Indonesia Healthcare IT Market Outlook to 2030

Region:Asia

Author(s):Khushi Khatreja

Product Code:KROD1423

September 2024

93

About the Report

Indonesia Healthcare IT Market Overview

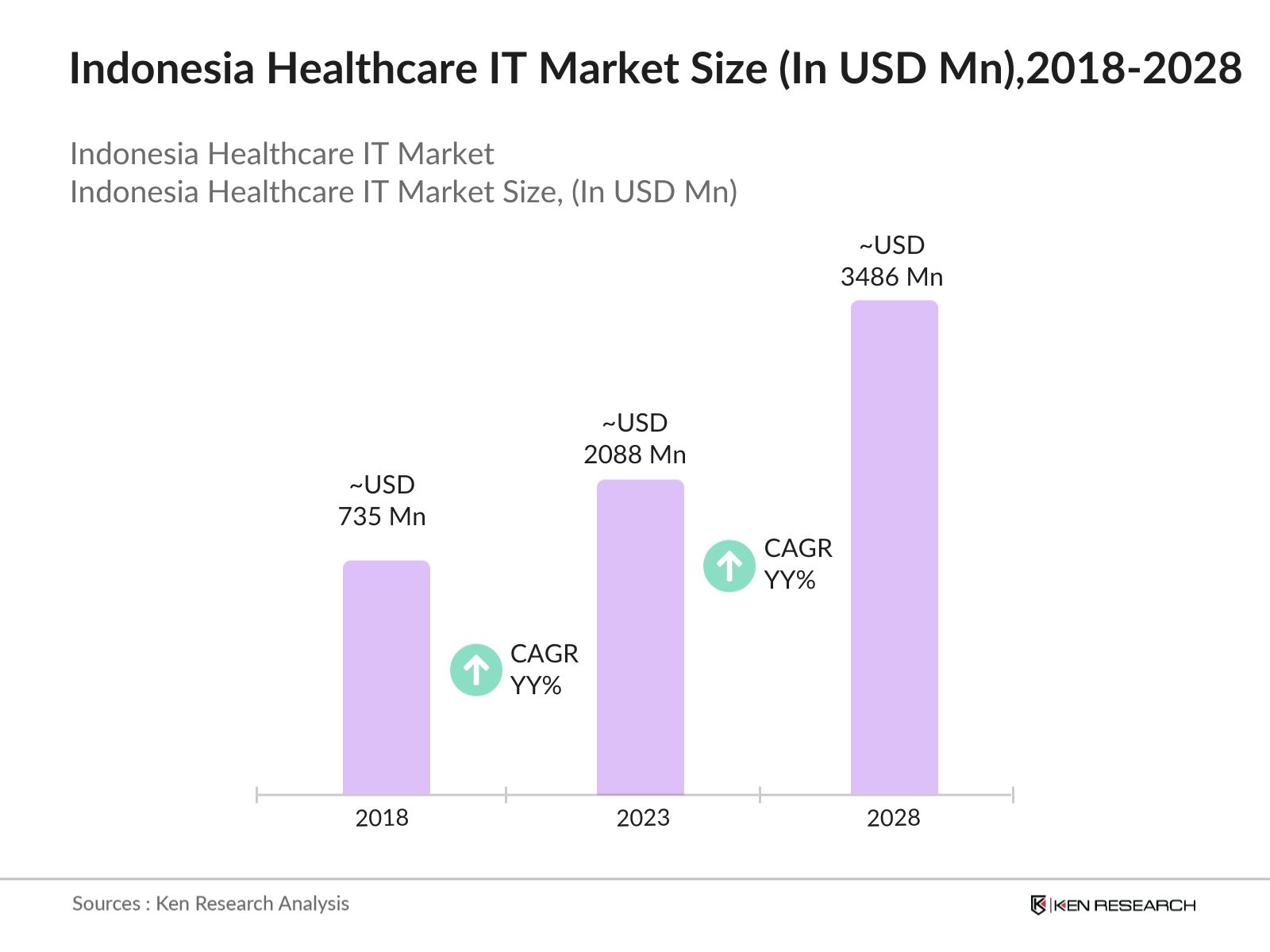

- The Indonesia Healthcare IT market has experienced notable growth, reaching a valuation of USD 2088 Million by revenue in 2023. This growth is driven by the increasing adoption of electronic health records (EHR) and telehealth services across hospitals and clinics.

- The key players in the Indonesia Healthcare IT Market include Medtronic Indonesia, PT Kimia Farma, PT Prodia Widyahusada Tbk, Telkom Indonesia, and Halodoc. These companies are at the forefront of innovation, offering a range of IT solutions from EHR systems to telemedicine platforms.

- In November 2023, Telkom Indonesia announced a partnership with the Ministry of Health to implement a national EHR system across public hospitals. This initiative, valued at $150 million, aims to standardize patient records and improve data accessibility across healthcare facilities, enhancing patient care and operational efficiency.

- Jakarta and Surabaya are the dominant cities in the Indonesia Healthcare IT Market. Jakarta, as the capital city, has the highest concentration of healthcare facilities and IT infrastructure, making it a hub for healthcare IT innovations.

Indonesia Healthcare IT Market Segmentation

Indonesia Healthcare IT Market is divided into following segments:

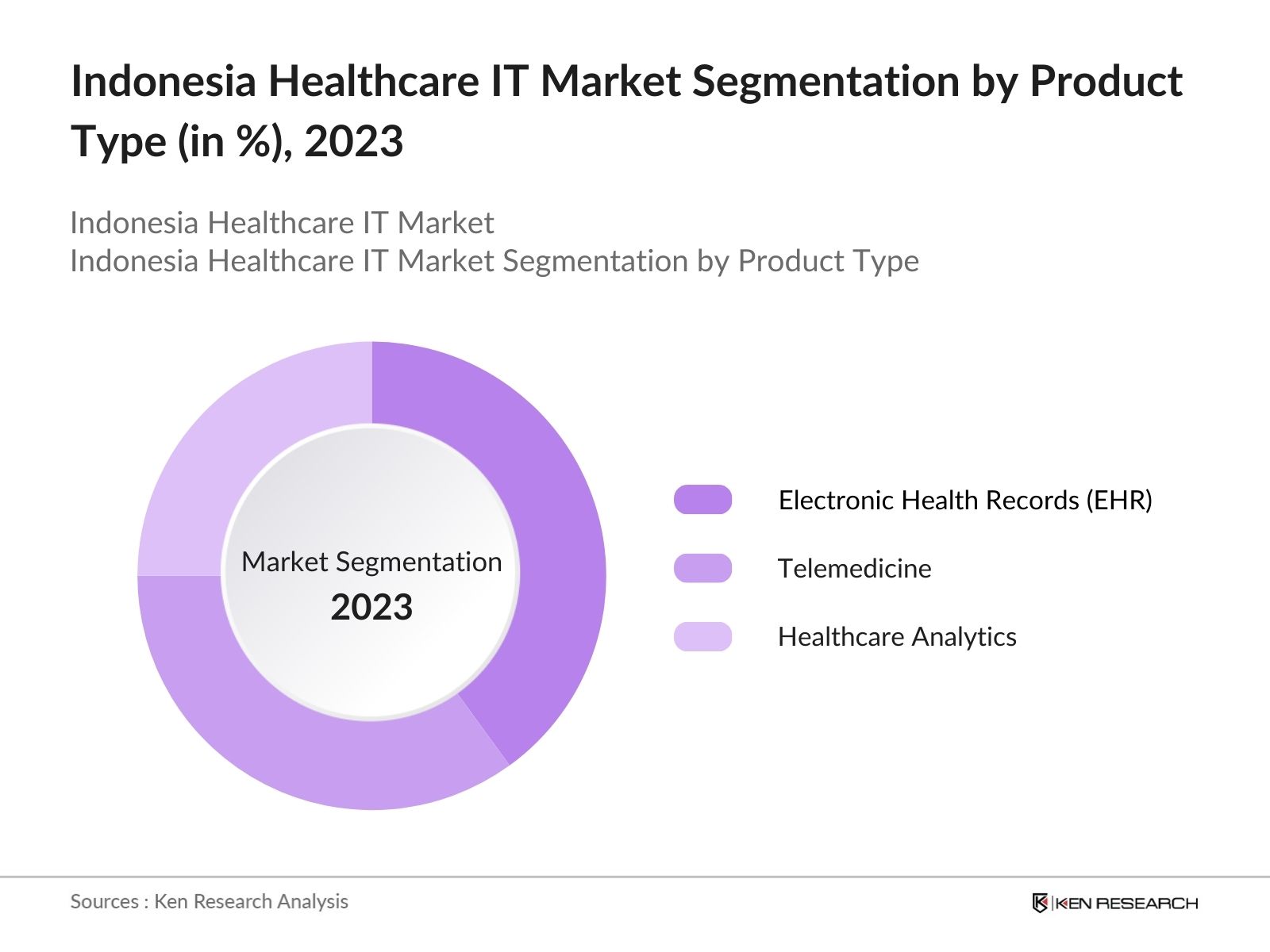

- By Product Type: The market is segmented by product type into electronic health records (EHR), telemedicine, and healthcare analytics. In 2023, EHR dominated the market with a significant share due to the increasing adoption of digital records by hospitals and clinics.

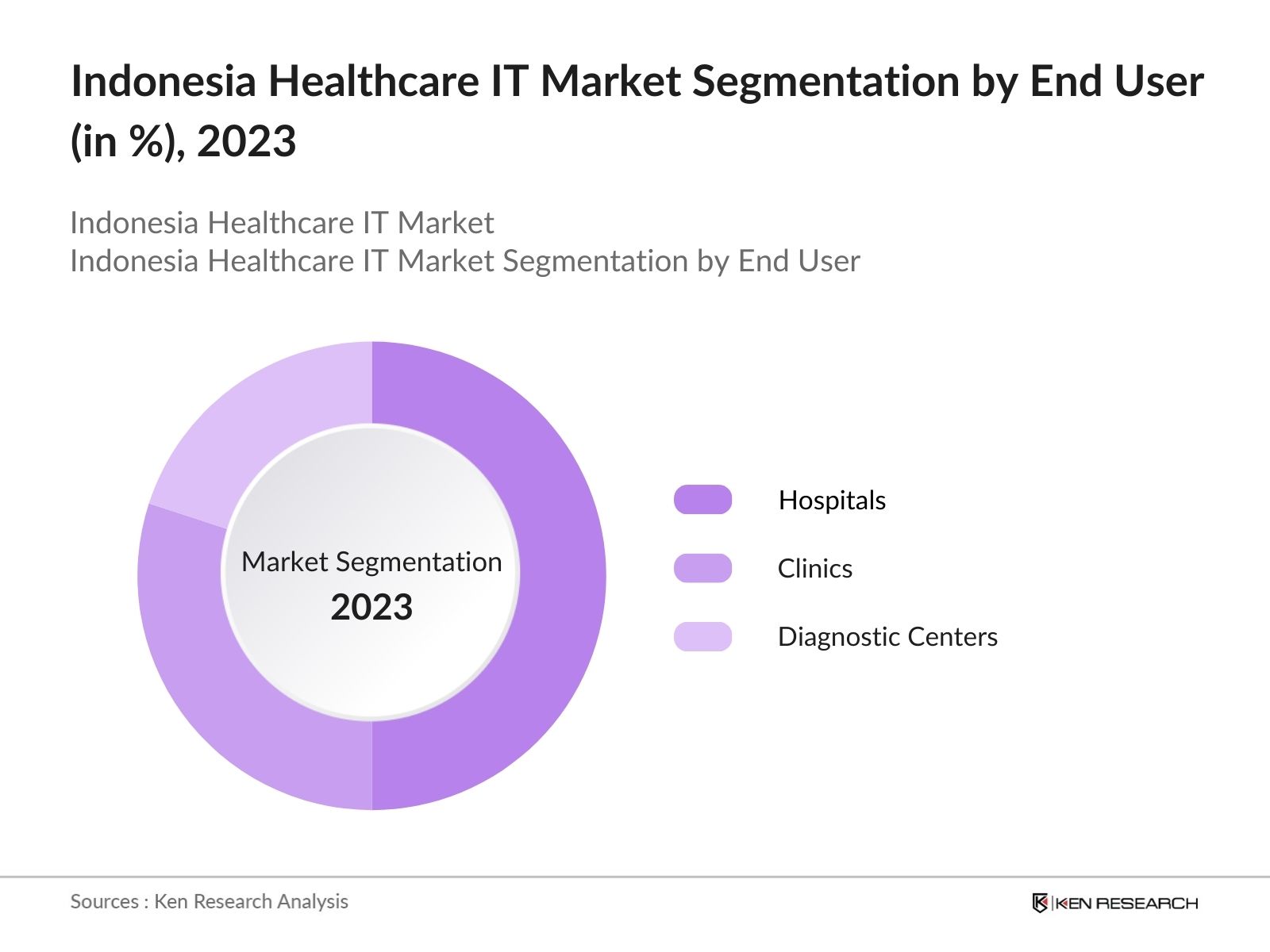

- By End User: The market is segmented by end-user into hospitals, clinics, and diagnostic centers. In 2023, hospitals hold the largest market share due to their extensive need for integrated IT systems to manage large volumes of patient data and streamline operations. The increasing investments in hospital IT infrastructure have further bolstered this segment's dominance.

- By Region: The market is segmented by region into North, South, East, and West. In 2023, the north region will dominate the market due to its advanced healthcare infrastructure and higher adoption rates of healthcare IT solutions. The presence of major healthcare providers and IT companies in Jakarta drives this regional dominance.

Indonesia Healthcare IT MarketCompetitive Landscape

|

Company |

Establishment Year |

Headquarters |

|

Medtronic Indonesia |

2008 |

Jakarta |

|

PT Kimia Farma |

1957 |

Jakarta |

|

PT Prodia Widyahusada Tbk |

1973 |

Jakarta |

|

Telkom Indonesia |

1965 |

Bandung |

|

Halodoc |

2016 |

Jakarta |

- PT Kimia Farma: On February 23, 2023, the Indonesia Investment Authority (INA) and Silk Road Fund (SRF) finalized their investment in PT Kimia Farma Tbk (KAEF) and its subsidiary PT Kimia Farma Apotek (KFA). This investment aims to enhance healthcare access across Indonesia and supports the government's focus on improving healthcare quality.

- Telkom Indonesia: In December 2023, a subsidiary of Telkom Indonesia, PT Administration Medika (Admedika), collaborated with Kalbe Farma's digital health service platform, KlikDokter, to launch cashless telemedicine services. This move aims to enhance the accessibility and convenience of healthcare services in Indonesia.

Indonesia Healthcare IT Industry Analysis

Indonesia Healthcare IT Market Growth drivers

- Increasing Adoption of Telemedicine: The adoption of telemedicine has significantly increased in Indonesia, especially post-pandemic. By 2023, the number of active users for major telemedicine applications like Halodoc and Alodokter reached a valuation of 38 million, indicating a strong acceptance of virtual healthcare solutions among the population.

- Rising Healthcare Spending: Indonesia's healthcare expenditure is on the rise, with government spending to reach $17.22 billion in 2024, up from $15.3 billion in 2022. This increase is part of the government's strategy to enhance healthcare infrastructure and services, including the adoption of healthcare IT solutions.

- Investment in Healthcare Infrastructure: Indonesia's healthcare industry is increasingly viewed as a lucrative investment opportunity, particularly due to the implementation of the universal healthcare program (JKN), which covers over 200 million people. This program has driven demand for hospitals, medical equipment, and healthcare services, attracting both domestic and foreign investors

Indonesia Healthcare IT Market Challenges

- Legacy Systems: Many healthcare facilities depend on outdated IT systems that do not meet modern healthcare requirements. These legacy systems are inflexible and hinder the adoption of innovative solutions. Additionally, maintaining and upgrading them can be expensive due to the need for specialized expertise and the difficulty in sourcing spare parts.

- Human Resource Limitations: Indonesia faces a significant shortage of trained healthcare professionals, including doctors and nurses, especially in rural areas. This scarcity of human resources severely hampers the effective delivery of healthcare services, leading to disparities in access and quality of care across the country.

Indonesia Healthcare IT Market Government Initiative

- E-Katalog Procurement System: The e-Katalog system, implemented in 2014, allows hospitals and clinics to procure medical devices and pharmaceuticals at pre-negotiated prices, increasing transparency in public health procurement. The e-Katalog has expanded to include a broader range of medical devices. As of early 2023, the system lists over 1,482 types of medical devices, with ongoing efforts to increase this number to meet the growing demands of healthcare facilities.

- Omnibus Health Law: The Omnibus Health Law, enacted in August 2023, mandates the prioritization of domestic production of medical devices and pharmaceuticals. It requires the central and regional governments to develop and strengthen the national supply chain of these products in an integrated manner.

Indonesia Healthcare IT Market Future Outlook

The Indonesia Healthcare IT Solutions market will grow significantly in the coming years, with a focus on solutions that enable data integration, streamline operations, and enhance patient care. Key areas of growth include electronic medical records (EMR), hospital information systems (HIS), and telemedicine platforms.

Future Market Trends

- Expansion of Telehealth Services: By 2028, the Indonesia Healthcare IT Market is expected to see a significant expansion of telehealth services, driven by the government's support and increasing demand for remote healthcare. This expansion will be supported by investments in telecommunications infrastructure and digital health platforms.

- Integration of AI and Big Data: The integration of AI and big data in healthcare IT systems will be a key trend over the next five years. By 2028, AI-powered diagnostic tools and predictive analytics will become more prevalent, improving the accuracy and efficiency of healthcare delivery.

Scope of the Report

|

By Product Type |

Electronic Health Records (EHR) Telemedicine Healthcare Analytics |

|

By End User |

Hospitals Clinics Diagnostic Centers |

|

By Region |

North South East West |

Products

Key Target Audience

Healthcare Providers

IT Solution Providers

Diagnostic Centers

Insurance Companies

Investment and Venture Capitalist Firms

Medical Device Manufacturers

Pharmaceutical Companies

Time Period Captured in the Report:

Historical Period: 2018-2023

Base Year: 2023

- Forecast Period: 2023-2028

Companies

Players Mentioned in the Report:

Medtronic Indonesia

PT Kimia Farma

PT Prodia Widyahusada Tbk

Telkom Indonesia

PT Kalbe Farma Tbk

RSUP Dr. Cipto Mangunkusumo

PT Mitra Keluarga Karyasehat Tbk

Table of Contents

1. Indonesia Healthcare IT Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Healthcare IT Market Size (in USD Bn), 2018-2023

2.1. Historical Market Size

2.2. Year-on-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Healthcare IT Market Analysis

3.1. Growth Drivers

3.1.1. Increasing Adoption of Telemedicine

3.1.2. Rising Healthcare Spending

3.1.3. Investment in Healthcare Infrastructure

3.1.4. Public Awareness

3.2. Restraints

3.2.1. Legacy Systems

3.2.2. Human Resource Limitations

3.2.3. Lack of Skilled Workforce

3.3. Opportunities

3.3.1. Technological Advancements

3.3.2. International Collaborations

3.3.3. Expansion into Rural Areas

3.4. Trends

3.4.1. Expansion of Telehealth Services

3.4.2. Integration of AI and Big Data

3.4.3. Increased Use of Mobile Monitoring Units

3.5. Government Regulation

3.5.1. E-Katalog Procurement System

3.5.2. Omnibus Health Law

3.5.3. Public-Private Partnerships

3.6. SWOT Analysis

3.7. Stake Ecosystem

3.8. Competition Ecosystem

4. Indonesia Healthcare IT Market Segmentation, 2023

4.1. By Product Type (in Value %)

4.1.1. Electronic Health Records (EHR)

4.1.2. Telemedicine

4.1.3. Healthcare Analytics

4.2. By End User (in Value %)

4.2.1. Hospitals

4.2.2. Clinics

4.2.3. Diagnostic Centers

4.5. By Region (in Value %)

4.5.1. North

4.5.2. South

4.5.3. East

4.5.4. West

5. Indonesia Healthcare IT Market Cross Comparison

5.1 Detailed Profiles of Major Companies

5.1.1. Medtronic Indonesia

5.1.2. PT Kimia Farma

5.1.3. PT Prodia Widyahusada Tbk

5.1.4. Telkom Indonesia

5.1.5. Halodoc

5.1.6. PT Indofarma

5.1.7. PT Kalbe Farma Tbk

5.1.8. Siloam Hospitals Group

5.1.9. RSUP Dr. Cipto Mangunkusumo

5.1.10. PT Mitra Keluarga Karyasehat Tbk

5.2 Cross Comparison Parameters (No. of Employees, Headquarters, Inception Year, Revenue)

6. Indonesia Healthcare IT Market Competitive Landscape

6.1. Market Share Analysis

6.2. Strategic Initiatives

6.3. Mergers and Acquisitions

7. Indonesia Healthcare IT Market Regulatory Framework

7.1. Licensing Procedures

7.2. Legal Framework for Medical Practice

7.3. Consolidation of Existing Laws

8. Indonesia Healthcare IT Future Market Size (in USD Bn), 2023-2028

8.1. Future Market Size Projections

8.2. Key Factors Driving Future Market Growth

9. Indonesia Healthcare IT Future Market Segmentation, 2028

9.1. By Product Type (in Value %)

9.2. By End User (in Value %)

9.3. By Region

10. Indonesia Healthcare IT Market Analysts’ Recommendations

10.1. TAM/SAM/SOM Analysis

10.2. Customer Cohort Analysis

10.3. Marketing Initiatives

10.4. White Space Opportunity Analysis

Disclaimer

Contact Us

Research Methodology

Step 1 Identifying Key Variables:

Ecosystem creation for all the major entities and referring to multiple secondary and proprietary databases to perform desk research around market to collate industry level information.

Step 2 Market Building:

Collating statistics on Indonesia Healthcare IT Market over the years, penetration of marketplaces and service providers ratio to compute revenue generated for Indonesia Healthcare IT industry. We will also review service quality statistics to understand revenue generated which can ensure accuracy behind the data points shared.

Step 3 Validating and Finalizing:

Building market hypothesis and conducting CATIs with industry experts belonging to different companies to validate statistics and seek operational and financial information from company representatives.

Step 4 Research Output:

Our team will approach multiple Healthcare IT Market industry companies and understand nature of product segments and sales, consumer preference and other parameters, which will support us validate statistics derived through bottom to top approach from such Indonesia Healthcare IT industry companies.

Frequently Asked Questions

01 How big is Indonesia Healthcare IT Market?

The Indonesia Healthcare IT market has seen significant growth, achieving a revenue valuation of USD 2,088 million in 2023. This expansion is largely attributed to the rising adoption of electronic health records (EHR) and telehealth services within hospitals and clinics.

02 Who are the major players in the Indonesia Healthcare IT Market?

Key players in the Indonesia Healthcare IT market include Medtronic Indonesia, PT Kimia Farma, PT Prodia Widyahusada Tbk, Telkom Indonesia, and Halodoc. These companies lead due to their innovative solutions and strong market presence.

03 What are the growth drivers of Indonesia Healthcare IT Market?

The Indonesia Healthcare IT market is driven by increased adoption of telemedicine, government initiatives on digital health, and rising healthcare spending. These factors contribute to the growing demand for healthcare IT solutions.

04 What are the challenges in Indonesia Healthcare IT Market?

Challenges in the Indonesia Healthcare IT market include data privacy and security concerns, limited IT infrastructure in rural areas, and high implementation costs for advanced healthcare IT systems. These factors hinder widespread adoption across the country.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.