Indonesia Breakfast Foods Market Outlook to 2030

Region:Global

Author(s):Abhinav Kumar

Product Code:KROD8801

December 2024

84

About the Report

Indonesia Breakfast Foods Market Overview

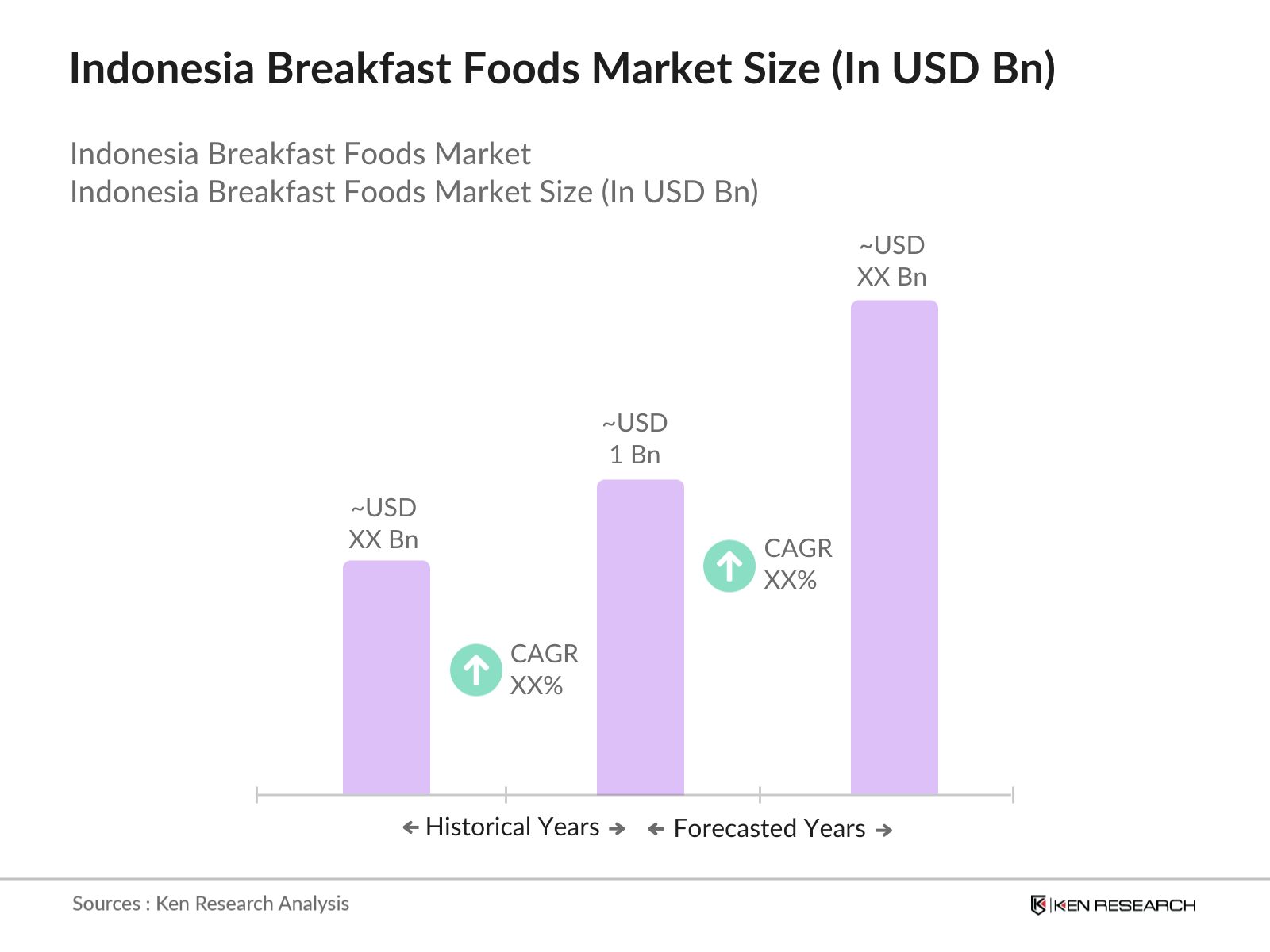

- The Indonesia breakfast foods market, valued at USD 1 billion in 2023, is driven by increasing consumer demand for convenience and healthy food options. This growth is particularly seen in urban areas where fast-paced lifestyles necessitate quick meal solutions. Key drivers include a rising working-class population, a growing e-commerce sector offering a wide range of breakfast products, and the increasing awareness of the importance of balanced breakfasts. Additionally, the introduction of healthier, organic, and plant-based alternatives has been pivotal in boosting market revenues.

- Indonesia's breakfast food market sees significant consumption in cities like Jakarta, Surabaya, and Bandung due to higher disposable incomes and urbanization trends. These cities dominate the market because of their high population density and the presence of large retail chains that make breakfast products widely available. Moreover, the tech-savvy younger population in these urban centers is driving the demand for convenient breakfast options, especially through e-commerce

- In 2024, the Indonesian government continued its focus on improving the nutritional health of its citizens through campaigns that promote balanced diets, particularly in schools and public institutions. The governments National Nutrition Program aims to reduce the prevalence of obesity and diabetes, encouraging the consumption of high-fiber breakfast products. Schools across Jakarta and Surabaya have integrated healthier breakfast options into their meal programs, significantly boosting demand for whole grain cereals and plant-based alternatives.

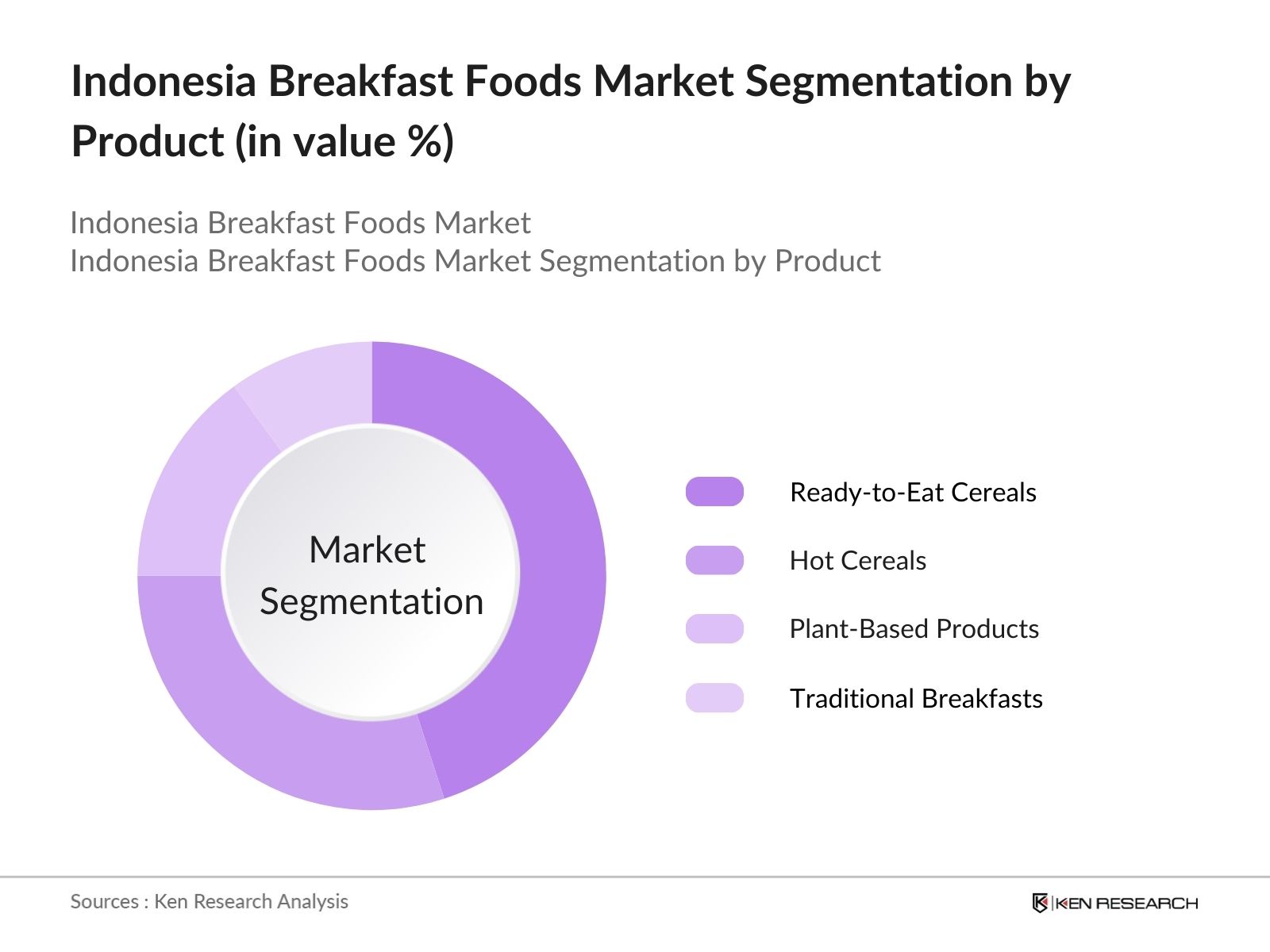

Indonesia Breakfast Foods Market Segmentation

By Product Type: The Indonesia breakfast foods market is segmented into ready-to-eat cereals, hot cereals, plant-based options, and traditional breakfast meals like instant noodles. The ready-to-eat (RTE) cereals segment is the dominant sub-segment due to its convenience and the increasing availability of fortified cereals. Brands like Nestl and Kelloggs offer products tailored to local tastes, contributing to their widespread adoption in urban households. The growing influence of Western breakfast habits has also boosted the RTE segment.

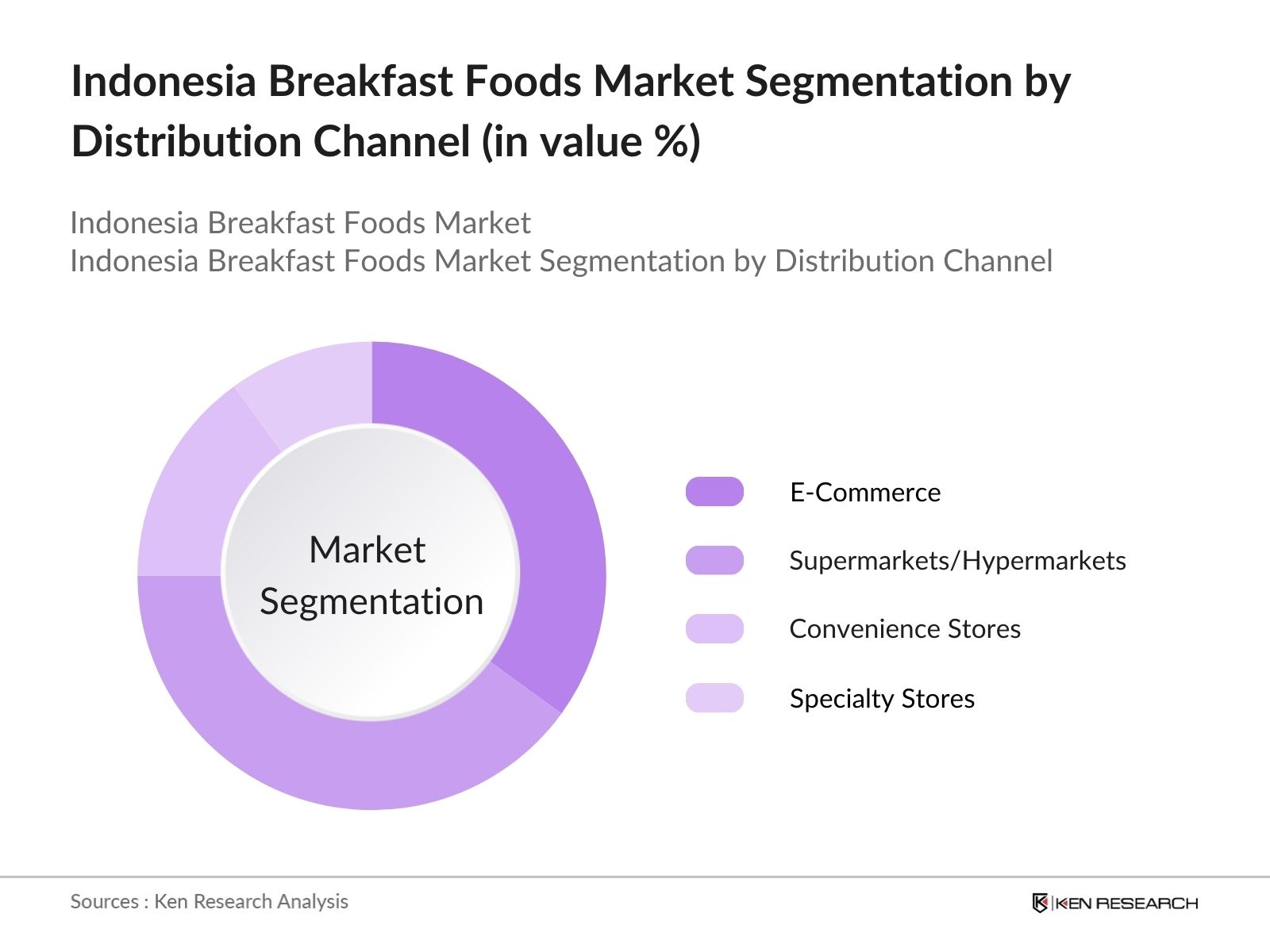

By Distribution Channel: Distribution is segmented into supermarkets/hypermarkets, e-commerce, convenience stores, and specialty stores. The e-commerce segment has seen the most rapid growth due to the convenience of online shopping and a wider selection of breakfast products, particularly organic and health-focused items. E-commerce platforms like Tokopedia and Shopee are leading the charge in making breakfast products available across Indonesia, even in remote areas.

Indonesia Breakfast Foods Competitive Landscape

The Indonesia breakfast foods market is consolidated with several dominant players. Major players include international giants and local brands that have established strong market positions through innovation, localization of product offerings, and extensive distribution networks.

Indonesia Breakfast Foods Market Analysis

Market Growth Drivers

- Increasing Demand for Convenience Foods: The rise in demand for convenience foods continues to drive the breakfast foods market in Indonesia. In 2024, the Indonesian workforce is increasingly seeking quick, easy-to-prepare meal options as busy schedules leave little time for traditional breakfasts. The availability of ready-to-eat (RTE) meals in supermarkets and e-commerce platforms, with innovations like fortified cereals and muesli, is expected to boost market demand. The Indonesian retail sector, especially in urban areas, has reported a significant rise in sales for such breakfast products. For example, Jakarta-based retail chains observed a noticeable uptick in RTE cereals in the first half of 2024, generating over USD 2 billion in sales.

- Shift Towards Healthier Diets: Health-conscious consumers are driving the growth of the breakfast food market as they seek products with added nutritional benefits. Plant-based, high-fiber, and organic cereals are increasingly being preferred over traditional, less nutritious breakfast options. A report from the Indonesia Ministry of Health in 2024 indicated that over 40 million Indonesians are actively looking for healthier alternatives, driving demand for organic breakfast foods and whole grain cereals. The government's nutritional campaigns have also played a significant role in promoting healthier eating habits, further supporting market growth.

- E-Commerce Expansion: The expanding reach of e-commerce platforms like Shopee and Tokopedia in Indonesia is helping breakfast food manufacturers tap into remote and rural areas that were previously inaccessible through traditional retail channels. In 2024, it was reported that breakfast food sales through e-commerce platforms accounted for USD 800 million in revenue, as more consumers opt for online shopping due to convenience and the wider availability of products. This growth is expected to continue as online retailers expand their product offerings and delivery networks across the archipelago.

Market Challenges

- Price Sensitivity Among Lower-Income Consumers: A significant portion of Indonesias population remains price-sensitive, particularly in rural areas where traditional breakfast options like rice and instant noodles are far more affordable than packaged cereals or premium breakfast items. The cost disparity between these traditional meals and modern breakfast products has resulted in a slower adoption rate among lower-income groups. Despite urban growth, the market is hindered by limited affordability for many Indonesian households, especially in regions like Kalimantan and Sulawesi, where the average monthly income remains below USD 300.

- Limited Consumer Awareness in Rural Areas: While urban areas are seeing a shift towards healthier and more convenient breakfast options, rural regions remain largely reliant on traditional meals. Lack of awareness about the benefits of nutrient-rich breakfast products, coupled with limited product availability in remote areas, continues to pose a challenge for market expansion. A recent government survey indicated that nearly 60% of rural households in eastern Indonesia are unaware of alternative breakfast options such as fortified cereals or granola, further delaying market penetration in these regions.

- Cultural Preference for Traditional Breakfasts: Indonesian consumers, particularly in rural areas, tend to favor traditional breakfast foods such as rice porridge (bubur), fried rice (nasi goreng), and boiled cassava over commercially available breakfast cereals. This cultural inclination has created a barrier for modern breakfast food companies trying to penetrate the market with Western-style offerings. Despite aggressive marketing campaigns, major brands have struggled to convince a large portion of the population to shift away from these long-established food traditions, affecting the overall growth of the market.

Indonesia Breakfast Foods Market Future Outlook

Over the next five years, the Indonesia breakfast foods market is expected to grow steadily. Key factors contributing to this growth include rising health consciousness, increasing disposable incomes, and the expansion of e-commerce platforms. Additionally, the market is likely to witness a surge in demand for plant-based and organic breakfast products as consumers become more health-conscious and environmentally aware. The continuous development of the retail sector, both online and offline, will further boost accessibility and availability of breakfast products

Future Market Opportunities

- Growing Demand for Organic and Plant-Based Breakfast Products: Over the next five years, the Indonesian breakfast food market will witness an increasing preference for organic and plant-based products. As consumers become more health-conscious and environmentally aware, the demand for cereals made from organic ingredients, along with plant-based milk alternatives, is expected to exceed USD 2.5 billion by 2028. Major brands are already positioning themselves to capitalize on this trend through product innovation and marketing campaigns.

- Expansion of E-Commerce in Rural Areas: E-commerce platforms like Tokopedia and Shopee are expected to dominate the breakfast food distribution channels by improving their reach into rural Indonesia. The construction of logistics hubs and enhanced delivery infrastructure will allow for greater accessibility, contributing to a projected revenue of USD 1.5 billion from e-commerce breakfast sales by 2028. The rise of online shopping for groceries is set to reshape the landscape of the market, particularly in remote regions.

- Technological Innovations in Product Packaging: The future of the breakfast food market will see an increase in the use of smart packaging solutions that help extend product shelf life and improve convenience for consumers. Companies like Mayora Indah and Nestl are already investing in biodegradable, recyclable, and temperature-sensitive packaging to meet both consumer demand for sustainability and regulatory requirements. By 2028, it is estimated that at least 60% of breakfast products will be packaged using sustainable materials.

Scope of the Report

|

Product Type |

Ready-to-Eat |

|

Distribution Channel |

Supermarkets |

|

Region |

North |

|

Consumer Group |

High-Income Middle-Income |

|

Ingredient Type |

Plant-Based |

Products

Key Target Audience

Retailers (supermarkets, e-commerce platforms)

Breakfast Food Manufacturers

Ingredient Suppliers

Packaging Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Trade, Indonesia National Agency of Drug and Food Control - BPOM)

Food and Beverage Distributors

Logistics Providers

Companies

Players Mentioned in the Report

Nestl S.A.

General Mills Inc.

Kellogg Company

Indofood CBP Sukses Makmur Tbk

PepsiCo Inc.

Mayora Indah Tbk

Quaker Oats Company

Britannia Inc.

Heinz ABC Indonesia

Campbell Soup Company

GarudaFood

Dr. Oetker

Danone Indonesia

Del Monte Foods

Heinz Indonesia

Table of Contents

01. Indonesia Breakfast Foods Market Overview

1.1. Definition and Scope (Market Definition, Key Players, Product Overview)

1.2. Market Taxonomy (Hot Cereals, Ready-to-Eat, Plant-Based Options)

1.3. Market Growth Rate (CAGR, Market Share, Growth Projections)

1.4. Key Market Developments and Trends (Health Consciousness, Organic Options)

02. Indonesia Breakfast Foods Market Size (In USD Bn)

2.1. Historical Market Size (Volume and Revenue Trends, Consumption Patterns)

2.2. Year-On-Year Growth Analysis (Market Revenue Breakdown, Consumer Shifts)

2.3. Key Drivers and Milestones (Rising E-Commerce, Consumer Preferences for Convenience)

03. Indonesia Breakfast Foods Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Busy Lifestyles

3.1.2. E-commerce Penetration in Breakfast Foods

3.1.3. Increasing Health Awareness (Demand for Whole Grain and Fiber-Rich Foods)

3.2. Restraints

3.2.1. Price Sensitivity in Low-Income Segments

3.2.2. Cultural Preferences for Traditional Breakfast Items

3.3. Opportunities

3.3.1. Growth in Plant-Based and Vegan Breakfast Products

3.3.2. Expansion in Rural Areas (Product Localization and Affordability)

3.4. Market Trends

3.4.1. Rise of Protein-Rich and Nutrient-Enriched Breakfast Products

3.4.2. Growing Demand for Ready-to-Eat (RTE) Meals

3.4.3. Use of Social Media in Marketing (Influencer Collaborations, Digital Campaigns)

3.5. Regulatory Overview

3.5.1. Food Safety Standards (BPOM Regulations, Nutritional Labeling)

3.5.2. Import Tariffs and Trade Policies Affecting Breakfast Foods

04. Indonesia Breakfast Foods Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Ready-to-Eat Cereal

4.1.2. Hot Cereal

4.1.3. Muesli and Granola

4.1.4. Instant Noodles

4.1.5. Others (Smoothie Bowls, Energy Bars)

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. E-Commerce

4.2.4. Specialty Stores

4.3. By Consumer Group (In Value %)

4.3.1. High-Income Consumers

4.3.2. Middle-Income Consumers

4.3.3. Low-Income Consumers

4.4. By Region (In Value %)

4.4.1. Java

4.4.2. Sumatra

4.4.3. Bali and Nusa Tenggara

4.4.4. Kalimantan

4.5. By Ingredient Type (In Value %)

4.5.1. Plant-Based (Soy, Almond, Oat)

4.5.2. Dairy-Based

05. Indonesia Breakfast Foods Market Competitive Landscape

5.1 Detailed Profiles of Major Companies

5.1.1. Nestle S.A.

5.1.2. General Mills Inc.

5.1.3. Kellogg Company

5.1.4. PepsiCo Inc.

5.1.5. PT Indofood CBP Sukses Makmur Tbk

5.1.6. GarudaFood

5.1.7. Mayora Indah Tbk

5.1.8. Unilever PLC

5.1.9. Quaker Oats Company

5.1.10. Britannia Inc.

5.1.11. Campbell Soup Company

5.1.12. Dr. Oetker

5.1.13. Nestle Indonesia

5.1.14. Del Monte Foods

5.1.15. Heinz ABC Indonesia

5.2 Cross Comparison Parameters (Revenue, Headquarters, Inception Year, Product Innovations)

5.3 Market Share Analysis

5.4 Strategic Initiatives (Product Launches, Market Expansion)

5.5 Mergers & Acquisitions

5.6 Investors Analysis (Private Equity, Venture Capital)

06. Indonesia Breakfast Foods Market Future Size and Projections (In USD Bn)

6.1. Future Growth Projections (Expansion of RTE and Hot Cereal Segments)

6.2. Factors Driving Future Growth (Convenience, Health Trends)

07. Market Analysts Recommendations

7.1. White Space Opportunities (Untapped Consumer Segments, New Product Formats)

7.2. Marketing Initiatives (Targeted Digital Campaigns, In-Store Promotions)

7.3. Consumer Behavior Analysis (Health-Conscious Shoppers, Price Sensitivity)

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping the breakfast food ecosystem in Indonesia. Desk research was conducted using secondary and proprietary databases to gather insights from industry reports and publications. This helped define the critical variables, such as consumer trends and key market players.

Step 2: Market Analysis and Construction

In this phase, historical data was analyzed to assess market performance from 2018 to 2023. This involved reviewing sales volumes, growth rates, and product preferences within the market. Factors such as distribution channels and urbanization trends were also considered to estimate market performance accurately.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses were validated through interviews with industry experts, including representatives from leading breakfast food manufacturers and distributors. These discussions helped refine the research findings and added deeper insights into market dynamics and challenges.

Step 4: Research Synthesis and Final Output

Finally, data from various sources was synthesized into a comprehensive market report. Cross-verification of data from different reports and consultations ensured the accuracy of market size, growth trends, and future projections.

Frequently Asked Questions

01. How big is the Indonesia Breakfast Foods Market?

The Indonesia breakfast foods market is valued at USD 1 billion, driven by increasing consumer demand for convenient and healthy breakfast options, especially among the working population.

02. What are the challenges in the Indonesia Breakfast Foods Market?

Challenges include price sensitivity in lower-income segments, competition from traditional breakfast options, and logistical issues in reaching remote areas. There are also challenges with regulatory compliance regarding food safety and labeling.

03. Who are the major players in the Indonesia Breakfast Foods Market?

Key players include Nestl, General Mills, Kellogg, Indofood CBP, and Mayora Indah. These companies dominate the market through strong brand recognition and distribution networks.

04. What are the growth drivers of the Indonesia Breakfast Foods Market?

Growth is driven by factors such as urbanization, a rising working-class population, and the expansion of e-commerce platforms. Additionally, the introduction of health-conscious breakfast products, such as plant-based cereals, is fueling demand.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.