User (In Value %) 8.5. By Region (In Value %)

9. Indonesia Box Truck Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing and Sales Strategies

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves identifying key variables influencing the Indonesia box truck market. This includes mapping all major stakeholders such as truck manufacturers, logistics providers, and government bodies. Desk research was conducted to gather insights from secondary and proprietary databases.

Step 2: Market Analysis and Construction

In this step, historical data was analyzed to understand the market dynamics. Data on fleet sizes, vehicle types, and application sectors were compiled. Market penetration was also assessed by evaluating logistics companies' truck usage and fleet expansion strategies.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts were consulted through interviews to validate market data. These experts provided valuable insights into operational challenges, regulatory changes, and technological trends, which were used to refine the market projections.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing the research data to produce a comprehensive report. This step included cross-verifying insights with multiple stakeholders, ensuring that the final output provided accurate, up-to-date information on the Indonesia box truck market.

Frequently Asked Questions

1. How big is the Indonesia Box Truck Market?

The Indonesia box truck market is valued at USD 1.9 billion, driven by the expansion of e-commerce, logistics, and government infrastructure initiatives.

2. What are the challenges in the Indonesia Box Truck Market?

Challenges include rising fuel costs, stringent emission regulations, and competition from other transport modes such as rail and sea logistics, which can hinder profitability.

3. Who are the major players in the Indonesia Box Truck Market?

Key players include Mitsubishi Fuso, Hino Motors, Isuzu Motors, Toyota, and Tata Motors, all of which have extensive distribution networks and offer a variety of truck models to meet different transportation needs.

4. What are the growth drivers of the Indonesia Box Truck Market?

Growth drivers include the rise in e-commerce demand, infrastructure development, urbanization, and technological advancements in electric and hybrid trucks, which cater to sustainability goals.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.