Indonesia Fertilizer Market Outlook to 2030

Region:Asia

Author(s):Paribhasha Tiwari

Product Code:KROD3687

October 2024

83

About the Report

Indonesia Fertilizer Market Overview

- The Indonesia fertilizer market, valued at USD 8.45 billion, is driven by the country’s rapidly expanding agricultural sector, which has been essential to meet the growing food demand. Fertilizers play a critical role in boosting crop yields, especially in rice and palm oil cultivation, two key crops for Indonesia. The country’s fertile land and government policies aimed at increasing productivity further contribute to the fertilizer market's expansion, making it a crucial component of Indonesia’s overall economy.

- Java and Sumatra dominate the fertilizer market in Indonesia due to their extensive agricultural activities. Java, in particular, accounts for a significant portion of Indonesia’s rice production, while Sumatra is a major hub for palm oil cultivation. These regions benefit from well-established supply chains and infrastructure that facilitate efficient distribution of fertilizers. Additionally, government initiatives to support sustainable farming practices in these regions continue to drive their dominance in the fertilizer market.

- In 2023, Indonesia continued to face a growing reliance on imports, particularly for key nutrients like potash, which is critical for crops such as rice and palm oil. This demand, coupled with Indonesia's ambitious agricultural productivity goals, has driven local manufacturers, including state-owned enterprises like PT Pupuk Indonesia and PT Petrokimia Gresik, to invest in new production plants and form strategic collaborations with international players?.

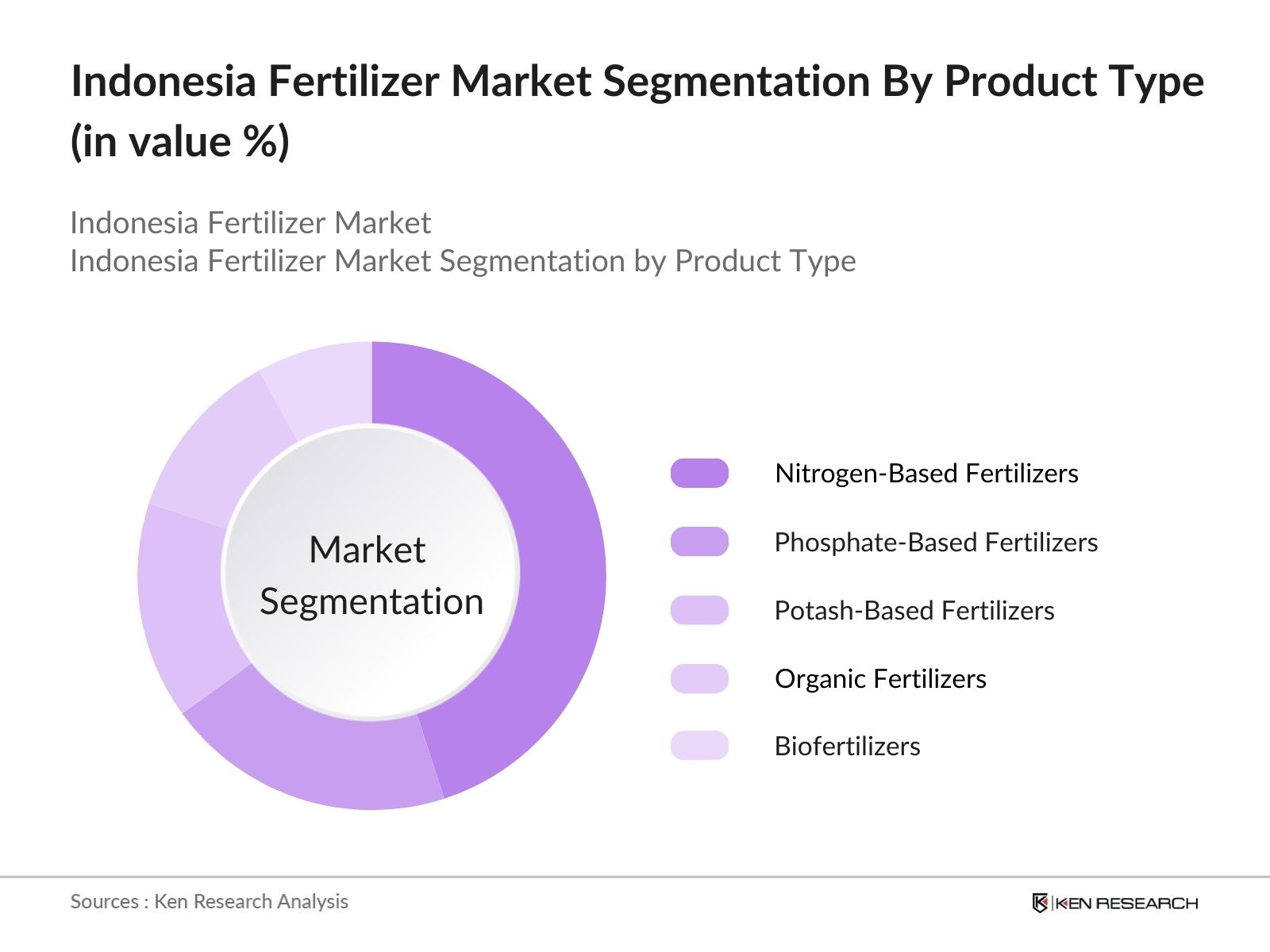

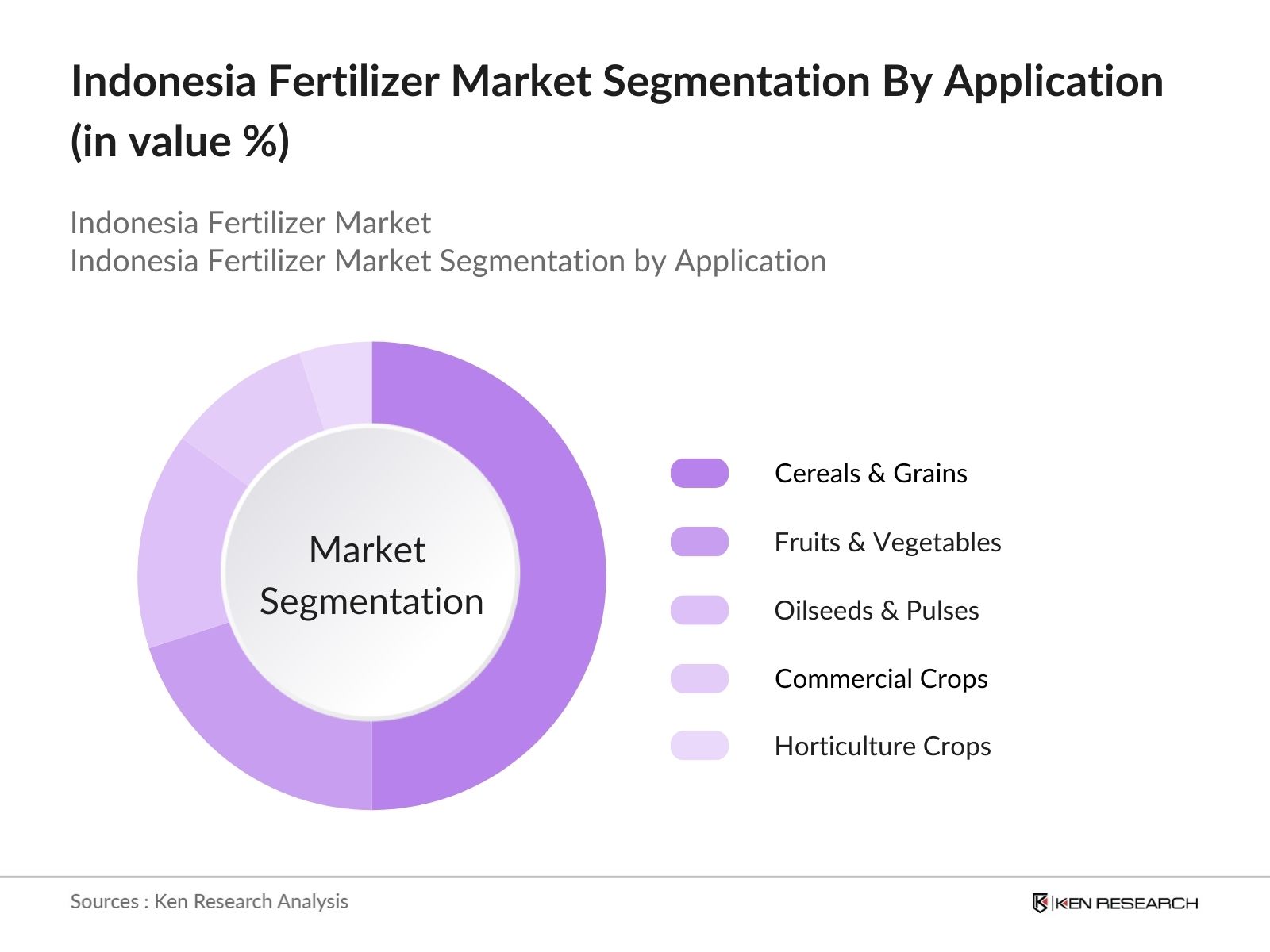

Indonesia Fertilizer Market Segmentation

By Product Type: Indonesia's fertilizer market is segmented by product type into nitrogen-based fertilizers, phosphate-based fertilizers, potash-based fertilizers, organic fertilizers, and biofertilizers. Nitrogen-based fertilizers have a dominant market share in Indonesia under the product type segmentation, owing to their widespread use in rice and corn production. Urea, the most popular nitrogen fertilizer, is essential for improving crop yield and enhancing soil fertility, which is crucial for Indonesia’s staple crops. The government's subsidy program for urea further cements its position as a leading product in the market.

By Application: The Indonesia fertilizer market is segmented by application into cereals & grains, fruits & vegetables, oilseeds & pulses, commercial crops, and horticultural crops. Cereals and grains, especially rice, dominate the market due to their importance as staple foods in Indonesia. The intensive cultivation of rice, which demands large quantities of nitrogen, phosphate, and potassium fertilizers, ensures that this segment remains the largest consumer of fertilizers. Government support for rice production and efforts to achieve food security further contribute to this sub-segment’s dominance.

Indonesia Fertilizer Market Competitive Landscape

The Indonesia fertilizer market is dominated by a combination of local companies such as PT Pupuk Indonesia and PT Petrokimia Gresik, along with major global players like Yara International and Nutrien Ltd. The consolidation within the market is driven by Indonesia's government regulation on fertilizer subsidies and distribution, allowing key players to maintain significant influence over market dynamics.

|

Company Name |

Establishment Year |

Headquarters |

Production Capacity |

R&D Investment |

Distribution Network |

Product Portfolio |

Regional Presence |

Strategic Partnerships |

|

PT Pupuk Indonesia |

1959 |

Jakarta |

|

|

|

|

|

|

|

Yara International ASA |

1905 |

Oslo |

|

|

|

|

|

|

|

Nutrien Ltd. |

2018 |

Saskatchewan |

|

|

|

|

|

|

|

PT Petrokimia Gresik |

1972 |

Gresik |

|

|

|

|

|

|

|

The Mosaic Company |

2004 |

Florida |

|

|

|

|

|

|

Indonesia Fertilizer Market Analysis

Growth Drivers

- Rising Agricultural Activities: The increase in agricultural activities in Indonesia is a significant growth driver for the fertilizer market. In 2023, Indonesia had approximately 41.7 million hectares of land under cultivation, according to data from the Ministry of Agriculture. This includes vast areas dedicated to the cultivation of staple crops like rice and palm oil. As one of the largest producers of these crops globally, Indonesia's agricultural sector heavily relies on fertilizers to maintain and enhance soil fertility. The expansion of cultivated land, especially in rice-producing regions, further necessitates increased fertilizer use.

- Increasing Demand for Food Security: With a population exceeding 277 million in 2024, Indonesia faces rising demand for food security, particularly for staple crops like rice and palm oil. Indonesia consumes around 33 million metric tons of rice annually, while palm oil production reached approximately 47.5 million metric tons in 2023. To meet growing food demands, the government has emphasized increasing agricultural productivity through the enhanced use of fertilizers. The rising consumption of these essential crops amplifies the need for efficient fertilizer application to ensure high yields and meet national food security goals.

- Government Subsidies and Support Programs: The Indonesian government continues to offer substantial subsidies and support programs to the fertilizer sector, which is a key driver for the market's growth. In 2024, the government allocated IDR 25 trillion (USD 1.6 billion) for fertilizer subsidies to support farmers and increase agricultural production. These subsidies primarily target small-scale farmers, covering a significant portion of the costs associated with purchasing chemical and organic fertilizers. Various government initiatives such as the "National Food Security Program" also encourage the use of bio-fertilizers and promote sustainable agricultural practices across the country.

Market Challenges

- Environmental Impact and Sustainability Concerns (Water Contamination, Soil Degradation): The widespread use of chemical fertilizers in Indonesia has led to concerns over water contamination and soil degradation. Excessive use of nitrogen-based fertilizers has resulted in high nitrate concentrations in water bodies, impacting public health and biodiversity. A 2023 report from the Indonesian Ministry of Environment revealed that 25% of agricultural land suffers from moderate to severe soil degradation due to improper fertilizer application. These environmental issues raise the need for more sustainable fertilizer alternatives and stricter regulatory frameworks to mitigate their impact.

- High Costs of Specialty Fertilizers: Specialty fertilizers, including compound and micronutrient-based variants, are often prohibitively expensive for small-scale farmers in Indonesia. In 2024, the average cost of compound fertilizers in the country stands at IDR 9 million (USD 600) per ton, which can be a significant financial burden for farmers with limited income. This high cost restricts the adoption of advanced fertilizers, limiting access to more efficient products that could boost agricultural productivity. Without sufficient subsidies or price reductions, the growth of specialty fertilizers may be hindered in the market.

Indonesia Fertilizer Market Future Outlook

Over the next five years, the Indonesia fertilizer market is expected to experience significant growth, driven by increasing agricultural demand, advancements in fertilizer technologies, and government subsidies aimed at improving food security. With a focus on sustainable agricultural practices, there will likely be a growing demand for organic and biofertilizers. Additionally, the expansion of digital farming technologies is anticipated to optimize fertilizer usage, leading to more efficient and sustainable farming practices in the country.

Market Opportunities

- Organic and Sustainable Farming Practices: The growing adoption of organic fertilizers and sustainable farming practices offers a significant opportunity for the fertilizer market. As of 2023, Indonesia had over 3.5 million hectares of land under organic farming, with a notable increase in the use of organic fertilizers such as compost and manure. This trend is supported by the government's "Sustainable Agriculture Program," which promotes organic farming to reduce environmental degradation and improve soil health. The shift toward organic and sustainable agriculture provides new growth avenues for eco-friendly fertilizer products.

- Fertilizer Export Potential to Neighboring Countries: Indonesia's strategic location in Southeast Asia provides substantial opportunities for fertilizer exports to neighboring countries such as Malaysia, Thailand, and Vietnam. In 2023, Indonesia exported 1.2 million metric tons of fertilizers, primarily urea and phosphate-based products, to these countries. The ASEAN Free Trade Area (AFTA) agreement has facilitated tariff reductions, making Indonesian fertilizers more competitive in regional markets. As regional agricultural activities expand, the demand for high-quality fertilizers from Indonesia is expected to rise, bolstering the country’s export potential.

Scope of the Report

|

Segment |

Sub-segments |

|

Product Type |

Nitrogen-Based Fertilizers (Urea, Ammonium Nitrate) |

|

Application |

Cereals & Grains (Rice, Wheat, Maize) |

|

Region |

Java |

|

Fertilizer Form |

Granular |

|

Distribution Channel |

Direct Sales |

Products

Key Target Audience

Fertilizer Manufacturers

Agricultural Associations (Indonesian Farmers Alliance)

Distribution Networks (Local and International Distributors)

Agritech Companies (Precision Agriculture Firms)

Exporters and Importers

Private Equity Firms

Government and Regulatory Bodies (Ministry of Agriculture, Ministry of Trade)

Investments and Venture Capitalist Firms

Companies

PT Pupuk Indonesia

Yara International ASA

Nutrien Ltd.

PT Petrokimia Gresik

The Mosaic Company

CF Industries

K+S AG

ICL Group

Haifa Group

BASF SE

OCI Nitrogen

OCP Group

Coromandel International Ltd.

EuroChem Group

PT Pupuk Kaltim

Table of Contents

1. Indonesia Fertilizer Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2.Indonesia Fertilizer Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Fertilizer Market Analysis

3.1. Growth Drivers

3.1.1. Rising Agricultural Activities (Hectares of Land under Cultivation)

3.1.2. Increasing Demand for Food Security (Population Growth, Rice & Palm Oil Demand)

3.1.3. Government Subsidies and Support Programs (Subsidy Allocation, Program Types)

3.1.4. Technological Advancements in Fertilizer Production (Nano Fertilizers, Bio-fertilizers)

3.2. Market Challenges

3.2.1. Environmental Impact and Sustainability Concerns (Water Contamination, Soil Degradation)

3.2.2. High Costs of Specialty Fertilizers (Cost per Ton of Compound Fertilizers)

3.2.3. Unpredictable Weather Conditions (Rainfall Variability, El Niño)

3.3. Opportunities

3.3.1. Organic and Sustainable Farming Practices (Adoption of Organic Fertilizers, Acreage under Organic Farming)

3.3.2. Fertilizer Export Potential to Neighboring Countries (Regional Trade Agreements, Export Volume)

3.3.3. Development of Smart Fertilizers (Slow-Release, Controlled-Release Technologies)

3.4. Trends

3.4.1. Shift Toward Customized Fertilizer Solutions (Precision Farming, Tailored Fertilizer Blends)

3.4.2. Adoption of Digital Agriculture (Fertilizer Application Optimization via IoT)

3.4.3. Increased Use of Micronutrient Fertilizers (Zinc, Boron, Manganese)

3.5. Government Regulation

3.5.1. Fertilizer Subsidy Programs (Budget Allocation, Program Recipients)

3.5.2. Import-Export Policies for Fertilizers (Tariff Structures, Licensing Regulations)

3.5.3. Environmental Compliance for Fertilizer Manufacturing (Emission Standards, Waste Management Guidelines)

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porter’s Five Forces

3.9. Competition Ecosystem

4. Indonesia Fertilizer Market Segmentation

4.1. By Product Type (In Value %)

4.1.1. Nitrogen-Based Fertilizers (Urea, Ammonium Nitrate)

4.1.2. Phosphate-Based Fertilizers (DAP, MAP)

4.1.3. Potash-Based Fertilizers (MOP, SOP)

4.1.4. Organic Fertilizers (Animal Waste, Compost)

4.1.5. Biofertilizers (Rhizobium, Azotobacter)

4.2. By Application (In Value %)

4.2.1. Cereals & Grains (Rice, Wheat, Maize)

4.2.2. Fruits & Vegetables (Potatoes, Tomatoes, Peppers)

4.2.3. Oilseeds & Pulses (Soybeans, Palm Oil, Groundnuts)

4.2.4. Commercial Crops (Rubber, Sugarcane, Tea)

4.2.5. Horticultural Crops (Flowers, Ornamental Plants)

4.3. By Region (In Value %)

4.3.1. Java

4.3.2. Sumatra

4.3.3. Kalimantan

4.3.4. Sulawesi

4.3.5. Papua

4.4. By Fertilizer Form (In Value %)

4.4.1. Granular

4.4.2. Liquid

4.4.3. Powdered

4.4.4. Gaseous

4.5. By Distribution Channel (In Value %)

4.5.1. Direct Sales

4.5.2. Distributors

4.5.3. Online Retail

5. Indonesia Fertilizer Market Competitive Analysis

5.1. Detailed Profiles of Major Competitors

5.1.1. PT Pupuk Indonesia

5.1.2. PT Petrokimia Gresik

5.1.3. PT Pupuk Kaltim

5.1.4. Yara International ASA

5.1.5. Nutrien Ltd.

5.1.6. K+S AG

5.1.7. The Mosaic Company

5.1.8. ICL Group

5.1.9. Haifa Group

5.1.10. CF Industries

5.1.11. EuroChem Group

5.1.12. OCP Group

5.1.13. Coromandel International Ltd.

5.1.14. OCI Nitrogen

5.1.15. BASF SE

5.2. Cross Comparison Parameters (Market Share, Product Portfolio, Regional Presence, R&D Investment, Production Capacity, Distribution Network, Brand Recognition, Strategic Partnerships)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Fertilizer Market Regulatory Framework

6.1. Environmental Standards

6.2. Compliance Requirements

6.3. Certification Processes

7. Indonesia Fertilizer Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Fertilizer Market Future Segmentation

8.1. By Product Type (In Value %)

8.2. By Application (In Value %)

8.3. By Region (In Value %)

8.4. By Fertilizer Form (In Value %)

8.5. By Distribution Channel (In Value %)

9. Indonesia Fertilizer Market Analyst’s Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The initial phase involves constructing an ecosystem map that covers all stakeholders within the Indonesia Fertilizer Market. This step is conducted through comprehensive desk research utilizing both secondary and proprietary data sources to ensure a holistic view of the industry. The key objective here is to identify and define market variables such as product types, distribution channels, and application areas.

Step 2: Market Analysis and Construction

In this phase, historical data related to the Indonesia Fertilizer Market is collected and analyzed. This includes factors such as market growth, price trends, and shifts in consumer demand. The market data is cross-verified with industry reports and company-level data to ensure accuracy. Key metrics such as market size, growth rate, and competitive landscape are calculated and verified.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are developed based on the data and validated through industry consultations. This step involves conducting structured interviews with executives and decision-makers in fertilizer manufacturing and distribution companies. Insights from these interviews help fine-tune the market analysis and validate projections.

Step 4: Research Synthesis and Final Output

The final phase integrates data from multiple sources, including desk research, expert interviews, and market surveys. This synthesis is used to produce a comprehensive analysis of the Indonesia Fertilizer Market, providing an accurate, validated, and detailed report that captures all market dynamics.

Frequently Asked Questions

01. How big is the Indonesia Fertilizer Market?

The Indonesia fertilizer market is valued at USD 8.45 billion, driven by strong agricultural activity and government subsidies aimed at increasing food production.

02. What are the challenges in the Indonesia Fertilizer Market?

Challenges include fluctuating raw material prices, environmental concerns regarding fertilizer overuse, and logistical issues, particularly in remote agricultural areas.

03. Who are the major players in the Indonesia Fertilizer Market?

Key players in the market include PT Pupuk Indonesia, Yara International, Nutrien Ltd., PT Petrokimia Gresik, and The Mosaic Company. These companies dominate through extensive production capacity and government support.

04. What are the growth drivers of the Indonesia Fertilizer Market?

Growth drivers include increasing agricultural productivity, government subsidies, technological advancements in fertilizer production, and the rise of organic farming practices.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.