Indonesia Diabetes Care Devices Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11420

December 2024

85

About the Report

Indonesia Diabetes Care Devices Market Overview

- The Indonesia Diabetes Care Devices Market is valued at USD 132.45 million, based on a five-year historical analysis. This growth is largely driven by the increasing prevalence of diabetes in the country, driven by unhealthy lifestyle habits and urbanization. The adoption of advanced glucose monitoring and insulin delivery systems further boosts the market as patients and healthcare providers prioritize better disease management. The demand for continuous glucose monitors (CGMs) and insulin pens is growing as these devices offer enhanced accuracy and ease of use.

- Indonesia's urban regions such as Java and Bali are the dominant areas in the market. Java, being home to the countrys capital, Jakarta, has the highest access to healthcare infrastructure, driving the adoption of diabetes care devices. Additionally, Bali's tourism-driven healthcare sector is expanding rapidly, contributing to higher demand for advanced diabetes monitoring and treatment systems. These regions benefit from improved healthcare access and higher consumer awareness.

- The Indonesian government has expanded the National Health Insurance (JKN) program, which aims to provide universal healthcare coverage. By 2023, the JKN program had covered over 220 million Indonesians, ensuring access to healthcare services, including diabetes management. This initiative helps lower-income populations access essential diabetes care devices, such as blood glucose monitors and insulin delivery systems, which may otherwise be unaffordable. The government's focus on non-communicable diseases, including diabetes, is expected to further improve early diagnosis and treatment access across the country.

Indonesia Diabetes Care Devices Market Segmentation

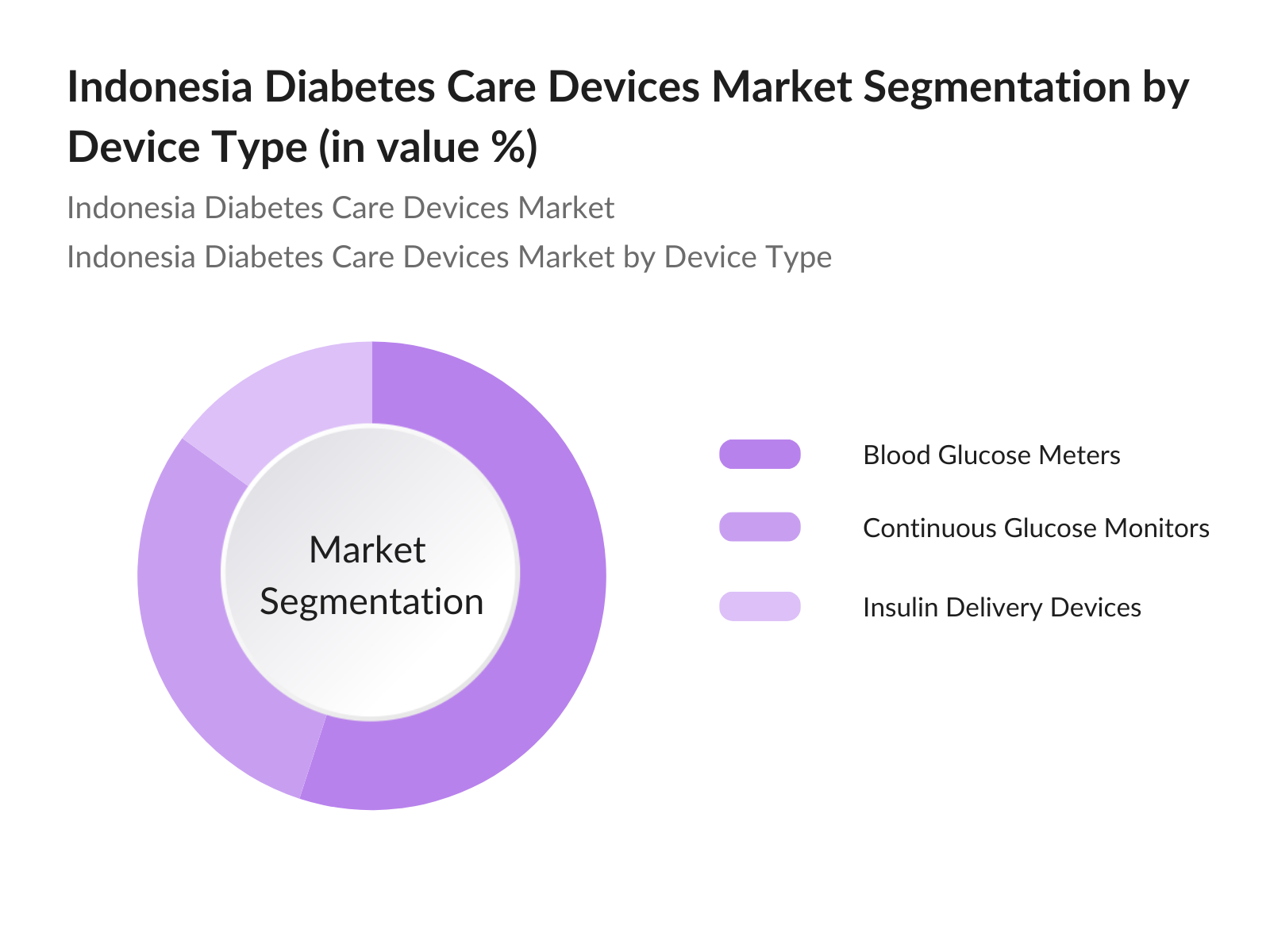

By Device Type: The Indonesia Diabetes Care Devices Market is segmented by device type into blood glucose meters, continuous glucose monitoring (CGM) devices, and insulin delivery devices. Blood glucose meters hold a dominant market share due to their affordability and accessibility, making them the preferred choice for regular blood sugar monitoring. Additionally, technological advancements in CGM devices have enhanced user convenience and accuracy, driving the growing preference for these devices among urban consumers.

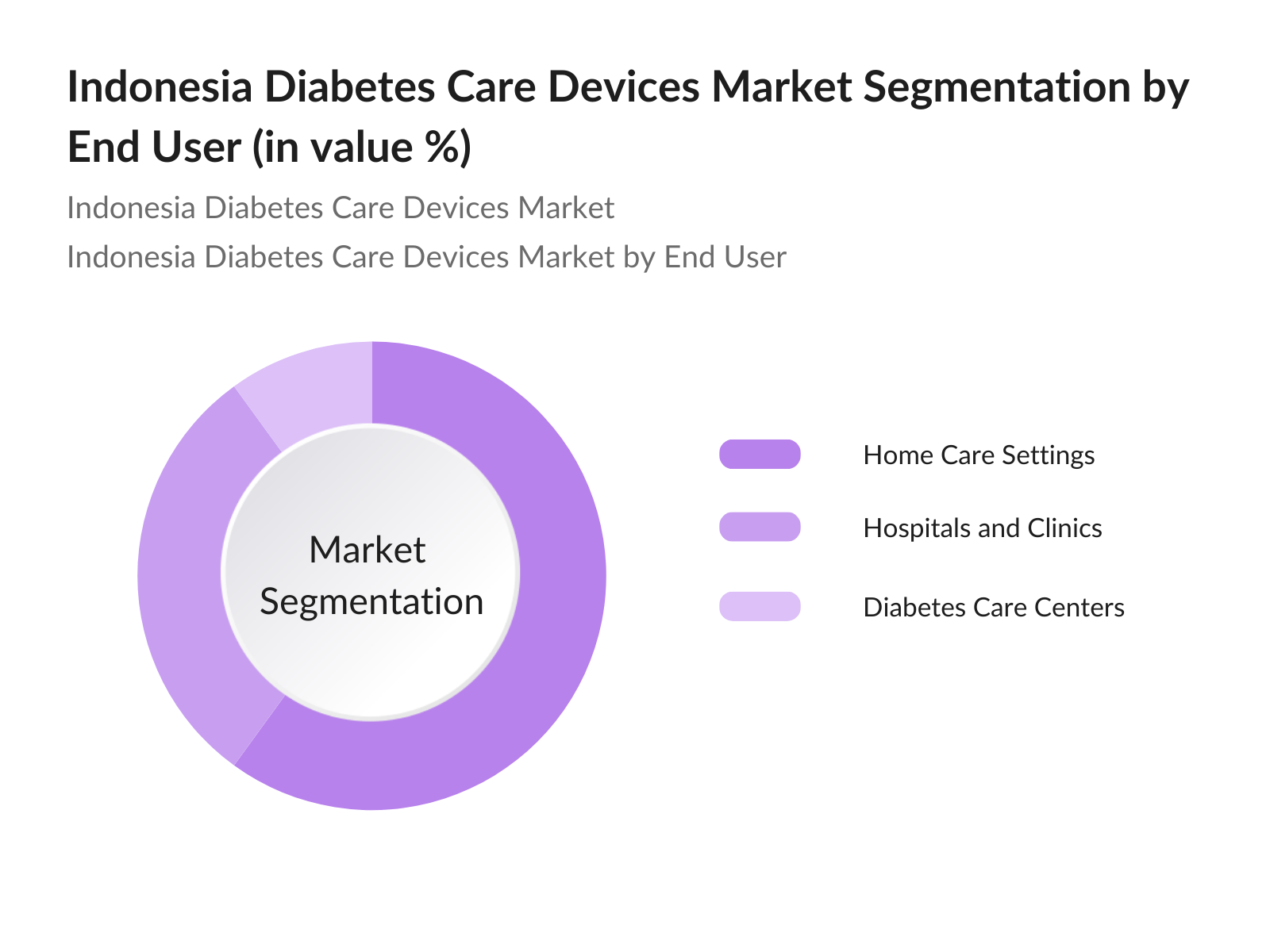

By End User: The market is segmented by end-user into hospitals and clinics, home care settings, and diabetes care centers. Home care settings dominate this segment as they offer patients the convenience of managing their condition from the comfort of their homes. The rise of home healthcare services, alongside telemedicine, has made self-monitoring blood glucose and insulin administration easier and more efficient, especially in urban areas.

Indonesia Diabetes Care Devices Market Competitive Landscape

The Indonesia Diabetes Care Devices Market is dominated by major global players and a few local manufacturers. The competition is driven by innovation, affordability, and access to distribution networks. Global brands such as Medtronic, Roche, and Dexcom are key players, leveraging their advanced product offerings and partnerships with local distributors to dominate the market. The consolidation of these key players underscores their influence in shaping market dynamics.

|

Company |

Established |

Headquarters |

Product Innovation |

Local Partnerships |

Technology Adoption |

Revenue in USD |

Product Portfolio |

|

Medtronic |

1949 |

USA |

High |

- |

- |

- |

- |

|

Roche |

1896 |

Switzerland |

Moderate |

- |

- |

- |

- |

|

Abbott |

1888 |

USA |

High |

- |

- |

- |

- |

|

Dexcom |

1999 |

USA |

High |

- |

- |

- |

- |

|

Novo Nordisk |

1923 |

Denmark |

Moderate |

- |

- |

- |

- |

Indonesia Diabetes Care Devices Market Analysis

Market Growth Drivers

- Rising Diabetes Prevalence: In Indonesia, the number of people with diabetes is rapidly increasing, with over 10 million adults living with diabetes in 2022, as reported by the International Diabetes Federation. The growing prevalence is a significant concern as it leads to higher demand for diabetes care devices. Factors such as obesity, sedentary lifestyles, and poor diets are driving this rise. Furthermore, the World Bank noted that urbanization rates in Indonesia have been steadily increasing, contributing to the adoption of unhealthy lifestyles. This surge in diabetes cases creates a consistent demand for monitoring and treatment devices in the market.

- Urbanization and Changing Lifestyles: Indonesia's rapid urbanization is altering lifestyles, particularly in cities like Jakarta and Surabaya, where access to fast food, sedentary work environments, and stress levels are contributing to higher diabetes risk. As per World Bank data, Indonesia's urban population grew to 156 million in 2022, which correlates with increasing consumption of processed foods and reduced physical activity. This transition drives demand for diabetes care devices as the urban populace is more susceptible to lifestyle-related health issues like diabetes.

- Increasing Government Initiatives: The Indonesian government has launched several healthcare programs aimed at managing and reducing diabetes cases. The Germas program, initiated in 2022, focuses on promoting healthier lifestyles, which indirectly impacts the demand for diabetes care devices. According to the Ministry of Health, the government allocated IDR 15 trillion in 2023 to healthcare improvements, a significant portion of which is aimed at non-communicable diseases like diabetes. These initiatives are expected to encourage early diagnosis and management, further boosting the market for diabetes care devices.

Market Challenges:

- High Cost of Advanced Devices: The cost of diabetes care devices, particularly advanced monitoring systems, remains high in Indonesia. A report by the Ministry of Health in 2023 noted that CGM devices and smart insulin pens can cost upwards of IDR 5 million per unit, making them unaffordable for a significant portion of the population, where the average monthly income is around IDR 4.7 million. This cost barrier limits the widespread adoption of these technologies, especially in low-income households.

- Low Diagnosis Rates: Indonesia faces a significant challenge in diagnosing diabetes early. The Ministry of Health reported in 2023 that a large portion of adults with diabetes remains undiagnosed, primarily due to limited awareness and access to screening facilities. This low diagnosis rate hampers the effective use of diabetes care devices, as patients often discover their condition too late to benefit from early-stage intervention tools like CGM systems or insulin pumps. Increased efforts in awareness and screening infrastructure are critical to addressing this issue and improving the effectiveness of diabetes management.

Indonesia Diabetes Care Devices Market Future Outlook

Over the next five years, the Indonesia Diabetes Care Devices Market is expected to witness substantial growth driven by technological advancements, an increasing prevalence of diabetes, and government initiatives. Continuous improvements in CGMs and insulin delivery systems will further drive adoption. Additionally, partnerships between healthcare providers and tech companies are expected to streamline diabetes care management.

Market Opportunities:

- Adoption of Continuous Glucose Monitoring (CGM) Devices: In recent years, CGM devices have gained popularity in Indonesia, particularly in urban areas. Data from the Indonesian Ministry of Health shows a growing number of diagnosed diabetes patients are using CGM devices by 2023. This trend reflects an increasing preference for real-time glucose monitoring, which allows patients to manage their diabetes more effectively. The rising adoption of these devices is driven by urbanization and the increasing prevalence of diabetes in Indonesias major cities, where patients seek more advanced solutions for diabetes management.

- Mobile Connectivity for Data Sharing with Healthcare Providers: Mobile health technology is being rapidly integrated into diabetes care in Indonesia, enabling patients to share real-time data with their healthcare providers. In 2023, the Ministry of Health reported that a significant number of diabetes patients in Indonesia were using mobile apps to track and share their health data with clinicians, enhancing the efficiency of diabetes management. This trend is supported by the increasing smartphone penetration rate in Indonesia, allowing for greater access to mobile healthcare solutions and improving the overall management of chronic conditions like diabetes.

Scope of the Report

|

By Device Type |

Blood Glucose Meters Insulin Pumps |

|

By End User |

Hospitals Home Care |

|

By Distribution Channel |

Online Platforms Pharmacies |

|

By Technology |

CGMs Connected Devices |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Healthcare Providers

Hospitals and Clinics

Medical Device Distributors

Government and Regulatory Bodies (Indonesian Ministry of Health)

Home Care Providers

Retail Pharmacies

Insurance Companies

Investment and Venture Capital Firms

Companies

Players Mention in the Report

Medtronic

Roche

Abbott

Dexcom

Novo Nordisk

Eli Lilly

Ascensia Diabetes Care

Insulet Corporation

Tandem Diabetes

Ypsomed

Sanofi

Becton Dickinson

GlucoModicum

Philips-Medisize

LifeScan (Johnson & Johnson)

Table of Contents

01. Indonesia Diabetes Care Devices Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

02. Indonesia Diabetes Care Devices Market Size (In USD Mn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

03. Indonesia Diabetes Care Devices Market Dynamics

Market Drivers

Rising Diabetes Prevalence

Urbanization and Changing Lifestyles

Technological Advancements in Monitoring Devices

Increasing Government Initiatives

Market Challenges

Limited Access to Healthcare in Rural Areas

High Cost of Advanced Devices

Low Diagnosis Rates

Opportunities

Expanding Home Healthcare Services

Growing Awareness and Patient Education Programs

Integration with Telemedicine Solutions

Trends

Adoption of Continuous Glucose Monitoring (CGM) Devices

Increasing Use of Smart Insulin Pens

Mobile Connectivity for Data Sharing with Healthcare Providers

SWOT Analysis

Porters Five Forces Analysis (Bargaining Power of Buyers, Suppliers, Threats of Substitutes, New Entrants, Competitive Rivalry)

04. Indonesia Diabetes Care Devices Market Segmentation (In Value %)

By Device Type

Blood Glucose Meters

Continuous Glucose Monitors (CGMs)

Insulin Delivery Devices (Insulin Pens, Pumps)

Test Strips and Lancets

By End User

Hospitals & Clinics

Home Care Settings

Diabetes Care Centers

Retail Pharmacies

By Distribution Channel

Online Platforms

Offline Pharmacies

Specialty Stores

By Technology

Self-Monitoring Devices

Automated Insulin Delivery

Connected Devices with Mobile Integration

By Region

Java

Bali

Sumatra

Sulawesi

Kalimantan

05. Indonesia Diabetes Care Devices Market Competitive Landscape

Key Competitors

Medtronic

Roche

Abbott

Dexcom

Novo Nordisk

Eli Lilly

Ascensia Diabetes Care

LifeScan

Insulet Corporation

Tandem Diabetes

Ypsomed

Sanofi

Becton Dickinson

GlucoModicum

Philips-Medisize

Market Share Analysis

Strategic Initiatives and Collaborations

Mergers and Acquisitions

06. Indonesia Diabetes Care Devices Market Regulatory Framework

Government Healthcare Initiatives

Compliance Requirements for Medical Devices

Public Health Policies

07. Indonesia Diabetes Care Devices Future Market Size (In USD Mn)

Future Market Size Projections

Key Factors Driving Future Growth

08. Indonesia Diabetes Care Devices Future Market Segmentation

By Device Type

Blood Glucose Monitoring Devices

Insulin Delivery Systems

By End User

Hospitals

Home Care Settings

By Region

09. Indonesia Diabetes Care Devices Market Analysts Recommendations

TAM/SAM/SOM Analysis

Emerging Trends and Technology Integration

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

In this phase, an extensive desk research approach was employed, utilizing secondary databases to map out the Indonesia Diabetes Care Devices Market's ecosystem. Major stakeholders, key variables, and market dynamics were identified, laying the groundwork for further analysis.

Step 2: Market Analysis and Construction

Data from previous years were compiled, analyzed, and synthesized to assess the market penetration of various device types. Further, revenue and service provider statistics were gathered to ensure reliability in market estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses developed during the research process were validated through consultations with industry experts and practitioners via computer-assisted telephone interviews (CATI). Their insights helped refine data accuracy.

Step 4: Research Synthesis and Final Output

This phase involved direct consultations with key players in the diabetes care device industry. This interaction validated the final output, ensuring that the data was accurate and aligned with market dynamics.

Frequently Asked Questions

01. How big is the Indonesia Diabetes Care Devices Market?

The Indonesia Diabetes Care Devices Market is valued at USD 132.45 million and is driven by the increasing prevalence of diabetes, urbanization, and improvements in healthcare infrastructure.

02. What are the challenges in the Indonesia Diabetes Care Devices Market?

Challenges include limited access to healthcare in rural areas, high costs of advanced devices, and low diagnosis rates in underserved populations.

03. Who are the major players in the Indonesia Diabetes Care Devices Market?

Key players in the market include Medtronic, Roche, Abbott, Dexcom, and Novo Nordisk, known for their technological advancements and comprehensive product portfolios.

04. What drives the Indonesia Diabetes Care Devices Market?

The market is propelled by rising diabetes prevalence, advancements in continuous glucose monitoring systems, and government initiatives to improve healthcare access.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.