Indonesia Chemiluminescence Immunoassay Market Outlook to 2029

Region:Asia

Author(s):Shashank, Sunaiyna, Rhythm

Product Code:KR1484

April 2025

80-100

About the Report

Indonesia CLIA Market Overview

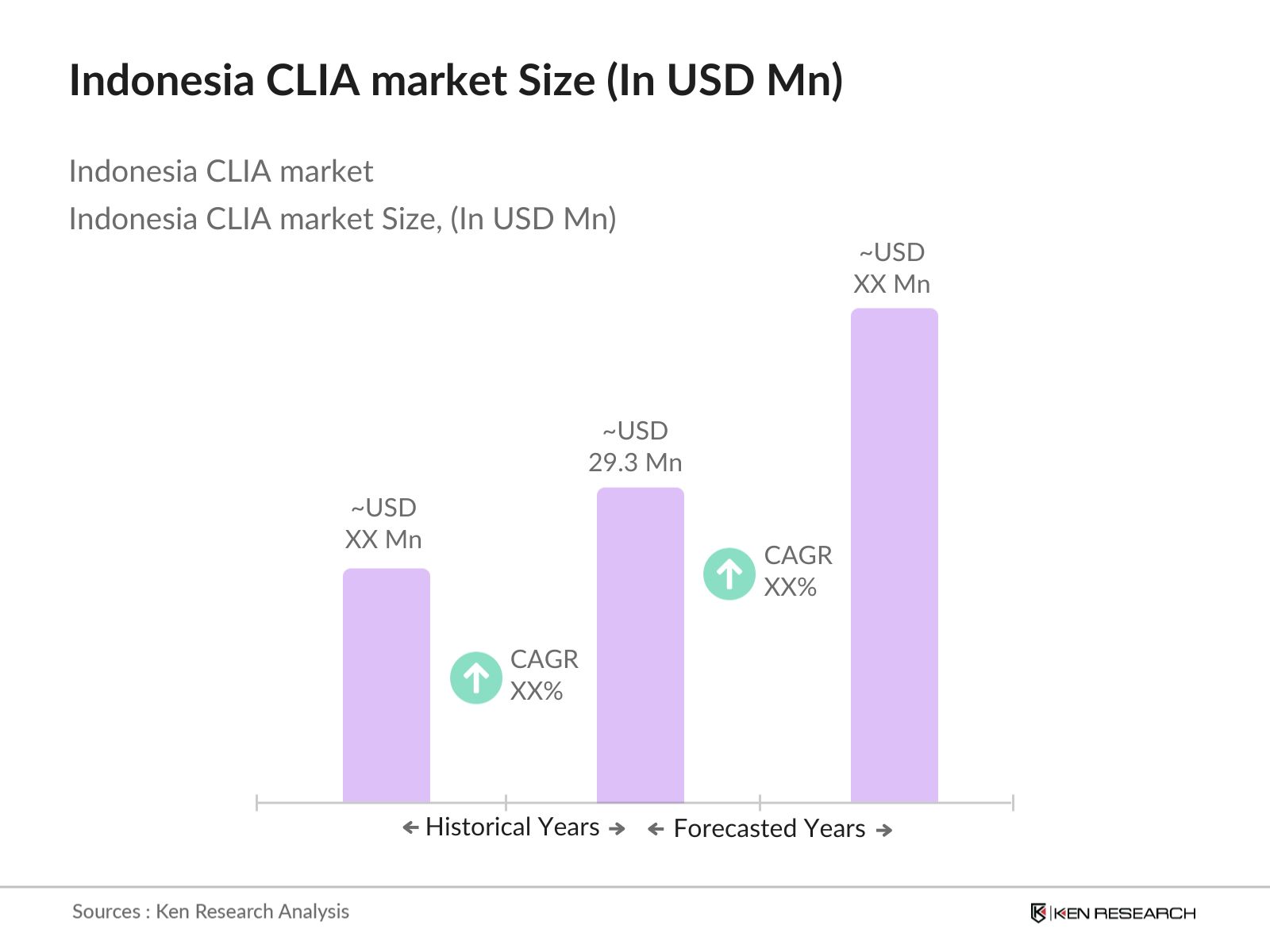

The Indonesia CLIA market is valued at USD 29.3 million, based on a five-year historical analysis. This growth is driven primarily by the rising demand for infectious disease diagnostics and oncology testing. The consistent need for reagent replenishment, increasing hospital coverage under the JKN health scheme, and the growing base of diagnostic laboratories have collectively pushed revenue upward.

Java dominates the Indonesia CLIA market due to its dense population, highly developed healthcare infrastructure, and concentration of leading public and private hospitals. With over 1,100 hospitals and nearly 3,000 public health centers, Javas diagnostic readiness and access are significantly ahead of other regions. Sumatra follows as another key region, driven by urban expansion and growing investment in diagnostic centers by private players.

Starting 2023, all imported CLIA kits used in public hospitals must be certified by BPJPH (Halal Authority) and meet TKDN thresholds set by Kemenperin (Ministry of Industry). Over 60% of tenders in 2024 are only open to kits listed in the national e-Katalog and compliant with domestic sourcing requirements. Products without a minimum 20% local content are now restricted from bidding in public procurement projects across the Ministry of Health network.

Indonesia CLIA Market Segmentation

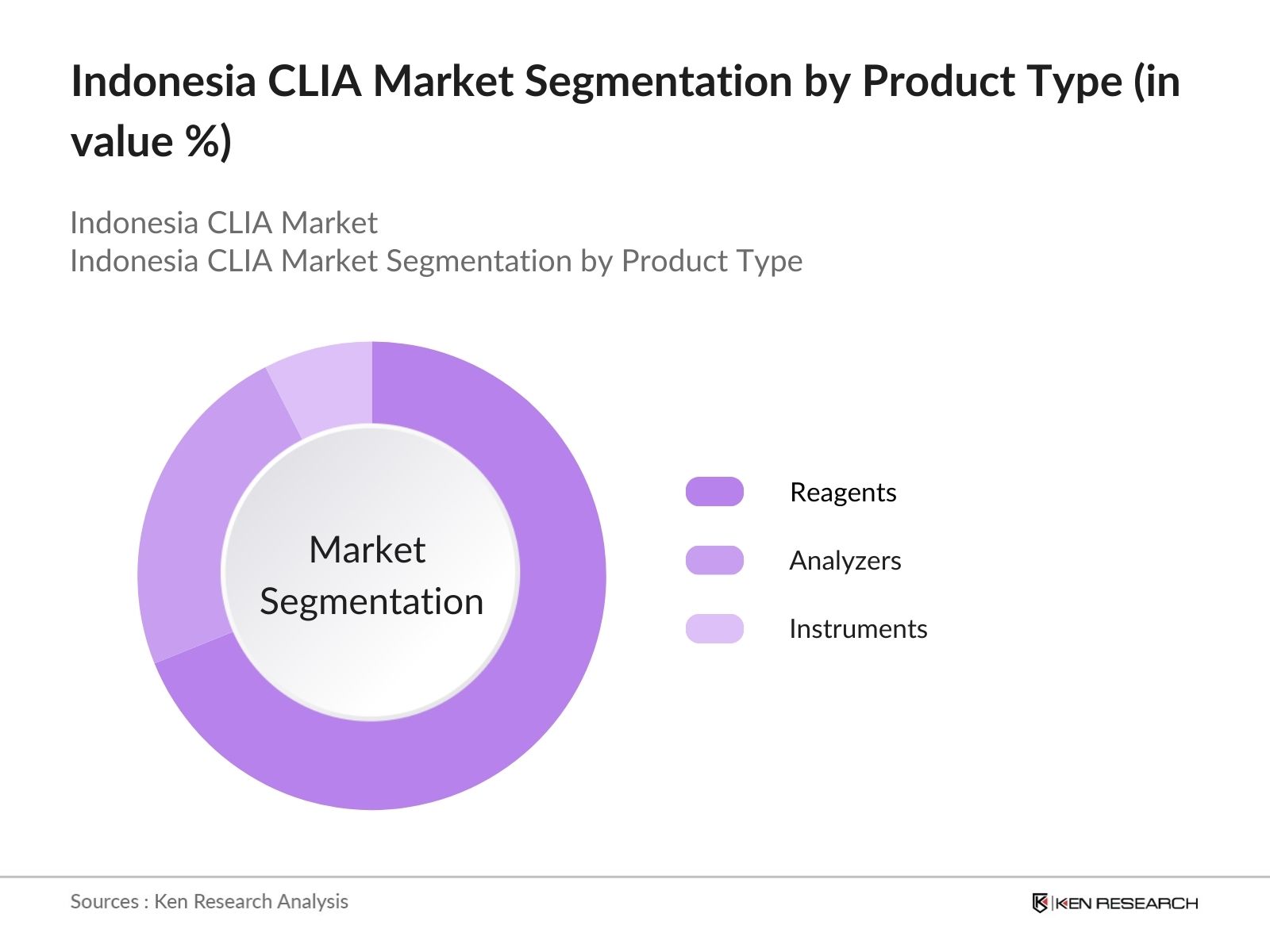

By Product Type: Indonesias CLIA market is segmented by product type into reagents, analyzers, and instruments. Reagents hold the dominant market share under the segmentation of product type. This is due to their recurring nature in diagnostics, where substrates, enzymes, and antibodies must be frequently replenished for each test cycle. Additionally, global players like Roche and Mindray have strong reagent portfolios, further boosting this segment's growth.

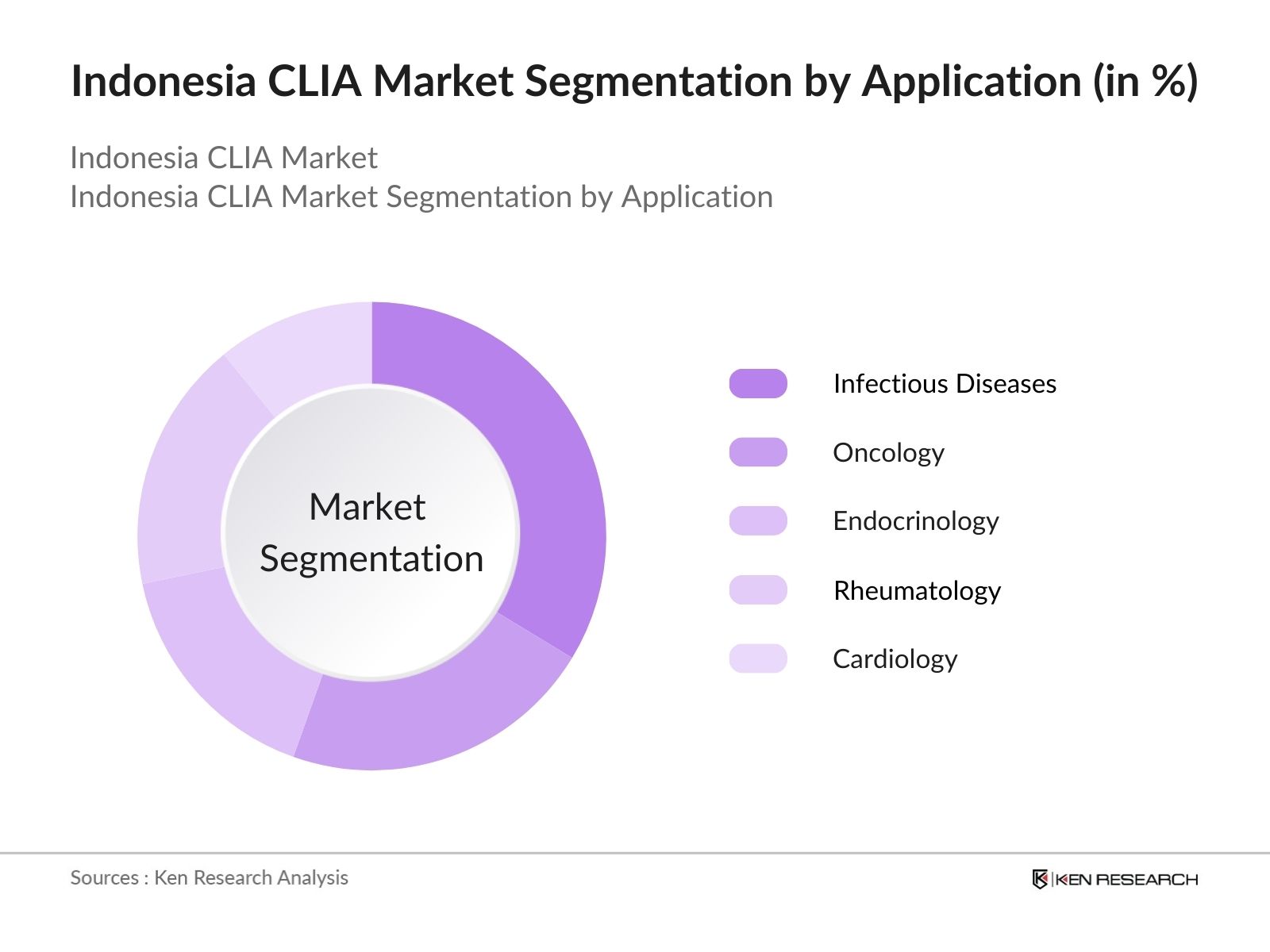

By Application: Indonesias CLIA market is segmented by application into infectious diseases, oncology, endocrinology, rheumatology, and cardiology. Infectious diseases have emerged as the leading application segment. The ongoing public health focus on communicable disease detection, especially with heightened testing post-pandemic, has kept this segment dominant. Government-sponsored insurance schemes further ensure large-scale testing, especially through hospital reimbursements for NCD screenings.

By Application: Indonesias CLIA market is segmented by application into infectious diseases, oncology, endocrinology, rheumatology, and cardiology. Infectious diseases have emerged as the leading application segment. The ongoing public health focus on communicable disease detection, especially with heightened testing post-pandemic, has kept this segment dominant. Government-sponsored insurance schemes further ensure large-scale testing, especially through hospital reimbursements for NCD screenings.

Indonesia CLIA Market Competitive Landscape

The Indonesia CLIA market is dominated by a few major players, including Mindray, Abbott, and Roche, supported by regional expansions of Siemens Healthineers and Snibe Diagnostics. This consolidation highlights the significant influence of these key companies, particularly in the reagent and analyzer segments.

Indonesia CLIA Market Analysis

Growth Drivers

Expansion of Healthcare Infrastructure: Indonesia added over 213 new hospitals between 2020 and 2023, raising the total to 2,636 general hospitals (MoH Indonesia, 2023). The number of public health centers surpassed 10,374 units by late 2023, supporting increased diagnostic demand. The government allocated IDR 197.8 trillion (USD 12.1 billion) to the health sector in its 2024 budget, enabling upgrades in hospital diagnostic labs that utilize CLIA testing as part of advanced diagnostic protocols.

Rise in Non-Communicable Diseases (NCDs): The Ministry of Health reported that over 35% of adult deaths in Indonesia are now due to NCDs such as diabetes and cardiovascular conditions. With an annual average of 4.5 million new hypertension diagnoses and over 1.2 million new diabetes cases, the need for reliable, rapid diagnostics like CLIA is rising sharply. BPJS-Kesehatan (national insurance) has reimbursed over 30 million NCD-related tests across public facilities.

High Birth Rate and Pediatric Testing: Indonesia recorded 4.09 million live births in 2022, according to BPS Statistics. As neonatal and infant screenings become a norm under national child health programs, demand for advanced immunoassay technologies like CLIA in early-stage diagnosis has grown. Pediatric hospitals and clinics are adopting CLIA for hormone level assessments and congenital screening, which is now integrated into national infant health tracking protocols across 514 districts.

Market Challenges

High Import Dependency on CLIA Devices: Indonesia imports 98% of CLIA analyzers, making the market heavily vulnerable to global supply chain fluctuations and forex risks. In 2023, the country spent over USD 200 million on diagnostic device imports (MoT Indonesia), with CLIA analyzers classified under Class B & C. The import process requires multiple certifications, including ISO, NIE, CE, and TKDN, extending procurement timelines to 6090 days, thereby delaying clinical deployments.

Logistics and Infrastructure Bottlenecks in Remote Regions: Indonesias Logistics Performance Index (LPI) score stands at 3.0, while the infrastructure score is only 2.9, as per the World Banks 2023 logistics report. Regions like Papua, Maluku, and East Nusa Tenggara lack temperature-controlled logistics needed for sensitive diagnostic reagents. Public hospitals in Kalimantan report 23 week delays in reagent shipments, hampering consistent CLIA test execution in remote healthcare centers.

Indonesia CLIA Market Future Outlook

Over the next few years, the Indonesia CLIA market is expected to show strong momentum, driven by expanding government healthcare coverage, increased localization of reagent production under TKDN mandates, and technological upgrades in diagnostic automation. Rapid growth in diagnostic centers outside Java especially in Sulawesi and Kalimantan will further shape market dynamics as public-private partnerships increase.

Market Opportunities

Localization of Reagent Production under TKDN: The Ministry of Industry is pushing domestic manufacturing via TKDN (Domestic Component Level), targeting 40% local content in medical devices. In 2023, over 125 CLIA-related products were listed under the e-Katalog for public procurement. Firms establishing local reagent manufacturing units will benefit from reduced customs duty and automatic inclusion in government tenders, enhancing access to Indonesias 514 district-level hospitals.

Underserved Diagnostic Penetration in Kalimantan and Sulawesi: Regions like Kalimantan and Sulawesi have less than 40% CLIA penetration in hospitals and clinics, according to the Ministry of Healths 2024 diagnostic infrastructure audit. However, these regions collectively house over 28 million residents and more than 495 hospitals and public health centers, reflecting an untapped diagnostic base. Investment in lab automation and regional reagent warehouses could unlock rapid growth in these underserved islands.

Scope of the Report

|

Product Type |

Reagents |

|

Application |

Infectious Diseases |

|

End User |

Hospitals |

|

Region |

Java, Sumatra |

|

Procurement Mode |

Public Procurement (e-Katalog) |

Products

Key Target Audience

Private Diagnostic Chains

Multi-specialty Hospitals

Medical Device Importers

Regional Healthcare Distributors

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health Indonesia, LKPP, BPJPH)

Public Sector Procurement Agencies (e-Katalog, MoH Tender Committees)

Reagent Manufacturing Units (with domestic expansion interests)

Companies

Players Mentioned in the Report

Mindray

Abbott

Roche

Siemens Healthineers

Snibe Diagnostics

Table of Contents

1. Indonesia CLIA Market Overview

1.1. Definition and Scope of CLIA in Indonesia (Testing Modality, End-Use, Regulatory Definitions)

1.2. Market Taxonomy (Product Category, Application Area, End-User Format, Distribution Mode)

1.3. Healthcare Infrastructure Overview (Public & Private Hospitals, Diagnostic Centers)

1.4. CLIA Penetration Rate by Region (Java, Sumatra, Kalimantan, Sulawesi)

1.5. CLIA Adoption Lifecycle in Indonesia (Emerging, Growth, and Maturity Stages)

2. Indonesia CLIA Market Size (In USD Mn)

2.1. Historical Market Revenue

2.2. Annual Growth Rate Analysis (Growth Components: Reagent Demand, Facility Growth, Imports)

2.3. Volume-Based Analysis: CLIA Tests Conducted (In Million Units)

2.4. Import Dependency & Reagent Usage Volume (Share of Imports vs. Local Production)

2.5. Key Milestones and Policy Shifts Impacting Growth

3. Indonesia CLIA Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Hospital Footprint (2,636+ hospitals)

3.1.2. Governments JKN Insurance Penetration (95% coverage)

3.1.3. Expansion of BPJS-Kesehatan Test Reimbursements

3.1.4. Technological Advancements in Automated Analyzers

3.2. Restraints

3.2.1. 98% Import Dependency of CLIA Analyzers

3.2.2. Limited Local Manufacturing Infrastructure

3.2.3. High Import Duties & VAT (10%)

3.2.4. Complex Regulatory Compliance Timelines

3.3. Opportunities

3.3.1. Government Procurement (e-Katalog) Expansion

3.3.2. Local Production Incentives under TKDN

3.3.3. Expansion to Kalimantan & Sulawesi (CAGR: 6.5%)

3.4. Market Trends

3.4.1. AI-Driven Automation and Multi-Analyte Panels

3.4.2. Demand for Personalized and Decentralized Diagnostics

3.4.3. Cloud Integration with CLIA Devices

3.5. Government Regulations

3.5.1. Medical Device Regulation PMK

3.5.2. e-Katalog Procurement Policy (LKPP)

3.5.3. Good Manufacturing & Distribution Practices (CDAKB)

3.5.4. TKDN Certification Norms (Domestic Component Requirement)

3.5.5. Halal Certification for Diagnostic Kits (BPJPH)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem Mapping (Public Health, Labs, OEMs, Regulators)

3.8. Porters Five Forces Analysis

3.9. Ecosystem Deep Dive (Supply-Demand Mapping)

4. Indonesia CLIA Market Segmentation

4.1. By Product Type (In Revenue %)

4.1.1. Reagents (Substrates, Enzymes, Antibodies)

4.1.2. Analyzers (Automated, Semi-Automated)

4.1.3. Instruments (Incubators, Washing Systems, Readers)

4.2. By Application (In Revenue %)

4.2.1. Infectious Diseases

4.2.2. Oncology

4.2.3. Endocrinology

4.2.4. Rheumatology

4.2.5. Cardiology

4.3. By End User (In Revenue %)

4.3.1. Hospitals

4.3.2. Diagnostic Centers

4.3.3. Research Institutes

4.3.4. Blood Donation Centers

4.3.5. Others (Food Safety, Pharma R&D)

4.4. By Region (In Revenue %)

4.4.1. Java

4.4.2. Sumatra

4.4.3. Kalimantan

4.4.4. Sulawesi

4.4.5. Other Islands (Papua, Nusa Tenggara, Maluku)

4.5. By Procurement Mode (In Revenue %)

4.5.1. Public Procurement (e-Katalog Channel)

4.5.2. Private Lab Chains

4.5.3. Direct Imports

4.5.4. Local Distributors

5. Indonesia CLIA Market Competitive Analysis

5.1. Detailed Company Profiles

5.1.1. Mindray (China)

5.1.2. Abbott (USA)

5.1.3. Roche (Switzerland)

5.1.4. Siemens Healthineers (Germany)

5.1.5. Snibe Diagnostics (China)

5.1.6. Beckman Coulter (USA)

5.1.7. Autobio (China)

5.1.8. Dirui (China)

5.1.9. Virtue Dtx (China)

5.1.10. Zybio (China)

5.1.11. Sysmex (Japan)

5.1.12. IncreCare (China)

5.1.13. TISENC (China)

5.1.14. Aikang (China)

5.1.15. BioMrieux (France)

5.2. Cross Comparison Parameters

5.2.1. Local Manufacturing Presence (Yes/No)

5.2.2. Distribution Partnerships (No. of Distributors)

5.2.3. Analyzer Automation Capabilities (High-Throughput, AI)

5.2.4. Regulatory Approvals (CDAKB, CE, Halal, TKDN)

5.2.5. Share of Revenue from Indonesia

5.2.6. Reagent Reusability & Pricing

5.2.7. Product Localization (Language/UI/Support)

5.2.8. Procurement Inclusion in e-Katalog

5.3. Market Share Analysis (By Company and Product Type)

5.4. Strategic Initiatives (Localization, Production, Expansion)

5.5. Mergers & Acquisitions in Southeast Asia

5.6. Investor and Funding Analysis

5.7. VC and PE Activity in Indonesia's Diagnostics Market

5.8. Government Tenders & Public Health Bids

5.9. Partner Lab Collaborations & Installed Base Size

6. Indonesia CLIA Regulatory & Compliance Landscape

6.1. Registration & Licensing Bodies (MoH, BPJPH, LKPP)

6.2. Certificate Issuance Framework (ISO, CE, TKDN, Halal)

6.3. Product Import and Distribution Timeline

6.4. Approval Timelines & Cost Metrics

6.5. Documentation Requirements (NIE, IDAK, Distribution Approval)

7. Indonesia CLIA Future Market Size (In USD Mn)

7.1. Forecasted Revenue Projections

7.2. Growth Outlook by Product Type and Application

7.3. Regional Forecast: Penetration Growth in Kalimantan, Sulawesi

7.4. Impact of Localization and Public Procurement Growth

8. Indonesia CLIA Future Market Segmentation

8.1. By Product Type (In Revenue %)

8.2. By Application (In Revenue %)

8.3. By End User (In Revenue %)

8.4. By Region (In Revenue %)

8.5. By Procurement Mode (In Revenue %)

9. Indonesia CLIA Analyst Recommendations

9.1. TAM/SAM/SOM Estimation

9.2. Market Entry Strategy (Regulatory Pathway, Local Partnering)

9.3. White Space Opportunity Analysis (Underserved Geographies)

9.4. Clinical Adoption Pathways and Tech Integration Scope

9.5. Training and Awareness Campaign Strategy

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia CLIA Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia CLIA Market. This includes assessing market penetration, public vs. private procurement modes, and regional spread across Java, Sumatra, and Kalimantan. An evaluation of healthcare reimbursement statistics is also conducted to validate revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through CATI interviews with hospital procurement heads, diagnostic center owners, and regional distributors. These consultations provide valuable operational and financial insights directly from industry practitioners, helping to corroborate bottom-up market findings.

Step 4: Research Synthesis and Final Output

The final phase includes consultations with OEMs and reagent suppliers to refine estimates related to installed base, reagent reusability, and future automation trends. This ensures that all insights reflect validated field intelligence and ground-level realities in Indonesias diagnostic ecosystem.

Frequently Asked Questions

01. How big is the Indonesia CLIA Market?

The Indonesia CLIA market was valued at USD 29.3 million, driven by the growing demand for infectious disease testing, oncology diagnostics, and rapid test turnaround across hospitals and labs.

02. What are the challenges in the Indonesia CLIA Market?

The key challenges of Indonesia CLIA market include high import dependency (98% for analyzers), complex registration procedures, 10% VAT on imports, and low manufacturing capabilities for reagents within Indonesia.

03. Who are the major players in the Indonesia CLIA Market?

Indonesia CLIA market Leading companies include Mindray, Abbott, Roche, Siemens Healthineers, and Snibe Diagnostics. These firms dominate based on their automated analyzers, large reagent portfolio, and inclusion in public procurement systems like e-Katalog.

04. What are the growth drivers of the Indonesia CLIA Market?

Indonesia CLIA market Growth is driven by the expansion of hospital infrastructure, widespread public health insurance (JKN), and government procurement platforms promoting CLIA device integration in public healthcare.

05. Which regions are key for the Indonesia CLIA Market?

in Indonesia CLIA market Java dominates due to its vast healthcare network, followed by Sumatra. Kalimantan and Sulawesi are emerging markets with high projected CAGR due to improving infrastructure and low initial CLIA penetration.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.