Indonesia Direct Thermal Paper Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD8146

November 2024

84

About the Report

Indonesia Direct Thermal Paper Market Overview

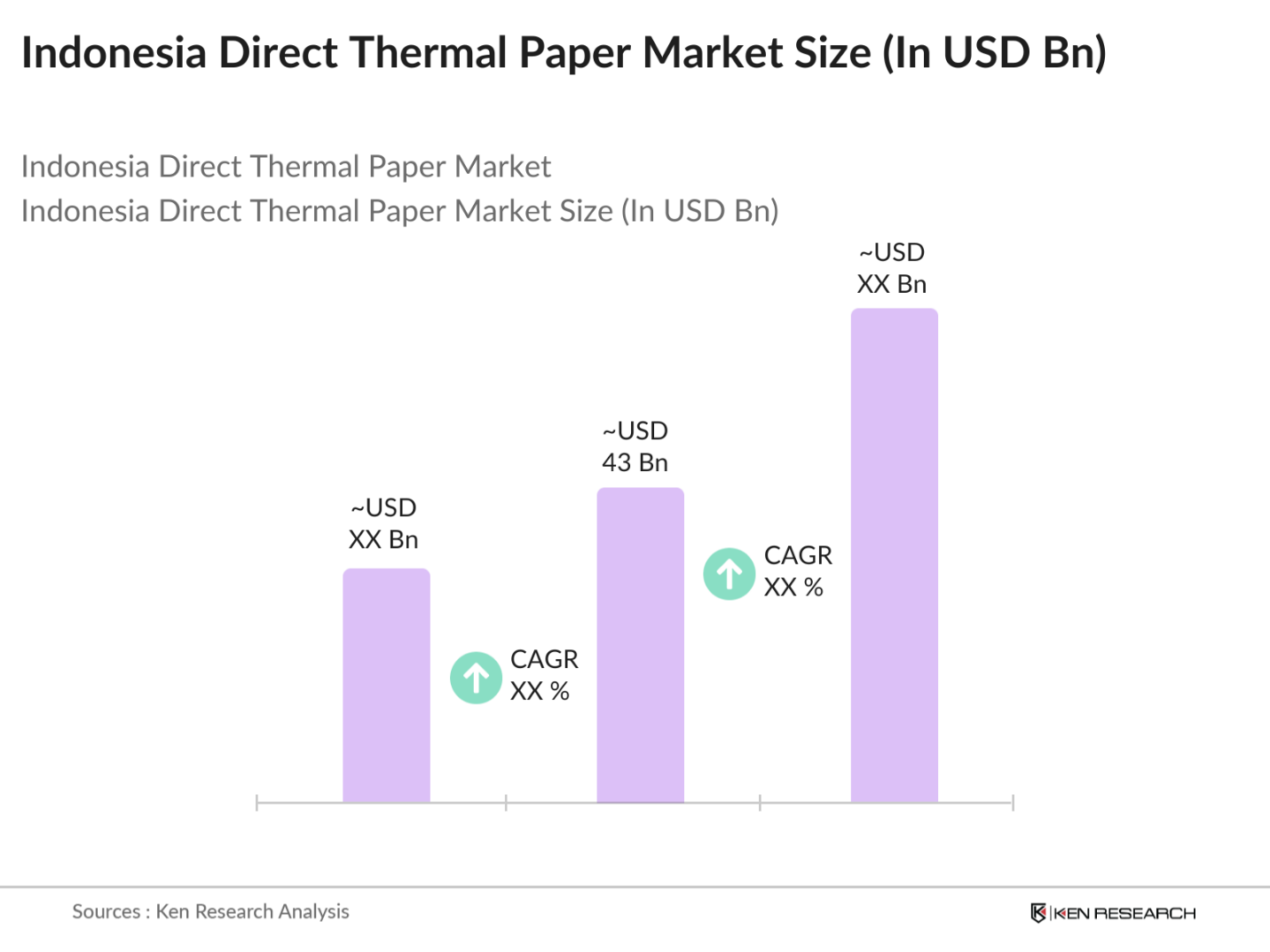

- The Indonesia Direct Thermal Paper Market is valued at USD 43 billion, based on a five-year historical analysis. Growth in this market is primarily driven by the expanding retail and logistics sectors, which have seen increased reliance on thermal paper for point-of-sale receipts, labels, and logistics tags. The surge in digital transactions and the adoption of thermal paper for efficient, low-cost printing solutions make it an essential tool in retail and warehousing. Its appeal lies in low maintenance and environmental benefits, aligning with the needs of businesses and service providers focused on operational efficiency.

- The market dominance is primarily centered in Java and Sumatra, as these regions have a high concentration of retail and logistics hubs due to their larger population and urbanization rates. Java, home to Indonesias capital and commercial hub Jakarta, serves as a significant driver, with high business activity and advanced infrastructure for warehousing and logistics. Sumatra, known for its industrial zones, follows closely due to the demand for labeling solutions in its agriculture and manufacturing sectors, propelling the direct thermal paper market forward.

- Indonesia enforces stringent safety standards for pulp and ink in thermal paper to minimize harmful chemicals and align with health and environmental protocols. Regulatory bodies closely monitor these standards to ensure thermal paper products meet safety and quality requirements, particularly for use in retail environments where product safety is essential.

Indonesia Direct Thermal Paper Market Segmentation

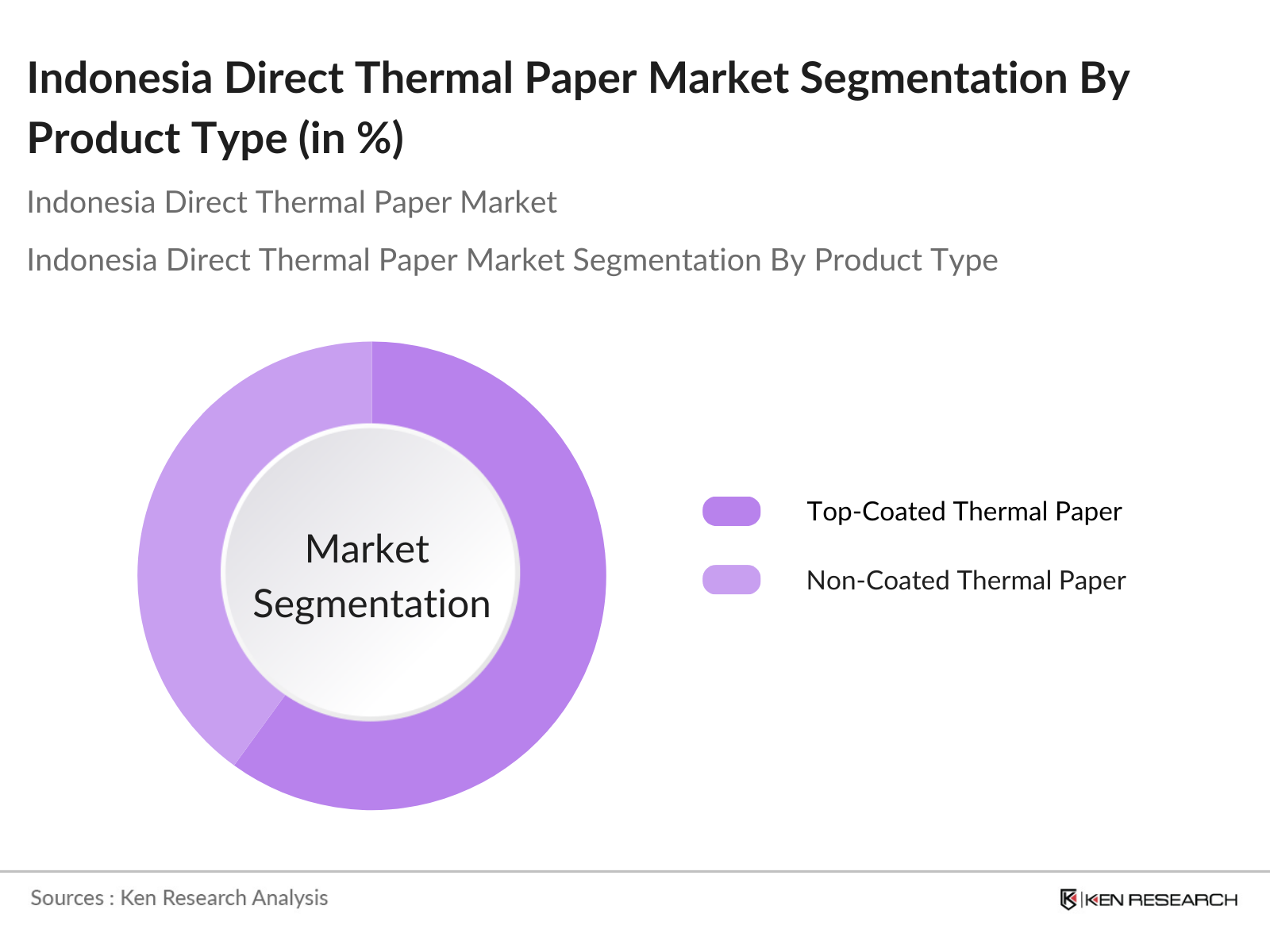

By Product Type: The market is segmented by product type into Top-Coated Thermal Paper and Non-Coated Thermal Paper. Recently, Top-Coated Thermal Paper holds a dominant market share within this segmentation due to its enhanced durability and print quality, which are crucial in sectors like healthcare and retail where documents need to be preserved longer.

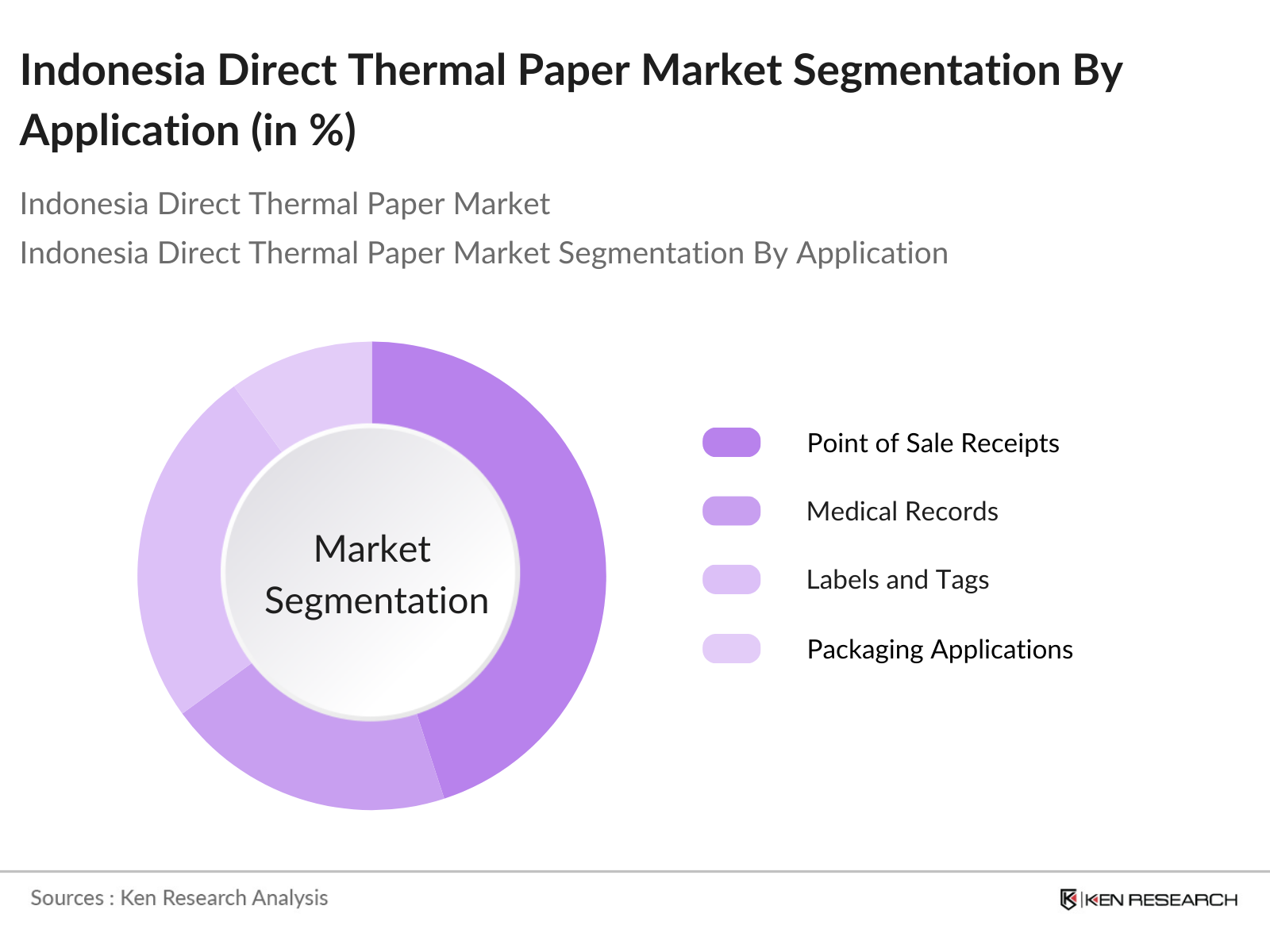

By Application: The market is further segmented by application into Point-of-Sale Receipts, Medical Records, Labels and Tags, and Packaging Applications. Point of Sale Receipts has a dominant market share within the application segment, driven by the expanding retail and e-commerce sectors in Indonesia. The surge in digital payments has led to increased demand for thermal paper in POS systems across supermarkets, convenience stores, and restaurants, where efficient, low-cost receipt printing is crucial to daily operations.

Indonesia Direct Thermal Paper Market Competitive Landscape

The Indonesia Direct Thermal Paper Market is characterized by a mix of both international and local players who dominate through their established supply chains and distribution networks. Key players include top international producers and regional firms, catering to both industrial and retail needs, from high-quality coated thermal paper to economically-priced options for high-volume use cases.

Indonesia Direct Thermal Paper Industry Analysis

Growth Drivers

- Demand from Retail and Logistics Sectors: Indonesias retail and logistics sectors, driven by the growth of its consumer market and its role as Southeast Asia's largest economy, present a significant demand for direct thermal paper. The logistics industry, expanding at an annual rate exceeding 5% as of 2024, leverages thermal paper for streamlined inventory management and order tracking, especially with Indonesias sizable retail networks covering over 17,000 islands. The economys strong private consumption, projected at IDR 8,238 trillion (USD 560 billion) in 2024, underpins these sector demands, accelerating adoption of thermal solutions in point-of-sale (POS) systems.

- Growth in E-Commerce (B2B, B2C Demand Surge): Indonesias e-commerce, valued over IDR 500 trillion in sales annually, has spurred the direct thermal paper market. Rising internet penetration, reaching 66% of the population, and a digital-savvy demographic contribute to the increasing B2B and B2C transactions, with higher needs for label printing, receipts, and shipment documentation. E-commerce expansion is aligned with the governments push for a digital economy, fostering demand across sectors like fashion, electronics, and FMCG.

- Rise in Digital Transactions (POS Applications): Indonesias adoption of digital payments in POS applications has seen rapid growth, backed by initiatives to reduce cash dependency and enhance transactional efficiency. In 2023, digital transactions reached IDR 2,200 trillion, signaling a transformation in retail interactions that require reliable thermal paper solutions for receipts. The central bank's encouragement of QRIS (QR Code Indonesian Standard) payments also broadens POS integration, amplifying demand for thermal paper as transaction volumes soar.

Market Challenges

- Raw Material Price Volatility (Pulp, Chemicals): Indonesias reliance on imported pulp and specialty chemicals has exposed its thermal paper market to international price volatility. With recent global inflationary pressures, Indonesia saw an increase in production costs, as pulp prices surged by 12% in 2023, impacting the pricing of thermal paper products. These challenges underscore the need for local sourcing strategies to mitigate dependency on volatile international markets.

- Sustainability Concerns (Environmental Standards, Recyclability): Environmental standards are increasingly affecting Indonesias thermal paper industry, with a heightened focus on recyclable materials and reduced chemical waste. As Indonesia aims to meet global sustainability goals, regulations mandating lower environmental impact in paper production put pressure on thermal paper manufacturers to adopt eco-friendly practices, such as switching to recyclable and BPA-free materials, which can increase production costs.

Indonesia Direct Thermal Paper Market Future Outlook

Over the next five years, the Indonesia Direct Thermal Paper Market is projected to experience significant growth driven by increased reliance on digital transactions, expanding retail infrastructure, and demand from logistics and warehousing sectors. Rising environmental awareness will push for more sustainable alternatives, with the industry likely to see advancements in BPA-free and eco-friendly paper solutions.

Market Opportunities

- Rising Demand for Mobile Receipt Printers: The increase in mobile commerce and informal business transactions in Indonesia has spurred demand for mobile receipt printers. Small to medium-sized enterprises (SMEs), constituting over 60% of Indonesia's economy, are adopting mobile solutions for receipt generation, promoting a rise in thermal paper use. With government support for digitizing SME operations, the market sees expanding opportunities for portable, cost-effective thermal printing.

- Technological Innovation in Printing Solutions: Innovations in thermal printing technology, such as lower-energy consumption models and wireless POS systems, are gaining traction in Indonesia. As manufacturers introduce more durable and eco-friendly products, demand is boosted within retail and logistics industries. This shift aligns with Indonesias 2025 Vision of becoming a digital economy hub, presenting growth avenues for thermal paper suppliers focused on innovative solutions.

Scope of the Report

|

Product Type |

Top-Coated Thermal Paper Non-Coated Thermal Paper |

|

Application |

Point of Sale Receipts Medical Records Labels and Tags Packaging Applications |

|

End-Use Industry |

Retail and Consumer Goods Healthcare Logistics and Warehousing Entertainment and Hospitality |

|

Coating Material |

BPA-Free Coated Paper Standard BPA Coated Paper |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Retail Chains and Point-of-Sale Solution Providers

Packaging and Labeling Companies

Healthcare Providers (Hospitals and Clinics)

Warehousing and Logistics Companies

Manufacturers in E-Commerce Sector

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry, National Standardization Agency of Indonesia - BSN)

Environmental Organizations

Companies

Players Mentioned in the Report

Oji Holdings Corporation

Appvion Operations, Inc.

Ricoh Company, Ltd.

Jujo Thermal Ltd.

Mitsubishi Paper Mills Ltd.

Hansol Paper Co., Ltd.

Koehler Paper Group

Nakagawa Manufacturing (USA), Inc.

Kanzaki Specialty Papers Inc.

Thermal Solutions International Inc.

Table of Contents

1. Indonesia Direct Thermal Paper Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Industry Evolution and Development (Key Technological Advancements, Production Techniques)

1.4 Market Segmentation Overview

1.5 Market Growth Rate (Market Value, Volume, Industry Penetration Rate)

2. Indonesia Direct Thermal Paper Market Size (USD & Tonnage)

2.1 Historical Market Size (Value, Volume Analysis)

2.2 Year-On-Year Growth Analysis (Y-o-Y Growth, Value Chain Impacts)

2.3 Key Market Developments and Strategic Milestones (Industry Collaborations, New Entrants)

3. Indonesia Direct Thermal Paper Market Analysis

3.1 Market Drivers

3.1.1 Demand from Retail and Logistics Sectors

3.1.2 Growth in E-Commerce (B2B, B2C Demand Surge)

3.1.3 Rise in Digital Transactions (POS Applications)

3.1.4 Economic Impact of Export Regulations

3.2 Market Challenges

3.2.1 Raw Material Price Volatility (Pulp, Chemicals)

3.2.2 Sustainability Concerns (Environmental Standards, Recyclability)

3.2.3 High Production Costs (Energy, Machinery)

3.2.4 Industry-Specific Tariffs and Regulations

3.3 Market Opportunities

3.3.1 Rising Demand for Mobile Receipt Printers

3.3.2 Technological Innovation in Printing Solutions

3.3.3 Expansion into SME and New Retailers

3.4 Trends

3.4.1 Shift towards Eco-Friendly Thermal Paper

3.4.2 Adoption of IoT-Integrated POS Systems

3.4.3 Growth of Thermal Labels in Healthcare (Pharmaceutical Labeling)

3.5 Government Regulations

3.5.1 Material Safety Standards (Pulp and Ink Standards)

3.5.2 Certification Requirements for Import/Export

3.5.3 Waste Management Initiatives

3.6 Industry Ecosystem and Value Chain Analysis

3.7 Competitive Landscape Assessment

3.8 Porters Five Forces Model Analysis

3.9 SWOT Analysis

4. Indonesia Direct Thermal Paper Market Segmentation

4.1 By Product Type (in Value %)

4.1.1 Top-Coated Thermal Paper

4.1.2 Non-Coated Thermal Paper

4.2 By Application (in Value %)

4.2.1 Point of Sale Receipts

4.2.2 Medical Records

4.2.3 Labels and Tags

4.2.4 Packaging Applications

4.3 By End-Use Industry (in Value %)

4.3.1 Retail and Consumer Goods

4.3.2 Healthcare

4.3.3 Logistics and Warehousing

4.3.4 Entertainment and Hospitality

4.4 By Coating Material (in Value %)

4.4.1 BPA-Free Coated Paper

4.4.2 Standard BPA Coated Paper

4.5 By Region (in Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Direct Thermal Paper Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1 Oji Holdings Corporation

5.1.2 Appvion Operations, Inc.

5.1.3 Ricoh Company, Ltd.

5.1.4 Jujo Thermal Ltd.

5.1.5 Koehler Paper Group

5.1.6 Hansol Paper Co., Ltd.

5.1.7 Mitsubishi Paper Mills Ltd.

5.1.8 Nakagawa Manufacturing (USA), Inc.

5.1.9 Kanzaki Specialty Papers Inc.

5.1.10 Siam Paper Public Co., Ltd.

5.1.11 PM Company LLC

5.1.12 Domtar Corporation

5.1.13 Thermal Solutions International Inc.

5.1.14 Chee Wah Corporation

5.1.15 Papertec, Inc.

5.2 Cross Comparison Parameters (Market Share, Product Range, Annual Revenue, R&D Expenditure, Production Capacity, Regional Focus, Sustainability Initiatives, Distribution Network)

5.3 Market Share Analysis (by Product, Application, Region)

5.4 Strategic Initiatives (Collaborations, Market Expansion Strategies)

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 Venture Capital and Private Equity Analysis

6. Indonesia Direct Thermal Paper Market Regulatory Framework

6.1 Environmental and Safety Standards

6.2 Import and Export Compliance Standards

6.3 Certification and Compliance Processes

7. Indonesia Direct Thermal Paper Market Future Outlook

7.1 Market Size Projections (USD & Tonnage)

7.2 Future Trends and Opportunities

7.3 Strategic Roadmap and Key Growth Factors

8. Indonesia Direct Thermal Paper Market Analysts Recommendations

8.1 TAM/SAM/SOM Analysis

8.2 Customer Cohort Analysis

8.3 Marketing and Distribution Strategy

8.4 White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The research began with defining key market variables that influence the demand and supply of direct thermal paper within Indonesia. This process involved analyzing a broad ecosystem map with major stakeholders through primary desk research, focusing on parameters such as end-user industries and material sources.

Step 2: Market Analysis and Construction

Following the identification of variables, a detailed analysis of historical data was conducted, assessing market penetration and operational density. This involved collecting data on direct thermal paper production and utilization rates across Indonesia, segmenting it by industry and geographic region.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses were formulated based on initial findings and validated through consultations with industry professionals via computer-assisted telephone interviews (CATIs). These consultations provided critical insights into product demand trends, price sensitivity, and competition levels.

Step 4: Research Synthesis and Final Output

The final research output was synthesized by collating responses and validating quantitative data through a bottom-up approach. This included verifying statistics and insights through direct feedback from thermal paper manufacturers and end-users, ensuring a comprehensive analysis of the Indonesia Direct Thermal Paper Market.

Frequently Asked Questions

01. How big is the Indonesia Direct Thermal Paper Market?

The Indonesia Direct Thermal Paper Market is valued at USD 43 billion, based on a five-year historical analysis. Growth in this market is primarily driven by the expanding retail and logistics sectors, which have seen increased reliance on thermal paper for point-of-sale receipts, labels, and logistics tags.

02. What are the challenges in the Indonesia Direct Thermal Paper Market?

Challenges include the volatility in raw material prices, such as pulp and chemicals, and stringent environmental regulations, which are pushing manufacturers to adopt sustainable practices. These factors add pressure on pricing and margins for market players.

03. Who are the major players in the Indonesia Direct Thermal Paper Market?

Leading players include Oji Holdings Corporation, Appvion Operations, Inc., Ricoh Company, Ltd., and Mitsubishi Paper Mills Ltd., each dominating due to established supply chains, advanced production techniques, and commitment to sustainability.

04. What are the growth drivers of the Indonesia Direct Thermal Paper Market?

The market is primarily driven by the rise in digital payments, growing e-commerce activities, and advancements in POS systems, which support efficient and durable printing options for various business needs.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.