Indonesia Frozen Food Market Outlook to 2030

Region:Asia

Author(s):Sanjna

Product Code:KROD2639

December 2024

88

About the Report

Indonesia Frozen Food Market Overview

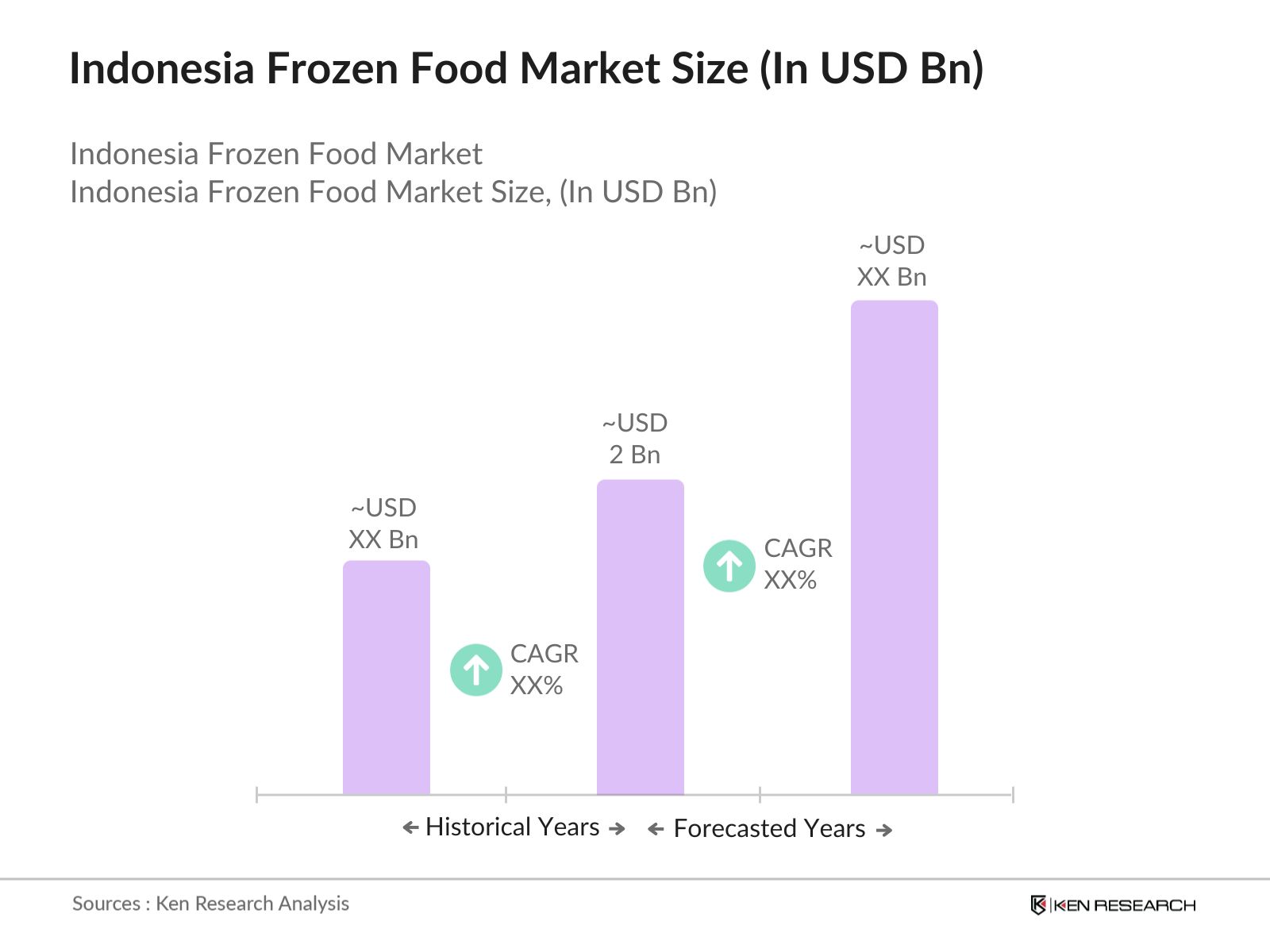

- Indonesia Frozen Food Market reached a market size of USD 2 billion, driven by a rising preference for convenience food and the increasing number of working individuals. A growth in cold chain logistics has also bolstered the market, enabling frozen food products to maintain their quality during distribution.

- Key players in the Indonesia Frozen Food Market include large domestic and international companies such as PT Charoen Pokphand Indonesia Tbk, PT Sumber Alfaria Trijaya Tbk (Alfamart), and PT Nippon Indosari Corpindo Tbk. These players dominate through widespread distribution networks and an expanding product range that caters to consumer preferences.

- In 2024, McCain Foods has recently completed the acquisition of Strong Roots, a Dublin-based plant-based frozen food producer. This acquisition follows McCain's initial investment of $55 million in Strong Roots back in 2021, which marked the beginning of their strategic partnership aimed at expanding Strong Roots' offerings and market reach.

- Jakarta, Surabaya, and Bandung are the cities that dominate Indonesia's frozen food market, mainly due to their large populations, high disposable incomes, and rapid urbanization. These cities have a strong demand for ready-to-eat meals due to busy lifestyles, and they have well-established cold chain infrastructure that supports the distribution and storage of frozen food products.

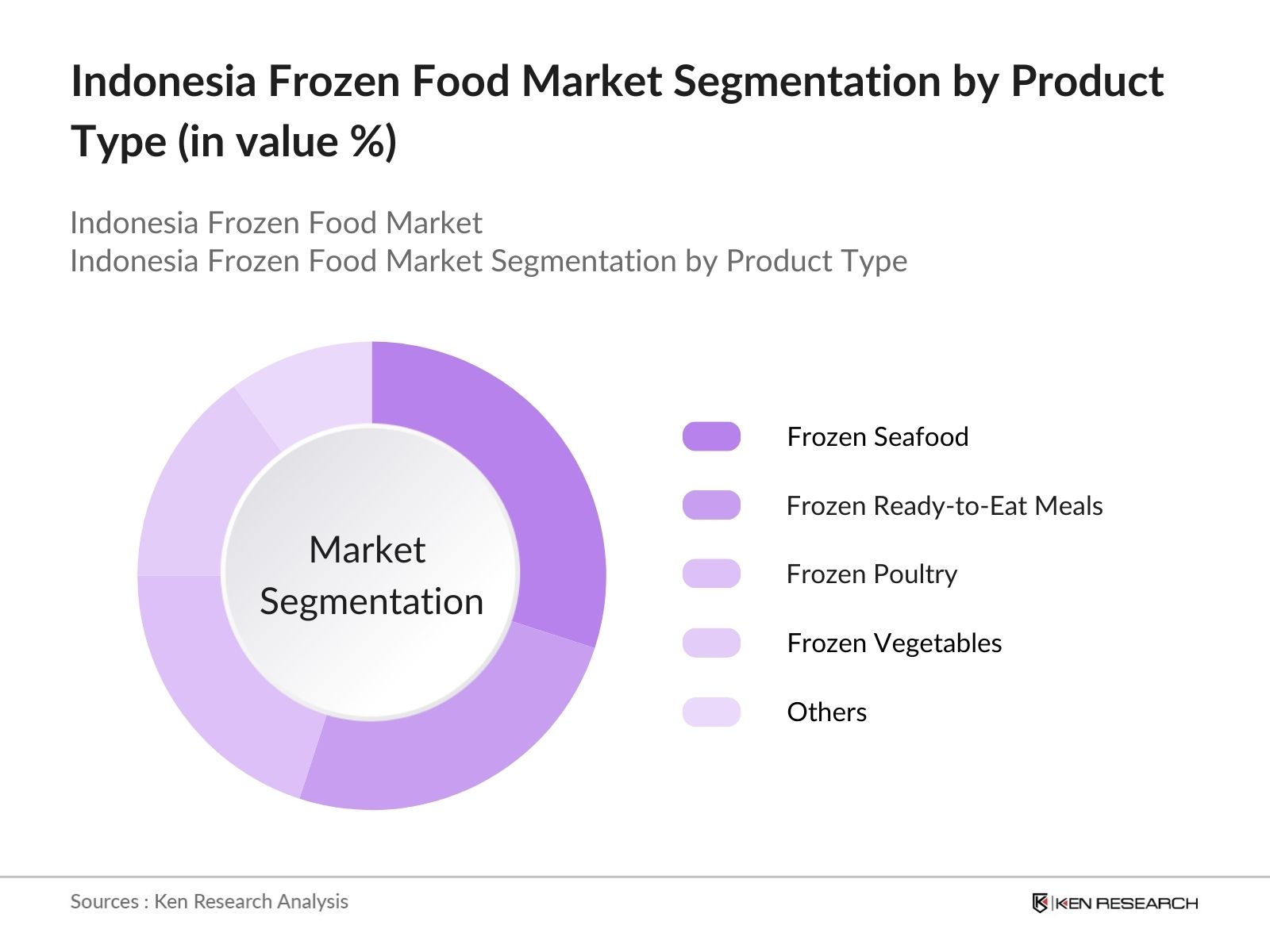

Indonesia Frozen Food Market Segmentation

By Product Type: The Indonesia frozen food market is segmented by product type into frozen ready-to-eat meals, frozen seafood, frozen vegetables, frozen poultry, and frozen desserts. In 2023, frozen seafood held the dominant market share, driven by Indonesias rich marine resources and the high demand for fish and shrimp products. Frozen seafood products are favored due to their convenience, and their nutritional value remains intact.

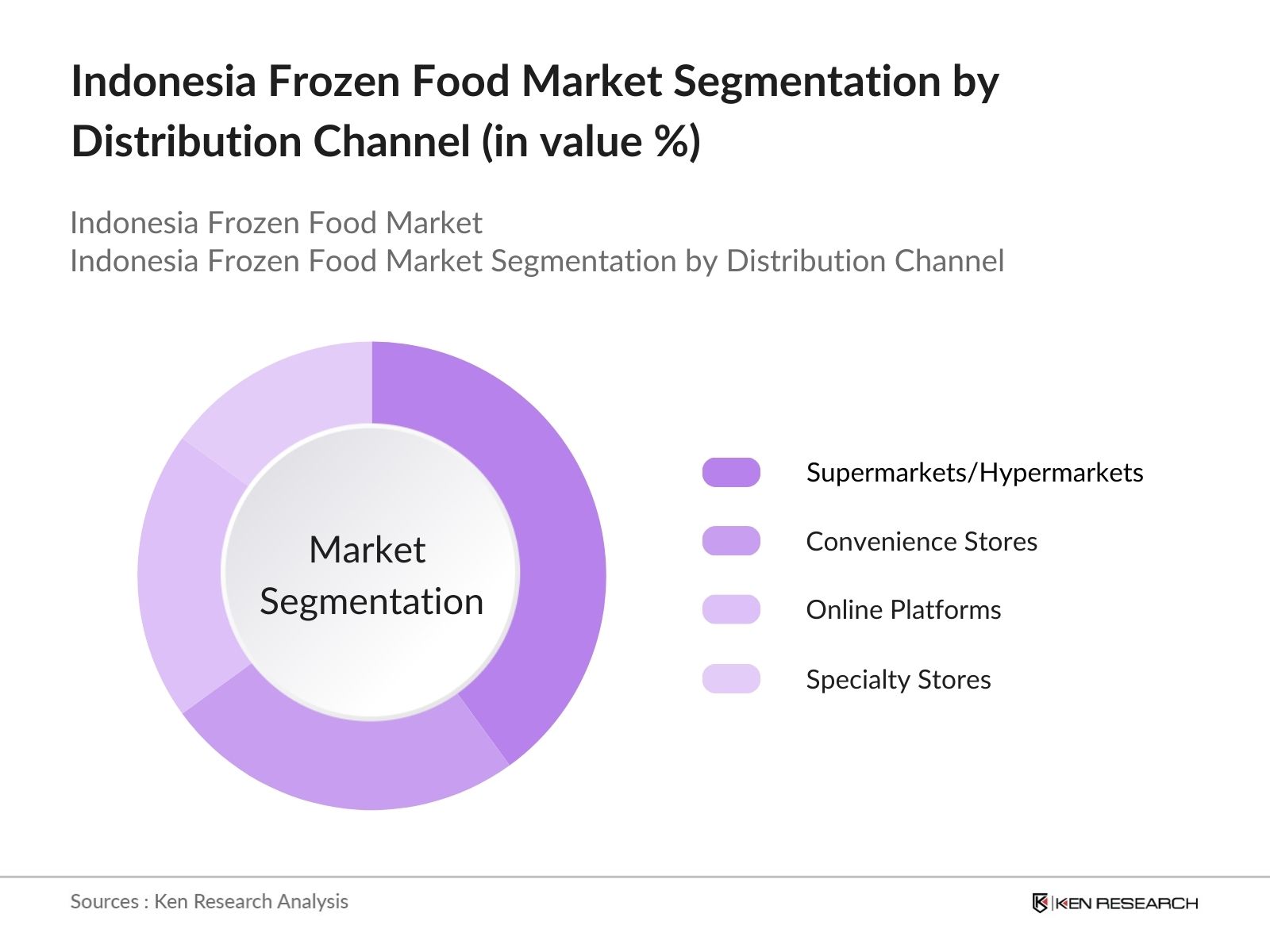

By Distribution Channel: The market is further segmented by distribution channel into supermarkets/hypermarkets, convenience stores, online platforms, and specialty stores. Supermarkets and hypermarkets lead the distribution channel with a market share in 2023. Their dominance is attributed to their ability to offer a wide range of products and frequent promotional activities.

By Region: Indonesia Frozen Food Market is segmented into Java, Sumatra, Kalimantan, Sulawesi, and others. Java holds the dominant market share in 2023, mainly due to its large population and well-developed infrastructure, including cold chain logistics. Java's economic centers, such as Jakarta and Bandung, drive consumption due to their dense urban populations and the popularity of frozen food among busy professionals.

Indonesia Frozen Food Market Competitive Landscape

|

Company Name |

Year of Establishment |

Headquarters |

|

PT Charoen Pokphand Indonesia Tbk |

1972 |

Jakarta |

|

PT Japfa Comfeed Indonesia Tbk |

1971 |

Jakarta |

|

PT Sumber Alfaria Trijaya Tbk (Alfamart) |

1989 |

Tangerang |

|

PT Nippon Indosari Corpindo Tbk |

1995 |

Bekasi |

|

PT Sinar Mas Agro Resources |

1962 |

Jakarta |

- PT Japfa Comfeed Indonesia Tbk: In 2024, PT Japfa Comfeed Indonesia Tbk officially launched Olagud, a new product line aimed at enhancing its presence in the frozen food sector. This initiative reflects the company's strategy to expand its downstream business and cater to the growing demand for frozen food products in Indonesia. This move is expected to strengthen Japfa's market position and capitalize on the increasing consumer preference for convenient, ready-to-cook meals.

- PT Charoen Pokphand Indonesia Tbk: In 2023, UBS AG Singapore has acquired approximately 6% of PT Charoen Pokphand Indonesia Tbk (CPIN), purchasing 974.91 million shares through Deutsche Bank AG. This transaction, valued at USD 0.34 per share, marks UBS as a significant new investor in the company, which specializes in broiler farming and animal feed. The acquisition reflects ongoing interest from foreign investors in Indonesia's agricultural sector.

Indonesia Frozen Food Industry Analysis

Growth Drivers:

- Cold Chain Infrastructure Expansion: The development of cold chain logistics has been a significant driver of the Indonesian frozen food market. Over 75 million kilograms of food are distributed daily in Indonesia, but only 50 thousand tons are transported using trucks and refrigerated containers, highlighting the need for enhanced integration and collaboration in cold parcel delivery services. The enhanced infrastructure allows businesses to expand their product offerings, improving the availability of frozen products in retail stores and online platforms.

- Surge in E-commerce Platforms Sales: Approximately 51 million Indonesians are currently using e-commerce platforms at present. The rising middle class and the growth in smartphone penetration across urban centers have contributed to this shift. As of early 2024, 68.1% of Indonesia's population owns a smartphone, which translates to approximately 187.7 million smartphone users. The convenience of ordering frozen products online, coupled with competitive pricing and promotional offers, has made e-commerce a pivotal driver for market expansion.

- Rising Demand for Processed Seafood: Indonesia, being one of the largest producers of seafood globally, has seen significant growth in the frozen seafood sector. In 2022, the export value of frozen foods was approximately $455.88 million for frozen fish products excluding fish fillets and other fish meat. Additionally, increasing health consciousness among consumers is driving demand for nutritious seafood options, supporting the growth of this segment.

Challenges:

- Inconsistent Power Supply in Remote Areas: A significant challenge for the frozen food market in Indonesia is the inconsistent electricity supply in remote regions, which directly affects cold storage facilities. This inconsistency hampers the markets growth, particularly for frozen seafood and poultry, which require stable cold storage conditions. Despite the government's efforts to improve rural infrastructure, the power supply issue remains a bottleneck for market expansion in these regions.

- Lack of Consumer Awareness in Rural Areas: Despite the growing popularity of frozen food in urban areas, consumer awareness in rural regions remains low. This lack of awareness, coupled with the high cost of frozen food in rural markets, presents a significant challenge to the expansion of the frozen food industry in Indonesia. Educating consumers about the benefits and convenience of frozen food will be crucial for long-term growth.

Government Initiatives:

- E-Commerce Roadmap: The Indonesian government has established a national e-commerce roadmap to facilitate the growth of the digital economy in 2016. This roadmap includes the formation of a Programme Management Unit to coordinate efforts across various ministries and organizations, aiming to provide a structured approach to e-commerce development in the country. By improving logistics infrastructure, reducing costs, and increasing consumer awareness, the roadmap helps frozen food businesses.

- Sustainable Fisheries and Aquaculture Initiative: The Coastal Fisheries Initiative (CFI) in Indonesia aims to enhance coastal fisheries management and environmental preservation for 70 million people reliant on marine resources. Covering over 1.6 million square kilometers. The initiative will also support local fishing communities by providing them with access to modern freezing technology, enabling them to sell frozen fish products in both domestic and international markets.

Indonesia Frozen Food Future Market Outlook

Indonesia Frozen Food Market is poised for steady growth over the next five years, driven by increasing consumer demand for convenience and ready-to-eat meals. By 2028, the market is expected to experience greater penetration in suburban and rural areas, facilitated by government-backed infrastructure improvements in cold chain logistics.

Future Trends

- Expansion of Plant-Based Frozen Meals: In the coming years, the demand for plant-based frozen meals is expected to rise significantly, driven by health-conscious consumers. Companies are likely to introduce a wider variety of plant-based frozen products, catering to the growing vegan and vegetarian populations. This trend will be especially prominent in urban centers like Jakarta, where consumers are more inclined towards sustainable and eco-friendly food options.

- Technological Innovations in Cold Chain Logistics: Technological advancements in cold chain logistics are expected to reshape the frozen food market. By 2028, the implementation of IoT and blockchain technology will improve the traceability and efficiency of the cold supply chain, ensuring that frozen products maintain their quality during transit. These innovations will also help reduce transportation costs and minimize food wastage, making frozen food more accessible to consumers in remote areas.

Scope of the Report

|

By Product Type |

Frozen Seafood Frozen Ready-to-Eat Meals Frozen Poultry Frozen Vegetables Frozen Desserts |

|

By Distribution Channel |

Supermarkets/Hypermarkets Convenience Stores Online Platforms Specialty Stores |

|

By Region |

North South East West |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Frozen Food Manufacturers

Frozen Food Distributors

Online Retail Platforms

Foodservice Industry (Restaurants, Hotels)

Cold Chain Logistics Providers

Exporters and Importers of Frozen Food Products

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Trade, Ministry of Agriculture)

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

Forecast Period: 2023-2028

Companies

Major Players Mentioned in the Report:

PT Charoen Pokphand Indonesia Tbk

PT Japfa Comfeed Indonesia Tbk

PT Sumber Alfaria Trijaya Tbk (Alfamart)

PT Nippon Indosari Corpindo Tbk

PT Sinar Mas Agro Resources and Technology

Nestl Indonesia

McCain Foods Indonesia

PT Sekar Bumi Tbk

PT Sierad Produce Tbk

PT Central Proteina Prima Tbk

PT Ultra Prima Abadi (Wings Group)

PT Indofood Sukses Makmur Tbk

PT Sukanda Djaya (Diamond Cold Storage)

PT Fajar Gelora Inti (Fiesta)

PT Mega Marine Pride

Table of Contents

1. Indonesia Frozen Food Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Dynamics

1.3.1. Market Drivers

1.3.2. Market Restraints

1.3.3. Market Opportunities

1.4. Market Growth Rate and Trends

1.5. Key Market Developments and Milestones

2. Indonesia Frozen Food Market Size (in USD Bn)

2.1. Historical Market Size and Growth

2.2. Market Size Analysis by Segment

2.2.1. Product Type

2.2.2. Distribution Channel

2.2.3. Region

2.3. Year-on-Year Growth Analysis

2.4. Key Market Developments and Milestones

3. Indonesia Frozen Food Market Analysis

3.1. Growth Drivers

3.1.1. Expansion of Cold Chain Infrastructure

3.1.2. Surge in E-Commerce Platform Sales

3.1.3. Rising Demand for Processed Seafood

3.2. Market Restraints

3.2.1. Inconsistent Power Supply in Remote Areas

3.2.2. Lack of Consumer Awareness in Rural Areas

3.3. Market Opportunities

3.3.1. Technological Innovations in Cold Chain Logistics

3.3.2. Expansion of Plant-Based Frozen Meals

3.3.3. Government Initiatives and Support

3.4. Market Trends

3.4.1. Technological Advancements

3.4.2. Growth of Online and Omnichannel Retailing

3.4.3. Increasing Health Consciousness

3.5. Government Regulation

3.5.1. E-Commerce Roadmap

3.5.2. Sustainable Fisheries and Aquaculture Initiative

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Competitive Landscape

4. Indonesia Frozen Food Market Segmentation

4.1. By Product Type (Market Share %)

4.1.1. Frozen Seafood

4.1.2. Frozen Ready-to-Eat Meals

4.1.3. Frozen Poultry

4.1.4. Frozen Vegetables

4.1.5. Frozen Desserts

4.2. By Distribution Channel (Market Share %)

4.2.1. Supermarkets/Hypermarkets

4.2.2. Convenience Stores

4.2.3. Online Platforms

4.2.4. Specialty Stores

4.3. By Region (Market Share %)

4.3.1. Java

4.3.2. Sumatra

4.3.3. Kalimantan

4.3.4. Sulawesi

4.3.5. Others

5. Indonesia Frozen Food Market Cross Comparison

5.1. Detailed Profiles of Major Companies

5.1.1. PT Charoen Pokphand Indonesia Tbk

5.1.2. PT Japfa Comfeed Indonesia Tbk

5.1.3. PT Sumber Alfaria Trijaya Tbk (Alfamart)

5.1.4. PT Nippon Indosari Corpindo Tbk

5.1.5. PT Sinar Mas Agro Resources

5.1.6. Nestl Indonesia

5.1.7. McCain Foods Indonesia

5.1.8. PT Sekar Bumi Tbk

5.1.9. PT Sierad Produce Tbk

5.1.10. PT Central Proteina Prima Tbk

5.1.11. PT Ultra Prima Abadi (Wings Group)

5.1.12. PT Indofood Sukses Makmur Tbk

5.1.13. PT Sukanda Djaya (Diamond Cold Storage)

5.1.14. PT Fajar Gelora Inti (Fiesta)

5.1.15. PT Mega Marine Pride

5.2. Cross Comparison Parameters

5.2.1. Number of Employees

5.2.2. Headquarters

5.2.3. Inception Year

5.2.4. Revenue

5.2.5. Market Share

6. Indonesia Frozen Food Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.2.1. Mergers and Acquisitions

6.2.2. New Product Launches

6.2.3. Strategic Partnerships

6.3. Investment Analysis

6.3.1. Venture Capital Funding

6.3.2. Government Grants

6.3.3. Private Equity Investments

7. Indonesia Frozen Food Market Regulatory Framework

7.1. Industry Standards and Compliance

7.2. Certification Processes

7.3. Government Regulations Impacting the Market

8. Indonesia Frozen Food Market Future Outlook

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

8.3. Emerging Trends and Technologies

9. Indonesia Frozen Food Market Future Segmentation

9.1. By Product Type (Future Market Share %)

9.2. By Distribution Channel (Future Market Share %)

9.3. By Region (Future Market Share %)

10. Market Analysts Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Strategic Marketing Initiatives

10.4. White Space Opportunity Analysis

11. Disclaimer

12. Contact Us

Research Methodology

Step 1: Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2: Market Building:

Collating statistics on Indonesia Frozen Food Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Frozen Food Market. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3: Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4: Research output:

Our team will approach multiple Frozen Food companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from Frozen Food companies.

Frequently Asked Questions

01. How big is Indonesia Frozen Food Market?

Indonesia Frozen Food Market reached a market size of USD 2 billion, driven by a rising preference for convenience food and the increasing number of working individuals. A growth in cold chain logistics has also bolstered the market, enabling frozen food products to maintain their quality during distribution.

02. What are the growth drivers of the Indonesia Frozen Food Market?

Key growth drivers of Indonesia Frozen Food Market are expansion of cold chain logistics, rising demand for ready-to-eat frozen foods, and the increasing role of e-commerce platforms. These factors contribute to better distribution and higher consumption rates.

03. What are challenges in Indonesia Frozen Food Market?

Challenges in the Indonesia Frozen Food Market include inconsistent power supply in remote areas affecting cold storage, high costs associated with cold chain logistics, and low consumer awareness in rural regions. These issues impact the efficiency and affordability of frozen food distribution.

04. Who are major players in Indonesia Frozen Food Market?

Major players include PT Charoen Pokphand Indonesia Tbk, PT Japfa Comfeed Indonesia Tbk, PT Sumber Alfaria Trijaya Tbk (Alfamart), PT Nippon Indosari Corpindo Tbk, and Nestl Indonesia. These companies lead the market through their extensive product ranges and distribution networks.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.