Indonesia Empty Medical Capsules Market Outlook to 2030

Region:Asia

Author(s):Sanjna Verma

Product Code:KROD10104

December 2024

85

About the Report

Indonesia Empty Medical Capsules Market Overview

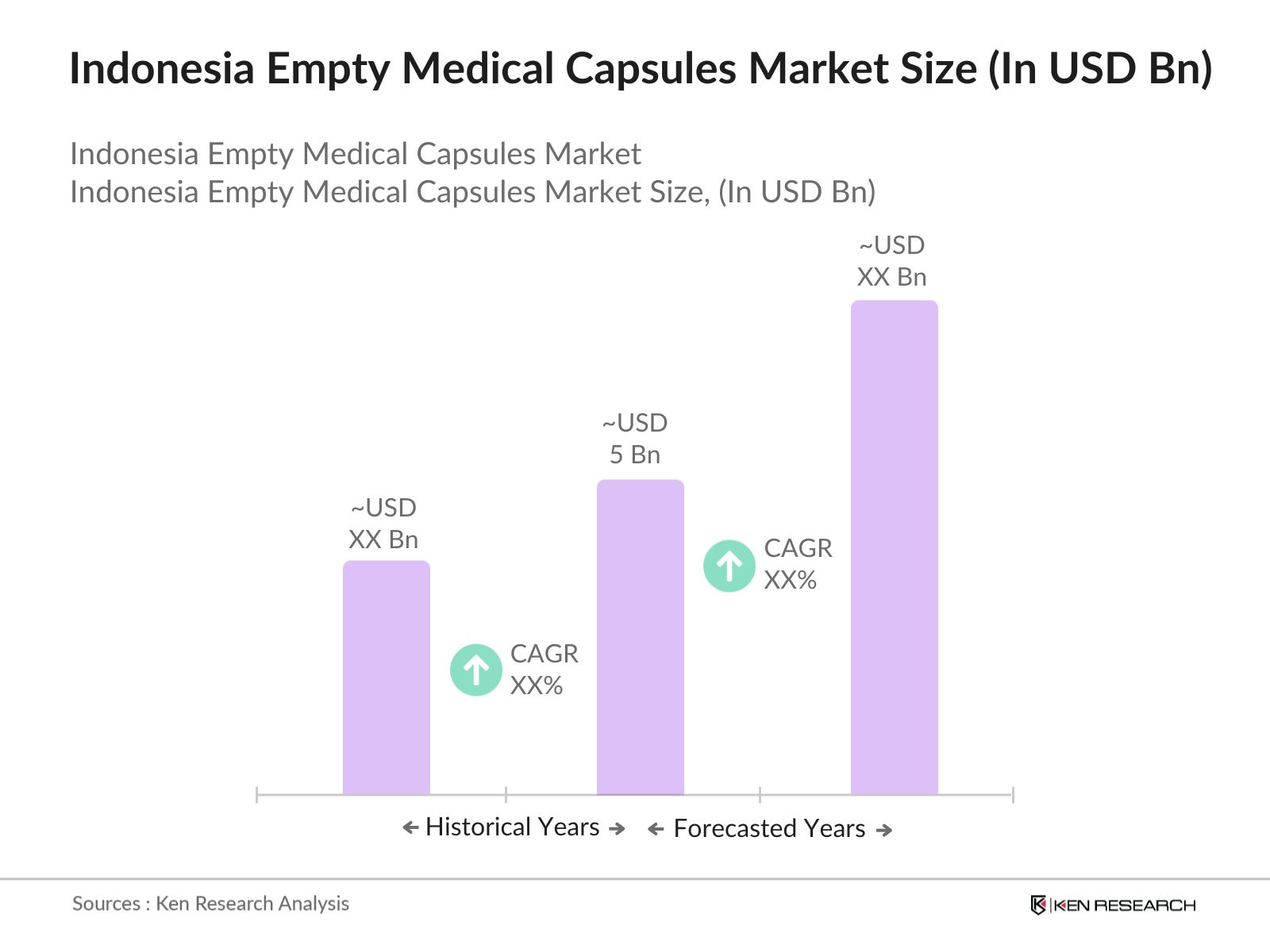

- The Indonesia Empty Medical Capsules market is valued at USD 5 billion, based on a five-year historical analysis. The market's growth is driven by the rising demand for pharmaceutical drugs and dietary supplements. As Indonesia expands its pharmaceutical manufacturing capabilities, the demand for empty capsules has increased significantly. Moreover, the healthcare industry's expansion, along with increasing awareness about nutraceuticals and personalized medicine, has played a key role in fueling the market growth.

- Java and Sumatra dominate the market due to the concentration of pharmaceutical manufacturing facilities and advanced distribution networks in these regions. The pharmaceutical hubs in these areas benefit from proximity to raw materials, skilled labor, and infrastructure, making them the leading contributors to the market. Additionally, government incentives to boost pharmaceutical exports from these regions further enhance their dominance in the empty medical capsules market.

- The Indonesian FDA (BPOM) has implemented strict regulations governing the production and sale of empty capsules. These regulations are designed to ensure the safety and quality of pharmaceutical and nutraceutical products. In 2023, the BPOM mandated that all empty capsules used in drug manufacturing must undergo rigorous testing and approval processes before they can be sold in the market. This has created a challenge for smaller manufacturers but ensures that only high-quality, compliant products are available to consumers.

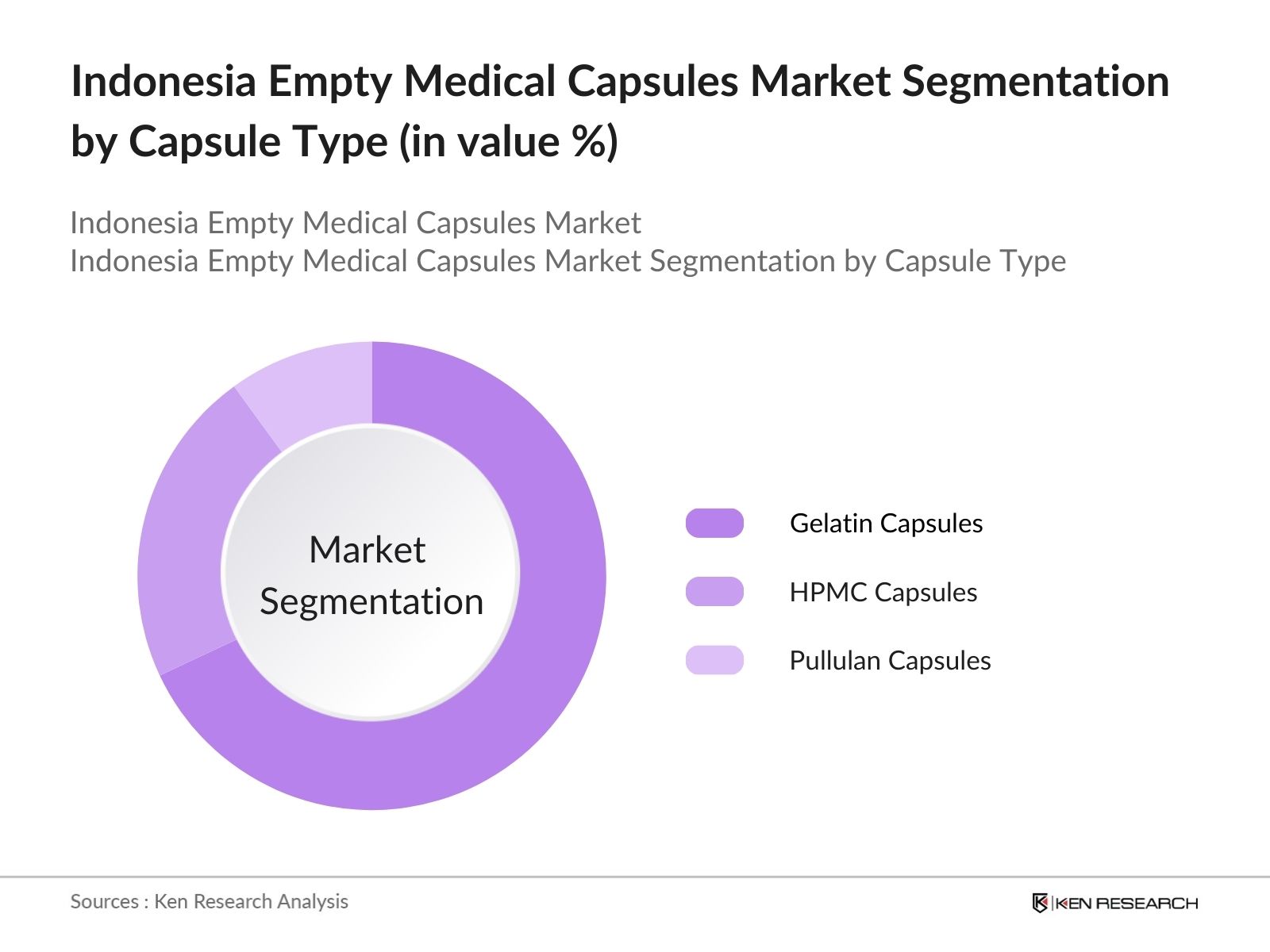

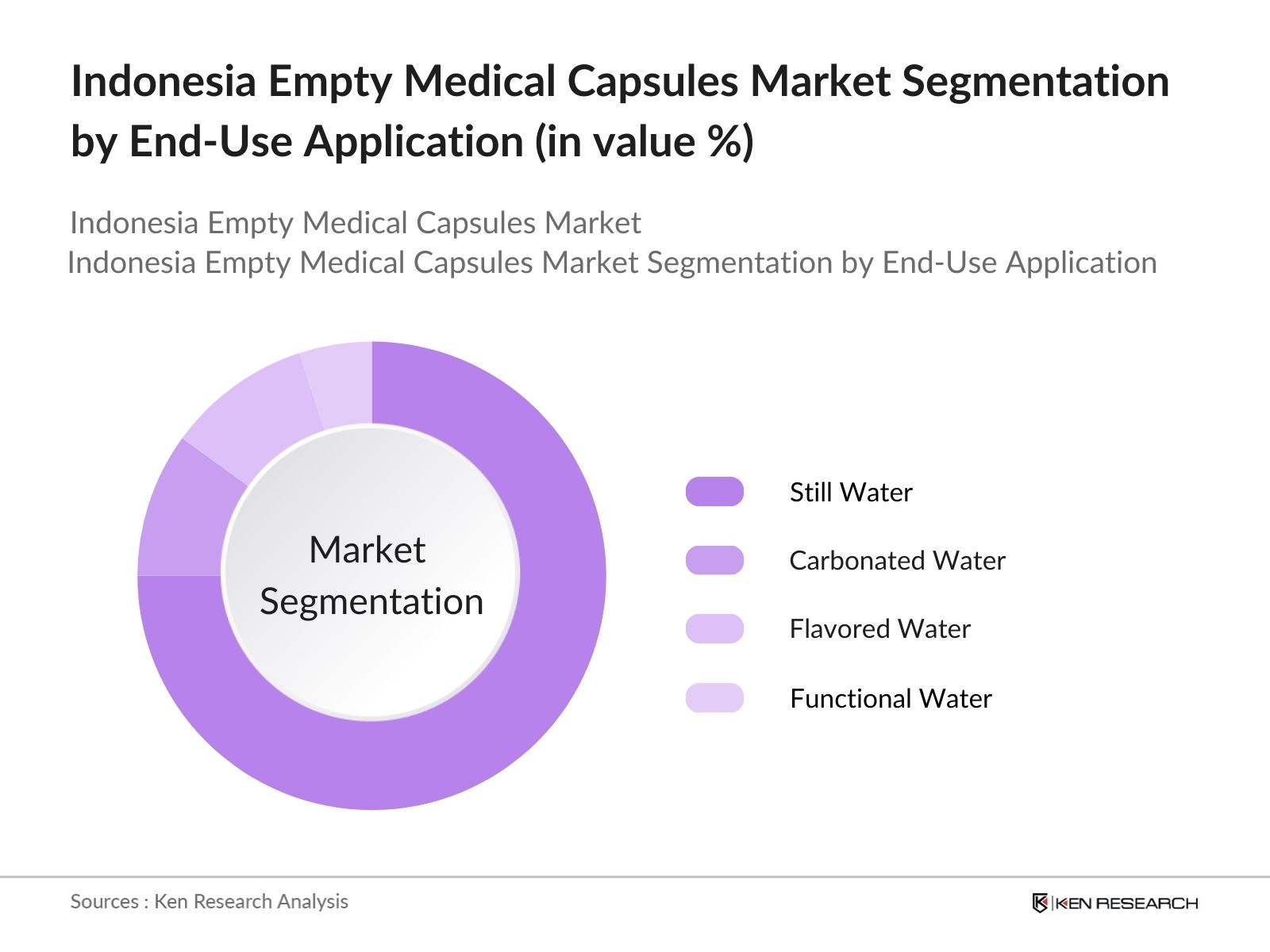

Indonesia Empty Medical Capsules Market Segmentation

By Capsule Type: The Indonesia Empty Medical Capsules market is segmented by capsule type into gelatin capsules, HPMC (hydroxypropyl methylcellulose) capsules, and pullulan capsules. Recently, gelatin capsules have dominated the market due to their widespread use in both pharmaceutical and nutraceutical industries. Gelatin's compatibility with a wide variety of drugs, coupled with its long-standing reputation for safety and efficacy, ensures its continued dominance. Pharmaceutical manufacturers prefer gelatin capsules due to their cost-efficiency and availability in the local market.

By End-Use Application: The market is segmented into the pharmaceutical industry, nutraceutical industry, cosmetic industry, and research & development. The pharmaceutical industry holds the largest share due to the increasing production of drugs in Indonesia. The governments push for domestic pharmaceutical production to meet the growing demand for healthcare services has significantly boosted the utilization of empty medical capsules in this sector. The pharmaceutical sectors compliance with stringent regulations also ensures sustained demand for high-quality capsules.

Indonesia Empty Medical Capsules Market Competitive Landscape

The Indonesia Empty Medical Capsules market is dominated by a mix of global and local manufacturers who have established strong production bases and supply chains. Global players benefit from advanced technology, while local players focus on cost-effective manufacturing and regional market expertise.

The competitive landscape is marked by key collaborations, mergers, and acquisitions aimed at increasing manufacturing capacities and enhancing product portfolios. Technological innovations in capsule manufacturing and growing competition are prompting companies to focus on expanding their presence in niche markets such as vegetarian capsules and customized capsule solutions.

|

Company Name |

Year of Establishment |

Headquarters |

Product Portfolio |

Production Capacity |

Halal Certification |

Regional Presence |

Export Markets |

Innovations in Capsules |

Sustainability Initiatives |

|

Capsugel (Lonza Group) |

1931 |

Switzerland |

- |

- |

- |

- |

- |

- |

- |

|

ACG Group |

1961 |

India |

- |

- |

- |

- |

- |

- |

- |

|

Qualicaps |

1931 |

Japan |

- |

- |

- |

- |

- |

- |

- |

|

Suheung Co. Ltd |

1973 |

South Korea |

- |

- |

- |

- |

- |

- |

- |

|

Sunil Healthcare Limited |

1976 |

India |

- |

- |

- |

- |

- |

- |

- |

Indonesia Empty Medical Capsules Market Analysis

Growth Drivers

- Increased Pharmaceutical Manufacturing: Indonesia's pharmaceutical sector is witnessing significant growth, driven by the rising demand for prescription drugs. The countrys pharmaceutical market is projected to expand, particularly due to the governments focus on universal healthcare. In 2023, Indonesias pharmaceutical industry output was valued at USD 25 million, with an increase in local manufacturing capabilities. The demand for empty capsules, particularly gelatin-based ones, is rising as prescription drug production expands.

- Growth in Nutraceutical Industry: Indonesia's nutraceutical sector is experiencing a surge due to rising health consciousness. The demand for dietary supplements has increased as more Indonesians prioritize preventative healthcare. This trend has driven the demand for empty capsules, especially gelatin and vegetarian-based ones, which are popular for encapsulating vitamins, minerals, and herbal supplements.

- Preference for Gelatin-Based Capsules: Gelatin-based capsules dominate the Indonesian market, driven by their widespread use in pharmaceutical and nutraceutical industries. Gelatin capsules are favored due to their stability, ease of production, and cost-effectiveness. In 2023, approximately 70% of all empty capsules consumed in Indonesia were gelatin-based, with the pharmaceutical sector being the largest consumer. The growing local production of medicines has also boosted the demand for these capsules, as manufacturers prefer gelatin for its ability to safely encapsulate various drug formulations.

Challenges

- Raw Material Supply Chain Disruptions: Indonesia imports a large portion of its gelatin, with disruptions in the global supply chain affecting local production. In 2023, the country faced a 15% decrease in gelatin imports due to logistical bottlenecks, impacting the availability of raw materials for capsule production. This challenge has been exacerbated by geopolitical tensions and shipping delays, which have led to fluctuations in the supply of raw materials critical for the pharmaceutical and nutraceutical sectors.

- Stringent Regulatory Requirements: Compliance with Indonesia FDA and international standards is essential for capsule producers. These regulations demand high levels of quality control, which increases production costs. For instance, local manufacturers must adhere to strict halal certification guidelines, further complicating the manufacturing process. In 2023, over 30% of capsule manufacturers in Indonesia reported difficulties in meeting these regulatory requirements, slowing down production and market entry.

Indonesia Empty Medical Capsules Market Future Outlook

Indonesia Empty Medical Capsules market is expected to show consistent growth driven by the continued expansion of the pharmaceutical and nutraceutical sectors. Government initiatives to promote local production and reduce dependency on imported drugs will further stimulate demand for empty capsules. Furthermore, increasing consumer interest in dietary supplements and personalized medication will present growth opportunities, especially in the production of HPMC and pullulan capsules, which cater to vegetarians and vegans.

Future Market Opportunities

- Growth of Herbal and Nutritional Supplements: With over 40 million Indonesians regularly consuming herbal supplements, the need for empty capsules, particularly those made from vegetarian materials, has increased. In 2023, the market for herbal supplements reached USD 850 million, with an increasing number of local manufacturers entering the market. This shift towards natural and plant-based supplements presents capsule producers with opportunities to diversify their product lines and cater to the growing demand for vegetarian and herbal supplement capsules.

- Expansion of Export Market: Indonesias empty capsule manufacturers are increasingly exploring export opportunities within the ASEAN region and beyond. In 2022, the country exported over 500 million empty capsules, primarily to neighboring countries like Malaysia and Thailand. This trend is expected to continue, with Indonesia's pharmaceutical exports projected to increase by 10% annually due to growing demand in regional markets.

Scope of the Report

|

Capsule Type |

Gelatin Capsules HPMC Capsules Pullulan Capsules |

|

Raw Material |

Pig-Sourced Gelatin Bovine-Sourced Gelatin Plant-Based Materials |

|

End-Use Application |

Pharmaceutical Industry Nutraceutical Industry Cosmetic Industry R&D |

|

Manufacturing Process |

Dipping Method Electrospinning Method Compression Method |

|

Region |

Java Sumatra Kalimantan Sulawesi Bali Nusa Tenggara |

Products

Key Target Audience

Pharmaceutical Manufacturers

Nutraceutical Producers

Healthcare Technology Firms

Pharmaceutical Packaging Companies

Cosmetic Companies

Government and Regulatory Bodies (Indonesia FDA, BPOM)

Investors and Venture Capitalist Firms

Dietary Supplement Producers

Companies

Players Mentioned in the Report

Capsugel (Lonza Group)

ACG Group

Qualicaps

Suheung Co. Ltd

Sunil Healthcare Limited

Roxlor Group

Bright Pharma Caps

HealthCaps India Ltd

Shanxi Guangsheng Medicinal Capsule Co., Ltd.

Medi-Caps Ltd

Table of Contents

Indonesia Empty Medical Capsules Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Empty Medical Capsules Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Empty Medical Capsules Market Analysis

3.1. Growth Drivers

3.1.1. Increased Pharmaceutical Manufacturing (Demand Surge in Prescription Drugs)

3.1.2. Growth in Nutraceutical Industry (Rising Health Consciousness)

3.1.3. Preference for Gelatin-Based Capsules (Capsule Type Preferences)

3.1.4. Government Support for Local Pharmaceutical Production (Regulatory Support)

3.2. Market Challenges

3.2.1. Raw Material Supply Chain Disruptions (Material Availability)

3.2.2. Stringent Regulatory Requirements (Compliance and Quality Standards)

3.2.3. High Manufacturing Costs (Cost Constraints)

3.2.4. Competition from Alternative Dosage Forms (Oral Dosage Alternatives)

3.3. Opportunities

3.3.1. Growth of Herbal and Nutritional Supplements (Product Diversification)

3.3.2. Expansion of Export Market (Export Opportunities in ASEAN and Beyond)

3.3.3. Investment in Capsule Manufacturing Technology (Process Optimization)

3.3.4. Increasing Adoption of Vegetarian Capsules (Shifts in Consumer Preferences)

3.4. Trends

3.4.1. Adoption of HPMC Capsules (Non-Gelatin Capsules)

3.4.2. Innovations in Capsule Delivery Systems (Enhanced Drug Delivery)

3.4.3. Environmentally Friendly Packaging Solutions (Sustainability Initiatives)

3.4.4. Rise of Personalization in Healthcare (Customized Capsule Formulations)

3.5. Government Regulations

3.5.1. Indonesia FDA Regulations (Product Approval Processes)

3.5.2. Compliance with Halal Certification (Religious Compliance in Capsules)

3.5.3. Import Tariff and Trade Policies (Capsule Import and Export Regulations)

3.5.4. Quality Control and Manufacturing Guidelines (Manufacturing Standards Enforcement)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

Indonesia Empty Medical Capsules Market Segmentation

4.1. By Capsule Type (In Value %)

4.1.1. Gelatin Capsules

4.1.2. Hydroxypropyl Methylcellulose (HPMC) Capsules

4.1.3. Pullulan Capsules

4.2. By Raw Material (In Value %)

4.2.1. Pig-Sourced Gelatin

4.2.2. Bovine-Sourced Gelatin

4.2.3. Plant-Based Materials

4.3. By End-Use Application (In Value %)

4.3.1. Pharmaceutical Industry

4.3.2. Nutraceutical Industry

4.3.3. Cosmetic Industry

4.3.4. Research and Development

4.4. By Manufacturing Process (In Value %)

4.4.1. Dipping Method

4.4.2. Electrospinning Method

4.4.3. Compression Method

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali and Nusa Tenggara

Indonesia Empty Medical Capsules Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Capsugel (Lonza Group)

5.1.2. ACG Group

5.1.3. Qualicaps

5.1.4. Suheung Co. Ltd

5.1.5. Sunil Healthcare Limited

5.1.6. Medi-Caps Ltd

5.1.7. Roxlor Group

5.1.8. Bright Pharma Caps

5.1.9. HealthCaps India Ltd

5.1.10. Shanxi Guangsheng Medicinal Capsule Co., Ltd.

5.2. Cross Comparison Parameters (Product Portfolio, Manufacturing Capacity, Capsule Type, Customer Base, Halal Certification, Capsule Innovation, Regional Presence, Expansion Strategies)

5.3. Market Share Analysis

5.4. Strategic Initiatives (Product Launches, Partnerships, and Collaborations)

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants and Support

5.9. Private Equity Investments

Indonesia Empty Medical Capsules Market Regulatory Framework

6.1. Indonesia FDA Standards (BPOM Requirements)

6.2. Halal Certification Compliance (Mandatory Halal Guidelines)

6.3. GMP and ISO Certification Requirements (Quality and Safety Standards)

Indonesia Empty Medical Capsules Future Market Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Empty Medical Capsules Future Market Segmentation

8.1. By Capsule Type (In Value %)

8.2. By Raw Material (In Value %)

8.3. By End-Use Application (In Value %)

8.4. By Manufacturing Process (In Value %)

8.5. By Region (In Value %)

Indonesia Empty Medical Capsules Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that includes all major stakeholders within the Indonesia Empty Medical Capsules market. This step incorporates extensive desk research, using both secondary and proprietary databases to collect comprehensive information on the industry. The aim is to identify critical variables, including key growth drivers, challenges, and opportunities influencing the market.

Step 2: Market Analysis and Construction

In this phase, historical data on the Indonesia Empty Medical Capsules market is compiled and analyzed. This involves assessing the market's penetration, production capabilities, and revenue generation. In addition, an evaluation of quality control and certification processes ensures the reliability and accuracy of the data collected.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed and validated through consultations with industry experts via computer-assisted telephone interviews (CATIs). These interviews provide valuable insights into market operations, consumer trends, and challenges directly from practitioners, refining the overall data accuracy.

Step 4: Research Synthesis and Final Output

The final phase involves synthesizing the data obtained from expert consultations and desk research. This step includes direct engagement with key capsule manufacturers to acquire detailed insights into product innovation, market strategies, and the competitive landscape. This interaction validates the data, ensuring a comprehensive analysis of the Indonesia Empty Medical Capsules market.

Frequently Asked Questions

01 How big is the Indonesia Empty Medical Capsules Market?

The Indonesia Empty Medical Capsules market is valued at USD 5 billion, driven by rising demand for pharmaceuticals and dietary supplements.

02 What are the challenges in the Indonesia Empty Medical Capsules Market?

Challenges in Indonesia Empty Medical Capsules Market include supply chain disruptions, stringent regulatory requirements, and high production costs. The increasing competition from alternative dosage forms also poses a threat.

03 Who are the major players in the Indonesia Empty Medical Capsules Market?

Key players in Indonesia Empty Medical Capsules Market include Capsugel (Lonza Group), ACG Group, Qualicaps, Suheung Co. Ltd, and Sunil Healthcare Limited.

04 What are the growth drivers of the Indonesia Empty Medical Capsules Market?

Growth drivers in Indonesia Empty Medical Capsules Market include the expansion of the pharmaceutical industry, increasing demand for dietary supplements, and government support for local production.

05 What are the opportunities in the Indonesia Empty Medical Capsules Market?

Opportunities include the growing demand for vegetarian capsules, innovations in capsule manufacturing technology, and expansion into the export market for ASEAN countries.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.