Indonesia CBD Beverage Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD6710

December 2024

83

About the Report

Indonesia CBD Beverage Market Overview

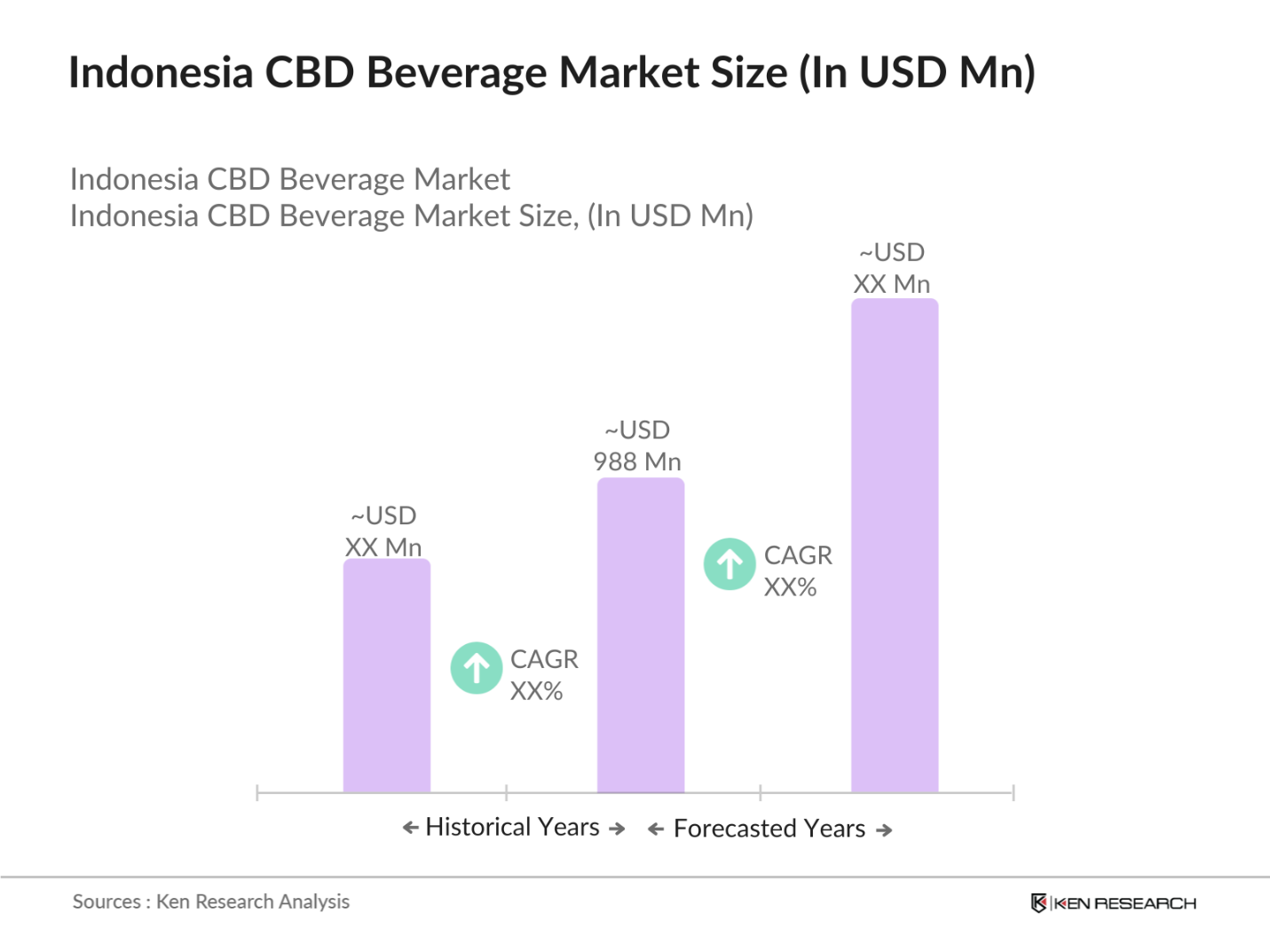

- The Indonesia CBD beverage market is valued at USD 988 million, driven by increasing consumer demand for health and wellness products infused with cannabidiol (CBD). The adoption of CBD in beverages is fueled by growing public awareness of its potential benefits, such as stress relief and improved focus. Indonesia's market has seen significant growth, largely due to favorable government regulations regarding hemp-derived CBD. This has opened up avenues for innovation in functional beverages, with companies launching new product lines aimed at health-conscious consumers.

- Java and Bali dominate the market due to their more progressive regulations and higher consumer demand for wellness products. Javas large urban population, including major cities like Jakarta and Surabaya, leads to higher consumption, while Bali's tourist-driven economy increases the demand for innovative beverage options like CBD-infused drinks. Both regions have advanced retail and distribution networks, making it easier for brands to reach consumers.

- The Indonesian Food and Drug Authority (BPOM) plays a crucial role in regulating CBD products within the country. As of 2024, BPOM has established clear guidelines for the approval of CBD-infused beverages, requiring comprehensive safety and efficacy data. The regulatory framework is designed to ensure consumer safety and product quality, with BPOM conducting regular inspections of production facilities. Compliance with these regulations is vital for market entry, as products must meet stringent health standards. This oversight can foster consumer trust in CBD beverages, aiding their acceptance in a market previously hesitant about cannabis-related products.

Indonesia CBD Beverage Market Segmentation

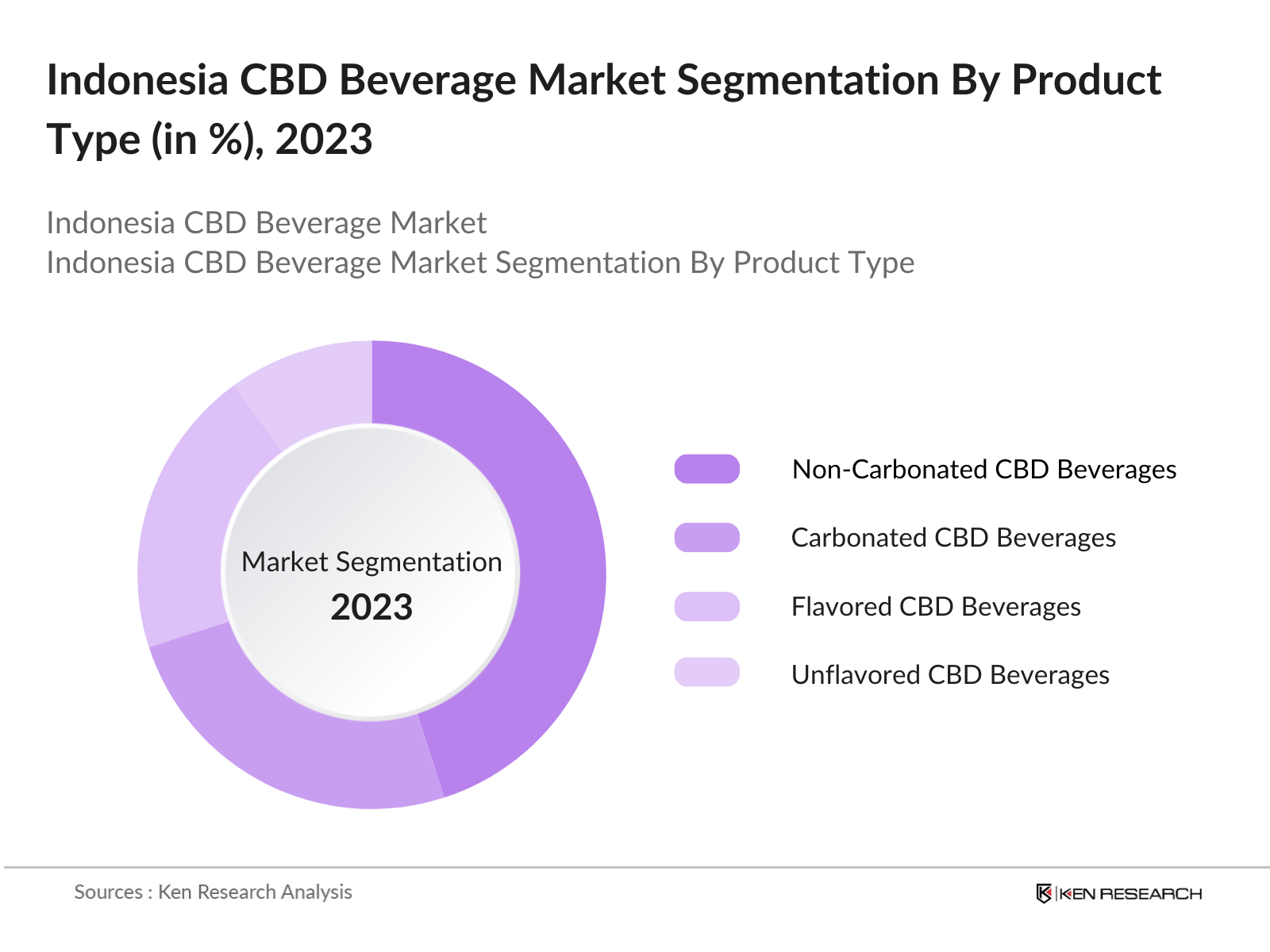

By Product Type: Indonesias CBD beverage market is segmented into carbonated CBD beverages, non-carbonated CBD beverages, flavored CBD beverages, and unflavored CBD beverages. Non-carbonated CBD beverages hold the dominant share of the market due to their versatility and consumer preference for traditional non-carbonated drinks such as iced teas, coffees, and juices. These products are often seen as healthier options and fit well into the daily routines of health-conscious consumers. The rise of the wellness trend has propelled the popularity of these beverages, as they are frequently marketed as promoting relaxation and overall wellbeing.

By Distribution Channel: The CBD beverage market in Indonesia is segmented by distribution channel into supermarkets/hypermarkets, specialty stores, online retail, and convenience stores. Supermarkets and hypermarkets currently dominate the distribution of CBD beverages due to their extensive networks and established trust among consumers. These large retail chains have the capacity to educate customers on the benefits of CBD beverages, providing product samples and in-store marketing initiatives that highlight the health advantages of consuming CBD-infused drinks.

Indonesia CBD Beverage Market Competitive Landscape

The Indonesian CBD beverage market is concentrated, with several key players holding significant market influence. Both domestic and international companies are participating in this market, leveraging their distribution networks, brand recognition, and product innovation capabilities to secure a competitive edge. The landscape is shaped by both legacy beverage brands entering the CBD space and new companies focused exclusively on CBD-infused products. This competitive nature is further enhanced by regulatory clarity in Indonesia, which has allowed more brands to confidently enter the market.

|

Company |

Established |

Headquarters |

CBD Beverage Portfolio |

Distribution Reach |

Product Innovation |

Market Share |

Partnerships |

Retail Strategy |

R&D Investment |

|

Recess |

2018 |

New York, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Pervida |

2017 |

Virginia, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Canopy Growth Corporation |

2013 |

Ontario, Canada |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

New Age Beverages |

2010 |

Colorado, USA |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

|

Love Hemp |

2015 |

London, UK |

_ |

_ |

_ |

_ |

_ |

_ |

_ |

Indonesia CBD Beverage Industry Analysis

Growth Drivers

- Increasing Legalization of CBD Products: The increasing legalization of CBD products in Indonesia is significantly influencing the CBD beverage market. As of 2024, the Indonesian government has indicated a shift in regulatory frameworks, with the National Narcotics Agency reporting a growing acceptance of hemp-derived products. In 2023, the country amended its narcotics laws, enabling the use of CBD for therapeutic purposes. This regulatory shift is critical as it aligns with global trends, where legal markets for CBD have seen substantial growth. The potential for expanding the product range to include CBD-infused beverages is further underscored by the rise in legal cannabis markets worldwide, projected to generate over $73 billion by 2024 globally. Such developments encourage local producers to innovate and cater to a broader consumer base.

- Growing Consumer Awareness of CBDs Health Benefits: Consumer awareness regarding the health benefits of CBD has markedly increased in Indonesia, significantly propelling the market for CBD beverages. A survey conducted by the Ministry of Health indicated that approximately 65% of urban consumers are aware of CBD's potential therapeutic effects, including anxiety relief and pain management. This growing interest is supported by the rise in health-conscious lifestyles, with the World Health Organization reporting a significant increase in the demand for functional beverages globally, estimated to reach $1 trillion in sales by 2025. The awareness drives product innovation and diversification in flavors and formulations, catering to health-focused consumers.

- Rising Demand for Functional Beverages: The demand for functional beverages is on the rise in Indonesia, creating a lucrative opportunity for CBD-infused products. According to a report from the Food and Drug Authority (BPOM), the functional beverage market in Indonesia was valued at approximately IDR 20 trillion in 2023, with projections indicating a continued upward trend. This growth is attributed to increasing consumer preferences for beverages that offer health benefits, such as improved immunity and relaxation. The surge in urban lifestyles and the corresponding interest in wellness and health products are driving this demand, leading to a significant uptick in the variety and availability of CBD beverages.

Market Challenges

- Regulatory Hurdles and Compliance Issues: Regulatory hurdles present a significant challenge for the CBD beverage market in Indonesia. While recent changes have relaxed some regulations, stringent compliance requirements remain. The Indonesian Food and Drug Authority mandates rigorous testing and approval processes for all food and beverage products, including those containing CBD. The complexity of navigating these regulations can deter new entrants and small producers. Furthermore, the lack of a clear regulatory framework specific to CBD products adds to the uncertainty, complicating the marketing and distribution of these beverages. This environment could lead to potential market fragmentation, with only larger companies able to navigate the complexities effectively.

- High Pricing of CBD-Infused Beverages: The high pricing of CBD-infused beverages poses a significant challenge to market growth in Indonesia. As of 2024, the average retail price for a CBD beverage is around IDR 50,000 per unit, which is significantly higher than conventional beverages priced at IDR 15,000 to IDR 20,000. This price differential can limit accessibility for the average consumer, particularly in rural areas where purchasing power is lower. Economic data from the World Bank indicates that approximately 30% of the Indonesian population lives below the national poverty line, impacting overall consumption patterns and limiting the potential market reach for premium-priced CBD products.

Indonesia CBD Beverage Market Future Outlook

The Indonesia CBD beverage market is poised for continued expansion, supported by regulatory developments, growing consumer interest in functional beverages, and the increasing availability of CBD products. As consumer preferences shift toward wellness and health-enhancing drinks, CBD beverages are likely to gain further traction, especially in major urban centers like Jakarta, Bali, and Surabaya. The evolving e-commerce landscape will also play a key role, offering consumers easy access to a wide range of CBD-infused beverages. Collaboration between domestic and international brands will further stimulate product innovation, while government clarity on CBD regulations will encourage more brands to enter the market.

Opportunities

- Expansion into New Flavors and Product Formats: There is a significant opportunity for growth in the Indonesian CBD beverage market through the expansion into new flavors and product formats. Current market trends indicate a consumer preference for diverse and innovative flavor profiles, with the Indonesian Ministry of Industry noting an increased interest in tropical flavors. In 2023, approximately 30% of beverage consumers reported seeking unique flavor experiences. This demand can be leveraged by introducing CBD-infused drinks that incorporate local flavors such as pandan, mango, and rambutan, tapping into cultural preferences. Such product innovation can attract a wider audience, thus enhancing market penetration. Source: Indonesian Ministry of Industry.

- Collaborations with International Beverage Brands: Collaborations with international beverage brands present a lucrative opportunity for local producers in Indonesia's CBD market. By partnering with established brands, local companies can benefit from global expertise in product development, marketing strategies, and distribution networks. This synergy could facilitate the introduction of high-quality CBD beverages in the local market. In 2023, the Indonesian beverage industry saw a notable increase in joint ventures, with the Ministry of Trade reporting a 25% rise in foreign direct investments within the sector, indicating a positive environment for strategic collaborations that could enhance product visibility and consumer trust.

Scope of the Report

|

Product Type |

Carbonated CBD Beverages Non-Carbonated CBD Beverages Flavored CBD Beverages Unflavored CBD Beverages |

|

Distribution Channel |

Supermarkets/Hypermarkets Specialty Stores Online Retail Convenience Stores |

|

End-Use |

Health and Wellness Recreational Use Nutritional Supplements |

|

Packaging Type |

Bottled Canned Pouch |

|

Region |

Java Sumatra Bali Kalimantan Papua |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

CBD Beverage Companies

Beverage Industries

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Indonesian Food and Drug Authority, BPOM)

Health and Wellness Companies

E-commerce Companies

Cannabis Cultivation Companies

Companies

Players Mentioned in the Report:

Recess

Pervida

Canopy Growth Corporation

New Age Beverages

Love Hemp

Aurora Cannabis

Alkaline88

Dixie Brands

Lifeaid Beverage Co.

Wyld CBD

Hempfy

Endoca

CBDfx

Beverage Trade Network

Youngevity International

Table of Contents

1. Indonesia CBD Beverage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Percentage Growth in CBD Beverage Consumption)

1.4. Market Segmentation Overview (Product Type, Distribution Channel, End-Use, Region, Packaging Type)

2. Indonesia CBD Beverage Market Size (In USD Mn)

2.1. Historical Market Size (Market Size Derived from Sales Volume and Revenue)

2.2. Year-On-Year Growth Analysis (CBD-Infused Beverage Sales Trends and CAGR Data)

2.3. Key Market Developments and Milestones (Regulatory Approvals, New Product Launches, Collaborations)

3. Indonesia CBD Beverage Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Legalization of CBD Products

3.1.2. Growing Consumer Awareness of CBDs Health Benefits

3.1.3. Rising Demand for Functional Beverages

3.2. Market Challenges

3.2.1. Regulatory Hurdles and Compliance Issues

3.2.2. High Pricing of CBD-Infused Beverages

3.2.3. Limited Consumer Knowledge about CBD Safety

3.3. Opportunities

3.3.1. Expansion into New Flavors and Product Formats

3.3.2. Collaborations with International Beverage Brands

3.3.3. Growing Popularity in Urban and Wellness-Oriented Segments

3.4. Trends

3.4.1. Infusion of CBD into Traditional Indonesian Beverages

3.4.2. Increasing Demand for Organic and Natural CBD Beverages

3.4.3. Growing Use of Sustainable and Eco-friendly Packaging

3.5. Government Regulation

3.5.1. Indonesian Food and Drug Authority (BPOM) CBD Regulations

3.5.2. Import Regulations on CBD Ingredients

3.5.3. Consumer Health and Safety Standards

3.6. SWOT Analysis

3.6.1. Strengths (Growing Health and Wellness Market)

3.6.2. Weaknesses (Lack of Large-Scale Manufacturers in Indonesia)

3.6.3. Opportunities (E-commerce Growth in Beverage Sales)

3.6.4. Threats (Global Supply Chain Issues for CBD Ingredients)

3.7. Stakeholder Ecosystem

3.7.1. Manufacturers

3.7.2. Distributors

3.7.3. Retailers

3.7.4. Government Agencies

3.7.5. Regulatory Bodies

3.8. Porters Five Forces Analysis

3.8.1. Bargaining Power of Suppliers

3.8.2. Bargaining Power of Buyers

3.8.3. Threat of New Entrants

3.8.4. Threat of Substitutes

3.8.5. Industry Rivalry

3.9. Competition Ecosystem

4. Indonesia CBD Beverage Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Carbonated CBD Beverages

4.1.2. Non-Carbonated CBD Beverages

4.1.3. Flavored CBD Beverages

4.1.4. Unflavored CBD Beverages

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Specialty Stores

4.2.3. Online Retail

4.2.4. Convenience Stores

4.3. By End-Use (In Value %)

4.3.1. Health and Wellness

4.3.2. Recreational Use

4.3.3. Nutritional Supplements

4.4. By Packaging Type (In Value %)

4.4.1. Bottled

4.4.2. Canned

4.4.3. Pouch

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Bali

4.5.4. Kalimantan

4.5.5. Papua

5. Indonesia CBD Beverage Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Recess

5.1.2. Pervida

5.1.3. Canopy Growth Corporation

5.1.4. Alkaline88

5.1.5. Aurora Cannabis

5.1.6. New Age Beverages

5.1.7. Dixie Brands

5.1.8. Love Hemp

5.1.9. Beverage Trade Network

5.1.10. Lifeaid Beverage Co.

5.1.11. Wyld CBD

5.1.12. Youngevity International

5.1.13. Endoca

5.1.14. Hempfy

5.1.15. CBDfx

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share (Indonesia)

5.2.6. Product Portfolio Depth

5.2.7. CBD Beverage Innovations

5.2.8. Distribution Network in Indonesia

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers And Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia CBD Beverage Market Regulatory Framework

6.1. CBD Beverage Labeling and Marketing Laws

6.2. Compliance with BPOM Standards

6.3. Permissible CBD Concentrations in Beverages

6.4. Import Tariffs and Trade Restrictions

7. Indonesia CBD Beverage Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia CBD Beverage Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-Use (In Value %)

8.4. By Packaging Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia CBD Beverage Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involves developing an ecosystem map encompassing key stakeholders in the Indonesia CBD beverage market. This stage incorporates comprehensive desk research, using a blend of proprietary databases and public data sources, to gather industry-level insights. The goal is to determine the variables that drive market dynamics, such as consumer trends, regulatory shifts, and distribution channels.

Step 2: Market Analysis and Construction

This phase includes historical data collection on the Indonesia CBD beverage market, examining market penetration, supply chain complexities, and revenue generation. Additionally, the distribution network for CBD beverages is assessed to ensure the accuracy of market share estimates for different segments.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are formed and then tested through structured interviews with industry experts. These consultations will deliver operational and financial insights, helping validate key market drivers and trends, as well as emerging threats and opportunities.

Step 4: Research Synthesis and Final Output

The last phase involves a bottom-up analysis where we engage with beverage manufacturers to verify product performance, sales data, and consumer preferences. This data will complement the top-down research methodology, resulting in a thorough and accurate final market report.

Frequently Asked Questions

01 How big is the Indonesia CBD Beverage Market?

The Indonesia CBD beverage market is valued at USD 988 million, largely driven by consumer interest in wellness products and regulatory support for hemp-based CBD products.

02 What are the challenges in the Indonesia CBD Beverage Market?

Key challenges include strict regulations regarding CBD content, high pricing due to supply chain issues, and limited consumer education about the benefits of CBD beverages.

03 Who are the major players in the Indonesia CBD Beverage Market?

The major players include Recess, Pervida, Canopy Growth Corporation, New Age Beverages, and Love Hemp, all of which have established significant market presence through product innovation and distribution partnerships.

04 What are the growth drivers of the Indonesia CBD Beverage Market?

The market is primarily driven by the rising demand for wellness and functional beverages, along with favorable government regulations allowing the use of hemp-derived CBD in beverages.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.