Indonesia Halal Hair Care Market Outlook to 2030

Region:Asia

Author(s):Shubham

Product Code:KROD5713

November 2024

98

About the Report

Indonesia Halal Hair Care Market Overview

- The Indonesia Halal Hair Care market, valued at USD 1.20 billion, is experiencing substantial growth, fueled by a rising demand for religiously compliant products and the increased purchasing power of Indonesian consumers. Indonesias predominantly Muslim population seeks halal-certified hair care products that align with their religious values, fostering a steady demand for products such as shampoos, conditioners, and hair oils. This growth trajectory is also supported by the expanding awareness and preference for halal certifications, which assure quality and compliance with Islamic principles.

- Dominance in the Indonesia Halal Hair Care market is most notable in urban areas, including Jakarta, Surabaya, and Bandung. These regions benefit from higher income levels, access to retail outlets, and greater awareness of halal standards, making them prime markets for both domestic and international halal-certified brands. Furthermore, the presence of reliable logistics and distribution networks in these cities enables efficient product availability, catering to the increasing demand for halal-certified personal care items in these bustling urban centers.

- Indonesias Halal Product Assurance Law requires all consumer goods to comply with halal certification by 2024. The Ministry of Religious Affairs oversees this certification, having processed over 50,000 applications from various sectors. This regulation ensures that hair care products meet strict religious and ethical standards, bolstering consumer confidence in halal brands and securing local market demand.

Indonesia Halal Hair Care Market Segmentation

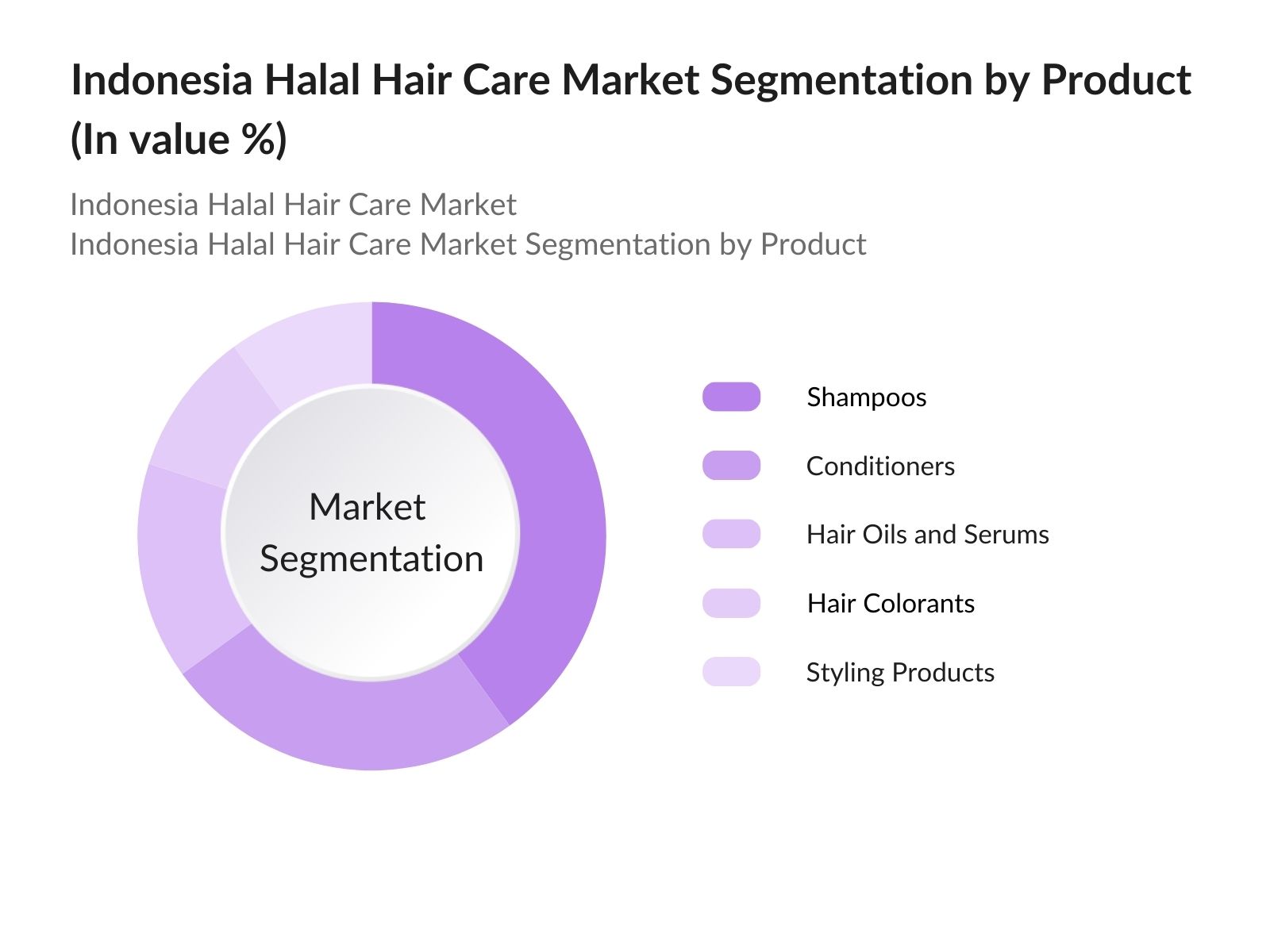

- By Product Type: The market is segmented by product type into shampoos, conditioners, hair oils and serums, hair colorants, and styling products. Recently, shampoos have held a dominant market share due to their status as essential personal care items, commonly purchased across demographics. Shampoos have established a strong foothold in the market as they are frequently used, and halal-certified options by popular brands like Wardah and Mustika Ratu attract a loyal consumer base. This dominant presence is sustained by the regular need for hair cleansing products, positioning shampoos as a critical segment within halal hair care.

- By Distribution Channel: The market is segmented by distribution channel into retail stores, online platforms, and specialty stores. Retail stores hold the largest market share due to their widespread availability and the consumer tendency to make in-person purchases for personal care products. Retail giants like Alfamart and Indomaret facilitate a vast distribution network that makes halal-certified products easily accessible to consumers. This channel's dominance is bolstered by the added trust consumers place in seeing and purchasing products firsthand, particularly for daily essentials like hair care products.

Indonesia Halal Hair Care Market Competitive Landscape

The Indonesia Halal Hair Care market is highly competitive, led by local and international brands that prioritize halal certification to meet the preferences of Indonesian consumers. Key players such as Wardah, Mustika Ratu, and Safi Indonesia have built strong market positions by offering halal-certified products and investing in brand visibility through digital marketing and influencer partnerships. This competitive landscape reflects the strategic efforts of these companies to align with halal standards, making them preferred choices among Muslim consumers.

Indonesia Halal Hair Care Market Industry Analysis

Growth Drivers

- Increasing Awareness of Halal Standards: Indonesia's Halal Product Assurance Law mandates halal certification for various consumer goods, enhancing consumer awareness around product certification. According to the Ministry of Religious Affairs, the law has certified more than five thousand cosmetic and personal care products by 2024, underlining the importance of halal labeling in consumer decisions. As awareness grows, consumers increasingly seek certified products, favoring those that meet Islamic guidelines. This shift is particularly evident in urban centers like Jakarta and Surabaya, where certified product demand aligns with consumers' trust and safety concerns.

- E-Commerce Expansion: The rise of e-commerce has been a catalyst for the growth of the halal hair care market, allowing consumers across Indonesia to access a wide range of halal-certified products with ease. Online platforms such as Tokopedia, Shopee, and Lazada play a crucial role in enabling product accessibility beyond urban centers, reaching consumers in remote areas. The convenience offered by online shopping, coupled with the assurance of halal certification, is drawing a growing number of consumers to halal hair care products.

- Rising Muslim Population: Indonesia, with an estimated 244 million Muslims, holds the world's largest Muslim population, representing over 87% of the countrys total populace. This demographic underpins a significant demand for halal-certified products, including hair care. Government reports emphasize that the Islamic population is projected to expand modestly through 2025, suggesting a sustained consumer base. This growth is fueling demand for halal hair care products that cater to religiously observant consumers, aligning with ethical and religious practices. The continuous rise in the Muslim population is thus a major contributor to the market's growth.

Market Challenges

- Stringent Certification Requirements: Indonesias halal certification involves rigorous requirements, overseen by the Indonesian Ulema Council (MUI). These standards demand complete transparency in product sourcing and manufacturing, posing challenges for companies striving to comply. For many small businesses, meeting these standards can be cost-intensive, limiting their ability to compete effectively. Although the MUI is currently considering adjustments to streamline the process, the stringent requirements continue to pose a barrier for new entrants and smaller brands in the halal hair care market.

- Competition from Non-Halal Brands: Despite the popularity of halal products, non-halal alternatives maintain a significant presence in Indonesia's hair care market, primarily due to their affordability and widespread availability. The accessibility of non-halal products in urban outlets presents a competitive challenge for halal-certified brands, as they often need to position their products against more affordable, established options. This affordability factor makes it challenging for halal brands to capture a larger share of the price-sensitive consumer base.

Indonesia Halal Hair Care Market Future Outlook

The Indonesia Halal Hair Care market is expected to witness significant growth in the coming years, driven by continuous demand for halal-certified personal care products and the expansion of online retail channels. As more consumers prioritize halal compliance, brands are likely to increase their investment in halal certification, innovative product formulations, and strategic marketing efforts to capture a larger share of the market. Additionally, as the middle-class population grows, consumers purchasing power will support the expansion of premium halal hair care offerings, allowing the market to thrive across both urban and semi-urban regions.

Future Market Opportunities

- Growing Demand for Organic Ingredients: Indonesia has witnessed a strong consumer inclination toward organic ingredients in hair care products. Data from the Indonesian Ministry of Agriculture show that organic product imports have grown by million of tons, indicating a growing market for naturally derived ingredients. Halal hair care brands are now integrating these ingredients to cater to health-conscious consumers who value ethical sourcing and natural formulations, aligning with both halal and organic trends.

- Export Opportunities in ASEAN Markets: Indonesias halal certification is recognized across ASEAN, enhancing export opportunities. In 2024, the Ministry of Trade reported that a substantial portion of Indonesias halal personal care exports were directed toward ASEAN markets, where demand for halal products is on the rise. This international acceptance of Indonesian halal standards provides local brands witha competitive advantage, particularly in countries like Malaysia and Brunei with high Muslim populations.

Scope of the Report

|

Product Type |

Shampoos Conditioners Hair Oils and Serums Hair Colorants Styling Products |

|

End-User |

Individual Consumers Professional Salons |

|

Distribution Channel |

Retail Stores Online Platforms Specialty Stores |

|

Ingredient Type |

Plant-Based Ingredients Animal-Derived Ingredients (Halal Certified) Synthetic Ingredients (Halal Compliant) |

|

Region |

Java Sumatra Kalimantan Sulawesi Papua |

Products

Key Target Audience

Investors and Venture Capitalist Firms

Banks and Financial Institutions

Government and Regulatory Bodies (Halal Product Assurance Agency, Indonesian Food and Drug Authority)

Manufacturers of Halal-Certified Products

E-Commerce Platforms

Retail Chains and Hypermarkets

Import/Export Agencies

Environmental and Sustainability Bodies

Companies

Players Mentioned in the Report

Wardah

Mustika Ratu

Safi Indonesia

Viva Cosmetics

Ellips

Colgate-Palmolive Indonesia

Unilever Indonesia

P&G Indonesia

Garnier Indonesia

Natur Hair Care

Dove Indonesia (Unilever)

Sunsilk Indonesia (Unilever)

Bio Essence

Mazaya Cosmetics

The Body Shop Indonesia (LOral)

Table of Contents

1. Indonesia Halal Hair Care Market Overview

1.1 Definition and Scope

1.2 Market Taxonomy

1.3 Market Dynamics Overview

1.4 Market Segmentation Overview

2. Indonesia Halal Hair Care Market Size (In USD Mn)

2.1 Historical Market Size

2.2 Current Market Growth Rate

2.3 Key Developments and Market Milestones

3. Indonesia Halal Hair Care Market Analysis

3.1 Growth Drivers

3.1.1 Rising Muslim Population

3.1.2 Increasing Awareness on Halal Certification

3.1.3 Consumer Preference for Ethical Products

3.1.4 Government Incentives and Regulations

3.2 Market Challenges

3.2.1 Stringent Halal Certification Standards

3.2.2 Competition with Non-Halal Products

3.2.3 Price Sensitivity of End-Consumers

3.3 Opportunities

3.3.1 Potential in E-commerce Expansion

3.3.2 Growing Demand for Organic Ingredients

3.3.3 Export Opportunities in ASEAN Markets

3.4 Trends

3.4.1 Surge in Vegan and Plant-Based Hair Care

3.4.2 Increase in Personalized Halal Hair Care Products

3.4.3 Emphasis on Eco-Friendly Packaging

3.5 Government Regulations

3.5.1 Halal Product Assurance Law

3.5.2 National Standardization on Halal Cosmetics

3.5.3 Import and Export Regulations for Halal Products

3.6 SWOT Analysis

3.7 Stakeholder Ecosystem

3.8 Porters Five Forces Analysis

3.9 Competitive Ecosystem Analysis

4. Indonesia Halal Hair Care Market Segmentation

4.1 By Product Type (In Value %)

4.1.1 Shampoos

4.1.2 Conditioners

4.1.3 Hair Oils and Serums

4.1.4 Hair Colorants

4.1.5 Styling Products

4.2 By End-User (In Value %)

4.2.1 Individual Consumers

4.2.2 Professional Salons

4.3 By Distribution Channel (In Value %)

4.3.1 Retail Stores

4.3.2 Online Platforms

4.3.3 Specialty Stores

4.4 By Ingredient Type (In Value %)

4.4.1 Plant-Based Ingredients

4.4.2 Animal-Derived Ingredients (Halal Certified)

4.4.3 Synthetic Ingredients (Halal Compliant)

4.5 By Region (In Value %)

4.5.1 Java

4.5.2 Sumatra

4.5.3 Kalimantan

4.5.4 Sulawesi

4.5.5 Papua

5. Indonesia Halal Hair Care Market Competitive Analysis

5.1 Profiles of Key Market Players

5.1.1 Wardah

5.1.2 Mustika Ratu

5.1.3 Safi Indonesia

5.1.4 Ellips

5.1.5 Viva Cosmetics

5.1.6 Colgate-Palmolive Indonesia

5.1.7 Unilever Indonesia

5.1.8 P&G Indonesia

5.1.9 Garnier Indonesia

5.1.10 Natur Hair Care

5.1.11 Dove Indonesia (Unilever)

5.1.12 Sunsilk Indonesia (Unilever)

5.1.13 Bio Essence

5.1.14 Mazaya Cosmetics

5.1.15 The Body Shop Indonesia (LOral)

5.2 Cross Comparison Parameters (Revenue, Product Range, Halal Certification, Market Presence, Brand Recognition, Customer Reviews, Marketing Channels, R&D Investments)

5.3 Market Share Analysis

5.4 Strategic Initiatives

5.5 Mergers and Acquisitions

5.6 Investment Analysis

5.7 New Product Launches

5.8 Government Incentives

5.9 Private Equity and Venture Capital Funding

6. Indonesia Halal Hair Care Market Regulatory Framework

6.1 Compliance and Halal Certification Standards

6.2 Halal Labeling and Packaging Requirements

6.3 Approval and Certification Processes

7. Indonesia Halal Hair Care Market Future Size (In USD Mn)

7.1 Future Market Size Forecast

7.2 Growth Drivers for Future Market Size

8. Indonesia Halal Hair Care Market Future Segmentation

8.1 By Product Type (In Value %)

8.2 By End-User (In Value %)

8.3 By Distribution Channel (In Value %)

8.4 By Ingredient Type (In Value %)

8.5 By Region (In Value %)

9. Indonesia Halal Hair Care Market Analyst Recommendations

9.1 Total Addressable Market (TAM) Analysis

9.2 Customer Behavior and Preferences Study

9.3 Brand Positioning Strategies

9.4 Emerging Opportunities and White Space Analysis

Disclaimer Contact UsResearch Methodology

Step 1: Identification of Key Variables

The initial stage involves mapping stakeholders and identifying influential variables such as consumer demographics, purchasing behavior, and regulatory frameworks within the Indonesia Halal Hair Care market. Extensive desk research supports this phase to define essential variables impacting market growth and dynamics.

Step 2: Market Analysis and Construction

This phase involves analyzing historical data and current market conditions to develop an understanding of product demand across the consumer base. The analysis covers market penetration levels, consumer preferences, and product performance to offer an accurate estimate of market size and growth trajectory.

Step 3: Hypothesis Validation and Expert Consultation

In this step, market assumptions are tested through expert interviews and discussions with industry representatives. These consultations provide insights into practical market conditions and potential shifts, offering validation for the collected data and its implications on market forecasts.

Step 4: Research Synthesis and Final Output

The concluding phase synthesizes insights gathered from both primary and secondary research, followed by interactions with product manufacturers. This collaboration ensures that all findings are well-rounded, reliable, and accurately reflect the current market dynamics.

Frequently Asked Questions

How big is the Indonesia Halal Hair Care market?

The Indonesia Halal Hair Care market was valued at USD 1.20 billion, reflecting the increasing demand for religiously compliant personal care products.

What are the growth drivers in the Indonesia Halal Hair Care market?

Major growth drivers in the Indonesia Halal Hair Care market was include consumer preference for certified products, the Muslim population's size, and regulatory support, encouraging more brands to seek halal certification.

Who are the leading players in the Indonesia Halal Hair Care market?

Key players in the Indonesia Halal Hair Care market include Wardah, Mustika Ratu, Safi Indonesia, and Unilever Indonesia. These brands lead the market due to strong brand recognition, wide distribution networks, and halal-compliant product offerings.

What challenges does the Indonesia Halal Hair Care market face?

Challenges in the Indonesia Halal Hair Care market include high certification costs, increasing competition, and the need for constant innovation to meet evolving consumer preferences for natural and sustainable products.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.