Indonesia Electric Vehicle Market Outlook to 2030

Region:Asia

Author(s):Shubham Kashyap

Product Code:KROD650

July 2024

86

About the Report

Indonesia Electric Vehicle Market Overview

- In the last five years, the Indonesia Electric Vehicle Market has experienced substantial growth, this is reflected by the global electric vehicle market reaching a valuation of USD 500 billion in 2023 driven by increasing environmental awareness and government incentives.

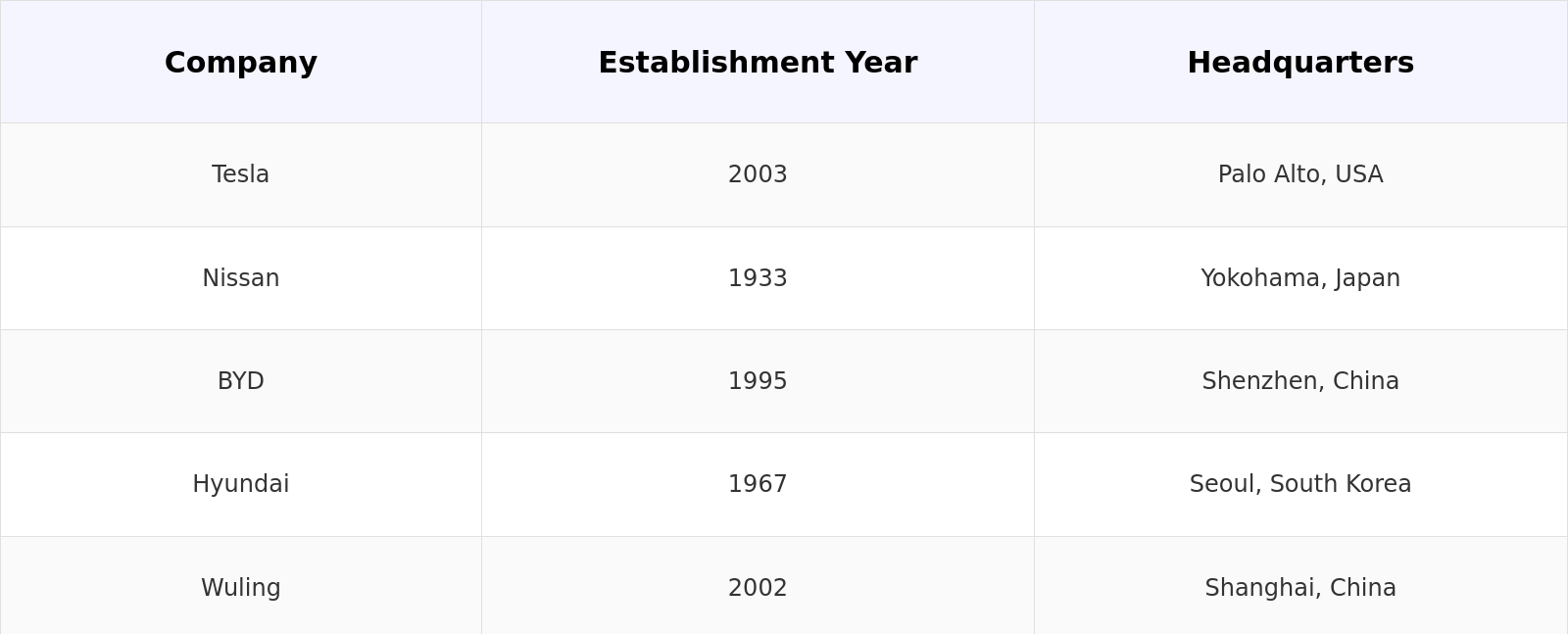

- The key players in the Indonesian EV Market include Tesla, Nissan, BYD, Hyundai, and Wuling. Tesla has captured substantial market interest with its advanced EV technology and high-performance models.

- Jakarta, Surabaya, and Bandung are the dominant cities in the Indonesian EV market. Jakarta leads due to its high population density and government-backed EV infrastructure projects. Surabaya follows with investments in charging facilities and local government support.

- In 2022, Wuling launched its first fully electric SUV in Indonesia, the Wuling Air EV, marking an important development in the local EV market. This model is expected to boost Wuling's market share by providing affordable, locally manufactured electric options.

Indonesia Electric Vehicle Market Segmentation

The Indonesia Electric Vehicle market is segmented by various factors like vehicle, battery, and region.

- By Vehicle Type: The Indonesian EV market is segmented by vehicle type into passenger vehicles, commercial vehicles, and two-wheelers. In 2023, passenger vehicles dominated the market due to increasing consumer demand for personal electric transportation. The preference for passenger EVs is driven by improved affordability and range, as well as substantial government incentives aimed at reducing personal vehicle emissions.

- By Battery Type: The Indonesian EV market is segmented by battery type into lithium-ion, lead-acid, and solid-state batteries. In 2023, Lithium-ion batteries dominated the market due to their higher energy density and longer lifespan compared to lead-acid and solid-state batteries. The rapid advancement in lithium-ion technology and its cost reduction have made it the preferred choice for both manufacturers and consumers in Indonesia.

- By Region: The market is further segmented by region into North, South, East, and West Indonesia. In 2023, Northern Indonesia dominates the market due to the high economic activity and government initiatives in cities like Medan and Jakarta. The region benefits from a growing number of charging stations and infrastructure development.

Indonesia Electric Vehicle Market Competitive Landscape

- Nissan: Nissan unveiled its new electric model, the Nissan Leaf e+, in Indonesia in 2022. This model offers extended range and improved performance compared to previous versions, catering to the increasing demand for high-performance EVs in the Indonesian market.

- BYD: BYD launched a new electric bus model in Jakarta in 2023, targeting public transport and commercial fleets. This development aligns with the government's push for cleaner public transportation options and is expected to capture a major share of the commercial EV market.

Indonesia Electric Vehicle Market Analysis

Indonesia Electric Vehicle Market Growth Drivers

- Expansion of EV Charging Infrastructure: The expansion of EV charging infrastructure is an important growth driver in Indonesia. The Indonesian state electricity company, PLN, is actively working on converting existing electricity poles into public EV charging stations. They plan to utilize millions of poles nationwide for this purpose and have already started with 3 stations in Jakarta, with plans to expand to 2,000 stations in 2024. This development is expected to address range anxiety among potential EV buyers and support the growing number of electric vehicles.

- Increased Foreign Investment: Foreign investment in the Indonesian EV sector is rapidly increasing. In 2024, international companies such as LG Chem and CATL committed over USD 1 billion to build battery manufacturing plants in Indonesia. This influx of investment is aimed at enhancing the local supply chain for EV components, reducing import dependency, and lowering production costs. Such investments are expected to boost local manufacturing capabilities and contribute to the growth of the EV market.

- Rising Corporate Adoption of EV Fleets: Rising corporate adoption of EV fleets is a substantial growth driver for the Indonesia Electric Vehicle market. Major corporations like Unilever and Telkom Indonesia are increasingly incorporating electric vehicles into their logistics and transportation operations. This trend is driven by companies' commitments to reducing their carbon footprint and achieving sustainability goals.

Indonesia Electric Vehicle Market Challenges

- Limited Charging Infrastructure in Rural Areas

While urban areas are seeing an increase in EV charging stations, rural regions in Indonesia are still underserved. As of mid-2024, only 15% of the new charging stations are planned for rural areas, leaving a gap in infrastructure coverage. This disparity in infrastructure availability poses a challenge for EV adoption in non-urban areas, where range anxiety and lack of charging facilities could deter potential buyers from purchasing electric vehicles. - Supply Chain Disruptions: The Indonesian EV market faces supply chain disruptions, particularly in the procurement of raw materials for batteries. In 2024, global supply chain issues and geopolitical tensions have led to delays and increased costs for critical components like lithium and cobalt. These disruptions are affecting local EV production, leading to longer delivery times and higher prices for consumers.

Indonesia Electric Vehicle Market Government Initiatives

- Electric Vehicle Roadmap 2024: In 2024, Indonesia's government introduced the "Electric Vehicle Roadmap," a strategic plan to support the growth of the EV market. It also outlines fiscal incentives for manufacturers and buyers, including reduced taxes and import duties on EV components. This comprehensive plan aims to establish a robust foundation for the EV market’s long-term growth.

- Green Transportation Subsidies: The Indonesian government has enhanced its green transportation subsidies program, offering additional financial support for electric vehicle purchases and infrastructure development. In 2024, the government increased the subsidy budget to USD 410 million, with new initiatives targeting both individual consumers and fleet operators.

Indonesia Electric Vehicle Future Market Outlook

The Indonesia electric vehicle market is poised for remarkable growth, driven by expansion of EV charging networks, increased market penetration of local EV manufacturers, and growth in EV export opportunities.

Future Market Trends

- Expansion of EV Charging Networks: By 2028, the EV charging infrastructure in Indonesia is expected to grow exceptionally. The government plans to increase the number of charging stations to 20,000 nationwide, with a focus on expanding coverage to rural areas. This expansion will alleviate range anxiety and support the increasing number of electric vehicles on the road, facilitating greater adoption and use of EVs across the country.

- Increased Market Penetration of Local EV Manufacturers: Local EV manufacturers are anticipated to capture a larger share of the market by 2028. With ongoing investments in technology and production capacity, companies like Wuling and Hyundai are expected to increase their market presence. Local production is projected to reduce vehicle costs and improve affordability, leading to a more significant penetration of electric vehicles among Indonesian consumers.

Scope of the Report

|

By Vehicle |

Passenger Vehicles Commercial Vehicles Two-Wheelers |

|

By Battery |

Lithium-Ion Lead-Acid Solid-State |

|

By Region |

North South East West |

Products

Key Target Audience – Organizations and Entities Who Can Benefit by Subscribing This Report:

Banks and Financial Institutions

Investments and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Industry of the Republic of Indonesia)

Automotive Manufacturers

Electric Vehicle Component Suppliers

Charging Infrastructure Providers

Fleet Operators

Time Period Captured in the Report:

- Historical Period: 2018-2023

- Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:Â

- Tesla

- Nissan

- BYD

- Hyundai

- Wuling

- Toyota

- BMW

- Mercedes-Benz

- Audi

- Honda

- Ford

- Rivian

- XPeng Motors

- Lucid Motors

- Geely

Table of Contents

1. Indonesia Electric Vehicle Market Overview

1.1 Indonesia Electric Vehicle Market Taxonomy

2. Indonesia Electric Vehicle Market Size (in USD Bn), 2018-2023

3. Indonesia Electric Vehicle Market Analysis

3.1 Indonesia Electric Vehicle Market Growth Drivers

3.2 Indonesia Electric Vehicle Market Challenges and Issues

3.3 Indonesia Electric Vehicle Market Trends and Development

3.4 Indonesia Electric Vehicle Market Government Regulation

3.5 Indonesia Electric Vehicle Market SWOT Analysis

3.6 Indonesia Electric Vehicle Market Stake Ecosystem

3.7 Indonesia Electric Vehicle Market Competition Ecosystem

4. Indonesia Electric Vehicle Market Segmentation, 2023

4.1 Indonesia Electric Vehicle Market Segmentation by Vehicle (in %), 2023

4.2 Indonesia Electric Vehicle Market Segmentation by Battery (in %), 2023

4.3 Indonesia Electric Vehicle Market Segmentation by Region (in %), 2023

5. Indonesia Electric Vehicle Market Competition Benchmarking

5.1 Indonesia Electric Vehicle Market Cross-Comparison (no. of employees, company overview, business strategy, USP, recent development, operational parameters, financial parameters and advanced analytics)

6. Indonesia Electric Vehicle Future Market Size (in USD Bn), 2023-2028

7. Indonesia Electric Vehicle Future Market Segmentation, 2028

7.1 Indonesia Electric Vehicle Market Segmentation by Vehicle (in %), 2028

7.2 Indonesia Electric Vehicle Market Segmentation by Battery (in %), 2028

7.3 Indonesia Electric Vehicle Market Segmentation by Region (in %), 2028

8. Indonesia Electric Vehicle Market Analysts’ Recommendations

8.1 Indonesia Electric Vehicle Market TAM/SAM/SOM Analysis

8.2 Indonesia Electric Vehicle Market Customer Cohort Analysis

8.3 Indonesia Electric Vehicle Market Marketing Initiatives

8.4 Indonesia Electric Vehicle Market White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step: 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.Â

Step: 2 Market Building:

Collating statistics on Indonesia Electric Vehicle market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Electric Vehicle market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.Â

Step: 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.Â

Step: 4 Research Output:

Our team will approach multiple essential electric vehicle companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from electric vehicle companies.Â

Â

Frequently Asked Questions

01 How big is the Indonesia Electric Vehicle market?

In last five years, the Indonesia Electric Vehicle market has experienced substantial growth, this is reflected by the global electric vehicle market reaching a valuation of USD 500 billion in 2023 driven by increasing environmental awareness and government incentives.

02 What are the challenges in the Indonesia Electric Vehicle market?

Challenges in the Indonesia Electric Vehicle market include high initial costs of EVs, limited charging infrastructure in rural areas, and supply chain disruptions affecting battery components. These factors hinder broader adoption and market growth.

03 Who are the major players in the Indonesia Electric Vehicle market?

Key players in the Indonesia Electric Vehicle market include Hyundai, Toyota, Wuling Motors, Nissan, and LG Chem. These companies lead due to their innovative technology, substantial investments in local production, and extensive distribution networks.

04 What are the growth drivers of the Indonesia Electric Vehicle market?

Growth drivers in the Indonesia Electric Vehicle market include government subsidies and incentives for EV purchases, expansion of EV charging infrastructure, and increased foreign investment in local manufacturing. These factors collectively enhance market attractiveness and adoption rates.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.