Indonesia Corporate Wellness Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD3767

December 2024

100

About the Report

Indonesia Corporate Wellness Market Overview

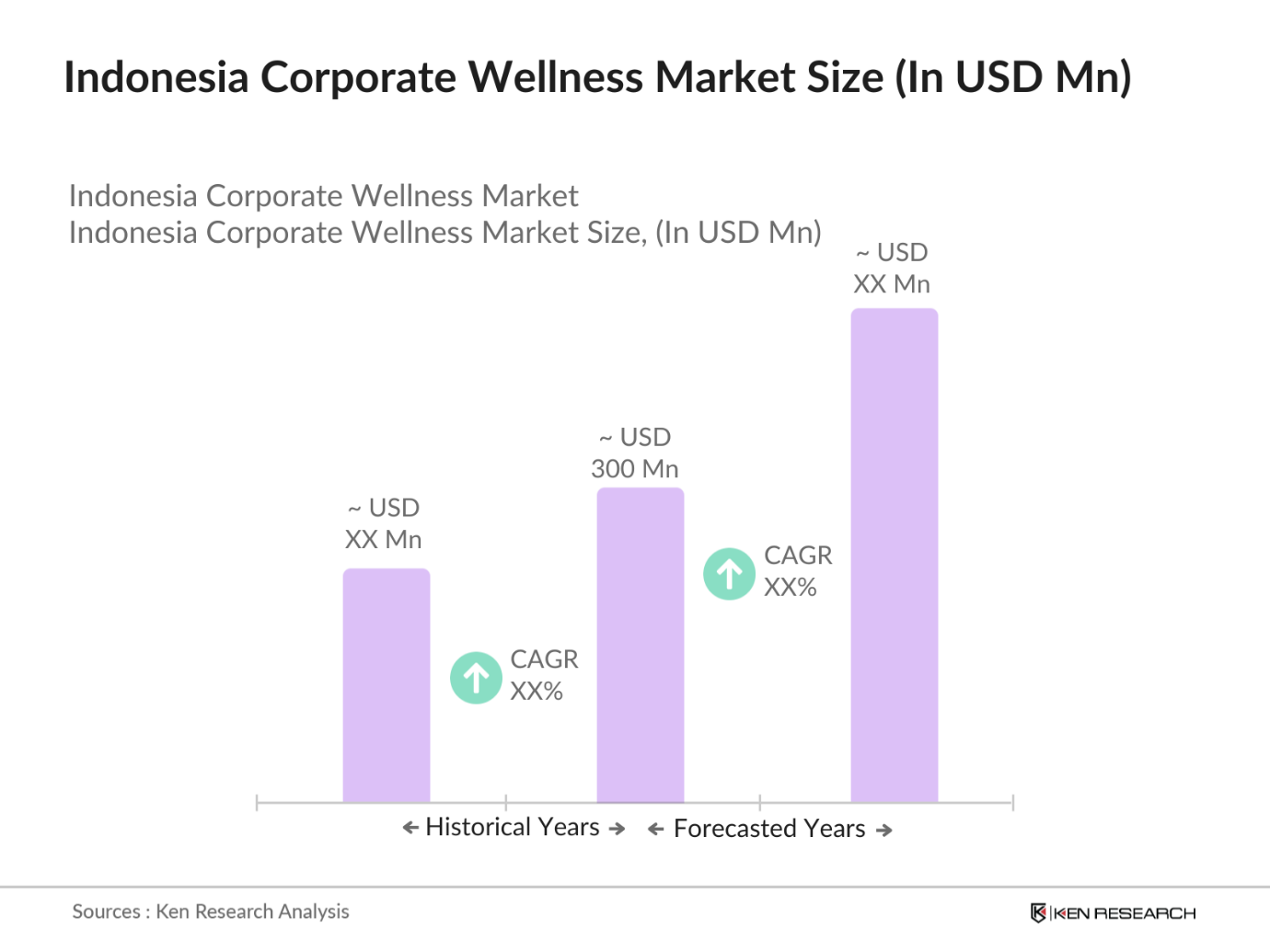

- The Indonesia corporate wellness market is valued at USD 300 million based on a five-year historical analysis. The market is driven by the increasing awareness among employers and employees regarding the long-term health benefits of corporate wellness programs. Factors like rising workplace stress, higher healthcare costs for employers, and government policies promoting employee well-being are significant drivers of growth. Corporate wellness programs in Indonesia have also seen growth due to increased interest in productivity-enhancing solutions, leading to widespread adoption in large enterprises.

- Jakarta, Surabaya, and Bandung are among the dominant cities leading the corporate wellness market in Indonesia. These cities dominate the market primarily due to their high concentration of large enterprises, multinational corporations, and a strong economic foundation. The rapid urbanization in these regions and the increasing number of professionals working in industries such as IT, finance, and manufacturing have made corporate wellness programs essential to sustaining workforce productivity and health.

- In Indonesia, the government mandates strict compliance with health and safety regulations in the workplace, which significantly impacts corporate wellness programs. The Indonesian Ministry of Manpower reported that 85% of large corporations complied with national health and safety laws by 2023, focusing on ergonomics, mental health support, and preventive health measures. Companies that fail to meet these regulations face penalties, including fines and operational suspensions.

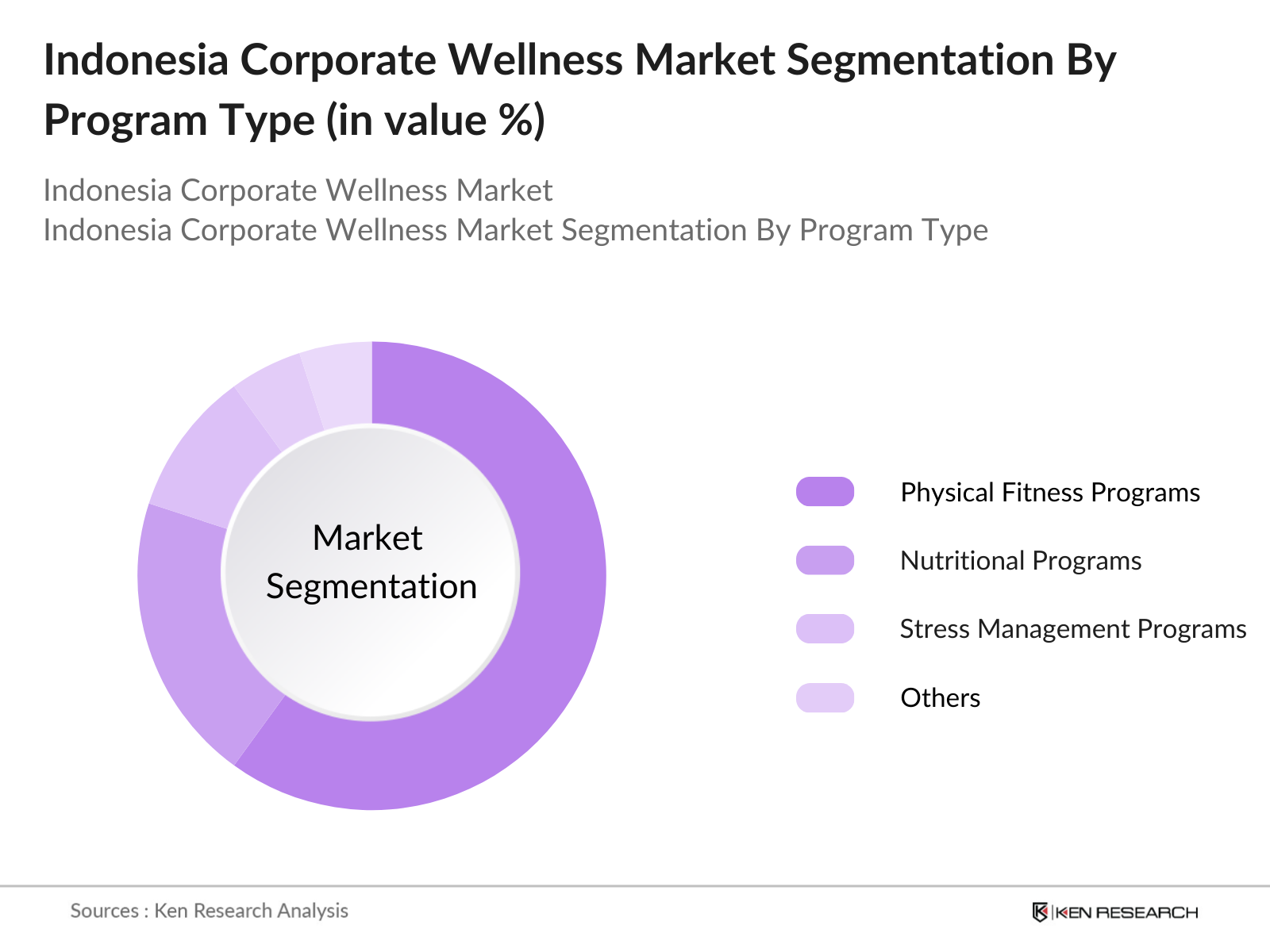

Indonesia Corporate Wellness Market Segmentation

By Program Type: The Indonesia corporate wellness market is segmented by program type into physical fitness programs, nutritional programs, stress management programs and others. Recently, stress management programs have gained a dominant share under the program type segmentation. This dominance is due to rising stress levels among employees, especially in fast-paced industries like IT and finance. Corporations are increasingly investing in stress relief initiatives, realizing their direct impact on productivity, retention rates, and mental well-being.

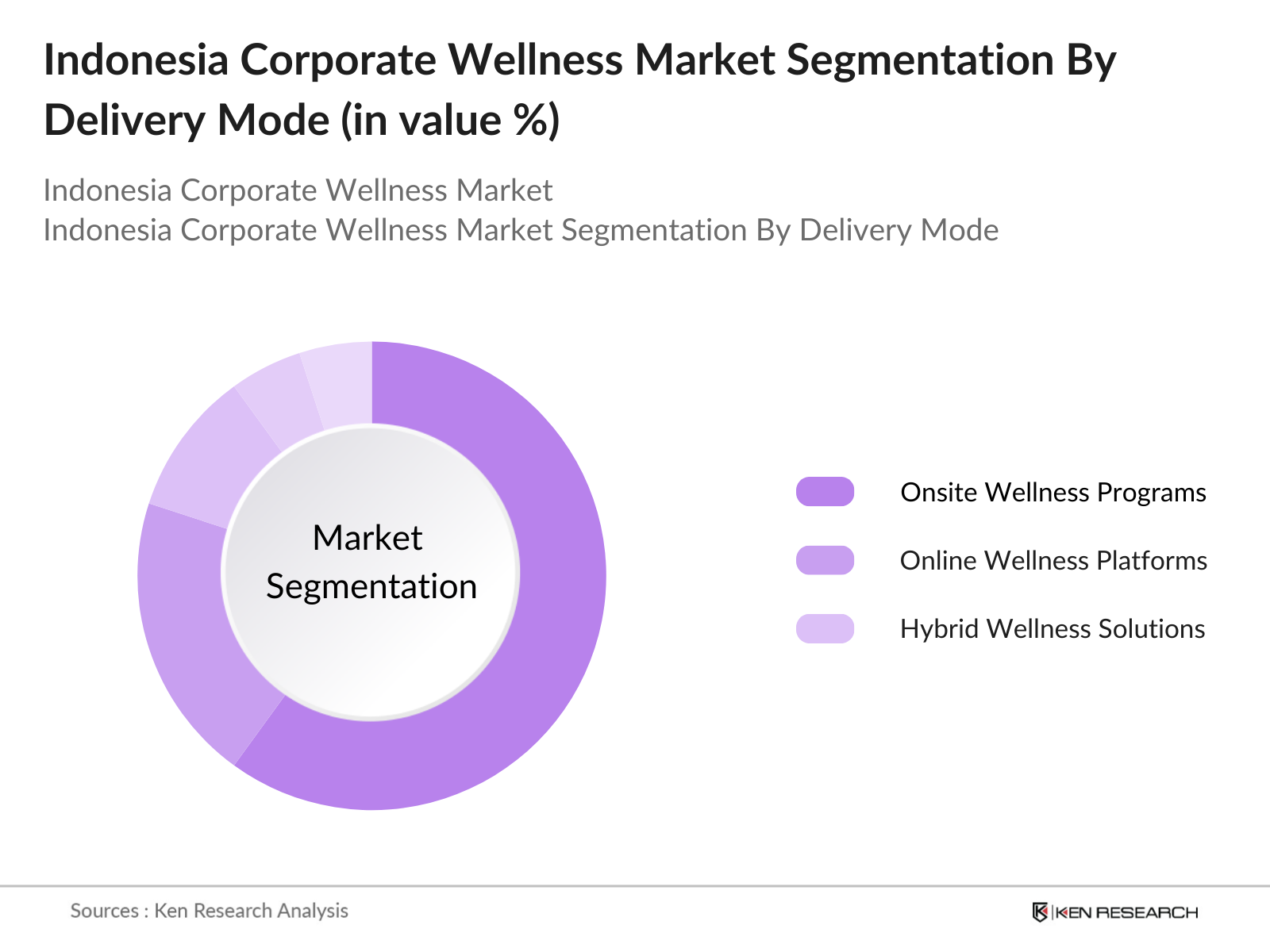

By Delivery Mode: Indonesia's corporate wellness market is also segmented by delivery mode into onsite wellness programs, online wellness platforms, and hybrid wellness solutions. Online wellness platforms are witnessing the highest share, driven by the demand for flexible, digital solutions that cater to remote workers. The adoption of these platforms has been accelerated by the COVID-19 pandemic, which necessitated the use of virtual tools for employee wellness, offering everything from telehealth consultations to fitness classes.

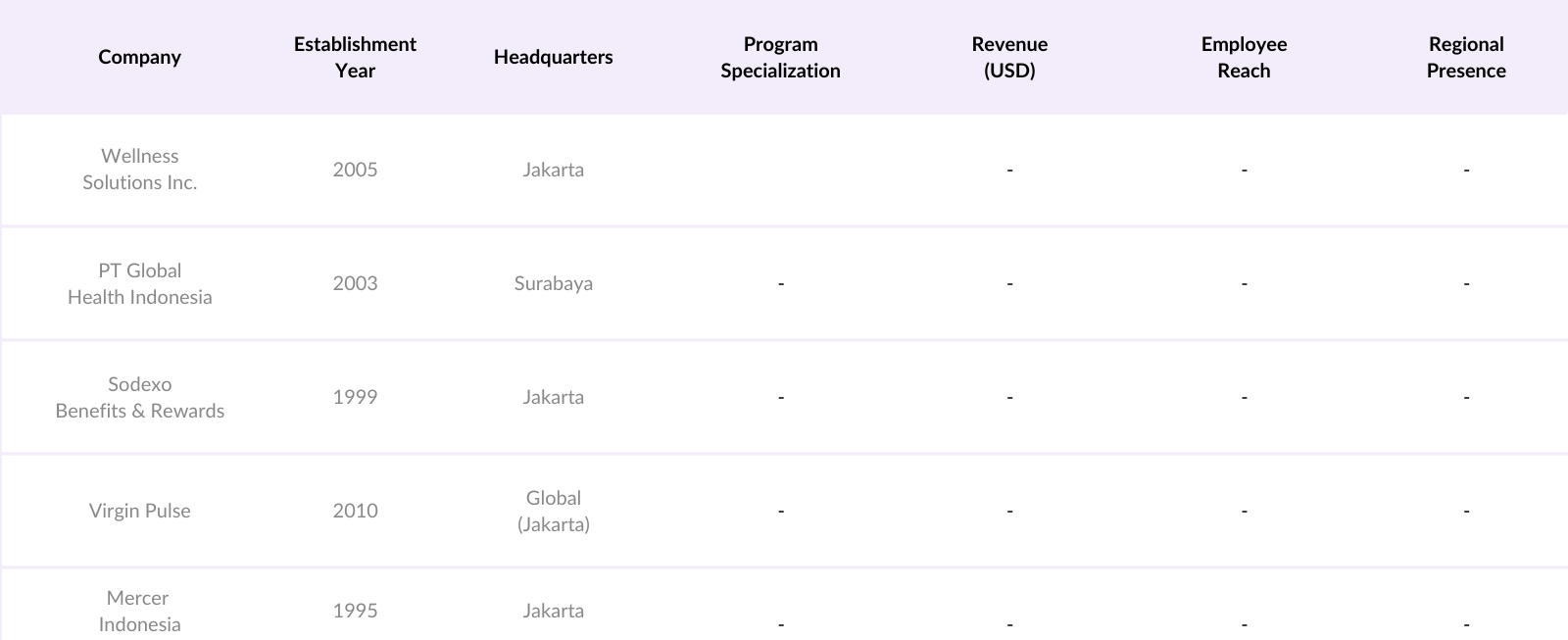

Indonesia Corporate Wellness Competitive Landscape

The Indonesia corporate wellness market is dominated by key domestic and international players that offer a wide range of wellness solutions, from physical fitness programs to comprehensive mental health support. The competition is characterized by the increasing adoption of digital wellness platforms and tailored solutions for specific industries.

The corporate wellness landscape in Indonesia reflects a mix of global and domestic companies catering to different wellness needs, with an increasing focus on digital and hybrid models to meet the evolving demand for flexible, scalable solutions.

Indonesia Corporate Wellness Market Analysis

Growth Drivers

- Corporate Social Responsibility (CSR) Initiatives (Company Initiatives): Corporate wellness programs have become a core component of CSR strategies for multinational and domestic firms in Indonesia. The Indonesian Ministry of Manpower highlighted that over 1,000 large companies implemented wellness programs as part of their CSR initiatives by 2023. These initiatives focus on improving employee well-being and promoting a healthier workforce. This trend is reinforced by government guidelines encouraging companies to participate in community health initiatives. Firms like Unilever Indonesia and Astra International have integrated these wellness programs, aiming to improve employee productivity and corporate image.

- Increased Focus on Employee Mental Health (Mental Wellness Programs): Mental health issues are becoming more visible in Indonesia, with data from the Indonesian Psychological Association revealing that 30 million Indonesians experienced mental health challenges in 2023. Employers are becoming more aware of the need for mental wellness programs to reduce stress, anxiety, and depression in the workplace. A key driver is the productivity loss that mental health conditions cause, with Indonesia losing approximately USD 10 billion annually due to poor mental health among workers. This has pushed corporations to integrate counseling, mental health days, and mindfulness activities into their wellness initiatives.

- Technological Integration (Telemedicine, Wellness Apps): Indonesia is seeing the rapid adoption of telemedicine and wellness apps in corporate wellness strategies, with over 10 million employees accessing digital health platforms as of 2024. This integration allows companies to provide health services and real-time monitoring of employee wellness. The Indonesian Ministry of Communication and Information Technology reports that telemedicine platforms like Halodoc and Alodokter have seen a 35% increase in corporate subscriptions. These platforms offer services such as virtual doctor consultations, health tracking, and personalized wellness plans, helping businesses reduce healthcare costs while improving employee health outcomes.

Market Challenges

- High Initial Program Costs (Program Investments): Despite the long-term benefits of corporate wellness programs, the initial costs remain a major challenge, particularly for smaller firms. According to the Indonesian Chamber of Commerce and Industry (KADIN), the average cost of implementing a comprehensive wellness program in Indonesia is around USD 1.5 million for medium-sized enterprises. These costs include health screenings, technology platforms, and specialized staff, which can be prohibitive for SMEs. Although large corporations can absorb these expenses, smaller companies often struggle to justify the short-term financial outlay.

- Limited Awareness Among Small and Medium Enterprises (SMEs) (Market Penetration): While large corporations are embracing wellness initiatives, awareness remains low among SMEs, which make up 99% of Indonesia's business landscape, employing over 116 million people. The Indonesian Ministry of Cooperatives and SMEs reports that less than 20% of these businesses have implemented structured wellness programs as of 2024. This limited uptake is due to a lack of understanding of the financial and productivity benefits of such initiatives, highlighting the need for more targeted awareness campaigns and government support.

Indonesia Corporate Wellness Market Future Outlook

Over the next five years, the Indonesia corporate wellness market is expected to experience significant growth, driven by increasing investments from corporations in employee well-being and the growing integration of digital health solutions. The emphasis on preventive healthcare, stress management, and employee productivity is projected to fuel demand for both onsite and virtual wellness programs. Additionally, the rising presence of multinational corporations and SMEs adopting corporate wellness solutions will continue to support market expansion.

Market Opportunities

- Emerging Demand for Personalized Wellness Programs (Customization): As employee expectations evolve, companies are increasingly offering personalized wellness solutions to cater to individual needs. Data from the Indonesian Health Ministry shows that personalized wellness programs, such as customized nutrition plans and fitness regimes, are becoming more popular, with over 5 million employees opting for such programs by 2024. These programs are driven by technological advancements and data analytics, which enable companies to tailor wellness initiatives based on employee health profiles, preferences, and goals. Companies that provide personalized wellness solutions are likely to see higher employee engagement and satisfaction.

- Expanding Market of Remote Wellness Services (Telehealth and Virtual Programs): The adoption of remote wellness services in Indonesia has grown significantly due to the increase in remote working arrangements and the popularity of telehealth solutions. The Indonesian Ministry of Communication reports that by 2024, 8 million employees across various industries are participating in virtual wellness programs, including online fitness classes, tele-counseling, and remote health monitoring. This expansion is supported by the countrys growing digital infrastructure and increasing demand for flexible wellness services that cater to employees working from home.

Scope of the Report

|

By Program Type |

Physical Fitness Programs |

|

Nutritional Programs |

|

|

Stress Management Programs |

|

|

Smoking Cessation Programs |

|

|

Employee Assistance Programs (EAPs) |

|

|

By Delivery Mode |

Onsite Wellness Programs |

|

Online Wellness Platforms |

|

|

Hybrid Wellness Solutions |

|

|

By End-User Industry |

IT & Telecom |

|

Banking, Financial Services, and Insurance |

|

|

Manufacturing |

|

|

Healthcare |

|

|

Retail |

|

|

By Enterprise Size |

Large Enterprises |

|

Small and Medium Enterprises (SMEs) |

|

|

By Region |

Jakarta |

|

Surabaya |

|

|

Bandung |

|

|

Medan |

|

|

Denpasar |

Products

Key Target Audience

Corporate Human Resource Departments

Corporate Health Officers

Investor and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, Indonesia)

Health Insurance Providers

Multinational Corporations

SMEs adopting wellness solutions

Employee Assistance Program Providers

Companies

Players mentioned in the report

Wellness Solutions Inc.

PT Global Health Indonesia

Corporate Wellness Asia

Sodexo Benefits and Rewards Services

Virgin Pulse

Mercer Indonesia

HealthifyMe

Manulife Indonesia

Prudential Indonesia

AIA Indonesia

IndoWellness

ProAktif Wellness Solutions

FitCompany Indonesia

Amway Indonesia

Thrive Indonesia

Table of Contents

01. Indonesia Corporate Wellness Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Indonesia Corporate Wellness Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indonesia Corporate Wellness Market Analysis

3.1. Growth Drivers

3.1.1. Increase in Employee Health Awareness

3.1.2. Corporate Investment in Employee Well-being

3.1.3. Government Health Initiatives

3.1.4. Rise in Workplace Stress Management Programs

3.2. Market Challenges

3.2.1. Low Adoption by Small and Medium Enterprises (SMEs)

3.2.2. Budget Constraints in Corporations

3.2.3. Lack of Awareness about Long-term Benefits

3.3. Opportunities

3.3.1. Digital Health Solutions for Corporates

3.3.2. Increasing Penetration of Mental Health Services

3.3.3. Tailored Wellness Programs for Industry Verticals

3.4. Trends

3.4.1. Integration of AI and Analytics in Wellness Solutions

3.4.2. Virtual Wellness Platforms and Telehealth

3.4.3. Growing Demand for Employee Assistance Programs (EAP)

3.5. Government Regulation

3.5.1. National Health Policy Initiatives

3.5.2. Health and Safety at Work Legislation

3.5.3. Mandatory Corporate Health Programs

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Landscape Overview

04. Indonesia Corporate Wellness Market Segmentation

4.1. By Program Type (In Value %)

4.1.1. Physical Fitness Programs

4.1.2. Nutritional Programs

4.1.3. Stress Management Programs

4.1.4. Smoking Cessation Programs

4.1.5. Employee Assistance Programs (EAPs)

4.2. By Delivery Mode (In Value %)

4.2.1. Onsite Wellness Programs

4.2.2. Online Wellness Platforms

4.2.3. Hybrid Wellness Solutions

4.3. By End-User Industry (In Value %)

4.3.1. IT & Telecom

4.3.2. Banking, Financial Services, and Insurance (BFSI)

4.3.3. Manufacturing

4.3.4. Healthcare

4.3.5. Retail

4.4. By Enterprise Size (In Value %)

4.4.1. Large Enterprises

4.4.2. Small and Medium Enterprises (SMEs)

4.5. By Region (In Value %)

4.5.1. Jakarta

4.5.2. Surabaya

4.5.3. Bandung

4.5.4. Medan

4.5.5. Denpasar

05. Indonesia Corporate Wellness Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Wellness Solutions Inc.

5.1.2. PT Global Health Indonesia

5.1.3. Corporate Wellness Asia

5.1.4. Sodexo Benefits and Rewards Services

5.1.5. Virgin Pulse

5.1.6. Mercer Indonesia

5.1.7. HealthifyMe

5.1.8. Manulife Indonesia

5.1.9. Prudential Indonesia

5.1.10. AIA Indonesia

5.1.11. IndoWellness

5.1.12. ProAktif Wellness Solutions

5.1.13. FitCompany Indonesia

5.1.14. Amway Indonesia

5.1.15. Thrive Indonesia

5.2. Cross Comparison Parameters (Number of Employees, Headquarters, Wellness Program Focus, Partnerships, Revenue, Regional Presence, Employee Reach, Program Effectiveness)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Subsidies

5.9. Private Equity Investments

06. Indonesia Corporate Wellness Market Regulatory Framework

6.1. Workplace Health and Safety Laws

6.2. Compliance Requirements for Wellness Programs

6.3. Certification and Accreditation Processes

07. Indonesia Corporate Wellness Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Indonesia Corporate Wellness Future Market Segmentation

8.1. By Program Type (In Value %)

8.2. By Delivery Mode (In Value %)

8.3. By End-User Industry (In Value %)

8.4. By Enterprise Size (In Value %)

8.5. By Region (In Value %)

09. Indonesia Corporate Wellness Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Segmentation Analysis

9.3. Marketing Strategies and Innovations

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial step involved constructing an ecosystem map of the Indonesia corporate wellness market by engaging in extensive desk research and utilizing both proprietary and secondary databases. The focus was on identifying the critical variables influencing the corporate wellness sector, such as employee demographics, corporate adoption rates, and regulatory requirements.

Step 2: Market Analysis and Construction

Historical market data was compiled and analyzed to understand market penetration rates, including segmentation by wellness program types and regional adoption. Data on revenue generation and corporate spending on wellness programs was also assessed to construct a reliable market model.

Step 3: Hypothesis Validation and Expert Consultation

In this phase, key market hypotheses were developed and validated through interviews with industry experts and stakeholders in Indonesias corporate wellness market. The data gathered was corroborated using primary interviews, ensuring accurate and actionable insights.

Step 4: Research Synthesis and Final Output

The final step involved synthesizing all the research data, supported by direct consultations with wellness program providers. This comprehensive analysis enabled the creation of a validated market forecast, covering growth trends and emerging opportunities for the Indonesia corporate wellness sector.

Frequently Asked Questions

01. How big is the Indonesia Corporate Wellness Market?

The Indonesia corporate wellness market was valued at USD 300 million, driven by corporate investment in employee well-being, rising workplace stress, and increasing healthcare costs.

02. What are the challenges in the Indonesia Corporate Wellness Market?

Key challenges include limited adoption by SMEs due to budget constraints, lack of awareness about the long-term benefits of wellness programs, and the high cost of implementing comprehensive wellness solutions.

03. Who are the major players in the Indonesia Corporate Wellness Market?

Major players in the market include Wellness Solutions Inc., PT Global Health Indonesia, Sodexo Benefits and Rewards Services, Virgin Pulse, and Mercer Indonesia, all of which offer a variety of wellness solutions tailored to corporate needs.

04. What are the growth drivers of the Indonesia Corporate Wellness Market?

Growth drivers include increasing corporate awareness of employee health, a rise in stress management programs, and government initiatives to promote employee well-being and productivity.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.