Indonesia Feminine Hygiene Market Outlook to 2030

Region:Asia

Author(s):Meenakshi Bisht

Product Code:KROD3187

October 2024

97

About the Report

Indonesia Feminine Hygiene Market Overview

- The Indonesia Feminine Hygiene Market is valued at USD 400 million, driven by increased awareness of menstrual hygiene, government initiatives promoting women's health, and the growing preference for organic products. The market has seen steady growth due to the expansion of e-commerce and urbanization. Increasing awareness campaigns by both governmental and non-governmental organizations have contributed to higher product adoption across various regions, especially in urban areas.

- Jakarta and other major urban centers, including Surabaya and Medan, dominate the feminine hygiene market in Indonesia. These cities have high-income consumers with access to a wide variety of feminine hygiene products. Their dominance stems from the presence of a large retail network and greater access to modern healthcare and education, driving demand for innovative and premium feminine hygiene products. Additionally, urbanization and lifestyle shifts in these cities have created a surge in demand for sustainable and convenient hygiene products.

- In 2023, the Indonesian Food and Drug Authority (BPOM) introduced stringent safety regulations for feminine hygiene products, mandating that all materials used be free from harmful chemicals and adhere to safety standards. These regulations have contributed to consumer trust and are expected to drive further product innovation as companies comply with the higher standards for both domestic and imported products.

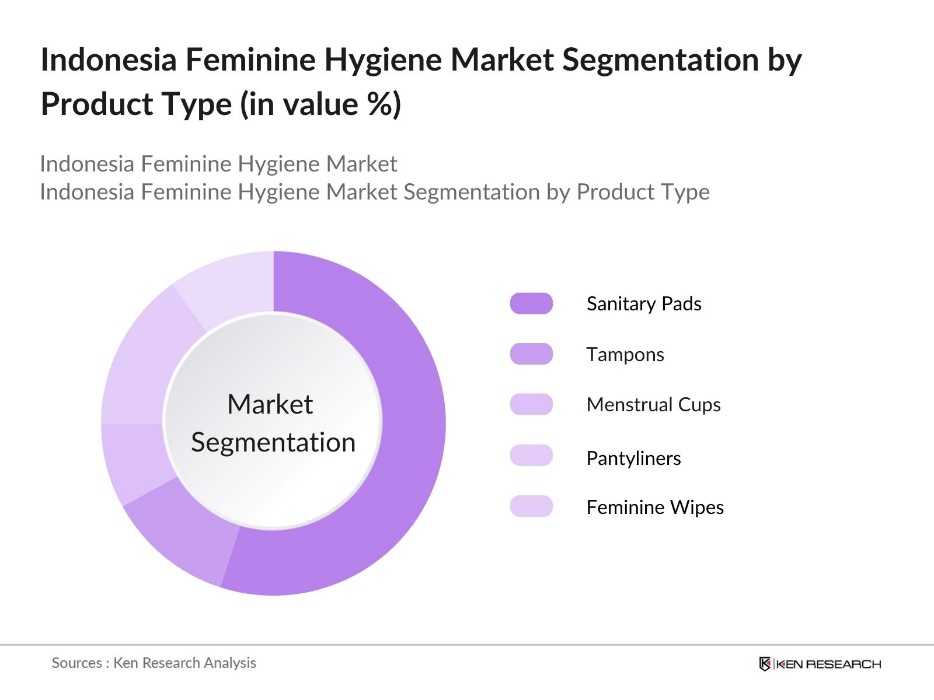

Indonesia Feminine Hygiene Market Segmentation

- By Product Type: The Indonesia Feminine Hygiene Market is segmented by product type into sanitary pads, tampons, menstrual cups, pantyliners, and feminine wipes. Sanitary pads hold a dominant share due to their longstanding market presence and wide availability across all retail channels. They are especially popular due to the ease of use and variety in offerings ranging from regular to organic options. Sanitary pads remain the preferred choice for most Indonesian women, particularly in rural areas where access to other products like tampons or menstrual cups is limited.

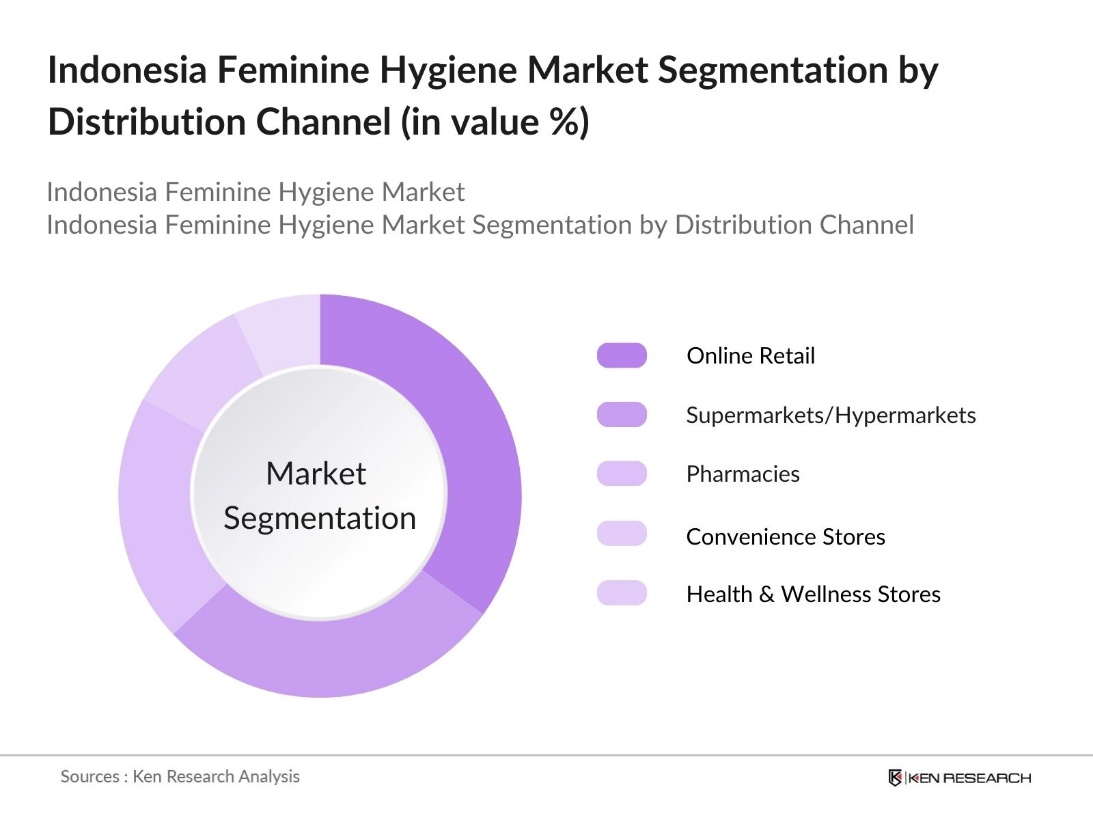

- By Distribution Channel: The Indonesia Feminine Hygiene Market is segmented by distribution channels, including supermarkets/hypermarkets, pharmacies, online retail, convenience stores, and health and wellness stores. Online retail has shown rapid growth due to increased internet penetration and the convenience it offers to consumers. The online retail segment leads with a dominant share, driven by growing e-commerce platforms such as Tokopedia and Shopee, which offer a wide range of products, ease of comparison, and home delivery services.

Indonesia Feminine Hygiene Market Competitive Landscape

The market is characterized by the presence of both domestic and global players. Leading companies such as P&G and Unicharm have established a strong foothold in the market, while local brands like Softex Indonesia have gained significant market share through localized marketing and affordable products. The competitive landscape shows that the market is dominated by a few major players who benefit from large distribution networks and brand loyalty.

|

Company |

Establishment Year |

Headquarters |

Revenue (USD Mn) |

Product Portfolio |

Sustainability Initiatives |

R&D Investment |

Geographical Reach |

Market Penetration |

|

P&G (Always) |

1837 |

USA |

||||||

|

Kimberly-Clark (Kotex) |

1872 |

USA |

||||||

|

Unicharm (Sofy) |

1961 |

Japan |

||||||

|

Johnson & Johnson (Stayfree) |

1886 |

USA |

||||||

|

Softex Indonesia |

1976 |

Indonesia |

Indonesia Feminine Hygiene Industry Analysis

Growth Drivers

- Increasing Female Workforce: The female workforce in Indonesia has grown significantly in recent years, driven by government policies promoting gender equality in the workplace. As per the 2022-23 Periodic Labour Force Survey (PLFS), women's work participation rate (WPR) is reported at 35.9%, significantly lower than men's participation rate of 76%. This increasing participation contributes to higher disposable incomes, leading to greater purchasing power for hygiene products. As more women enter the workforce, demand for convenient and high-quality feminine hygiene products has risen, particularly in urban areas, where professional lifestyles require reliable hygiene solutions.

- Government Programs for Women Health: The Indonesian government has implemented several programs focusing on improving womens health. These include initiatives under the National Health Insurance (JKN), which covers menstrual hygiene management. Such programs, along with public health campaigns, have boosted product adoption in underserved regions. Government subsidies for feminine hygiene products are also under consideration to ensure broader access across rural areas.

- Growing Demand for Organic Products: Organic feminine hygiene products are gaining significant traction in Indonesia as more consumers prioritize health and environmental consciousness. A growing number of women are opting for natural and chemical-free options, driven by increased awareness about the potential health benefits of organic products. Government regulations encouraging safe and sustainable products are pushing manufacturers to offer more organic alternatives. The market for organic tampons, pads, and menstrual cups continues to expand, especially among urban and educated women who are increasingly conscious of eco-friendly and health-focused product choices.

Market Challenges

- Lack of Awareness in Rural Areas: Despite growing awareness of menstrual hygiene in urban areas of Indonesia, rural regions continue to face significant challenges. Limited access to menstrual health education and hygiene products remains a major issue in these areas. Factors such as inadequate infrastructure, lower literacy rates, and cultural stigmas contribute to the slow penetration of feminine hygiene products in rural communities. Addressing these barriers is crucial to expanding the market, especially since a significant portion of the female population resides in rural regions.

- High Product Cost: The high cost of feminine hygiene products presents a substantial obstacle for many women, particularly those in lower-income and rural areas. Many women are unable to afford sanitary products and are forced to rely on less hygienic alternatives. This affordability challenge limits the overall growth of the feminine hygiene market, especially for premium and organic products. Without targeted interventions, such as subsidies or price regulations, this cost barrier will continue to hinder market expansion and access for a broader range of consumers.

Indonesia Feminine Hygiene Market Future Outlook

Over the next five years, the Indonesia Feminine Hygiene Market is expected to experience robust growth due to factors such as increasing awareness about menstrual hygiene, the growing middle-class population, and shifts toward organic and sustainable products. The expansion of e-commerce platforms and government-backed initiatives to make feminine hygiene products more accessible in rural areas will further drive market growth. The trend toward eco-friendly and reusable products like menstrual cups is also expected to gain traction, particularly among younger consumers who are more environmentally conscious.

Market Opportunities

- Innovative and Sustainable Products: The feminine hygiene market in Indonesia is experiencing a shift towards more innovative and sustainable products. Brands are increasingly focusing on developing biodegradable and eco-friendly options to cater to the growing demand for sustainable alternatives. This trend aligns with global environmental movements and is being supported by government initiatives promoting sustainable manufacturing practices. Companies investing in eco-friendly materials and innovative product designs are well-positioned to capture a larger share of the market, particularly as consumers become more environmentally conscious and seek out products that reduce plastic waste.

- Growth of E-commerce Sales Channels: E-commerce has emerged as a major distribution channel for feminine hygiene products in Indonesia, offering consumers greater convenience and access to a wide range of options. The rise of platforms such as Tokopedia and Shopee has significantly expanded the market reach, allowing women across urban and semi-urban areas to purchase products online. This shift towards online shopping is further supported by increasing smartphone penetration and improved internet access, making e-commerce a critical driver for market growth. As more consumers turn to digital platforms, the demand for diverse product offerings, including organic and eco-friendly options, continues to rise.

Scope of the Report

|

Product Type |

Sanitary Pads Tampons Menstrual Cups Pantyliners Feminine Wipes |

|

Distribution Channel |

Online Retail Supermarkets/Hypermarkets Pharmacies Convenience Stores Health & Wellness Stores |

|

Age Group |

Adolescents (12-18) Young Adults (18-30) Adults (30-45) Senior Women (45+) |

|

Material Type |

Organic Products Synthetic Products |

|

Region |

Java Sumatra Kalimantan Sulawesi Bali |

Products

Key Target Audience

Feminine Hygiene Product Manufacturers

Personal Care Packaging Manufacturers

Online E-commerce Platforms

Female Entrepreneurs and Startups in the Personal Care Industry

Government and Regulatory Bodies (Ministry of Health, BPOM)

Investment and Venture Capitalist Firms

Banks and Financial Institution

Companies

Major Players Mentioned in the Report

P&G (Always)

Kimberly-Clark (Kotex)

Unicharm (Sofy)

Johnson & Johnson (Stayfree)

Softex Indonesia

Kao Corporation (Laurier)

Rael

Natracare

Organyc

Bella

The Honest Company

Saathi Pads

Aunt Flow

Veeda

Whisper

Table of Contents

1. Indonesia Feminine Hygiene Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate (Rising Awareness, Product Penetration)

1.4. Market Segmentation Overview (By Product Type, Distribution Channel, Age Group, Region)

2. Indonesia Feminine Hygiene Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones (Product Innovations, Government Initiatives)

3. Indonesia Feminine Hygiene Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Female Workforce

3.1.2. Awareness of Menstrual Hygiene

3.1.3. Growing Demand for Organic Products

3.1.4. Government Programs for Womens Health

3.2. Market Restraints

3.2.1. Lack of Awareness in Rural Areas

3.2.2. High Product Cost

3.2.3. Cultural Taboos and Stigmas

3.3. Opportunities

3.3.1. Expansion in Rural Markets

3.3.2. Innovative and Sustainable Products

3.3.3. Growth of E-commerce Sales Channels

3.4. Trends

3.4.1. Preference for Organic Products

3.4.2. Subscription-based Services

3.4.3. Increasing Focus on Biodegradable Materials

3.5. Government Regulation

3.5.1. Subsidies for Feminine Hygiene Products

3.5.2. Regulation on Product Safety Standards

3.5.3. Public Health Initiatives

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia Feminine Hygiene Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Sanitary Pads

4.1.2. Tampons

4.1.3. Menstrual Cups

4.1.4. Pantyliners

4.1.5. Feminine Wipes

4.2. By Distribution Channel (In Value %)

4.2.1. Online Retail

4.2.2. Supermarkets/Hypermarkets

4.2.3. Pharmacies

4.2.4. Convenience Stores

4.2.5. Health & Wellness Stores

4.3. By Age Group (In Value %)

4.3.1. Adolescents (12-18)

4.3.2. Young Adults (18-30)

4.3.3. Adults (30-45)

4.3.4. Senior Women (45+)

4.4. By Material Type (In Value %)

4.4.1. Organic Products

4.4.2. Synthetic Products

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Bali

5. Indonesia Feminine Hygiene Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. P&G (Always)

5.1.2. Kimberly-Clark (Kotex)

5.1.3. Johnson & Johnson (Stayfree)

5.1.4. Unicharm (Sofy)

5.1.5. Kao Corporation (Laurier)

5.1.6. Softex Indonesia

5.1.7. Organyc

5.1.8. Rael

5.1.9. Natracare

5.1.10. Whisper

5.1.11. Bella

5.1.12. The Honest Company

5.1.13. Saathi Pads

5.1.14. Aunt Flow

5.1.15. Veeda

5.2 Cross Comparison Parameters (Revenue, Market Share, Product Portfolio, Geographic Reach, Sustainability Initiatives, R&D Investment, Manufacturing Capacity, Brand Positioning)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. New Product Launches

5.8. Marketing and Promotion Strategies

6. Indonesia Feminine Hygiene Market Regulatory Framework

6.1. Product Safety Standards

6.2. Taxation and Tariffs on Feminine Hygiene Products

6.3. Certification and Quality Assurance

6.4. Regulations on Product Labeling

7. Indonesia Feminine Hygiene Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth (Increased Awareness, Shift Toward Organic Products, E-commerce Growth)

8. Indonesia Feminine Hygiene Future Market Segmentation

8.1. By Product Type (In Value %)

8.2. By Distribution Channel (In Value %)

8.3. By Age Group (In Value %)

8.4. By Material Type (In Value %)

8.5. By Region (In Value %)

9. Indonesia Feminine Hygiene Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial step involves identifying and mapping key stakeholders in the Indonesia Feminine Hygiene Market. This phase relies heavily on desk research, including secondary databases, government publications, and proprietary sources. The focus is on determining the primary variables that shape the market's demand and supply.

Step 2: Market Analysis and Construction

In this phase, historical data on market penetration, sales channels, and revenue generation are analyzed. This includes a thorough assessment of the competitive landscape, consumer preferences, and the influence of new product launches on overall market dynamics.

Step 3: Hypothesis Validation and Expert Consultation

Hypotheses concerning market trends, growth drivers, and challenges are formulated. These are then validated through interviews with industry experts and key opinion leaders in the feminine hygiene sector. Insights from these interviews are crucial for refining the data and providing real-time insights into market trends.

Step 4: Research Synthesis and Final Output

The final phase involves combining findings from the bottom-up and top-down approaches. This ensures that the final report includes accurate, detailed insights from manufacturers, consumers, and retailers, culminating in a comprehensive market analysis.

Frequently Asked Questions

01. How big is the Indonesia Feminine Hygiene Market?

The Indonesia Feminine Hygiene Market is valued at USD 400 million, driven by increased consumer awareness, growing preference for organic products, and government support for women’s health initiatives.

02. What are the challenges in the Indonesia Feminine Hygiene Market?

Challenges in Indonesia Feminine Hygiene Market include cultural stigmas associated with menstruation, high product costs in rural areas, and the need for improved product accessibility in remote regions.

03. Who are the major players in the Indonesia Feminine Hygiene Market?

Key players in Indonesia Feminine Hygiene Market include P&G (Always), Unicharm (Sofy), Kimberly-Clark (Kotex), Softex Indonesia, and Johnson & Johnson (Stayfree), all benefiting from strong brand loyalty and wide distribution networks.

04. What are the growth drivers of the Indonesia Feminine Hygiene Market?

Growth drivers in Indonesia Feminine Hygiene Market is propelled by rising awareness of menstrual hygiene, an increasing female workforce, and the availability of organic and biodegradable feminine hygiene products through e-commerce platforms.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.