Indonesia Frozen Fruit Market Outlook to 2030

Region:Asia

Author(s):Shreya Garg

Product Code:KROD5323

November 2024

85

About the Report

Indonesia Frozen Fruit Market Overview

- The Indonesia Frozen Fruit Market, valued at USD 1.9 billion, has experienced substantial growth, driven by the rising demand for convenient and healthy food options. The market's expansion is attributed to the increasing consumer preference for frozen fruit due to its extended shelf life and retention of nutritional content, making it ideal for urban populations with busy lifestyles. The governments focus on enhancing agricultural productivity and infrastructure, especially cold chain logistics, has further supported the frozen fruit industry's growth.

- Java and Sumatra dominate the frozen fruit market in Indonesia. Java, as the countrys most populous island, boasts advanced infrastructure, including modern retail and cold chain logistics, which facilitates the distribution of frozen fruits. Sumatra, known for its agricultural production, particularly of tropical fruits like mangoes and pineapples, plays a pivotal role due to its proximity to export markets and strategic investments in cold storage facilities.

- The Indonesian government enforces export guidelines and quotas to regulate the export of agricultural products, including frozen fruits. In 2023, export quotas were implemented to ensure that domestic demand for fruits is not compromised, with a target of 400,000 tons set for frozen fruit exports. These regulations help stabilize domestic supply while promoting exports.

Indonesia Frozen Fruit Market Segmentation

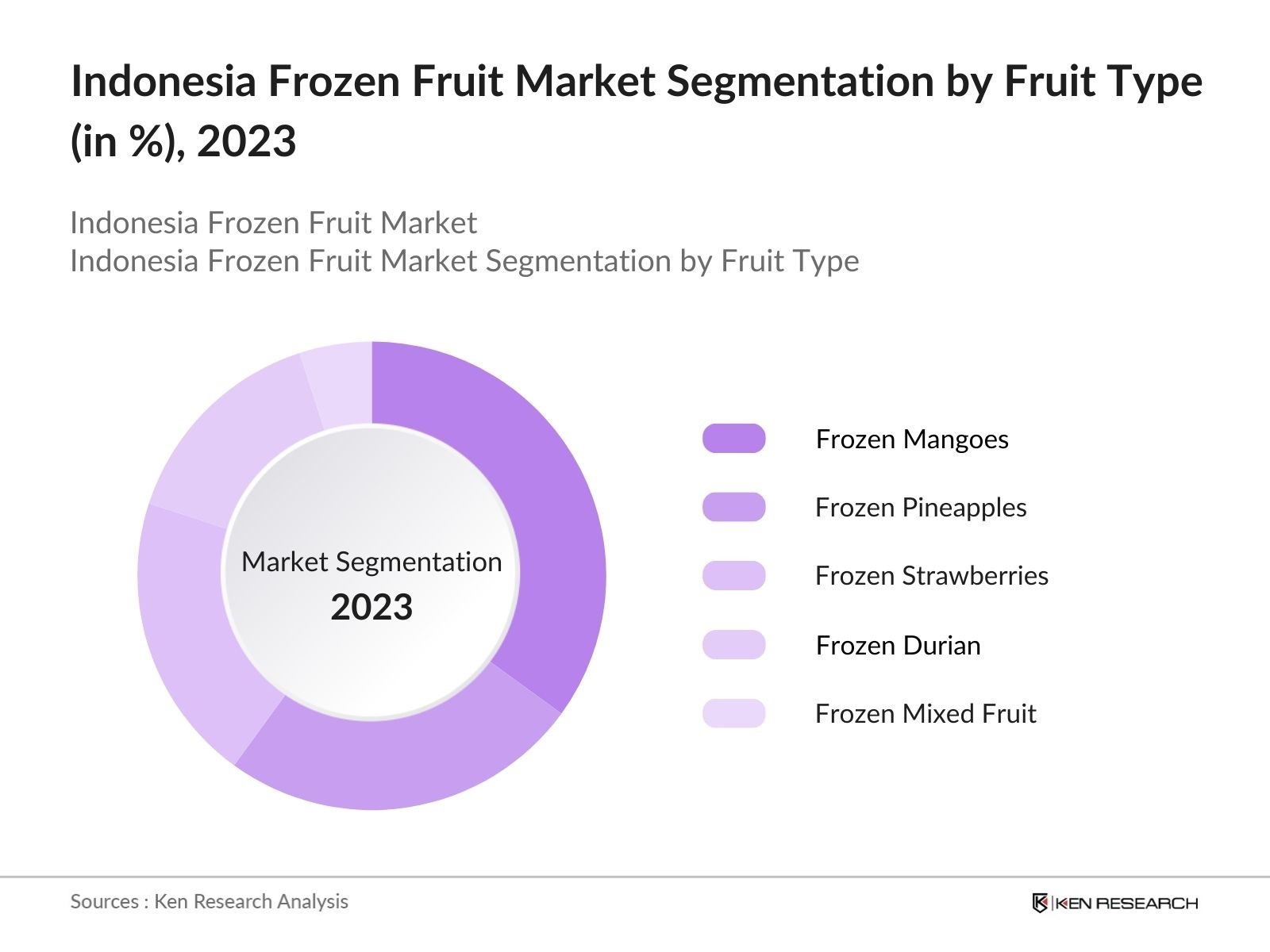

By Fruit Type: The market is segmented by fruit type into frozen mangoes, frozen pineapples, frozen strawberries, frozen durian, and frozen mixed fruit. Frozen Mangoes have a dominant market share under the fruit type segmentation, primarily due to their popularity in both domestic and international markets. Mangoes are considered a staple fruit in Indonesian cuisine and are widely exported, contributing to their prominence in the frozen segment. The consistent demand for mangoes in juices, smoothies, and desserts also supports their leading position in the market.

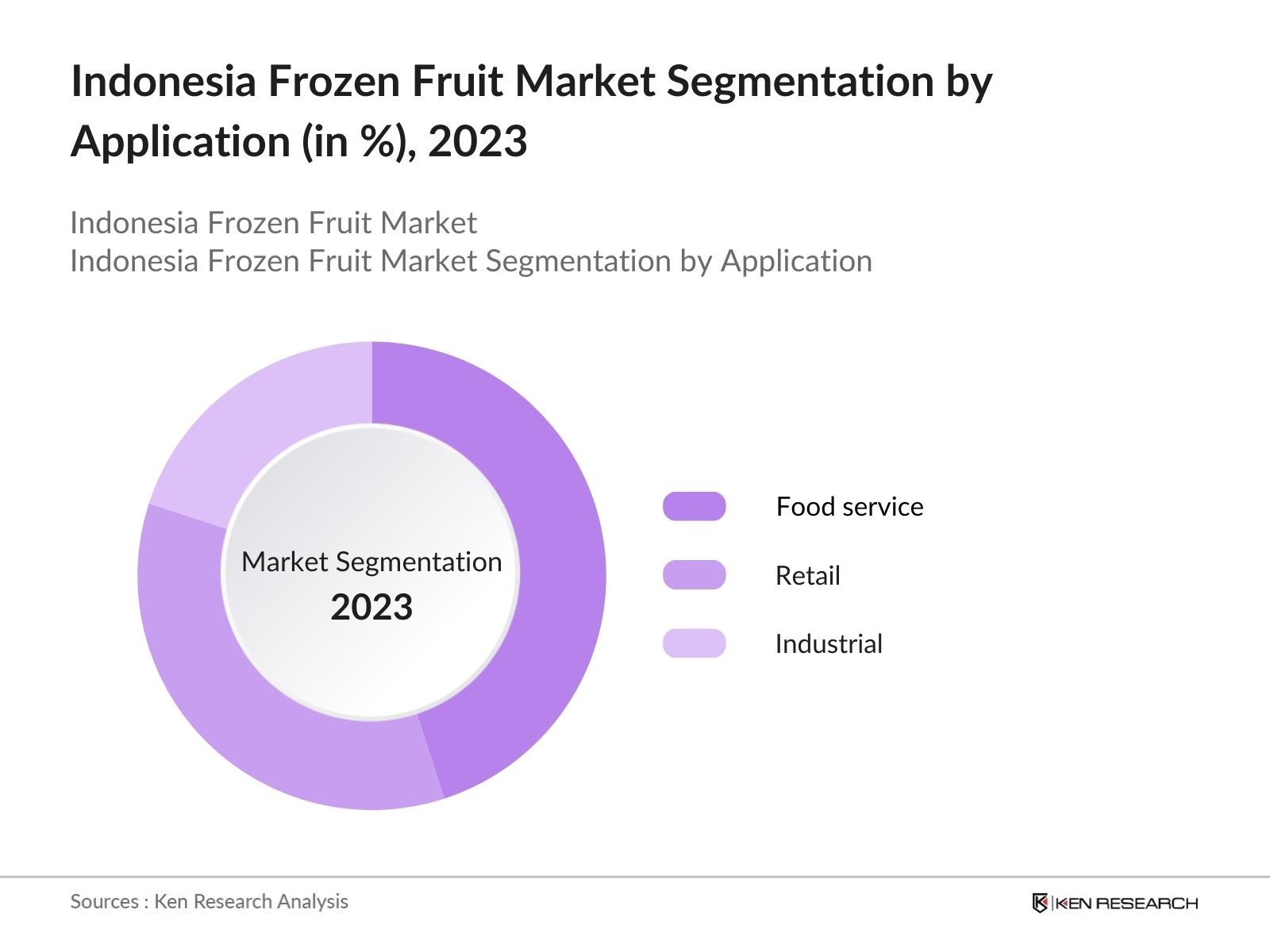

By Application: The market is further segmented by application into retail, foodservice, and industrial uses (including smoothies, juices, and baked goods). The foodservice segment holds the largest share of the frozen fruit market, driven by the increasing use of frozen fruits in the hospitality sector. Restaurants, hotels, and catering services rely heavily on frozen fruit due to its convenience and availability throughout the year. The rise in health-conscious consumers seeking fruit-based dishes and beverages further accelerates the demand in this segment.

Indonesia Frozen Fruit Market Competitive Landscape

The Indonesia frozen fruit market is highly competitive, with both local and international players vying for market dominance. Local companies focus on tropical fruits, leveraging Indonesias rich agricultural resources, while global players bring advanced freezing technologies and wide distribution networks. The market is dominated by key players such as PT Sewu Segar Nusantara, Indo Frozen, and PT Unifruitti, who have solidified their presence through strong supplier relationships, advanced freezing techniques, and robust logistics infrastructure. These companies benefit from Indonesias strategic location for fruit exports to global markets, including Asia-Pacific and Europe.

|

Company |

Year Established |

Headquarters |

Revenue |

Product Portfolio |

Freezing Technology |

Distribution Reach |

Export Volume |

Production Capacity |

|

PT Sewu Segar Nusantara |

1987 |

Jakarta |

||||||

|

Indo Frozen |

1995 |

Surabaya |

||||||

|

PT Unifruitti |

2001 |

Medan |

||||||

|

Pacific Fruits |

1990 |

Bali |

||||||

|

Java Fresh |

2005 |

Bandung |

Indonesia Frozen Fruit Industry Analysis

Growth Drivers

- Increasing Demand for Convenient and Healthy Foods: Indonesia has experienced a shift towards more convenient and healthy food options, with frozen fruits becoming increasingly popular. The Indonesian frozen fruit market has benefited from this trend, driven by urbanization and busy lifestyles, as more consumers seek ready-to-eat products. In 2023, the urban population in Indonesia stood at 151 million, accounting for 55% of the total population. This growing urban base has pushed demand for easily accessible frozen fruits. Additionally, Indonesias fruit production reached 23 million metric tons in 2022, providing a substantial domestic supply for frozen fruit processing.

- Expansion of Retail and E-commerce Channels: The rise of e-commerce and modern retail outlets has facilitated greater access to frozen fruit products across Indonesia. E-commerce platforms saw a 30% increase in transactions in 2023, particularly for frozen foods, reflecting a robust shift towards online grocery shopping. As Indonesias retail market is projected to grow, the expansion of these channels is helping frozen fruit manufacturers reach a broader customer base. Retail sales of frozen foods, including fruits, are thriving as over 55,000 modern retail outlets were recorded across Indonesia in 2023 .

- Rising Export Opportunities for Indonesian Frozen Fruit: Indonesias frozen fruit exports have grown steadily, with increased global demand for tropical fruits such as mangosteen, pineapples, and avocados. In 2023, Indonesia exported over 350,000 tons of frozen fruits, primarily to China, Japan, and the Middle East. Government-backed trade agreements, such as Indonesia's participation in ASEAN-China Free Trade Agreement (ACFTA), have reduced tariffs on these exports, enhancing the country's competitive edge in the global market.

Market Challenges

- High Energy and Storage Costs: The cost of energy required for freezing and storing fruits has posed a challenge for the Indonesian frozen fruit market. Electricity prices have increased by approximately 15% over the past two years due to rising fuel costs, directly impacting the cost of maintaining cold storage facilities. This has raised concerns for small and medium-sized enterprises (SMEs) involved in the industry. The average electricity tariff for businesses in Indonesia was IDR 1,444 per kWh in 2023, adding to the operational costs for frozen fruit manufacturers.

- Limited Cold Chain Infrastructure: Indonesias cold chain infrastructure remains underdeveloped, particularly in rural areas, affecting the efficiency of the frozen fruit supply chain. In 2022, the country had only 1.5 million cubic meters of cold storage capacity, which is insufficient to meet the increasing demand for frozen foods. This lack of infrastructure limits the ability to store and transport frozen fruits efficiently across the archipelago, leading to spoilage and increased costs.

Indonesia Frozen Fruit Market Future Outlook

Over the next five years, the Indonesia Frozen Fruit Market is expected to witness continued growth, driven by an expanding export market, advancements in freezing technologies, and increasing consumer demand for ready-to-eat, healthy food options. The government's investment in cold chain infrastructure and initiatives aimed at boosting agricultural productivity will also play a significant role in the market's future development. Moreover, as global interest in organic and tropical fruits grows, Indonesias frozen fruit sector is poised for further expansion.

Future Market Opportunities

- Growth in Demand for Organic and Specialty Fruits: There has been increasing global demand for organic and specialty frozen fruits, with markets in Europe and North America showing a preference for sustainably grown produce. In 2022, organic frozen fruit imports into the European Union increased by 18%, creating a significant export opportunity for Indonesian producers. Organic farming initiatives in Indonesia, particularly in Bali and Java, have seen a 12% annual growth in recent years, positioning the country to capitalize on this growing demand for premium, pesticide-free frozen fruit.

- Expansion into Emerging Markets: Emerging markets in Asia and the Middle East present untapped potential for Indonesias frozen fruit exports. Countries like India and Saudi Arabia have shown growing interest in tropical frozen fruits, driven by rising disposable incomes and changing dietary preferences. In 2023, Indonesia exported 50,000 tons of frozen fruits to India, a 25% increase from the previous year. Expanding into these regions can help diversify export destinations and reduce reliance on traditional markets.

Scope of the Report

|

By Fruit Type |

Frozen Mangoes Frozen Pineapples Frozen Strawberries Frozen Durian Frozen Mixed Fruit |

|

By Application |

Retail (Supermarkets, Hypermarkets, Convenience Stores) Foodservice (Restaurants, Hotels, Catering) Industrial (Smoothies, Juices, Baked Goods) |

|

By Freezing Technique |

IQF (Individually Quick Frozen) Blast Freezing Cryogenic Freezing |

|

By Distribution Channel |

Offline Retail Online Retail |

|

By Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Frozen fruit manufacturers

Foodservice chains (Restaurants, Hotels, Catering)

Retailers (Supermarkets, Hypermarkets, Convenience Stores)

Cold storage and logistics companies

Agricultural exporters

Investor and venture capitalist firms

Government and regulatory bodies (Ministry of Agriculture, Indonesian Customs Office)

Banks and Financial Institutions

Companies

Major Players

PT Sewu Segar Nusantara

Indo Frozen

PT Unifruitti

Pacific Fruits

Java Fresh

PT Alamboga Internusa

Baraka Fruits

Balinese Fruit

Freshko Indonesia

Sunpride Indonesia

Buavita

GGF Frozen

Mayora Group

Sinar Sosro

Tiga Pilar Sejahtera

Table of Contents

Indonesia Frozen Fruit Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

Indonesia Frozen Fruit Market Size (In USD Bn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

Indonesia Frozen Fruit Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Demand for Convenient and Healthy Foods

3.1.2. Expansion of Retail and E-commerce Channels

3.1.3. Rising Export Opportunities for Indonesian Frozen Fruit

3.1.4. Government Support for Agricultural Exports

3.2. Market Challenges

3.2.1. High Energy and Storage Costs

3.2.2. Limited Cold Chain Infrastructure

3.2.3. Perishable Nature of Fruits

3.2.4. Competitive Pricing in the Global Market

3.3. Opportunities

3.3.1. Growth in Demand for Organic and Specialty Fruits

3.3.2. Expansion into Emerging Markets

3.3.3. Technological Advancements in Preservation and Packaging

3.3.4. Strategic Partnerships with Global Retailers

3.4. Trends

3.4.1. Adoption of Freezing Technology Innovations

3.4.2. Growth in Health-Conscious Consumer Preferences

3.4.3. Increasing Focus on Sustainability in Packaging and Distribution

3.4.4. Popularity of Ready-to-Eat and Smoothie Mixes

3.5. Government Regulations

3.5.1. Indonesian Export Guidelines and Quotas

3.5.2. Sanitary and Phytosanitary Measures for Frozen Fruit

3.5.3. Import Tariffs on Frozen Fruit

3.5.4. Subsidies for Cold Chain Infrastructure Development

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

Indonesia Frozen Fruit Market Segmentation

4.1. By Fruit Type (In Value %)

4.1.1. Frozen Mangoes

4.1.2. Frozen Pineapples

4.1.3. Frozen Strawberries

4.1.4. Frozen Durian

4.1.5. Frozen Mixed Fruit

4.2. By Application (In Value %)

4.2.1. Retail (Supermarkets, Hypermarkets, Convenience Stores)

4.2.2. Foodservice (Restaurants, Hotels, Catering)

4.2.3. Industrial (Smoothies, Juices, Baked Goods)

4.3. By Freezing Technique (In Value %)

4.3.1. IQF (Individually Quick Frozen)

4.3.2. Blast Freezing

4.3.3. Cryogenic Freezing

4.4. By Distribution Channel (In Value %)

4.4.1. Offline Retail

4.4.2. Online Retail

4.5. By Region (In Value %)

4.5.1. Java

4.5.2. Sumatra

4.5.3. Kalimantan

4.5.4. Sulawesi

4.5.5. Papua

Indonesia Frozen Fruit Market Competitive Analysis

5.1 Detailed Profiles of Major Companies

5.1.1. PT Sewu Segar Nusantara

5.1.2. PT Alamboga Internusa

5.1.3. PT Fruit ING

5.1.4. PT Unifruitti

5.1.5. Indo Frozen

5.1.6. Pacific Fruits

5.1.7. Java Fresh

5.1.8. Balinese Fruit

5.1.9. Baraka Fruits

5.1.10. GGF Frozen

5.1.11. Sunpride Indonesia

5.1.12. Buavita

5.1.13. Mayora Group

5.1.14. Sinar Sosro

5.1.15. Freshko Indonesia

5.2 Cross Comparison Parameters (Revenue, Export Volume, Market Share, Product Portfolio, Freezing Technique, Distribution Reach, Production Capacity, Innovation Capabilities)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7 Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

Indonesia Frozen Fruit Market Regulatory Framework

6.1. Agricultural Export Standards

6.2. Food Safety Compliance

6.3. Certifications (HACCP, ISO, Organic)

6.4. Import-Export Restrictions

Indonesia Frozen Fruit Market Future Size (In USD Bn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

Indonesia Frozen Fruit Future Market Segmentation

8.1. By Fruit Type (In Value %)

8.2. By Application (In Value %)

8.3. By Freezing Technique (In Value %)

8.4. By Distribution Channel (In Value %)

8.5. By Region (In Value %)

Indonesia Frozen Fruit Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1: Identification of Key Variables

The research began with identifying key variables affecting the Indonesia Frozen Fruit Market, such as consumer demand for frozen food, government policies on agricultural exports, and cold chain logistics. This was achieved through extensive desk research and secondary sources, including government databases and industry reports.

Step 2: Market Analysis and Construction

The historical market data was gathered to analyze growth trends in Indonesia's frozen fruit sector, focusing on production volumes, export data, and revenue streams. We examined the penetration of frozen fruits in both domestic and international markets to construct a comprehensive market analysis.

Step 3: Hypothesis Validation and Expert Consultation

Our research team conducted interviews with industry professionals from leading frozen fruit manufacturers and logistics providers. These interviews provided insight into production processes, freezing technologies, and distribution challenges, helping validate our market hypotheses.

Step 4: Research Synthesis and Final Output

The final output was generated by synthesizing market data from both primary and secondary sources. The results were cross-referenced with industry insights to ensure accuracy and comprehensiveness, delivering a validated report for stakeholders in the Indonesia Frozen Fruit Market.

Frequently Asked Questions

01 How big is the Indonesia Frozen Fruit Market?

The Indonesia Frozen Fruit Market is valued at USD 1.9 billion, driven by the rising demand for convenient and nutritious food options, and is supported by government initiatives to boost agricultural exports.

02 What are the challenges in the Indonesia Frozen Fruit Market?

Key challenges in the Indonesia Frozen Fruit Market include the high costs of cold storage infrastructure, energy consumption, and the perishable nature of fruit, which increases operational complexities in maintaining quality during transport and storage.

03 Who are the major players in the Indonesia Frozen Fruit Market?

The Indonesia Frozen Fruit Market is dominated by companies such as PT Sewu Segar Nusantara, Indo Frozen, and PT Unifruitti, which have strong supply chains, innovative freezing technologies, and established export networks.

04 What drives the growth of the Indonesia Frozen Fruit Market?

The Indonesia Frozen Fruit Market's growth is driven by increasing consumer demand for healthy, ready-to-eat food options, government investment in cold chain logistics, and rising exports of tropical fruits such as mangoes and pineapples.

05 Which regions dominate the Indonesia Frozen Fruit Market?

Java and Sumatra are the dominant regions in the market due to their advanced cold chain logistics and significant agricultural production of fruits like mangoes, pineapples, and durian in the Indonesia Frozen Fruit Market.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.