Indonesia Games Market Outlook to 2030

Region:Asia

Author(s):Yogita Sahu

Product Code:KROD3951

December 2024

100

About the Report

Indonesia Games Market Overview

- The Indonesia games market, reaching USD 425 million in valuation, has grown over the past five years, primarily fueled by increased mobile penetration and a rapidly growing young population actively engaging with digital content. The market's upward trajectory is supported by the expansion of digital payment solutions, facilitating in-app purchases and microtransactions, as well as increased investments from both local and international game developers.

- Java, along with other urban regions like Jakarta and Bali, dominates the Indonesian games market due to its dense population and higher internet penetration rates. The large number of smartphone users in these cities and robust digital infrastructure provide an ideal environment for game developers to capture a wide audience and generate revenue through mobile gaming.

- This strategic roadmap, which prioritizes the gaming industry as a key growth sector, includes initiatives for digital skills development, with IDR 1 trillion allocated to training programs for developers in 2024. This is expected to address the talent gap and support a local gaming ecosystem capable of producing high-quality games and platforms.

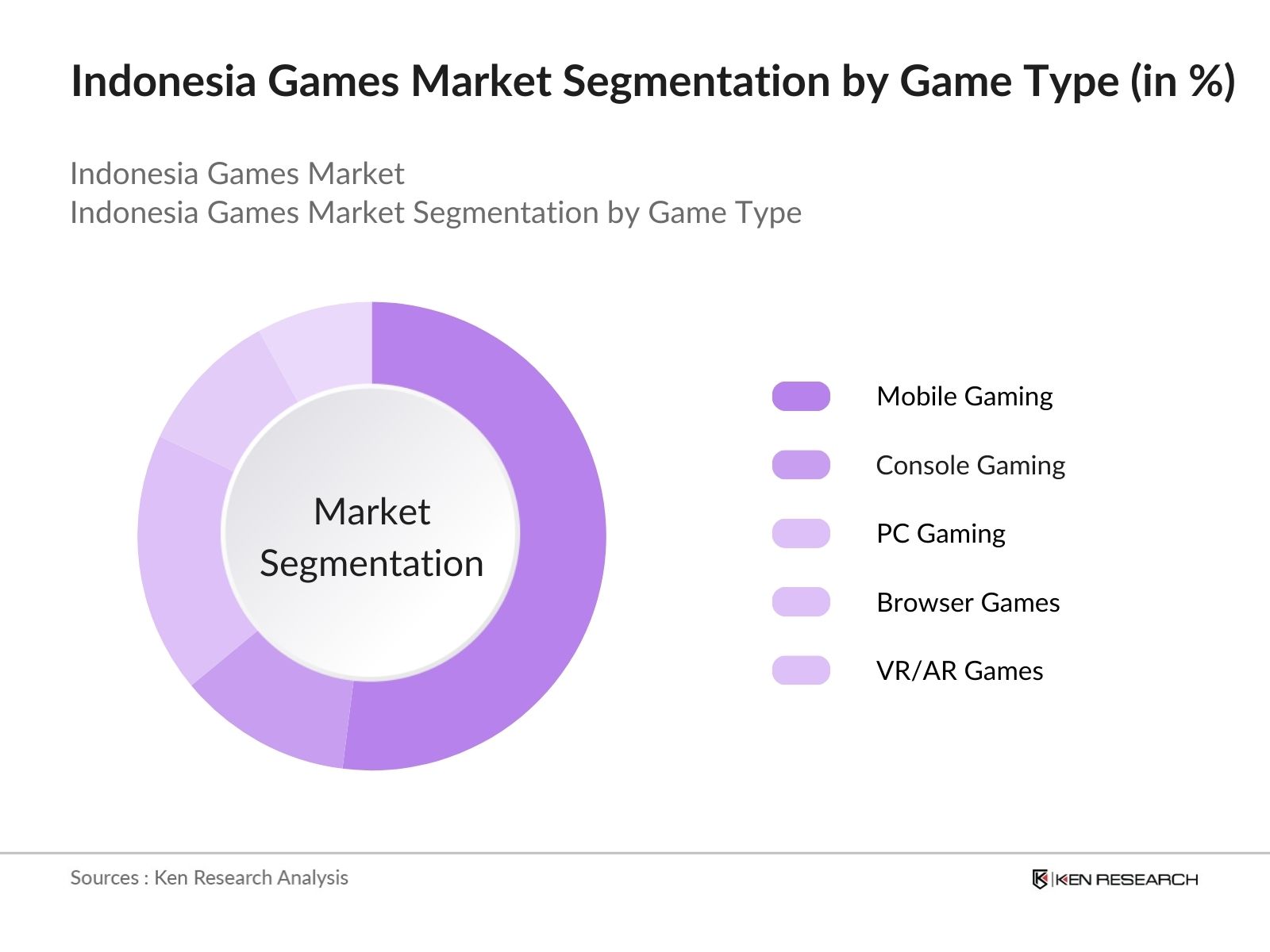

Indonesia Games Market Segmentation

By Game Type: The market is segmented by game type into mobile games, PC games, console games, browser games, and VR/AR games. Among these, mobile games hold a dominant market share due to Indonesias high mobile penetration and accessibility of smartphones. Affordable mobile internet and a preference for casual, on-the-go entertainment make mobile games the most popular segment.

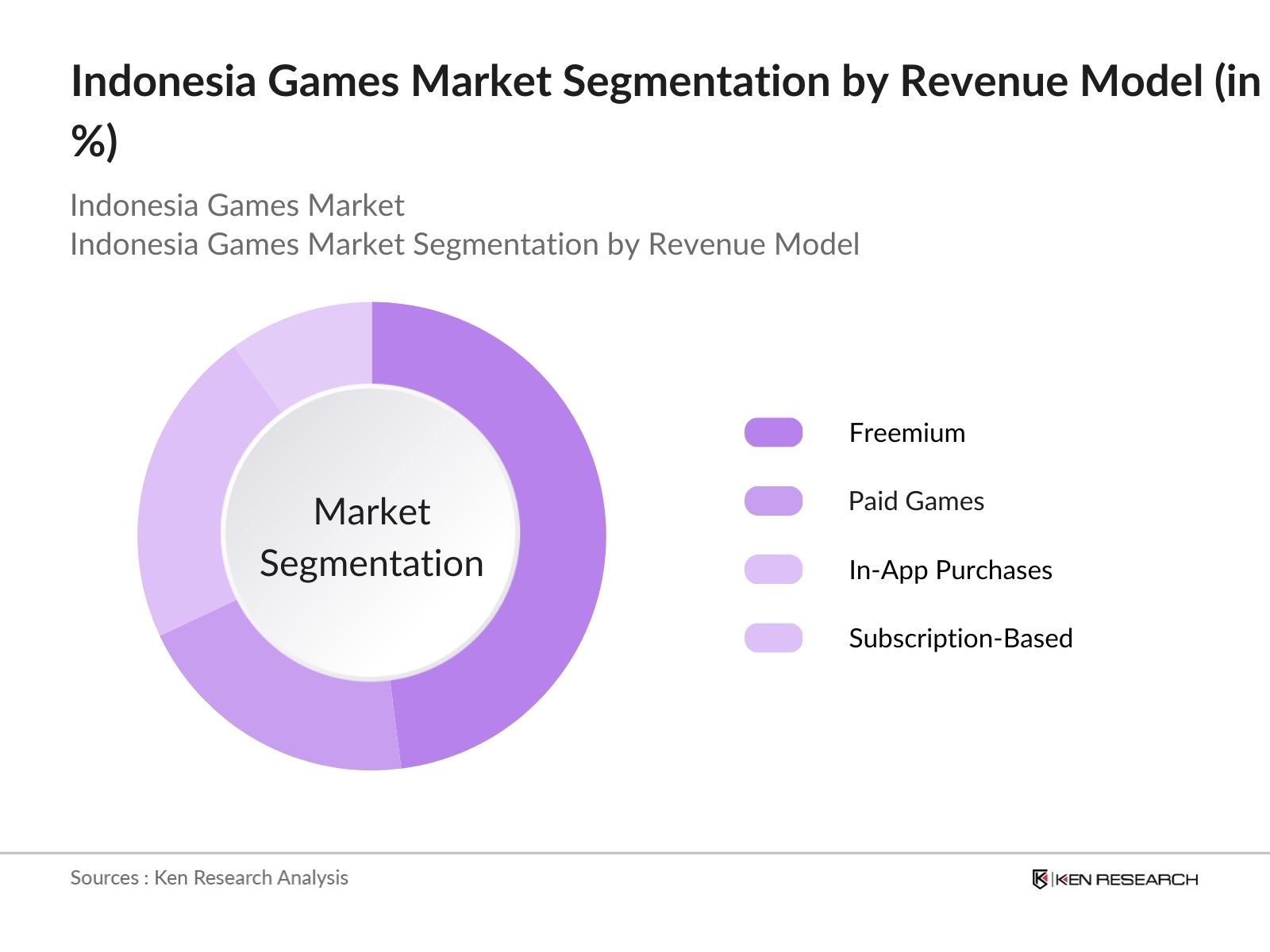

By Revenue Model: The market is further segmented by revenue model into freemium, paid games, in-app purchases, and subscription-based models. The freemium model dominates due to Indonesia's price-sensitive market, where users are more inclined to engage with free games initially and later make in-app purchases for enhancements. This model attracts a large player base and drives revenue without upfront costs.

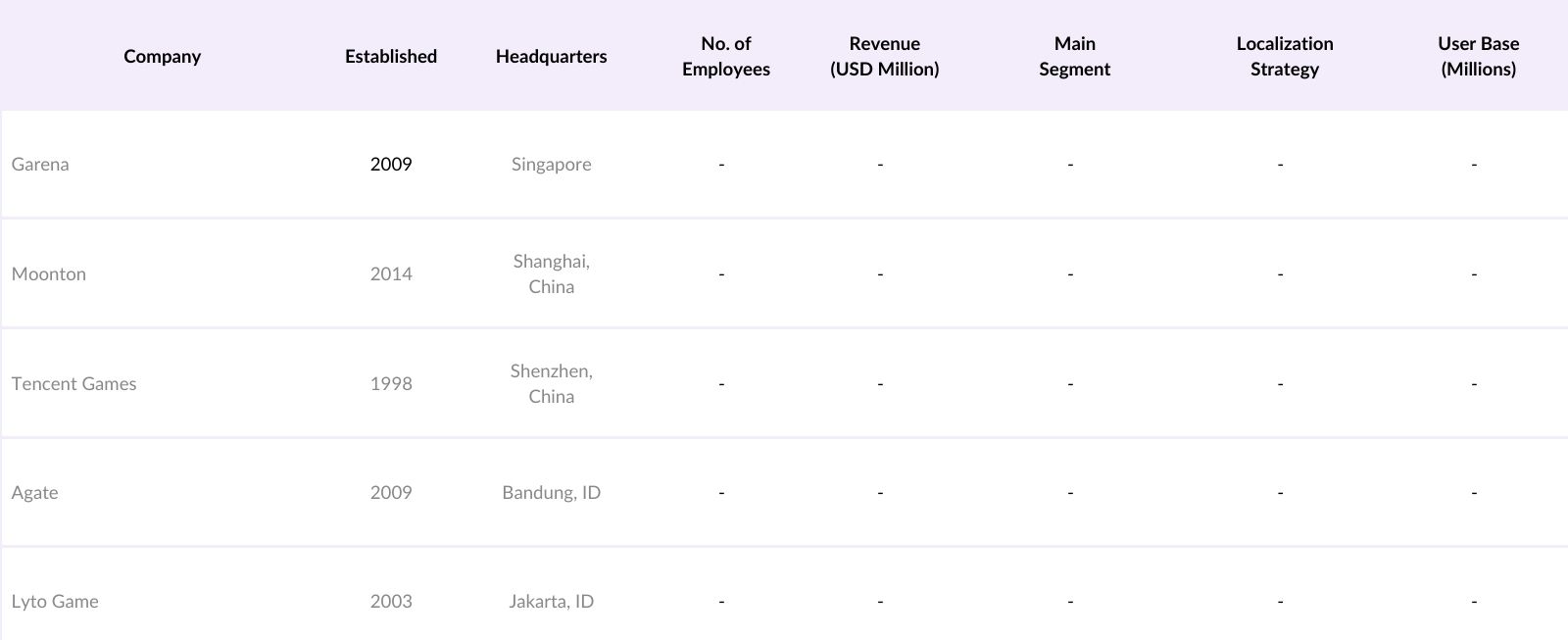

Indonesia Games Market Competitive Landscape

The market is shaped by several key players, with strong competition among local and international developers. Companies like Moonton, Tencent, and Garena dominate, leveraging localized content and advanced monetization strategies to capture Indonesian players.

Indonesia Games Market Analysis

Market Growth Drivers

- Increase in Smartphone Penetration: Indonesias smartphone user base has grown to over 160 million in 2024, with nearly 90 million of those users actively engaging in mobile gaming. As smartphone prices become more affordable, particularly in rural and semi-urban areas, a wider audience is adopting gaming as a form of entertainment. This growth in smartphone penetration provides a substantial boost to the mobile gaming sector, allowing developers to tap into a growing user base.

- Rising Investments in Esports: Esports in Indonesia has seen investment injections totaling over USD 50 million from both domestic and international sources in 2024 alone, aimed at promoting tournaments, gaming platforms, and streaming services. These investments are helping to create infrastructure, support professional gamers, and elevate the profile of gaming as a legitimate form of sports, increasing the sector's visibility and attractiveness among younger audiences.

- Improvement in Internet Infrastructure: The governments recent initiative to improve internet connectivity across the nation has led to the installation of over 50,000 new broadband towers in 2024. The upgrade in digital infrastructure has reduced latency and connection issues, making online gaming more accessible and enjoyable for users in both urban and rural areas. The enhanced connectivity has been a crucial factor in the adoption and growth of online gaming.

Market Challenges

- Lack of Skilled Game Developers: The Indonesian gaming industry currently faces a shortage of skilled developers, with fewer than 5,000 trained professionals available in 2024, as per government data. This talent shortage hinders the production of locally developed games, resulting in an over-reliance on foreign-developed games and limiting the sectors capacity to innovate and create region-specific content.

- Challenges with Game Monetization: Despite an active user base, in-app purchases are relatively low in Indonesia, with an average monthly spend per user at only IDR 30,000. The limited spending power of the average gamer challenges developers to find alternative monetization models, which affects the financial sustainability of many gaming companies.

Indonesia Games Market Future Outlook

Over the next five years, the Indonesia games industry is poised for robust growth, driven by the continued expansion of digital infrastructure, increasing affordability of smartphones, and the rise of digital payment solutions.

Future Market Opportunities

- Rise of Subscription-Based Gaming Services: Over the next five years, subscription-based gaming services will see increased adoption, with an estimated 12 million subscribers by 2029. As local telecom companies partner with gaming providers, gamers will benefit from affordable subscription models, which will make premium gaming content more accessible to a wider audience in Indonesia.

- Expansion of Augmented Reality (AR) Games: The popularity of augmented reality gaming is set to rise as smartphone technology advances, with AR-based games expected to capture a significant user base. By 2029, it is estimated that over 20 million Indonesian gamers will actively engage with AR games, supported by investments in AR software and localized content.

Scope of the Report

|

Game Type |

Mobile Games PC Games Console Games Browser Games VR/AR Games |

|

Revenue Model |

Freemium Paid Games In-App Purchases Subscription-Based |

|

Genre |

Action and Adventure Strategy Sports RPG Casual and Social |

|

Platform |

Android iOS PC Console |

|

Region |

North East West South |

Products

Key Target Audience Organizations and Entities Who Can Benefit by Subscribing This Report:

Game Publishers

Mobile Network Providers

Payment Gateway Providers

Investor and Venture Capitalist Firms

Gaming Influencers and Content Creators

Advertising Agencies Specializing in Digital Media

Government and Regulatory Bodies (Ministry of Communications and Informatics of Indonesia)

Local Game Development Studios

Companies

Players Mentioned in the Report:

Garena

Moonton

Tencent Games

Agate

Lyto Game

Gravity Game Link

GoTo Game Studios

Netmarble

MainGames

Telkom Indonesia (Oona)

Table of Contents

1. Indonesia Games Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Games Market Size (USD Million)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Games Market Analysis

3.1. Growth Drivers

3.1.1. Rising Mobile Penetration

3.1.2. Increasing In-App Purchases

3.1.3. Expanding Digital Payment Ecosystem

3.1.4. Government Initiatives for Gaming Sector Growth

3.2. Market Challenges

3.2.1. High Competition in Mobile Segment

3.2.2. Limited Monetization Options for Indie Developers

3.2.3. Data Privacy Concerns

3.3. Opportunities

3.3.1. Cross-Platform Integration

3.3.2. Expansion of Cloud Gaming

3.3.3. E-sports Growth and Sponsorship Opportunities

3.4. Trends

3.4.1. Localization of Game Content

3.4.2. Adoption of Virtual Reality and Augmented Reality in Gaming

3.4.3. Increased Focus on Blockchain-based Games

3.5. Government Regulation

3.5.1. Digital Content Regulations

3.5.2. Tax Policies for Digital Purchases

3.5.3. Investment Incentives for Game Development Studios

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces

3.9. Competition Ecosystem

4. Indonesia Games Market Segmentation

4.1. By Game Type (In Value %)

4.1.1. Mobile Games

4.1.2. PC Games

4.1.3. Console Games

4.1.4. Browser Games

4.1.5. VR/AR Games

4.2. By Revenue Model (In Value %)

4.2.1. Freemium

4.2.2. Paid Games

4.2.3. In-App Purchases

4.2.4. Subscription-Based

4.3. By Genre (In Value %)

4.3.1. Action and Adventure

4.3.2. Strategy

4.3.3. Sports

4.3.4. Role-Playing Games (RPG)

4.3.5. Casual and Social

4.4. By Platform (In Value %)

4.4.1. Android

4.4.2. iOS

4.4.3. PC

4.4.4. Console

4.5. By Region (In Value %)

4.5.1. North

4.5.2. East

4.5.3. West

4.5.4. South

5. Indonesia Games Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Garena

5.1.2. Tencent Games

5.1.3. Moonton

5.1.4. Netmarble

5.1.5. GoTo Game Studios

5.1.6. Gravity Game Link

5.1.7. Agate

5.1.8. Lyto Game

5.1.9. MainGames

5.1.10. Telkom Indonesia (Oona)

5.1.11. Tencent Cloud (Indonesia)

5.1.12. Niantic Labs (Southeast Asia)

5.1.13. Anantarupa Studios

5.1.14. Touchten Games

5.1.15. Niji Games

5.2. Cross Comparison Parameters (Market Share, Revenue, Game Portfolio, User Base, Localization Strategy, Marketing Initiatives, Partnerships, Technological Adoption)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Government Grants

5.9. Private Equity Investments

6. Indonesia Games Market Regulatory Framework

6.1. Digital Content Standards

6.2. Compliance Requirements for Game Developers

6.3. Certification and Licensing Processes

7. Indonesia Games Future Market Size (USD Million)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Games Market Future Segmentation

8.1. By Game Type (In Value %)

8.2. By Revenue Model (In Value %)

8.3. By Genre (In Value %)

8.4. By Platform (In Value %)

8.5. By Region (In Value %)

9. Indonesia Games Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. User Retention Strategies

9.4. White Space Opportunity Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

This phase involves establishing an ecosystem map to include all relevant stakeholders in the Indonesia games market. In-depth secondary research, supplemented by proprietary databases, aids in defining the critical factors affecting market dynamics.

Step 2: Market Analysis and Construction

This phase consolidates historical data for the Indonesia games market, analyzing penetration rates, user demographics, and revenue generation. Additionally, assessments of popular gaming platforms and user preferences are conducted to validate market structure and projections.

Step 3: Hypothesis Validation and Expert Consultation

Formulated hypotheses on market trends are validated via structured interviews with industry professionals, including game developers and marketing experts. This direct feedback provides practical insights, refining data accuracy and market understanding.

Step 4: Research Synthesis and Final Output

In this stage, comprehensive insights into product segments, revenue models, and consumer trends are compiled through direct engagement with major industry players. This data is then synthesized to produce a cohesive and verified analysis of the Indonesia games market.

Frequently Asked Questions

01. How big is the Indonesia Games Market?

The Indonesia games market is valued at USD 425 million, driven by factors such as high mobile penetration, increased spending on digital entertainment, and strong local and global developer presence.

02. What are the challenges in the Indonesia Games Market?

Challenges in the Indonesia games market include high competition in the mobile gaming sector, limited revenue models for indie developers, and concerns over data privacy and regulatory compliance.

03. Who are the major players in the Indonesia Games Market?

Major players in the Indonesia games market include Garena, Moonton, Tencent Games, Lyto Game, and Agate, which lead due to their localized content, strong user engagement, and effective monetization strategies.

04. What are the growth drivers of the Indonesia Games Market?

Key drivers in the Indonesia games market include the proliferation of smartphones, affordable internet access, and increased adoption of digital payment solutions, which make in-app purchases and microtransactions seamless for users.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.