Indonesia E-Health Market Outlook to 2030

Region:Global

Author(s):Shambhavi

Product Code:KROD4661

December 2024

80

About the Report

Indonesia E-Health Market Overview

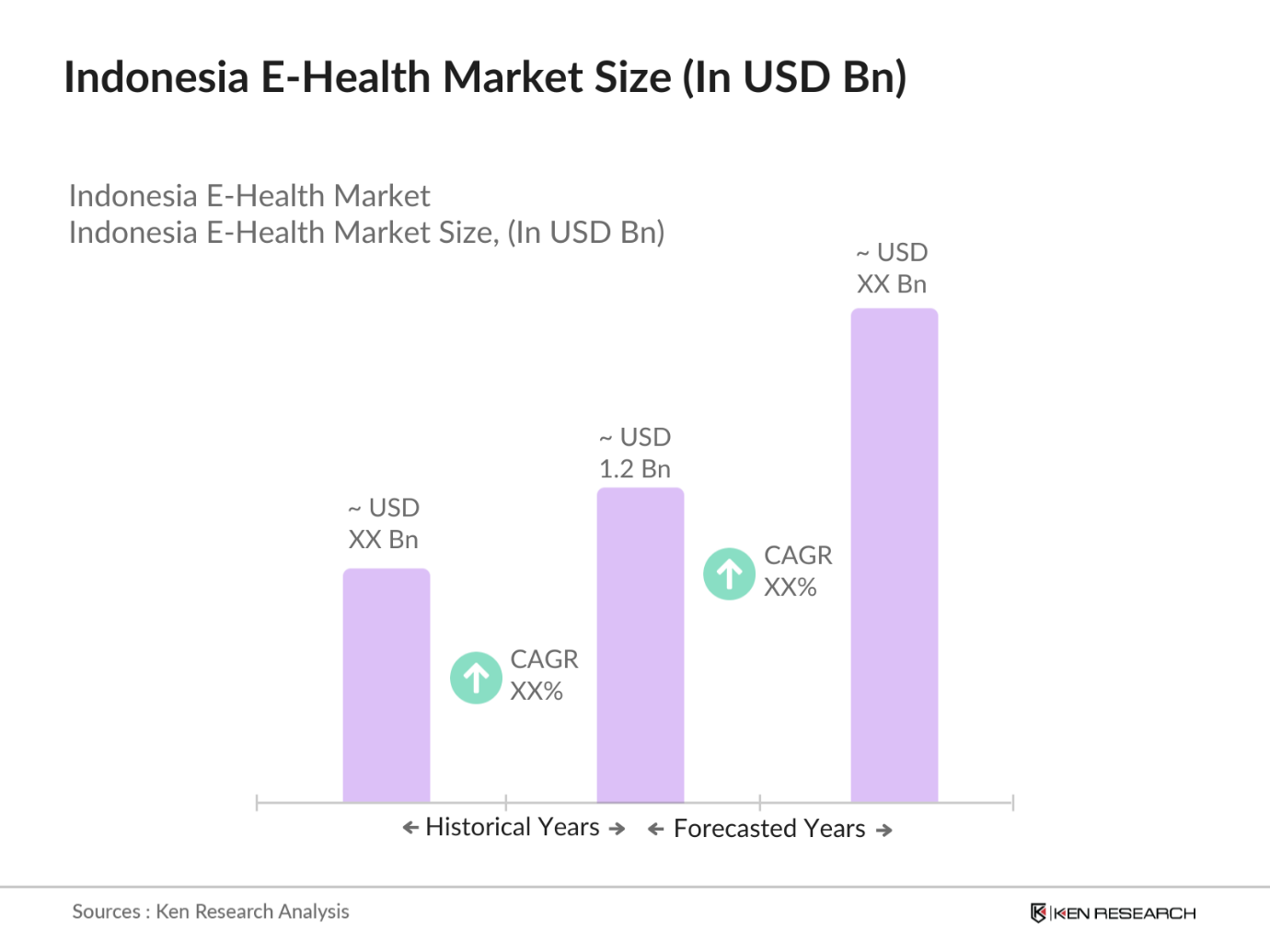

- The Indonesia E-Health market is valued at USD 1.2 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for digital health solutions, the government's push for universal healthcare, and the growth of telemedicine platforms like Halodoc and Alodokter. The rising adoption of Electronic Health Records (EHRs), mobile health applications, and other digital healthcare solutions further contributes to the market's expansion. Additionally, growing investments in digital infrastructure and the spread of high-speed internet across urban and semi-urban regions have supported the rise of E-health services.

- Jakarta, being Indonesias capital and a hub for technology and healthcare development, dominates the e-health market due to its advanced infrastructure and higher concentration of healthcare providers and tech startups. Other major cities such as Surabaya and Medan also contribute significantly to the market because of their large urban populations and growing healthcare needs. These cities serve as central points for health tech adoption, telemedicine services, and partnerships between health providers and technology companies, fostering a competitive edge over rural regions that still face infrastructural challenges.

- Indonesia's National Health Insurance Program (Jaminan Kesehatan Nasional, JKN) is one of the largest public health initiatives globally, covering over 222 million individuals as of 2023. The program aims to expand its reach by increasing healthcare accessibility through digital means, such as telemedicine, e-pharmacies, and remote health monitoring. In 2022, the government allocated 142 trillion IDR to healthcare programs, which includes ICT infrastructure improvements for health services. These funds are expected to enhance telemedicine availability and the digitization of health services in both urban and rural areas.

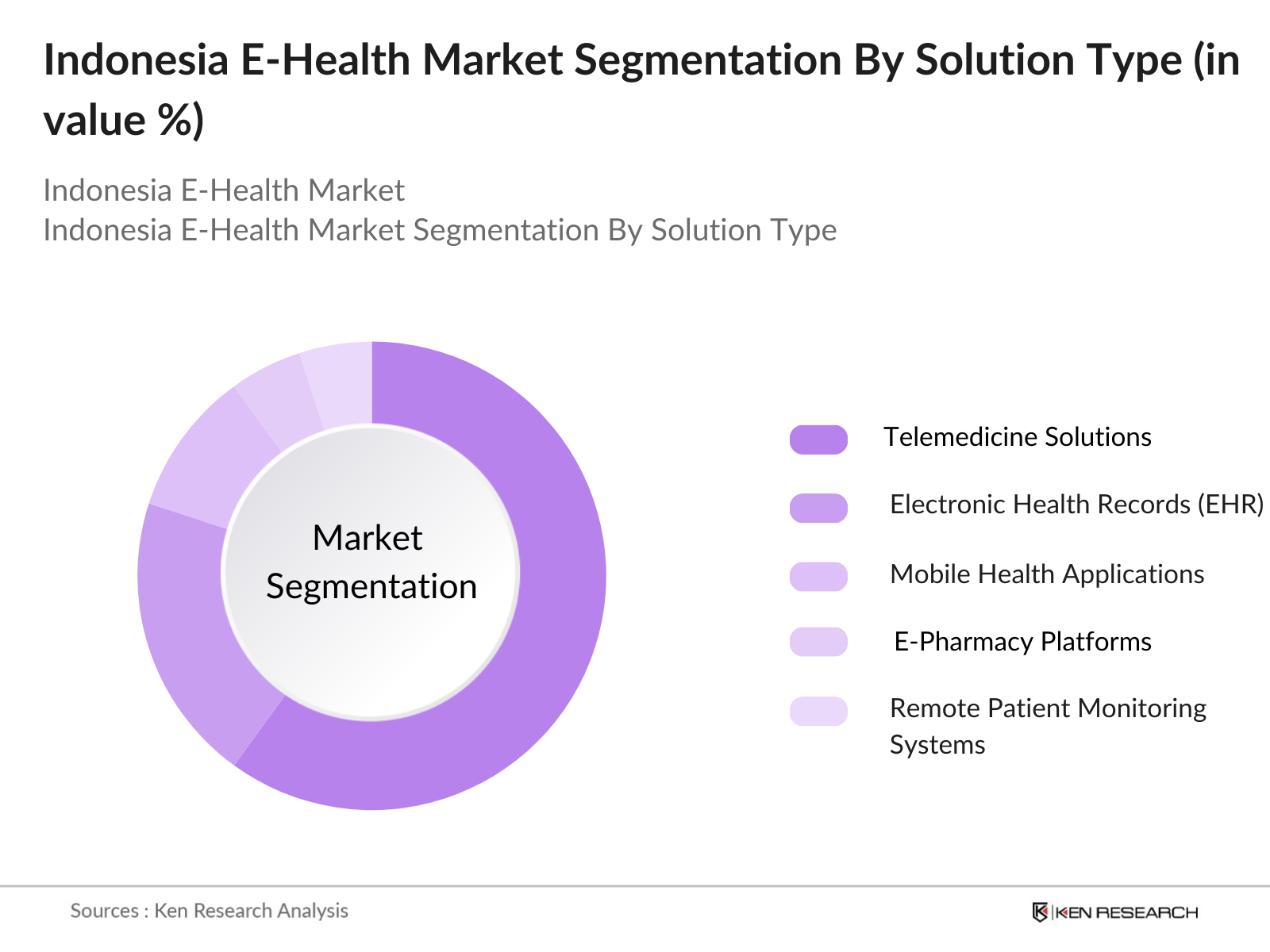

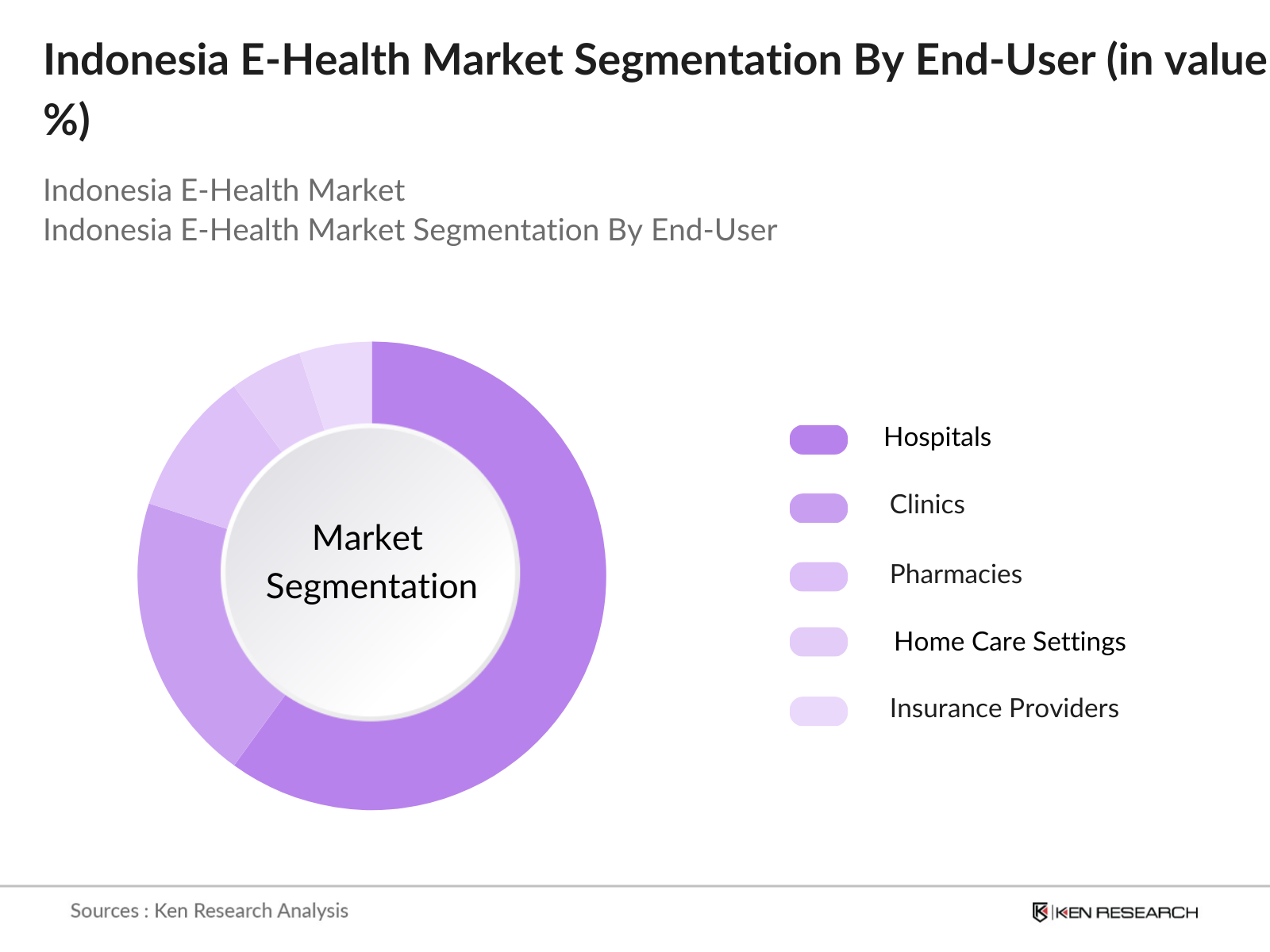

Indonesia E-Health Market Segmentation

By Solution Type: The Indonesia E-Health market is segmented by solution type into Telemedicine Solutions, Electronic Health Records (EHR), Mobile Health Applications, E-Pharmacy Platforms, and Remote Patient Monitoring Systems. Among these, Telemedicine Solutions hold a dominant market share. This dominance is attributed to the country's geographical fragmentation, which makes remote healthcare solutions particularly valuable. Telemedicine platforms such as Halodoc and Alodokter have experienced rapid growth due to their convenience and cost-effectiveness, allowing patients to consult with healthcare professionals via video calls, minimizing travel time and costs, particularly in remote areas.

By End-User: The market is also segmented by end-users, which include Hospitals, Clinics, Pharmacies, Home Care Settings, and Insurance Providers. Hospitals currently dominate the end-user segment of the Indonesia E-Health market, largely due to their widespread adoption of comprehensive EHR systems and telemedicine platforms. Ma ny hospitals are integrating digital solutions to streamline patient data management, diagnostics, and treatment processes, contributing to improved efficiency and patient outcomes. The rising number of private hospitals adopting advanced digital tools further strengthens this segment's dominance.

Indonesia E-Health Market Competitive Landscape

The Indonesia E-Health market is dominated by both local and international players. Major companies like Halodoc and Alodokter have gained significant traction by providing telemedicine and mobile health services, while other players focus on EHR and remote monitoring technologies. The competitive landscape is shaped by technological innovations, partnerships with healthcare providers, and government backing.

The competitive landscape shows that the top players not only focus on digital health services but also leverage partnerships with hospitals, pharmacies, and the government to gain a competitive edge. Many players are increasing their regional footprints and are aggressively expanding their customer base.

Indonesia E-Health Market Analysis

Growth Drivers

- Increasing Adoption of Telemedicine: Telemedicine usage in Indonesia has grown rapidly, driven by government regulations that outline clear frameworks for its practice. In 2023, telemedicine services reached approximately 60% of the Indonesian population, with major cities such as Jakarta and Surabaya leading in usage rates. The Ministry of Healths telemedicine guidelines stipulate standards for data security, physician-patient interactions, and prescription regulations. With the expansion of ICT infrastructure, telemedicine consultations have surged to over 2 million monthly consultations in 2024, supported by legal frameworks that encourage its adoption.

- Growing Internet Penetration: Indonesia has seen substantial improvements in its internet infrastructure, with 2023 data from the Ministry of Communication and Information Technology showing 95% internet coverage in urban areas and 70% in rural areas. This growth has facilitated the adoption of e-health services, as high-speed internet is crucial for video consultations and cloud-based health records. Government investments in ICT infrastructure have increased to 60 trillion IDR in 2024, specifically targeting healthcare digitization projects. By 2024, around 198 million people have access to the internet, creating a strong foundation for telemedicine growth.

- Rising Demand for Remote Patient Monitoring: Indonesias aging population and the growing prevalence of chronic diseases such as diabetes, cardiovascular disorders, and respiratory issues have driven demand for remote patient monitoring (RPM). According to 2023 health data, Indonesia has over 11 million diabetics and a growing population of elderly patients needing continuous monitoring. RPM technologies, powered by IoT and mobile applications, allow doctors to track patients' conditions remotely, reducing the burden on hospitals. This is further supported by the Ministry of Health's allocation of 25 trillion IDR to chronic disease management in 2024, which includes RPM services.

Market Challenges

- Data Privacy Concerns: Data privacy remains a major challenge in Indonesias e-health market, particularly after the enactment of the Personal Data Protection Law in 2022, which mirrors the EU's GDPR. The Ministry of Communication and Information Technology has registered over 400 data breach cases in healthcare alone during 2023. Compliance with this law requires e-health platforms to implement robust security measures, which increases operational costs. Despite this, over 60% of healthcare providers have been compliant by 2024, though concerns over cybersecurity vulnerabilities remain a key barrier to adoption.

- Limited Digital Literacy: A key challenge to the widespread adoption of e-health services is the lack of digital literacy among both healthcare professionals and patients, particularly in rural areas. According to a 2023 survey by Indonesia's Ministry of Education, around 40% of healthcare workers reported difficulty in using telemedicine platforms. This is further compounded by patients in remote areas, where digital literacy rates are as low as 35%. Government programs have started addressing this by offering digital health training, but the issue remains a significant barrier to achieving nationwide e-health adoption.

Indonesia E-Health Market Future Outlook

The Indonesia E-Health market is expected to experience sustained growth over the next five years, driven by continuous investments in digital health infrastructure, the expansion of 4G/5G networks, and the growing demand for remote healthcare services. The governments push for universal healthcare through initiatives such as Jaminan Kesehatan Nasional (JKN) is also expected to boost the adoption of E-health solutions, as more citizens become aware of and gain access to telemedicine and EHR platforms. The rise of AI and machine learning in healthcare diagnostics, alongside the integration of IoT devices, will further enhance the capabilities of digital health solutions, allowing for real-time patient monitoring and predictive diagnostics. Additionally, e-pharmacy platforms are likely to see increased adoption as digital literacy improves and e-commerce continues to thrive in the region.

Market Opportunities

- Expansion of E-Pharmacy Platforms: E-pharmacy platforms have gained significant traction in Indonesia, with over 5 million users regularly accessing these services in 2023. E-pharmacies offer convenient access to medications, particularly in rural areas where physical pharmacies may be scarce. The government has introduced regulations in 2024 to streamline the licensing of e-pharmacies, ensuring compliance with safety standards. With improved ICT infrastructure and growing internet penetration, the e-pharmacy market is set to expand further, enhancing accessibility to essential medications.

- Development of Mobile Health Apps: Indonesia's smartphone penetration reached 180 million users in 2023, driving the development of mobile health apps that offer services such as appointment scheduling, medication reminders, and health tracking. The growing reliance on smartphones, particularly among younger demographics, has fueled the demand for mobile health solutions. The government has allocated funds for the development of locally produced health apps, which are expected to increase accessibility to healthcare services, particularly in remote areas.

Scope of the Report

|

By Solution Type |

E-Prescriptions |

|

Telemedicine Solutions |

|

|

EHR/EMR Solutions |

|

|

Mobile Health Apps |

|

|

E-Pharmacy Platforms |

|

|

By End-User |

Hospitals |

|

Clinics |

|

|

Home Care Settings |

|

|

Pharmacies |

|

|

By Deployment Mode |

On-Premise Solutions |

|

Cloud-Based Solutions |

|

|

By Technology |

AI and Machine Learning |

|

Blockchain |

|

|

Internet of Medical Things (IoMT) |

|

|

Big Data Analytics |

|

|

By Region |

Java |

|

Sumatra |

|

|

Sulawesi |

|

|

Kalimantan |

|

|

Bali and Nusa Tenggara |

Products

Key Target Audience

Healthcare Providers (Hospitals, Clinics)

Technology Companies (HealthTech Startups)

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Health, BPJS Kesehatan)

Pharmaceutical Companies

Insurance Providers

Medical Device Manufacturers

Telemedicine Service Providers

Companies

Players Mention in the Report

Halodoc

Alodokter

Siloam Hospitals

ProSehat

Good Doctor Technology

KlikDokter

SehatQ

Zenius Health

Indonesia Medika

DokterSehat

GoDok

Omni Hospitals

GrabHealth

Dokter.id

Lifepack

Table of Contents

1. Indonesia E-Health Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia E-Health Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia E-Health Market Analysis

3.1. Growth Drivers

3.1.1. Government Initiatives (Indonesia's National Health Insurance Program)

3.1.2. Increasing Adoption of Telemedicine (Regulations on Telemedicine Usage)

3.1.3. Growing Internet Penetration (ICT Infrastructure Improvements)

3.1.4. Rising Demand for Remote Patient Monitoring (Increased Chronic Disease Burden)

3.2. Market Challenges

3.2.1. Data Privacy Concerns (Compliance with Data Protection Regulations)

3.2.2. Limited Digital Literacy (Challenges in Adoption of Digital Health Solutions)

3.2.3. Infrastructure Gaps in Rural Areas (Limited Access to High-Speed Internet)

3.3. Opportunities

3.3.1. Integration with AI and Machine Learning (AI-driven Diagnostic Tools)

3.3.2. Expansion of E-Pharmacy Platforms (Ease of Access to Medications)

3.3.3. Development of Mobile Health Apps (Increased Smartphone Usage)

3.4. Trends

3.4.1. Adoption of Cloud-Based E-Health Solutions (Cloud-Based Health Records Management)

3.4.2. Rise in Wearable Health Devices (IoT Integration in Wearables)

3.4.3. Increase in Digital Therapeutics (Regulatory Push for Digital Health Solutions)

3.5. Government Regulation

3.5.1. National E-Health Strategy (Indonesia's Digital Health Roadmap)

3.5.2. Telemedicine Regulation (MOH's Telemedicine Guidelines)

3.5.3. Patient Data Protection Law (Regulations on Health Data Security)

3.5.4. E-Pharmacy Legal Framework (E-Pharmacy Licensing Requirements)

3.6. SWOT Analysis

3.7. Stake Ecosystem (Role of Hospitals, Insurers, Tech Firms in the E-Health Ecosystem)

3.8. Porters Five Forces (Impact of Suppliers, Buyers, New Entrants, Substitutes, Rivalry)

3.9. Competition Ecosystem

4. Indonesia E-Health Market Segmentation

4.1. By Solution Type (In Value %)

4.1.1. E-Prescriptions

4.1.2. Telemedicine Solutions

4.1.3. EHR/EMR Solutions

4.1.4. Mobile Health Apps

4.1.5. E-Pharmacy Platforms

4.2. By End-User (In Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Home Care Settings

4.2.4. Pharmacies

4.3. By Deployment Mode (In Value %)

4.3.1. On-Premise Solutions

4.3.2. Cloud-Based Solutions

4.4. By Technology (In Value %)

4.4.1. AI and Machine Learning

4.4.2. Blockchain

4.4.3. Internet of Medical Things (IoMT)

4.4.4. Big Data Analytics

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Sulawesi

4.5.4. Kalimantan

4.5.5. Bali and Nusa Tenggara

5. Indonesia E-Health Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Telkom Indonesia

5.1.2. Halodoc

5.1.3. Alodokter

5.1.4. GrabHealth

5.1.5. GoDok

5.1.6. Good Doctor Technology

5.1.7. Siloam Hospitals

5.1.8. Omni Hospitals

5.1.9. SehatQ

5.1.10. KlikDokter

5.1.11. Konsula

5.1.12. Zenius Health

5.1.13. ProSehat

5.1.14. Indonesia Medika

5.1.15. DokterSehat

5.2. Cross Comparison Parameters (Market Share, Technology Stack, Services Offered, Revenue Models, Regional Presence, Customer Base, Digital Maturity, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Mergers & Acquisitions, New Product Launches, Collaborations)

5.5. Investment Analysis (Venture Capital Investments, Private Equity Investments)

5.6. Government Grants and Funding

6. Indonesia E-Health Market Regulatory Framework

6.1. Health Data Privacy Standards (Personal Data Protection Act)

6.2. Compliance Requirements (Ministry of Health's Guidelines)

6.3. Certification Processes (Medical Device Licensing for E-Health Platforms)

7. Indonesia E-Health Market Analysts Recommendations

7.1. TAM/SAM/SOM Analysis

7.2. Go-to-Market Strategies

7.3. Customer Targeting Strategies

7.4. Innovation White Spaces

Research Methodology

Step 1: Identification of Key Variables

In this stage, we map the ecosystem of the Indonesia E-Health market, identifying major stakeholders, including health service providers, digital platforms, and regulatory bodies. Extensive desk research is conducted to gather relevant data from secondary sources such as industry reports and governmental databases.

Step 2: Market Analysis and Construction

We analyze historical data and compile market insights related to e-health platform penetration, user adoption, and service provider data. This involves an examination of service usage patterns and the overall efficiency of digital health solutions in Indonesia.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through expert consultations, including interviews with key players in the E-health and telemedicine fields. This feedback refines our market forecasts and provides operational insights into digital health services.

Step 4: Research Synthesis and Final Output

We finalize the report by cross-referencing the gathered data with industry feedback. Detailed insights on product segments, consumer behavior, and future market trends are provided to offer a comprehensive analysis of the Indonesia E-Health market.

Frequently Asked Questions

01. How big is the Indonesia E-Health Market?

The Indonesia E-Health market was valued at USD 1.2 billion, driven by rising demand for telemedicine solutions, electronic health records, and mobile health applications.

02. What are the challenges in the Indonesia E-Health Market?

Challenges in the market include limited digital literacy in rural areas, data privacy concerns, and infrastructure gaps that hinder the adoption of advanced digital health technologies.

03. Who are the major players in the Indonesia E-Health Market?

Key players include Halodoc, Alodokter, Siloam Hospitals, ProSehat, and Good Doctor Technology, each leveraging technology and partnerships to lead the market.

04. What are the growth drivers of the Indonesia E-Health Market?

Growth is driven by government initiatives such as JKN, the increasing penetration of smartphones, and the rising popularity of telemedicine platforms across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.