Indonesia Butter Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4260

December 2024

97

About the Report

Indonesia Butter Market Overview

- The Indonesia butter market is valued at USD 147.82 million, driven by a combination of increasing consumer demand for dairy products and rising health consciousness among the populace. The growing trend towards premium and organic products is significantly influencing market dynamics, leading to the expansion of product offerings. The market's robust growth can also be attributed to the rising popularity of butter as a key ingredient in various culinary applications, from baking to cooking. This has fostered a more significant acceptance and incorporation of butter in Indonesian households.

- Indonesia's butter market is predominantly driven by major urban centers such as Jakarta, Surabaya, and Bandung. These cities are characterized by higher disposable incomes and changing dietary preferences, with consumers increasingly opting for dairy products. Jakarta, as the capital, leads due to its vast population and significant economic activity, while Surabaya benefits from its status as an important trading hub in Eastern Indonesia. These urban areas have shown a propensity for premium butter products, further solidifying their dominance in the market.

- Sustainability is becoming a central focus in the Indonesian butter market, with consumers increasingly prioritizing eco-friendly products. In 2024, approximately 60% of consumers expressed a willingness to pay more for sustainably sourced dairy products. Many producers are adopting sustainable practices, such as reducing carbon footprints and implementing responsible sourcing strategies. The government is also promoting sustainable agriculture through initiatives aimed at reducing waste and enhancing resource efficiency. This trend aligns with global sustainability goals, positioning the Indonesian butter market for growth as environmentally conscious consumers seek sustainable options.

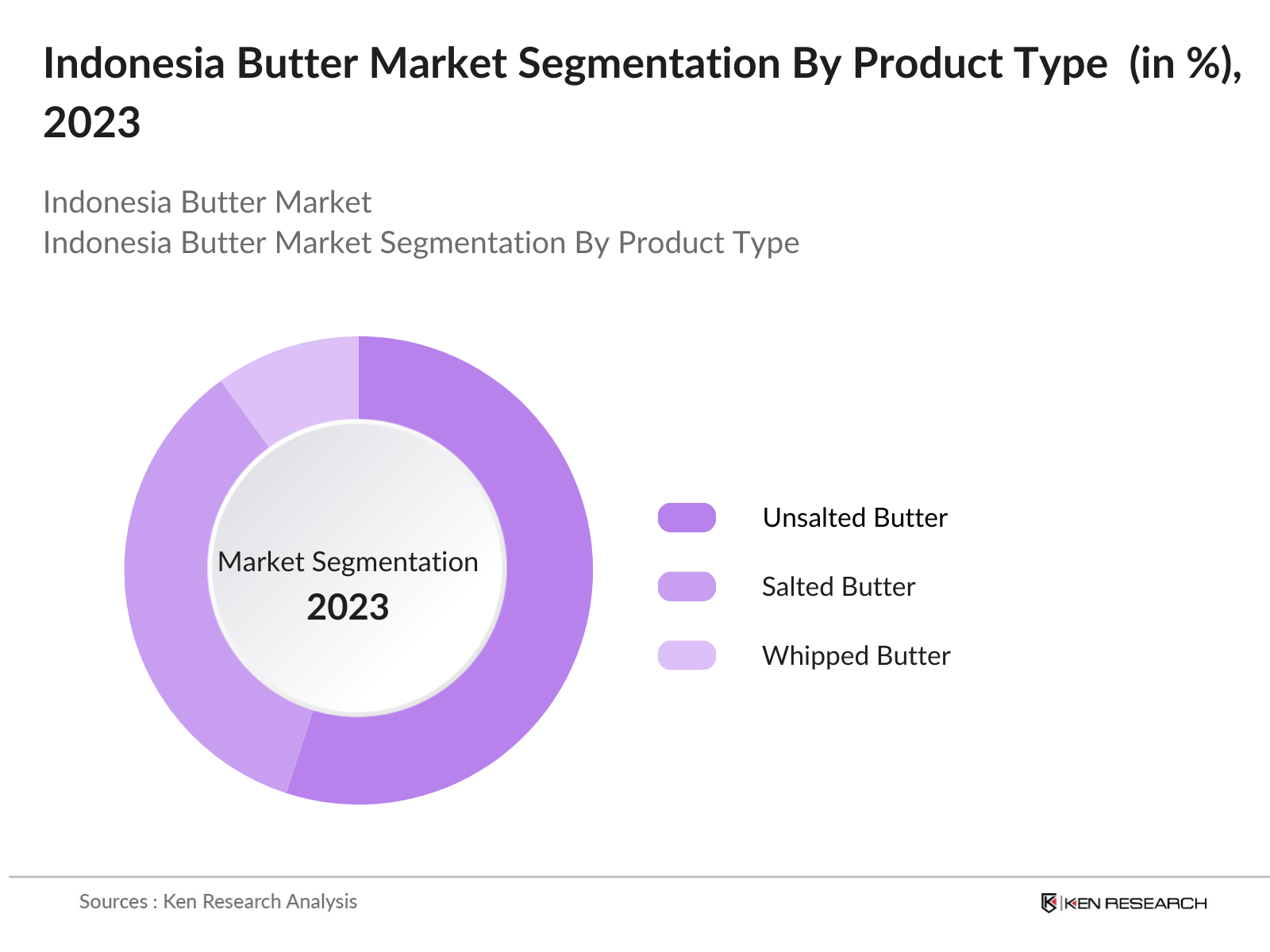

Indonesia Butter Market Segmentation

By Product Type: The Indonesia butter market is segmented by product type into unsalted butter, salted butter, and whipped butter. Recently, unsalted butter has emerged as the dominant sub-segment in this classification. This trend can be attributed to a growing consumer preference for natural flavors and healthier options. Unsalted butter is widely perceived as a purer form of butter, allowing for better control over salt intake, which aligns with health-conscious dietary practices. Additionally, its versatility in culinary applications, especially in baking, enhances its appeal among both home cooks and professional chefs.

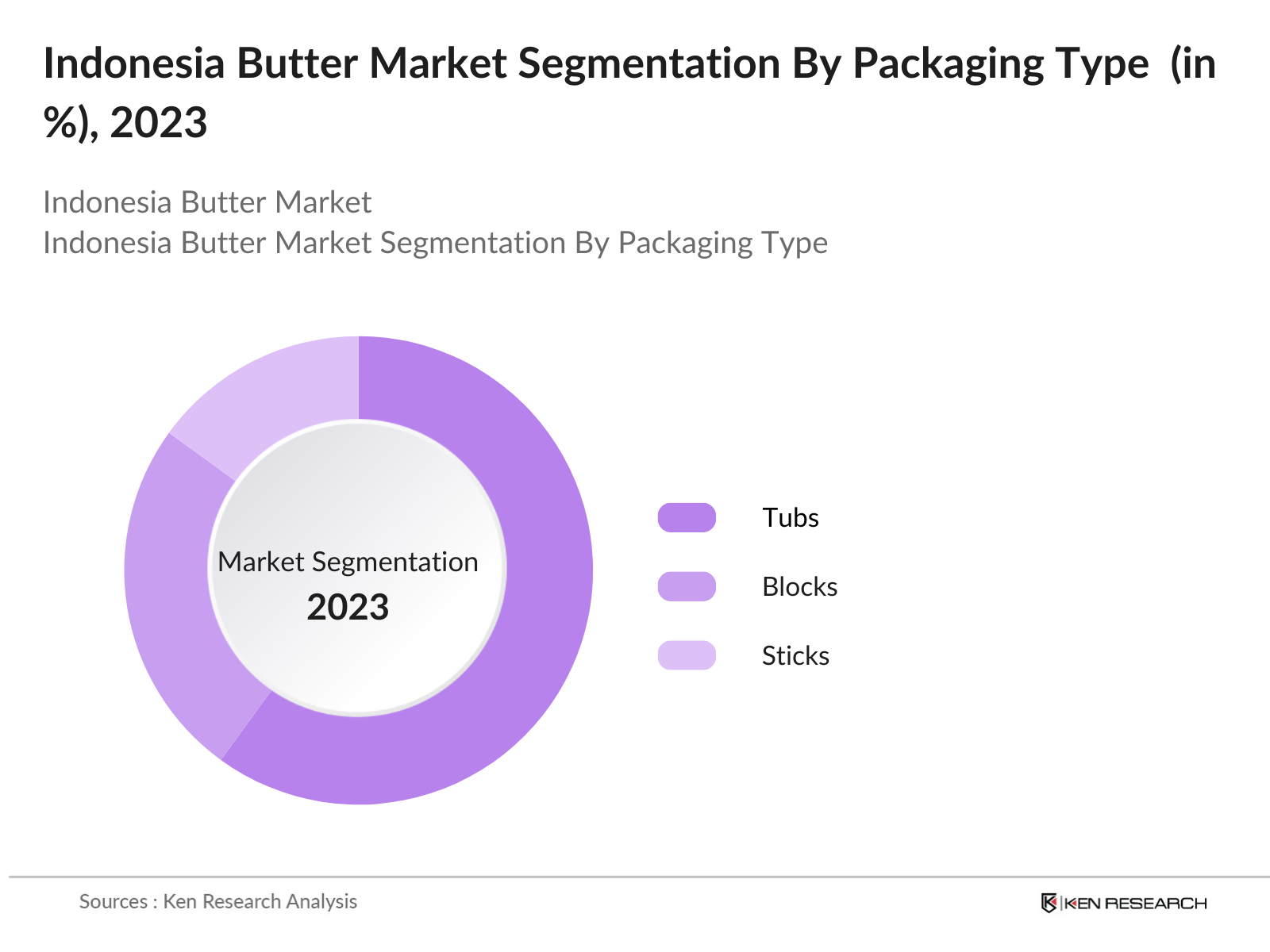

By Packaging Type: The market is also segmented by packaging type, which includes blocks, tubs, and sticks. Among these, tubs have captured the largest market share, primarily due to their convenience and ease of use. The demand for butter in tub packaging is on the rise as consumers appreciate the practicality of spreadable products. Tubs often feature resealable lids, enhancing product longevity and reducing waste, making them increasingly popular among households. This packaging type is especially favored for its functionality in everyday cooking and spreading applications.

Indonesia Butter Market Competitive Landscape

The Indonesia butter market is characterized by a competitive landscape dominated by several major players, including both local and international brands. Key companies include PT. Milkco Indonesia, FrieslandCampina, and Fonterra. These companies have established strong market positions due to their extensive distribution networks and brand loyalty. The consolidation of these players indicates a competitive environment where innovation, product quality, and marketing strategies play a crucial role in capturing consumer interest.

|

Company Name |

Establishment Year |

Headquarters |

Market Presence |

Product Range |

Distribution Network |

Sustainability Practices |

|

PT. Milkco Indonesia |

1994 |

Jakarta |

_ |

_ |

_ |

_ |

|

FrieslandCampina |

1871 |

Amersfoort, Netherlands |

_ |

_ |

_ |

_ |

|

Fonterra |

2001 |

Auckland, New Zealand |

_ |

_ |

_ |

_ |

|

Danone |

1919 |

Paris, France |

_ |

_ |

_ |

_ |

|

Unilever |

1929 |

London, UK |

_ |

_ |

_ |

_ |

Indonesia Butter Industry Analysis

Growth Drivers

- Increasing Demand for Dairy Products: The demand for dairy products, including butter, in Indonesia has seen a substantial increase due to a growing population and rising income levels. In 2024, dairy consumption per capita is projected to reach 12.1 kilograms, reflecting a shift towards healthier dietary options. The Indonesian government has actively promoted dairy farming, aiming to boost domestic production. This initiative is crucial as the country's dairy imports reached $1.09 billion in 2022, with butter accounting for a significant portion. The increased awareness of the nutritional benefits of dairy further drives this demand.

- Rise in Health Consciousness: Health consciousness among Indonesian consumers has risen, influencing dietary choices. As of 2024, approximately 65% of the population is inclined towards natural and organic products, driving the demand for butter made from high-quality, natural ingredients. Reports indicate that the organic food market in Indonesia is valued at approximately $1.2 billion in 2024, with butter being a significant segment due to its perceived health benefits over margarine. This trend aligns with the government's health initiatives to promote dairy products as part of a balanced diet, reflecting the growing preference for healthier options among consumers.

- Urbanization and Changing Lifestyles: Urbanization in Indonesia is accelerating, with over 56% of the population expected to reside in urban areas by 2024. This shift contributes to changing lifestyles, where consumers are increasingly adopting Western dietary habits, including higher butter consumption. The rise of modern retail channels, such as supermarkets and e-commerce, makes butter more accessible. Furthermore, the urban middle class, projected to reach 160 million by 2025, favors convenience and quality, leading to increased butter usage in cooking and baking. This evolving landscape highlights the market's growth potential, driven by urban lifestyle changes.

Market Challenges

- Price Volatility of Raw Materials: The Indonesian butter market faces challenges due to the volatility in raw material prices, particularly milk and cream. In 2023, the average price of milk was around IDR 9,000 per liter, which has fluctuated significantly over the past years, affecting production costs. This price instability can lead to higher retail prices, impacting consumer purchasing behavior. Additionally, global supply chain disruptions due to geopolitical factors have caused fluctuations in import prices, affecting the availability and affordability of butter products in the market. The government is monitoring these trends to ensure stable supply and prices. Source: Central Bureau of Statistics, Indonesia

- Competition from Margarine and Other Substitutes: The Indonesian butter market faces intense competition from margarine and other substitutes, which are often cheaper and marketed as healthier alternatives. In 2023, margarine consumption in Indonesia reached approximately 300,000 tons, driven by its affordability and versatility. This competition poses challenges for butter producers as consumers, particularly in lower-income brackets, may opt for margarine due to cost considerations. Furthermore, the promotion of plant-based diets adds to this competition, as more consumers explore alternatives to traditional dairy products. The butter industry must focus on highlighting its health benefits to compete effectively.

Indonesia Butter Market Future Outlook

Over the next five years, the Indonesia butter market is expected to show significant growth, driven by continuous innovations in product offerings, increasing consumer health consciousness, and a rising demand for convenience in food preparation. The expansion of e-commerce channels and the growing trend of home cooking are likely to bolster sales, making butter an essential pantry staple. Additionally, consumer preferences are shifting towards organic and specialty butters, enhancing market opportunities for premium products.

Opportunities

- Growth of Organic and Specialty Butters: The growth of organic and specialty butters presents significant opportunities for the Indonesian butter market. As of 2024, the organic food segment in Indonesia is valued at approximately $1.2 billion, reflecting a growing consumer preference for natural and healthy options. Specialty butters, including those infused with herbs and spices, are gaining popularity in urban areas, with sales projected to increase by 20% annually. The government's support for organic agriculture further enhances this trend, encouraging farmers to adopt organic practices and meet the rising demand for high-quality butter products. This shift towards organic and specialty options positions the market for substantial growth. Source: Indonesian Ministry of Agriculture

- E-commerce Expansion: E-commerce in Indonesia is booming, with online retail sales expected to reach $55 billion in 2024. This trend offers significant opportunities for butter producers to reach a broader audience through digital platforms. In 2023, approximately 40% of consumers reported purchasing groceries online, and this figure continues to grow, particularly among urban millennials. Butter brands that leverage e-commerce can enhance their visibility and cater to the increasing consumer demand for convenient shopping options. This trend is supported by improved logistics and delivery services, making it easier for consumers to access a variety of butter products online.

Scope of the Report

|

By Product Type |

Unsalted Butter Salted Butter Whipped Butter |

|

By Packaging Type |

Blocks Tubs Sticks |

|

By Distribution Channel |

Supermarkets/Hypermarkets Online Retail Specialty Stores |

|

By End-Use |

Residential Commercial Industrial |

|

By Region |

Java Sumatra Bali Sulawesi Kalimantan |

Products

Key Target Audience

Food and Beverage Companies

Restaurants and Cafs Industry

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Agriculture, Indonesia)

Health and Nutrition Companies

Food Idustries

Import and Export Industries

Companies

Major Players in the Market

PT. Milkco Indonesia

FrieslandCampina

Fonterra

Danone

Unilever

PT. Cisarua Mountain Dairy

Saputo Inc.

Arla Foods

Land O'Lakes

Lactalis

Almarai

Engro Foods

Anchor Dairy

Agri-Food Technologies

Dairy Farmers of America

Table of Contents

1. Indonesia Butter Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Butter Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Butter Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Dairy Products

3.1.2. Rise in Health Consciousness

3.1.3. Urbanization and Changing Lifestyles

3.1.4. Expanding Foodservice Sector

3.2. Market Challenges

3.2.1. Price Volatility of Raw Materials

3.2.2. Competition from Margarine and Other Substitutes

3.2.3. Supply Chain Disruptions

3.3. Opportunities

3.3.1. Growth of Organic and Specialty Butters

3.3.2. E-commerce Expansion

3.3.3. Product Innovation and Diversification

3.4. Trends

3.4.1. Increasing Use of Plant-Based Alternatives

3.4.2. Sustainability Initiatives

3.4.3. Health and Nutritional Fortification

3.5. Government Regulation

3.5.1. Food Safety Standards

3.5.2. Labeling Requirements

3.5.3. Trade Policies

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Butter Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Unsalted Butter

4.1.2. Salted Butter

4.1.3. Whipped Butter

4.2. By Packaging Type (In Value %)

4.2.1. Blocks

4.2.2. Tubs

4.2.3. Sticks

4.3. By Distribution Channel (In Value %)

4.3.1. Supermarkets/Hypermarkets

4.3.2. Online Retail

4.3.3. Specialty Stores

4.4. By End-Use (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Bali

4.5.4. Sulawesi

4.5.5. Kalimantan

5. Indonesia Butter Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT. Milkco Indonesia

5.1.2. FrieslandCampina

5.1.3. Danone

5.1.4. Fonterra

5.1.5. Nestl

5.1.6. PT. Cisarua Mountain Dairy

5.1.7. Saputo Inc.

5.1.8. Arla Foods

5.1.9. Land O'Lakes

5.1.10. Lactalis

5.1.11. Unilever

5.1.12. Almarai

5.1.13. Engro Foods

5.1.14. Anchor Dairy

5.1.15. Agri-Food Technologies

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, Product Portfolio, Market Reach, Sustainability Initiatives, R&D Investment)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Butter Market Regulatory Framework

6.1. Food Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Butter Market Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Butter Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Packaging Type (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End-Use (In Value %)

8.5. By Region (In Value %)

9. Indonesia Butter Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia butter market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia butter market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple butter manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia butter market.

Frequently Asked Questions

01. How big is the Indonesia Butter Market?

The Indonesia butter market is valued at USD 147.82 million, driven by increasing consumer demand for dairy products and a growing trend towards premium and organic options.

02. What are the challenges in the Indonesia Butter Market?

Challenges include price volatility of raw materials, competition from margarine and other substitutes, and supply chain disruptions that can affect availability and pricing.

03. Who are the major players in the Indonesia Butter Market?

Key players in the market include PT. Milkco Indonesia, FrieslandCampina, Fonterra, and Danone, which dominate due to their extensive distribution networks and strong brand loyalty.

04. What are the growth drivers of the Indonesia Butter Market?

The market is propelled by factors such as rising health consciousness among consumers, increasing popularity of home cooking, and a growing trend towards organic and specialty butter products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.