Indonesia Elevator Market Outlook 2030

Region:Global

Author(s):Shivani Mehra

Product Code:KROD11422

December 2024

97

About the Report

Indonesia Elevator Market Overview

- The Indonesia Elevator Market is valued at USD 386.38 million, reflecting the country's robust urban development and rising infrastructure needs. This growth is primarily driven by increasing urbanization and the government's commitment to enhancing public transportation systems and building high-rise structures. As urban centers expand, the demand for reliable vertical transportation solutions becomes essential, prompting significant investments from both public and private sectors.

- Key cities such as Jakarta, Surabaya, and Bandung dominate the Indonesian elevator market due to their rapid population growth and economic development. Jakarta, the capital city, is experiencing a construction boom with numerous high-rise buildings and shopping complexes. Surabaya and Bandung are also undergoing substantial urban development, leading to an increased need for efficient elevator systems. The concentration of economic activities in these cities ensures sustained demand for elevators, positioning them as vital markets for industry players.

- Indonesia's regulatory framework mandates stringent safety standards for elevators, ensuring their safe operation. The National Standardization Agency (BSN) oversees the implementation of safety regulations, requiring regular inspections and compliance with international standards. As of 2022, over 1,200 inspections were conducted across various regions, highlighting the government's commitment to safety in vertical transportation. These regulations create a structured environment that enhances public confidence in elevator systems while fostering compliance among manufacturers and service providers.

Indonesia Elevator Market Segmentation

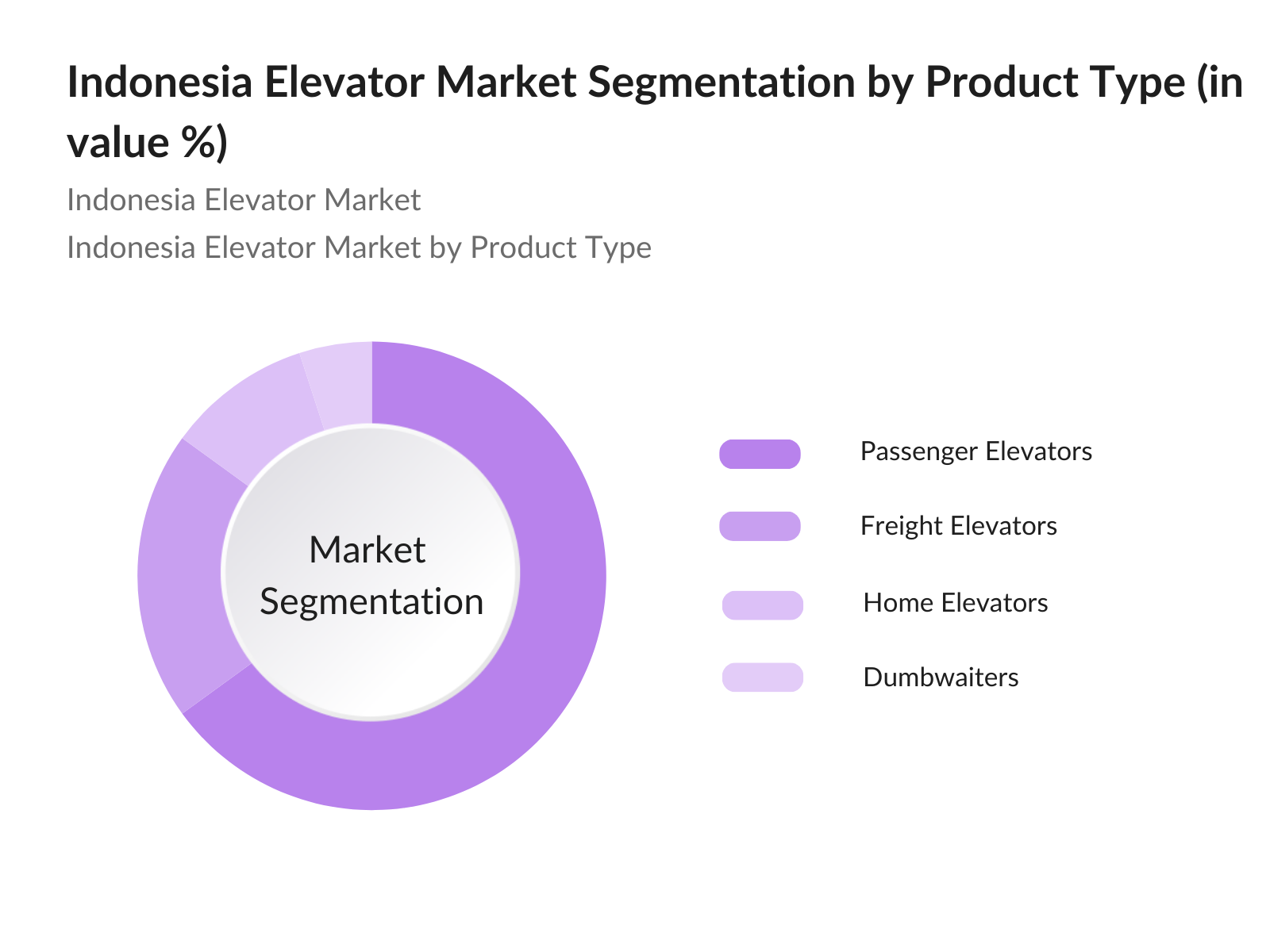

By Product Type: The Indonesian Elevator Market is segmented by product type into passenger elevators, freight elevators, home elevators, and dumbwaiters. Among these, passenger elevators hold a dominant market share, attributed to their widespread use in commercial and residential buildings. The increasing number of high-rise constructions and skyscrapers in urban areas significantly boosts demand for efficient passenger elevator systems. Furthermore, innovations in technology, such as smart elevators and energy-efficient systems, are enhancing the user experience and operational efficiency, further solidifying their market position.

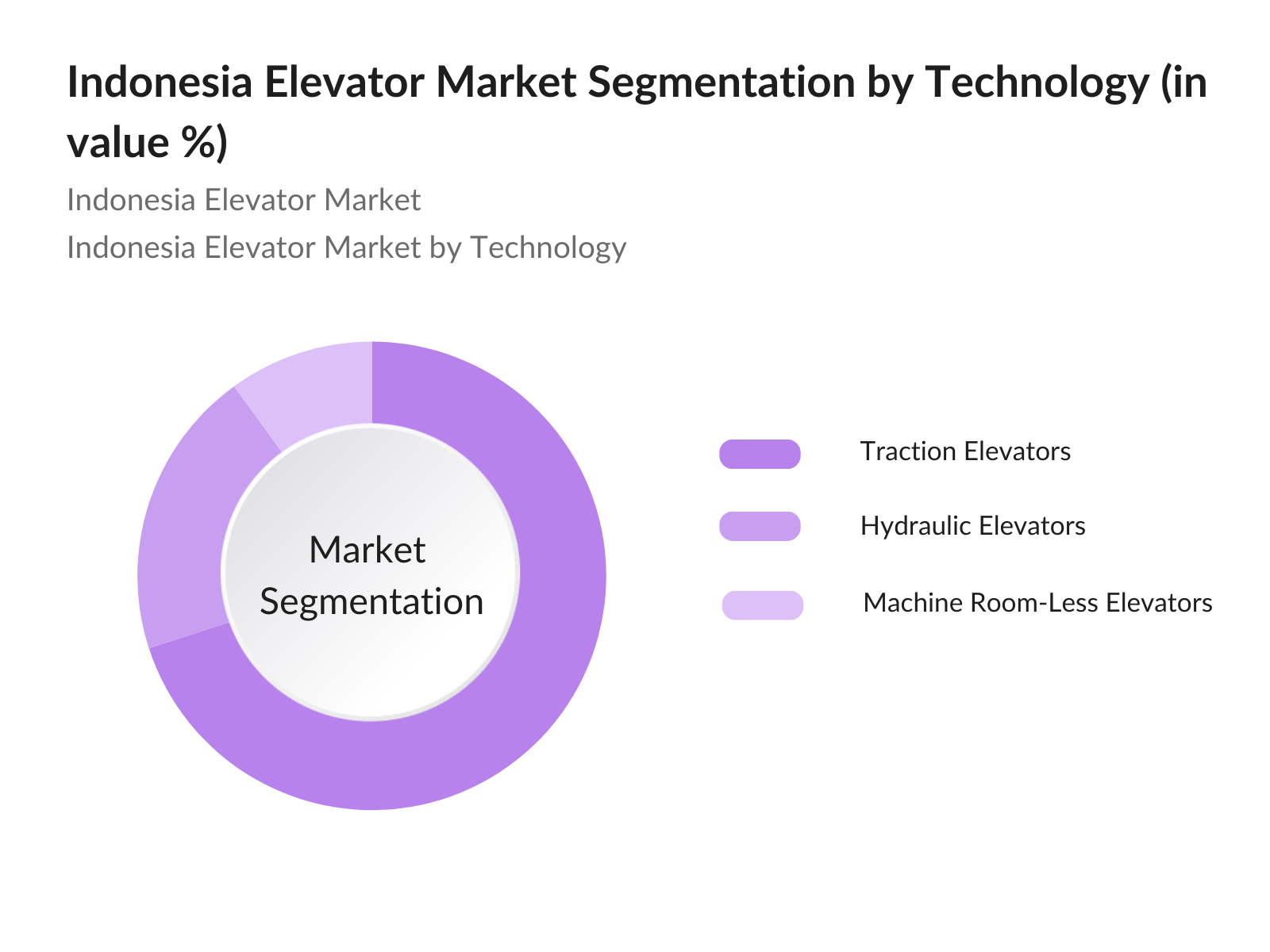

By Technology: The market is also segmented by technology, including traction elevators, hydraulic elevators, and machine room-less (MRL) elevators. Traction elevators are leading this segment due to their superior efficiency and ability to service high-rise buildings. Their design allows for smoother and faster operations, making them a preferred choice among builders and developers. As urbanization continues, the need for high-capacity and energy-efficient solutions further strengthens the dominance of traction elevators in the market.

Indonesia Elevator Market Competitive Landscape

The Indonesian Elevator Market is characterized by a few major players, including local and international manufacturers. Key companies include Otis Elevator Company, KONE Corporation, and Schindler Group, which have established strong market positions through innovation, quality, and customer service. This consolidation indicates a significant influence of these leading players, which continue to shape market dynamics and set industry standards.

|

Company |

Establishment Year |

Headquarters |

Product Offering |

Market Presence |

Technology Adoption |

Customer Base |

|

Otis Elevator Company |

1853 |

Farmington, CT, USA |

- |

- |

- |

- |

|

KONE Corporation |

1910 |

Helsinki, Finland |

- |

- |

- |

- |

|

Schindler Group |

1874 |

Ebikon, Switzerland |

Elevators, Escalators |

|||

|

Mitsubishi Electric |

1921 |

Tokyo, Japan |

Elevators, Escalators |

- |

- |

- |

|

ThyssenKrupp AG |

1999 |

Essen, Germany |

Elevators, Escalators |

- |

- |

- |

Indonesia Elevator Market Analysis

Market Growth Drivers

- Urban Development: Indonesia's urban development is significantly influenced by the government's push for infrastructure expansion. In 2022, the country allocated approximately $18 billion for urban development projects, including transportation, housing, and public facilities. This investment aims to enhance living conditions in urban areas, leading to higher demand for elevators in residential and commercial buildings. As urbanization continues, the need for vertical transportation will increase, fostering growth in the elevator market and reflecting the government's commitment to improving urban infrastructure.

- Rising Urban Population: Indonesia's urban population reached around 151 million in 2022. This number is projected to grow, contributing to an increasing demand for vertical transportation solutions. As cities expand and more people reside in high-rise buildings, the need for elevators becomes essential for efficient movement within these structures. The trend of urbanization reflects a shift in lifestyle, with a growing number of individuals living in metropolitan areas, further driving the elevator market's growth.

- Government Infrastructure Initiatives: The Indonesian government has prioritized infrastructure development, investing approximately $23 billion in 2022 for transportation and urban projects. Initiatives such as the National Medium-Term Development Plan (RPJMN) emphasize enhancing public transportation systems, including elevators in urban transit hubs. These investments aim to improve mobility and accessibility in cities, which will lead to increased demand for modern elevator systems. As urban infrastructure improves, the elevator market is positioned to benefit from these government-led initiatives.

Market Challenges:

- High Installation Costs: The initial costs of elevator installation in Indonesia can be significant, often exceeding $50,000 for high-rise buildings. These costs encompass equipment, labor, and compliance with safety regulations. As urban development accelerates, the challenge of managing these high installation costs becomes evident, particularly for developers. Many smaller construction firms struggle to allocate adequate budgets for elevator systems, potentially delaying projects. This financial barrier can hinder market growth, emphasizing the need for innovative financing solutions to overcome these challenges.

- Maintenance and Service Issues: Elevator maintenance is crucial for safety and functionality, yet it poses challenges in Indonesia. The country has an estimated average maintenance cost of $1,200 annually per unit, which can be burdensome for building owners, particularly in older structures. Additionally, the lack of skilled technicians to perform regular maintenance exacerbates safety concerns and operational downtime. As the market expands, addressing these maintenance challenges is vital for ensuring the longevity and reliability of elevator systems.

Indonesia Elevator Market Future Outlook

Over the coming years, the Indonesia Elevator Market is poised for substantial growth, driven by ongoing urbanization, government infrastructure initiatives, and technological advancements. The government's focus on developing smart cities and enhancing public transportation systems will continue to fuel demand for efficient elevator solutions. Additionally, increasing investments in high-rise construction and the rising trend of eco-friendly buildings will further bolster market growth.

Market Opportunities:

- Smart Elevator Technologies: The integration of smart technologies into elevators presents a significant opportunity for market growth. In 2022, investments in smart building technologies reached $4.5 billion in Indonesia, with an increasing focus on automation and IoT solutions. Smart elevators enhance operational efficiency through predictive maintenance and energy management, aligning with the growing demand for sustainable building solutions. As developers increasingly prioritize smart technologies, the elevator market can capitalize on this trend to offer advanced solutions that meet modern building requirements.

- Expansion into Emerging Cities: Emerging cities in Indonesia, such as Makassar and Medan, are experiencing rapid urbanization, presenting significant growth opportunities for the elevator market. With populations projected to grow substantially, the need for vertical transportation solutions in new residential and commercial developments is increasing. The governments commitment to improving infrastructure in these regions further supports market expansion, providing a fertile ground for elevator manufacturers and service providers to establish a presence and meet the rising demand.

Scope of the Report

|

By Product Type |

Passenger Elevators Freight Elevators Home Elevators Dumbwaiters |

|

By Technology |

Traction Elevators Hydraulic Elevators Machine Room-Less Elevators |

|

By Application |

Residential Commercial Industrial Institutional |

|

By End-User |

Real Estate Developers Government Institutions Facility Management Companies |

|

By Region |

North-East Midwest West Coast Southern States |

Products

Key Target Audience

Construction Companies

Real Estate Developers

Property Management Firms

Government and Regulatory Bodies (Ministry of Public Works and Housing, Ministry of Trade)

Investment and Venture Capitalist Firms

Commercial Property Owners

Facility Management Companies

Architects and Engineers

Companies

Players Mention in the Report

Otis Elevator Company

KONE Corporation

Schindler Group

Mitsubishi Electric

ThyssenKrupp AG

Fujitec Co., Ltd.

Hitachi, Ltd.

Hyundai Elevator Co., Ltd.

Sigma Elevator Company

Toshiba Elevator and Building Systems Corporation

Schindler Indonesia

KONE Indonesia

Mitsubishi Electric Indonesia

ThyssenKrupp Indonesia

Elevator Consulting Group

Table of Contents

01. Indonesia Elevator Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

02. Indonesia Elevator Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

03. Indonesia Elevator Market Analysis

3.1. Growth Drivers

3.1.1. Urban Development

3.1.2. Rising Urban Population

3.1.3. Government Infrastructure Initiatives

3.1.4. Economic Growth

3.2. Market Challenges

3.2.1. High Installation Costs

3.2.2. Maintenance and Service Issues

3.2.3. Regulatory Compliance

3.3. Opportunities

3.3.1. Smart Elevator Technologies

3.3.2. Green Building Initiatives

3.3.3. Expansion into Emerging Cities

3.4. Trends

3.4.1. Adoption of IoT in Elevators

3.4.2. Integration with Smart Building Systems

3.4.3. Focus on Energy Efficiency

3.5. Government Regulation

3.5.1. Safety Standards and Regulations

3.5.2. Environmental Compliance

3.5.3. Building Codes

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

04. Indonesia Elevator Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Passenger Elevators

4.1.2. Freight Elevators

4.1.3. Home Elevators

4.1.4. Dumbwaiters

4.2. By Technology (In Value %)

4.2.1. Traction Elevators

4.2.2. Hydraulic Elevators

4.2.3. Machine Room-Less Elevators

4.3. By Application (In Value %)

4.3.1. Residential

4.3.2. Commercial

4.3.3. Industrial

4.3.4. Institutional

4.4. By End-User (In Value %)

4.4.1. Real Estate Developers

4.4.2. Government Institutions

4.4.3. Facility Management Companies

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali

05. Indonesia Elevator Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Schindler Group

5.1.2. Otis Elevator Company

5.1.3. KONE Corporation

5.1.4. ThyssenKrupp AG

5.1.5. Mitsubishi Electric

5.1.6. Hitachi, Ltd.

5.1.7. Fujitec Co., Ltd.

5.1.8. Hyundai Elevator Co., Ltd.

5.1.9. Toshiba Elevator and Building Systems Corporation

5.1.10. Sigma Elevator Company

5.1.11. Otis Indonesia

5.1.12. Schindler Indonesia

5.1.13. KONE Indonesia

5.1.14. Mitsubishi Electric Indonesia

5.1.15. ThyssenKrupp Indonesia

5.2. Cross Comparison Parameters (Market Share, Number of Employees, Headquarters, Inception Year, Revenue, Technology Used, Product Offering, Customer Base)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

06. Indonesia Elevator Market Regulatory Framework

6.1. Safety Standards

6.2. Compliance Requirements

6.3. Certification Processes

07. Indonesia Elevator Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

08. Indonesia Elevator Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Technology (In Value %)

8.3. By Application (In Value %)

8.4. By End-User (In Value %)

8.5. By Region (In Value %)

09. Indonesia Elevator Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

This phase includes developing an ecosystem map that captures all key stakeholders in the Indonesian Elevator Market. This step involves comprehensive desk research, drawing from both secondary and proprietary databases to collect in-depth industry-level information. The primary aim is to identify and define the critical variables affecting market dynamics.

Step 2: Market Analysis and Construction

In this stage, we compile and analyze historical data related to the Indonesian Elevator Market. This includes assessing market penetration, evaluating the ratio of service providers, and analyzing the corresponding revenue generation. Furthermore, service quality metrics will be examined to ensure the accuracy and reliability of the revenue estimates.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses will be formulated and validated through interviews with industry experts representing a broad spectrum of companies. These consultations are critical for gaining operational and financial insights directly from industry practitioners, which will help refine and validate the market data.

Step 4: Research Synthesis and Final Output

The final stage involves engaging with various elevator manufacturers to gather detailed insights into product segments, sales performance, and consumer preferences. This interaction will verify and complement the statistics derived from the bottom-up approach, ensuring a comprehensive, accurate, and validated analysis of the Indonesian Elevator Market.

Frequently Asked Questions

01. How big is the Indonesia Elevator Market?

The Indonesia Elevator Market is valued at USD 386.38 million, driven by urbanization, high-rise construction, and technological advancements in elevator systems.

02. What are the challenges in the Indonesia Elevator Market?

Challenges include high installation costs, regulatory compliance hurdles, and competition among major players. The need for skilled labor for maintenance also poses a significant challenge.

03. Who are the major players in the Indonesia Elevator Market?

Key players include Otis Elevator Company, KONE Corporation, Schindler Group, and Mitsubishi Electric. These companies dominate due to their extensive product offerings and strong brand recognition.

04. What are the growth drivers of the Indonesia Elevator Market?

The market is propelled by factors such as rapid urbanization, increased investment in infrastructure, and advancements in elevator technologies aimed at enhancing efficiency and sustainability.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.