Indonesia Endoscopy Devices Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD9251

November 2024

86

About the Report

Indonesia Endoscopy Devices Market Overview

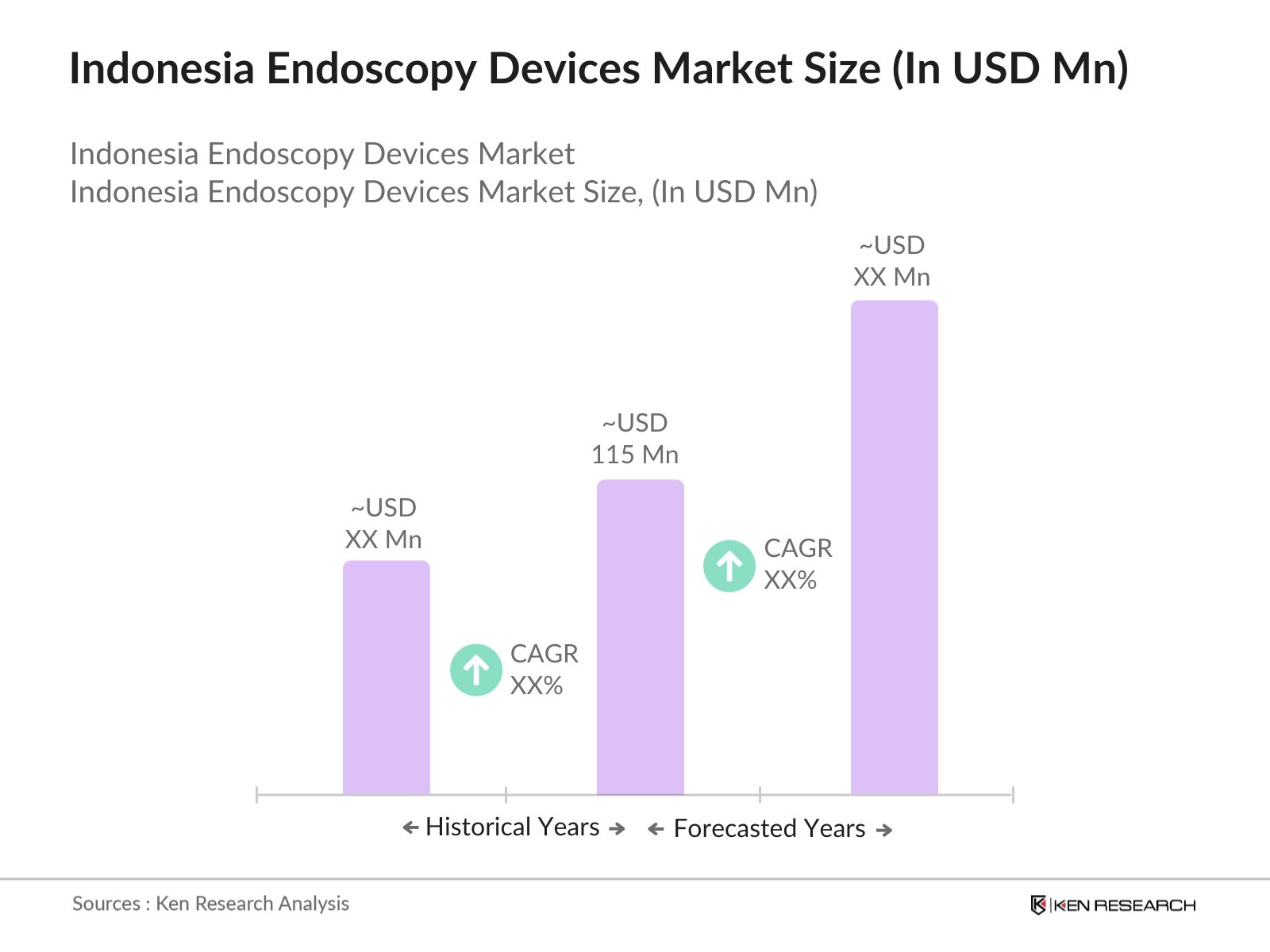

- The Indonesia Endoscopy Devices market is valued at USD 115 million, driven by the growing demand for minimally invasive surgeries, advancements in healthcare technology, and an increasing number of patients with chronic conditions requiring diagnostic procedures. The availability of advanced endoscopy systems in major hospitals, along with the government's healthcare initiatives, further boosts market demand. The market has shown strong performance, with consistent demand for both rigid and flexible endoscopes, particularly in the major urban healthcare centers.

- Indonesia's market dominance in cities such as Jakarta, Surabaya, and Bandung stems from their well-developed healthcare infrastructure, a higher concentration of specialty hospitals, and the presence of international healthcare providers. These cities have seen significant investments in modern medical facilities, making them focal points for advanced medical procedures, including endoscopic surgeries. Their dominance is largely due to the availability of trained healthcare professionals and state-of-the-art medical equipment.

- The Indonesian government has invested heavily in developing healthcare infrastructure, spending IDR 125 trillion on healthcare facilities in 2022 alone. These investments aim to expand the availability of advanced medical equipment like endoscopic devices in public hospitals. The Ministry of Health is focused on improving access to high-quality healthcare services across the country, which is expected to support the growth of the endoscopy devices market as hospitals receive funding for modernization.

Indonesia Endoscopy Devices Market Segmentation

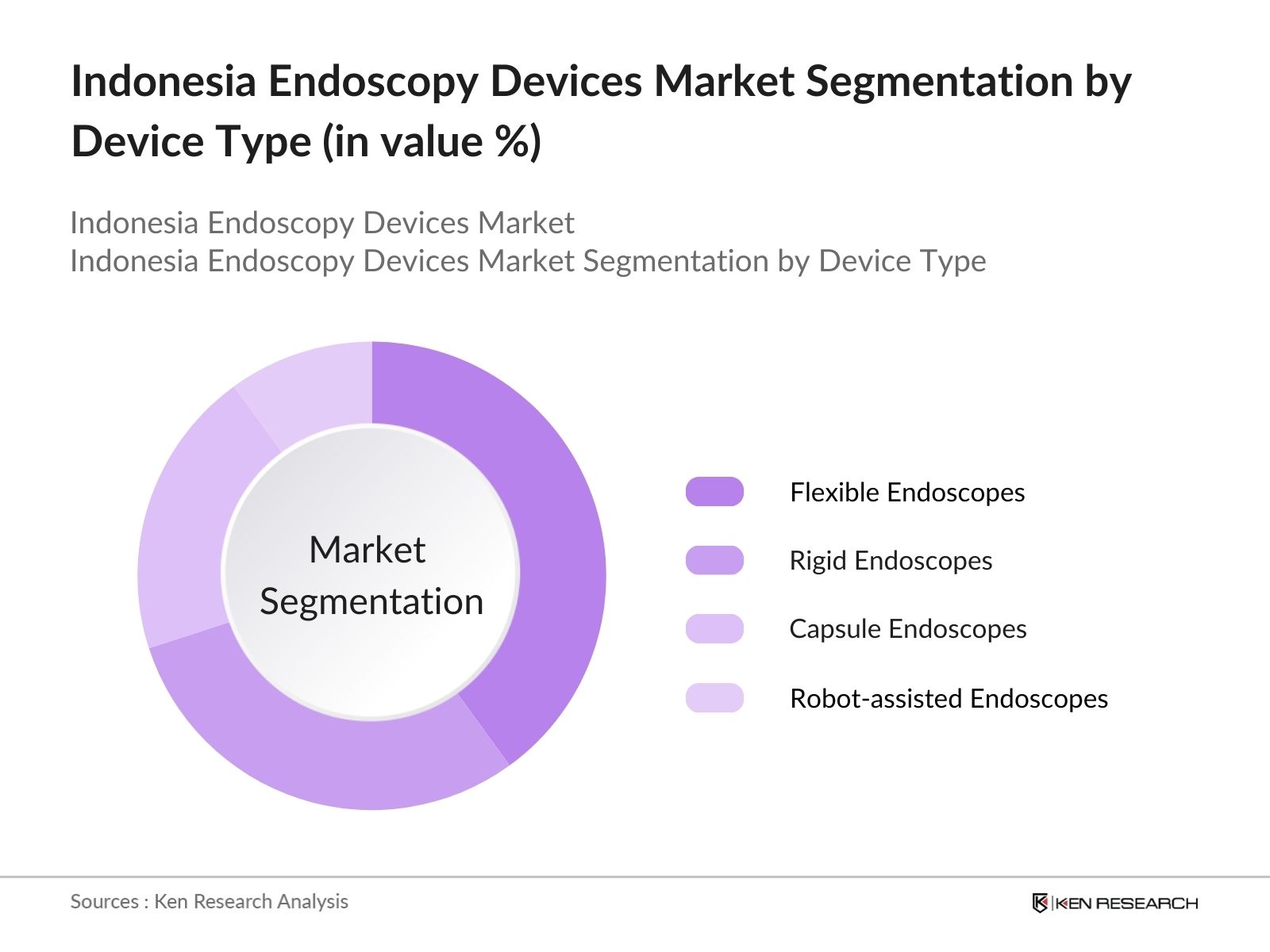

- By Device Type: The market is segmented by device type into rigid endoscopes, flexible endoscopes, capsule endoscopes, and robot-assisted endoscopes. Recently, flexible endoscopes have dominated the market due to their versatility in performing a wide range of diagnostic and therapeutic procedures. These devices are essential in gastrointestinal, pulmonary, and urological examinations, offering greater patient comfort and improved diagnostic capabilities. Their wide adoption in hospitals and ambulatory centers across Indonesia reflects their critical role in addressing the increasing demand for minimally invasive diagnostic tools.

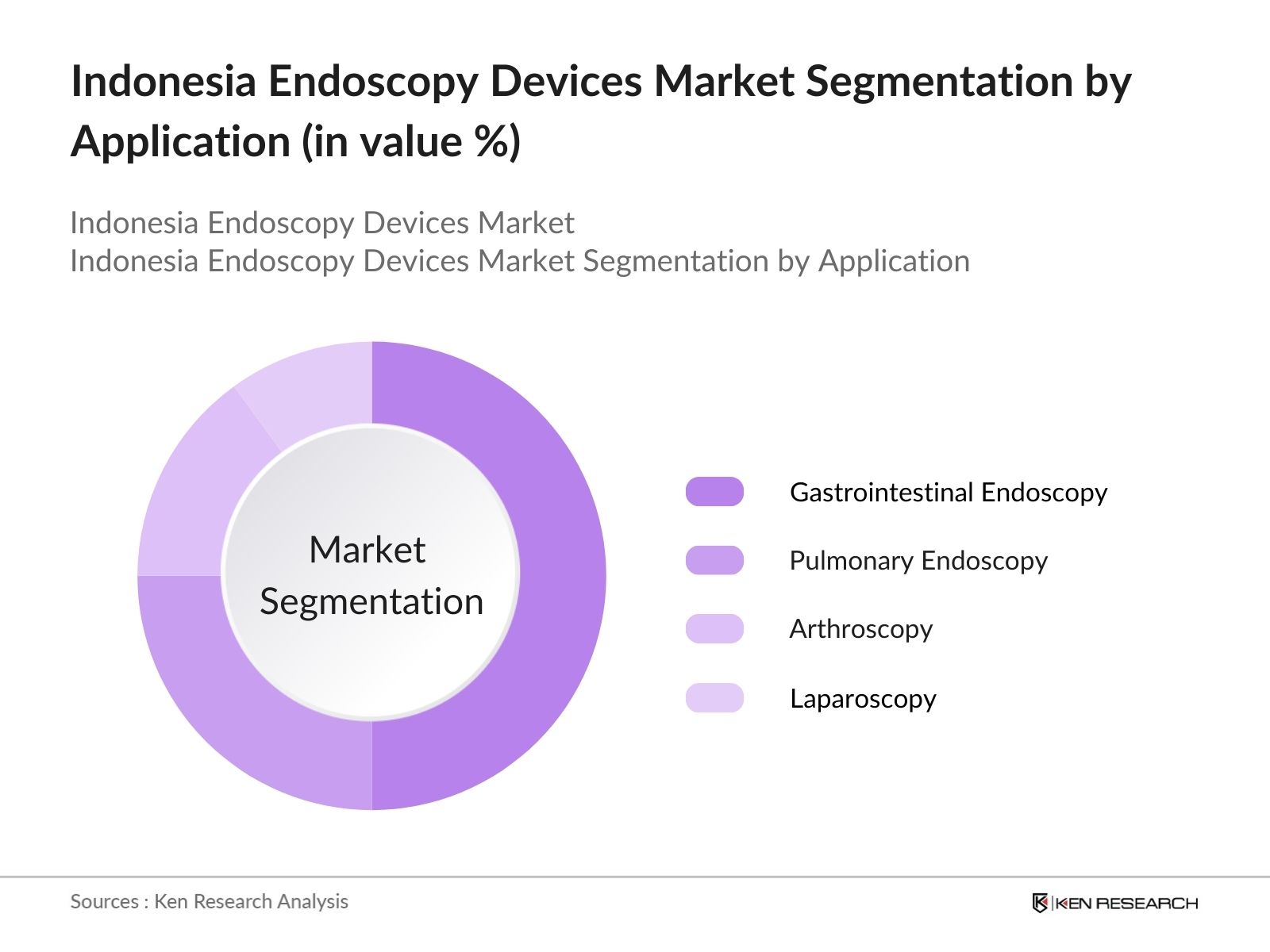

- By Application: The market is further segmented by application into gastrointestinal (GI) endoscopy, pulmonary endoscopy, arthroscopy, and laparoscopy. The gastrointestinal (GI) endoscopy segment leads the market due to the high prevalence of gastrointestinal disorders in Indonesia, coupled with the increasing need for early diagnosis and treatment. The growing awareness of colorectal cancer screening and government support for preventive healthcare programs also contribute to the dominance of this segment.

Indonesia Endoscopy Devices Market Competitive Landscape

The Indonesia Endoscopy Devices market is dominated by both international and domestic players. Major companies in this space leverage innovation, partnerships, and strategic acquisitions to strengthen their market position. Local hospitals and specialty clinics prefer products from well-known brands due to their reliability and advanced technology.

|

Company |

Establishment Year |

Headquarters |

R&D Investment |

Product Portfolio |

Market Penetration |

Revenue |

Regional Focus |

Innovation Strategy |

|

Olympus Corporation |

1919 |

Tokyo, Japan |

||||||

|

Fujifilm Holdings |

1934 |

Tokyo, Japan |

||||||

|

Karl Storz GmbH |

1945 |

Tuttlingen, Germany |

||||||

|

Medtronic |

1949 |

Dublin, Ireland |

||||||

|

Stryker Corporation |

1941 |

Kalamazoo, USA |

Indonesia Endoscopy Devices Industry Analysis

Market Growth Drivers

- Technological Advancements: Technological progress in Indonesia's healthcare sector has fueled the adoption of advanced endoscopic devices. The countrys spending on healthcare technology stood at IDR 150 trillion in 2023, with a significant portion allocated to diagnostic equipment, including endoscopy devices. The introduction of innovative technologies such as high-definition imaging and minimally invasive procedures is enabling more accurate diagnoses, leading to greater demand for endoscopic devices. The Indonesian Ministry of Health continues to emphasize the need for advanced medical equipment across its 3,000 public hospitals.

- Healthcare Infrastructure Development: Indonesias healthcare infrastructure has seen a marked improvement, with IDR 125 trillion spent on healthcare infrastructure in 2022. This includes expanding public hospitals, upgrading facilities, and increasing the availability of advanced medical devices such as endoscopic tools. The government's "Healthy Indonesia" program aims to enhance medical infrastructure in both urban and rural areas, ensuring better access to advanced procedures like endoscopy. With the number of hospitals in Indonesia growing by 6% annually, demand for endoscopy devices is expected to rise.

- Increasing Demand for Minimally Invasive Procedures: Indonesia has seen a sharp increase in demand for minimally invasive procedures due to shorter recovery times and lower risks. With over 4 million surgeries performed in 2023, minimally invasive procedures accounted for a significant portion, as patients and healthcare providers prioritize less invasive options. Endoscopic surgeries are becoming more popular, contributing to the increased use of endoscopy devices. The government's emphasis on reducing hospital stays and improving patient outcomes further drives this demand.

Market Challenges

- High Cost of Endoscopic Devices: One of the significant challenges in the Indonesian market is the high cost of endoscopic devices, which can reach IDR 200 million for a single unit. Hospitals in rural and lower-income regions often struggle to afford these devices, limiting their adoption. Despite government efforts to provide financial support, the initial investment remains a barrier for many smaller hospitals. These high costs continue to hinder the widespread use of advanced endoscopy technologies, particularly in regions outside major metropolitan areas.

- Limited Access in Rural Areas: Access to advanced healthcare technologies, including endoscopy, is still limited in rural parts of Indonesia. With over 40% of the population residing in rural areas, only a small percentage of hospitals in these regions are equipped with endoscopic devices. The Indonesian government is working to address this disparity, with initiatives to improve rural healthcare infrastructure, but logistical and financial challenges remain. Rural hospitals often lack the necessary infrastructure to support endoscopic procedures, slowing the adoption of such devices.

Indonesia Endoscopy Devices Market Future Outlook

Over the next five years, the Indonesia Endoscopy Devices market is expected to exhibit significant growth, driven by advancements in healthcare technology, increasing demand for early disease diagnosis, and government healthcare initiatives. As the healthcare infrastructure continues to expand in both urban and rural areas, demand for minimally invasive diagnostic procedures will further rise. Moreover, the ongoing development of AI and robotic-assisted endoscopy is likely to revolutionize the industry, providing more accurate diagnostics and patient outcomes.

Future Market Opportunities

- Emergence of Capsule Endoscopy: The development of capsule endoscopy offers a significant opportunity for the Indonesian market. Capsule endoscopy, which allows for non-invasive imaging of the gastrointestinal tract, is gaining traction as an alternative to traditional methods. In 2023, the number of capsule endoscopy procedures performed in Indonesia increased by 25%, demonstrating growing acceptance among both patients and healthcare providers. This method reduces patient discomfort and broadens the potential for diagnosing gastrointestinal diseases without the need for invasive procedures.

- Government Initiatives to Promote Healthcare: The Indonesian government has launched several healthcare initiatives, such as the "National Health Insurance" (JKN) program, aimed at improving access to advanced medical procedures, including endoscopy. The government allocated IDR 46 trillion in 2023 to expand healthcare services and ensure that public hospitals are equipped with modern medical devices. These initiatives present opportunities for increased adoption of endoscopy devices, especially as healthcare coverage expands across the country.

Scope of the Report

|

|||

|

By Application |

Gastrointestinal Endoscopy Pulmonary Endoscopy Arthroscopy Laparoscopy |

||

|

By End-User |

Hospitals Ambulatory Surgical Centers Specialty Clinics Diagnostic Centers |

||

|

By Technology |

HD Visualization Systems 3D Imaging Systems Capsule-based Technology Robotic-assisted Technology |

||

|

By Region |

North East West South |

Products

Key Target Audience

Hospitals and Clinics

Ambulatory Surgical Centers

Endoscopy Device Manufacturers

Medical Distributors and Suppliers

Government and Regulatory Bodies (Indonesia Ministry of Health, BPOM - Indonesian Food and Drug Authority)

Research and Development Institutes

Investments and Venture Capital Firms

Banks and Financial Institutes

Medical Device Importers and Exporters

Companies

Indonesia Endoscopy Devices Market Major Players

Olympus Coarporation

Fujifilm Holdings

Karl Storz GmbH

Medtronic

Stryker Corporation

Pentax Medical

Cook Medical

Hoya Corporation

B. Braun Melsungen AG

Richard Wolf GmbH

Smith & Nephew

Boston Scientific Corporation

Conmed Corporation

Ethicon Endo-Surgery, Inc.

Ambu A/S

Table of Contents

1. Indonesia Endoscopy Devices Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Endoscopy Devices Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Endoscopy Devices Market Analysis

3.1. Growth Drivers (Technological Advancements, Healthcare Infrastructure Development, Increasing Demand for Minimally Invasive Procedures, Rising Prevalence of Chronic Diseases)

3.2. Market Challenges (High Cost of Endoscopic Devices, Limited Access in Rural Areas, Lack of Skilled Professionals)

3.3. Opportunities (Emergence of Capsule Endoscopy, Government Initiatives to Promote Healthcare, Rising Medical Tourism)

3.4. Trends (Adoption of AI in Endoscopy, Integration of Robotic Endoscopy, Increasing Use of Disposable Endoscopes)

3.5. Government Regulation (Healthcare Infrastructure Development, Medical Device Regulation, Public Health Programs)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem (Hospitals, Medical Device Manufacturers, Healthcare Providers, Insurance Companies)

3.8. Porters Five Forces

3.9. Competitive Landscape

4. Indonesia Endoscopy Devices Market Segmentation

4.1. By Device Type (In Value %)

4.1.1. Rigid Endoscopes

4.1.2. Flexible Endoscopes

4.1.3. Capsule Endoscopes

4.1.4. Robot-assisted Endoscopes

4.2. By Application (In Value %)

4.2.1. Gastrointestinal Endoscopy

4.2.2. Pulmonary Endoscopy

4.2.3. Arthroscopy

4.2.4. Laparoscopy

4.2.5. Others

4.3. By End-User (In Value %)

4.3.1. Hospitals

4.3.2. Ambulatory Surgical Centers

4.3.3. Specialty Clinics

4.3.4. Diagnostic Centers

4.4. By Technology (In Value %)

4.4.1. HD Visualization Systems

4.4.2. 3D Imaging Systems

4.4.3. Capsule-based Technology

4.4.4. Robotic-assisted Technology

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Indonesia Endoscopy Devices Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. Olympus Corporation

5.1.2. Karl Storz GmbH & Co. KG

5.1.3. Fujifilm Holdings Corporation

5.1.4. Stryker Corporation

5.1.5. Boston Scientific Corporation

5.1.6. Pentax Medical

5.1.7. Smith & Nephew

5.1.8. Medtronic

5.1.9. B. Braun Melsungen AG

5.1.10. Hoya Corporation

5.1.11. Conmed Corporation

5.1.12. Richard Wolf GmbH

5.1.13. Cook Medical

5.1.14. Ethicon Endo-Surgery, Inc.

5.1.15. Ambu A/S

5.2. Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Product Portfolio, Revenue, Regional Presence, R&D Investment, Market Penetration)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Endoscopy Devices Market Regulatory Framework

6.1. Medical Device Regulatory Compliance

6.2. Approval Processes for Medical Devices

6.3. Certification Requirements

6.4. Health and Safety Standards

7. Indonesia Endoscopy Devices Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Endoscopy Devices Future Market Segmentation

8.1. By Device Type (In Value %)

8.2. By Application (In Value %)

8.3. By End-User (In Value %)

8.4. By Technology (In Value %)

8.5. By Region (In Value %)

9. Indonesia Endoscopy Devices Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

In the first step, a detailed mapping of the Indonesian endoscopy devices market ecosystem is conducted. This involves identifying all key stakeholders, including healthcare providers, medical device manufacturers, regulatory bodies, and distributors. Comprehensive secondary research is utilized to gather critical industry-level data.

Step 2: Market Analysis and Construction

This phase involves collecting and analyzing historical market data on endoscopic devices, such as product penetration and usage across hospitals and clinics. Market size and revenue generation are also evaluated to understand growth dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses on market trends and potential growth drivers are developed and tested through interviews with industry experts. This provides valuable insights from leading hospitals and medical device manufacturers, helping to refine the research findings.

Step 4: Research Synthesis and Final Output

In the final step, a comprehensive synthesis of all collected data is undertaken. Direct input from endoscopy device manufacturers is used to verify the findings, ensuring an accurate and holistic analysis of the Indonesian market.

Frequently Asked Questions

1. How big is the Indonesia Endoscopy Devices Market?

The Indonesia Endoscopy Devices market is valued at USD 115 million, driven by growing demand for minimally invasive surgeries and advancements in healthcare technology.

2. What are the challenges in the Indonesia Endoscopy Devices Market?

Challenges in Indonesia Endoscopy Devices market include high device costs, a lack of skilled healthcare professionals, and limited access to advanced endoscopy systems in rural areas of the country.

3. Who are the major players in the Indonesia Endoscopy Devices Market?

Key players in the Indonesia Endoscopy Devices market include Olympus Corporation, Fujifilm Holdings, Karl Storz GmbH, Medtronic, and Stryker Corporation. These companies dominate due to their innovative product offerings and global presence.

4. What are the growth drivers of the Indonesia Endoscopy Devices Market?

Indonesia Endoscopy Devices Market Growth is driven by the increasing prevalence of chronic diseases, rising demand for minimally invasive diagnostic procedures, and government initiatives aimed at improving healthcare infrastructure.

5. What are the key trends in the Indonesia Endoscopy Devices Market?

Key trends in Indonesia Endoscopy Devices market include the integration of AI in endoscopy, the rise of robotic-assisted endoscopic procedures, and the increasing use of disposable endoscopes to reduce infection risks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.