Indonesia Cleaning And Hygiene Products Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD10996

November 2024

85

About the Report

Indonesia Cleaning and Hygiene Products Market Overview

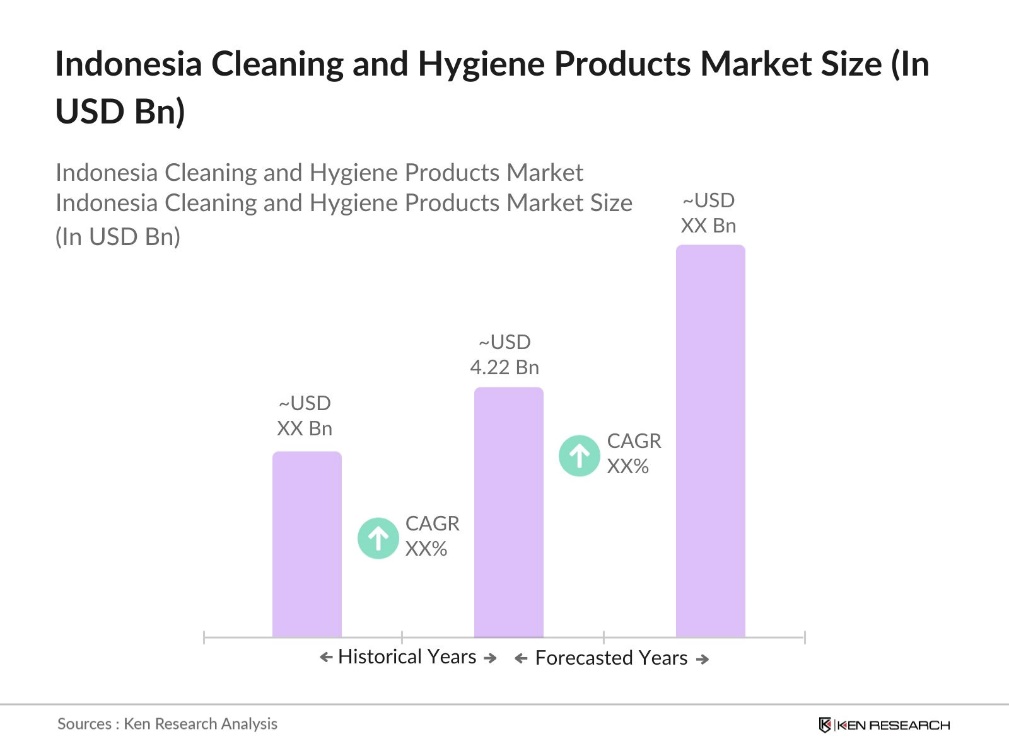

- The Indonesia Cleaning and Hygiene Products Market is valued at USD 4.22 billion, driven by growing health awareness among consumers and increased demand for sanitary solutions across residential, commercial, and industrial sectors. Government initiatives promoting hygiene, combined with rising disposable income, have also encouraged spending on quality cleaning products.

- Jakarta, Surabaya, and Bandung lead Indonesias cleaning and hygiene products market due to high population density, urbanization, and industrial activity. Jakarta, as the capital and largest city, has extensive commercial and industrial operations that drive demand for cleaning products in various sectors.

- Indonesias regulatory bodies enforce stringent guidelines regarding the chemical composition of cleaning products. In 2024, the National Agency of Drug and Food Control mandated that household cleaning chemicals must not contain hazardous compounds above government-specified limits (Indonesia BPOM). Compliance with these safety regulations ensures that products are safe for domestic use, reflecting Indonesia's commitment to public health and product safety. These regulations shape the market, pushing brands towards safer formulations.

Indonesia Cleaning and Hygiene Products Market Segmentation

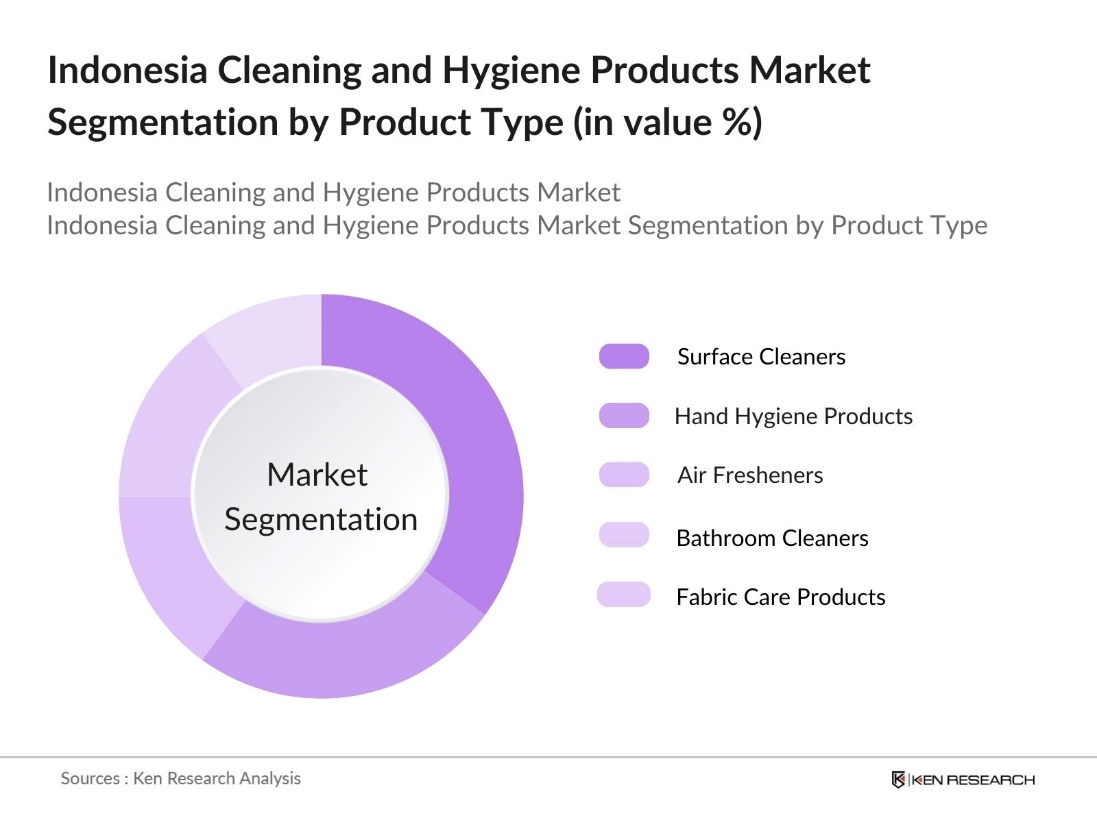

By Product Type: The market is segmented by product type into surface cleaners, hand hygiene products, air fresheners, bathroom cleaners, and fabric care products. Surface cleaners hold a dominant market share due to their widespread use in both residential and commercial spaces. The need for effective and easy-to-use cleaning solutions has driven growth in this segment, with consumers increasingly choosing products that guarantee high-quality disinfection and environmental safety. The strong brand presence of companies offering surface cleaning solutions has also reinforced dominance in this category.

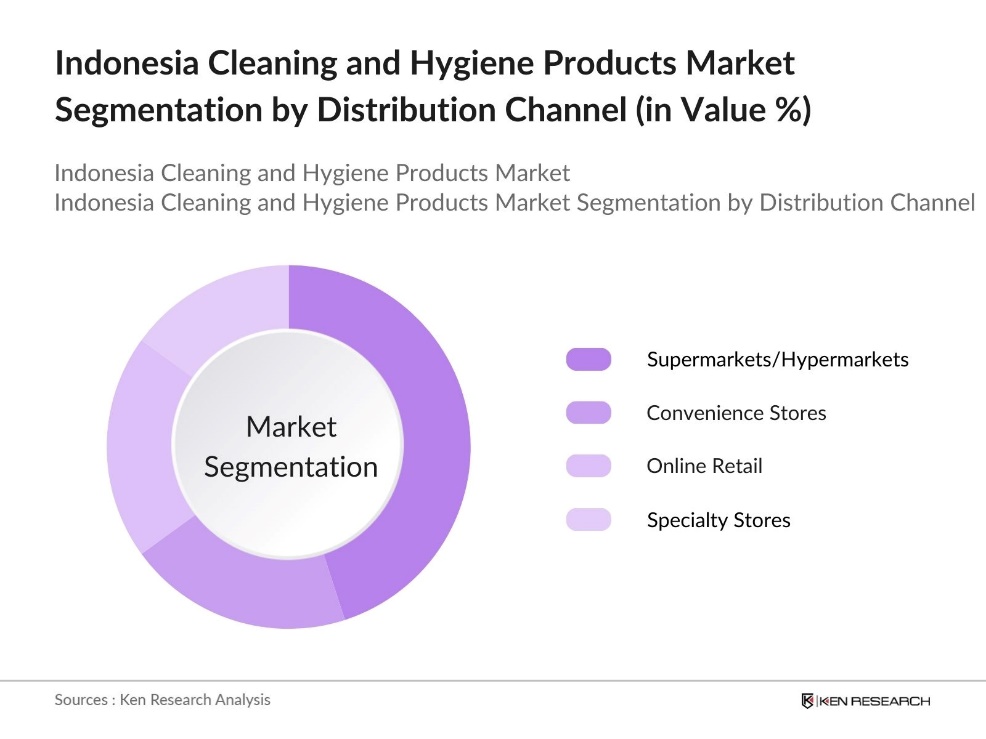

By Distribution Channel: The market is segmented by distribution channels into supermarkets and hypermarkets, convenience stores, online retail, and specialty stores. Supermarkets and hypermarkets dominate this segment due to their extensive reach and accessibility, offering a wide range of cleaning products under one roof. With increasing consumer preference for in-store purchases of cleaning products, supermarkets and hypermarkets have capitalized on consumer demand by maintaining stock and running promotional offers. Their presence across urban and suburban areas further solidifies this segments dominance.

Indonesia Cleaning and Hygiene Products Market Competitive Landscape

The Indonesia Cleaning and Hygiene Products market is dominated by both local and international companies, with strong competition in product quality, pricing, and innovation. Local manufacturers are increasing their foothold by launching cost-effective and eco-friendly products, while global players like Unilever Indonesia and Procter & Gamble continue to lead through established brand loyalty and extensive distribution networks. This competitive landscape indicates a steady push for quality and sustainability in response to changing consumer demands.

Indonesia Cleaning and Hygiene Products Industry Analysis

Growth Drivers

- Rise in Urban Population: The increase in Indonesia's urban population significantly impacts the cleaning and hygiene products market. According to the World Bank, the urban population in Indonesia was reported at approximately 162.6 million in 2023. This urban concentration accelerates the need for sanitation in densely populated areas, with over 20 million households in major cities like Jakarta and Surabaya showing higher purchase patterns for hygiene products than rural counterparts. These demographic trends suggest increasing market demand for household cleaning products.

- Increased Health Awareness: Health awareness among Indonesians has grown, partly due to government public health campaigns and private health initiatives. In 2023, approximately 80% of the population acknowledged hygiene as essential to prevent diseases, a noticeable increase from 72% in 2022 (Indonesia Ministry of Health). This heightened awareness has led to a marked increase in demand for hygiene products such as hand sanitizers, disinfectants, and surface cleaners, making health consciousness a critical growth driver.

- Impact of Consumer Education on Hygiene: Ongoing consumer education campaigns in Indonesia have effectively increased public awareness around hygiene practices, particularly regarding the importance of disinfecting surfaces. These initiatives emphasize the role of hygiene in preventing infections and encourage informed choices in purchasing cleaning products. As a result, the public is more inclined to seek quality-assured hygiene products, reflecting a shift in consumer behavior.

Market Challenges

- Raw Material Price Volatility: Indonesias cleaning product industry faces challenges from fluctuating raw material prices, particularly for essential chemicals. This volatility affects product pricing stability in a low-margin market, pressuring manufacturers to either absorb increased costs or pass them to consumers. Balancing affordability with profitability becomes difficult as companies strive to maintain product quality amidst unpredictable costs.

- High Competition in Low-Margin Products: Intense competition in Indonesias hygiene products market, with numerous local and global brands offering low-cost options, drives prices down and creates a low-margin environment. This price sensitivity among consumers pressures brands to innovate while keeping costs low, making profitability a challenge in a market that prioritizes affordability over premium offerings.

Indonesia Cleaning and Hygiene Products Market Future Outlook

Indonesia cleaning and hygiene products market is projected to witness sustained growth due to the increasing importance of health and hygiene among the population. The market dynamics are expected to shift with more focus on organic, eco-friendly, and multifunctional products that cater to environmentally conscious consumers. Technological advancements in product formulations and the expansion of online retail channels are anticipated to further boost the markets growth trajectory. Rising urbanization and government campaigns on sanitation will reinforce demand for cleaning products across various consumer segments.

Market Opportunities

- E-commerce Penetration: The rapid expansion of e-commerce in Indonesia offers cleaning product manufacturers a valuable channel to reach a wider customer base. Online platforms have become popular for purchasing hygiene products, particularly due to the convenience and variety they provide. This shift allows brands to extend their reach into remote areas that were traditionally underserved, offering greater accessibility and helping meet rising consumer demand for cleaning supplies.

- Product Diversification in Premium and Natural Segments: A growing interest in premium and eco-friendly cleaning products is shaping Indonesias market, driven by increased environmental awareness and middle-class expansion. Consumers are showing a preference for products with natural ingredients and less chemical content. Brands that align with these eco-conscious choices are well-positioned to capture this emerging segment, reflecting a trend toward premium, higher-value options in the cleaning product category.

Scope of the Report

|

Product Type |

Surface Cleaners Air Fresheners Fabric Care Products Hand Hygiene Products Bathroom Cleaners |

|

Distribution Channel |

Supermarkets and Hypermarkets Convenience Stores Online Retail Specialty Stores |

|

Ingredient Type |

Chemical-Based Organic and Natural Fragrance-Free |

|

End-User |

Residential Commercial Industrial |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Event Management Companies

Construction Site Management Firms

Recycling and Waste Management Facilities

Hospitality and Tourism Sector

Government and Regulatory Bodies (Indonesian Ministry of Health, BPOM)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Unilever Indonesia

PT Wings Surya

SC Johnson & Son Indonesia

Procter & Gamble Indonesia

Reckitt Benckiser Indonesia

Kao Indonesia

Lion Corporation

PT Cosway Indonesia

Clorox Indonesia

3M Indonesia

Table of Contents

1. Indonesia Cleaning and Hygiene Products Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics Overview

1.4. Product Lifecycle Analysis

2. Indonesia Cleaning and Hygiene Products Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Demand Supply Gap Analysis

2.4. Key Developments and Milestones

3. Indonesia Cleaning and Hygiene Products Market Analysis

3.1. Growth Drivers

3.1.1. Rise in Urban Population

3.1.2. Increased Health Awareness

3.1.3. Government Initiatives on Sanitation

3.1.4. Impact of Consumer Education on Hygiene

3.2. Market Challenges

3.2.1. Raw Material Price Volatility

3.2.2. High Competition in Low-Margin Products

3.2.3. Counterfeit Product Concerns

3.3. Opportunities

3.3.1. E-commerce Penetration

3.3.2. Product Diversification in Premium and Natural Segments

3.3.3. Expansion into Untapped Rural Markets

3.4. Trends

3.4.1. Shift to Eco-Friendly and Sustainable Products

3.4.2. Rising Popularity of Multi-Purpose Cleaners

3.4.3. Growth of Private Label Brands

3.5. Government Regulations

3.5.1. Environmental and Packaging Standards

3.5.2. Chemical Safety Regulations

3.5.3. Import Tariffs on Cleaning Agents

3.6. SWOT Analysis

3.7. Value Chain Analysis

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Mapping

4. Indonesia Cleaning and Hygiene Products Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Surface Cleaners

4.1.2. Air Fresheners

4.1.3. Fabric Care Products

4.1.4. Hand Hygiene Products

4.1.5. Bathroom Cleaners

4.2. By Distribution Channel (In Value %)

4.2.1. Supermarkets and Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Retail

4.2.4. Specialty Stores

4.3. By Ingredient Type (In Value %)

4.3.1. Chemical-Based

4.3.2. Organic and Natural

4.3.3. Fragrance-Free

4.4. By End-User (In Value %)

4.4.1. Residential

4.4.2. Commercial

4.4.3. Industrial

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Cleaning and Hygiene Products Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Unilever Indonesia

5.1.2. SC Johnson & Son Indonesia

5.1.3. PT Wings Surya

5.1.4. Procter & Gamble Indonesia

5.1.5. Reckitt Benckiser Indonesia

5.1.6. Kao Indonesia

5.1.7. Lion Corporation

5.1.8. PT Cosway Indonesia

5.1.9. Clorox Indonesia

5.1.10. SC Johnson & Son Indonesia

5.1.11. PT Gajah Tunggal

5.1.12. PT Dunia Kimia Utama

5.1.13. PT Kusuma Mulia Inetriks

5.1.14. 3M Indonesia

5.1.15. PT Megasari Makmur

5.2. Cross Comparison Parameters (Revenue, Product Range, Market Share, R&D Investment, Market Reach, Distribution Network, Sustainability Initiatives, Product Customization Capabilities)

5.3. Market Share Analysis

5.4. Competitive Strategy Overview

5.5. Mergers and Acquisitions

5.6. Strategic Alliances and Partnerships

5.7. Regional Market Penetration Analysis

5.8. New Product Launches

6. Indonesia Cleaning and Hygiene Products Market Regulatory Framework

6.1. Chemical Use Standards

6.2. Consumer Safety Compliance

6.3. Labeling and Packaging Requirements

6.4. Product Certification Standards

7. Indonesia Cleaning and Hygiene Products Future Market Size (In USD Mn)

7.1. Projected Market Growth Trends

7.2. Potential Market Drivers and Challenges

8. Indonesia Cleaning and Hygiene Products Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Ingredient Type (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

9. Indonesia Cleaning and Hygiene Products Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Consumer Demographic Analysis

9.3. Emerging Marketing Strategies

9.4. Identified Growth Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This step focuses on building a comprehensive ecosystem map that encompasses all stakeholders in Indonesias Cleaning and Hygiene Products market. Extensive desk research through secondary databases helps identify critical variables impacting market trends and dynamics.

Step 2: Market Analysis and Construction

Historical data related to market size, penetration, and distribution channels are compiled and analyzed. This phase emphasizes assessing product categories and consumer preferences to ensure accuracy in revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses are tested by engaging with industry experts through telephonic interviews, providing insights on market operations, product demand, and distribution networks. The feedback obtained validates the quantitative analysis and enhances data reliability.

Step 4: Research Synthesis and Final Output

Direct interactions with cleaning product manufacturers and retailers supplement the insights gained, ensuring an accurate representation of the market landscape. This final phase synthesizes all data into a comprehensive analysis report.

Frequently Asked Questions

01. How big is Indonesia's Cleaning and Hygiene Products Market?

The Indonesia Cleaning and Hygiene Products market, valued at USD 4.22 billion, is driven by heightened awareness of health and hygiene, robust distribution channels, and government initiatives promoting sanitary standards.

02. What are the challenges in Indonesias Cleaning and Hygiene Products Market?

The Indonesia Cleaning and Hygiene Products market faces challenges such as fluctuating raw material costs, intense competition in a price-sensitive market, and the threat posed by counterfeit products, impacting profitability and brand credibility.

03. Who are the major players in the Indonesia Cleaning and Hygiene Products Market?

Leading players in Indonesia Cleaning and Hygiene Products market include Unilever Indonesia, PT Wings Surya, SC Johnson & Son Indonesia, Procter & Gamble Indonesia, and Reckitt Benckiser Indonesia, who leverage extensive distribution networks and strong brand loyalty.

04. What factors are driving growth in Indonesias Cleaning and Hygiene Products Market?

Key growth drivers in Indonesia Cleaning and Hygiene Products market include increased consumer spending on hygiene products, urbanization, and government-backed sanitation campaigns that promote cleanliness in public spaces and residential areas.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.