Indonesia Digital Health Components Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD2121

December 2024

95

About the Report

Indonesia Digital Health Components Market Overview

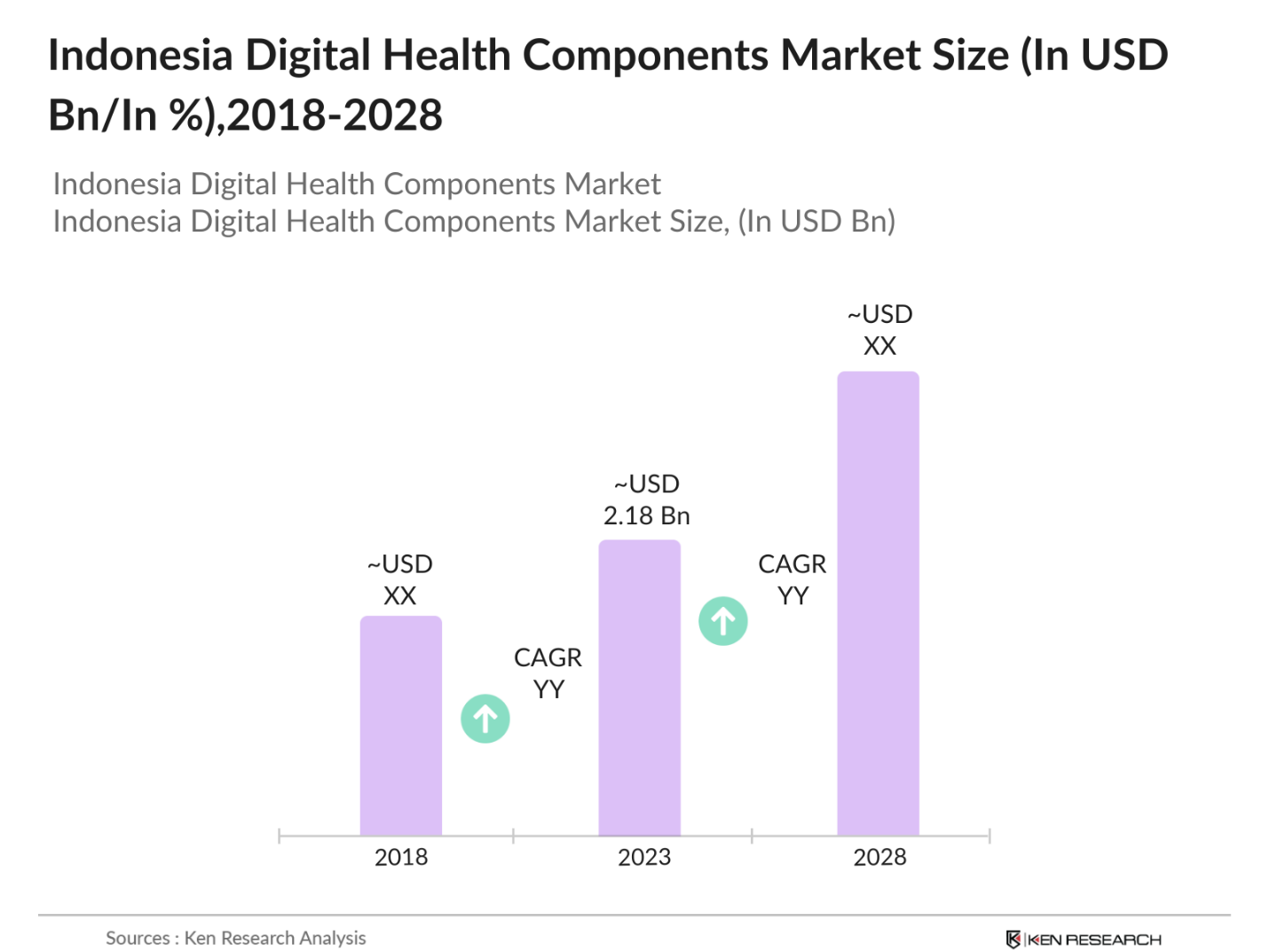

- The Indonesia Digital Health Components Market was valued at USD 2.18 billion in 2023. The market's growth is driven by the Indonesian government's efforts to improve healthcare accessibility through telemedicine and digital health records, particularly in rural areas. The expansion of cloud-based healthcare services and the rise in telemedicine use have positioned Indonesia as a significant player in Southeast Asia's digital health landscape.

- Key players in the Indonesia digital health market include Halodoc, Alodokter, SehatQ, and Good Doctor. These companies have been at the forefront of the digital health revolution, offering services ranging from teleconsultations to AI-powered diagnostics, making healthcare more accessible across the archipelago.

- In 2023, the Ministry of Health of Indonesia launched the Healthy Indonesia Program aimed at integrating digital health records into 80% of the country's healthcare facilities by 2024. This program includes telemedicine expansion and investments in cloud infrastructure, significantly boosting the market.

- Jakarta is the dominant region in Indonesia's digital health components market due to its advanced infrastructure, high population density, and growing adoption of digital health services. The region is home to several key players, making it a central hub for the market.

Indonesia Digital Health Components Market Segmentation

The Indonesia Digital Health Components Market is segmented by product type, end user, and region.

By Product Type:: Indonesia's digital health components market is segmented by product type into telemedicine platforms, wearable health devices, and digital health records. In 2023, telemedicine platforms hold the largest share, driven by the high demand for remote healthcare access. Halodoc and Alodokter dominate this segment due to their extensive user base and partnerships with healthcare providers.

By End User: The market is segmented into hospitals, clinics, and individual consumers. In 2023, hospitals dominate the market, accounting for the largest share. Digital health record systems and telemedicine services are widely adopted in urban hospitals, improving patient care and hospital efficiency.

|

Segment |

Sub-Segment |

Market Share (2023) |

|

Hospitals |

EHR Systems, Telemedicine |

50% |

|

Clinics |

Telemedicine Services |

30% |

|

Individual Consumers |

Wearable Health Devices |

20% |

By Region: The Indonesia Digital Health Components Market is segmented regionally into Jakarta, Java, Sumatra, Kalimantan, and Bali & Nusa Tenggara. In 2023, Jakarta dominates the digital health components market in Indonesia, driven by its advanced healthcare infrastructure, higher internet penetration, and large urban population.

Indonesia Digital Health Components Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Halodoc |

2016 |

Jakarta, Indonesia |

|

Alodokter |

2014 |

Jakarta, Indonesia |

|

SehatQ |

2018 |

Jakarta, Indonesia |

|

Good Doctor |

2019 |

Jakarta, Indonesia |

|

Gojek Health |

2020 |

Jakarta, Indonesia |

Halodoc (2023 Data): In 2024, the company is actively working to improve healthcare access in Indonesia, particularly in underserved regions. The company has raised significant funding including $135 million in a Series D round to enhance its digital health services and has a large user base of over 20 million monthly active users.

SehatQ (2023 Data): SehatQ secured a USD 20 million investment to scale its digital pharmacy network, providing medication delivery services to over 500 rural areas by mid-2024. This expansion is part of a broader strategy to integrate telemedicine and pharmacy services.

Good Doctor (2023 Data): Good Doctor introduced AI-driven diagnostics into its telemedicine services in 2023, improving diagnosis times and enhancing service quality. The company processed over 3 million consultations using this new feature by the end of the year.

Indonesia Digital Health Components Market Analysis

Indonesia Digital Health Components Market Growth Drivers

- Expansion of Telemedicine Services: In 2023, the Indonesian government has been heavily promoting telemedicine as part of its healthcare strategy. Companies such as Halodoc and Alodokter have seen a surge in user base, with Halodoc reporting of many users by the end of 2023. The Indonesian Ministry of Health has also collaborated with tech firms to expand telemedicine to rural areas, where access to healthcare is limited.

- Increased Healthcare Investments: In 2023, Indonesia saw a rise in healthcare investments aimed at digitalizing its medical infrastructure. SehatQ secured a USD 30 million investment in early 2023, which was channeled into expanding its telemedicine and digital pharmacy services. These investments reflect the growing trust in digital health platforms, driven by both public and private sector funding.

- Partnerships and Collaborations: Major players have formed strategic partnerships with healthcare providers and technology firms to enhance digital health services. For example, Alodokter collaborated with local clinics to extend telemedicine services, improving service accessibility and fostering market growth.

Indonesia Digital Health Components Market Challenges

- Digital Infrastructure Gaps (2023 Data): As of 2023, only 60% of rural healthcare facilities in Indonesia have access to reliable internet, which hampers the expansion of telemedicine services. This digital divide poses a significant challenge to market growth, particularly in remote regions.

- Data Privacy Concerns (2023 Data): With the rise of digital health services, concerns over patient data privacy have increased. In 2023, several telemedicine platforms faced scrutiny over data breaches, pushing the government to introduce stricter cybersecurity regulations.

Indonesia Digital Health Components Market Government Initiatives

- Healthy Indonesia Program: In 2023, the Indonesian government launched the Healthy Indonesia Program, which focuses on integrating digital health records into 80% of healthcare facilities by 2024. This initiative is crucial for improving healthcare efficiency and patient outcomes across the country.

- National Digital Health Strategy: In 2023, the Indonesian government unveiled its National Digital Health Strategy in 2023, which outlines a long-term plan for expanding the use of digital health technologies. The strategy includes key investments in cloud-based healthcare systems, AI-driven diagnostics, and the expansion of wearable health devices.

Indonesia Digital Health Components Market Future Market Outlook

The Indonesia Digital Health Components Market is expected to witness significant growth over the next five years, driven by increasing government investments, technological advancements, and the growing demand for digital healthcare services.

Future Trends

- Integration of AI in Healthcare (2028 Outlook): By 2028, AI-powered diagnostics and predictive analytics will play a crucial role in Indonesia's healthcare system. The government is expected to invest heavily in AI technologies, enabling faster diagnoses and improving patient outcomes across the country.

- Telemedicine to Become a Primary Healthcare Channel (2028 Outlook): Telemedicine will continue to grow, becoming a primary channel for healthcare delivery, especially in rural areas. By 2028, over 50 million Indonesians are expected to regularly use telemedicine platforms for consultations, driven by the expansion of internet access and government support.

- Wearable Devices and Preventive Healthcare (2028 Outlook):

Wearable health devices are projected to see widespread adoption by 2028, with over 10 million users. These devices will become integral to preventive healthcare, enabling continuous monitoring of vital health metrics and contributing to better disease prevention.

Scope of the Report

|

By Product Type |

Telemedicine Platforms Wearable Devices Digital Health Records |

|

By End User |

Hospitals Clinics Individual Consumers |

|

By Service Type |

Teleconsultation Diagnostics Digital Health Record Management |

|

By Technology Integration |

AI-powered Diagnostics Cloud Platforms Wearable Devices |

|

By Region |

Jakarta Java Sumatra Kalimantan Bali & Nusa Tenggara |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing to This Report:

Digital Health Companies

Healthcare Industries

Technology Solution Industries

Telemedicine Companies

Government and Regulatory Bodies (BPOM)

Investments and Venture Capitalist Firms

Insurance Companies

Pharmaceutical Companies

Telecommunication Companies

Time Period Captured in the Report

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Halodoc

Alodokter

SehatQ

Gojek Health

Good Doctor

GrabHealth

KlikDokter

ProSehat

Lifepal

SiapDok

Table of Contents

1. Indonesia Digital Health Components Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Digital Health Components Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Digital Health Components Market Analysis

3.1. Growth Drivers [Expansion of Telemedicine Services, Government Healthcare Initiatives, Technological Advancements, AI-driven Healthcare Solutions]

3.1.1. Telemedicine Expansion

3.1.2. Government Healthcare Initiatives (Healthy Indonesia Program)

3.1.3. Rising Demand for Wearable Devices

3.1.4. Investments in Digital Health Infrastructure

3.2. Market Challenges [Digital Infrastructure Gaps, Data Privacy Concerns, Regulatory Hurdles, Limited Digital Literacy]

3.2.1. Limited Access in Rural Areas

3.2.2. Data Privacy Regulations

3.2.3. Interoperability Issues in Healthcare Systems

3.2.4. Cybersecurity Threats

3.3. Opportunities [Healthcare Digitalization, Growing Consumer Demand for Digital Health, Telemedicine in Rural Regions]

3.3.1. Growth of Digital Health Records and EHR Systems

3.3.2. Expansion into Rural Healthcare Markets

3.3.3. Cloud-based Healthcare Platforms

3.4. Trends [Wearable Health Devices, AI Integration in Diagnostics, Remote Healthcare Solutions, Teleconsultations]

3.4.1. AI-powered Diagnostics and Predictive Analytics

3.4.2. Expansion of Telemedicine Services

3.4.3. Growth in Preventive Healthcare Solutions

3.4.4. Cloud-based Healthcare Records

3.5. Government Regulation [National Digital Health Strategy, Healthy Indonesia Program, Data Privacy Regulations, Cybersecurity Initiatives]

3.5.1. National Healthcare Digitalization Framework

3.5.2. Compliance and Data Protection Regulations

3.5.3. Government Investments in Cloud Infrastructure

4. Indonesia Digital Health Components Market Segmentation

4.1. By Product Type (In Value %) [Telemedicine Platforms, Wearable Devices, Digital Health Records]

4.1.1. Telemedicine Platforms

4.1.2. Wearable Health Devices

4.1.3. Digital Health Record Systems

4.2. By End User (In Value %) [Hospitals, Clinics, Individual Consumers]

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Individual Consumers

4.3. By Service Type (In Value %) [Teleconsultation, Digital Health Record Management, Diagnostics]

4.3.1. Teleconsultation Services

4.3.2. EHR Management

4.3.3. AI-based Diagnostics

4.4. By Technology Integration (In Value %) [AI, Cloud-based Solutions, Wearable Devices]

4.4.1. AI-powered Solutions

4.4.2. Cloud-based Healthcare Platforms

4.4.3. Wearable Health Devices

4.5. By Region (In Value %) [Jakarta, Java, Sumatra, Kalimantan, Bali & Nusa Tenggara]

5. Indonesia Digital Health Components Market Competitive Landscape

5.1. Detailed Profiles of Major Companies

5.1.1. Halodoc

5.1.2. Alodokter

5.1.3. SehatQ

5.1.4. Good Doctor

5.1.5. Gojek Health

5.1.6. GrabHealth

5.1.7. KlikDokter

5.1.8. ProSehat

5.1.9. Lifepal

5.1.10. SiapDok

5.1.11. Medigo

5.1.12. DokterSehat

5.1.13. GetDoc

5.1.14. Medis Online

5.1.15. Trustmedis

5.2. Cross Comparison Parameters (Headquarters, Inception Year, User Base, Revenue, AI Integration, Teleconsultation Capacity, Digital Record Management, Service Expansion)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Digital Health Components Market Regulatory Framework

6.1. Data Privacy and Protection Laws

6.2. National Digital Health Integration Guidelines

6.3. Healthcare Technology Compliance Standards

6.4. Digital Health Licensing and Certifications

7. Indonesia Digital Health Components Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Growth

8. Indonesia Digital Health Components Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By End User (In Value %)

8.3. By Service Type (In Value %)

8.4. By Technology Integration (In Value %)

8.5. By Region (In Value %)

9. Indonesia Digital Health Components Market Analysts’ Recommendations

9.1. Customer Cohort Analysis

9.2. Strategic Partnerships and Collaborations

9.3. White Space Opportunity Analysis

9.4. TAM/SAM/SOM Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around the Market to collate Market-level information.

Step: 2 Market Building

Collating statistics on the Indonesia Digital Health Components Market over the years, and analyzing the penetration of Marketplaces as well as the ratio of service providers to compute the revenue generated for the market. We will also review service quality statistics to understand the revenue generated which can ensure accuracy behind the data points shared.

Step: 3 Validating and Finalizing

Building Market hypotheses and conducting CATIs with Market experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step: 4 Research Output

Our team will approach multiple Digital Health Components companies to understand the nature of service segments, consumer preferences, and other parameters. This supports validating statistics derived through a bottom-to-top approach from these Digital Health Components companies, ensuring accuracy and reliability in the report.

Frequently Asked Questions

01. How big is the Indonesia Digital Health Components Market?

The Indonesia Digital Health Components Market was valued at USD 2.18 billion in 2023, driven by increasing telemedicine adoption, government investments in digital healthcare infrastructure, and the growing use of digital health records.

02. What are the challenges in the Indonesia Digital Health Components Market?

Challenges include limited digital infrastructure in rural areas, which restricts the reach of digital health services. Additionally, data privacy concerns and the lack of digital literacy among healthcare workers pose significant hurdles to market growth.

03. Who are the major players in the Indonesia Digital Health Components Market?

Key players include Halodoc, Alodokter, SehatQ, Good Doctor, and Gojek Health. These companies dominate the market due to their robust telemedicine platforms, strong partnerships with healthcare providers, and extensive user bases.

04. What are the growth drivers of the Indonesia Digital Health Components Market?

Growth drivers include the expansion of telemedicine services, increased government investments in digital health infrastructure, and the rising demand for remote healthcare solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.