Indonesia Digital Media Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD7998

October 2024

100

About the Report

Indonesia Digital Media Market Overview

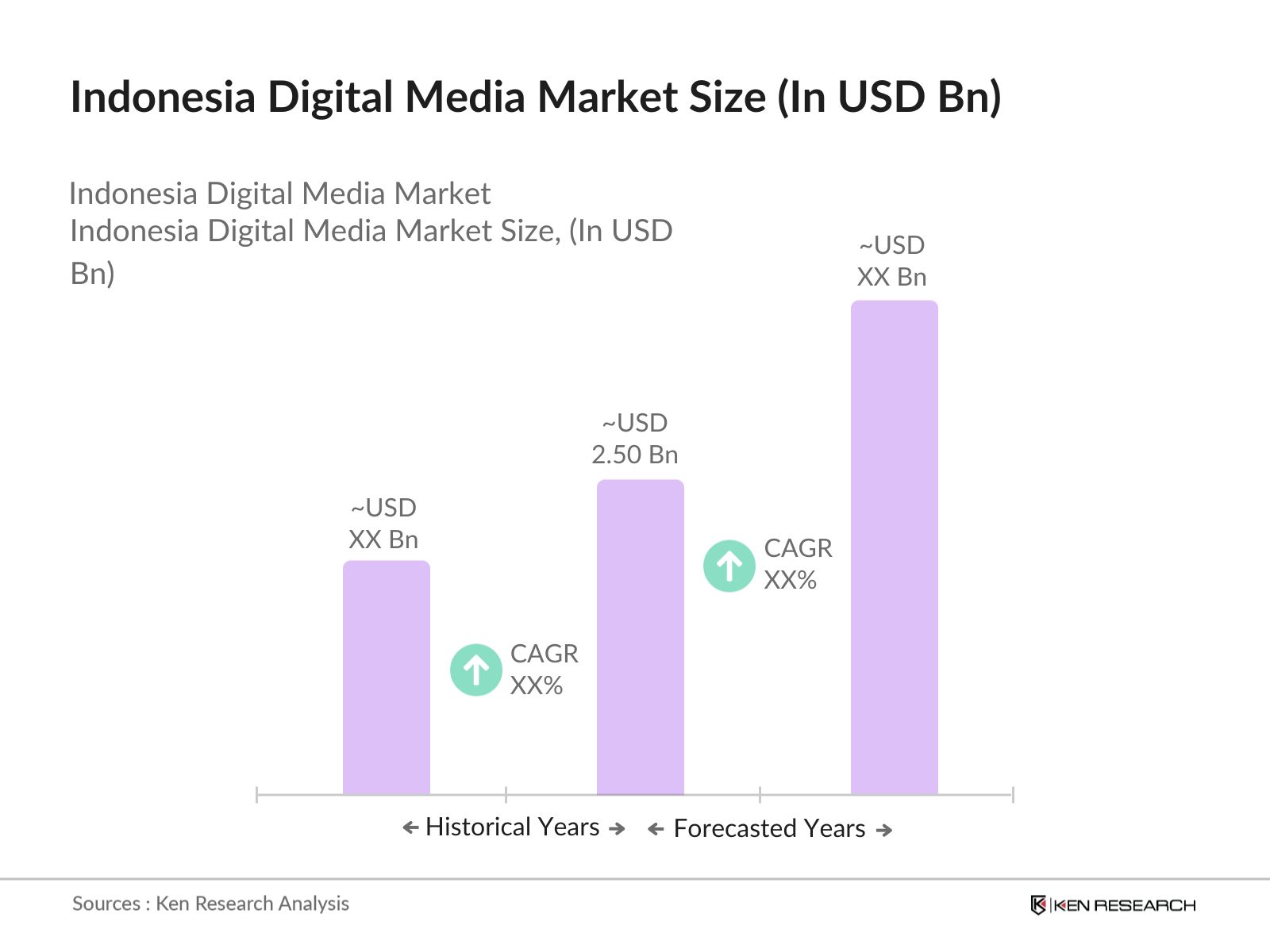

- The Indonesia digital media market is valued at USD 2.50 billion based on a five-year historical analysis. This growth is driven by the countrys rapid digitalization, fueled by a rise in internet and mobile penetration. The increasing adoption of smartphones, combined with the popularity of social media platforms and the expansion of OTT (Over-The-Top) content streaming services, have significantly contributed to market growth. Government initiatives supporting the digital economy, including incentives and frameworks to improve online businesses and digital payments, further accelerate market development.

- Dominant cities such as Jakarta, Surabaya, and Bandung lead the digital media market due to their large urban populations, better internet infrastructure, and strong consumer spending on digital platforms. These cities host numerous tech companies, e-commerce platforms, and digital content creators, making them the epicenter of digital innovation in the country. The concentration of businesses and consumers in these urban areas leads to a significant demand for digital content, services, and advertising.

- Indonesias digital economy is governed by a comprehensive national digital strategy, which prioritizes the development of e-commerce, digital payments, and cybersecurity. In 2024, the government continued to promote its "100 Smart Cities" initiative, aiming to foster digital transformation across urban areas. Regulatory policies focus on boosting local digital content creation, improving cybersecurity standards, and encouraging foreign investments in the digital sector. This framework has created a favorable environment for the digital media industry to flourish, supporting the growth of both local and global digital platforms operating in Indonesia.

Indonesia Digital Media Market Segmentation

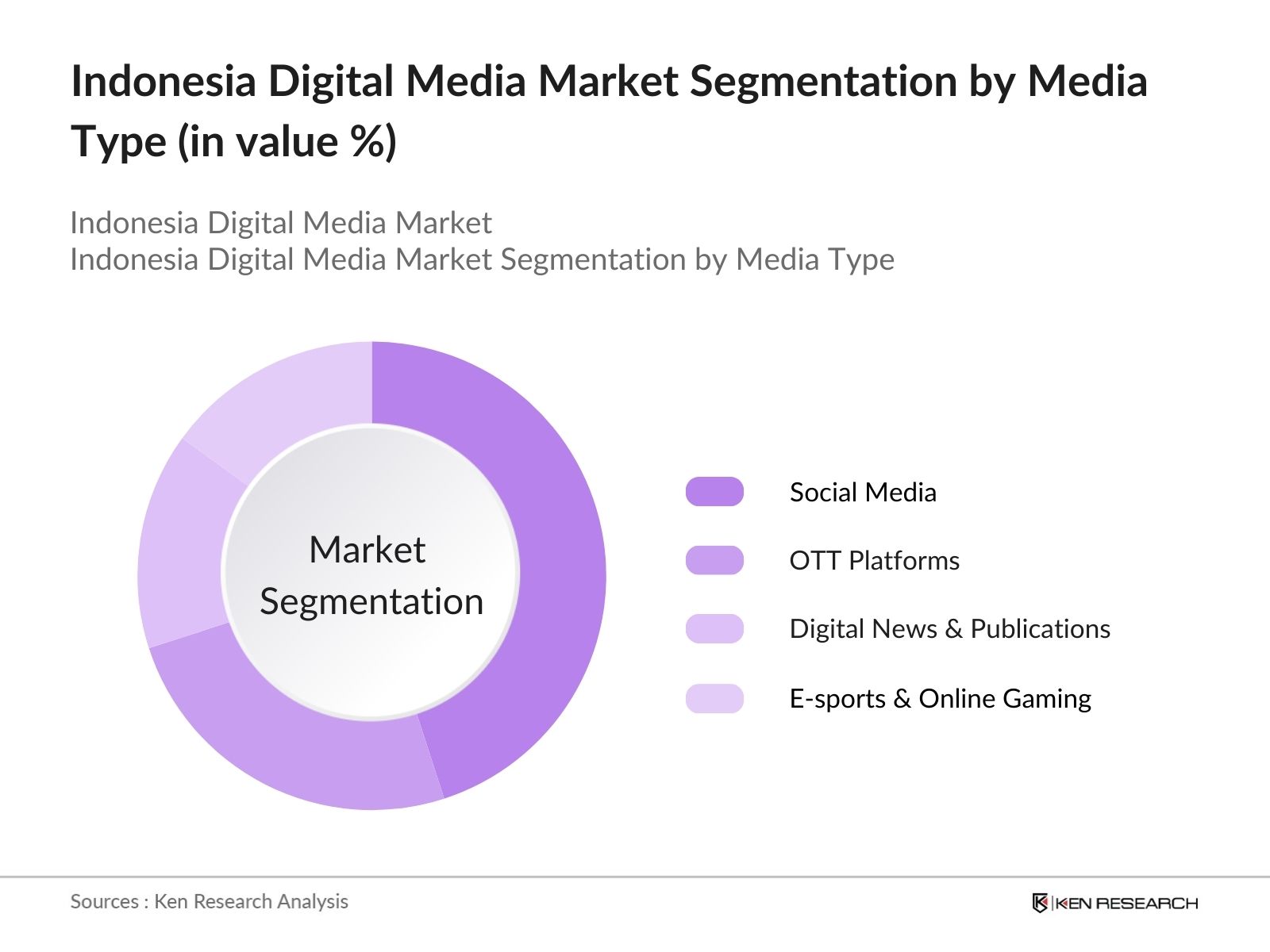

- By Media Type: The Indonesia digital media market is segmented by media type into social media, OTT platforms, digital news and publications, e-sports and online gaming, and digital advertising. Recently, social media has captured the largest market share due to its widespread use by consumers of all age groups. Platforms like Facebook, Instagram, and TikTok have successfully maintained user engagement through interactive content, influencer marketing, and social commerce integration. As a result, these platforms have become primary channels for advertising, content consumption, and direct-to-consumer sales, driving their dominance in the market.

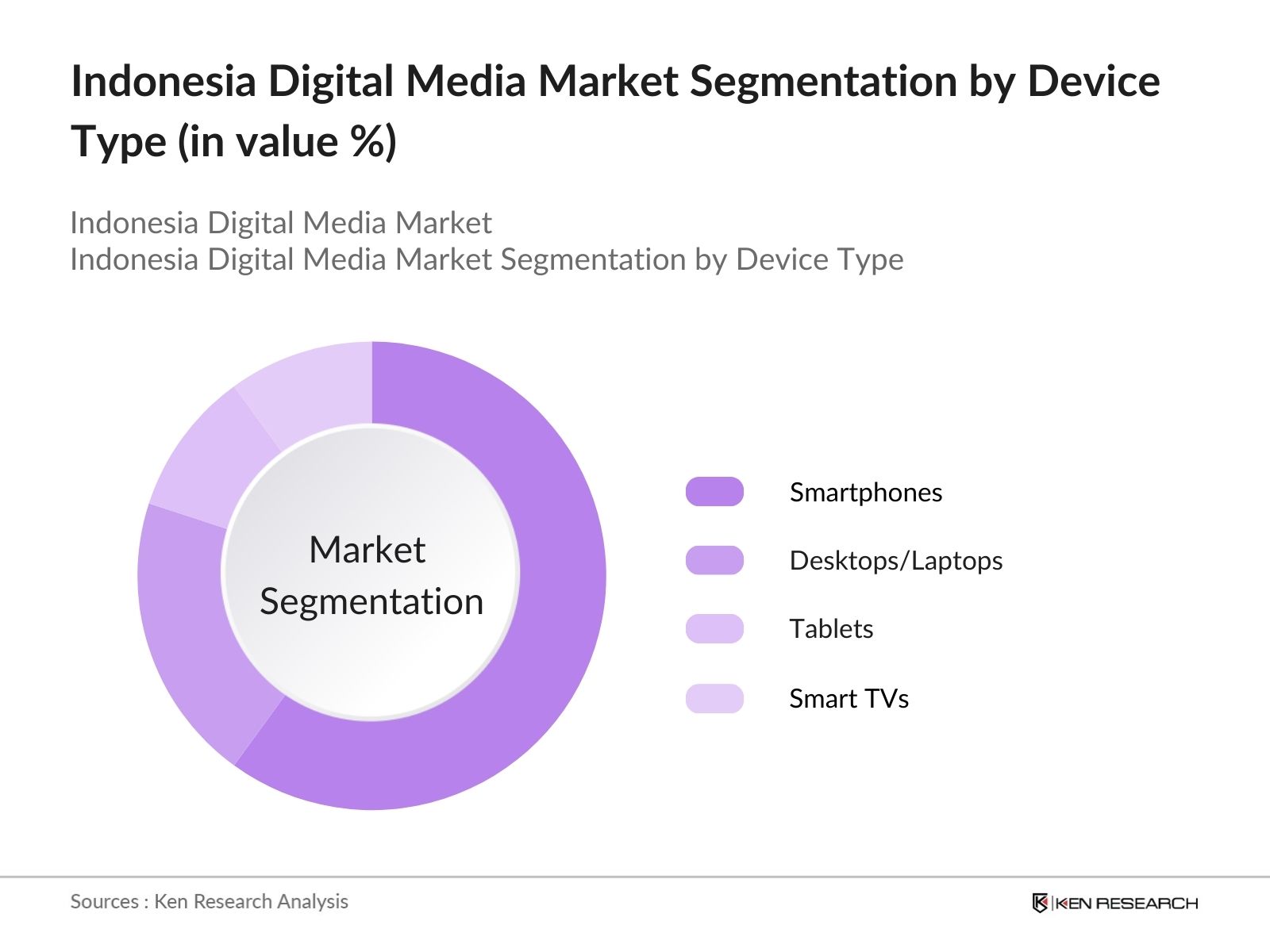

- By Device Type: The Indonesia digital media market is further segmented by device type into smartphones, desktops/laptops, tablets, smart TVs, and other connected devices. Among these, smartphones hold the dominant share due to the growing affordability of devices, improved mobile internet access, and increasing digital consumption patterns, particularly in rural and semi-urban areas. Indonesians prefer mobile platforms for accessing social media, streaming services, and gaming, as they provide portability and convenience. Brands are optimizing their services for mobile, further fueling this trend.

Indonesia Digital Media Market Competitive Landscape

The Indonesia digital media market is highly competitive, with both local and international players influencing the market's dynamics. Large e-commerce players like GoTo Group (merging Gojek and Tokopedia) and Bukalapak have a dominant presence in digital commerce and advertising. Similarly, OTT platforms like Vidio and global players like Netflix and Disney+ continue to expand their reach by offering localized content and strategic partnerships. This competition has led to a rapidly evolving landscape with companies striving to enhance user engagement and diversify content offerings.

|

Company |

Year of Establishment |

Headquarters |

Revenue (2023) |

Active User Base |

Content Partnerships |

Subscription Growth |

Local Content Investments |

Advertising Revenue |

|

GoTo Group |

2021 |

Jakarta |

||||||

|

Bukalapak |

2010 |

Jakarta |

||||||

|

Vidio |

2014 |

Jakarta |

||||||

|

Netflix Indonesia |

2016 |

Global/Indonesia |

||||||

|

Kompas TV |

1996 |

Jakarta |

Indonesia Digital Media Industry Analysis

Growth Drivers

- Rapid Digitalization (Penetration of Internet and Digital Services) Indonesia has seen rapid digitalization, with over 205 million internet users in 2024, accounting for a substantial part of its 280 million population. Internet services have become essential for communication, entertainment, and business activities, driven by government initiatives aimed at boosting digital literacy and infrastructure development. Internet penetration, particularly in urban areas, is driven by fiber-optic expansions and increased demand for online services like education and e-commerce. The countrys growing reliance on digital platforms is supported by World Bank data showing an increase in digital infrastructure investments by both public and private sectors.

- Expanding Mobile Connectivity (Mobile Usage, Smartphone Penetration) Mobile connectivity in Indonesia has expanded significantly, with over 370 million mobile connections reported in 2023. Around 70% of the population uses smartphones, with the number growing steadily, driven by affordable device options and expanding 4G networks. The shift towards mobile-first internet usage makes Indonesia one of the most connected countries in Southeast Asia. Increased smartphone penetration is largely attributed to the availability of low-cost smartphones and improvements in telecom infrastructure, particularly in urban centers. The mobile-first strategy has fueled the digital economy, particularly for social media and e-commerce services.

- Social Media Dominance (Active User Base, Platform Usage) As of 2024, Indonesia is home to over 191 million active social media users. Platforms like WhatsApp, Instagram, and Facebook dominate, with a considerable portion of the population using these networks for communication, entertainment, and business. Indonesias active user base is one of the largest globally, driven by the widespread availability of affordable smartphones and data packages. Social media usage is also a critical factor in digital marketing, with businesses increasingly using influencers and targeted advertising to reach consumers. This growth is fueled by the countrys youthful demographics and tech-savvy population.

Market Restraints

- Limited Digital Infrastructure (Rural Area Connectivity, Bandwidth Issues) Despite the progress in urban areas, Indonesias rural regions still face significant digital infrastructure gaps, limiting connectivity and digital service access. In 2024, approximately 20% of the population, predominantly in rural and remote areas, has limited or no internet access. The lack of high-speed internet in these regions creates a digital divide that slows down the growth of digital media and other internet-dependent industries. Bandwidth issues further exacerbate the problem, with slow internet speeds affecting the quality of digital services, particularly video streaming and e-commerce.

- High Competition (Digital Media Providers, Content Saturation) Indonesia's digital media landscape is highly competitive, with an influx of local and international players offering similar services. As of 2024, content providers face intense competition, particularly in sectors like OTT streaming and digital advertising, leading to market saturation. Popular platforms like YouTube, TikTok, and local streaming services like Vidio have flooded the market with content, making it difficult for new entrants to gain a foothold. This competition has also led to content redundancy, with many platforms struggling to offer differentiated content that keeps users engaged.

Indonesia Digital Media Market Future Outlook

Over the next five years, the Indonesia digital media market is expected to grow significantly, driven by advancements in mobile connectivity, increased 5G deployment, and the rising influence of digital advertising. The proliferation of online content, including localized programming on OTT platforms and the growing prominence of social commerce, will continue to shape consumer behavior and drive revenue growth. Key sectors such as online gaming and e-sports are likely to see increased investment, reflecting broader global trends toward interactive entertainment and digital engagement.

Market Opportunities

- Growth in E-commerce (Digital Payment Systems, Marketplace Platforms) E-commerce in Indonesia continues to grow, driven by a combination of digital payment systems and the rise of marketplace platforms like Tokopedia and Shopee. In 2024, over 40 million Indonesians used digital payment services, and e-commerce transactions surpassed $40 billion. The government has introduced policies that encourage cashless transactions, contributing to the rapid adoption of digital wallets and online banking. This shift has created opportunities for digital media platforms to monetize through advertising and partnerships with e-commerce providers.

- Development of OTT Platforms (Streaming Services, Local Content Creation) Indonesias OTT platform market is booming, with significant investments in local content creation. In 2024, OTT platforms, including Vidio and Disney+ Hotstar, reached over 25 million active users. Local content creation is also on the rise, with government support for the production of culturally relevant films and series. This creates an opportunity for growth in local-language content and partnerships between global streaming platforms and Indonesian content creators. As internet connectivity improves, particularly in rural areas, these services are expected to reach a broader audience.

Scope of the Report

|

Media Type |

Social Media, OTT Platforms, Digital News, E-Sports, Digital Advertising |

|

Device Type |

Smartphones, Desktops/Laptops, Tablets, Smart TVs, Connected Devices |

|

Revenue Model |

Subscription-Based, Advertising-Based, Pay-Per-View, Freemium |

|

Industry Application |

Entertainment, Education, News, E-commerce, Advertising & Marketing |

|

Region |

Java, Sumatra, Kalimantan, Sulawesi, Papua |

Products

Key Target Audience

Digital Media Companies

Content Creators

E-commerce Companies

Mobile Network Providers

Government and Regulatory Bodies (Ministry of Communication and Information Technology)

Advertising Agencies

Investors and Venture Capital Firms

OTT and Streaming Platforms

Companies

Players Mentioned in the Report:

GoTo Group

Bukalapak

Vidio

Kompas TV

Netflix Indonesia

Blibli

Detik.com

RCTI+

Emtek Group

Traveloka

Tokopedia

Grab Indonesia

Mola TV

HOOQ

Disney+ Hotstar

Table of Contents

1. Indonesia Digital Media Market Overview

Definition and Scope

Market Taxonomy

Market Growth Rate

Market Segmentation Overview

2. Indonesia Digital Media Market Size (In USD Bn)

Historical Market Size

Year-On-Year Growth Analysis

Key Market Developments and Milestones

3. Indonesia Digital Media Market Analysis

3.1 Growth Drivers

Rapid Digitalization (Penetration of Internet and Digital Services)

Expanding Mobile Connectivity (Mobile Usage, Smartphone Penetration)

Social Media Dominance (Active User Base, Platform Usage)

Government Initiatives for Digital Economy (Regulatory Support, Digital Transformation Policies)

3.2 Market Challenges

Limited Digital Infrastructure (Rural Area Connectivity, Bandwidth Issues)

High Competition (Digital Media Providers, Content Saturation)

Cybersecurity Concerns (Digital Privacy, Online Fraud)

Monetization Issues (Content Monetization, Advertising Revenue)

3.3 Opportunities

Growth in E-commerce (Digital Payment Systems, Marketplace Platforms)

Development of OTT Platforms (Streaming Services, Local Content Creation)

Increased Penetration of 5G Networks (High-Speed Data Access, New Content Formats)

Rise of Influencer Marketing (Content Creators, Direct-to-Consumer Channels)

3.4 Trends

Growth in Video Content Consumption (Short-Form, Long-Form Content, VOD)

Digital Advertising Evolution (Programmatic Ads, AI in Targeting)

Expansion of E-Sports and Online Gaming (User Engagement, Tournament Sponsorship)

Growth in Podcasting and Audio Streaming (Audio Content Monetization, Regional Language Content)

3.5 Government Regulation

Digital Economy Framework (National Digital Strategy, Regulatory Policies)

Intellectual Property Rights in Digital Media (Content Protection, Copyright Enforcement)

Digital Advertising Laws (Consumer Protection, Ad Transparency)

Taxation of Digital Services (VAT on Digital Platforms, E-commerce Regulations)

SWOT Analysis

Stakeholder Ecosystem

Porters Five Forces Analysis

Competition Ecosystem

4. Indonesia Digital Media Market Segmentation

4.1 By Media Type (In Value %)

Social Media

OTT Platforms

Digital News and Publications

E-Sports & Online Gaming

Digital Advertising

4.2 By Device Type (In Value %)

Smartphones

Desktops/Laptops

Tablets

Smart TVs

Other Connected Devices

4.3 By Revenue Model (In Value %)

Subscription-Based

Advertising-Based

Pay-Per-View

Freemium

4.4 By Industry Application (In Value %)

Entertainment

Education

News & Information

E-commerce

Advertising & Marketing

4.5 By Region (In Value %)

Java

Sumatra

Kalimantan

Sulawesi

Papua

5. Indonesia Digital Media Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

GoTo Group

Bukalapak

Vidio

RCTI+

Kompas TV

Emtek Group

Traveloka

Blibli

Tokopedia

Detik.com

Mola TV

Trans Media

Grab Indonesia

HOOQ

Netflix Indonesia

5.2 Cross Comparison Parameters

Number of Employees

Headquarters

Inception Year

Revenue

Active User Base

Market Share

Advertising Revenue

Content Partnerships

Market Share Analysis

Strategic Initiatives

Mergers And Acquisitions

Investment Analysis

Venture Capital Funding

Government Grants

Private Equity Investments

6. Indonesia Digital Media Market Regulatory Framework

Digital Content Regulations

Data Protection and Privacy Laws

E-commerce Law Compliance

Advertising Regulations

7. Indonesia Digital Media Market Future Market Size (In USD Bn)

Future Market Size Projections

Key Factors Driving Future Market Growth

8. Indonesia Digital Media Future Market Segmentation

8.1 By Media Type (In Value %)

8.2 By Device Type (In Value %)

8.3 By Revenue Model (In Value %)

8.4 By Industry Application (In Value %)

8.5 By Region (In Value %)

9. Indonesia Digital Media Market Analysts Recommendations

TAM/SAM/SOM Analysis

Customer Cohort Analysis

Marketing Initiatives

White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves creating an ecosystem map that identifies major stakeholders in the Indonesia digital media market. This step includes comprehensive desk research using secondary and proprietary databases to gather data on critical variables influencing market dynamics, such as user engagement, content consumption trends, and digital advertising metrics.

Step 2: Market Analysis and Construction

In this phase, historical market data for Indonesia's digital media market is compiled and analyzed. The research assesses market penetration by media types, advertising revenues, and the distribution of users across platforms. The market's competitive landscape is examined through revenue models and content consumption rates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through expert consultations, particularly with industry professionals representing digital platforms, telecom companies, and advertising agencies. These insights provide first-hand operational data and are critical in confirming the study's findings.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing research from various data sources to develop a detailed and accurate representation of the Indonesia digital media market. A bottom-up approach is used to validate data on market size, growth rates, and future trends. This ensures a comprehensive report that covers all market dynamics and future potential.

Frequently Asked Questions

1. How big is the Indonesia Digital Media Market?

The Indonesia digital media market is valued at USD 2.50 billion, driven by strong internet and mobile penetration, along with government initiatives to digitize the economy.

2. What are the challenges in the Indonesia Digital Media Market?

Key challenges include limited infrastructure in rural areas, cybersecurity risks, and increasing competition among content providers. Additionally, monetization and digital payment adoption present hurdles for growth in certain segments.

3. Who are the major players in the Indonesia Digital Media Market?

Major players in the market include GoTo Group, Bukalapak, Vidio, Netflix Indonesia, and Kompas TV. These companies dominate due to their strong content offerings, market presence, and investment in local talent.

4. What are the growth drivers of the Indonesia Digital Media Market?

The market is driven by the increasing consumption of online content, rapid smartphone adoption, and the rise of digital advertising. Government support for digital transformation is also a significant growth driver.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.