Indonesia Data Center Networking Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD6749

December 2024

96

About the Report

Indonesia Data Center Networking Market Overview

- The Indonesia Data Center Networking Market, valued at USD 282.5 million, reflects steady growth driven by increased digitalization efforts across various sectors. The demand is bolstered by rising cloud adoption, exponential data growth from IoT implementations, and the governments initiatives supporting digital infrastructure.

- Jakarta leads Indonesia's data center networking market due to its concentration of tech-based industries, access to reliable connectivity, and well-established infrastructure. Being Indonesias capital and business hub, Jakarta attracts major investments, facilitating large-scale data center developments. Other regions, like West Java and East Java, are emerging due to expanded industrial activity and government-backed infrastructure projects, reinforcing their presence in the data center market.

- The Indonesian government provides incentives, including tax reductions, to encourage data center investments. For instance, Louisiana's House Bill 827 offers significant tax rebates on equipment for data centers, requiring a minimum investment of $200 million and the creation of at least 50 jobs to qualify. These incentives are designed to stimulate economic growth and enhance digital infrastructure within the state.

Indonesia Data Center Networking Market Segmentation

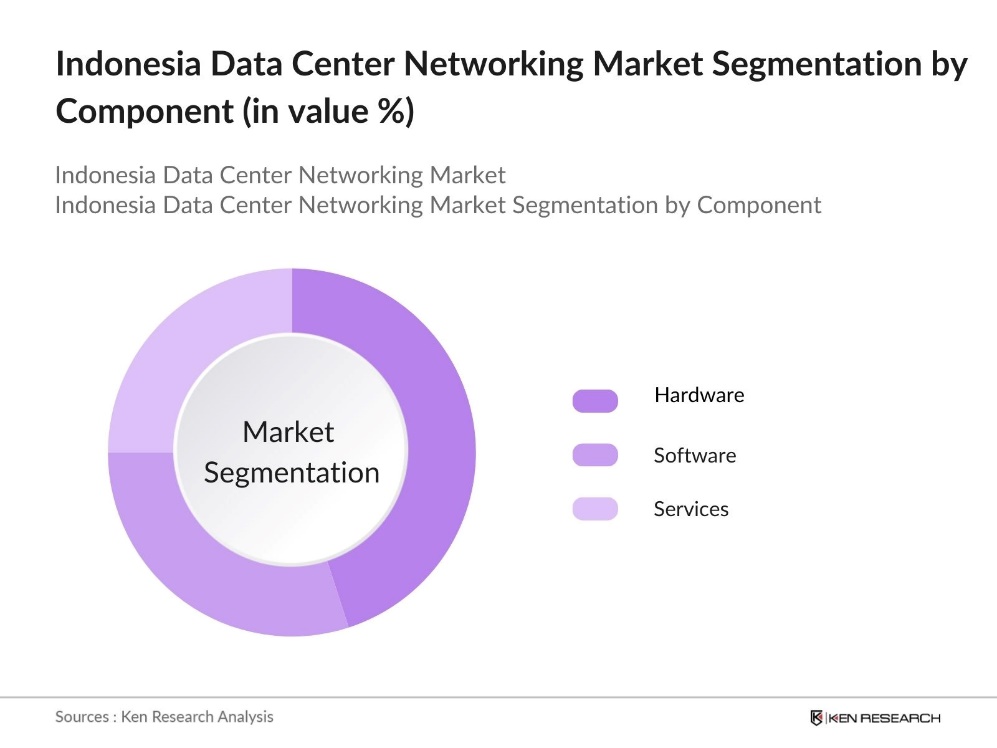

By Component: The market is segmented by component into hardware, software, and services. Recently, hardware holds a dominant share within the market component segmentation. This is largely due to Indonesias increasing focus on establishing robust physical infrastructures that can support high data processing and storage capacities. Leading companies prioritize hardware for scalable networks, ensuring low-latency connectivity and security, which are crucial for operational efficiency in Indonesias data-driven industries.

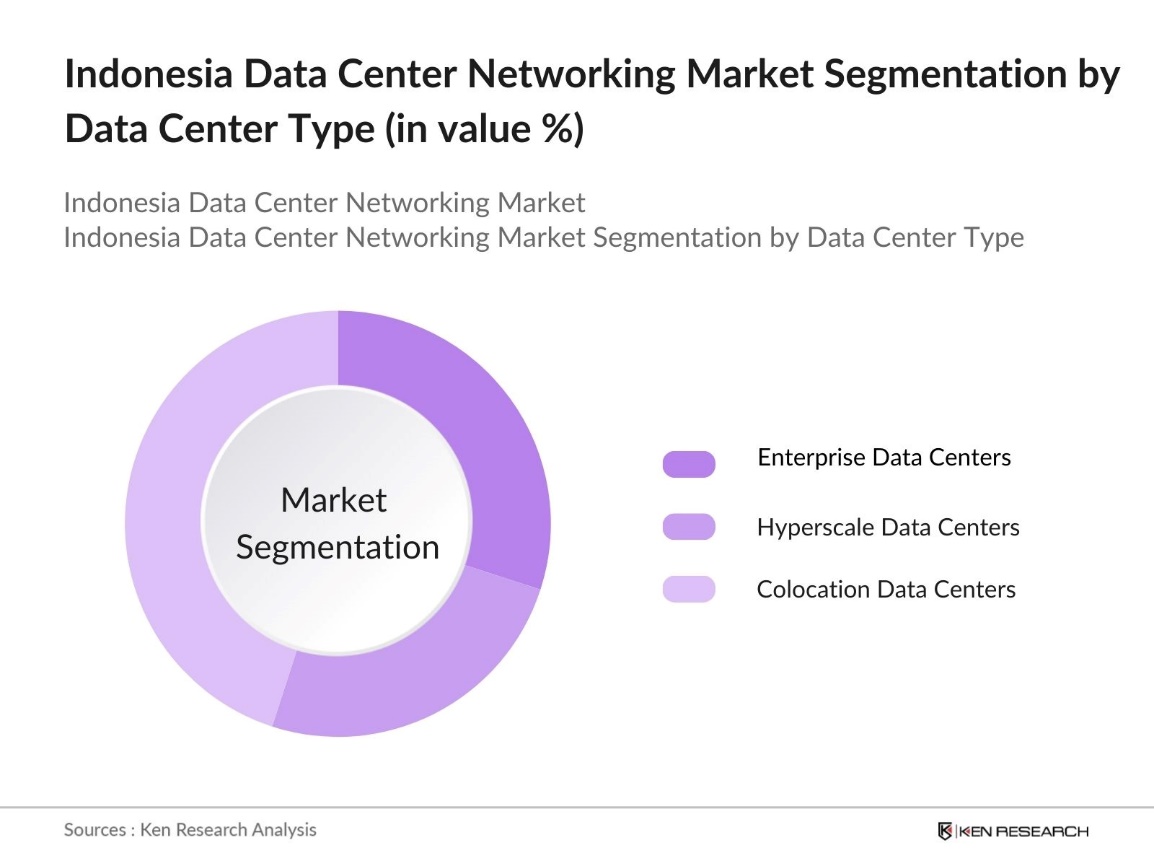

By Data Center Type: The market is segmented by data center type into enterprise, hyperscale, and colocation data centers. Colocation data centers have gained a significant market share, driven by a growing trend among businesses to outsource data management functions to specialized providers. This preference helps reduce capital expenditures on in-house infrastructure, as colocation centers offer scalability, security, and regulatory compliance, aligning with the needs of various Indonesian enterprises and global tech firms establishing a local presence.

Indonesia Data Center Networking Market Competitive Landscape

The Indonesia Data Center Networking Market is dominated by a select number of key players, each bringing extensive expertise and advanced networking solutions tailored for the regions unique digital requirements. Companies such as Cisco Systems and Huawei Technologies stand out for their infrastructure prowess, while local companies are increasingly collaborating with global players to improve scalability and service offerings.

Indonesia Data Center Networking Industry Analysis

Growth Drivers

- Rise in Data-Driven Operations: Indonesias surge in data-intensive industries, particularly in banking, e-commerce, and telecommunications, has led to a marked increase in data center demands. In 2023, Indonesia's digital economy was valued at USD 77 billion, with data centers central to this growth as they support data handling and storage for various applications. This expansion reflects the transition towards data-driven operations, as businesses rely heavily on data insights for decision-making, boosting the requirement for robust data networking infrastructures.

- Increase in Cloud Adoption: A survey highlighted that 92% of businesses in Indonesia planned to complete their cloud migration within two years, demonstrating a strong commitment to adopting these technologies. This cloud adoption push has necessitated advanced data networking solutions in data centers to support the massive influx of cloud traffic, particularly from sectors like finance and retail, further fueling data center networking growth.

- Growth in IoT Deployments: The expansion of Indonesias Internet of Things (IoT) ecosystem has increased demand on data center networks to handle vast amounts of real-time data from connected devices. As IoT becomes integral to industries like manufacturing, logistics, and urban management, reliable, high-speed networking solutions are essential for data centers to manage these data flows effectively and maintain operational performance in IoT-driven environments.

Market Challenges

- High Setup Costs: Building data centers with advanced networking capabilities presents significant financial challenges due to the high setup expenses involved. This substantial initial investment in state-of-the-art networking infrastructure limits expansion opportunities, especially for smaller enterprises operating with tighter budgets. As a result, the high cost barrier can deter new entrants and slow the growth of the data center networking market in Indonesia.

- Network Security Concerns: As data center utilization grows, network security risks also increase, creating pressing concerns for operators. The rising frequency of cyber threats targeting data centers highlights the need for stringent security protocols within networking infrastructure. To mitigate these risks, data center operators must invest in robust cybersecurity measures, making network security a critical and ongoing focus for the industry.

Indonesia Data Center Networking Market Future Outlook

In the coming years, the Indonesia Data Center Networking Market is anticipated to experience further growth, attributed to sustained demand for digital solutions and connectivity. Key factors include the expansion of edge computing, governmental support for IT infrastructure development, and an expected surge in cloud service adoption. These elements collectively signal a promising future for data centers as Indonesia moves towards a digitally integrated economy.

Market Opportunities

- Expansion of Edge Computing: Indonesias vast geography creates a strong demand for edge computing, which enables data processing closer to end-users and reduces latency. The expansion of edge data centers, especially in remote and rural areas, allows improved service delivery by decentralizing data processing. This trend presents data center operators with opportunities to integrate advanced networking solutions that support a distributed data management approach, enhancing efficiency and connectivity.

- Partnerships with Hyperscale Providers: Global hyperscale cloud providers are increasingly collaborating with local data center firms in Indonesia to build and enhance infrastructure. These partnerships improve local data centers' networking capabilities, facilitating the management of high data volumes and optimizing cloud access. Such collaborations help strengthen Indonesias data center ecosystem, offering growth potential through increased data handling capacity and advanced network solutions.

Scope of the Report

|

By Component |

Hardware |

|

By Data Center Type |

Enterprise Data Centers |

|

By Network Type |

Local Area Network (LAN) |

|

By Application |

Cloud Computing |

|

By Region |

North |

Products

Key Target Audience

Telecom Service Providers

Enterprise IT Infrastructure

Cloud Service Companies

Network Security Solution

Industrial IoT Solution Integrators

Energy Management Firms

Government and Regulatory Bodies (Indonesian Ministry of Communication and Informatics, Indonesia Investment Coordinating Board)

Investors and venture capital Firms

Banks and Financial Institutions

Companies

Players Mentioned in the Report

Cisco Systems

Huawei Technologies

Arista Networks

Juniper Networks

Nokia Corporation

Hewlett Packard Enterprise (HPE)

Dell Technologies

Extreme Networks

VMware Inc.

IBM Corporation

Table of Contents

1. Indonesia Data Center Networking Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Key Growth Indicators

1.4. Market Segmentation Overview

2. Indonesia Data Center Networking Market Size (USD Mn)

2.1. Historical Market Size Analysis

2.2. Year-On-Year Growth Trends

2.3. Key Developments and Strategic Milestones

3. Indonesia Data Center Networking Market Analysis

3.1. Market Drivers

3.1.1. Rise in Data-Driven Operations

3.1.2. Increase in Cloud Adoption

3.1.3. Growth in IoT Deployments

3.1.4. Regulatory Support for Data Sovereignty

3.2. Market Challenges

3.2.1. High Setup Costs

3.2.2. Network Security Concerns

3.2.3. Skilled Workforce Shortage

3.3. Opportunities

3.3.1. Expansion of Edge Computing

3.3.2. Partnerships with Hyperscale Providers

3.3.3. Regional Network Integration

3.4. Emerging Trends

3.4.1. Software-Defined Networking (SDN)

3.4.2. Network Virtualization

3.4.3. Integration with Green Energy Solutions

3.5. Regulatory Framework

3.5.1. Data Protection Regulations

3.5.2. Compliance Standards (ISO, SOC)

3.5.3. Government Incentives for Data Centers

3.6. Stakeholder Ecosystem

3.7. Porters Five Forces Analysis

3.8. Competitive Landscape Overview

4. Indonesia Data Center Networking Market Segmentation

4.1. By Component (In Value %)

4.1.1. Hardware

4.1.2. Software

4.1.3. Services

4.2. By Data Center Type (In Value %)

4.2.1. Enterprise Data Centers

4.2.2. Hyperscale Data Centers

4.2.3. Colocation Data Centers

4.3. By Network Type (In Value %)

4.3.1. Local Area Network (LAN)

4.3.2. Wide Area Network (WAN)

4.3.3. Metro Area Network (MAN)

4.4. By Application (In Value %)

4.4.1. Cloud Computing

4.4.2. Artificial Intelligence

4.4.3. High-Performance Computing

4.5. By Region (In Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Indonesia Data Center Networking Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Cisco Systems

5.1.2. Huawei Technologies

5.1.3. Arista Networks

5.1.4. Juniper Networks

5.1.5. Hewlett Packard Enterprise (HPE)

5.1.6. Dell Technologies

5.1.7. Extreme Networks

5.1.8. Nokia Corporation

5.1.9. NEC Corporation

5.1.10. Fortinet Inc.

5.1.11. VMware Inc.

5.1.12. IBM Corporation

5.1.13. Check Point Software Technologies

5.1.14. ZTE Corporation

5.1.15. Broadcom Inc.

5.2. Cross Comparison Parameters (Product Portfolio, R&D Investment, Market Presence, Strategic Partnerships, Data Center Certifications, Customer Segmentation, Regional Coverage, Revenue Share)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Collaborations, New Product Launches, Regional Expansions)

5.5. Mergers & Acquisitions

5.6. Investment Landscape (Venture Capital, Private Equity, Government Funding)

5.7. Technology Advancements and Patents

5.8. Service-Level Agreement (SLA) Standards and Compliance

6. Indonesia Data Center Networking Market Regulatory Framework

6.1. Compliance with Data Sovereignty Laws

6.2. Certification Standards (ISO, Uptime Institute)

6.3. Cybersecurity Mandates

6.4. Environmental Regulations and Green Certifications

7. Indonesia Data Center Networking Future Market Segmentation

7.1. By Component (In Value %)

7.2. By Data Center Type (In Value %)

7.3. By Network Type (In Value %)

7.4. By Application (In Value %)

7.5. By Region (In Value %)

8. Indonesia Data Center Networking Market Analyst Recommendations

8.1. Market Penetration Strategies

8.2. Expansion in High-Growth Regions

8.3. Technology Differentiation Opportunities

8.4. Long-Term Investment Opportunities

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research begins with identifying crucial variables influencing the Indonesia Data Center Networking Market. An extensive review of the current digital landscape in Indonesia is conducted, covering primary stakeholders such as telecom providers, government bodies, and key technology firms.

Step 2: Market Analysis and Construction

Data for this phase includes analyzing market penetration levels, adoption rates of advanced networking solutions, and assessing bandwidth requirements across various industries. Historical and present-day data are processed to construct an accurate market landscape.

Step 3: Hypothesis Validation and Expert Consultation

Primary interviews with industry experts, including technology heads and infrastructure managers, validate the data gathered. These consultations provide real-world insights into operational and security challenges within data center networks in Indonesia.

Step 4: Research Synthesis and Final Output

This phase involves aggregating findings from both primary and secondary sources to produce a cohesive report. In this synthesis, qualitative data is reconciled with quantitative metrics to present a holistic and reliable view of the Indonesia Data Center Networking Market.

Frequently Asked Questions

01. How big is the Indonesia Data Center Networking Market?

The Indonesia Data Center Networking Market is valued at USD 282.5 million, driven by digital transformation, increased cloud adoption, and government initiatives supporting the IT sector.

02. What are the challenges in the Indonesia Data Center Networking Market?

Key challenges in Indonesia Data Center Networking Market include high initial setup costs, regulatory compliance requirements, and a limited skilled workforce, which collectively impact the operational efficiency of the data centers.

03. Who are the major players in the Indonesia Data Center Networking Market?

Major players in Indonesia Data Center Networking Market include Cisco Systems, Huawei Technologies, Arista Networks, Juniper Networks, and Nokia Corporation, each offering advanced networking solutions for varied applications.

04. What drives growth in the Indonesia Data Center Networking Market?

The Indonesia Data Center Networking Market growth drivers are centered on increased digitalization, cloud-based applications, expansion of IoT, and the governments commitment to modernizing Indonesias IT infrastructure.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.