Indonesia Commercial Vehicle Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3762

December 2024

82

About the Report

Indonesia Commercial Vehicle Market Overview

- The Indonesia Commercial Vehicle market is valued at USD 4.6 billion, based on a five-year historical analysis. The market's growth is primarily driven by rapid urbanization and the expansion of e-commerce, which has increased the demand for efficient logistics solutions. Government infrastructure initiatives and investments in transportation networks further bolster the sector, while the construction boom and the growing mining industry also contribute significantly to market expansion.

- Java, including cities like Jakarta and Surabaya, dominates the Indonesia Commercial Vehicle market. This dominance is due to the region's high population density, advanced infrastructure, and the concentration of industrial activities. Java serves as the country's economic hub, where most goods are distributed, and major transportation networks are concentrated, making it the most important market for commercial vehicles in Indonesia.

- Indonesia's low emission vehicle (LEV) policies, implemented in 2024, require commercial vehicles to meet stringent emission standards. Fleet operators who switch to electric or hybrid models are eligible for subsidies and tax incentives. The government aims to have 50,000 low-emission commercial vehicles in operation by 2025. These policies are designed to reduce air pollution, particularly in urban areas like Jakarta, where emissions from commercial vehicles account for 40% of transportation-related pollution.

Indonesia Commercial Vehicle Market Segmentation

The Indonesia Commercial Vehicle market is segmented by vehicle type and by fuel type.

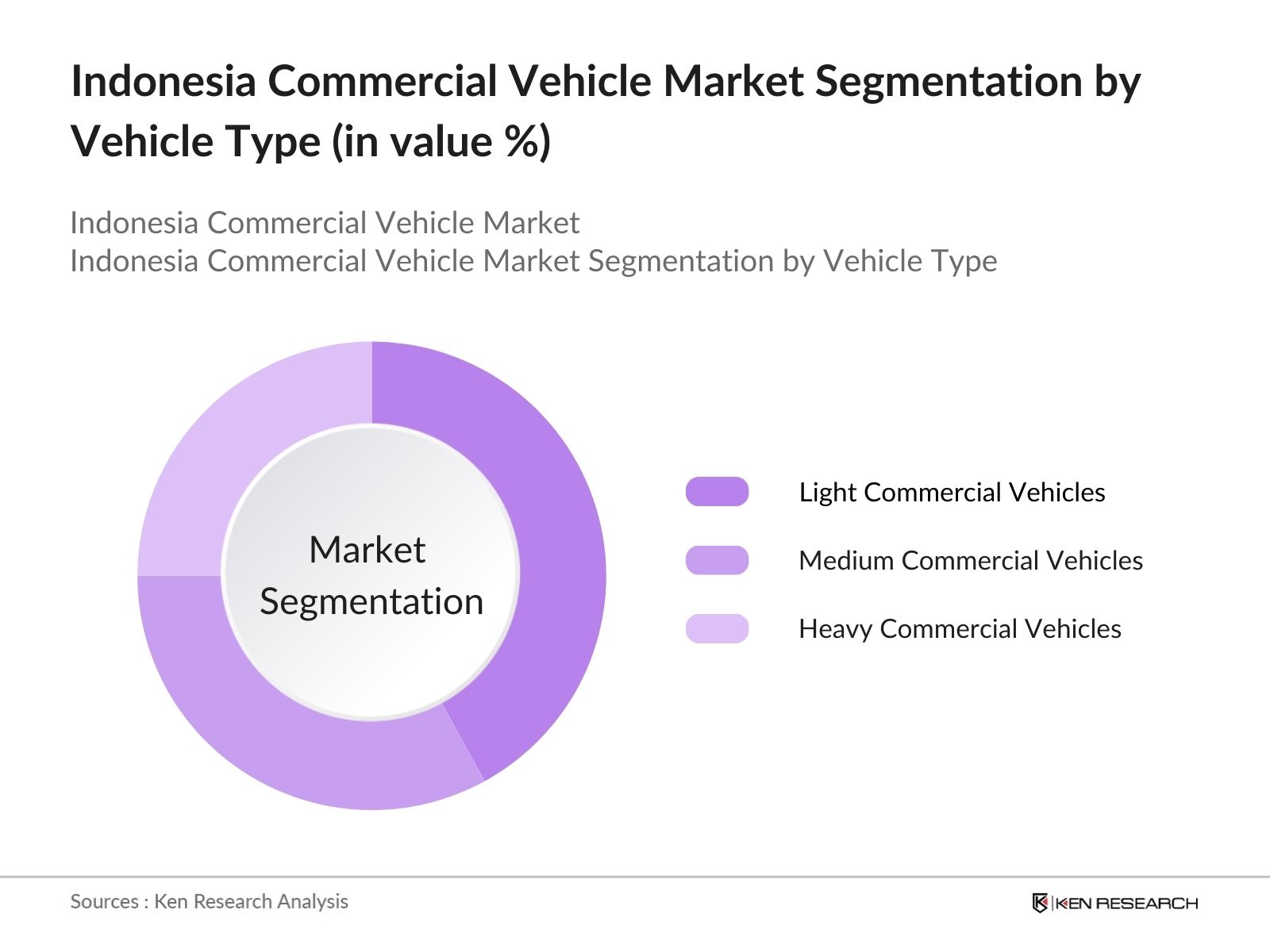

- By Vehicle Type: The market is segmented by vehicle type into light commercial vehicles (LCVs), medium commercial vehicles (MCVs), and heavy commercial vehicles (HCVs). Among these, light commercial vehicles hold the dominant market share due to their versatility and high demand in urban logistics, particularly for last-mile delivery in congested cities. The ongoing growth of e-commerce in Indonesia has spurred the use of smaller, more maneuverable vehicles, particularly for deliveries in narrow and crowded streets.

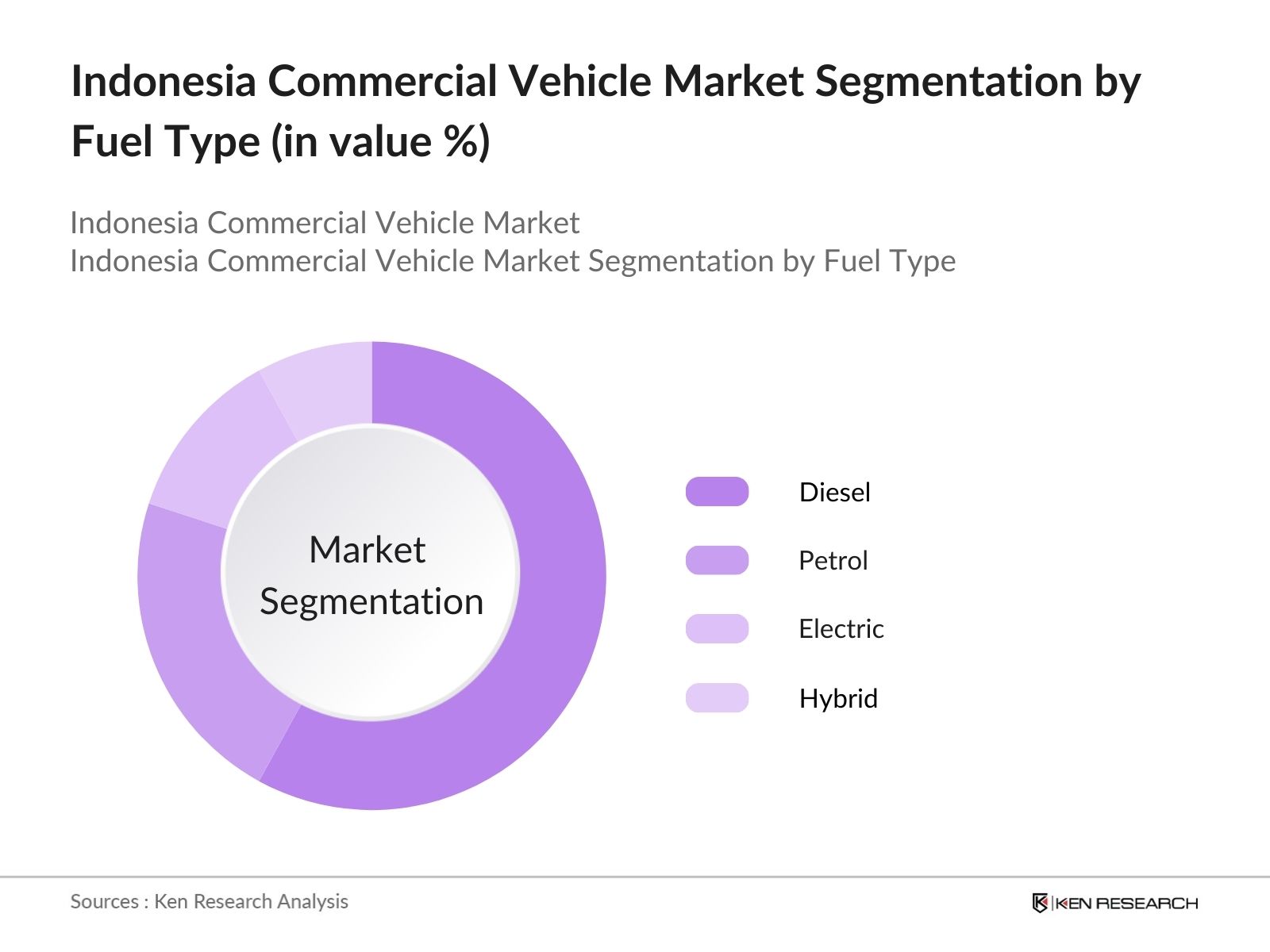

- By Fuel Type: The market is also segmented by fuel type into diesel, petrol, electric, and hybrid commercial vehicles. Diesel vehicles dominate the segment due to their cost-efficiency for long-distance transport and the robustness required for heavy-duty applications. Despite the rise of alternative energy vehicles, diesel remains a key fuel type, especially in sectors such as mining and construction, where powerful engines and extended driving ranges are critical.

Indonesia Commercial Vehicle Market Competitive Landscape

The Indonesia Commercial Vehicle market is dominated by several global and local players, with established brands like Toyota, Isuzu, and Mitsubishi holding strong positions due to their extensive dealer networks and reliable vehicle models. The competition is driven by factors such as product innovation, after-sales service quality, and the ability to meet the increasing demand for more environmentally friendly vehicles.

|

Company |

Establishment Year |

Headquarters |

Vehicle Types |

Revenue |

No. of Dealerships |

|

PT Toyota Astra Motor |

1971 |

Jakarta, Indonesia |

|||

|

PT Isuzu Astra Motor Indonesia |

1960 |

Jakarta, Indonesia |

|||

|

Mitsubishi Fuso Indonesia |

1967 |

Bekasi, Indonesia |

|||

|

Hino Motors Indonesia |

1982 |

Jakarta, Indonesia |

|||

|

Tata Motors Indonesia |

2012 |

Jakarta, Indonesia |

Indonesia Commercial Vehicle Market Analysis

Growth Drivers

- Surge in Construction Activities: The Indonesian governments infrastructure push, such as the $32 billion allocated for road projects in 2024, is driving demand for commercial vehicles, especially heavy trucks and dumpers. Key construction projects, including the Trans-Sumatra Toll Road and Indonesia's New Capital (Nusantara) project, have led to an increased need for transportation of raw materials and equipment. The construction of Nusantara alone requires thousands of commercial vehicles, with an estimated 25,000 trucks utilized for logistics and construction operations in the region. These ongoing infrastructure investments make Indonesia a crucial market for commercial vehicle sales in Southeast Asia.

- Expansion of E-commerce Logistics: Indonesia's e-commerce market, valued at $86 billion, has led to a surge in demand for commercial vehicles, particularly in logistics and last-mile delivery solutions. The rise in e-commerce companies, including Tokopedia and Bukalapak, has required a robust logistics infrastructure, contributing to a significant increase in light commercial vehicle sales. At most about, 15 million packages are delivered daily across the country, necessitating advanced fleet management and a surge in vehicle acquisitions to meet demand. Logistics firms are increasingly investing in fleet expansions to handle the rising volume of online orders.

- Rapid Urbanization: Indonesias urban population has reached 160 million in 2024, creating significant demand for public and private transport solutions. The surge in urbanization has led to higher demand for commercial vehicles for urban freight transport, waste management, and intra-city logistics. Jakarta, one of the fastest-growing cities in Southeast Asia, is seeing increased commercial vehicle usage, with approximately 60% of urban goods transported via trucks. As urbanization intensifies, the need for efficient commercial vehicle fleets to cater to urban freight needs continues to grow, promoting vehicle fleet expansion.

Market Challenges

- Stringent Emission Standards: The Indonesian governments enforcement of Euro 4 emission standards in 2024 has placed pressure on commercial vehicle manufacturers to adopt cleaner technologies. Non-compliant vehicles face significant penalties, and older commercial vehicle models have been phased out. Manufacturers and fleet operators must now invest heavily in cleaner, more fuel-efficient engines and electric vehicles. Around 75% of existing commercial vehicle fleets are impacted, leading to increased costs for retrofitting or upgrading fleets to meet the stringent environmental laws.

- High Vehicle Maintenance Costs: The Indonesian commercial vehicle market faces high maintenance costs due to poor road conditions and extensive vehicle usage, especially in the logistics and construction sectors. In 2024, maintenance costs for commercial vehicles increased by 25%, with companies spending an average of $4,500 annually per vehicle on repairs and upkeep. This financial burden has led fleet owners to adopt predictive maintenance technologies and reconsider operational strategies to cut down maintenance expenses, especially for vehicles used in long-haul logistics across diverse terrains.

Indonesia Commercial Vehicle Market Future Outlook

The Indonesia Commercial Vehicle market is set for significant growth in the coming years. Driven by continuous infrastructure development, increasing demand for goods transportation, and rising e-commerce activities, the sector will see further expansion. The shift towards electric and hybrid vehicles is expected to accelerate, supported by government incentives aimed at reducing carbon emissions and promoting cleaner energy solutions. Moreover, the anticipated surge in construction projects will provide ample opportunities for heavy commercial vehicles, particularly in the mining and construction sectors.

Market Opportunities

- Adoption of Electric Commercial Vehicles: The Indonesian governments push for the adoption of electric vehicles (EVs) is creating new opportunities for the commercial vehicle market. In 2024, Indonesia provided $700 million in subsidies for electric vehicle adoption, with plans to roll out 50,000 electric buses and trucks over the next two years. The Indonesian Ministry of Energy and Mineral Resources also announced incentives for fleet operators who switch to EVs, reducing fuel dependency and carbon emissions. Jakarta alone is expected to see a 40% increase in electric commercial vehicles by the end of the year.

- Integration of IoT in Fleet Management: The integration of IoT technology in fleet management is revolutionizing Indonesias commercial vehicle market. With over 2 million commercial vehicles in operation, IoT-based fleet management solutions allow for real-time tracking, predictive maintenance, and fuel efficiency optimization. In 2024, around 30% of fleet operators in Indonesia adopted IoT solutions to improve operational efficiency and reduce fuel consumption, leading to a reduction in logistics costs by up to 15%. The IoT infrastructure in Indonesia is expanding, enabling smoother logistics operations and enhancing fleet performance.

Scope of the Report

|

Light Commercial Vehicles (LCVs) Medium Commercial Vehicles (MCVs) Heavy Commercial Vehicles (HCVs) |

|

|

By Fuel Type |

Diesel Petrol Electric Hybrid |

|

By Application |

Goods Transportation Passenger Transportation Construction and Mining |

|

By Industry Vertical |

Logistics Construction Mining Retail |

|

By Region |

North East West South |

Products

Key Target Audience

Commercial Vehicle Manufacturers

Logistics and Supply Chain Companies

Government and Regulatory Bodies (Ministry of Transportation, Indonesian Automotive Industry Association)

Construction and Mining Companies

E-commerce and Retail Companies

Electric Vehicle Charging Infrastructure Providers

Investors and Venture Capitalist Firms

Heavy Equipment Leasing Companies

Companies

Players Mention in the Report:

PT Toyota Astra Motor

PT Isuzu Astra Motor Indonesia

Mitsubishi Fuso Indonesia

Hino Motors Indonesia

Tata Motors Indonesia

Mercedes-Benz Distribution Indonesia

Hyundai Motor Company

Volvo Group Indonesia

FAW Group Corporation

Dongfeng Commercial Vehicles

Scania Indonesia

MAN Truck & Bus Indonesia

UD Trucks Indonesia

Daihatsu Motor Indonesia

Ford Motor Indonesia

Table of Contents

1. Indonesia Commercial Vehicle Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Commercial Vehicle Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Commercial Vehicle Market Analysis

3.1. Growth Drivers (Infrastructure Development, E-commerce Growth, Urbanization)

3.1.1. Surge in Construction Activities

3.1.2. Expansion of E-commerce Logistics

3.1.3. Rapid Urbanization

3.1.4. Rise in Last-Mile Delivery Solutions

3.2. Market Challenges (Regulatory Environment, High Import Tariffs, Traffic Congestion)

3.2.1. Stringent Emission Standards

3.2.2. High Vehicle Maintenance Costs

3.2.3. Complex Regulatory Framework

3.3. Opportunities (EV Adoption, Smart Fleet Management, Export Potential)

3.3.1. Adoption of Electric Commercial Vehicles

3.3.2. Integration of IoT in Fleet Management

3.3.3. Export Potential to Neighboring Markets

3.4. Trends (Fleet Electrification, Digital Transformation, Sustainable Transport Solutions)

3.4.1. Fleet Electrification and Hybrid Models

3.4.2. Growth in Digital Fleet Management Solutions

3.4.3. Shift Towards Sustainable Transport Solutions

3.5. Government Regulation (Environmental Standards, Trade Policies, Vehicle Registration Laws)

3.5.1. Low Emission Vehicle Policies

3.5.2. Import and Export Trade Regulations

3.5.3. Incentives for Local Manufacturing of Vehicles

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces (Market Power, Supplier Dependency, Bargaining Power)

3.9. Competition Ecosystem

4. Indonesia Commercial Vehicle Market Segmentation

4.1. By Vehicle Type (In Value %)

4.1.1. Light Commercial Vehicles (LCVs)

4.1.2. Medium Commercial Vehicles (MCVs)

4.1.3. Heavy Commercial Vehicles (HCVs)

4.2. By Fuel Type (In Value %)

4.2.1. Diesel

4.2.2. Petrol

4.2.3. Electric

4.2.4. Hybrid

4.3. By Application (In Value %)

4.3.1. Goods Transportation

4.3.2. Passenger Transportation

4.3.3. Construction and Mining

4.4. By Region (In Value %)

4.4.1. North

4.4.2. South

4.4.3. East

4.4.4. West

4.5. By Industry Vertical (In Value %)

4.5.1. Logistics

4.5.2. Construction

4.5.3. Mining

4.5.4. Retail

5. Indonesia Commercial Vehicle Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Toyota Astra Motor

5.1.2. PT Isuzu Astra Motor Indonesia

5.1.3. Mitsubishi Fuso Truck & Bus Corporation

5.1.4. Hino Motors Sales Indonesia

5.1.5. PT Nissan Motor Indonesia

5.1.6. Tata Motors Indonesia

5.1.7. Mercedes-Benz Distribution Indonesia

5.1.8. Hyundai Motor Company

5.1.9. Volvo Group Indonesia

5.1.10. FAW Group Corporation

5.1.11. Dongfeng Commercial Vehicles

5.1.12. Scania Indonesia

5.1.13. MAN Truck & Bus Indonesia

5.1.14. UD Trucks Indonesia

5.1.15. Daihatsu Motor Indonesia

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Vehicle Sales, Market Share, R&D Investments, Revenue, Fleet Size, Expansion Strategy)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants

5.8. Private Equity Investments

6. Indonesia Commercial Vehicle Market Regulatory Framework

6.1. Emission Standards

6.2. Vehicle Safety Regulations

6.3. Fuel Efficiency Standards

7. Indonesia Commercial Vehicle Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Commercial Vehicle Future Market Segmentation

8.1. By Vehicle Type (In Value %)

8.2. By Fuel Type (In Value %)

8.3. By Application (In Value %)

8.4. By Industry Vertical (In Value %)

8.5. By Region (In Value %)

10. Indonesia Commercial Vehicle Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Commercial Vehicle Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Commercial Vehicle Market. This includes assessing market penetration, the ratio of vehicles to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple commercial vehicle manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia Commercial Vehicle market.

Frequently Asked Questions

01. How big is the Indonesia Commercial Vehicle Market?

The Indonesia Commercial Vehicle Market is valued at USD 4.6 billion, driven by rapid urbanization, infrastructure projects, and the growth of e-commerce logistics.

02. What are the challenges in the Indonesia Commercial Vehicle Market?

Challenges in Indonesia Commercial Vehicle Market include regulatory complexities, high import tariffs, and traffic congestion in urban areas, which can affect delivery times and operating costs.

03. Who are the major players in the Indonesia Commercial Vehicle Market?

Key players in the Indonesia Commercial Vehicle Market include PT Toyota Astra Motor, PT Isuzu Astra Motor Indonesia, Mitsubishi Fuso, Hino Motors, and Tata Motors, all of which dominate due to strong dealer networks and reliable vehicle offerings.

04. What are the growth drivers of the Indonesia Commercial Vehicle Market?

Growth drivers in Indonesia Commercial Vehicle Market include the government's continued infrastructure development efforts, the rise of e-commerce, and the demand for last-mile delivery solutions, especially in urban areas like Jakarta.

05. What is the future of the Indonesia Commercial Vehicle Market?

The Indonesia Commercial Vehicle Market is expected to grow with increased adoption of electric vehicles and hybrid models, supported by government incentives and a growing focus on sustainability in the transportation sector.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.