Indonesia Construction Equipment Rental Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD8022

December 2024

88

About the Report

Indonesia Construction Equipment Rental Market Overview

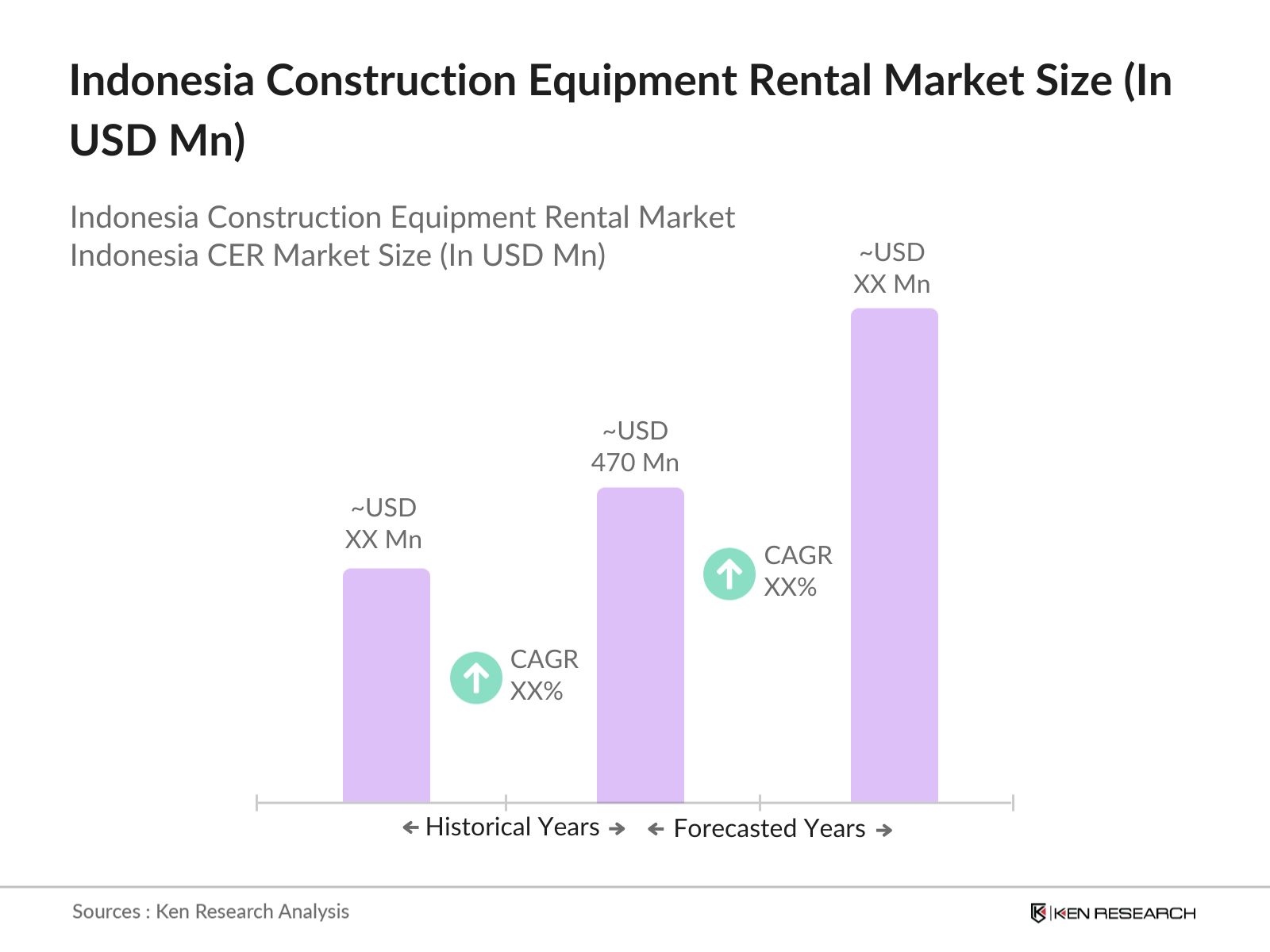

- The Indonesia construction equipment rental market has witnessed significant growth over the historical period, currently valued at USD 470 Mn, driven by rapid infrastructure development and increasing demand for cost-effective construction solutions. The market is bolstered by rising urbanization, government-led construction projects, and the expansion of the industrial sector across the country. These factors have led contractors and developers to prefer renting equipment over purchasing to reduce capital expenditure.

- Major cities like Jakarta, Surabaya, and Medan have become key hubs for construction equipment rental services due to ongoing infrastructure development. Jakarta, the nation's capital, is witnessing significant investments in public transportation, including metro lines and highways, which drive the demand for construction machinery. In Surabaya, large-scale industrial projects and commercial developments are contributing to the growth of the rental market. Medans burgeoning construction sector, focusing on real estate and transportation, has also seen a surge in equipment rental services.

- Indonesia's government has rolled out numerous infrastructure development plans as part of its National Medium-Term Development Plan (RPJMN) 2020-2024. The plan outlines ambitious projects, such as new airports, toll roads, and housing developments, all of which are expected to fuel the demand for construction equipment rental services in the coming years. This increase in construction activity is creating a favorable environment for rental companies to expand their fleets and service offerings.

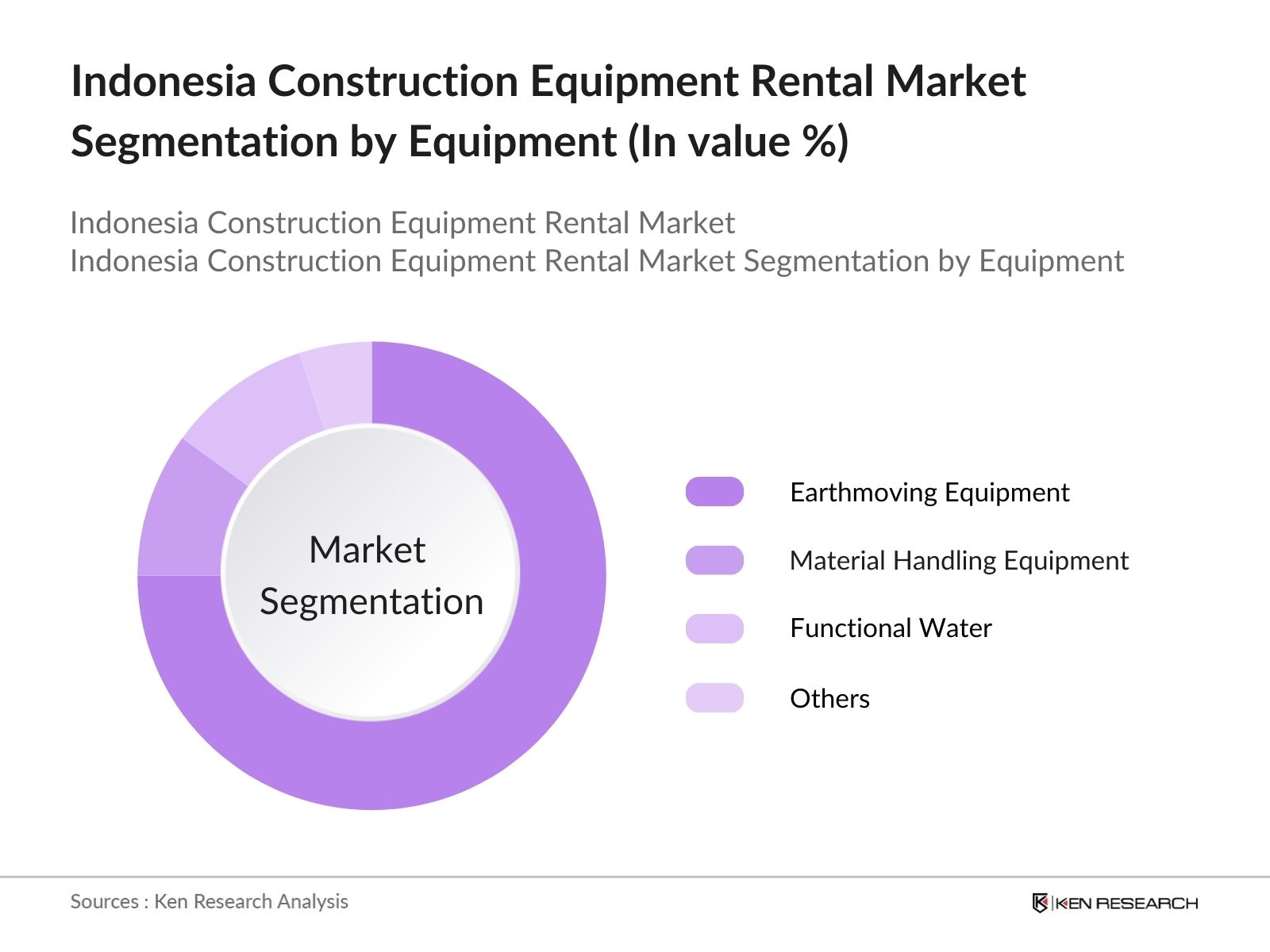

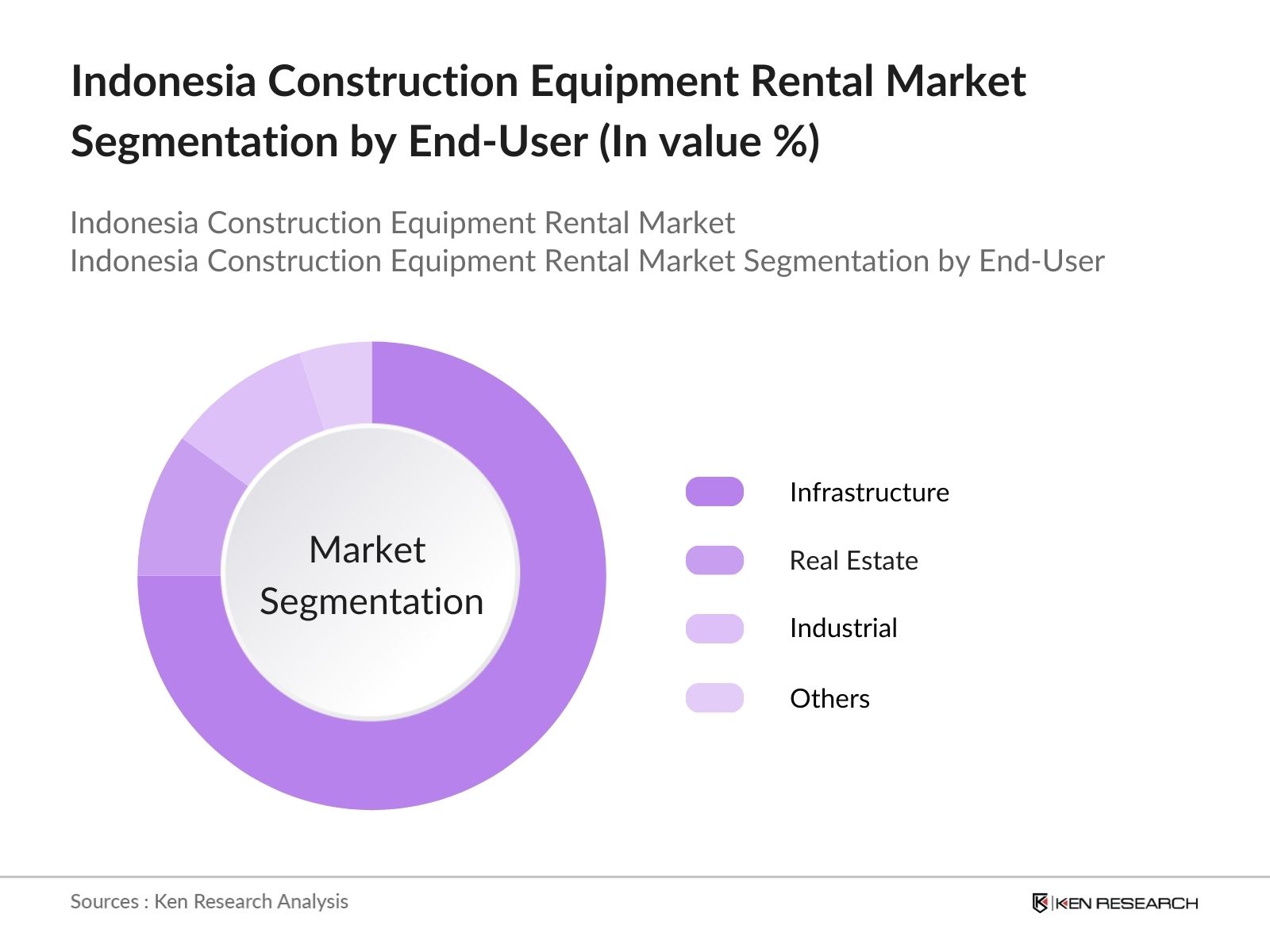

Indonesia Construction Equipment Rental Market Segmentation

- By Equipment Type: The market is segmented by equipment type into earthmoving equipment, material handling equipment, concrete equipment, and road construction equipment. Earthmoving Equipment, which includes excavators, backhoes, bulldozers, and loaders, holds the largest share in the Indonesian construction equipment rental market. The increasing demand for large-scale infrastructure projects, such as road and highway construction, is the primary driver for this segment. Earthmoving equipment rentals are particularly popular among small- and medium-sized contractors who require high-capacity machinery without the burden of ownership costs.

- By End-User : The market is further segmented by end-user industry into infrastructure, real estate, industrial, mining, and oil & gas.The infrastructure sector is the largest end-user of construction equipment rentals in Indonesia. The governments focus on expanding transport infrastructure, such as highways, airports, and ports, has spurred significant demand for rental services. Major projects like the Trans-Java Toll Road and the development of the New Capital City in Kalimantan are key drivers of this segment.

Indonesia Construction Equipment Rental Market Competitive Landscape

The construction equipment rental market in Indonesia is highly competitive, with both local and international players vying for market share. Key players in the market include Trakindo Utama, United Tractors, and Hexindo Adiperkasa. These companies offer a wide range of rental equipment, from earthmoving machinery to cranes and material handling equipment, catering to the diverse needs of the Indonesian construction industry.

Local companies, such as Altrak 1978 and Intraco Penta, have established strong footholds in the market by offering customized rental services to small- and medium-sized contractors. These companies have also formed strategic partnerships with global manufacturers to provide advanced equipment solutions. In addition, international players like Caterpillar and Komatsu, through their local distributors, are expanding their rental operations to meet the growing demand in Indonesias construction sector.

|

Company Name |

Establishment Year |

Headquarters |

Fleet Size |

Equipment Range |

Technology Integration |

Geographic Reach |

Market Segment Focus |

Maintenance Support |

|

Trakindo Utama |

1970 |

Indonesia |

||||||

|

United Tractors |

1972 |

Indonesia |

||||||

|

Hexindo Adiperkasa |

1972 |

Indonesia |

||||||

|

Altrak 1978 |

1978 |

Indonesia |

||||||

|

Intraco Penta |

1970 |

Indonesia |

Indonesia Construction Equipment Rental Industry Analysis

Growth Drivers

- Government Infrastructure Initiatives: The Indonesian governments infrastructure projects, particularly under the National Medium-Term Development Plan (RPJMN) 2020-2024, have allocated USD 340 billion for infrastructure development. These projects, including the construction of 2,500 kilometers of toll roads and 25 new airports, create a high demand for construction equipment. Equipment rental services play a critical role in supporting these initiatives by providing flexible access to necessary machinery .

- Expansion of SME Sector: The growth of small and medium enterprises (SMEs) in Indonesia, which contribute over 60% to the country's GDP, has spurred demand for construction equipment rental services. These enterprises, especially in construction and real estate, prefer renting equipment to minimize capital expenditure. In 2023, over 65 million SMEs operated in Indonesia, with many relying on short-term, project-based equipment rentals to remain competitive in infrastructure projects.

- Growing Urbanization: Indonesia's urban population has grown significantly, with cities like Jakarta, Surabaya, and Medan expanding at a fast rate. In 2023, Indonesias urban population reached 60% of the total population, which stood at 277 million. This rapid urbanization drives the demand for infrastructure projects such as housing, roads, and utilities, necessitating the use of construction equipment. The government's ongoing urban development projects, such as the New Capital City project (Nusantara), also rely heavily on rental construction equipment for efficiency and cost savings.

Market Challenges

- High Equipment Maintenance Costs: Despite the benefits of renting, construction equipment requires regular maintenance to ensure it operates efficiently. Rental companies often bear the burden of these costs, which can erode profitability. Furthermore, the harsh working conditions in some construction sites, such as mining operations, can lead to accelerated wear and tear, increasing maintenance expenses for rental providers. Additionally, frequent repairs due to the challenging operational conditions further drive up maintenance costs, putting pressure on rental service providers .

- Limited Availability of Skilled Operators: While demand for construction equipment rental is growing, the availability of skilled operators is limited. Many rental companies struggle to find operators who are proficient in handling advanced machinery, particularly in remote areas. This skills gap is a significant challenge for the industry, as it can lead to equipment misuse, accidents, and costly repairs. This shortage increases downtime and limits the efficient use of rented equipment, affecting project timelines and equipment utilization rates .

Indonesia Construction Equipment Rental Market Future Outlook

The Indonesia construction equipment rental market is expected to continue its upward trajectory over the next five years, supported by government infrastructure initiatives, growing urbanization, and the need for cost-effective construction solutions. The market is also likely to see increased investment in advanced equipment, such as autonomous machinery and telematics systems, to improve operational efficiency and reduce downtime.

Future Market Opportunities

- Technological Advancements in Telematics, GPS, and Autonomous Equipment: Technological advancements such as GPS tracking and telematics systems offer significant opportunities for rental companies to enhance operational efficiency. In 2023, a major portion of construction equipment rental companies in Indonesia adopted telematics systems to monitor real-time performance and usage. This technology helps in reducing fuel consumption, optimizing routes, and ensuring equipment security, thereby lowering operational costs and increasing the appeal of renting equipment.

- Rising Demand from Real Estate and Infrastructure Projects: The real estate and infrastructure sectors in Indonesia saw an increase in project launches in 2023, with more than 200 major projects underway, including residential complexes, commercial buildings, and roads. In 2023, the Indonesian government planned 49 new projects, which included 33 Public-Private Partnership (PPP) projects and 16 non-PPP projects. Additionally, there are reports indicating that there are over 200 national strategic projects. This spike in construction activities has boosted the demand for rented construction equipment like loaders, bulldozers, and concrete mixers, offering significant growth potential for the rental market.

Scope of the Report

|

By Equipment Type |

Earthmoving Equipment Material Handling Equipment Concrete Equipment Road Construction Equipment Others |

|

By End-User Industry |

Infrastructure Real Estate Industrial Mining Oil & Gas |

|

By Rental Duration |

Short-Term Rentals Long-Term Rentals |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

|

By Provider Type |

Local Rental Providers International Rental Providers |

Products

Key Target Audience

Construction Companies

Infrastructure Development Firms

Real Estate Developers

Mining Companies

Oil & Gas Firms

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Public Works and Housing)

Heavy Machinery Manufacturers

Companies

Major Players Mentioned in the Report

Trakindo Utama

United Tractors

Hexindo Adiperkasa

Altrak 1978

Intraco Penta

ABM Investama

Caterpillar (through local distributors)

Komatsu Indonesia

Liebherr Indonesia

Hitachi Construction Machinery Indonesia

Doosan Infracore Indonesia

Sumitomo Construction Machinery Indonesia

Sany Indonesia

Volvo Construction Equipment Indonesia

Darma Henwa Tbk

Table of Contents

1. Indonesia Construction Equipment Rental Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Construction Equipment Rental Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Construction Equipment Rental Market Analysis

3.1. Growth Drivers

- Rapid Urbanization

- Government Infrastructure Initiatives

- Increasing Industrialization

- Expansion of SME Sector

3.2. Market Challenges

- High Operational Costs for Rental Providers

- Maintenance and Downtime Issues

- Limited Skilled Operators

- Equipment Mismanagement Risks

3.3. Opportunities

- Technological Advancements (Telematics, GPS, Autonomous Equipment)

- Rising Demand from Real Estate and Infrastructure Projects

- Expansion of Rental Services in Rural Areas

- Green Construction and Energy-Efficient Equipment Rentals

3.4. Trends

- Adoption of Telematics and Fleet Management Solutions

- Shift Toward Electric and Hybrid Equipment

- Rising Popularity of Short-Term Equipment Rental Contracts

- Rental of Specialized Equipment for Mega Projects

3.5. Government Regulation

- National Strategic Projects (PSN) Impact on Rental Demand

- Local Content Requirements for Equipment Providers

- Safety Standards and Certifications for Construction Equipment

- Environmental Compliance and Green Equipment Regulations

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia Construction Equipment Rental Market Segmentation

4.1. By Equipment Type (In Value %)

- Earthmoving Equipment

- Material Handling Equipment

- Concrete Equipment

- Road Construction Equipment

- Others

4.2. By End-User Industry (In Value %)

- Infrastructure

- Real Estate

- Industrial

- Mining

- Oil & Gas

4.3. By Rental Duration (In Value %)

- Short-Term Rentals

- Long-Term Rentals

4.4. By Region (In Value %)

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Papua

4.5. By Provider Type (In Value %)

- Local Rental Providers

- International Rental Providers

5. Indonesia Construction Equipment Rental Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Trakindo Utama

5.1.2. United Tractors

5.1.3. Hexindo Adiperkasa

5.1.4. Intraco Penta

5.1.5. Altrak 1978

5.1.6. PT Darma Henwa Tbk

5.1.7. ABM Investama

5.1.8. Caterpillar (through local dealers)

5.1.9. Komatsu (through local distributors)

5.1.10. Liebherr Indonesia

5.1.11. Hitachi Construction Machinery Indonesia

5.1.12. Doosan Infracore Indonesia

5.1.13. Sumitomo Construction Machinery Indonesia

5.1.14. Sany Indonesia

5.1.15. Volvo Construction Equipment Indonesia

5.2. Cross Comparison Parameters (Fleet Size, Rental Rates, Service Availability, Customer Support, Geographical Coverage, Equipment Availability, After-Sales Service, Technology Integration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Construction Equipment Rental Market Regulatory Framework

6.1. Safety Standards for Construction Equipment

6.2. Compliance Requirements for Rental Companies

6.3. Certification Processes for Equipment Usage

6.4. Import Regulations for Construction Machinery

7. Indonesia Construction Equipment Rental Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Construction Equipment Rental Future Market Segmentation

8.1. By Equipment Type (In Value %)

- Earthmoving Equipment

- Material Handling Equipment

- Concrete Equipment

- Road Construction Equipment

- Others

8.2. By End-User Industry (In Value %)

- Infrastructure

- Real Estate

- Industrial

- Mining

- Oil & Gas

8.3. By Rental Duration (In Value %)

- Short-Term Rentals

- Long-Term Rentals

8.4. By Region (In Value %)

- Java

- Sumatra

- Kalimantan

- Sulawesi

- Papua

8.5. By Provider Type (In Value %)

- Local Rental Providers

- International Rental Providers

9. Indonesia Construction Equipment Rental Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research begins by identifying the key variables that influence the Indonesia construction equipment rental market. This involves an in-depth analysis of stakeholders, including construction firms, rental companies, and government bodies. Extensive desk research is conducted to gather data from secondary sources such as government publications and proprietary industry reports.

Step 2: Market Analysis and Construction

In this phase, historical data related to the rental market's size, equipment utilization, and end-user segments are compiled and analyzed. This includes evaluating key infrastructure projects and their impact on rental demand. The data is validated using multiple secondary sources to ensure accuracy.

Step 3: Hypothesis Validation and Expert Consultation

To validate the findings, interviews with industry experts and senior executives from construction equipment rental companies are conducted. These consultations provide valuable insights into market trends, competitive dynamics, and challenges. The data gathered is refined based on expert feedback.

Step 4: Research Synthesis and Final Output

The final stage involves synthesizing all research findings and producing a comprehensive market report. This report includes a detailed analysis of market drivers, segmentation, competitive landscape, and future trends. The output is validated through a top-down and bottom-up approach, ensuring comprehensive market insights.

Frequently Asked Questions

01. How big is the Indonesia Construction Equipment Rental Market?

The Indonesia construction equipment rental market is valued at USD 470 million, supported by the increasing number of infrastructure projects and industrial developments across the country.

02. What are the challenges in the Indonesia Construction Equipment Rental Market?

The primary challenges in the Indonesia construction equipment market include high maintenance costs for rental companies, limited availability of skilled operators, and the need for advanced fleet management systems to reduce equipment downtime.

03. Who are the major players in the Indonesia Construction Equipment Rental Market?

Key players in the Indonesia construction equipment market include Trakindo Utama, United Tractors, Hexindo Adiperkasa, Altrak 1978, and Intraco Penta. These companies dominate the market due to their extensive fleet size and strong customer support.

04. What are the growth drivers of the Indonesia Construction Equipment Rental Market?

Growth drivers in the Indonesia construction equipment market include government infrastructure initiatives, increasing demand for real estate development, and the rising preference for renting over purchasing equipment due to cost efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.