Indonesia Cloud Computing Market Outlook to 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD2578

December 2024

95

About the Report

Indonesia Cloud Computing Market Overview

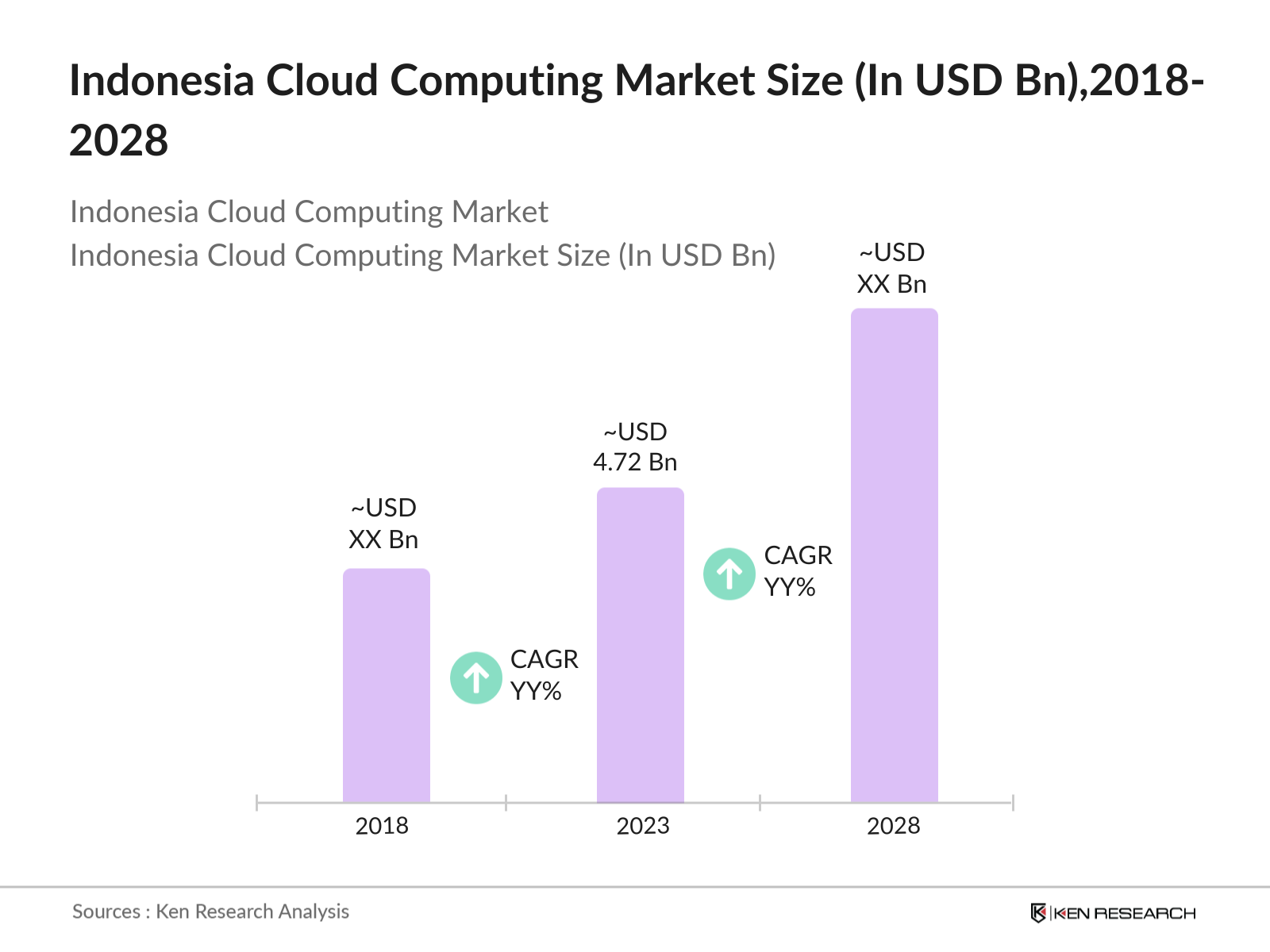

- The Indonesia cloud computing market reached USD 4.72 billion in 2023, driven by the rapid digital transformation across industries and a surge in cloud adoption by businesses, particularly SMEs. The sector has experienced consistent growth due to government support and the expansion of internet infrastructure. Indonesia's digital economy, also fuels cloud services demand as companies strive to enhance operational efficiency and scalability.

- Major cloud service providers such as Amazon Web Services (AWS), Google Cloud, and Alibaba Cloud dominate Indonesias cloud computing landscape. These companies have established strong local presences by investing in data centers and forming strategic partnerships with Indonesian enterprises. Google Cloud's data center in Jakarta, operational since mid-2023, is an example of this trend.

- On September 6, 2024, Google Cloud announced the integration of Google Cloud Functions into a unified serverless platform called Cloud Run functions. This integration aims to streamline event-driven programming for developers, enhancing their ability to build scalable applications. The new platform allows developers to leverage the capabilities of both Cloud Functions and Cloud Run, providing a more cohesive environment for deploying serverless applications and managing event-driven workloads

- Cities like Jakarta, Surabaya, and Bandung dominate the cloud computing market in Indonesia due to their established infrastructure and thriving startup ecosystems. Jakarta, as the capital, hosts several leading cloud providers and benefits from its strong ICT infrastructure and proximity to key industries such as finance and e-commerce.

Indonesia Cloud Computing Market Segmentation

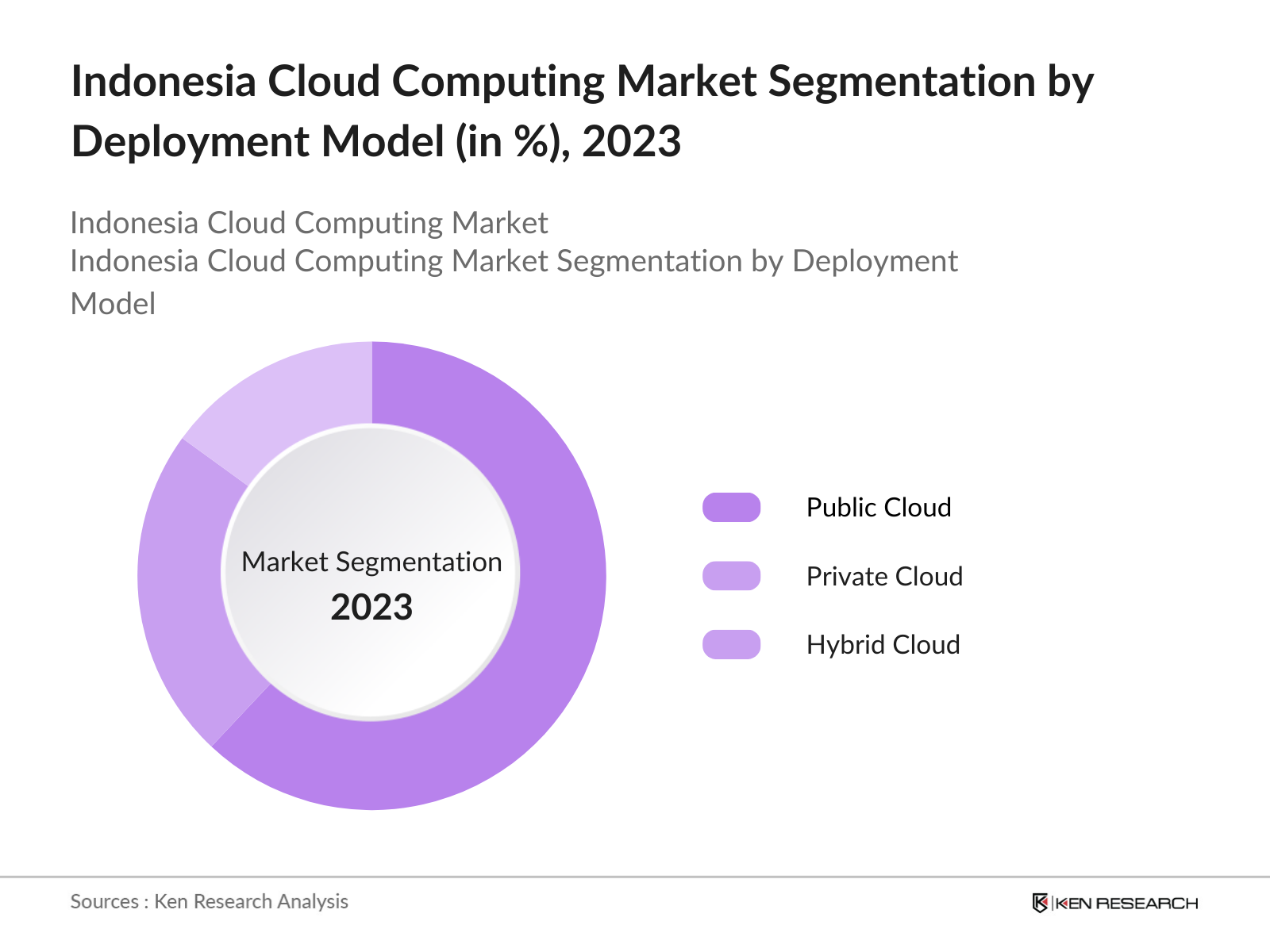

By Deployment Model: The Indonesia cloud computing market is segmented by deployment model into public cloud, private cloud, and hybrid cloud. In 2023, the public cloud dominated the market due to its flexibility, scalability, and cost-effectiveness. Small and medium-sized enterprises (SMEs) across Indonesia prefer public cloud services as it enables rapid scaling without the need for large infrastructure investments. Sectors like fintech are particularly reliant on public cloud solutions to support their growth and operational efficiency.

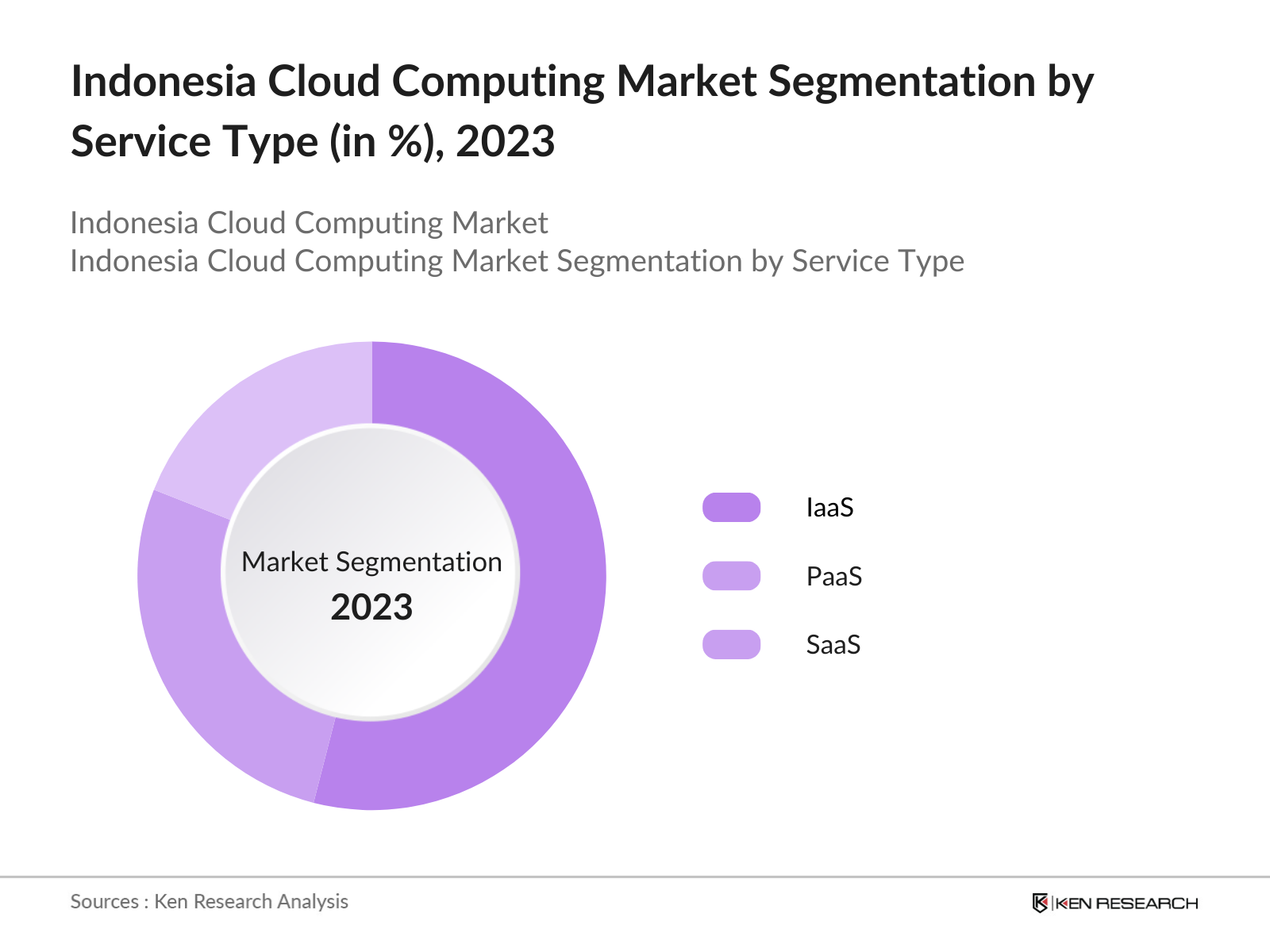

By Service Type: The cloud computing market in Indonesia is segmented by service type into Infrastructure as a Service (IaaS), Platform as a Service (PaaS), and Software as a Service (SaaS). In 2023, IaaS leads the market, driven by the increasing demand for scalable and cost-efficient infrastructure solutions. Companies in sectors such as e-commerce and banking rely on IaaS for managing data storage, networking, and processing power. AWS and Google Cloud are prominent providers in this segment.

By Region: The Indonesia cloud computing market is regionally segmented into North, South, East, and West Indonesia. In 2023, North Indonesia, led by Jakarta, holds the largest market share, driven by its concentration of key industries, high internet penetration, and dense population. Jakarta acts as a central hub for numerous cloud service providers, offering seamless and high-speed services. Other regions, such as South and East Indonesia, are also witnessing growth, supported by infrastructure improvements and government initiatives.

Indonesia Cloud Computing Market Competitive Landscape

|

Company |

Year of Establishment |

Headquarters |

|

Amazon Web Services |

2006 |

Seattle, USA |

|

Google Cloud |

2008 |

Mountain View, USA |

|

Alibaba Cloud |

2009 |

Hangzhou, China |

|

Microsoft Azure |

2010 |

Redmond, USA |

|

Telkomsigma |

1987 |

Jakarta, Indonesia |

- Amazon Web Services (AWS): AWS opened its first Indonesian data center in late 2022, further expanding its footprint in the country. This facility supports Indonesian businesses across sectors like finance, healthcare, and e-commerce by providing scalable cloud infrastructure. AWS continues to expand its partner ecosystem, particularly in AI and machine learning. AWS plans to invest $5 billion in Indonesia over the next 15 years through the new region, which is estimated to create 24,700 direct and indirect jobs.

- Google Cloud: In June 2020, Google Cloud did indeed open its first data center in Jakarta, Indonesia, which aims to support the increasing demand for cloud services in the region. This initiative is particularly beneficial for sectors such as banking and healthcare, as it enhances security protocols and data protection, making it a preferred option for these industries.

Indonesia Cloud Computing Market Analysis

Indonesia Cloud Computing Market Growth Drivers

- Increasing Cloud Adoption by SMEs: Small and medium-sized enterprises (SMEs) in Indonesia are adopting cloud computing at an accelerated pace, driven by the need for cost-effective and scalable IT infrastructure solutions. SMEs are leveraging cloud services to streamline operations, manage data more efficiently, and improve customer experiences. With the governments Making Indonesia 4.0 initiative aiming to digitize industries, cloud adoption among SMEs is projected to rise further by 2024.

- Rising E-commerce Sector: Indonesias e-commerce sector is rapidly growing, with cloud computing playing a crucial role in supporting this expansion. Platforms like Tokopedia, Shopee, and Bukalapak rely on cloud services to manage vast amounts of transactional data, improve security, and scale their operations efficiently. As the sector continues to thrive, the demand for cloud services is steadily increasing to meet the needs of these platforms.

- Governments Digital Transformation Roadmap: The Indonesian governments digital transformation roadmap emphasizes its commitment to advancing digital infrastructure. It encourages cloud computing adoption across sectors such as healthcare, finance, and education. The roadmap aims to strengthen the countrys digital capabilities, promoting wider cloud adoption and positioning Indonesia as a leading digital hub in the region, boosting cloud solutions in public sector organizations.

Indonesia Cloud Computing Market Challenges

- Limited Digital Literacy: Despite the rapid growth of cloud services, digital literacy among small business owners remains a significant challenge. The lack of adequate knowledge of cloud computing and its benefits hinders wider adoption, particularly in rural areas where technological awareness and infrastructure are limited. This knowledge gap slows the integration of cloud technologies across smaller businesses.

- High Costs for Advanced Solutions: While basic cloud services are generally affordable, advanced offerings such as AI-driven analytics, big data processing, and enhanced cybersecurity services tend to be prohibitively expensive for many small businesses. This financial barrier limits their ability to fully leverage cloud technology, consequently hindering the overall growth potential of the market.

Indonesia Cloud Computing Market Government Initiatives

- Digital Talent Scholarship Program: The Indonesian government launched the Digital Talent Scholarship Program to train individuals in cloud computing, cybersecurity, and data analytics. This initiative addresses the talent gap in the technology sector, equipping professionals with the skills needed to manage cloud infrastructure and optimize its use across various industries.

- Government Cloud Initiative (GCI): In 2023, the Indonesian government launched the GCI, focusing on migrating government data and applications to the cloud. This initiative aims to enhance operational efficiency, improve public service delivery, and ensure data integrity through cloud solutions. It also reduces IT infrastructure costs, making government operations more sustainable and secure, while promoting greater transparency and accessibility of public services.

Indonesia Cloud Computing Market Outlook

The Indonesia cloud computing market is poised for substantial growth by 2028, driven by the increasing adoption of advanced technologies such as AI and edge computing. As businesses across sectors like healthcare, retail, and agriculture integrate cloud services to enhance operations, the market will see more innovative applications of cloud technology.

Future Trends:

- Cloud AI Integration: By 2028, cloud computing in Indonesia will see a significant integration of AI-driven services. Cloud providers like AWS and Microsoft Azure are expected to introduce more AI and machine learning platforms tailored for sectors such as healthcare and retail. These AI-powered solutions will enhance decision-making, predictive analytics, and automation across various industries, helping businesses optimize operations and customer engagement.

- Growth in Edge Computing: The demand for low-latency cloud services, particularly in sectors like telecommunications and smart cities, will drive the adoption of edge computing over the next five years. By 2028, edge computing is expected to play a major role in Indonesia's cloud infrastructure, especially in areas like Jakarta and Surabaya, where real-time data processing and analytics will be essential for industries such as logistics and public transportation. This shift will significantly enhance efficiency and service delivery in these sectors.

Scope of the Report

|

By Deployment Model |

Public Cloud Private Cloud Hybrid Cloud |

|

By Service Type |

IaaS PaaS SaaS |

|

By Region |

North Indonesia South Indonesia East Indonesia West Indonesia |

Products

Key Target Audience:

Large enterprises

Small and medium-sized enterprises (SMEs)

Cloud service providers

IT infrastructure companies

Telecommunication companies

E-commerce companies

Financial institutions

Healthcare institutions

Government and regulatory bodies (BSSN)

Investments and venture capital firms

Public sector agencies

Companies

Players Mentioned in the Report:

Amazon Web Services (AWS)

Google Cloud

Alibaba Cloud

Microsoft Azure

Telkomsigma

IBM Cloud

Oracle Cloud

Tencent Cloud

Fujitsu Indonesia

SAP Indonesia

Rackspace Technology

Salesforce

Equinix

OVHcloud

NTT Communications

Table of Contents

01. Indonesia Cloud Computing Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Indonesia Cloud Computing Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indonesia Cloud Computing Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Cloud Adoption by SMEs

3.1.2. Expansion of E-commerce Platforms

3.1.3. Government's Digital Transformation Roadmap

3.2. Challenges

3.2.1. Data Localization Requirements

3.2.2. Limited Digital Literacy

3.2.3. High Costs for Advanced Solutions

3.3. Opportunities

3.3.1. Government Initiatives Supporting Cloud Adoption

3.3.2. Local Data Center Expansion

3.3.3. Emerging Sectors Adopting Cloud Solutions

3.4. Recent Trends

3.4.1. Multi-Cloud Strategies Among Enterprises

3.4.2. Expansion of Cloud Data Centers

3.4.3. Cloud-Driven Fintech Solutions

3.5. Government Initiatives

3.5.1. Digital Talent Scholarship Program

3.5.2. Regulation No. 71/2019 on Data Protection

3.5.3. Government Cloud Initiative (GCI)

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

04. Indonesia Cloud Computing Market Segmentation, 2023

4.1. By Deployment Model (in Value %)

4.1.1. Public Cloud

4.1.2. Private Cloud

4.1.3. Hybrid Cloud

4.2. By Service Type (in Value %)

4.2.1. Infrastructure as a Service (IaaS)

4.2.2. Platform as a Service (PaaS)

4.2.3. Software as a Service (SaaS)

4.3. By Region (in Value %)

4.3.1. North Indonesia

4.3.2. South Indonesia

4.3.3. East Indonesia

4.3.4. West Indonesia

05. Indonesia Cloud Computing Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Amazon Web Services (AWS)

5.1.2. Google Cloud

5.1.3. Alibaba Cloud

5.1.4. Microsoft Azure

5.1.5. Telkomsigma

5.1.6. IBM Cloud

5.1.7. Oracle Cloud

5.1.8. Tencent Cloud

5.1.9. SAP Indonesia

5.1.10. Fujitsu Indonesia

5.1.11. Rackspace Technology

5.1.12. Equinix

5.1.13. OVHcloud

5.1.14. Salesforce

5.1.15. NTT Communications

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

06. Indonesia Cloud Computing Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

07. Indonesia Cloud Computing Market Regulatory Framework

7.1. Data Localization and Protection Regulations

7.2. Compliance Requirements

7.3. Certification Processes

08. Indonesia Cloud Computing Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

09. Indonesia Cloud Computing Market Future Segmentation, 2028

9.1. By Deployment Model (in Value %)

9.2. By Service Type (in Value %)

9.3. By Region (in Value %)

10. Indonesia Cloud Computing Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step: 2 Market Building:

Collating statistics on Indonesia Cloud Computing Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Cloud Computing Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output:

Our team will approach multiple Cloud Computing and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Cloud Computing.

Frequently Asked Questions

01. How big is the Indonesia Cloud Computing Market?

The Indonesia cloud computing market was valued at USD 4.72 billion in 2023. This growth is fueled by the increasing adoption of cloud solutions by SMEs, expanding e-commerce platforms, and supportive government initiatives aimed at fostering digital transformation.

02. What are the challenges in the Indonesia Cloud Computing Market?

Key challenges include stringent data localization requirements, limited digital literacy among small businesses, and the high costs associated with advanced cloud services such as AI-driven solutions and enhanced cybersecurity measures, making adoption difficult for smaller enterprises.

03. Who are the major players in the Indonesia Cloud Computing Market?

Major players in the Indonesia cloud computing market include Amazon Web Services (AWS), Google Cloud, Alibaba Cloud, Microsoft Azure, and Telkomsigma. These companies dominate the market through their investments in local data centers and strategic partnerships with Indonesian businesses.

04. What are the growth drivers of the Indonesia Cloud Computing Market?

Growth drivers include the rapid adoption of cloud technologies by SMEs, the expansion of the e-commerce sector, and the Indonesian government's push towards digital transformation through initiatives like the Digital Indonesia Roadmap 2021-2024 aimed at building digital infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.