Indonesia Construction Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD2737

December 2024

93

About the Report

Indonesia Construction Market Overview

- The Indonesia Construction market is valued at USD 280 billion, based on a five-year historical analysis. This market is primarily driven by rapid urbanization, government infrastructure projects, and the rising demand for residential and commercial spaces. With a growing focus on sustainability and green initiatives, the construction sector is witnessing significant advancements in technologies and materials, making Indonesia a key market in Southeast Asia for construction activities.

- The market dominance is concentrated in major cities such as Jakarta, Surabaya, and Bandung due to the rapid urban expansion and the influx of investments in commercial and residential construction. These regions benefit from improved infrastructure, a rise in foreign direct investments, and a demand surge in housing and commercial office spaces, driven by economic growth and population increase. Additionally, government initiatives such as the National Strategic Projects (PSN) play a crucial role in boosting construction activities, with key developments in transport and public facilities.

- The Indonesian government has established regulatory frameworks and standards that focus on enhancing safety, environmental sustainability, and energy efficiency. Indonesia has updated its National Standards to include mandatory green requirements for all public buildings by 2024. This regulation lays out a suite of green standards but is only mandatory for very large buildings, specifically those with a floor area exceeding 5,000 m.

Indonesia Construction Market Segmentation

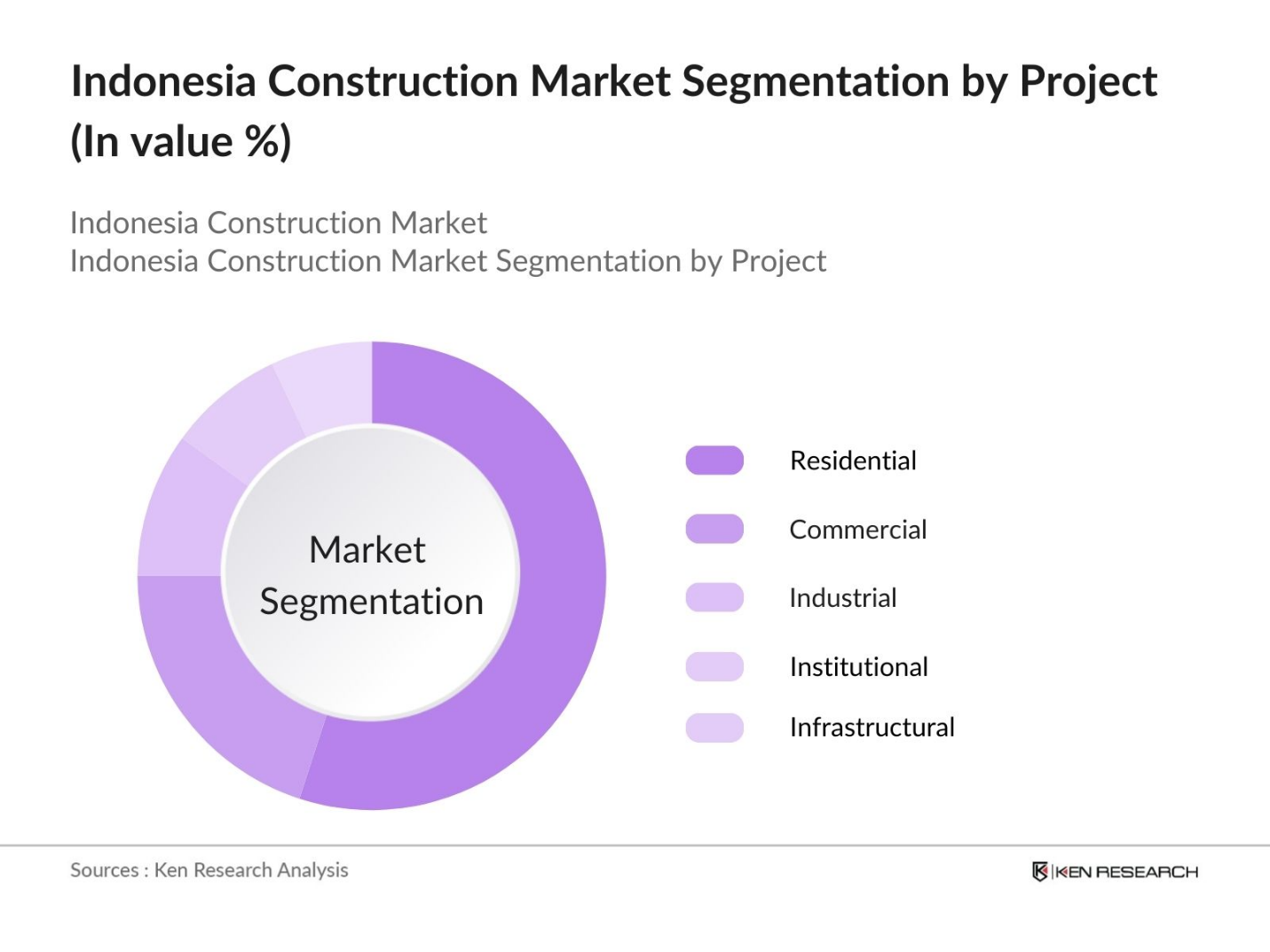

- By Project Type: The market is segmented by project type into residential, commercial, industrial, institutional, and infrastructural. The residential segment holds the dominant market share due to the rising demand for affordable housing, driven by the growing urban population and government housing programs like the One Million Houses initiative. Developers are increasingly focusing on high-density housing projects in urban areas to meet the demand for affordable housing. Companies such as Ciputra Group and Agung Podomoro Land are key players in this segment, contributing to the sectors substantial growth.

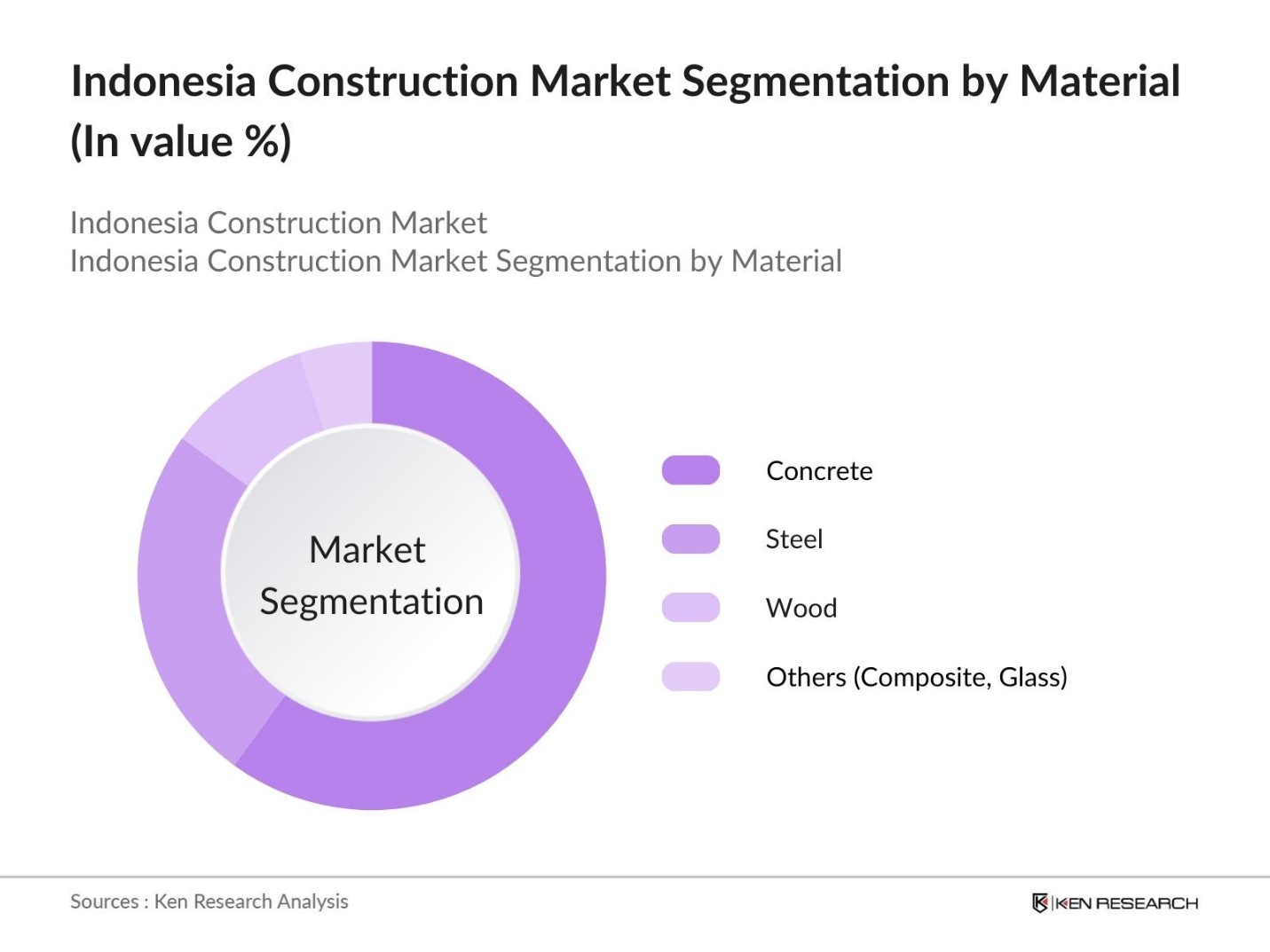

- By Material Type: The market is segmented by material type into concrete, steel, wood, and others. Concrete dominates the market due to its extensive use in large-scale infrastructure and high-rise residential projects. The Indonesian construction industry is heavily reliant on reinforced concrete, especially in the development of apartment complexes and office buildings. In addition, innovations in concrete technologies, such as precast and lightweight concrete, are gaining traction, allowing for faster and more cost-effective construction.

Indonesia Construction Market Competitive Landscape

The Indonesia construction market is characterized by a mix of established local firms and global players, making it highly competitive and diverse. Prominent companies such as PT Wijaya Karya, PT Pembangunan Perumahan, and global firms like Hyundai Engineering & Construction and China State Construction Engineering Corporation are key players in this market.

|

Company Name |

Establishment Year |

Headquarters |

Specialization |

Revenue (USD Billion) |

Market Share (%) |

Key Projects |

Sustainability Practices |

Technology Adoption |

Regional Presence |

|

PT Wijaya Karya (Persero) Tbk (WIKA) |

1960 |

Jakarta, Indonesia |

|||||||

|

PT Pembangunan Perumahan (Persero) |

1953 |

Jakarta, Indonesia |

|||||||

|

Hyundai Engineering & Construction |

1947 |

Seoul, South Korea |

|||||||

|

China State Construction Engineering |

1982 |

Beijing, China |

|||||||

|

PT Adhi Karya (Persero) Tbk |

1960 |

Jakarta, Indonesia |

Indonesia Construction Industry Analysis

Growth Drivers

- Urbanization and Housing Demand: Indonesia is experiencing significant urbanization, with 58% of the population now living in urban areas in 2024, according to the World Bank. The United Nations reports that Jakarta and Surabaya have seen large migration influxes, resulting in a demand for residential and commercial buildings. The government plans significant investments in infrastructure to support urban growth, including the development of a new capital city estimated to cost around USD 33 billion. Urban population expansion, particularly in Java and Sumatra, has increased the need for infrastructure development to accommodate this growth, including housing and public amenities.

- Government Infrastructure Projects: Indonesia's government has allocated USD 429 billion for infrastructure development under its National Medium-Term Development Plan (RPJMN) for 2020-2024. This includes more than 200 National Strategic Projects (NSPs), such as toll roads, airports, and public housing, aimed at supporting economic growth. The Ministry of Public Works and Housing confirmed that 87 NSPs have been completed by 2024, including major highway projects in Sumatra and Kalimantan, boosting the construction sector significantly.

- Rising Middle-Class Population: Indonesias middle class, defined by the World Bank as earning between USD 132 and USD 640 per day, now makes up around 16.5 % of the population in 2024, a significant increase from prior years. This population growth is driving demand for residential construction, particularly in suburban areas of major cities like Jakarta, Bandung, and Surabaya. Increased disposable income among this group has also led to higher spending on real estate and home improvements.

Market Challenges

- High Construction Costs: One of the key challenges in the Indonesia Construction market is the high cost of construction materials and labor. The price of cement, steel, and other construction materials has been rising due to inflationary pressures and supply chain disruptions. In 2023, the average cost of construction materials increased by 8%, making it challenging for developers to maintain cost-effective project delivery.

- Regulatory and Permit Complexities: Indonesia's construction sector continues to face regulatory hurdles, particularly concerning permits and environmental compliance. The World Bank's 2024 Doing Business report highlights that obtaining construction permits in Indonesia takes an average of 200 days, involving at least 17 procedures, which slows down project implementation. Government efforts to streamline these processes, such as the Omnibus Law, have made only modest improvements so far.

Indonesia Construction Market Future Outlook

Over the next five years, the Indonesia Construction market is expected to witness significant growth, driven by continued government investments in infrastructure, rising urbanization, and a growing middle class demanding residential and commercial spaces. The adoption of advanced construction technologies such as prefabrication, BIM, and sustainable practices is anticipated to reshape the market. The construction of smart buildings, focusing on energy efficiency and connectivity, will further drive innovation in the sector.

Future Market Opportunities

- Smart City and Infrastructure Development: The Indonesian government has earmarked 100 cities for smart city development under its 2024 Smart City Program. Projects in cities like Jakarta, Surabaya, and Makassar involve integrated infrastructure with IoT technology for better resource management, public safety, and transport systems. According to Indonesia's Ministry of Communication and Informatics, over $1 billion has been invested in smart city infrastructure by 2024, creating new opportunities for construction firms specialized in high-tech solutions.

- Expansion of Tourism Infrastructure: The tourism sector continues to offer robust growth potential for Indonesia's construction industry, especially with the governments focus on expanding tourism infrastructure. Indonesia is targeting 17 million tourist arrivals in 2024, up from 16 million in 2023. From January to May 2024, Indonesia recorded 5,244,213 international tourist arrivals, a 23.78% increase compared to the same period in 2023. These projects include the construction of hotels, resorts, and supporting infrastructure like airports and roads, providing opportunities for contractors in this segment.

Scope of the Report

|

Project Type |

Residential Commercial Industrial Institutional Infrastructural |

|

Material Type |

Concrete Steel Wood Others (Composite, Glass) |

|

End-User |

Private Sector Government Public-Private Partnerships (PPP) |

|

Region |

Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara |

|

Technology |

Prefabrication 3D Printing Information Modeling (BIM) |

Products

Key Target Audience

Private Real Estate Developers

Government Agencies (Ministry of Public Works and Housing, Ministry of Finance)

Construction Material Suppliers

Banks and Financial Institutes

Infrastructure Investors

Venture Capital Firms

Public-Private Partnership Firms

Commercial Real Estate Investors

International Construction Companies

Companies

Major Players in Indonesia Construction Market

Ciputra Group

Agung Podomoro Land

PT Waskita Karya

Summarecon Agung

Sinar Mas Land

Lippo Group

Adhi Karya

PP Property

PT Wijaya Karya

Duta Anggada Realty

PT Nusa Konstruksi Enjiniring

PT Total Bangun Persada

PT Jaya Konstruksi Manggala Pratama

PT Hutama Karya

PT Indofood Sukses Makmur

Table of Contents

Indonesia Construction Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Construction Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Construction Market Analysis

3.1. Growth Drivers

3.1.1. Rapid Urbanization

3.1.2. Government Infrastructure Initiatives (National Strategic Projects)

3.1.3. Rising Middle-Class Population

3.1.4. Technological Advancements in Construction (BIM, Prefabrication)

3.2. Market Challenges

3.2.1. High Cost of Materials (Concrete, Steel)

3.2.2. Regulatory and Permit Complexities

3.2.3. Skilled Labor Shortage

3.3. Opportunities

3.3.1. Green Initiatives and Sustainable Materials

3.3.2. Smart City and Infrastructure Development

3.3.3. Expansion of Tourism Infrastructure

3.4. Trends

3.4.1. Adoption of Information Modeling (BIM)

3.4.2. Increasing Demand for Prefabrication Techniques

3.4.3. Eco-friendly and Energy-Efficient Construction

3.5. Government Regulation

3.5.1. National Standards and Codes (Green Building)

3.5.2. Environmental Compliance Regulations

3.5.3. Public-Private Partnerships (PPP) in Infrastructure Projects

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

Indonesia Construction Market Segmentation

4.1. By Project Type (In Value %)

4.1.1. Residential

4.1.2. Commercial

4.1.3. Industrial

4.1.4. Institutional

4.1.5. Infrastructural

4.2. By Material Type (In Value %)

4.2.1. Concrete

4.2.2. Steel

4.2.3. Wood

4.2.4. Others (Composite, Glass)

4.3. By End-User (In Value %)

4.3.1. Private Sector

4.3.2. Government

4.3.3. Public-Private Partnerships (PPP)

4.4. By Region (In Value %)

4.4.1. Java

4.4.2. Sumatra

4.4.3. Kalimantan

4.4.4. Sulawesi

4.4.5. Bali & Nusa Tenggara

4.5. By Technology (In Value %)

4.5.1. Prefabrication

4.5.2. 3D Printing

4.5.3. Information Modeling (BIM)

Indonesia Construction Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Ciputra Group

5.1.2. Agung Podomoro Land

5.1.3. PT Waskita Karya

5.1.4. Summarecon Agung

5.1.5. PP Property

5.1.6. Adhi Karya

5.1.7. PT Total Bangun Persada

5.1.8. PT Jaya Konstruksi Manggala Pratama

5.1.9. PT Wijaya Karya

5.1.10. Duta Anggada Realty

5.1.11. PT Nusa Konstruksi Enjiniring

5.1.12. Lippo Group

5.1.13. Sinar Mas Land

5.1.14. PT Hutama Karya

5.1.15. PT Indofood Sukses Makmur

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Revenue, Market Presence, Technological Adoption, Project Type Expertise, Regional Focus, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

Indonesia Construction Market Regulatory Framework

6.1. Environmental Standards

6.2. Green Certification

6.3. Safety and Quality Compliance

6.4. Permit Regulations

6.5. Public-Private Partnerships (PPP) Regulations

Indonesia Construction Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Construction Future Market Segmentation

8.1. By Project Type (In Value %)

8.2. By Material Type (In Value %)

8.3. By End-User (In Value %)

8.4. By Region (In Value %)

8.5. By Technology (In Value %)

Indonesia Construction Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segment Analysis

9.3. Marketing and Branding Initiatives

9.4. Opportunity Mapping in Untapped Segments

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Construction Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we compile and analyze historical data pertaining to the Indonesia Construction Market. This includes assessing market penetration, the ratio of residential to commercial projects, and the resultant revenue generation. Additionally, the service quality statistics are evaluated to ensure the reliability and accuracy of revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and subsequently validated through computer-assisted telephone interviews (CATIS) with industry experts representing a diverse array of companies. These consultations provide valuable operational and financial insights directly from industry practitioners, which are instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple construction companies and material suppliers to acquire detailed insights into project segmentation, sales performance, and consumer preferences. This interaction serves to verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesia Construction market.

Frequently Asked Questions

01. How big is the Indonesia Construction Market?

The Indonesia Construction market was valued at USD 45 billion in 2023, driven by strong government infrastructure investments, urbanization, and rising demand for residential and commercial spaces.

02. What are the challenges in the Indonesia Construction Market?

Challenges include high construction costs, regulatory hurdles, and the skilled labor shortage. Additionally, the complex process of acquiring permits can cause delays in project execution.

03. Who are the major players in the Indonesia Construction Market?

Key players include Ciputra Group, Agung Podomoro Land, PT Waskita Karya, Summarecon Agung, and Sinar Mas Land. These companies lead due to their strong market presence and involvement in large-scale infrastructure projects.

04. What are the growth drivers of the Indonesia Construction Market?

The market is propelled by rapid urbanization, government investments in infrastructure projects, and the rising demand for affordable housing. Technological advancements like BIM and prefabrication also enhance construction efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.