Indonesia Eggs Market Outlook to 2030

Region:Asia

Author(s):Vijay Kumar

Product Code:KROD5473

October 2024

94

About the Report

Indonesia Eggs Market Overview

- The Indonesia Eggs Market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for affordable and protein-rich food sources, particularly eggs, which serve as a staple in the Indonesian diet. Growth in both urban and rural areas, fueled by rising population and government initiatives supporting sustainable agricultural practices, has contributed to a steady demand for eggs across retail and foodservice channels. The shift toward healthier, organic egg varieties is also driving market expansion.

- The dominant regions within the Indonesia Eggs Market include Java and Sumatra, mainly due to their high population density, established poultry infrastructure, and strong agricultural output. Java, being the economic center, also has a well-developed distribution network, making it easier for egg producers to access markets. Sumatras large poultry farms benefit from proximity to export hubs, which enables competitive pricing and large-scale production capabilities. These regions dominate the market due to better supply chain efficiencies and higher egg production capacities.

- The Indonesian government continues to offer substantial agricultural subsidies to poultry farmers to support egg production. In 2024, the Ministry of Agriculture allocated over $300 million in subsidies aimed at improving infrastructure, modernizing equipment, and providing financial aid to smallholder farms. These subsidies have helped increase production efficiency and lower costs, making eggs more affordable for consumers while improving the profitability of farmers.

Indonesia Eggs Market Segmentation

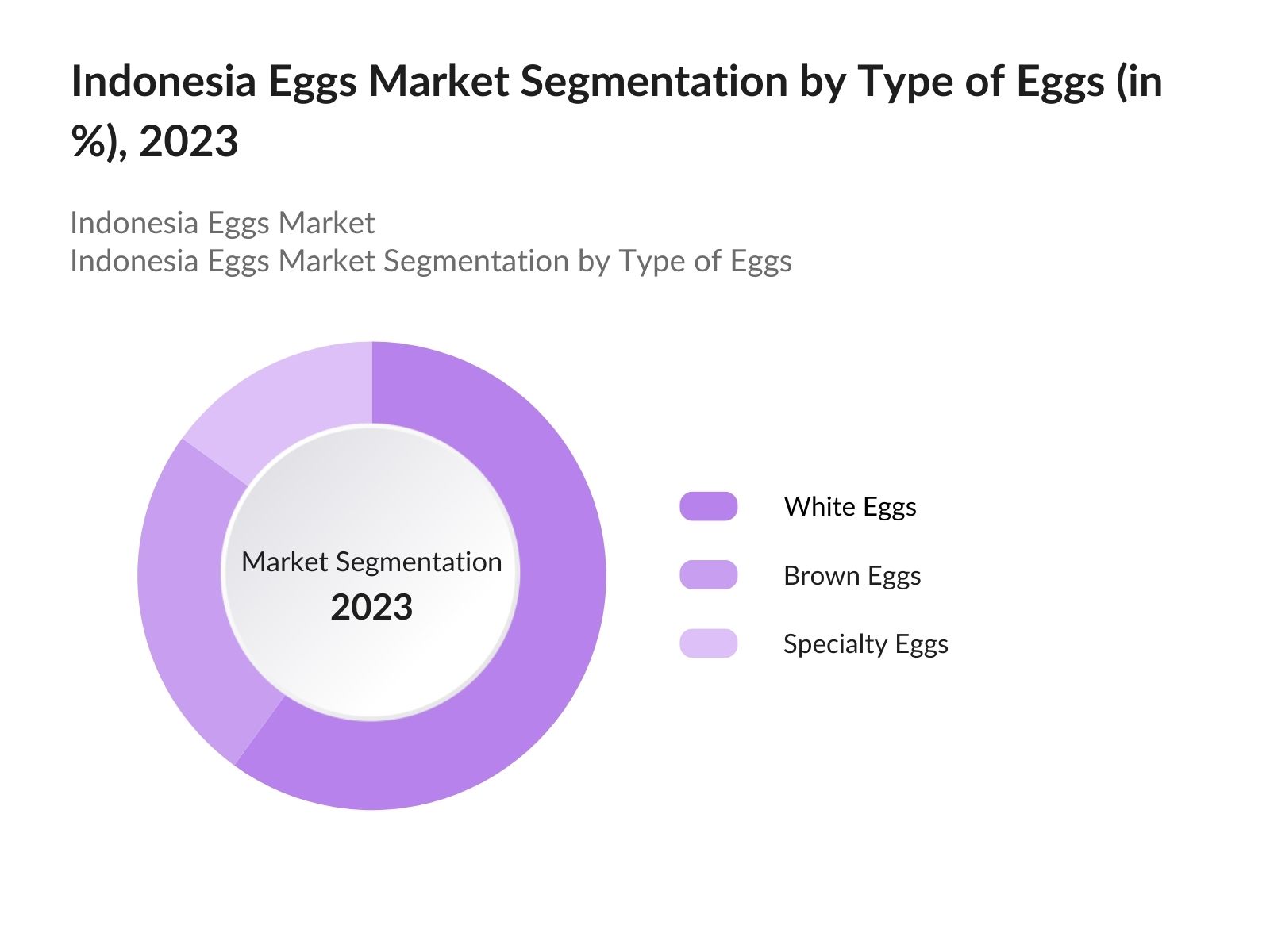

By Type of Eggs: The Indonesia Eggs Market is segmented by type of eggs into white eggs, brown eggs, and specialty eggs (such as organic, omega-3, and free-range eggs). Recently, white eggs have held the dominant market share under the segmentation by type. This is primarily due to their lower production costs and widespread consumer preference for their affordability.

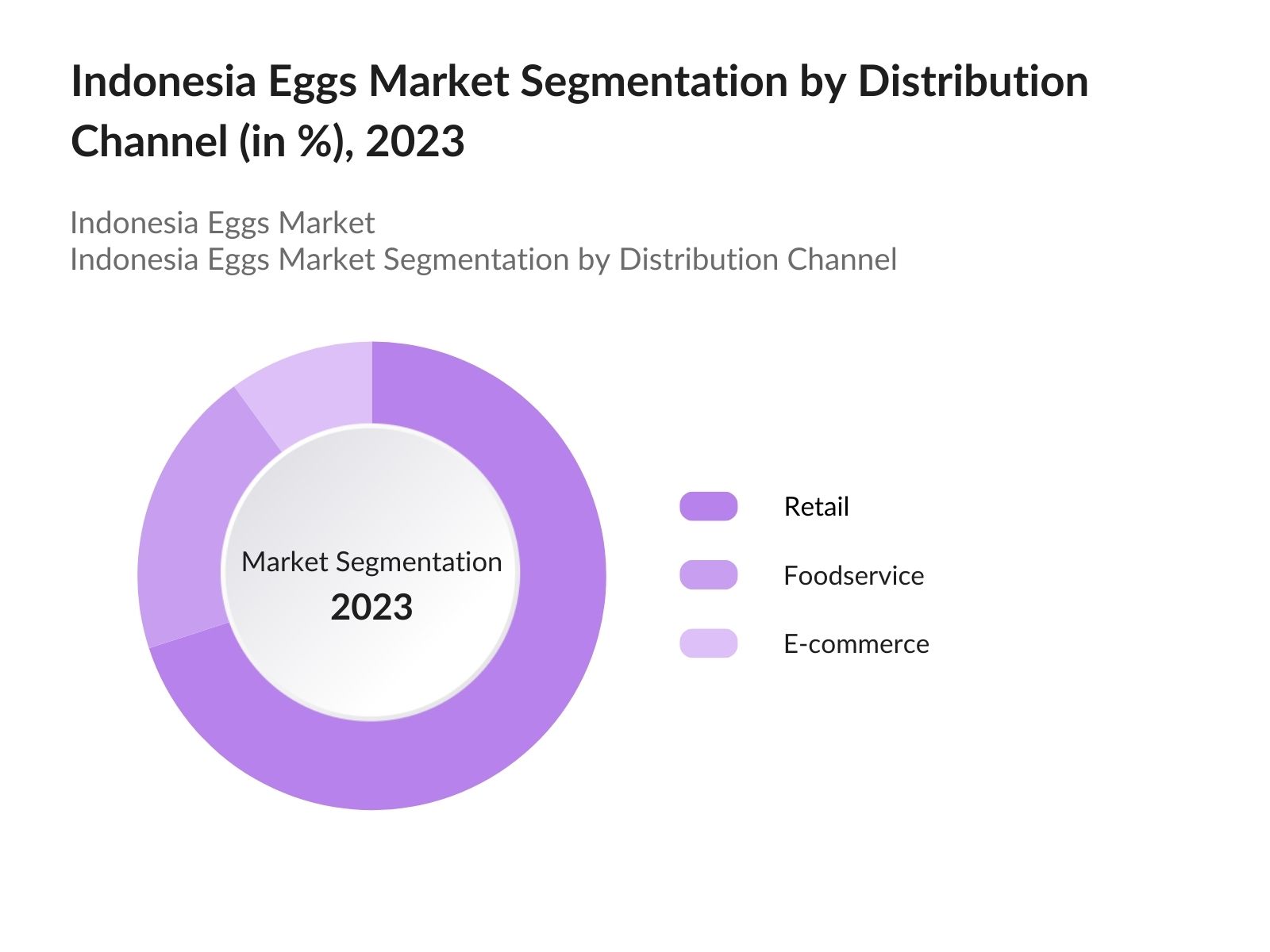

By Distribution Channel: The Indonesia Eggs Market is segmented by distribution channel into retail (supermarkets, hypermarkets, convenience stores), foodservice (hotels, restaurants, catering), and e-commerce. Retail dominates the distribution channel segmentation due to the extensive presence of supermarkets and convenience stores across urban and semi-urban areas. This segment benefits from its established distribution networks and ability to reach a large consumer base.

Indonesia Eggs Market Competitive Landscape

The Indonesia Eggs Market is dominated by a mix of local and regional players, including both large corporations and smaller poultry farms. The market consolidation reflects the presence of vertically integrated companies that control feed production, egg farming, and distribution, enabling them to have strong control over the supply chain. This consolidation also allows the leading companies to benefit from economies of scale, further solidifying their dominance in the market.

|

Company Name |

Established Year |

Headquarters |

Market Share |

Production Capacity |

Revenue (USD Mn) |

Number of Farms |

Export Markets |

Certifications |

Employee Count |

|

Charoen Pokphand Indonesia |

1972 |

Jakarta |

|||||||

|

Japfa Comfeed Indonesia |

1971 |

Jakarta |

|||||||

|

Sierad Produce |

1985 |

Bekasi |

|||||||

|

Malindo Feedmill |

1997 |

Jakarta |

|||||||

|

Wonokoyo Group |

1983 |

Surabaya |

Indonesia Eggs Industry Analysis

Growth Drivers

- Increasing Population and Protein Consumption: Indonesia's population is expected to reach over 276 million in 2024, according to World Bank data, driving up demand for protein-rich foods, including eggs, which serve as a staple protein source. With a growing focus on balanced nutrition, egg consumption has increased as more families prioritize affordable and accessible protein. This aligns with government efforts to address malnutrition, which remains a concern in rural areas.

- Rising Demand for Organic and Free-Range Eggs: The demand for organic and free-range eggs is growing in Indonesia, especially in urban areas where consumers are increasingly conscious of health and animal welfare. In 2024, Indonesia saw an increase in organic food production by over 10%, according to the Ministry of Agriculture. Organic egg production is supported by the governments Go Organic 2024 initiative, which promotes sustainable farming.

- Growing Middle-Class and Changing Dietary Preferences: Indonesias middle-class population, which now accounts for over 50% of the total population, has shifted its dietary preferences toward healthier, protein-rich foods, such as eggs. With disposable income rising to an average of $4,900 per capita in 2024 (World Bank), households are able to afford higher-quality food products. Egg consumption, particularly for organic and fortified varieties, has grown significantly among the middle-class as part of broader lifestyle changes favoring balanced diets.

Market Challenges

- Fluctuating Feed Costs (Feed Prices, Raw Material Availability): Feed costs account for approximately 70% of the total cost of egg production in Indonesia, and fluctuations in global prices for key feed ingredients, such as corn and soybean meal, have a direct impact on profitability. In 2024, the global price for corn rose to $270 per metric ton, causing concern for local egg producers. Additionally, supply chain disruptions due to geopolitical tensions and climate events have exacerbated the volatility in feed prices, creating challenges for the stable pricing of eggs in the domestic market.

- Threat of Avian Influenza Outbreaks: Indonesia continues to be vulnerable to avian influenza outbreaks, which pose significant risks to poultry production. In 2023, the Ministry of Agriculture reported 18 confirmed cases of avian influenza, affecting over 100,000 poultry. While vaccination efforts and biosecurity measures have been implemented, the risk remains high, especially in densely populated farming regions.

Indonesia Eggs Market Future Outlook

Over the next five years, the Indonesia Eggs Market is expected to witness steady growth, driven by rising consumer demand for affordable protein sources, government initiatives supporting sustainable agriculture, and technological advancements in poultry farming. The shift towards organic and free-range egg production is also expected to contribute to the markets future growth, as more consumers become health-conscious and willing to pay a premium for such products.

Market Opportunities

- Increasing Adoption of Cage-Free and Organic Farming: The growing consumer demand for animal welfare has led to an increased adoption of cage-free and organic farming practices among Indonesian poultry farmers. In 2024, the government introduced incentives for farmers transitioning to cage-free systems, including tax breaks and technical assistance. Approximately 5% of Indonesias total egg production now comes from cage-free farms, with this figure expected to rise as consumer demand increases for ethical food products.

- Export Growth Potential to Neighboring Countries: Indonesia's strategic location in Southeast Asia offers opportunities for exporting eggs to neighboring countries with rising demand for poultry products. In 2023, Indonesia exported over 20,000 tons of eggs to Malaysia, Singapore, and the Philippines. With ASEAN free trade agreements reducing barriers, there is potential for further growth in egg exports.

Scope of the Report

|

Type of Eggs |

White Eggs Brown Eggs Specialty Eggs |

|

Form |

Fresh Eggs Processed Eggs |

|

Distribution Channel |

Retail Foodservice E-commerce |

|

End User |

Households Commercial |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Egg Producers

Poultry Feed Manufacturers

Retailers (Supermarkets, Hypermarkets)

Foodservice Industry (Hotels, Restaurants)

Government and Regulatory Bodies (Ministry of Agriculture)

Investors and Venture Capitalist Firms

Importers and Exporters of Agricultural Goods

Poultry Farming Equipment Suppliers

Companies

Players Mentioned in the Report

Charoen Pokphand Indonesia

Japfa Comfeed Indonesia

Sierad Produce

Malindo Feedmill

Wonokoyo Group

New Hope Indonesia

CP Prima

KUB Farm

QL Agrofood

Belfoods Indonesia

Table of Contents

1. Indonesia Eggs Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Eggs Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Eggs Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Population and Protein Consumption

3.1.2. Rising Demand for Organic and Free-Range Eggs

3.1.3. Government Support for Agricultural Sustainability

3.1.4. Growing Middle-Class and Changing Dietary Preferences

3.2. Market Challenges

3.2.1. Fluctuating Feed Costs (Feed Prices, Raw Material Availability)

3.2.2. Threat of Avian Influenza Outbreaks

3.2.3. Limited Cold Chain Infrastructure

3.3. Opportunities

3.3.1. Increasing Adoption of Cage-Free and Organic Farming

3.3.2. Export Growth Potential to Neighboring Countries

3.3.3. Technological Advancements in Egg Production

3.4. Trends

3.4.1. Shift Toward Sustainable and Eco-Friendly Egg Farming

3.4.2. Development of Value-Added Egg Products (Fortified, Omega-3)

3.4.3. Vertical Integration in Poultry Farms

3.5. Government Regulations

3.5.1. Agricultural Subsidies for Poultry Farmers

3.5.2. Sanitary and Phytosanitary (SPS) Regulations

3.5.3. Import and Export Regulations on Eggs

3.5.4. Policies Promoting Free-Range and Organic Egg Farming

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competitive Ecosystem

4. Indonesia Eggs Market Segmentation

4.1. By Type of Eggs (In Value %)

4.1.1. White Eggs

4.1.2. Brown Eggs

4.1.3. Specialty Eggs (Organic, Omega-3, Free-Range)

4.2. By Form (In Value %)

4.2.1. Fresh Eggs

4.2.2. Processed Eggs (Powdered, Liquid, Frozen)

4.3. By Distribution Channel (In Value %)

4.3.1. Retail (Supermarkets, Hypermarkets, Convenience Stores)

4.3.2. Foodservice (Hotels, Restaurants, Catering)

4.3.3. E-commerce

4.4. By End User (In Value %)

4.4.1. Households

4.4.2. Commercial (Bakeries, Food Manufacturers)

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia Eggs Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Charoen Pokphand Indonesia

5.1.2. Japfa Comfeed Indonesia

5.1.3. Sierad Produce

5.1.4. Malindo Feedmill

5.1.5. Wonokoyo Group

5.1.6. New Hope Indonesia

5.1.7. CP Prima

5.1.8. KUB Farm

5.1.9. QL Agrofood

5.1.10. Belfoods Indonesia

5.1.11. PT Sumber Unggas Perkasa

5.1.12. PT Cibadak Farm

5.1.13. PT Java Egg Specialities

5.1.14. PT Ultra Prima Abadi

5.1.15. PT Perkasa Farms

5.2. Cross Comparison Parameters (Revenue, Market Share, Number of Farms, Production Capacity)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Government Grants and Subsidies

5.8. Private Equity Investments

6. Indonesia Eggs Market Regulatory Framework

6.1. Agricultural and Poultry Regulations

6.2. Food Safety Standards (Egg Quality, Packaging, and Storage)

6.3. Certification Processes for Organic and Free-Range Eggs

6.4. Licensing Requirements for Egg Farms

7. Indonesia Eggs Market Future Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Eggs Market Future Segmentation

8.1. By Type of Eggs (In Value %)

8.2. By Form (In Value %)

8.3. By Distribution Channel (In Value %)

8.4. By End User (In Value %)

8.5. By Region (In Value %)

9. Indonesia Eggs Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map of the Indonesia Eggs Market, focusing on key stakeholders such as egg producers, distributors, and regulatory authorities. A comprehensive desk research approach, utilizing proprietary databases and government resources, was employed to gather industry-level insights. Key variables influencing the market include production capacity, feed prices, and regulatory policies.

Step 2: Market Analysis and Construction

In this step, historical data pertaining to the Indonesia Eggs Market was compiled to assess market trends, segment penetration, and revenue generation. Production volumes and market share distribution across different segments were evaluated. This phase also involved analyzing the demand from key consumer groups, such as households and commercial entities.

Step 3: Hypothesis Validation and Expert Consultation

To ensure the reliability of the data, industry experts from leading egg production companies were consulted through CATI. These interviews provided insights into operational efficiencies, supply chain dynamics, and market trends, helping to validate the initial findings and refine the data.

Step 4: Research Synthesis and Final Output

The final phase involved integrating data from egg producers with government records and agricultural reports to verify production volumes, export data, and market segmentation. This data synthesis ensures that the report provides a comprehensive and accurate representation of the Indonesia Eggs Market.

Frequently Asked Questions

01. How big is the Indonesia Eggs Market?

The Indonesia Eggs Market is valued at USD 3 billion, based on a five-year historical analysis. This market is primarily driven by the increasing demand for affordable and protein-rich food sources, particularly eggs, which serve as a staple in the Indonesian diet.

02. What are the challenges in the Indonesia Eggs Market?

Challenges include fluctuating feed prices, limited cold chain infrastructure, and the threat of disease outbreaks, such as avian influenza, which can disrupt production and supply chains.

03. Who are the major players in the Indonesia Eggs Market?

Key players in the market include Charoen Pokphand Indonesia, Japfa Comfeed Indonesia, Sierad Produce, Malindo Feedmill, and Wonokoyo Group, all of which dominate due to their vertical integration and strong distribution networks.

04. What are the growth drivers of the Indonesia Eggs Market?

The market is propelled by the increasing demand for affordable protein, government support for the poultry industry, and the growing popularity of organic and free-range eggs among health-conscious consumers.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.