Indonesia Electric Motors Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD10024

December 2024

90

About the Report

Indonesia Electric Motors Market Overview

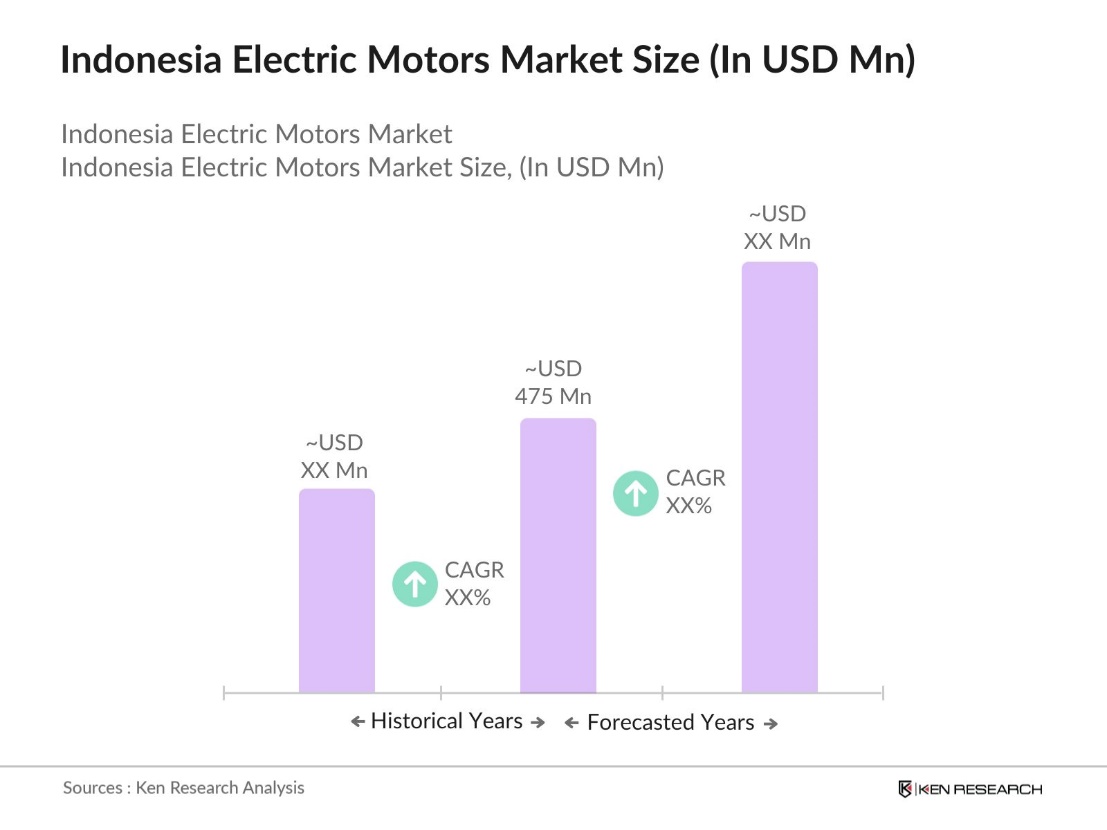

- The Indonesia Electric Motors Market is valued at USD 475 million, based on a five-year historical analysis. The market is driven by the rapid industrialization across Indonesia, as the manufacturing sector demands efficient electric motor solutions for automation and production processes. Additionally, the government's focus on electrification, particularly in rural areas, has increased the demand for electric motors in utilities and renewable energy applications like solar and wind power generation.

- Java and Sumatra are the dominant regions in the Indonesia Electric Motors Market. Java's dominance is due to its status as an industrial and manufacturing hub, housing significant numbers of manufacturing plants and automotive assembly lines. Sumatra follows as it has a strong agricultural sector where electric motors are utilized in machinery for palm oil processing and other agri-businesses. Additionally, Sumatra's emerging industrial zones contribute to the rising demand for industrial-grade motors.

- Indonesia's National Energy Policy aims to diversify energy sources and increase renewable energy usage. According to the International Energy Agency (IEA), renewable energy is expected to meet 35% of global electricity generation by 2025. This policy has a direct impact on the electric motor market, as renewable energy projects like solar and wind power require efficient motor solutions. The government's push for renewable energy has increased the demand for motors in applications like wind turbines and solar panel tracking system.

Indonesia Electric Motors Market Segmentation

By Motor Type: The Indonesia Electric Motors market is segmented by motor type into AC motors, DC motors, stepper motors, servo motors, and synchronous motors. Recently, AC motors have a dominant market share under this segmentation due to their widespread use in industrial machinery and HVAC systems. AC motors are preferred for their robust design and ability to handle high power applications, making them ideal for large-scale manufacturing and commercial setups. Additionally, their low maintenance requirements and long operational lifespan make them a cost-effective choice for businesses across various sectors.

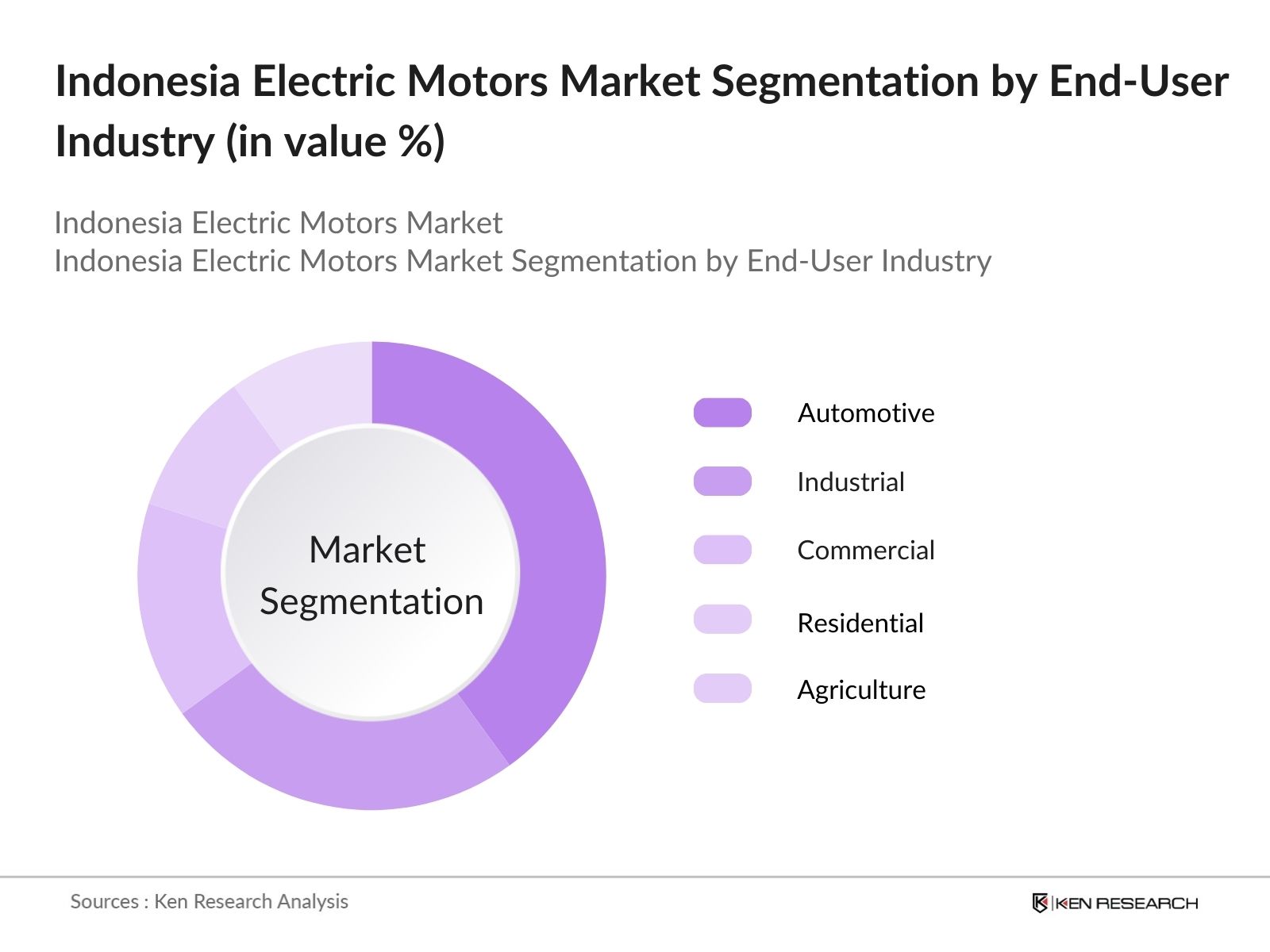

By End-User Industry: The Indonesia Electric Motors market is segmented by end-user industries into automotive, industrial, commercial, residential, and agriculture. The Automotive dominates the market share within this segmentation, largely due to the surge in electric vehicle (EV) manufacturing in Indonesia. As the country positions itself as a hub for EV production, the demand for electric motors used in EVs has significantly increased. This is driven by the presence of manufacturing facilities for major global automotive brands and local initiatives to promote electric mobility.

Indonesia Electric Motors Market Competitive Landscape

The market is dominated by a few key players, which include both international giants and local manufacturers. This concentration highlights the influence of these companies on market dynamics, such as pricing, technology integration, and supply chain management. Companies like ABB Ltd. and Siemens AG lead in industrial motor solutions, while local firms focus on niche applications and small-scale motor manufacturing.

|

Company Name |

Establishment Year |

Headquarters |

Annual Revenue (USD Mn) |

Production Capacity (Units) |

R&D Expenditure (USD Mn) |

Number of Patents |

Key Partnerships |

Local Manufacturing Plants |

Product Portfolio |

|

ABB Ltd. |

1988 |

Zurich, Switzerland |

|||||||

|

Siemens AG |

1965 |

Jakarta, Indonesia |

|||||||

|

PT. Panasonic Gobel Indonesia |

1970 |

Jakarta, Indonesia |

|||||||

|

Mitsubishi Electric Indonesia |

1982 |

Tokyo, Japan |

|||||||

|

PT. Teco Electro Devices Indonesia |

1985 |

Bekasi, Indonesia |

Indonesia Electric Motors Industry Analysis

Growth Drivers

- Industrialization and Manufacturing Expansion (Industrial Applications): Indonesias industrial sector contributed 20,892 trillion ($1.371 trillion) to its GDP in 2023, driven by expanding manufacturing activities in automotive and electronics. The growth in manufacturing has led to a rise in demand for electric motors used in industrial machinery, assembly lines, and automation processes. This shift towards industrial automation boosts demand for both low-voltage and high-voltage motors in factories and manufacturing plants.

- Rising Energy Efficiency Standards (IE2, IE3, and IE4 Motor Standards): Indonesia has adopted energy efficiency standards for electric motors, including the promotion of IE2 and IE3 standards for industrial applications, aiming to cut down energy consumption. According to the Indonesian Ministry of Energy, industries implementing IE3 motors have seen up to 15% energy savings compared to lower-grade motors. This regulatory push aligns with the country's target to reduce energy intensity by 1% annually through 2025. The adoption of IE4 motors, which offer even higher efficiency, is being encouraged to support the nation's energy conservation goals.

- Infrastructure Development (Smart Grids, Energy Solutions): Indonesias focus on modernizing its energy infrastructure through smart grid development is driving demand for efficient electric motors. These motors are crucial for improving the reliability and efficiency of grid equipment like transformers and distribution systems. As the country upgrades its electricity network, energy-efficient motors play a key role in reducing transmission losses and supporting sustainable power distribution to millions of households.

Market Challenges

- High Capital Investment (Cost Analysis): Implementing high-efficiency electric motors, such as those adhering to IE3 and IE4 standards, often involves considerable upfront investment. While these motors offer long-term energy savings, the initial costs can be a barrier, especially for smaller manufacturers. This challenge slows the transition to energy-efficient technologies as businesses struggle with financing. The high capital required for these upgrades makes widespread adoption a challenge across various industrial sectors.

- Supply Chain Disruptions (Raw Material Shortages): Supply chain challenges, particularly in sourcing essential materials for electric motor production, have impacted the markets stability. Disruptions in obtaining rare earth elements and other critical components have led to production delays, increasing reliance on imported electric motors. Additionally, fluctuations in the prices of key raw materials like copper and steel contribute to uncertainty, affecting the profitability and production schedules of motor manufacturers.

Indonesia Electric Motors Market Future Outlook

The Indonesia Electric Motors market is poised for significant growth over the next few years, driven by increased investments in infrastructure development, expansion of the EV market, and a shift towards energy-efficient solutions. As Indonesia aims to reduce its carbon footprint, the demand for high-efficiency motors (such as IE3 and IE4 standards) is expected to rise, offering opportunities for manufacturers to capitalize on this shift. The government's initiatives to strengthen the manufacturing sector and promote localization of production are likely to further boost the market.

Market Opportunities

- Adoption of IoT in Electric Motors (Smart Motors): The integration of the Internet of Things (IoT) into industrial equipment, including electric motors, is growing in Indonesia. This technological shift enhances the demand for smart motors capable of predictive maintenance and real-time monitoring. The use of IoT in these motors allows industries to improve efficiency and reduce downtime, making it particularly beneficial for sectors like oil and gas, where maintaining operational efficiency is critical.

- Investment in Green Manufacturing Technologies: Indonesias focus on sustainable industrial practices is driving the adoption of green technologies, including energy-efficient electric motors. The shift towards greener manufacturing processes aligns with national goals for reducing carbon emissions and fostering environmentally friendly production methods. Industries that adopt these energy-saving motors not only benefit from lower energy consumption but also position themselves as leaders in sustainable practices, gaining access to various incentives and support for eco-friendly initiatives.

Scope of the Report

|

By Motor Type |

AC Motors DC Motors Stepper Motors Servo Motors Synchronous Motors |

|

By Power Rating |

Fractional HP Motors Integral HP Motors (1 HP - 10 HP, 10 HP - 50 HP, Above 50 HP) |

|

By End-User |

Automotive (Electric Vehicles, Hybrid Vehicles) Industrial (Manufacturing, Oil & Gas) Commercial (HVAC, Pumps) Residential (Household Appliances) Agriculture (Irrigation Pumps) |

|

By Technology |

Conventional Motors Brushless Motors Smart Motors (IoT Integrated) Energy-Efficient Motors |

|

By Region |

Java Sumatra Kalimantan Sulawesi Bali & Nusa Tenggara |

Products

Key Target Audience

Automotive Manufacturers

Industrial Equipment Manufactures

Electric Vehicle OEMs

Utilities and Power Generation Companies

Investors and venture capital Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Ministry of Industry, Ministry of Energy and Mineral Resources)

Companies

Players Mentioned in the Report

ABB Ltd.

Siemens AG

PT. Panasonic Gobel Indonesia

Mitsubishi Electric Indonesia

PT. Schneider Electric Indonesia

Nidec Corporation

Regal Rexnord Corporation

Toshiba Asia Pacific

Hitachi Industrial Equipment Systems Co., Ltd.

WEG Indonesia

Table of Contents

1. Indonesia Electric Motors Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy (Motor Types, Applications, Power Ratings)

1.3. Market Growth Rate (In % CAGR)

1.4. Market Segmentation Overview

2. Indonesia Electric Motors Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis (Y-o-Y)

2.3. Key Market Developments and Milestones

3. Indonesia Electric Motors Market Analysis

3.1. Growth Drivers

3.1.1. Industrialization and Manufacturing Expansion (Industrial Applications)

3.1.2. Government Incentives for Electric Mobility (EV Penetration)

3.1.3. Rising Energy Efficiency Standards (IE2, IE3, and IE4 Motor Standards)

3.1.4. Infrastructure Development (Smart Grids, Energy Solutions)

3.2. Market Challenges

3.2.1. High Capital Investment (Cost Analysis)

3.2.2. Supply Chain Disruptions (Raw Material Shortages)

3.2.3. Competition from Local Manufacturers

3.2.4. Limited Awareness about Advanced Motor Technologies

3.3. Opportunities

3.3.1. Adoption of IoT in Electric Motors (Smart Motors)

3.3.2. Investment in Green Manufacturing Technologies

3.3.3. Export Opportunities to Neighboring Countries (ASEAN Market)

3.3.4. Strategic Partnerships with EV Manufacturers

3.4. Trends

3.4.1. Shift Towards Permanent Magnet Motors (Efficiency Enhancements)

3.4.2. Growing Demand for AC Motors in HVAC Systems

3.4.3. Use of AI and Predictive Maintenance in Industrial Motors

3.4.4. Decarbonization Initiatives Driving Market Growth

3.5. Government Regulation

3.5.1. National Energy Policy (Renewable Energy Targets)

3.5.2. Import Tariffs on Electric Motors

3.5.3. Compliance with Indonesian National Standards (SNI)

3.5.4. Incentives for Domestic Production

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Manufacturers, Suppliers, Distributors, End-users)

3.8. Porters Five Forces Analysis (Competition, Supplier Power, Buyer Power, Threat of Substitutes, Industry Rivalry)

3.9. Competition Ecosystem

4. Indonesia Electric Motors Market Segmentation

4.1. By Motor Type (In Value %)

4.1.1. AC Motors

4.1.2. DC Motors

4.1.3. Stepper Motors

4.1.4. Servo Motors

4.1.5. Synchronous Motors

4.2. By Power Rating (In Value %)

4.2.1. Fractional HP Motors

4.2.2. Integral HP Motors (1 HP - 10 HP, 10 HP - 50 HP, Above 50 HP)

4.3. By End-User Industry (In Value %)

4.3.1. Automotive (Electric Vehicles, Hybrid Vehicles)

4.3.2. Industrial (Manufacturing, Oil & Gas, Power Generation)

4.3.3. Commercial (HVAC, Pumps, Compressors)

4.3.4. Residential (Household Appliances)

4.3.5. Agriculture (Irrigation Pumps, Agricultural Machinery)

4.4. By Technology (In Value %)

4.4.1. Conventional Motors

4.4.2. Brushless Motors

4.4.3. Smart Motors (IoT Integrated)

4.4.4. Energy-Efficient Motors

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali & Nusa Tenggara

5. Indonesia Electric Motors Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. ABB Ltd.

5.1.2. Siemens AG

5.1.3. PT. Panasonic Gobel Indonesia

5.1.4. Mitsubishi Electric Indonesia

5.1.5. PT. Schneider Electric Indonesia

5.1.6. Nidec Corporation

5.1.7. Regal Rexnord Corporation

5.1.8. Toshiba Asia Pacific

5.1.9. Hitachi Industrial Equipment Systems Co., Ltd.

5.1.10. WEG Indonesia

5.1.11. PT. Teco Electro Devices Indonesia

5.1.12. Crompton Greaves Consumer Electricals Ltd.

5.1.13. Emerson Electric Co.

5.1.14. PT. Hyundai Electric & Energy Systems Indonesia

5.1.15. Danfoss Indonesia

5.2. Cross Comparison Parameters (Annual Revenue, Production Capacity, Market Share, R&D Investments, Product Portfolio, Distribution Network, Strategic Partnerships, Innovation Index)

5.3. Market Share Analysis (By Motor Type, By Application)

5.4. Strategic Initiatives (Expansions, New Product Launches, Collaborations)

5.5. Mergers And Acquisitions

5.6. Investment Analysis (Foreign Direct Investment, Domestic Investment)

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Electric Motors Market Regulatory Framework

6.1. Energy Efficiency Standards (IE2, IE3, IE4 Compliance)

6.2. Environmental Regulations (E-Waste Management)

6.3. Compliance Requirements for Domestic Manufacturing

6.4. Certification Processes (SNI, CE Marking)

7. Indonesia Electric Motors Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (EV Adoption, Industry 4.0, Renewable Energy Projects)

8. Indonesia Electric Motors Future Market Segmentation

8.1. By Motor Type (In Value %)

8.2. By Power Rating (In Value %)

8.3. By Technology (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Indonesia Electric Motors Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis (Total Addressable Market, Serviceable Available Market, Serviceable Obtainable Market)

9.2. Customer Cohort Analysis (Behavioral Segmentation)

9.3. Marketing Initiatives (Digital Transformation, Product Differentiation)

9.4. White Space Opportunity Analysis (Unserved Markets, Emerging Applications)

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map encompassing all major stakeholders within the Indonesia Electric Motors Market. This step is underpinned by extensive desk research, utilizing a combination of secondary and proprietary databases to gather comprehensive industry-level information. The primary objective is to identify and define the critical variables that influence market dynamics.

Step 2: Market Analysis and Construction

In this phase, we will compile and analyze historical data pertaining to the Indonesia Electric Motors Market. This includes assessing market penetration, the ratio of marketplaces to service providers, and the resultant revenue generation. Furthermore, an evaluation of service quality statistics will be conducted to ensure the reliability and accuracy of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be developed and subsequently validated through computer-assisted telephone interviews (CATIs) with industry experts representing a diverse array of companies. These consultations will provide valuable operational and financial insights directly from industry practitioners, which will be instrumental in refining and corroborating the market data.

Step 4: Research Synthesis and Final Output

The final phase involves direct engagement with multiple electric motor manufacturers to acquire detailed insights into product segments, sales performance, consumer preferences, and other pertinent factors. This interaction will serve to verify and complement the statistics derived from the bottom-up approach, thereby ensuring a comprehensive, accurate, and validated analysis of the Indonesia Electric Motors market.

Frequently Asked Questions

01. How big is the Indonesia Electric Motors Market?

The Indonesia Electric Motors Market is valued at USD 475 million, driven by rapid industrialization, infrastructure growth, and rising demand for electric vehicles.

02. What are the challenges in the Indonesia Electric Motors Market?

Challenges in Indonesia Electric Motors Market include high initial capital investment, raw material supply chain disruptions, and competition from local manufacturers, impacting profit margins and growth.

03. Who are the major players in the Indonesia Electric Motors Market?

Key players in Indonesia Electric Motors Market include ABB Ltd., Siemens AG, Mitsubishi Electric Indonesia, and PT. Panasonic Gobel Indonesia, known for their technological innovation and extensive distribution networks.

04. What are the growth drivers of the Indonesia Electric Motors Market?

The Indonesia Electric Motors Market is propelled by increasing demand from the EV sector, government incentives for electrification, and the shift towards energy-efficient motor solutions.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.