Indonesia Digital Health Market Outlook to 2030

Region:Asia

Author(s):Abhinav kumar

Product Code:KROD4386

December 2024

83

About the Report

Indonesia Digital Health Market Overview

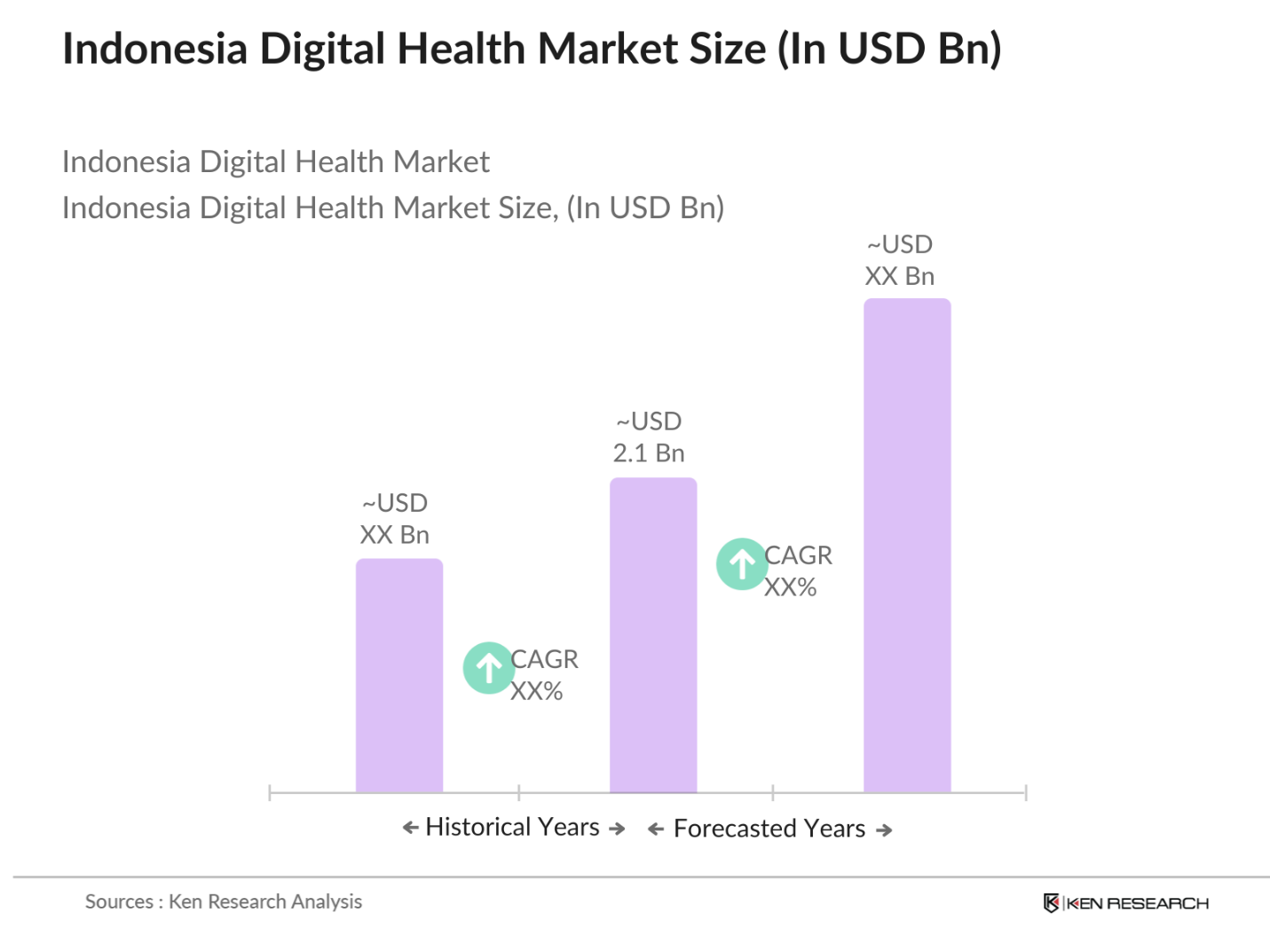

- The Indonesia Digital Health market is valued at USD 2.1 billion, driven primarily by the rapid adoption of telemedicine and e-health services across urban centers. With a significant rise in internet and smartphone penetration, alongside government support for health digitalization initiatives, the digital health sector has seen consistent growth over the past five years. The market's expansion is further propelled by the increasing demand for accessible healthcare solutions, particularly in remote regions, as more Indonesians rely on mobile health apps for medical consultations and prescriptions.

- Dominant regions in the Indonesia Digital Health market include Jakarta, West Java, and Central Java, which lead due to their advanced digital infrastructure and higher urban population density. The presence of key digital health players in these cities, combined with a robust healthcare framework, positions them as central hubs for the market. These cities also attract investment from both local and international health tech startups, reinforcing their dominance in the digital health landscape.

- The National Health Digital Transformation Roadmap, initiated in 2022, outlines Indonesias long-term strategy to enhance healthcare through digital technology. This policy aims to digitize medical records, expand telemedicine services, and develop a comprehensive e-health infrastructure across the nation. As of 2023, IDR 25 trillion has been allocated for these projects, with key targets including the implementation of telemedicine in 80% of healthcare facilities by 2025. The roadmap is a major pillar in Indonesias efforts to modernize its healthcare system.

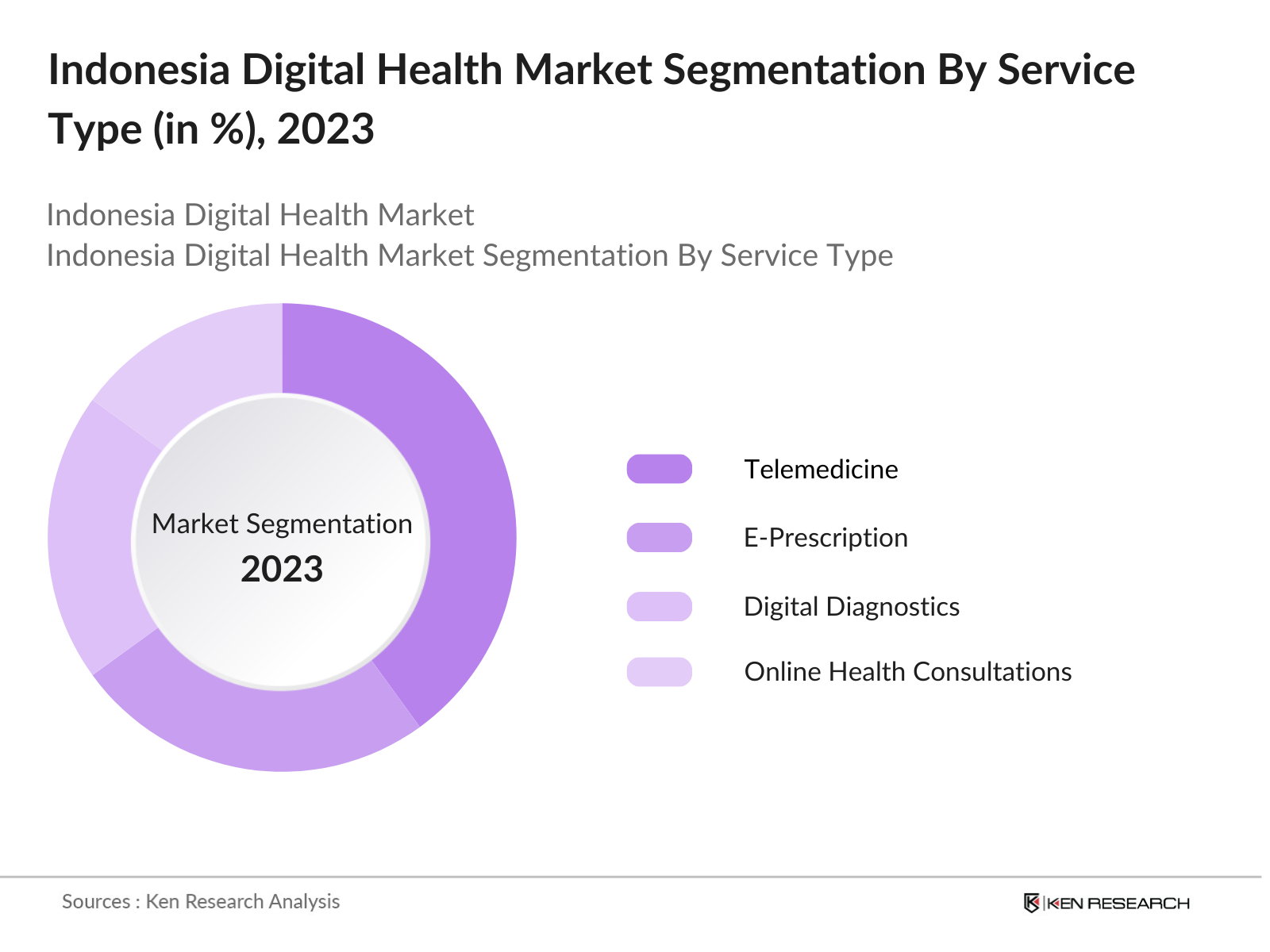

Indonesia Digital Health Market Segmentation

By Service Type: The Indonesia Digital Health market is segmented by service type into telemedicine, e-prescription, digital diagnostics, and online health consultations. Among these, telemedicine commands the highest market share, driven by the growing need for remote healthcare services, especially in rural areas where medical facilities are scarce. Telemedicine platforms have flourished due to the ease with which patients can access medical professionals via smartphones, reducing the need for in-person visits and significantly improving healthcare accessibility in Indonesia.

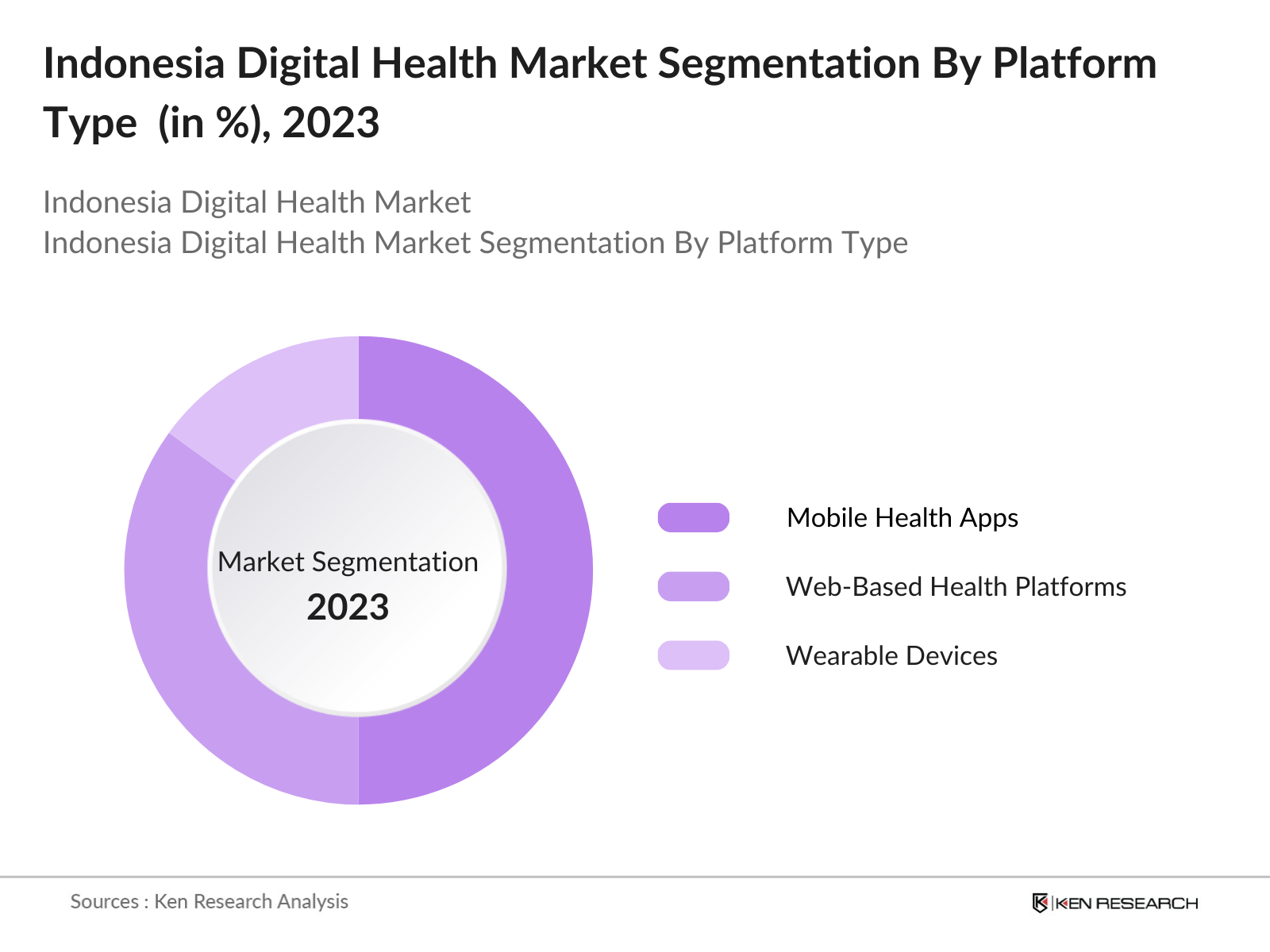

By Platform: Indonesia Digital Health is further segmented by platform into mobile health apps, web-based health platforms, and wearable devices. Mobile health apps are currently the dominant platform, holding the largest market share due to the increasing smartphone penetration across the country. These apps offer a wide range of services, from booking medical appointments to receiving digital prescriptions, making healthcare more accessible for the tech-savvy population. Moreover, the rise of health apps during the COVID-19 pandemic has further cemented their role as indispensable tools in the countrys healthcare ecosystem.

Indonesia Digital Health Market Competitive Landscape

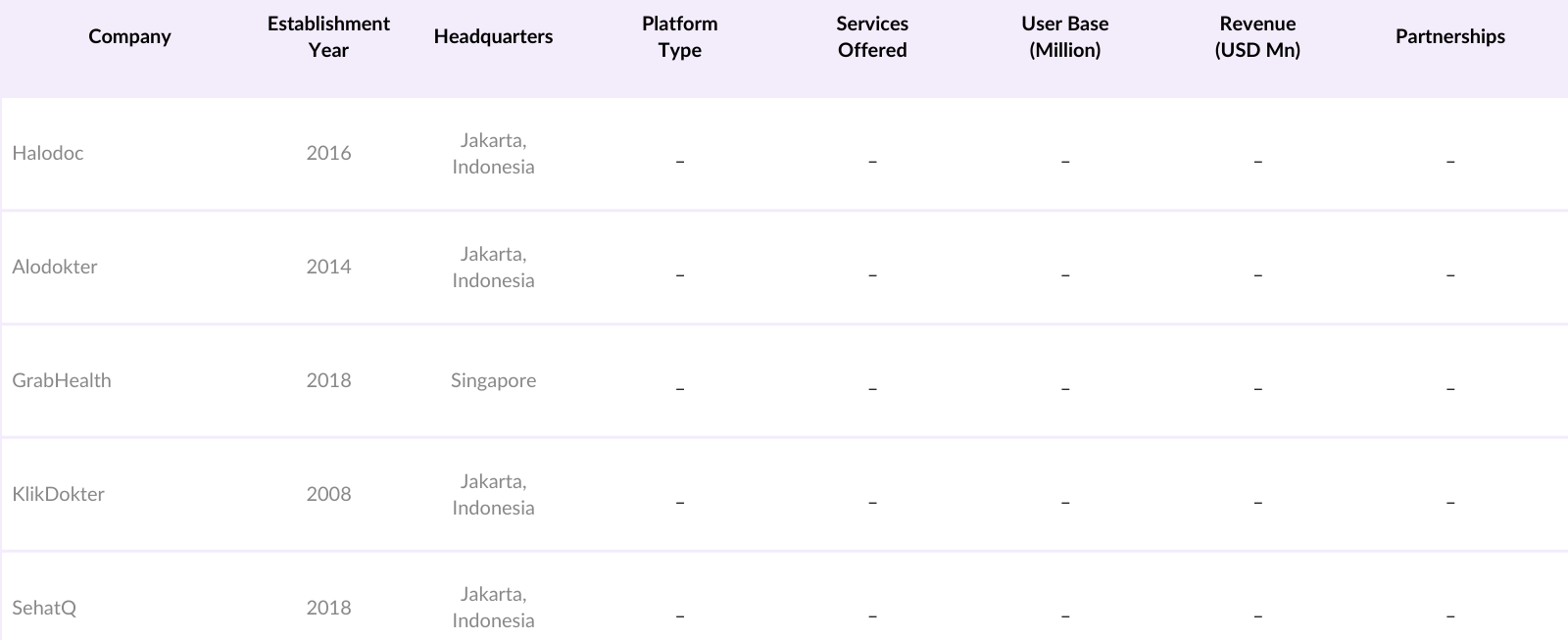

The Indonesia Digital Health market is dominated by key players, both local and international, who are driving the expansion of digital healthcare solutions. The market features strong competition, with companies continuously innovating to improve their service offerings. Local firms such as Halodoc and Alodokter lead the market with robust user bases, while global platforms like GrabHealth also contribute to the competitive landscape. This consolidation of players underscores the significant influence these companies hold, as they collaborate with healthcare providers, insurance firms, and government bodies to further digitalize the healthcare system.

Indonesia Digital Health Industry Analysis

Growth Drivers

- Increasing Internet and Smartphone Penetration: The surge in internet and smartphone penetration across Indonesia has greatly influenced the adoption of digital health solutions. By 2023, the Indonesian government reported that over 202 million people, or approximately 73% of the population, had access to the internet, with 94% of users accessing it via smartphones. This increasing connectivity has facilitated access to e-health platforms, enabling millions to consult healthcare professionals remotely. Furthermore, the Ministry of Communications and Informatics has outlined plans to expand 4G networks to rural areas, further supporting digital health integration.

- Government Support for Health Digitalization: The Indonesian government has shown strong support for the digitalization of healthcare through initiatives like the National Health Digital Transformation Roadmap launched in 2022. This policy aims to enhance the quality of healthcare services by leveraging telemedicine and digital health platforms, especially within public health systems. Additionally, the government allocated IDR 25 trillion to healthcare digital transformation projects in 2023, focusing on telemedicine and electronic medical records, ensuring the system's expansion across the country.

- Rising Demand for Telemedicine: Telemedicine has seen substantial growth in Indonesia, driven by increasing demand from patients seeking convenient and remote healthcare options. According to Indonesias Ministry of Health, over 5 million telemedicine consultations occurred in 2023, compared to less than 1 million in 2020. This growth reflects a growing shift in patient preference for digital platforms, particularly as rural populations gain access to better internet connectivity. The demand for telemedicine services is further supported by initiatives such as Indonesias Healthy Indonesia Program which promotes digital healthcare in remote areas.

Market Challenges

- Lack of Digital Infrastructure in Rural Areas: While Indonesia has made significant strides in expanding internet coverage, many rural areas still lack sufficient digital infrastructure to support comprehensive e-health services. As of 2023, the Ministry of Communications and Informatics reported that approximately 10,000 villages still do not have access to reliable 4G networks, limiting the reach of telemedicine and other digital health services in these regions. The lack of high-speed internet in rural and remote areas remains a significant challenge for the nationwide adoption of digital healthcare platforms.

- Data Privacy and Security Concerns: Data privacy and security remain significant concerns within Indonesias digital health sector. The introduction of the Personal Data Protection Law in 2022 aimed to regulate how health data is collected, stored, and shared across platforms. However, healthcare providers continue to face challenges in implementing secure digital infrastructure. Reports from Indonesias Ministry of Health indicate that over 60% of healthcare facilities lack adequate cybersecurity measures, raising concerns about potential data breaches. This is a critical issue that the government is working to address with further regulatory frameworks

Indonesia Digital Health Market Future Outlook

The Indonesia Digital Health market is poised for remarkable growth over the next five years, driven by a combination of government support, the expansion of digital infrastructure, and increasing consumer demand for accessible healthcare solutions. The government's push for digitalization in healthcare, alongside the rise of health-tech startups, is expected to lead to a wider adoption of telemedicine, AI-driven diagnostics, and mobile health platforms. In addition, advancements in internet penetration and the growing popularity of wearable health devices will further boost market growth, positioning Indonesia as a leading digital health market in Southeast Asia.

Opportunities

- Expansion of E-health Platforms: The expansion of e-health platforms presents a major opportunity for growth in Indonesias digital health market. With the increasing availability of smartphones and internet services, e-health platforms are expected to reach a larger portion of the population. In 2023, over 45 million Indonesians used e-health apps, according to the Ministry of Health, and the number is projected to rise with continued improvements in infrastructure. The governments E-Health Roadmap also promotes the integration of these platforms into the national healthcare system, opening new doors for public and private sector partnerships.

- Public-Private Partnerships in Healthcare Technology: Public-private partnerships (PPPs) are expected to play a crucial role in the future of Indonesias digital health sector. In 2023, the government announced several partnerships with private tech companies to improve digital healthcare access. For instance, Indonesia partnered with Telkom Indonesia to enhance telemedicine services in rural areas by utilizing their extensive network infrastructure. These collaborations are essential in overcoming infrastructure challenges and supporting the deployment of advanced healthcare technologies

Scope of the Report

|

Service Type |

Telemedicine E-Prescription Digital Diagnostics Online Health Consultations |

|

Platform |

Mobile Health Apps Web-based Health Platforms Wearable Devices |

|

End-User |

Hospitals Clinics Individual Patients Corporate Wellness Programs |

|

|

Artificial Intelligence (AI) Internet of Medical Things (IoMT) Blockchain |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, Ministry of Communication and Information Technology)

Digital Health Companies

Healthcare Companies

Telemedicine Industries

Insurance Companies

Pharmaceutical Companies

Medical Device Companies

Companies

Major Players in Indonesia Digital Health Market

Halodoc

Alodokter

GrabHealth

KlikDokter

SehatQ

Lifepack

Medigo

DoctorOnCall

FitHappy

VSee

Praktis

Jovee

HealthHub

Dokita

Bio Farma Digital

Table of Contents

1. Indonesia Digital Health Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Growth Rate

1.4 Market Segmentation Overview

2. Indonesia Digital Health Market Size (In USD Bn)

2.1 Historical Market Size

2.2 Year-On-Year Growth Analysis

2.3 Key Market Developments and Milestones

3. Indonesia Digital Health Market Analysis

3.1 Growth Drivers

3.1.1. Increasing Internet and Smartphone Penetration

3.1.2. Government Support for Health Digitalization

3.1.3. Rising Demand for Telemedicine

3.1.4. Growth in Digital Health Startups

3.2 Market Challenges

3.2.1. Lack of Digital Infrastructure in Rural Areas

3.2.2. Data Privacy and Security Concerns

3.2.3. High Initial Implementation Costs

3.3 Opportunities

3.3.1. Expansion of E-health Platforms

3.3.2. Public-Private Partnerships in Healthcare Technology

3.3.3. Adoption of AI and Machine Learning in Health Services

3.4 Trends

3.4.1. Adoption of AI-Driven Diagnostic Tools

3.4.2. Integration of Wearables in Healthcare Monitoring

3.4.3. Growth of Digital Therapeutics

3.5 Government Regulation

3.5.1. Indonesias National Health Digital Transformation Roadmap

3.5.2. Regulations on Telemedicine Platforms

3.5.3. Compliance with Health Data Protection Laws

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces

3.9 Competition Ecosystem

4. Indonesia Digital Health Market Segmentation

4.1 By Service Type (In Value %)

4.1.1 Telemedicine

4.1.2 E-Prescription

4.1.3 Digital Diagnostics

4.1.4 Online Health Consultations

4.2 By Platform (In Value %)

4.2.1 Mobile Health Apps

4.2.2 Web-based Health Platforms

4.2.3 Wearable Devices

4.3 By End-User (In Value %)

4.3.1 Hospitals

4.3.2 Clinics

4.3.3 Individual Patients

4.3.4 Corporate Wellness Programs

4.4 By Technology (In Value %)

4.4.1 Artificial Intelligence (AI)

4.4.2 Internet of Medical Things (IoMT)

4.4.3 Blockchain

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Digital Health Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Halodoc

5.1.2 Alodokter

5.1.3 Gojek Health (via GoMed)

5.1.4 GrabHealth

5.1.5 KlikDokter

5.1.6 SehatQ

5.1.7 HealthHub

5.1.8 Praktis

5.1.9 Lifepack

5.1.10 DoctorOnCall

5.1.11 VSee

5.1.12 Medigo

5.1.13 Dokita

5.1.14 Jovee

5.1.15 FitHappy

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue, R&D Spend, Technology Adoption, Market Presence, Regional Focus)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers And Acquisitions

5.6 Investment Analysis

5.7 Venture Capital Funding

5.8 Government Grants

5.9 Private Equity Investments

6. Indonesia Digital Health Market Regulatory Framework

6.1 Telemedicine Licensing Standards

6.2 Health Data Privacy Compliance (PDPA)

6.3 Digital Health Platform Accreditation Processes

7. Indonesia Digital Health Future Market Size (In USD Bn)

7.1 Future Market Size Projections

7.2 Key Factors Driving Future Market Growth

8. Indonesia Digital Health Future Market Segmentation

8.1 By Service Type (In Value %)

8.2 By Platform (In Value %)

8.3 By End-User (In Value %)

8.4 By Technology (In Value %)

8.5 By Region (In Value %)

9. Indonesia Digital Health Market Analysts Recommendations

9.1 TAM/SAM/SOM Analysis

9.2 Customer Cohort Analysis

9.3 Marketing Initiatives

9.4 White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The research process began with constructing an ecosystem map encompassing all key stakeholders in the Indonesia Digital Health market. This involved extensive desk research, utilizing a combination of secondary and proprietary databases to gather industry-level information and define the critical variables that influence the market.

Step 2: Market Analysis and Construction

In this phase, historical data on the Indonesia Digital Health market was compiled and analyzed, including telemedicine adoption, mobile health platform usage, and revenue generated by the key players. This analysis provided insight into current market dynamics and the distribution of digital health services across urban and rural regions.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and growth drivers were developed and validated through interviews with industry experts from key digital health companies. This consultation provided operational and financial insights, which were instrumental in refining and corroborating market data.

Step 4: Research Synthesis and Final Output

The final phase involved engaging with digital health service providers to acquire detailed insights into product segments, user preferences, and technological advancements. This interaction helped verify the findings from the bottom-up approach, ensuring a comprehensive and accurate analysis of the Indonesia Digital Health market.

Frequently Asked Questions

01. How big is the Indonesia Digital Health Market?

The Indonesia Digital Health market is valued at USD 2.1 billion, driven by the growing demand for telemedicine and the increased use of mobile health platforms, particularly in urban areas.

02. What are the challenges in the Indonesia Digital Health Market?

Challenges include limited digital infrastructure in rural areas, data privacy concerns, and high initial costs for implementing advanced technologies such as AI and IoMT.

03. Who are the major players in the Indonesia Digital Health Market?

Major players include Halodoc, Alodokter, GrabHealth, KlikDokter, and SehatQ, which lead the market with their comprehensive digital health services and partnerships with healthcare providers.

04. What are the growth drivers of the Indonesia Digital Health Market?

The market is driven by factors such as increasing internet and smartphone penetration, government support for health digitalization, and rising demand for telemedicine and e-prescription services.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.