Indonesia Electric 3-Wheeler Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD1603

December 2024

87

About the Report

Indonesia Electric 3-Wheeler Market Overview

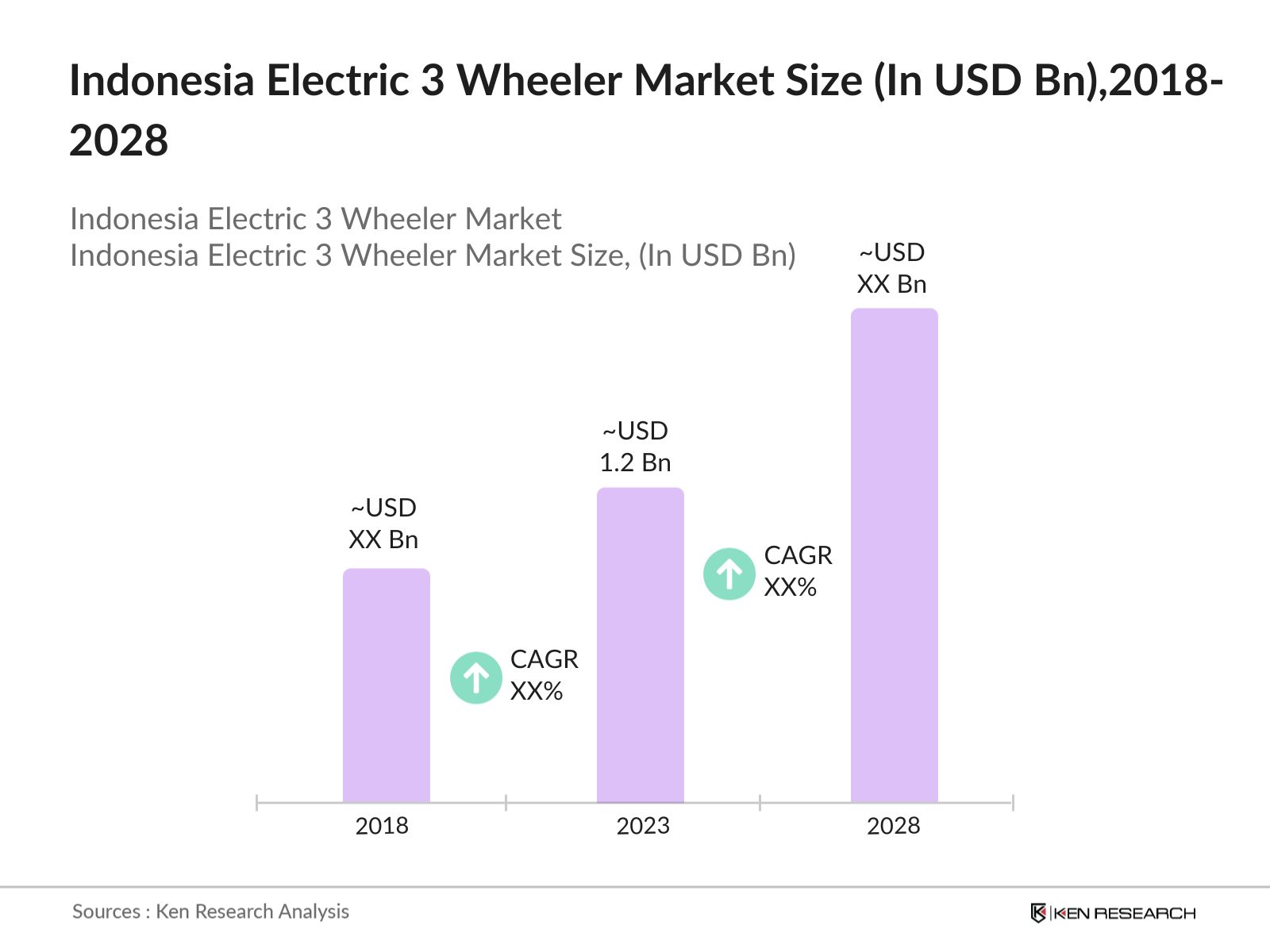

- Indonesia Electric 3-Wheeler Market is experiencing rapid growth, driven by the government's push for sustainable transportation and the rising demand for cost-effective mobility solutions. In 2023, the market size reached USD 1.2 billion. This growth is fueled by urbanization, environmental concerns, and increasing fuel prices.

- Indonesia Electric 3-Wheeler Market is dominated by several key players, including Viar Motor Indonesia, Selis, and Ternyata. These companies have capitalized on the growing demand for EVs by offering affordable and reliable vehicles tailored to the local market.

- In 2023, Clean Motion AB collaborated with EU Horizon Europe. The project GIANTS (Green Intelligent Affordable Nano Transport Solutions) have a total of 23 project partners and a total budget of 16.61 million, of which USD 13.2 million are grants from the EU.

- Jakarta, Surabaya, and Bandung are the leading cities in Indonesia's electric 3-wheeler market. Jakarta dominates due to its high population density, severe traffic congestion, and the local government's initiatives to promote electric vehicles. Surabaya and Bandung follow closely, driven by similar urbanization trends and increasing environmental awareness.

Indonesia Electric 3-Wheeler Market Segmentation

The Indonesia Electric 3-Wheeler Market can be segmented based on several factors:

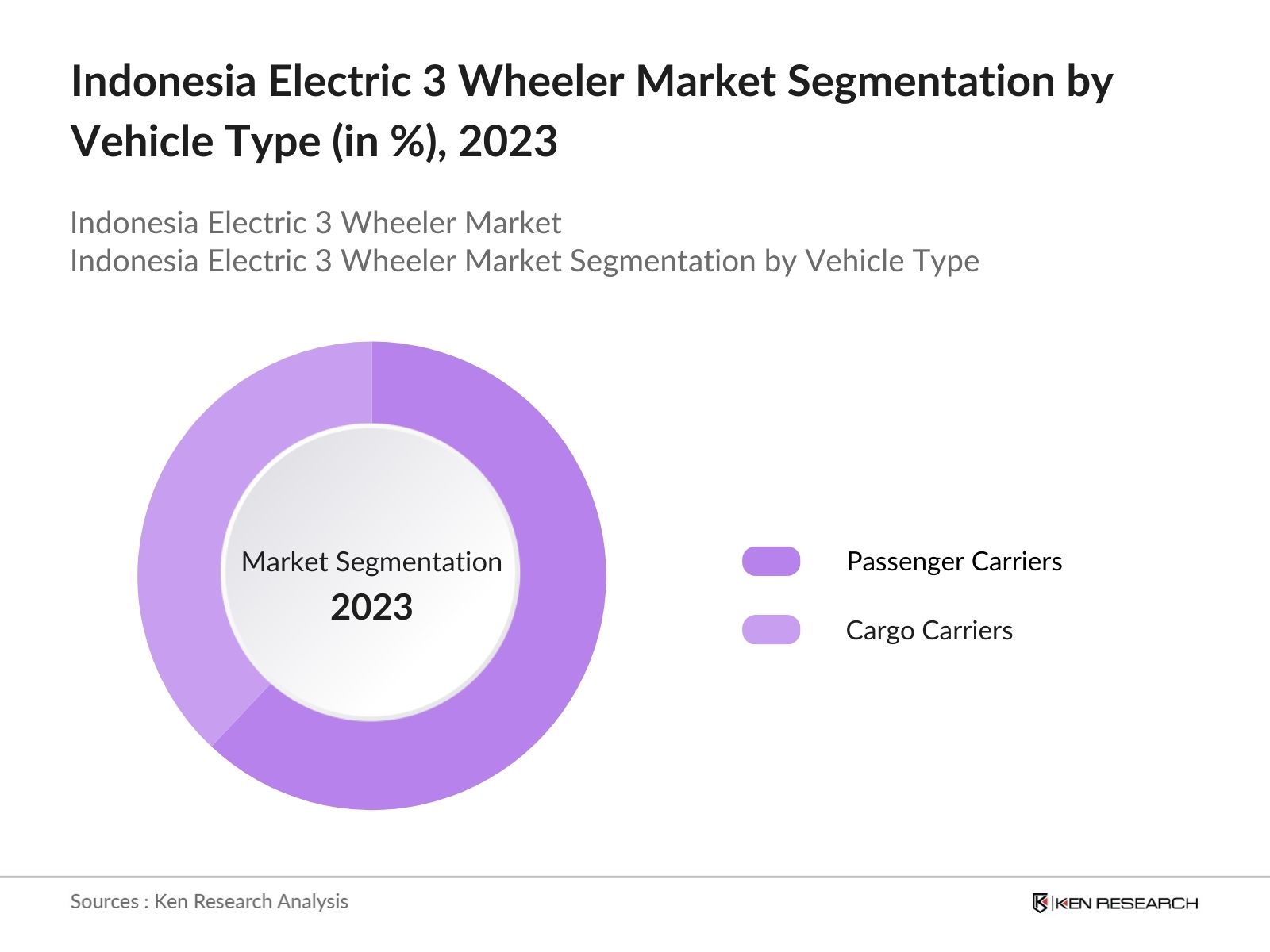

By Vehicle Type: Indonesia Electric 3-Wheeler market is segmented by vehicle type into passenger carriers and cargo carriers. In 2023, passenger carriers dominated this segment due to their widespread use in urban areas for short-distance travel. These vehicles are popular among ride-sharing services and local transportation providers, particularly in congested cities where maneuverability and cost-efficiency are crucial.

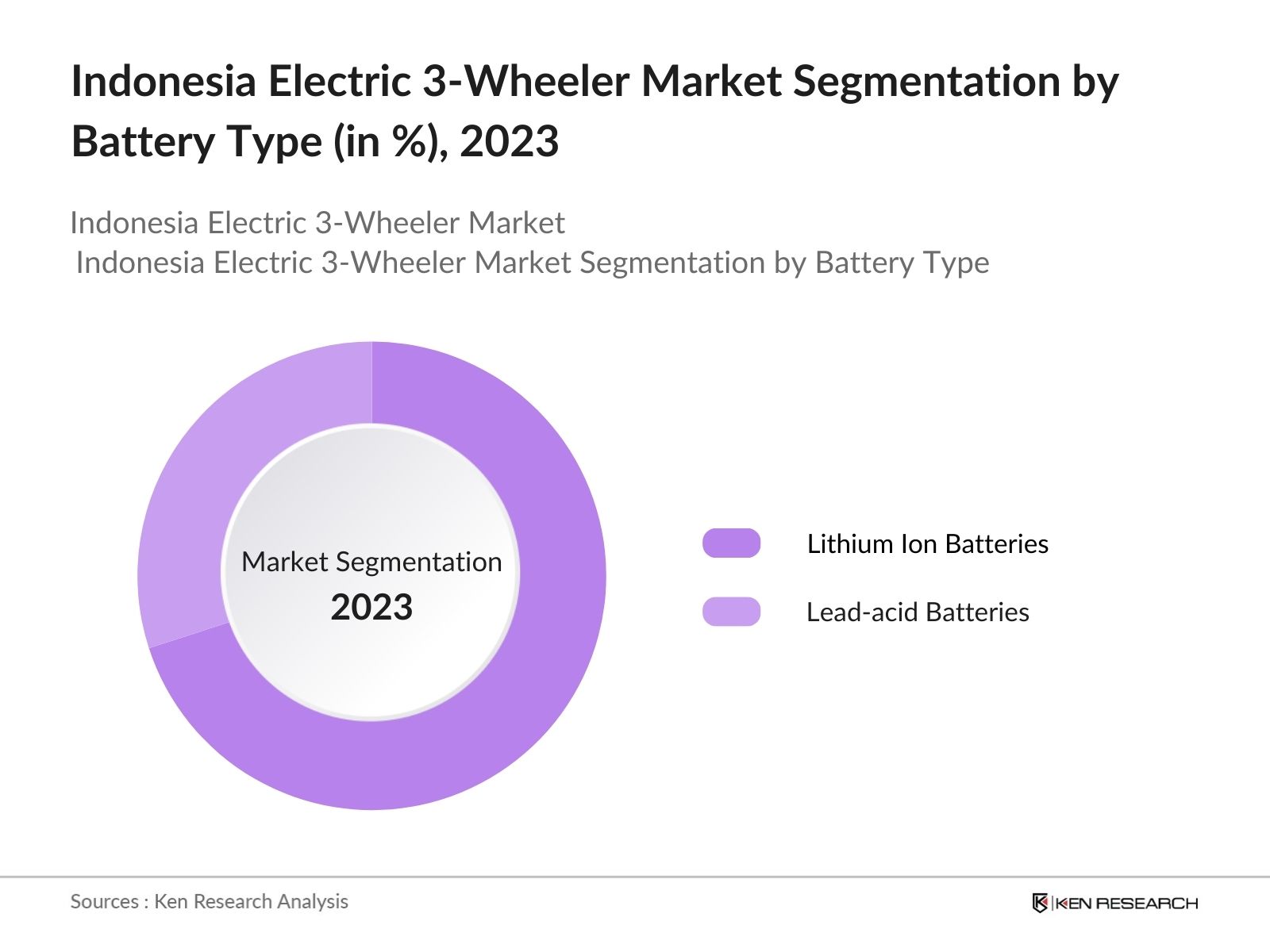

By Battery Type: Indonesia Electric 3-Wheeler Market is segmented by battery type into lithium-ion batteries and lead-acid batteries. In 2023, lithium-ion batteries dominated the segment due to their superior energy density, longer lifespan, and faster charging times. The adoption of lithium-ion batteries has been further accelerated by government initiatives promoting advanced battery technology and the reduction of lead-acid battery usage due to environmental concerns.

By Region: Indonesia Electric 3-Wheeler Market is segmented by region into North, South, East, and West Indonesia. In 2023, West Indonesia dominated the market. This dominance is attributed to the region's high population density, robust infrastructure development, and early adoption of electric vehicles driven by local government policies and incentives aimed at reducing pollution and improving urban mobility.

Indonesia Electric 3-Wheeler Market Competitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Viar Motor Indonesia |

2000 |

Jakarta, Indonesia |

|

Selis |

2011 |

Tangerang, Indonesia |

|

Ternyata |

2015 |

Bandung, Indonesia |

|

PT Juara Bike |

2018 |

Surabaya, Indonesia |

|

GESITS |

2016 |

Jakarta, Indonesia |

- TVS Motor: In 2024, TVS Motor launched operations in Italy, introducing a range of products, including electric scooters and conventional bikes. This move is part of a broader strategy to enhance its global footprint, which may include three-wheeler offerings in the future as part of its expanding portfolio.

- GESITS: In 2022, GESITS is part of a collaboration with Electrum, Pertamina, and Gogoro to accelerate the development of Indonesia's electric vehicle ecosystem. This partnership aims to enhance the infrastructure and technology surrounding electric vehicles in the country, showcasing GESITS as a key player in the local electric motorcycle market

Indonesia Electric 3-Wheeler Industry Analysis

Growth Drivers:

- Increased Government Incentives for Electric Vehicles: In 2023, the Indonesian government allocated IDR 7 trillion in subsidies to support EV purchases, significantly focusing on electric 3-wheelers. These incentives have dramatically lowered the initial cost of these vehicles, enhancing their affordability and accessibility for individuals and businesses alike. By reducing the financial barriers to entry, the subsidies are fostering greater adoption of electric 3-wheelers, aligning with national goals for sustainable transportation and reducing carbon emissions.

- Expanding Charging Infrastructure: As of 2023, Indonesia had over 2,700 units of EV charging infrastructure, including 1,722 public electric vehicle battery exchange stations (SPBKLU) and 911 public electric vehicle charging stations (SPKLU). This expansion is essential in supporting the increasing number of electric 3-wheelers on the road, ensuring convenient access to charging and promoting the adoption of EVs across the country, in line with Indonesia's sustainability goals.

- Rising Fuel Costs Pushing Demand for Alternatives: The global rise in crude oil prices has sharply driven up fuel costs in Indonesia, with petrol averaging IDR 14,520 per liter in 2024. This substantial increase in fuel expenses has made electric 3-wheelers an appealing alternative for cost-conscious consumers and businesses, offering a more economical solution amidst escalating fuel prices. This shift is contributing to the growing interest in and adoption of electric vehicles across the country.

Market Challenges

- Insufficient After-Sales Service Network: The after-sales service network for electric 3-wheelers in Indonesia is still underdeveloped with a limited number of service centers equipped to handle the unique requirements of electric vehicles. This has led to concerns among potential buyers about the availability of maintenance and repairs, particularly in remote areas.

- Challenges in Battery Disposal and Recycling: With the rise in electric 3-wheeler usage, Indonesia faces significant challenges in managing the disposal and recycling of used batteries. Improper disposal of these batteries poses environmental hazards, and the absence of a robust recycling program could lead to regulatory crackdowns and increased costs for manufacturers and consumers alike.

Government Initiatives

- National EV Acceleration Program (2023): National EV Acceleration Program in Indonesia aims to significantly boost the adoption and production of electric vehicles (EVs) as part of the country's broader environmental and economic strategy. Indonesia has set ambitious targets to produce 13 million electric motorcycles and 2.2 million electric cars by 2030 with the transport sector being a major focus due to its substantial contribution to greenhouse gas emissions.

- Electric Vehicle Charging Infrastructure Development Plan (2024): In 2024, the Ministry of Energy and Mineral Resources unveiled the Electric Vehicle Charging Infrastructure Development Plan, which outlines the governments strategy to establish 10,000 charging stations across Indonesia by 2025. The plan prioritizes high-density urban areas and major transportation hubs to ensure that electric 3-wheelers and other EVs have easy access to charging facilities.

Indonesia Electric 3-Wheeler Future Market Outlook

Indonesia Electric 3-Wheeler Market is poised for significant growth by 2028, driven by a combination of government initiatives, technological advancements, and increasing consumer demand for sustainable transportation solutions.

Future Trends

- Diversification of Product Offerings: Over the next five years, the Indonesian electric 3-wheeler market will likely see a diversification of product offerings, with manufacturers introducing a wider range of models tailored to different segments, including urban commuters, commercial transport, and rural mobility.

- Integration of Smart Technologies: Future electric 3-wheelers in Indonesia are expected to incorporate smart technologies such as IoT connectivity, advanced telematics, and autonomous driving features. These innovations will enhance vehicle performance, improve safety, and offer better fleet management solutions for commercial users.

Scope of the Report

|

By Vehicle Type |

Passenger Carriers Cargo Carriers |

|

By Battery Type |

Lithium-ion batteries Lead-acid batteries |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Electric Vehicle Manufacturers

Automotive Component Manufacturers

Ride-sharing Companies

Fleet Management Companies

Logistics and Delivery Companies

Energy and Utility Companies

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry, Ministry of Transportation)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

Viar Motor Indonesia

Selis

Ternyata

PT Juara Bike

GESITS

Bajaj Auto

Kymco

TVS Motor Company

Yadea Technology Group Co., Ltd.

Mahindra Electric Mobility Ltd.

Piaggio Group

Hero Electric

Terra Motors

Kinetic Green

Omega Seiki Mobility

Table of Contents

1. Indonesia Electric 3-Wheeler Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

2. Indonesia Electric 3-Wheeler Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Electric 3-Wheeler Market Analysis

3.1. Growth Drivers

3.1.1. Urbanization and Demand for Last-Mile Connectivity

3.1.2. Government Incentives and Subsidies

3.1.3. Rising Fuel Prices and Environmental Concerns

3.2. Restraints

3.2.1. High Initial Costs

3.2.2. Limited Charging Infrastructure

3.2.3. Battery Performance and Range Anxiety

3.3. Opportunities

3.3.1. Expansion of Charging Infrastructure

3.3.2. Technological Advancements in Battery Technology

3.3.3. Growth in E-Commerce and Last-Mile Delivery

3.4. Trends

3.4.1. Adoption of Lithium-Ion Batteries

3.4.2. Integration with Ride-Sharing Platforms

3.4.3. Increasing Investments in EV Startups

3.5. Government Regulation

3.5.1. National EV Acceleration Program

3.5.2. Electric Vehicle Charging Infrastructure Development Plan

3.5.3. Vehicle Registration and Licensing Policies

3.5.4. Public-Private Partnerships in EV Infrastructure

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Ecosystem

4. Indonesia Electric 3-Wheeler Market Segmentation, 2023

4.1. By Vehicle Type (in Value %)

4.1.1. Passenger Carriers

4.1.2. Cargo carriers

4.2. By Battery Type (in Value %)

4.2.1. Lithium-Ion Batteries

4.2.2. Lead-Acid Batteries

4.3. By End-User (in Value %)

4.3.1. Commercial Use

4.3.2. Personal Use

4.4. By Region (in Value %)

4.4.1. North

4.4.2. South

4.4.3. East

4.4.4. West

5. Indonesia Electric 3-Wheeler Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1 Viar Motor Indonesia

5.1.2 Selis

5.1.3 Ternyata

5.1.4 PT Juara Bike

5.1.5 GESITS

5.1.6 Bajaj Auto

5.1.7 Kymco

5.1.8 TVS Motor Company

5.1.9 Yadea Technology Group Co., Ltd.

5.1.10 Mahindra Electric Mobility Ltd.

5.1.11 Piaggio Group

5.1.12 Hero Electric

5.1.13 Terra Motors

5.1.14 Kinetic Green

5.1.15 Omega Seiki Mobilit

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Indonesia Electric 3-Wheeler Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

6.4. Investment Analysis

6.4.1. Venture Capital Funding

6.4.2. Government Grants

6.4.3. Private Equity Investments

7. Indonesia Electric 3-Wheeler Market Regulatory Framework

7.1. Electric Vehicle Standards

7.2. Compliance Requirements

7.3. Certification Processes

8. Indonesia Electric 3-Wheeler Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Indonesia Electric 3-Wheeler Future Market Segmentation, 2028

9.1. By Vehicle Type (in Value %)

9.2. By Battery Type (in Value %)

9.3. By End-User (in Value %)

9.4. By Region (in Value %)

10. Indonesia Electric 3-Wheeler Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Indonesia Electric 3-Wheeler Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Electric 3-Wheeler Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple electric three-wheeler companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from electric three-wheeler companies.

Frequently Asked Questions

01 How big is Indonesia Electric 3-Wheeler Market?

Indonesia Electric 3-Wheeler Market reached USD 1.2 billion, driven by the government's push for sustainable transportation and the rising demand for cost-effective mobility solutions, urbanization, environmental concerns and increasing fuel prices.

02 What are the growth drivers of the Indonesia Electric 3-Wheeler Market?

Growth drivers for the Indonesia Electric 3-Wheeler Market include increasing government incentives for EV adoption, expanding charging infrastructure, and the rising costs of traditional fuel, which make electric 3-wheelers a more cost-effective alternative.

03 What are challenges in Indonesia Electric 3-Wheeler Market?

Challenges in the Indonesia Electric 3-Wheeler Market include high initial costs of vehicles, limited after-sales service networks, and the inadequate infrastructure for battery disposal and recycling. These factors hinder broader market adoption, especially in rural areas

04 Who are major players in Indonesia Electric 3-Wheeler Market?

Indonesia Electric 3-Wheeler Market is dominated by several key players, including Viar Motor Indonesia, Selis, and Ternyata. These companies have capitalized on the growing demand for EVs by offering affordable and reliable vehicles tailored to the local market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.