Indonesia Delivery Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD11176

December 2024

81

About the Report

Indonesia Delivery Market Overview

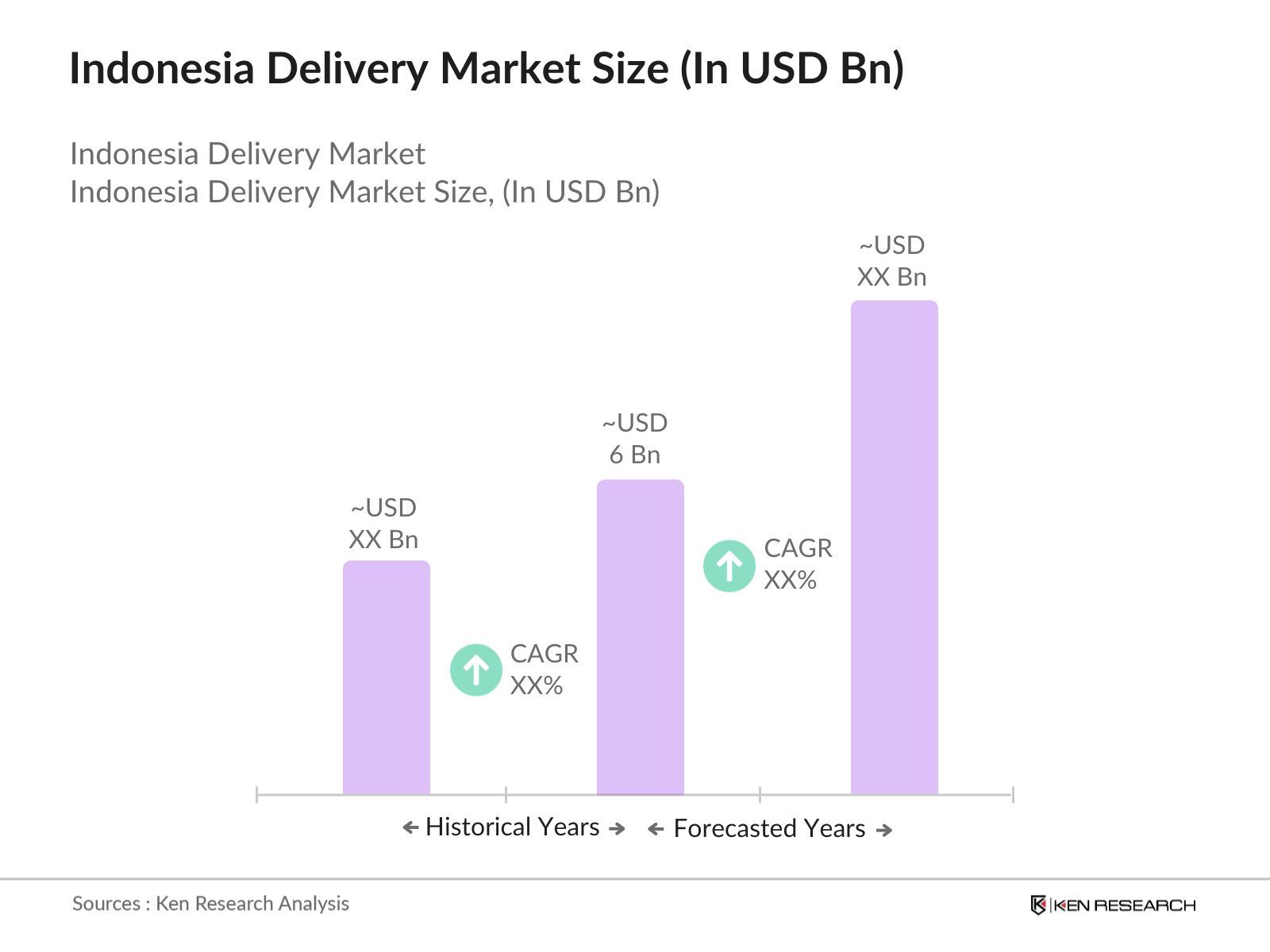

- The Indonesia Delivery Market is valued at USD 6 billion, supported by strong growth due to the expansion of e-commerce and consumer demand for convenience in last-mile delivery. Government support for digital payments has also bolstered market expansion. driven by a digitally active population and significant technological adoption in logistics. The rise of digital marketplaces and increased use of mobile applications have been instrumental in this market's expansion, alongside improvements in urban infrastructure.

- Java and Sumatra lead Indonesia's delivery market, primarily due to their dense populations and advanced logistical networks, particularly in urban hubs like Jakarta. Javas infrastructure supports quick and efficient delivery, while Sumatra shows rising demand in metropolitan areas. These regions are supported by infrastructure investments and consumer purchasing power, making them the key contributors to market growth.

- Indonesias digital transaction regulations require compliance with data privacy standards, impacting all delivery companies handling online payments. Over 80% of delivery providers are now aligned with these standards to secure consumer data during digital transactions (Indonesia Ministry of Communications and Information, source). This regulation reinforces consumer trust in digital transactions, a critical component of the online delivery ecosystem, especially as digital transactions become increasingly prevalent in e-commerce and on-demand delivery services.

Indonesia Delivery Market Segmentation

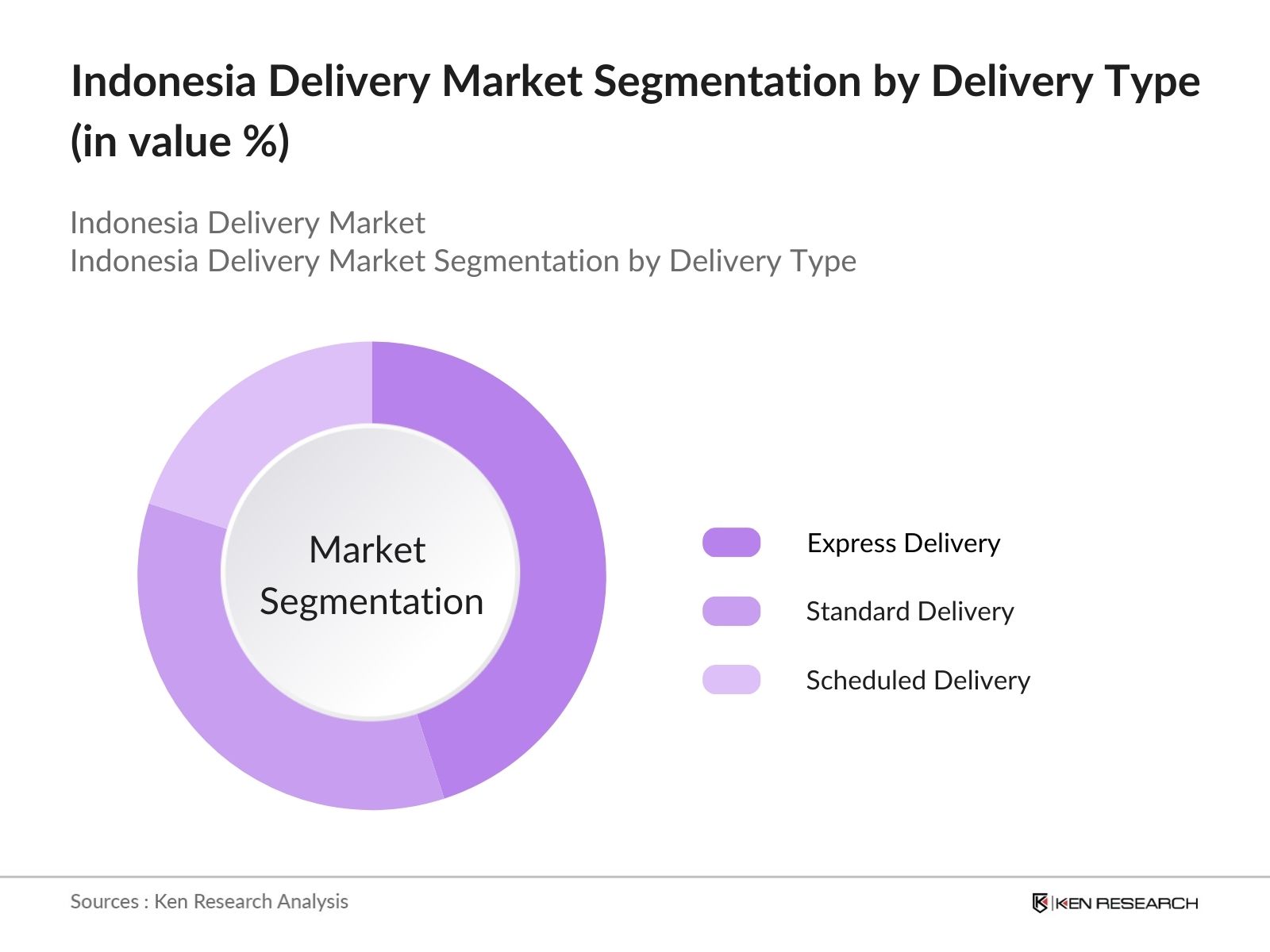

By Delivery Type: The Indonesia Delivery Market is segmented by delivery type into express delivery, standard delivery, and scheduled delivery. Express delivery is the most significant segment, driven by consumer demand for quick service for essential goods, including food and groceries. Investments by major players in route optimization technologies and on-demand delivery capabilities help reinforce the dominance of express delivery.

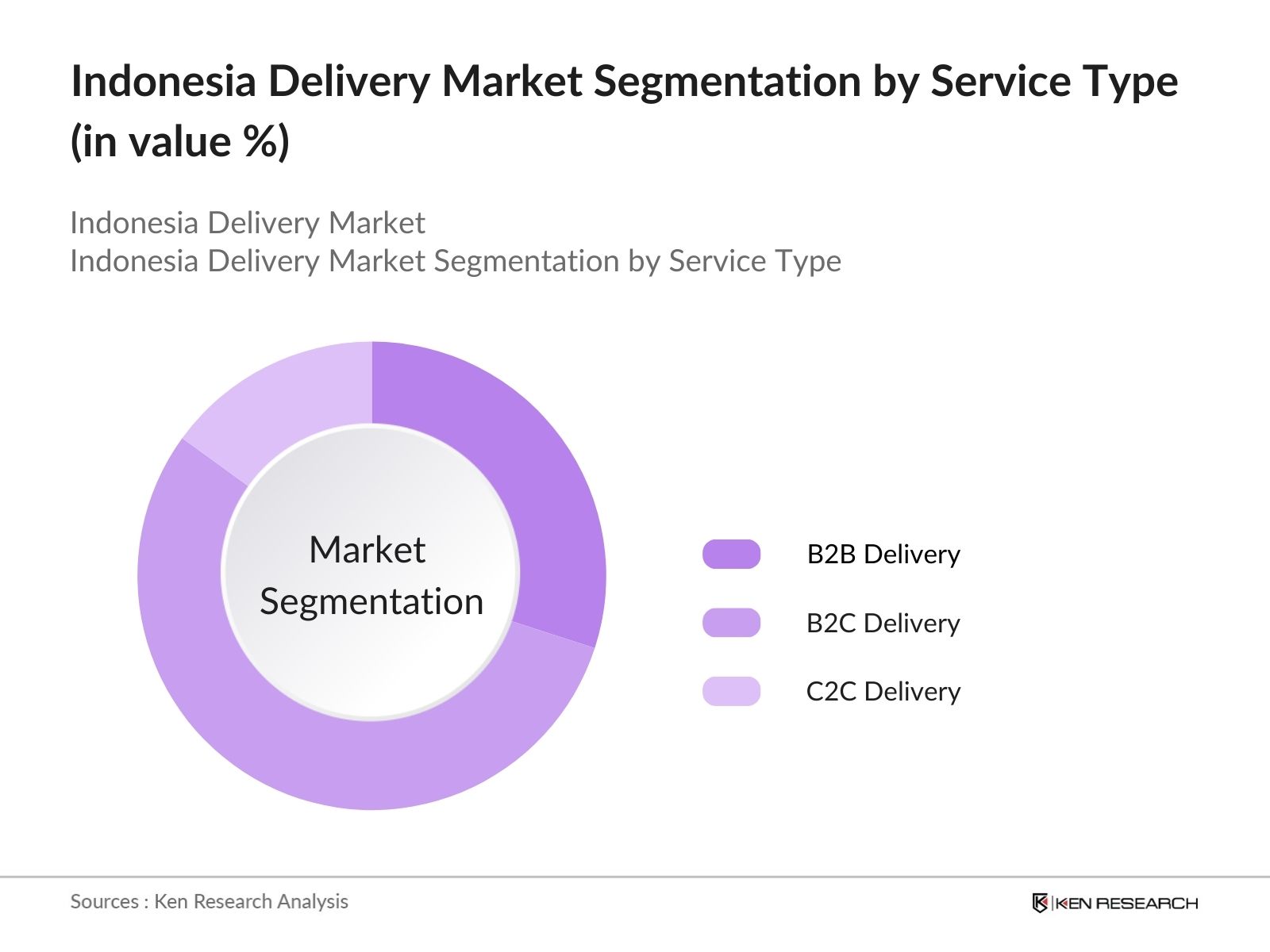

By Service Type: The market is also segmented by service type, including B2B, B2C, and C2C delivery. B2C delivery holds the largest share, due to high online retail activity. Major e-commerce and food delivery platforms have established efficient networks that appeal to end consumers, thus supporting B2C dominance. The growth of this segment aligns with consumer preferences for fast, reliable deliveries from retailers and food outlets.

Indonesia Delivery Market Competitive Landscape

The Indonesia Delivery Market is highly competitive, with several key players, including both local and international firms. Companies such as Go-Jek and Grab dominate the market through their extensive delivery networks and advanced technology integration.

Indonesia Delivery Market Analysis

Growth Drivers

- E-commerce Expansion: Indonesias e-commerce sector is rapidly expanding, reaching new heights due to increasing digital connectivity. In 2024, approximately 212 million Indonesians have internet access, facilitating online purchases. The Indonesian governments promotion of digital transformation has also accelerated the growth of e-commerce, with over 34,000 Small and Medium Enterprises (SMEs) now engaged in digital selling (Indonesia Ministry of Trade, source). Furthermore, daily online transactions have surged, with an estimated 3.5 million daily orders, reflecting the rising reliance on delivery services in urban and rural areas alike.

- Digital Payment Integration: The integration of digital payment systems has significantly supported delivery market growth, with over 65 million Indonesians using digital payment apps, as reported in early 2024. The increase in financial inclusivity due to apps like GoPay and OVO has fueled digital purchasing behavior. The transaction volume through digital payments has reached over USD 19.3 billion, directly benefiting the delivery market by making transactions more seamless for both sellers and buyers, further supporting on-demand deliveries in urban centers and rural areas.

- Urbanization and Consumer Behavior: Indonesias urban population is now approximately 158 million people, or 57% of the total population, indicating an increasing demand for convenient delivery options in urbanized areas. With rising disposable incomes, consumers are increasingly willing to pay for faster delivery services. A shift in consumer preference for convenience and rapid delivery in urban settings, driven by a 40% increase in urban households opting for online grocery services, has also contributed to the steady rise in demand for reliable delivery services.

Challenges

- Delivery Logistics Complexity: Indonesias unique geography, comprising over 17,000 islands, poses significant logistical challenges. According to Indonesia's National Logistics Agency, delivery across these islands involves complex routing and higher operational costs. Delays are frequent due to factors such as inter-island shipping times and limited logistical hubs. The additional transportation stages required to reach remote areas increase delivery times, highlighting a pressing need for more effective cross-regional logistical solutions.

- Regulatory Constraints: Regulatory barriers, including licensing requirements and restrictions on foreign investments in logistics, impact the operational scalability of delivery services in Indonesia. The recent regulatory updates by the Indonesian government require delivery companies to comply with stringent consumer protection standards (Indonesia Ministry of Transport, source). Moreover, varying regional regulations complicate uniform service provision across the country, posing additional compliance and operational challenges that could impact service expansion.

Indonesia Delivery Market Future Outlook

The Indonesia Delivery Market is projected to experience robust growth over the next five years, driven by further e-commerce expansion, continuous technological enhancements in delivery processes, and heightened demand for quick and sustainable delivery services. Increasing investments in logistics infrastructure will further strengthen the markets growth trajectory, making it an attractive segment for new entrants and investors alike.

Market Opportunities

- Growth of On-demand Services: On-demand delivery services, particularly in sectors like food and grocery, have witnessed rapid growth, with over 4 million active daily users across various delivery platforms. The popularity of quick-delivery options has provided companies the opportunity to scale operations. With continuous technological improvements, companies are better positioned to meet the demand for real-time and personalized deliveries, especially in urban centers where demand for rapid services continues to climb.

- Technological Innovations: Technological advancements, such as AI-powered route optimization, are revolutionizing Indonesias delivery market. Companies implementing AI have reported reductions in delivery times by up to 30%, enhancing operational efficiency. The Indonesian governments support for tech startups has also led to the growth of innovation in delivery solutions. With continued investment in technological infrastructure, such as 5G networks, delivery providers can improve accuracy and efficiency, particularly in high-demand urban zones.

Scope of the Report

|

Segment |

Sub-Segment |

|

By Delivery Type |

Express Delivery Standard Delivery Scheduled Delivery |

|

By Service Type |

B2B Delivery B2C Delivery C2C Delivery |

|

By End-Use Sector |

Food and Beverages Retail and E-commerce Pharmaceuticals |

|

By Payment Mode |

Cash on Delivery Digital Wallets Bank Transfers |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience

E-commerce Companies

Retail and Consumer Goods Firms

Logistics and Freight Companies

Food and Beverage Companies

Pharmaceuticals and Healthcare Providers

Local and International Corporates Seeking Efficient Delivery Solutions

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Indonesia Ministry of Communication and Information Technology)

Companies

Players Mentioned in the Report

Go-Jek

Grab

Ninja Xpress

JNE Express

SiCepat

Lion Parcel

Lalamove

Anteraja

Paxel

DHL Express

Table of Contents

1. Indonesia Delivery Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Delivery Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Delivery Market Analysis

3.1 Growth Drivers

3.1.1 E-commerce Expansion

3.1.2 Digital Payment Integration

3.1.3 Urbanization and Consumer Behavior

3.1.4 Logistics and Infrastructure Development

3.2 Market Challenges

3.2.1 Delivery Logistics Complexity

3.2.2 Regulatory Constraints

3.2.3 High Cost of Last-Mile Delivery

3.3 Opportunities

3.3.1 Growth of On-demand Services

3.3.2 Technological Innovations

3.3.3 Emerging Suburban Demand

3.4 Trends

3.4.1 Rise of Sustainable Delivery Solutions

3.4.2 Integration of AI in Route Optimization

3.4.3 Enhanced Consumer Personalization

3.5 Regulatory Environment

3.5.1 National Regulations on Delivery Services

3.5.2 Consumer Protection Policies

3.5.3 Compliance with Digital Transaction Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Indonesia Delivery Market Segmentation

4.1 By Delivery Type (In Value %)

4.1.1 Express Delivery

4.1.2 Standard Delivery

4.1.3 Scheduled Delivery

4.2 By Service Type (In Value %)

4.2.1 B2B Delivery

4.2.2 B2C Delivery

4.2.3 C2C Delivery

4.3 By End-Use Sector (In Value %)

4.3.1 Food and Beverages

4.3.2 Retail and E-commerce

4.3.3 Pharmaceuticals

4.4 By Payment Mode (In Value %)

4.4.1 Cash on Delivery

4.4.2 Digital Wallets

4.4.3 Bank Transfers

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Bali

5. Indonesia Delivery Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Go-Jek

5.1.2 Grab

5.1.3 Ninja Xpress

5.1.4 JNE Express

5.1.5 SiCepat

5.1.6 Lion Parcel

5.1.7 Lalamove

5.1.8 Anteraja

5.1.9 Paxel

5.1.10 DHL Express

5.2 Cross Comparison Parameters (Market Share, No. of Active Couriers, Coverage Area, Revenue, Customer Base, Digital Integration Level, Delivery Speed, Customer Satisfaction Index)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment and Funding Analysis

5.7 Key Partnerships

5.8 Technology Adoption

6. Indonesia Delivery Market Regulatory Framework

6.1 Service Licensing Requirements

6.2 Environmental Compliance

6.3 Labor and Workforce Regulations

6.4 E-commerce Delivery Regulations

7. Indonesia Delivery Market Future Market Size (In USD Mn)

7.1 Future Market Size Projections

7.2 Key Drivers of Future Market Growth

8. Indonesia Delivery Market Future Market Segmentation

8.1 By Delivery Type (In Value %)

8.2 By Service Type (In Value %)

8.3 By End-Use Sector (In Value %)

8.4 By Payment Mode (In Value %)

8.5 By Region (In Value %)

9. Indonesia Delivery Market Analysts Recommendations

9.1 Target Market Analysis

9.2 Growth Strategy Analysis

9.3 Investment Opportunities

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involved developing an ecosystem map of the Indonesia Delivery Market, analyzing logistics, technology adoption, and regional distribution. This step was carried out through desk research using proprietary databases and industry resources to pinpoint influential market variables.

Step 2: Market Analysis and Data Collection

This stage involved compiling historical data and assessing service quality statistics to provide a baseline for market analysis. Key areas of focus included service adoption rates and delivery success rates to ensure data reliability.

Step 3: Hypothesis Testing and Expert Validation

Market hypotheses were constructed based on initial findings and validated through interviews with key industry players. Insights gathered from these expert consultations provided critical data to refine and confirm the initial assumptions.

Step 4: Data Synthesis and Final Report Compilation

In this final stage, extensive consultations were held with delivery firms to validate service statistics and consumer trends. This synthesis phase allowed for a comprehensive and precise depiction of the market landscape, ensuring accuracy in the final report output.

Frequently Asked Questions

01. How big is the Indonesia Delivery Market?

The Indonesia Delivery Market is valued at USD 6 billion in 2023, driven by rising consumer demand for reliable delivery solutions across multiple sectors, including retail and food.

02. What are the main challenges in the Indonesia Delivery Market?

Indonesia Delivery Market faces challenges such as logistical complexities, high costs for last-mile delivery, and regulatory constraints. Infrastructure limitations also present hurdles in rural expansion.

03. Who are the major players in the Indonesia Delivery Market?

Key players in Indonesia Delivery Market include Go-Jek, Grab, Ninja Xpress, JNE Express, and SiCepat. These companies hold substantial market presence due to their brand reach and service quality.

04. What drives growth in the Indonesia Delivery Market?

Indonesia Delivery Markets growth is supported by the rise of e-commerce, digital payment adoption, and consumer preference for efficient delivery services. Urbanization also fuels demand for timely deliveries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.