Indonesia ERP Software Market Outlook to 2030

Region:Asia

Author(s):Mukul

Product Code:KROD8068

October 2024

89

About the Report

Indonesia ERP Software Market Overview

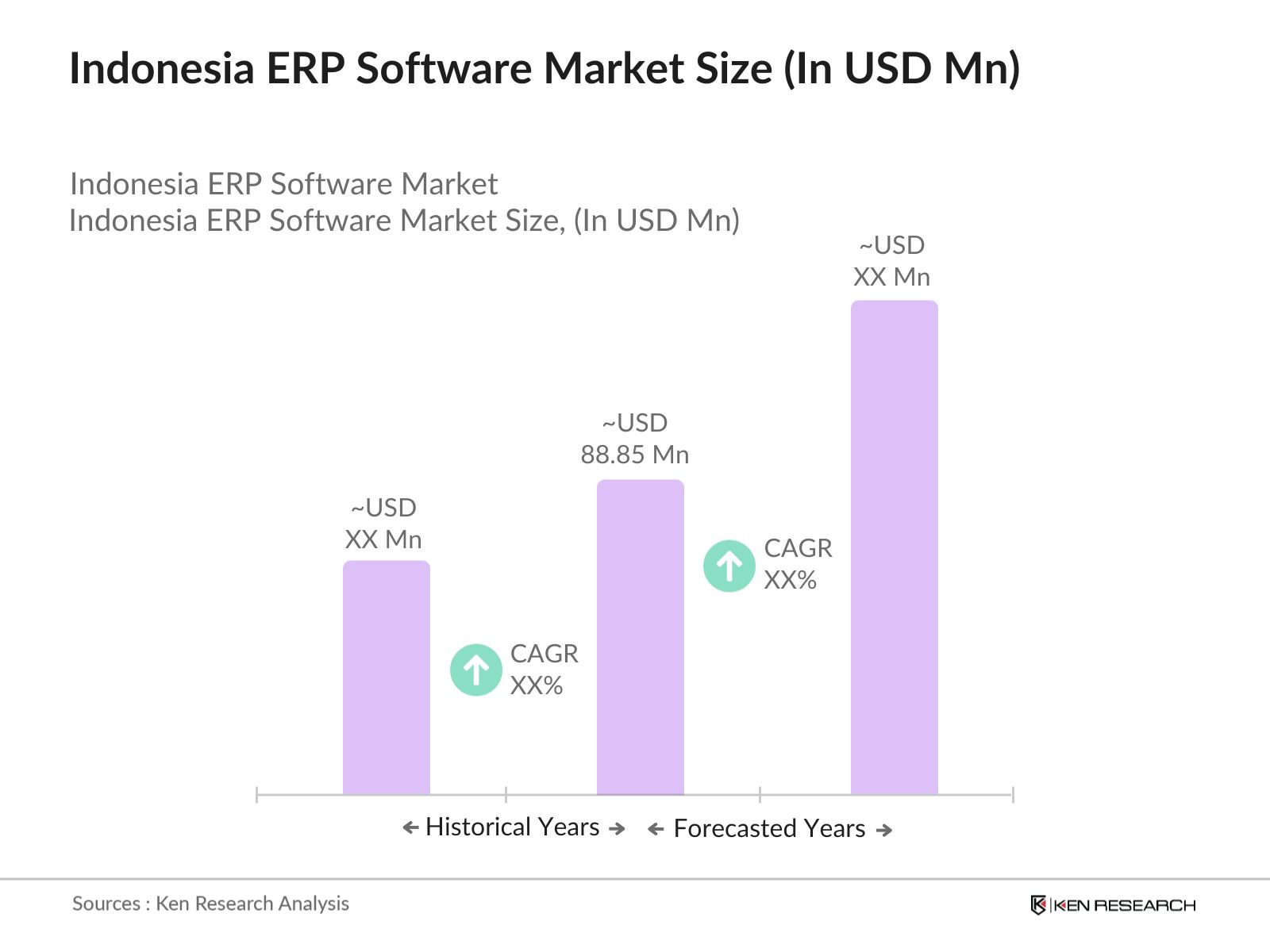

- The Indonesia ERP Software market is valued at USD 88.85 million, driven primarily by the rapid digital transformation of businesses across various sectors such as manufacturing, retail, and IT. A growing demand for cloud-based solutions and increasing reliance on data-driven decision-making have significantly contributed to the market's expansion. Small and medium-sized enterprises (SMEs) in Indonesia are actively adopting ERP solutions to enhance operational efficiency, reduce costs, and improve customer management, thereby fueling the market growth further.

- Dominant regions such as Java and Sumatra lead the market due to their high concentration of industries and enterprises, strong economic activities, and widespread adoption of technology. Java, in particular, being home to Indonesias capital, Jakarta, serves as the countrys economic hub, housing the majority of Indonesia's top industries, financial institutions, and IT infrastructure. Meanwhile, Sumatra has also emerged as a major player due to the region's industrial expansion and government incentives to promote technology-driven solutions.

- The agriculture and food processing sectors in Indonesia are exploring ERP adoption to enhance supply chain efficiency and ensure food safety compliance. In 2024, the agriculture sector contributed approximately USD 115 billion to the countrys GDP. The growing need for real-time data management in food production, inventory control, and distribution is encouraging businesses in these sectors to implement ERP systems.

Indonesia ERP Software Market Segmentation

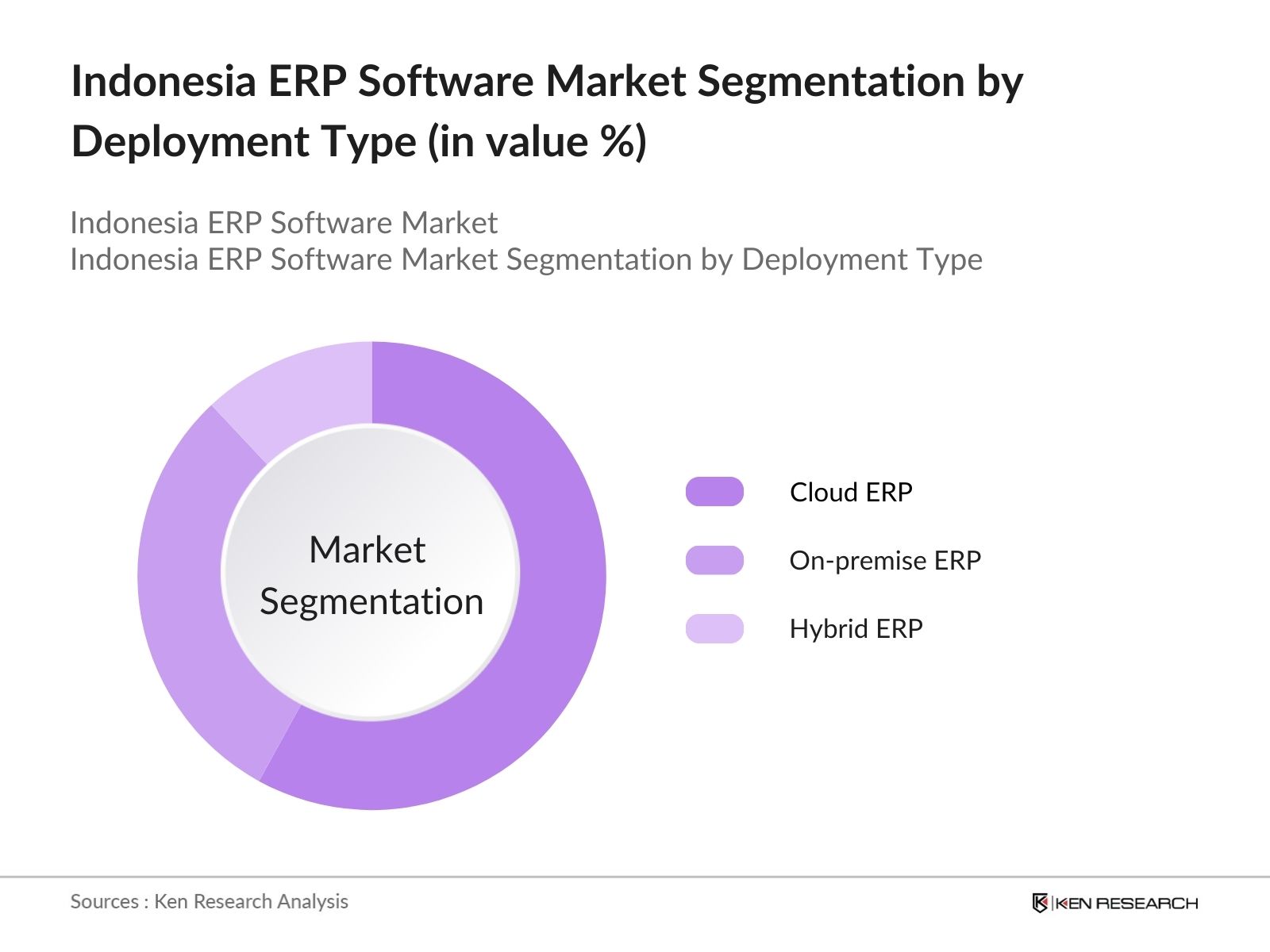

- By Deployment Type: The Indonesia ERP Software market is segmented by deployment type into on-premise ERP, cloud ERP, and hybrid ERP. In 2023, cloud ERP solutions dominate the market share due to the increasing preference for scalable, flexible, and cost-effective solutions. As enterprises in Indonesia continue to move away from traditional IT infrastructures, cloud-based ERP systems have become the preferred choice for businesses of all sizes. This shift is particularly prominent among SMEs, which are leveraging cloud ERP to lower upfront costs, enable remote access, and improve system integration across multiple business functions.

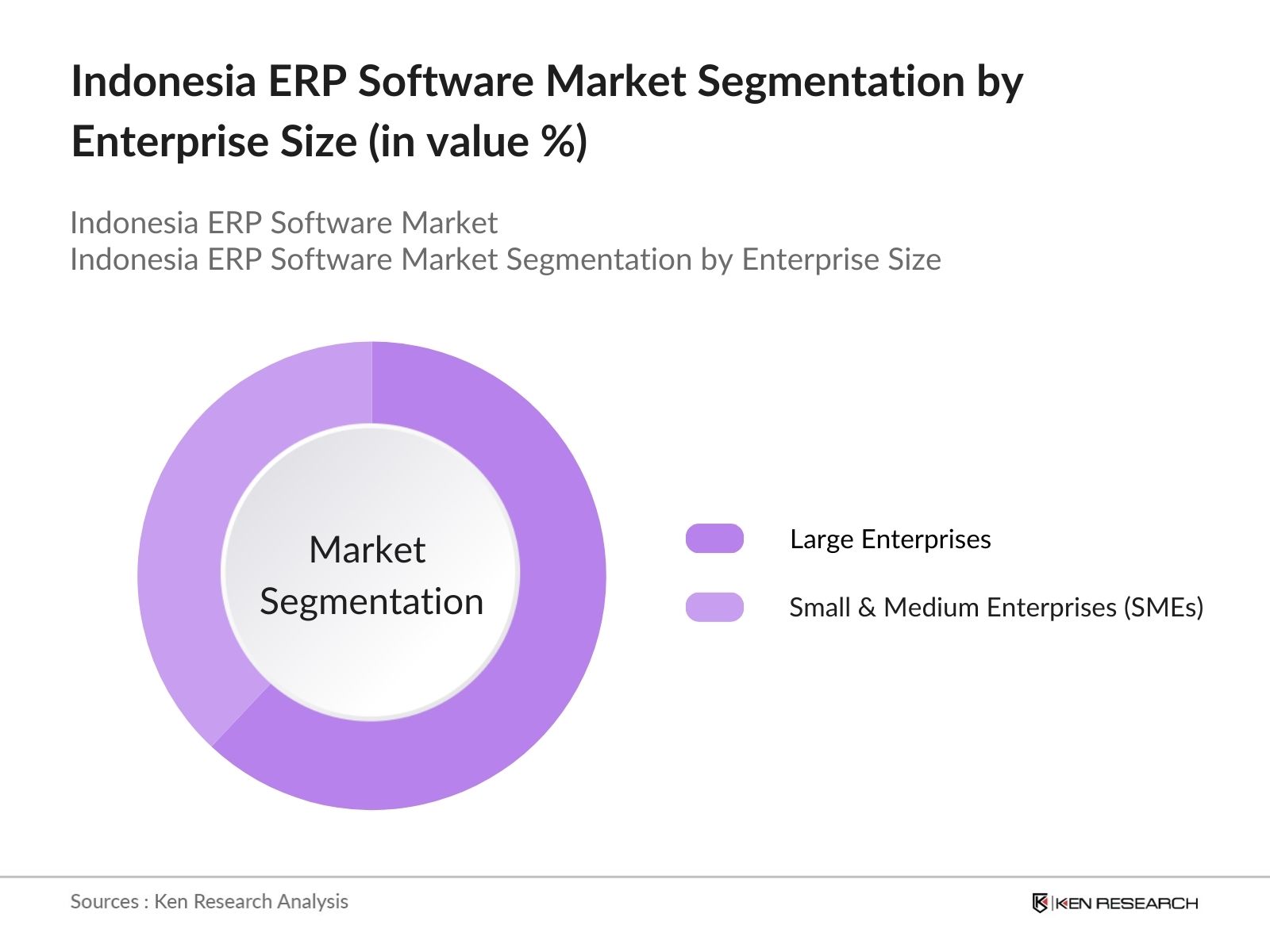

- By Enterprise Size: ERP adoption varies significantly by enterprise size, with the market segmented into small and medium enterprises (SMEs) and large enterprises. Large enterprises hold a dominant market share due to their complex operational structures and the need for advanced ERP systems that offer customization and scalability. These companies invest heavily in ERP to streamline processes, ensure compliance, and improve data-driven decision-making. However, SMEs are witnessing a rapid increase in ERP adoption, as cloud-based ERP solutions have made the technology more affordable and accessible for smaller businesses seeking to improve operational efficiency and competitiveness.

Indonesia ERP Software Market Competitive Landscape

The Indonesia ERP Software market is characterized by the presence of both global and local players. Major companies like SAP and Oracle dominate the landscape due to their strong brand reputation, comprehensive solutions, and extensive support for both cloud and on-premise models. Meanwhile, local players such as PT Abyor International are gaining traction by offering customized ERP solutions that cater specifically to the Indonesian market.

|

Company Name |

Establishment Year |

Headquarters |

Number of Customers |

Deployment Type Focus |

Industry Focus |

Revenue |

Cloud Offering |

Customization Capability |

Support Services |

|

SAP SE |

1972 |

Walldorf, Germany |

|||||||

|

Oracle Corporation |

1977 |

Austin, USA |

|||||||

|

Microsoft Corporation |

1975 |

Redmond, USA |

|||||||

|

PT Abyor International |

2008 |

Jakarta, Indonesia |

|||||||

|

HashMicro |

2013 |

Singapore |

Indonesia ERP Software Industry Analysis

Growth Drivers

- Increase in Cloud ERP Adoption: Cloud ERP adoption has been growing significantly in Indonesia, driven by the push for digital transformation across various industries. As of 2024, Indonesias cloud computing market is valued at approximately USD 1.6 billion, with a substantial portion of this being driven by enterprise IT spending on cloud-based ERP solutions. Government initiatives, such as the Making Indonesia 4.0 program, are encouraging industries to adopt cloud technologies to streamline operations, further boosting ERP uptake.

- Expansion of SMEs in Indonesia: Indonesia's SME sector is one of the primary drivers of ERP software adoption. In 2024, SMEs represent over 60 million businesses, accounting for more than 97% of total enterprises in the country. SMEs are increasingly seeking ERP solutions to improve operational efficiency and compete in a digital economy. Government programs such as the "SME Digitalization Initiative" have enhanced ERP adoption by providing financial incentives and support for digital tools.

- Industry 4.0 Integration in Manufacturing: The integration of Industry 4.0 technologies into manufacturing has bolstered ERP software demand, particularly in sectors like electronics and automotive. As of 2024, the manufacturing sector contributes over USD 250 billion to Indonesias GDPsource 3(link). ERP systems have become crucial in managing supply chains and integrating automation systems in line with Industry 4.0 goals. Government support for smart manufacturing under the Making Indonesia 4.0 initiative has accelerated ERP software deployment across the sector.

Market Restraints

- Data Security Concerns with Cloud ERP: The increasing adoption of cloud ERP systems in Indonesia raises concerns about data security. As of 2024, Indonesia is ranked among the top 10 countries globally in terms of cybercrime incidents. Many enterprises are wary of migrating sensitive business data to the cloud due to these risks, despite the benefits of cloud ERP. The government has introduced the Personal Data Protection Law (PDP) in 2022 to mitigate such risks, but apprehensions remain due to gaps in enforcement.

- Integration Complexities with Legacy Systems: One of the major challenges in ERP adoption in Indonesia is the difficulty of integrating new ERP systems with existing legacy IT infrastructure. A significant number of businesses, especially in sectors like manufacturing and retail, still rely on outdated systems that are not compatible with modern ERP solutions. This leads to operational disruptions and increased implementation time. In 2024, over 40% of Indonesian enterprises report issues with legacy system integration during their ERP implementation processes.

Indonesia ERP Software Market Future Outlook

The Indonesia ERP Software market is poised for robust growth over the coming years, driven by a combination of rapid digitization efforts, government policies supporting SME growth, and the increasing reliance on cloud technologies. As businesses across Indonesia continue to streamline their operations, demand for ERP systems, particularly cloud-based solutions, will continue to rise. Additionally, innovations in artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are expected to integrate further into ERP solutions, offering new opportunities for businesses to enhance their productivity and competitiveness.

Market Opportunities

- AI and Machine Learning Integration in ERP: The integration of AI and machine learning (ML) into ERP systems presents a significant opportunity for businesses in Indonesia. AI-enhanced ERP systems can help automate routine tasks, improve decision-making, and optimize resource management. By 2024, over 15% of large enterprises in Indonesia are already incorporating AI into their ERP systems, especially in the financial services and retail sectors. The government's push towards digital innovation, including the promotion of AI technologies, is expected to accelerate this trend.

- Government Support for ERP Adoption in Public Sector: The Indonesian government is a major driver of ERP adoption, particularly in the public sector. Government agencies and state-owned enterprises (SOEs) are increasingly implementing ERP systems to improve transparency and operational efficiency. In 2024, SOEs alone accounted for over USD 500 million in IT expenditure, much of which was allocated to ERP software. The governments ongoing digital transformation initiatives are expected to further drive ERP adoption in public institutions.

Scope of the Report

|

Deployment Type |

On-Premise ERP, Cloud ERP, Hybrid ERP |

|

Enterprise Size |

Small and Medium Enterprises (SMEs), Large Enterprises |

|

Function |

Finance & Accounting, Human Resource Management, Supply Chain Management, Customer Relationship Management (CRM) |

|

End-User Industry |

Manufacturing, Retail, Healthcare, IT & Telecom, BFSI |

|

Region |

Java, Sumatra, Kalimantan, Sulawesi, Papua |

Products

Key Target Audience

Enterprise IT Departments

ERP Solution Providers

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (Ministry of Communication and Informatics Indonesia, Statistics Indonesia)

Cloud Service Providers

Manufacturing and Industrial Firms

SME Associations

Retail and E-commerce Companies

Companies

Players Mentioned in the Report:

AP SE

Oracle Corporation

Microsoft Corporation

PT Abyor International

HashMicro

PT SISFO Indonesia

Focus Softnet

Infor

Epicor Software Corporation

Zoho Corporation

Sage Group plc

Odoo S.A.

IFS AB

Acumatica

Workday, Inc.

Table of Contents

1. Indonesia ERP Software Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. ERP Market Growth Rate

1.4. ERP Market Segmentation Overview

2. Indonesia ERP Software Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key ERP Software Market Developments and Milestones

3. Indonesia ERP Software Market Analysis

3.1. Growth Drivers (Enterprise Digital Transformation, Government IT Initiatives, Cloud Adoption, SME Growth, Industry 4.0 Integration)

3.1.1. Increase in Cloud ERP Adoption

3.1.2. Expansion of SMEs in Indonesia

3.1.3. Industry 4.0 Integration in Manufacturing

3.1.4. Digital Transformation in Large Enterprises

3.2. Market Challenges (Data Security Concerns, Integration Complexities, High Customization Costs, Lack of Skilled IT Workforce)

3.2.1. Data Security Concerns with Cloud ERP

3.2.2. Integration Complexities with Legacy Systems

3.2.3. High Customization and Implementation Costs

3.2.4. Shortage of ERP Implementation Experts

3.3. Opportunities (Cloud ERP Expansion, SME Sector Growth, Government Digital Initiatives, AI and ML Integration)

3.3.1. AI and Machine Learning Integration in ERP

3.3.2. Government Support for ERP Adoption in Public Sector

3.3.3. Rise of Cloud ERP Solutions

3.3.4. Increased Adoption by Small and Medium Enterprises (SMEs)

3.4. Trends (Cloud-Based ERP, Mobile-First ERP Solutions, Integration with IoT, Demand for SaaS ERP)

3.4.1. Shift Towards Cloud-Based ERP

3.4.2. Integration of IoT with ERP Systems

3.4.3. Rise of Mobile-First ERP Solutions

3.4.4. Increased Demand for SaaS-Based ERP Solutions

3.5. Government Regulation (Indonesian IT Policy, Data Localization Laws, Government Support for SME Digitization)

3.5.1. Indonesian IT Governance Policies

3.5.2. Data Localization Requirements

3.5.3. Government Funding and Support for SMEs to Implement ERP Solutions

3.5.4. Compliance Standards for ERP Systems

3.6. SWOT Analysis

3.7. ERP Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competitive Ecosystem

4. Indonesia ERP Software Market Segmentation

4.1. By Deployment Type (In Value %)

4.1.1. On-Premise ERP

4.1.2. Cloud ERP

4.1.3. Hybrid ERP

4.2. By Enterprise Size (In Value %)

4.2.1. Small and Medium Enterprises (SMEs)

4.2.2. Large Enterprises

4.3. By Function (In Value %)

4.3.1. Finance & Accounting

4.3.2. Human Resource Management

4.3.3. Supply Chain Management

4.3.4. Customer Relationship Management (CRM)

4.4. By End-User Industry (In Value %)

4.4.1. Manufacturing

4.4.2. Retail

4.4.3. Healthcare

4.4.4. IT & Telecom

4.4.5. BFSI

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

5. Indonesia ERP Software Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. SAP SE

5.1.2. Oracle Corporation

5.1.3. Microsoft Corporation

5.1.4. Infor

5.1.5. Epicor Software Corporation

5.1.6. Workday, Inc.

5.1.7. Odoo S.A.

5.1.8. PT Abyor International

5.1.9. PT SISFO Indonesia

5.1.10. HashMicro

5.1.11. Focus Softnet

5.1.12. Acumatica

5.1.13. IFS AB

5.1.14. Zoho Corporation

5.1.15. Sage Group plc

5.2. Cross Comparison Parameters (Number of Customers, Deployment Type, Cloud Offering, Service Type, Integration Capabilities, Industry Focus, Revenue, Market Share)

5.3. ERP Software Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants for ERP Implementation

5.9. Private Equity Investments

6. Indonesia ERP Software Market Regulatory Framework

6.1. IT Compliance Regulations

6.2. Data Protection and Privacy Laws

6.3. Software Licensing and Intellectual Property Laws

7. Indonesia ERP Software Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia ERP Software Future Market Segmentation

8.1. By Deployment Type (In Value %)

8.2. By Enterprise Size (In Value %)

8.3. By Function (In Value %)

8.4. By End-User Industry (In Value %)

8.5. By Region (In Value %)

9. Indonesia ERP Software Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Key Marketing Initiatives

9.3. White Space Opportunity Analysis

9.4. Customer Segmentation Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The first step involved mapping out all the critical stakeholders and entities in the Indonesia ERP Software market. Comprehensive desk research was conducted, combining secondary data sources such as government reports and proprietary databases to identify key variables, including cloud adoption rates, industry demand, and SME participation.

Step 2: Market Analysis and Construction

The next phase focused on gathering historical data on ERP adoption, growth trends, and deployment preferences in Indonesia. This included evaluating market penetration across key regions like Java and Sumatra, as well as analyzing industry-specific demand for ERP solutions in manufacturing, retail, and IT sectors.

Step 3: Hypothesis Validation and Expert Consultation

To verify our data, we conducted expert interviews via computer-assisted telephone interviews (CATI) with key industry practitioners. These consultations provided valuable insights on emerging trends, industry pain points, and the competitive landscape, which were used to refine our analysis.

Step 4: Research Synthesis and Final Output

The final step involved consolidating our findings into a comprehensive report. Data from ERP vendors and cloud providers was used to verify revenue and adoption rates, ensuring a thorough and accurate depiction of the Indonesia ERP Software market.

Frequently Asked Questions

1. How big is the Indonesia ERP Software market?

The Indonesia ERP Software market is valued at USD 88.85 million, driven by a surge in cloud-based solutions and widespread ERP adoption among SMEs and large enterprises.

2. What are the key challenges in the Indonesia ERP Software market?

Key challenges include data security concerns, integration complexities with legacy systems, and the high cost of customization. Additionally, a shortage of skilled IT professionals to implement and manage ERP systems further constrains market growth.

3. Who are the major players in the Indonesia ERP Software market?

Major players include SAP, Oracle, Microsoft, PT Abyor International, and HashMicro. These companies dominate due to their robust offerings, strong partnerships, and ability to provide both cloud and on-premise solutions.

4. What are the growth drivers of the Indonesia ERP Software market?

Growth is driven by factors such as the rapid digital transformation of businesses, government initiatives supporting SME digitization, and increasing reliance on cloud ERP solutions, particularly among small and medium-sized enterprises.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.