Indonesia Cosmetics Market Outlook to 2030

Region:Asia

Author(s):Meenakshi

Product Code:KROD3772

October 2024

81

About the Report

Indonesia Cosmetics Market Overview

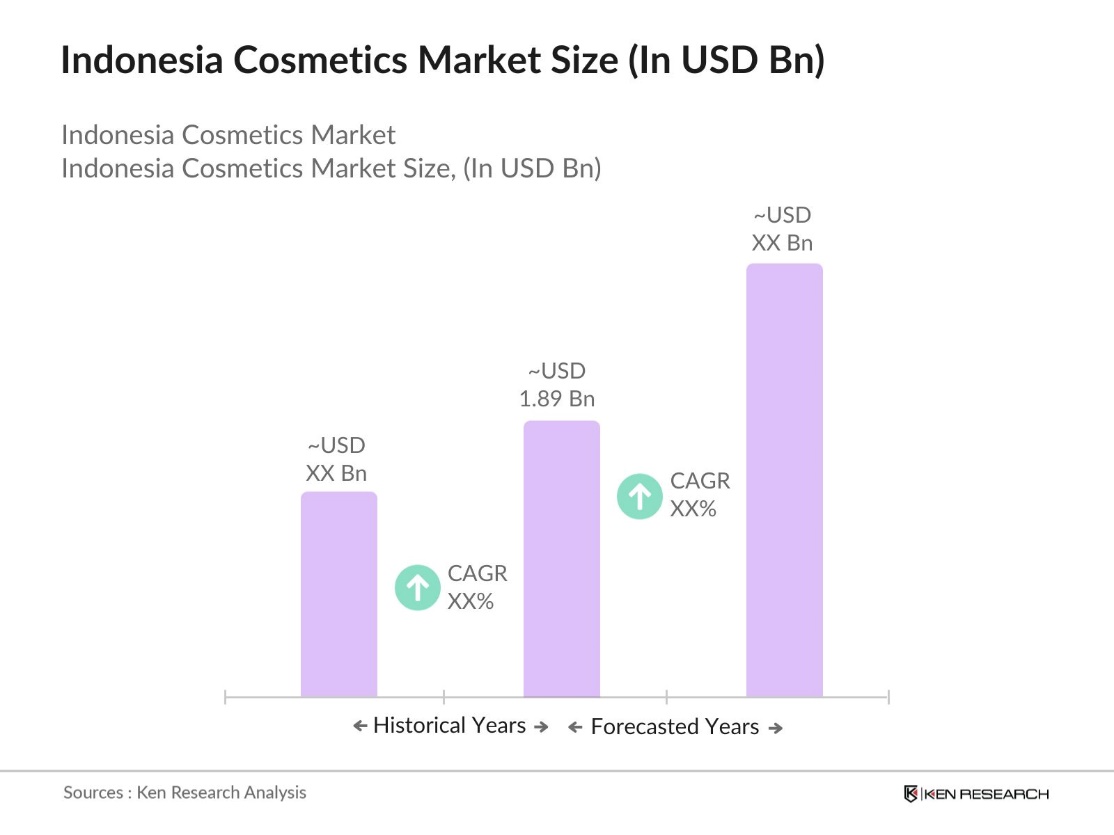

- The Indonesia Cosmetics Market is valued at USD 1.86 billion, based on a five-year historical analysis. This market is driven by the rising disposable income, growing middle-class population, and a shift toward more personal grooming and self-care practices among Indonesian consumers. The increasing influence of social media and the rise of e-commerce platforms such as Tokopedia and Shopee are also boosting the demand for cosmetics in the country.

- Jakarta, Surabaya, and Bandung dominate the cosmetics market in Indonesia due to their large urban populations and higher purchasing power. Jakarta, as the capital and largest city, has a high concentration of beauty-conscious consumers who are heavily influenced by global beauty trends. Surabaya and Bandung follow suit with their growing middle-class populations and increasing retail penetration of both local and international cosmetic brands.

- Indonesias import tariffs on cosmetics, particularly premium and foreign brands, present a challenge for international companies entering the market. In 2024, import duties on cosmetics have increased, with rates of 200% varying depending on product type and origin country. These tariffs can drive up costs for international brands, making it more difficult to compete with local companies offering similar products at lower prices.

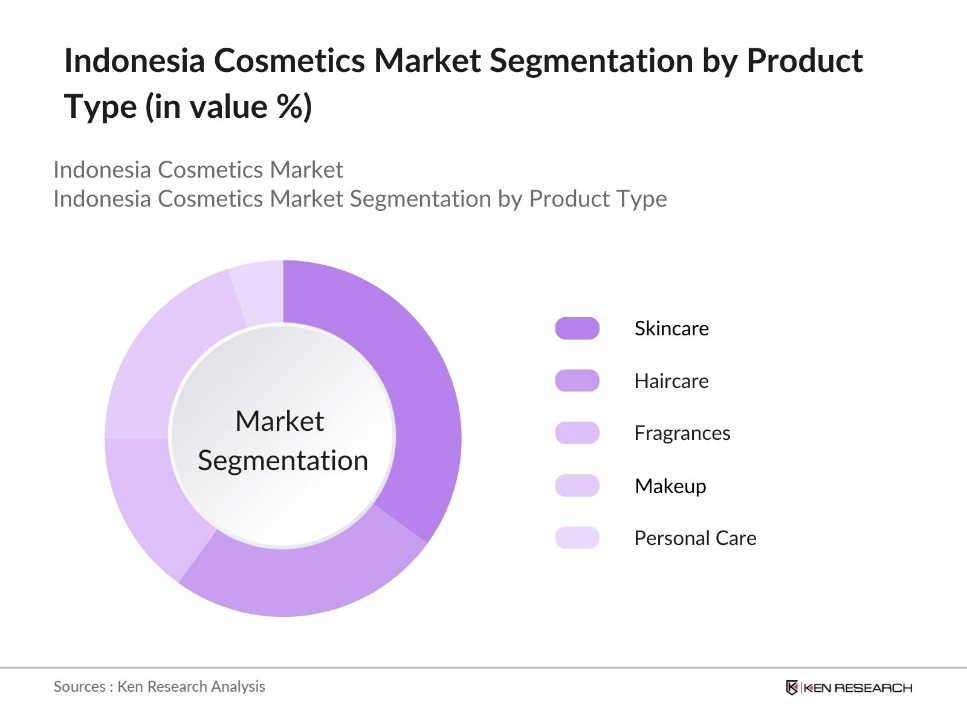

Indonesia Cosmetics Market Segmentation

By Product Type: The Indonesia Cosmetics Market is segmented by product type into skincare, haircare, fragrances, makeup, and personal care products. Skincare products have a dominant market share in the Indonesia Cosmetics Market due to their increasing popularity among consumers concerned with health and personal care. This segment includes products such as moisturizers, anti-aging creams, and sunscreen lotions, which are widely used by both men and women. The rise of skincare routines and the influence of Korean beauty (K-beauty) trends also contribute to the dominance of this segment.

By Distribution Channel: The Indonesia Cosmetics Market is segmented by distribution channel into online retail, supermarkets/hypermarkets, specialty stores, department stores, and pharmacies. Online retail holds the largest market share within the distribution channel segment. This is driven by the increasing penetration of the internet and the growing popularity of e-commerce platforms like Tokopedia, Shopee, and Lazada. Consumers find it more convenient to purchase cosmetics online due to discounts, doorstep delivery, and a wide variety of choices. The pandemic has further accelerated this shift toward online shopping for beauty products.

Indonesia Cosmetics Market Competitive Landscape

The Indonesia Cosmetics Market is dominated by a few key players, including both domestic and international brands. Local brands like Wardah and Mustika Ratu have a stronghold in the halal beauty segment, while global giants like L'Oral and Unilever maintain a significant presence through their wide product portfolios and strong marketing strategies. This consolidation of power highlights the significant influence of these key players, with the competition largely focusing on innovation, pricing strategies, and product differentiation.

|

Company Name |

Year of Establishment |

Headquarters |

Product Range |

Market Focus |

Halal Certified |

Distribution Network |

Revenue (2023) |

Sustainability Initiatives |

|

Wardah |

1985 |

Jakarta |

||||||

|

Mustika Ratu |

1975 |

Jakarta |

||||||

|

L'Oral Indonesia |

1979 |

Jakarta |

||||||

|

Unilever Indonesia |

1933 |

Jakarta |

||||||

|

PZ Cussons Indonesia |

1975 |

Jakarta |

Indonesia Cosmetics Industry Analysis

Growth Drivers

- Expansion of E-Commerce: Indonesia is one of the largest e-commerce markets in Southeast Asia, with over 221.6 million internet users by 2024, contributing to online sales growth, especially in the beauty and cosmetics sectors. The convenience of online shopping platforms such as Tokopedia, Shopee, and Lazada has enabled consumers, particularly in remote regions, to access a broader range of beauty products. As a result, online cosmetic sales have surged, with companies leveraging e-commerce platforms to enhance their presence. The increase in e-commerce penetration also supports the growth of local and international cosmetic brands in the Indonesian market.

- Urbanization and Changing Lifestyles: Indonesias urban population 58.9 percent in 2024, driving the cosmetics market as consumers living in urban centers increasingly prioritize appearance and personal grooming. Urbanization brings changes in lifestyles, including higher demand for convenience and self-care products, which extends to cosmetics. Indonesian consumers, particularly in cities like Jakarta and Surabaya, are adopting new beauty trends and seeking innovative products tailored to their needs.

- Influence of Social Media (Instagram, YouTube, etc.): Social media platforms like Instagram and YouTube play a significant role in influencing beauty trends, product awareness, and consumer purchasing decisions. Beauty influencers and bloggers regularly share tutorials and reviews, shaping consumer preferences and driving demand for cosmetics. Brands leverage these platforms to increase their visibility, engage with potential customers, and promote new products.

Market Challenges

- High Competition from Local Brands: Indonesias cosmetics market is highly competitive, with local brands catering to the specific preferences of Indonesian consumers. Brands like Wardah, Emina, and Make Over have established a strong presence by offering affordable products and aligning with local beauty standards. This intense competition poses challenges for international brands, which must navigate price sensitivity and adapt their offerings to resonate with Indonesian consumers.

- Stringent Government Regulations (BPOM Indonesia): The Indonesian National Agency of Drug and Food Control (BPOM) imposes strict regulations on cosmetic products, including mandatory licensing, testing, and certification processes. These regulations are designed to ensure consumer safety, particularly concerning the use of chemicals in cosmetics. While this regulatory framework enhances product safety, it also increases the compliance burden for both local and international cosmetic companies.

Indonesia Cosmetics Market Future Outlook

Over the next five years, the Indonesia Cosmetics Market is expected to experience significant growth, driven by increasing consumer demand for premium, natural, and halal-certified cosmetics. The rise of e-commerce platforms will continue to fuel market expansion as more consumers prefer the convenience of online shopping. Moreover, the growing male grooming segment and increasing awareness of anti-aging and skincare routines are anticipated to provide new growth opportunities for market players.

Market Opportunities

- Growing Male Grooming Segment: The male grooming segment presents a significant opportunity in Indonesias cosmetics market, as more men are becoming conscious of personal grooming and self-care. This shift is driving demand for male-specific grooming products, including skincare, haircare, and grooming tools. Brands are recognizing this trend and launching targeted campaigns and product lines that cater specifically to mens grooming needs. The rise of male grooming reflects a broader cultural shift towards self-care among men, making it a promising and growing segment within the overall beauty market.

- Increasing Demand for Organic & Natural Cosmetics: The demand for organic and natural cosmetics is gaining traction in Indonesia, as consumers become more aware of the potential risks associated with synthetic chemicals in beauty products. This growing preference for eco-friendly and organic cosmetics has created opportunities for companies to develop and market products made from sustainable ingredients and packaged in environmentally friendly materials. The trend aligns with the global movement toward sustainability, as more consumers seek products that are both effective and environmentally responsible.

Scope of the Report

|

Product Type |

Skincare Haircare Fragrances Makeup Personal Care |

|

Distribution Channel |

Online Retail Supermarkets Specialty Stores |

|

Consumer Group |

Women Men Children |

|

Price Range |

Premium Mass |

|

Region |

Java Bali Sumatra Kalimantan Sulawesi |

Products

Key Target Audience

Cosmetics Manufacturers

Online Retailer Companies

Exporters and Importers of Cosmetics

Private Label Cosmetics Manufacturers

Halal Certification Bodies (BPJPH)

Cosmetic Industry Associations (KOSMETIK INDONESIA)

Government Regulatory Bodies (BPOM Indonesia)

Investments and Venture Capitalist Firms

Companies

Major Players

Wardah

Mustika Ratu

L'Oral Indonesia

Unilever Indonesia

PZ Cussons Indonesia

Procter & Gamble Indonesia

The Body Shop Indonesia

Shiseido Indonesia

Estee Lauder Indonesia

Oriflame Indonesia

PT Martina Berto Tbk

PT Kino Indonesia Tbk

Revlon Indonesia

Kao Corporation Indonesia

Innisfree Indonesia

Table of Contents

1. Indonesia Cosmetics Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Cosmetics Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Cosmetics Market Analysis

3.1. Growth Drivers

3.1.1. Rising Disposable Income

3.1.2. Expansion of E-Commerce

3.1.3. Urbanization and Changing Lifestyles

3.1.4. Influence of Social Media (Instagram, YouTube, etc.)

3.2. Market Challenges

3.2.1. High Competition from Local Brands

3.2.2. Stringent Government Regulations (BPOM Indonesia)

3.2.3. High Cost of Raw Materials (Natural Ingredients)

3.3. Opportunities

3.3.1. Growing Male Grooming Segment

3.3.2. Increasing Demand for Organic & Natural Cosmetics

3.3.3. Rising Awareness on Anti-aging Products

3.4. Trends

3.4.1. Personalization and Customization of Beauty Products

3.4.2. Surge in K-Beauty and J-Beauty Products

3.4.3. Shift Toward Sustainable and Eco-friendly Packaging

3.5. Government Regulation

3.5.1. Indonesian National Agency of Drug and Food Control (BPOM) Regulations

3.5.2. Import Tariff Policies

3.5.3. Product Labeling and Certification Standards

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia Cosmetics Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Skincare

4.1.2. Haircare

4.1.3. Fragrances

4.1.4. Makeup

4.1.5. Personal Care Products

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Specialty Stores

4.2.4. Department Stores

4.2.5. Pharmacy/Drug Stores

4.3. By Consumer Group (In Value %)

4.3.1. Women

4.3.2. Men

4.3.3. Children

4.4. By Price Range (In Value %)

4.4.1. Premium Segment

4.4.2. Mass Segment

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Bali

4.5.3. Sumatra

4.5.4. Kalimantan

4.5.5. Sulawesi

5. Indonesia Cosmetics Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. PT Martina Berto Tbk

5.1.2. Wardah

5.1.3. Mustika Ratu

5.1.4. PZ Cussons Indonesia

5.1.5. L'Oral Indonesia

5.1.6. Unilever Indonesia

5.1.7. Procter & Gamble Indonesia

5.1.8. The Body Shop Indonesia

5.1.9. Shiseido Indonesia

5.1.10. Estee Lauder Indonesia

5.1.11. Oriflame Indonesia

5.1.12. Kao Corporation Indonesia

5.1.13. Revlon Indonesia

5.1.14. PT Kino Indonesia Tbk

5.1.15. Innisfree Indonesia

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Product Range, Revenue, Distribution Channels, Market Share, Growth Strategies, Sustainability Initiatives)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Cosmetics Market Regulatory Framework

6.1. BPOM Regulatory Standards

6.2. Import Restrictions and Certifications

6.3. Certification Process for Natural and Organic Cosmetics

7. Indonesia Cosmetics Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Cosmetics Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Consumer Group (In Value %)

8.4. By Price Range (In Value %)

8.5. By Region (In Value %)

9. Indonesia Cosmetics Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves mapping out all key stakeholders in the Indonesia Cosmetics Market, utilizing a combination of desk research and secondary sources such as government databases, market reports, and proprietary research. This phase is crucial in identifying the key variables that drive market dynamics, such as consumer behavior, regulatory environment, and distribution channels.

Step 2: Market Analysis and Construction

In this phase, historical data from various sources is compiled to assess market penetration, product segments, and revenue generation. The focus is on analyzing the performance of different product types and distribution channels, with an emphasis on identifying growth trends and potential areas for market expansion.

Step 3: Hypothesis Validation and Expert Consultation

Industry experts are consulted through structured interviews to validate market hypotheses and gain firsthand insights into market trends, challenges, and opportunities. These consultations also provide valuable information on industry best practices and emerging trends, which are crucial for refining market projections.

Step 4: Research Synthesis and Final Output

The final step involves synthesizing all collected data into a comprehensive report. This includes analyzing the market performance of major players, consumer preferences, and product segments to ensure that the report offers a detailed and accurate representation of the Indonesia Cosmetics Market.

Frequently Asked Questions

01. How big is the Indonesia Cosmetics Market?

The Indonesia Cosmetics Market is valued at USD 1.89 billion, driven by increasing disposable income, a growing middle-class population, and the popularity of halal-certified products among the predominantly Muslim population.

02. What are the challenges in the Indonesia Cosmetics Market?

Challenges in Indonesia Cosmetics Market include high competition from both local and international brands, regulatory hurdles related to halal certification and product registration, and the increasing cost of natural raw materials.

03. Who are the major players in the Indonesia Cosmetics Market?

Key players in Indonesia Cosmetics Market include Wardah, Mustika Ratu, L'Oral Indonesia, Unilever Indonesia, and PZ Cussons Indonesia. These companies dominate due to their strong brand presence, wide distribution networks, and product innovation.

04. What are the growth drivers of the Indonesia Cosmetics Market?

The Indonesia Cosmetics Market is driven by rising disposable incomes, increasing consumer awareness of personal care, the growth of e-commerce, and the demand for halal-certified and natural cosmetic products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.