Indonesia Data Storage Market Outlook to 2030

Region:Asia

Author(s):Naman Rohilla

Product Code:KROD1135

November 2024

85

About the Report

Indonesia Data Storage Market Overview

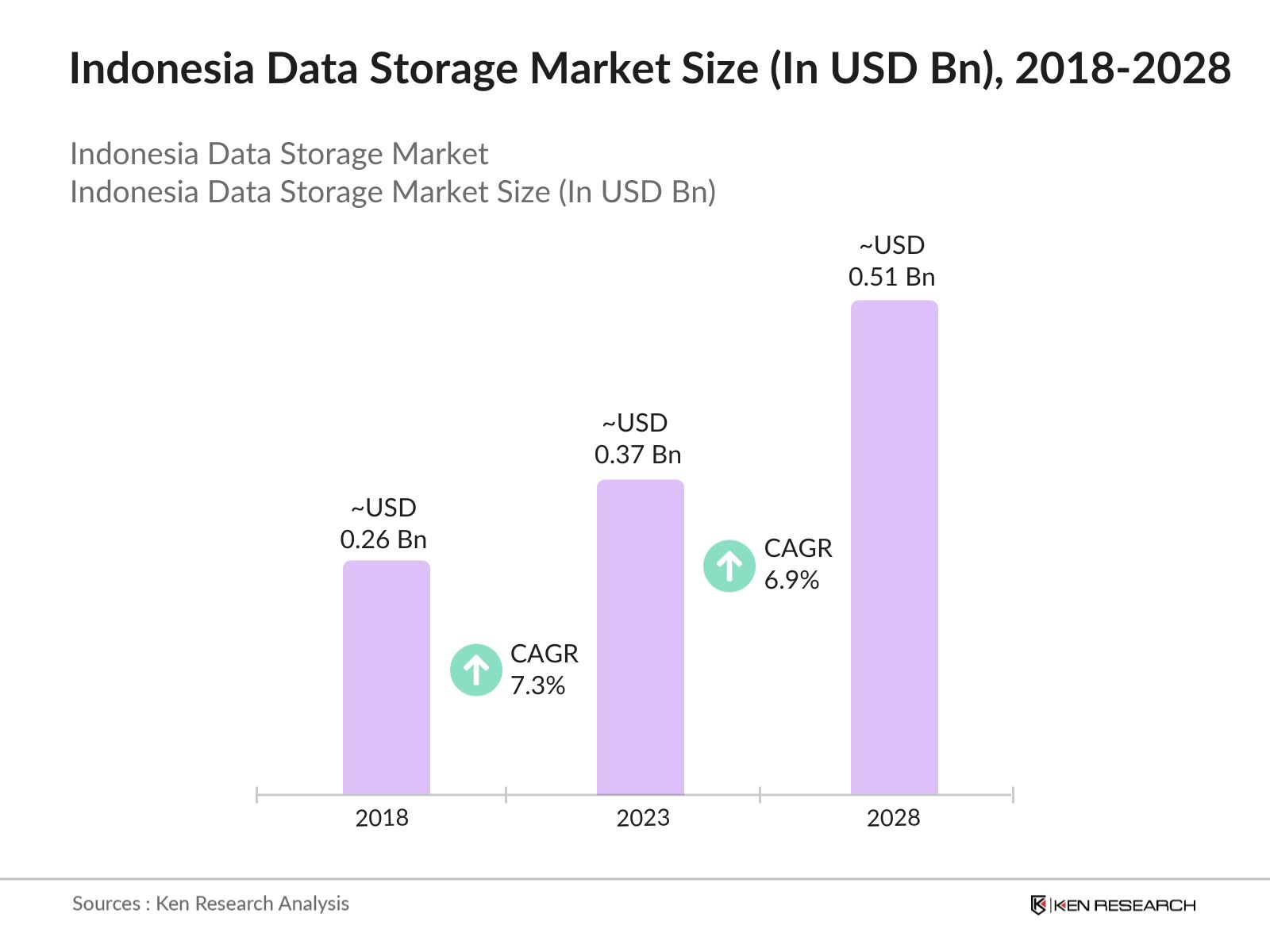

- The Indonesia Data Storage Market size was valued at USD 0.26 billion in 2018 and has increased to USD 0.37 billion in 2023. The rapid expansion of the digital economy in Indonesia, coupled with the increasing adoption of cloud computing, big data analytics, and the proliferation of Internet of Things (IoT) devices, has fueled the demand for data storage solutions in the country.

- The key players in the Indonesia Data Storage market include Dell Technologies, Hewlett Packard Enterprise (HPE), IBM, and local players like PT Data Sinergitama Jaya and PT Sigma Cipta Caraka (Telkomsigma). These companies offer a wide range of data storage solutions, including traditional storage systems, cloud storage, and data management software, catering to the diverse needs of businesses and government agencies in Indonesia.

- In 2023, Dell Technologies announced the expansion of its data center in Jakarta, aiming to enhance its cloud storage offerings in the Indonesian market. The expansion is part of Dell's strategy to cater to the growing demand for cloud-based data storage solutions in Southeast Asia, particularly in Indonesia.

- The Java region, particularly Jakarta, dominated the Indonesia Data Storage Market in 2023. Jakarta's dominance can be attributed to its status as the economic and business hub of Indonesia, with a high concentration of data centers, IT companies, and financial institutions.

Indonesia Data Storage Market Segmentation

The Indonesia Data Storage is segmented into Storage Type, end-user industry, and region.

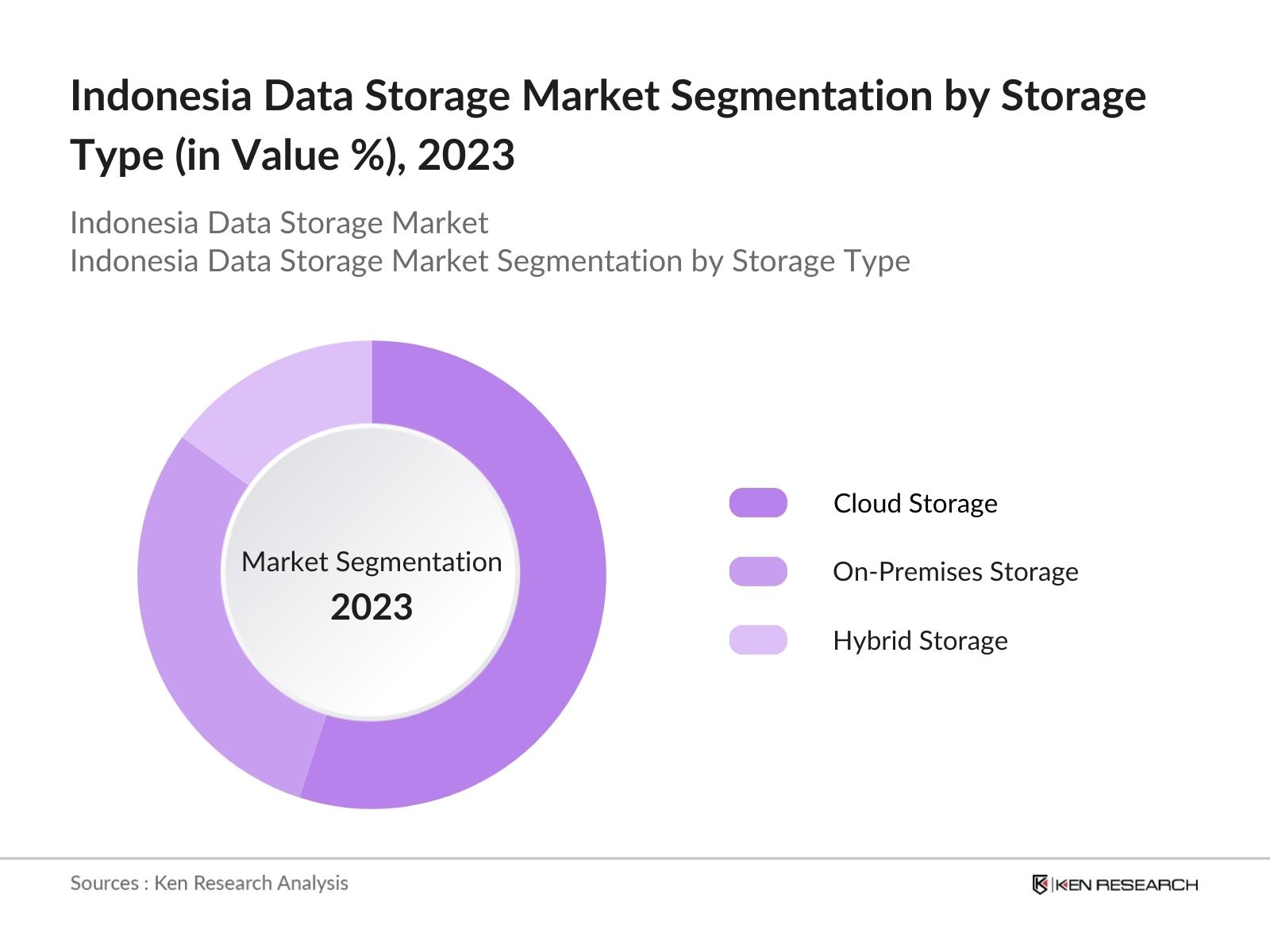

- By Storage Type: The market is segmented by storage type into cloud storage, on-premises storage, and hybrid storage. Cloud storage holds the dominant market share in 2023. This dominance is driven by the increasing adoption of cloud-based solutions by businesses looking for scalable and cost-effective storage options.

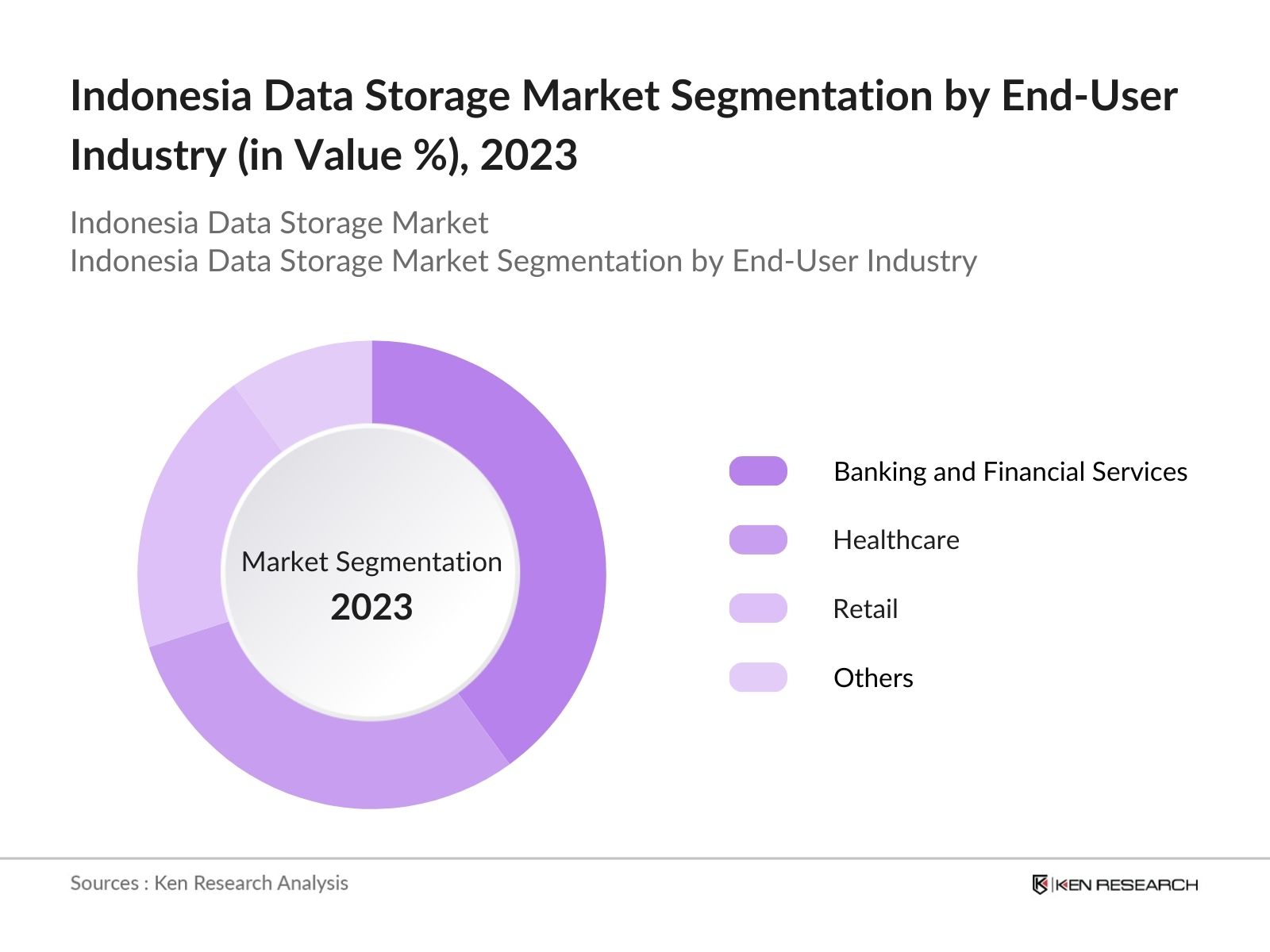

- By End-User Industry: The market is also segmented by end-user industry into banking and financial services, healthcare, and retail. The banking and financial services segment holds the largest market share in 2023, driven by the increasing volume of data generated by financial transactions and the need for secure storage solutions to comply with regulatory requirements.

- By Region: The Indonesia Data Storage Market is segmented by region into North, South, East, and West. The western region dominated the market in 2023. The region's dominance is due to its well-developed infrastructure and access to high-speed internet makes it an attractive location for data storage providers.

Indonesia Data Storage Market Competitive Landscape

|

Company Name |

Establishment Year |

Headquarters |

|

Dell Technologies |

1984 |

Round Rock, Texas, USA |

|

Hewlett Packard Enterprise |

2015 |

Houston, Texas, USA |

|

IBM |

1911 |

Armonk, New York, USA |

|

PT Data Sinergitama Jaya |

2002 |

Jakarta, Indonesia |

|

PT Sigma Cipta Caraka (Telkomsigma) |

1987 |

Tangerang, Indonesia |

- PT Sigma Cipta Caraka and Microsoft Azure: In 2023, PT Sigma Cipta Caraka (Telkomsigma) entered into a strategic partnership with Microsoft Azure to offer cloud storage services to businesses in Indonesia. This partnership aims to leverage Microsoft Azure's global cloud infrastructure and Telkomsigma's local expertise to provide scalable and secure data storage solutions. The collaboration is expected to drive the adoption of cloud storage in Indonesia, particularly among SMEs and government agencies looking for reliable and cost-effective storage options.

- PT Data Sinergitama Jaya Tbk: In 2023, PT Data Sinergitama Jaya Tbk (Elitery) was named a Google Cloud managed services provider in Indonesia, aiming to enhance cloud services for businesses. Elitery also partnered with the Association of Indonesia Municipalities to provide generative AI solutions for city governments. The company was listed on the Indonesia Stock Exchange in January 2023.

Indonesia Data Storage Market Analysis

Indonesia Data Storage Market Growth Drivers:

- Expansion of Cloud Services: The adoption of cloud services in Indonesia has seen a substantial increase, with the number of businesses utilizing cloud storage solutions expected to surpass 50,000 by the end of 2024. This shift is driven by the need for scalable, cost-effective, and flexible storage solutions that can accommodate the growing data storage requirements of companies across various industries.

- Expansion of the Financial Services Sector: The increasing utilization of data centers in the financial industry to ensure secure and efficient financial operations is contributing to market growth. The Financial Services Authority (OJK) has issued a Code of Ethics for Responsible and Trustworthy AI in the Financial Technology Industry, which is expected to drive the adoption of data center storage solutions.

- Rising Demand for Cloud Computing and Big Data Analytics: The increasing adoption of cloud computing services and big data analytics solutions is driving the demand for data center storage in Indonesia. The number of cloud computing subscribers in Indonesia reached 27.8 million in 2023, up from 22.4 million in 2020.

Indonesia Data Storage Market Challenges:

- Lack of Skilled IT Professionals: In 2024, the country is projected to face a shortage of over 600,000 skilled IT professionals, particularly in data management and cybersecurity, due to rapid digital transformation and increased demand for advanced data solutions. This skills gap is a major hurdle for businesses looking to implement and optimize data storage solutions, leading to potential inefficiencies and increased operational costs.

- High Operational Cost: The operational costs associated with maintaining data centers in Indonesia are projected to rise due to increasing electricity prices and real estate costs. In 2024, the average electricity cost is expected to be around USD 0.12 per kWh, which could lead to an estimated increase of USD 50 million in annual operational expenses for data center operators. This financial burden may hinder smaller companies from investing in necessary data storage infrastructure.

Indonesia Data Storage Government Initiatives:

- Investment in Digital Infrastructure: The Indonesian government has allocated USD 1.5 billion for the development of digital infrastructure under the National Digital Strategy. This initiative aims to enhance data center capabilities and improve connectivity across the country, which is expected to increase the demand for data storage solutions over the next five years.

- Support for Local Data Center Development: The government is promoting the establishment of local data centers through tax incentives and subsidies. In 2024, these incentives are projected to attract investments of around USD 500 million from domestic and international players, fostering growth in the data storage market.

Indonesia Data Storage Future Market Outlook

The Indonesia Data Storage market is expected to grow by USD 0.51 billion in 2028. The market is also likely to shift towards more organized with established players and online platforms expanding their reach.

Indonesia Data Storage Future Market Trends:

- Increased Adoption of Edge Computing: Over the next five years, the adoption of edge computing solutions is expected to increase in Indonesia, driven by the growing demand for real-time data processing and storage. By 2028, it is projected that over 20,000 businesses in Indonesia will have implemented edge computing solutions, particularly in industries such as manufacturing, healthcare, and retail.

- Integration of Artificial Intelligence in Data Management: The integration of artificial intelligence (AI) into data management and storage solutions is expected to become a major trend in the Indonesia Data Storage Market. By 2028, it is estimated that the majority of large enterprises in Indonesia will use AI-powered data management tools to optimize their storage systems, reduce costs, and enhance data security.

Scope of the Report

|

By Storage Type |

Cloud Storage On-Premises Storage Hybrid Storage |

|

By End-User Industry |

Banking and Financial Services Healthcare Retail |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Government and Regulatory Bodies

Banks and Financial Institutes

Investors and Venture Capitalists

Retail Companies

Manufacturing Industries

Telecommunication Companies

E-commerce Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Dell Technologies

Hewlett Packard Enterprise (HPE)

IBM

Amazon Web Services (AWS)

Google Cloud

PT Data Sinergitama Jaya

PT Sigma Cipta Caraka (Telkomsigma)

Microsoft Azure

Oracle Corporation

Alibaba Cloud

Hitachi Vantara

Fujitsu Indonesia

Seagate Technology

Western Digital

Pure Storage

NetApp

Veeam Software

Quantum Corporation

Huawei Technologies

Lenovo Indonesia

Table of Contents

1. Indonesia Data Storage Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Data Storage Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Data Storage Market Analysis

3.1. Growth Drivers

3.1.1. Rising Data Generation by Businesses and Government Agencies

3.1.2. Expansion of Cloud Services

3.1.3. Growing Demand for Data Security Solutions

3.1.4. Development of Data Centers

3.2. Restraints

3.2.1. Lack of Skilled IT Professionals

3.2.2. High Operational Costs of Data Centers

3.2.3. Regulatory Compliance and Data Sovereignty Issues

3.2.4. Inadequate Digital Infrastructure in Rural Areas

3.3. Opportunities

3.3.1. Adoption of Edge Computing Solutions

3.3.2. Green Data Center Development

3.3.3. Expansion of Cloud Services to Rural Areas

3.3.4. AI Integration in Data Management

3.4. Trends

3.4.1. Increased Adoption of Edge Computing

3.4.2. Growth of Green Data Centers

3.4.3. Expansion of Cloud Services to Rural Areas

3.4.4. Integration of AI in Data Management

3.5. Government Regulation

3.5.1. Digital Indonesia Initiative

3.5.2. National Cybersecurity Strategy

3.5.3. Incentives for Data Center Development

3.5.4. Smart City Initiatives

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competition Ecosystem

4. Indonesia Data Storage Market Segmentation, 2023

4.1. By Storage Type (in Value %)

4.1.1. Cloud Storage

4.1.2. On-Premises Storage

4.1.3. Hybrid Storage

4.2. By End-User Industry (in Value %)

4.2.1. Banking and Financial Services

4.2.2. Healthcare

4.2.3. Retail

4.2.4. Government and Public Sector

4.3. By Region (in Value %)

4.3.1. North

4.3.2. South

4.3.3. East

4.3.4. West

5. Indonesia Data Storage Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Dell Technologies

5.1.2. Hewlett Packard Enterprise (HPE)

5.1.3. IBM

5.1.4. Amazon Web Services (AWS)

5.1.5. Google Cloud

5.1.6. Microsoft Azure

5.1.7. PT Data Sinergitama Jaya

5.1.8. PT Sigma Cipta Caraka (Telkomsigma)

5.1.9. Oracle Corporation

5.1.10. Alibaba Cloud

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Indonesia Data Storage Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Indonesia Data Storage Market Regulatory Framework

7.1. Data Protection Regulations

7.2. Compliance Requirements

7.3. Certification Processes

8. Indonesia Data Storage Market Future Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Indonesia Data Storage Market Future Segmentation, 2028

9.1. By Storage Type (in Value %)

9.2. By End-User Industry (in Value %)

9.3. By Region (in Value %)

10. Indonesia Data Storage Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the Indonesia data storage market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple cloud storage companies and understand the nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through the bottom-to-top approach from the cloud storage companies.

Frequently Asked Questions

01 How big is the Indonesia Data Storage Market?

The Indonesia Data Storage Market was valued at USD 0.26 billion in 2018 and has increased to USD 0.37 billion in 2023. The rapid expansion of the digital economy in Indonesia, coupled with the increasing adoption of cloud computing, big data analytics, and the proliferation of Internet of Things (IoT) devices, has fueled the demand for data storage solutions in the country.

02 Who are the major players in the Indonesia Data Storage market?

The major players in Indonesia Data Storage include Salesforce.com, Oracle Corporation, SAP SE, Microsoft Corporation, and Impartner Inc. These companies have established themselves as leaders in the market by offering comprehensive PRM solutions that cater to a wide range of industries.

03 What are the growth drivers of the Indonesia Data Storage market?

The growth drivers of the Indonesia Data Storage market include increasing data generation by businesses and government, expansion of cloud services, rising demand for data security solutions, and some developments of data center infrastructure across the country.

04 What are the challenges in the Indonesia Data Storage market?

The Indonesia Data Storage market faces challenges like high operational costs of data centers, lack of skilled IT professionals, regulatory compliance issues, and inadequate digital infrastructure in rural areas. These factors impact the market's growth and efficiency.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.