Indonesia Chocolate Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD6754

November 2024

84

About the Report

Indonesia Chocolate Market Overview

- Indonesia Chocolate Market, valued at USD 850 million, is driven by increasing consumer demand for indulgent confectionery products and rising disposable incomes across urban areas. A five-year historical analysis indicates that the consumption of chocolate has been fueled by the growing middle class, urbanization, and the expansion of retail channels. Consumers are also becoming more inclined towards premium and artisanal chocolate varieties, which are enhancing the overall market value. Additionally, the growing preference for chocolate as a gift during festive occasions is propelling market demand.

- Key cities that dominate the Indonesian chocolate market include Jakarta, Surabaya, and Bandung. Jakartas dominance stems from its large population, affluent consumer base, and high concentration of modern retail outlets such as supermarkets and hypermarkets. Meanwhile, Surabaya and Bandung are strong players due to their rapidly expanding retail infrastructures and growing middle-class populations. These cities contribute significantly to the market's growth by driving sales in both mass-market and premium chocolate segments.

- Indonesia imposes import tariffs on cocoa products ranging from 5% to 10%, depending on the type of product. These tariffs are part of the governments strategy to protect the local cocoa industry and encourage domestic production. However, the reliance on imported cocoa beans has made these tariffs a double-edged sword for chocolate manufacturers, who face higher production costs. In 2024, Indonesia imported over 40,000 metric tons of cocoa, indicating the ongoing challenge for domestic producers.

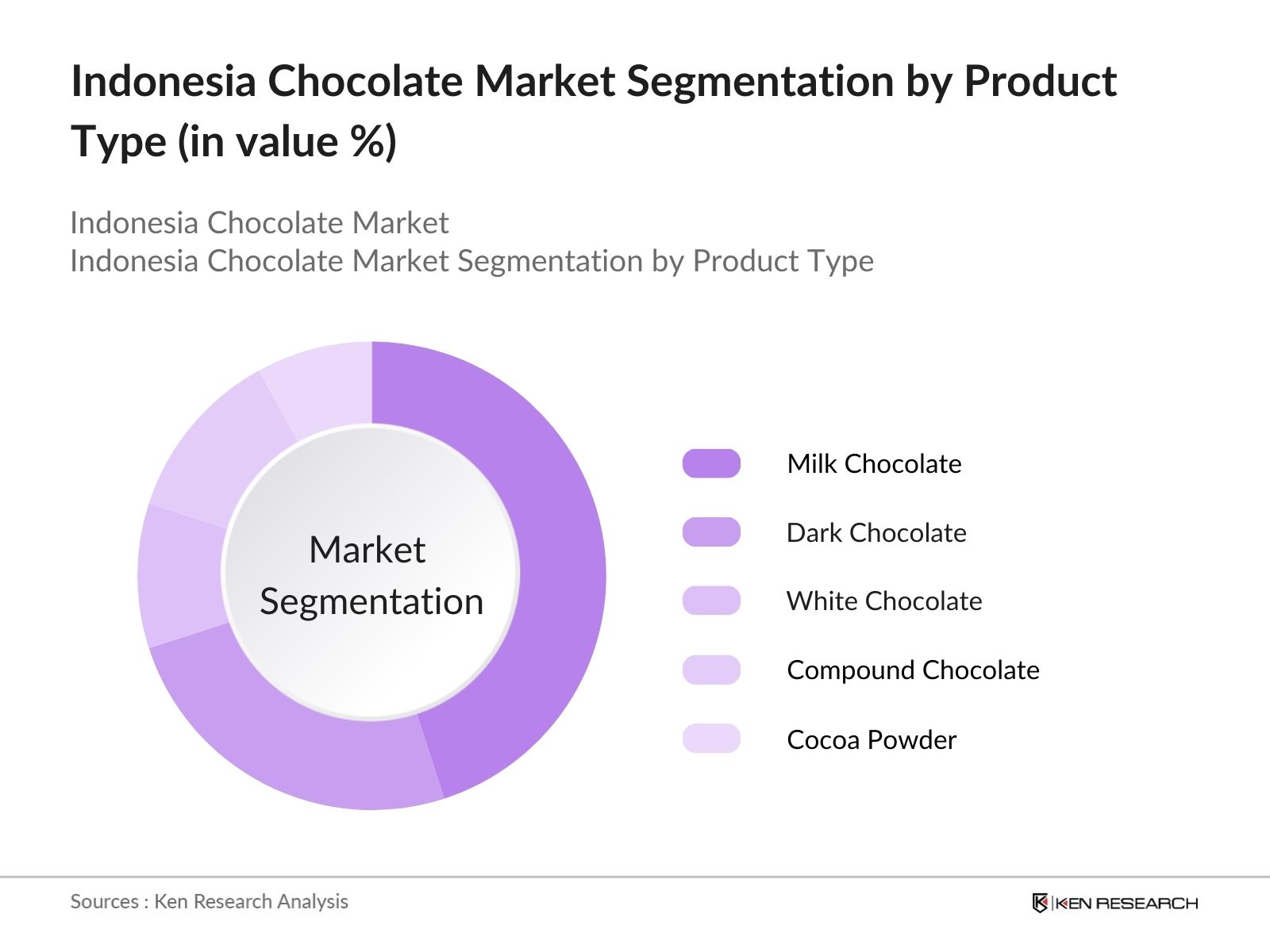

Indonesia Chocolate Market Segmentation

By Product Type: The Indonesia chocolate market is segmented by product type into milk chocolate, dark chocolate, white chocolate, compound chocolate, and cocoa powder. Recently, milk chocolate holds the dominant market share in Indonesia under the product type segmentation, as it is widely popular among a diverse demographic. Its sweeter flavor appeals to a broad spectrum of consumers, especially children and young adults, who prefer its taste over the bitterness of dark chocolate.

|

|

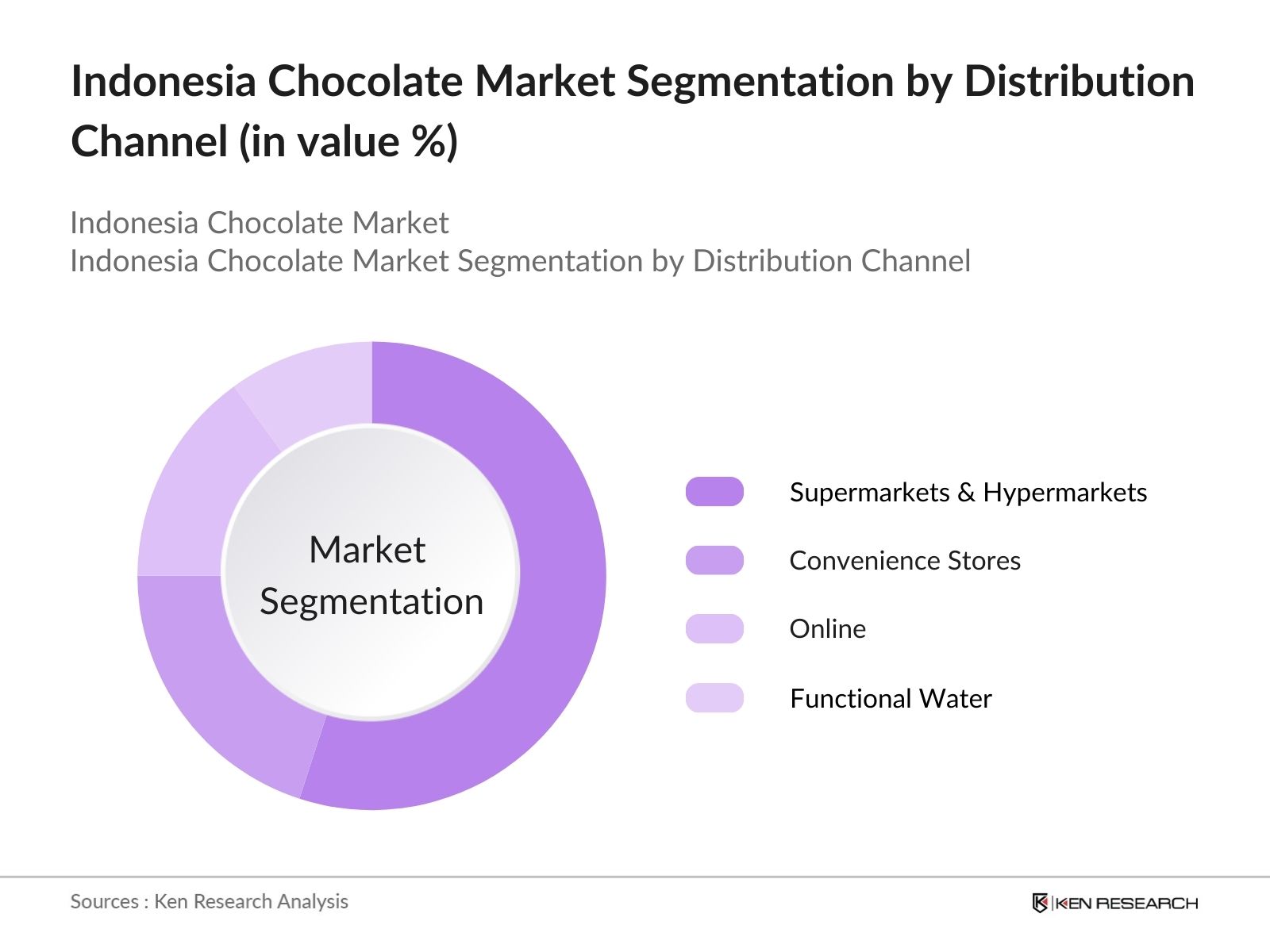

|---|

By Distribution Channel: Indonesia's chocolate market is also segmented by distribution channels into supermarkets & hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets and hypermarkets dominate this segment due to the wide availability and variety of chocolate products offered, making them a one-stop-shop for consumers. Retail giants like Indomaret and Alfamart provide consumers with easy access to international and local chocolate brands, contributing to the higher market share of this segment.

|

Distribution Channel |

Market Share (2023) |

|---|---|

|

Supermarkets & Hypermarkets |

55% |

|

Convenience Stores |

20% |

|

Online Retail |

15% |

|

Specialty Stores |

10% |

Indonesia Chocolate Market Competitive Landscape

The Indonesia chocolate market is dominated by a combination of local and international players, with a few major companies holding substantial influence. Local brands such as PT Mayora Indah Tbk and PT Kaldu Sari Nabati have made significant inroads, leveraging their local distribution networks and brand loyalty. Meanwhile, global players like Mondelez and Ferrero benefit from strong brand recognition and the appeal of premium products.

|

Company |

Establishment Year |

Headquarters |

Production Capacity |

Distribution Network |

Product Range |

Sustainability Certification |

Revenue (USD) |

No. of Employees |

|

PT Mayora Indah Tbk |

1977 |

Jakarta, Indonesia |

- |

- |

- |

- |

- |

- |

|

Mondelez International |

1923 |

Deerfield, USA |

- |

- |

- |

- |

- |

- |

|

PT Kaldu Sari Nabati |

1999 |

Bandung, Indonesia |

- |

- |

- |

- |

- |

- |

|

Ferrero Indonesia |

1946 |

Alba, Italy |

- |

- |

- |

- |

- |

- |

|

Nestle Indonesia |

1867 |

Vevey, Switzerland |

- |

- |

- |

- |

- |

- |

Indonesia Chocolate Market Analysis

Growth Drivers

- Increasing Disposable Income: In 2024, Indonesias per capita income stands at USD 5,218 according to the World Bank, reflecting a steady rise from USD 4,941 in 2023. This increase in disposable income enables consumers to allocate more resources towards non-essential goods like chocolate. The purchasing power of the middle class has been growing due to wage growth, supporting the trend of higher chocolate consumption.

- Urbanization and Lifestyle Changes: Urbanization in Indonesia has reached 58% of the total population in 2024, significantly impacting lifestyle choices. As more Indonesians move to urban areas, exposure to Western habits, including chocolate consumption, has increased. Urban consumers prefer convenience products, and chocolate, being easily accessible, fits well into this trend.

- Expansion of Organized Retail: Indonesias retail sector has grown steadily, with over 28,000 supermarkets and hypermarkets operating in 2024. The expansion of organized retail provides consumers with easy access to a wide variety of chocolate products, from mass-market brands to premium selections. Supermarkets and hypermarkets, particularly in urban centers, account for a significant portion of chocolate sales, creating a conducive environment for brands to tap into the rising demand for convenience-driven shopping experiences.

Challenges

-

Fluctuating Cocoa Prices: Cocoa prices have shown considerable volatility, with recent reports indicating prices fluctuating between USD 8,000 to USD 10,000 per metric ton as of mid-2024. Indonesia, being a significant importer of cocoa due to insufficient local production, is particularly vulnerable to global price swings. These price fluctuations, influenced by factors such as climate change and supply chain disruptions have raised production costs for local chocolate manufacturers, affecting profitability and pricing strategies.

- Limited Local Cocoa Production: Indonesia's cocoa production has steadily declined, with output dropping to approximately 220,000 metric tons in 2024, down from 275,000 tons a decade earlier. This has increased the countrys reliance on imported cocoa beans to meet domestic chocolate manufacturing demands. The lack of sufficient local production stems from aging plantations and inadequate farming techniques, which have hindered productivity growth.

Indonesia Chocolate Future Market Outlook

Over the next five years, the Indonesia chocolate market is expected to witness robust growth driven by increasing demand for premium chocolates, growing online retail channels, and heightened consumer awareness about sustainable sourcing. The rise in health-conscious consumers has also created opportunities for manufacturers to develop healthier chocolate options such as dark chocolate and low-sugar alternatives. Moreover, the increasing popularity of e-commerce platforms is expected to enhance the market reach, particularly among younger and tech-savvy consumers.

Market Opportunities

- Health-Conscious Consumer Trends: Dark chocolate, perceived as a healthier alternative due to its high antioxidant content, has seen growing demand in Indonesia. The rise of organic and sugar-free options also presents a significant opportunity for manufacturers to cater to this growing demographic. With the global wellness industry booming, the trend towards healthier indulgence is expected to create room for product innovations such as functional chocolates infused with vitamins and minerals.

- Expansion of E-commerce: The chocolate market has benefited from this boom, as more consumers turn to online platforms to purchase premium and imported chocolates. Major e-commerce players like Tokopedia, Shopee, and Lazada have expanded their product offerings to include a wide range of chocolates, making it easier for brands to reach consumers in remote areas. This trend is expected to continue as internet penetration increases and logistics infrastructure improves.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Product Type |

Milk Chocolate Dark Chocolate White Chocolate Compound Chocolate Cocoa Powder |

|

By Distribution Channel |

Supermarkets & Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

By End-User |

Household Consumption Food and Beverage Industry Hospitality Industry (Hotels, Restaurants) Gifting and Premium Purchases |

|

By Flavor Type |

Plain Flavored (Mint, Fruit, Coffee, etc.) Nut-filled |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Chocolate Manufacturers

Food and Beverage Companies

Confectionery Companies

Packaging Manufacturers

Packaging Companies

E-commerce Platforms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Trade, Ministry of Industry)

Companies

Major Players

PT Mayora Indah Tbk

Mondelez International

PT Kaldu Sari Nabati

Ferrero Indonesia

Nestle Indonesia

PT Garudafood

Hershey Indonesia

Mars Indonesia

Glico Indonesia

Barry Callebaut Indonesia

Lindt & Sprngli Indonesia

Kraft Heinz Indonesia

Ovomaltine Indonesia

PT Cokelat Rasa

PT Monggo Chocolates

Table of Contents

1. Indonesia Chocolate Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Chocolate Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Chocolate Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Disposable Income (per capita consumption, purchasing power)

3.1.2. Urbanization and Lifestyle Changes (chocolate consumption habits, cultural shifts)

3.1.3. Expansion of Organized Retail (supermarkets, hypermarkets)

3.1.4. Growing Popularity of Premium Chocolates (premiumization trend)

3.2. Market Challenges

3.2.1. Fluctuating Cocoa Prices (raw material cost volatility)

3.2.2. Limited Local Cocoa Production (dependency on imports)

3.2.3. Competition from Confectionery Alternatives (market share impact)

3.3. Opportunities

3.3.1. Health-Conscious Consumer Trends (dark chocolate, organic products)

3.3.2. Expansion of E-commerce (online chocolate sales growth)

3.3.3. Emerging Local Brands (domestic chocolate producers)

3.4. Trends

3.4.1. Increased Demand for Sustainable Sourcing (fair-trade, ethically sourced cocoa)

3.4.2. Rise of Plant-Based and Vegan Chocolates (vegan product development)

3.4.3. Introduction of Functional Chocolates (added ingredients for health benefits)

3.5. Government Regulation

3.5.1. Import Tariffs on Cocoa Products (import regulations)

3.5.2. Food Safety and Quality Standards (local regulatory bodies)

3.5.3. Promotional Campaigns for Indonesian Cocoa (government export support programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Chocolate Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Milk Chocolate

4.1.2. Dark Chocolate

4.1.3. White Chocolate

4.1.4. Compound Chocolate

4.1.5. Cocoa Powder

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets & Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By End-User (In Value %)

4.3.1. Household Consumption

4.3.2. Food and Beverage Industry

4.3.3. Hospitality Industry (Hotels, Restaurants)

4.3.4. Gifting and Premium Purchases

4.4. By Flavor Type (In Value %)

4.4.1. Plain

4.4.2. Flavored (Mint, Fruit, Coffee, etc.)

4.4.3. Nut-filled

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Chocolate Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Cokelat Rasa

5.1.2. PT Kaldu Sari Nabati

5.1.3. PT Monggo Chocolates

5.1.4. PT Mayora Indah Tbk

5.1.5. Nestle Indonesia

5.1.6. Mondelez International

5.1.7. PT Garudafood

5.1.8. Mars Indonesia

5.1.9. Ferrero Indonesia

5.1.10. Barry Callebaut Indonesia

5.1.11. Lindt & Sprngli Indonesia

5.1.12. Kraft Heinz Indonesia

5.1.13. Hershey Indonesia

5.1.14. Glico Indonesia

5.1.15. Ovomaltine Indonesia

5.2. Cross Comparison Parameters

5.2.1. No. of Employees

5.2.2. Headquarters

5.2.3. Market Share

5.2.4. Revenue (USD)

5.2.5. Product Range (types of chocolate offered)

5.2.6. Distribution Network (local and export markets)

5.2.7. Certification (Fair Trade, Organic, etc.)

5.2.8. Production Capacity (in tons)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Chocolate Market Regulatory Framework

6.1. Food and Beverage Standards

6.2. Compliance with Indonesian Health and Safety Regulations

6.3. Import and Export Regulations

6.4. Environmental Impact Regulations

7. Indonesia Chocolate Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Chocolate Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By End-User (In Value %)

8.4. By Flavor Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Chocolate Market Analysts' Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out all the key stakeholders in the Indonesia chocolate market. This was achieved through extensive desk research using a mix of proprietary databases and secondary resources to gather relevant data, including industry reports and financial data.

Step 2: Market Analysis and Construction

In this stage, we analyzed historical data for the Indonesia chocolate market, assessing key performance indicators such as market size, revenue growth, and consumer trends. This analysis also included understanding chocolate consumption across various segments.

Step 3: Hypothesis Validation and Expert Consultation

Interviews were conducted with industry experts, including chocolate manufacturers, distributors, and retail executives, using a mix of computer-assisted telephone interviews (CATIs) and web-based surveys to validate market assumptions.

Step 4: Research Synthesis and Final Output

The final step was to consolidate the research findings into an accurate and comprehensive market report. Data collected from both primary and secondary sources were synthesized to ensure that market forecasts were reliable and accurate.

Frequently Asked Questions

01. How big is the Indonesia Chocolate Market?

The Indonesia chocolate market is valued at USD 850 million, driven by a rise in disposable incomes and growing consumer demand for premium chocolate products.

02. What are the challenges in the Indonesia Chocolate Market?

Key challenges of Indonesia Chocolate Market include fluctuating cocoa prices, which impact the cost of production, and competition from other confectionery products such as snacks and biscuits.

03. Who are the major players in the Indonesia Chocolate Market?

Major players in Indonesia Chocolate Market include PT Mayora Indah Tbk, Mondelez International, PT Kaldu Sari Nabati, Ferrero Indonesia, and Nestle Indonesia.

04. What are the growth drivers of the Indonesia Chocolate Market?

Indonesia Chocolate Market is propelled by rising disposable incomes, increasing urbanization, the expansion of modern retail outlets, and a growing preference for premium and artisanal chocolate products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.