Indonesia Healthcare Market Outlook to 2022

By Hospitals, Clinical Laboratories, Pharmaceutical, Pharmacy Chains, Medical Device Segment

Region:Asia

Product Code:KR586

February 2018

362

About the Report

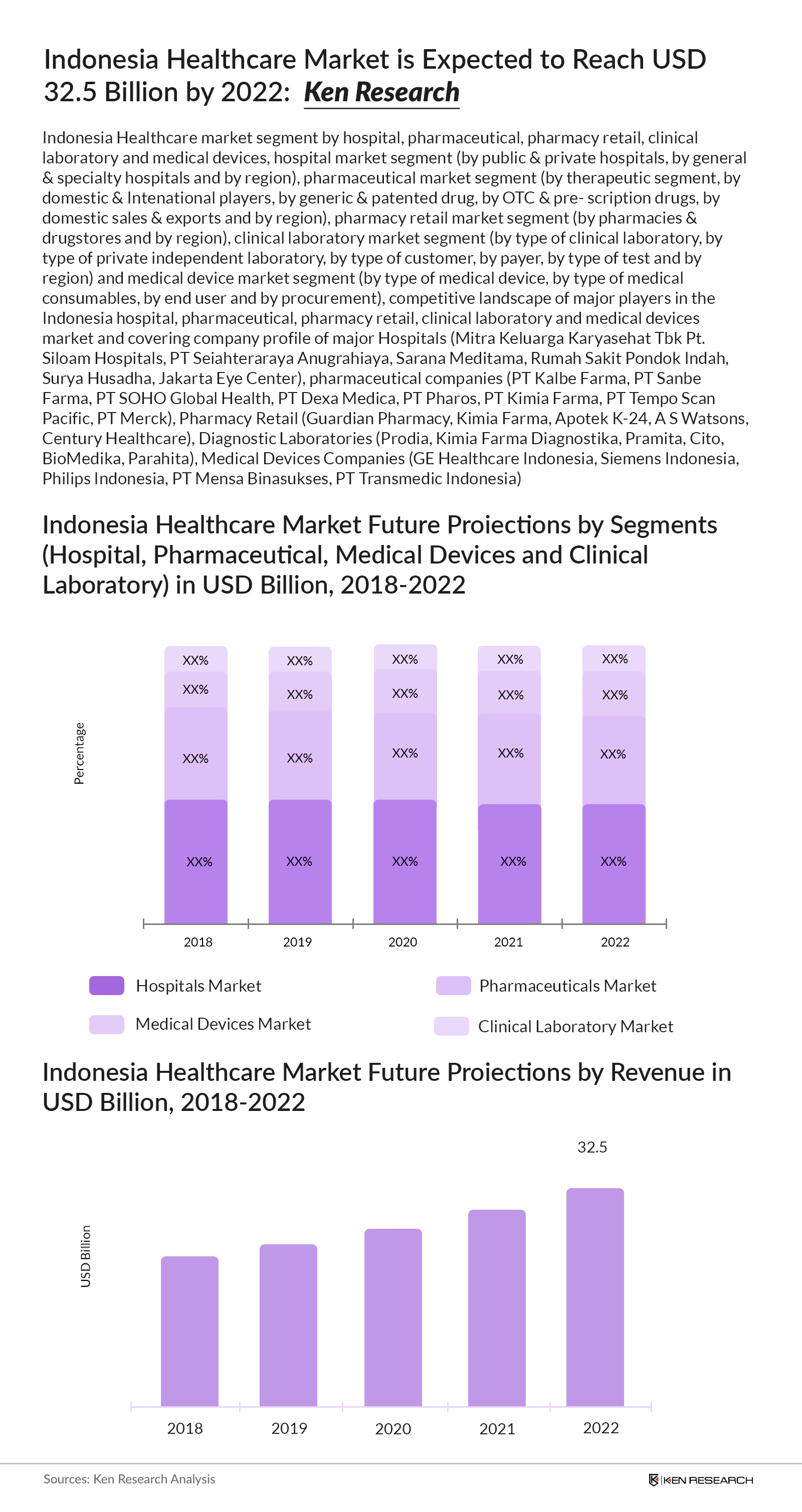

The report titled "Indonesia Healthcare Market Outlook to 2022 - by Hospitals, Clinical Laboratories, Pharmaceutical, Pharmacy Chains, Medical Device Segment" provides information on market size for Indonesia Healthcare, hospital, pharmaceutical, pharmacy retail, clinical laboratory and medical devices. The report covers aspects such as healthcare market segment (by hospitals, pharmaceuticals, medical devices and clinical laboratory), hospital market segment (by public & private hospitals, by general & specialty hospitals and by region), pharmaceutical market segment (by therapeutic segment, by domestic & international players, by generic & patented drug, by OTC & prescription drugs, by domestic sales & exports and by region), pharmacy retail market segment (by pharmacies & drugstores and by region), clinical laboratory market segment (by type of clinical laboratory, by type of private independent laboratory, by type of customer, by payer, by type of test and by region) and medical device market segment (by type of medical device, by type of medical consumables, by end user and by procurement), competitive landscape of major Hospitals (Mitra Keluarga Karyasehat Tbk Pt, Siloam Hospitals, PT Sejahteraraya Anugrahjaya, Sarana Meditama, Rumah Sakit Pondok Indah, Surya Husadha, Jakarta Eye Center), pharmaceutical companies (PT Kalbe Farma, PT Sanbe Farma, PT SOHO Global Health, PT Dexa Medica, PT Pharos, PT Kimia Farma, PT Tempo Scan Pacific, PT Merck), Pharmacy Retail (Guardian Pharmacy, Kimia Farma, Apotek K-24, A S Watsons, Century Healthcare), Diagnostic Laboratories (Prodia, Kimia Farma Diagnostika, Pramita, Cito, BioMedika, Parahita), Medical Devices Companies (GE Healthcare Indonesia, Siemens Indonesia, Philips Indonesia, PT Mensa Binasukses, PT Transmedic Indonesia). The report concludes with market projection for future and analyst recommendations highlighting the major opportunities and cautions.

Market Segmentation

Key Topics Covered in the Report:

- Indonesia Healthcare, Hospitals, Pharmaceutical, Pharmacy Retail, Clinical Laboratory, Medical Devices Market Size, 2012-2017

- Indonesia Hospitals Market Segmentation (by public & private hospitals, by general & specialty hospitals and by region)

- Indonesia Hospitals, Pharmaceutical, Pharmacy Retail, Clinical Laboratory, Medical Devices Market Competitive Landscape

- Indonesia Hospital, Pharmaceutical, Pharmacy Retail, Clinical Laboratory, Medical Devices Future Outlook and Projections, 2018-2022

- Indonesia Pharmaceuticals Market Segmentation (by therapeutic segment, by domestic & international players, by generic & patented drug, by OTC & prescription drugs, by domestic sales & exports and by region)

- Indonesia Pharmacy Retail Market Segmentation (by pharmacies & drugstores and by region)

- Indonesia Clinical Laboratory Market Segmentation (by type of clinical laboratory, by type of private independent laboratory, by type of customer, by payer, by type of test and by region)

- Indonesia Medical Devices Market Segmentation (by type of medical device, by type of medical consumables, by end-user and by procurement)

- Analyst Recommendations

- Macro-economic Factors Impacting Indonesia Healthcare Market

Products

Companies

Hospitals (Mitra Keluarga Karyasehat Tbk Pt,

Siloam Hospitals,

PT Sejahteraraya Anugrahjaya,

Sarana Meditama,

Rumah Sakit Pondok Indah,

Surya Husadha,

Jakarta Eye Center),

pharmaceutical companies (PT Kalbe Farma,

PT Sanbe Farma,

PT SOHO Global Health,

PT Dexa Medica,

PT Pharos,

PT Kimia Farma,

PT Tempo Scan Pacific,

PT Merck),

Pharmacy Retail (Guardian Pharmacy,

Kimia Farma,

Apotek K-24, A S Watsons,

Century Healthcare),

Diagnostic Laboratories (Prodia,

Kimia Farma Diagnostika,

Pramita, Cito, BioMedika, Parahita),

Medical Devices Companies (GE Healthcare Indonesia,

Siemens Indonesia,

Philips Indonesia,

PT Mensa Binasukses,

PT Transmedic Indonesia)

Table of Contents

1. Executive Summary

Indonesia Healthcare Market Overview

Market Segmentation

Indonesia Hospital Market

Indonesia Pharmaceutical Market

Indonesia Pharmacy Retail Market

Indonesia Clinical Laboratory Market

Indonesia Medical Device Market

Snapshot on indonesia Polyclinic market

2. Research Methodology

2.1. Market Definitions

2.2. Abbreviations

2.3. Market Size and Modeling

Consolidated Research Approach

Market Sizing - Medical Devices Market

Market Sizing - Hospitals Market

Market Sizing - Clinical Laboratories Market

Market Sizing - Pharmaceutical Market

Market Sizing - Pharmacy Retail Market

Variables (Dependent and Independent)

Multi Factor Based Sensitivity Model

Final Conclusion

3. Indonesia Healthcare Market, 2012-2017

3.1. Indonesia Healthcare Statistics

3.2. Universal Health Coverage and Health Care Financing Indonesia

3.3. Indonesia Healthcare Insurance

3.4. Indonesia Healthcare Value Chain

3.5. SWOT Analysis for Indonesia Healthcare Market

3.6. Indonesia Healthcare Market Size, 2012-2017

3.7. Indonesia Healthcare Segmentation

3.7.1. By Hospitals, Pharmaceuticals, Medical Devices and Clinical Laboratory, 2012-2017

4. Indonesia Hospital Market Overview and Genesis

4.1. Indonesia Hospital Market Size, 2012-2017

4.2. Indonesia Hospital Market Segmentation

4.2.1. By Public and Private Hospitals, 2012-2016

4.2.2. By General and Specialty Hospitals, 2012-2016

By Type of Specialty Hospitals on the Basis of Number of Hospitals and Beds, 2012-2015

4.2.3. By Region, 2016

4.3. Business Model for Indonesia Hospital Market

4.4. Trends and Developments in Indonesia Hospital Market

Rising Foreign Investment

Implementation of Universal Health Coverage Programme

Increasing Prevalence of Chronic Diseases

Increase in Hospitals and Clinics

Rising number of Private Hospitals

Rising Adoption of Technology Enabled Healthcare Services in Indonesia

4.5. Issues and Challenges

Lack of Qualified Doctors and Nurses

Low Bed to Population Ratio

4.6. Government Initiatives, Rules and Regulation In Indonesia Hospital Market

4.7. Major Hospital Projects in Indonesia Hospital Market

4.8. Competitive Landscape of Major Hospital Chains in Indonesia Hospital Market

4.9. Company Profiles

4.9.1. Mitra Keluarga Karyasehat Tbk PT

4.9.2. Siloam Hospitals

Case Study on Siloam Hospitals Located in Purwakarta, Java

Demand Analysis for Siloam Hospitals Located in Purwakarta, Java

4.9.3. PT Sejahteraraya Anugrahjaya

4.9.4. Sarana Meditama

4.9.5. Rumah Sakit Pondok Indah

4.9.6. Surya Husadha General Hospital

4.9.7. Jakarta Eye Center

4.9.8. Other Company Profiles

4.10. Indonesia Hospitals Future Outlook and Projections by Revenue, 2018-2022

4.11. Analyst Recommendations

5. Indonesia Pharmaceutical Market Introduction

5.1. Indonesia Pharmaceutical Market Size, 2012-2017

5.2. Indonesia Pharmaceutical Market Segmentation, 2017

5.2.1. By Therapeutic Segments (Anti-Infectives, Gastrointestinal and Metabolism, Cardiovascular System, Central Nervous System, Respiratory, Musculoskeletal, Dermatology, Genitourinary and Hormones, Blood, Oncology and Others), 2015 & 2017

Vitamins and Dietary Supplements Market, 2012-2017

5.2.2. By Domestic and International Players, 2012-2017

5.2.3. By Generic and Patented Drug, 2017

By Type of Generic Drugs (Unbranded, Ethical and Free Sales), 2013 and 2017

5.2.4. By OTC and Prescription Drugs, 2012-2017

5.2.5. By Domestic Sales and Exports, 2012-2016

5.2.6. By Region (West Java, East Java, Central Java, Jakarta and Others), Dec 2016

5.3. Trends, Developments and Restraint in Indonesia Pharmaceutical Market

Growth in Indonesia Animal Pharmaceutical and Vaccine Market

Increased Government Support

Rise in Mergers and Acquisitions Activities

Growing Investment from Foreign Companies

Dependence on Imports for API (Active Pharmaceutical ingredient) Procurement

Other Challenges Faced

5.4. Government Regulations for Indonesia Pharmaceutical market

Pharmaceutical Finished Products Registration Requirement

Registration Procedure

Pharmaceutical Raw Materials

Advertising and Distribution

FDI in Pharmaceutical Industry

Procedure of Applying for Patent in Indonesia

Import Regulations

Draft Law on Monitoring of Pharmaceutical Supply, Medical Devices and Household Health Products

Draft law on Hala Product Guarantee

Regulations for Non-Indonesian Stakeholders Planning to Enter the Pharmaceutical Market

5.5. Indonesia Biopharmaceutical Industry Snapshot

Innogene Kalbiotech

5.6. Snapshot on Indonesia Vaccine Market

5.7. Competitive Scenario for Major Players in Indonesia Pharmaceutical Market

5.8. Market Share of Major Players in Indonesia Pharmaceutical Market, 2015

5.9. Competitive Landscape of Major Players in Indonesia Pharmaceutical Market

5.9.1. PT Kalbe Farma

Product Portfolio for PT Kalbe Farma

5.9.2. PT Sanbe Farma

Product Portfolio for PT Sanbe Farma

5.9.3. PT SOHO Global Health

5.9.4. PT Dexa Medica

Product Portfolio for Dexa Medica

5.9.5. PT Pharos

Product Portfolio for PT Pharos

5.9.6. PT Kimia Farma

Product Portfolio for PT Kimia Farma

5.9.7. PT Tempo Scan Pacific Tbk

Product Portfolio for PT Tempo Scan Pacific Tbk, Indonesia

5.9.8. PT Merck Tbk

5.9.9. Overview for Other Major Players (Fahrenheit, Sanofi Aventis, PT. Novell Pharmaceutical Laboratories, Biofarma, Darya Varia and Konimex) in Indonesia Pharmaceutical Market

5.10. Indonesia Pharmaceutical Market Future Outlook and Projections, 2018-2022

5.10.1. By Therapeutic Segments (Anti Infectives, Gastrointestinal and Metabolism, Cardiovascular System, Central Nervous System, Respiratory, Musculoskeletal, Dermatology, Genitourinary and Hormones, Blood, Oncology and Others), 2022

5.10.2. By Generic and Patent Drugs, 2022

5.11. Analyst Recommendations

6. Indonesia Pharmacy Retail Market Introduction

6.1. Indonesia Pharmacy Retail Market Size by Revenue and Number of Pharmacies, 2012-2017

6.2. Indonesia Pharmacy retail Market Segmentation

6.2.1. By Pharmacies and Drugstores, 2012-2017

6.2.2. By Region on the basis of Number of Pharmacies and Drugstores (Central Java, East Java, West Java, North Sumatra, Jakarta and Others), 2015

6.3. Value Chain

Margin Analysis

6.4. Trends and Developments in Pharmacy Retail Market

Indonesia Encouraging Investments from Foreign Companies

Emergence of Science and Technology Parks

Surging imports of Drugs

Increased Life Expectancy and Ageing Population

High Prevalence of Lifestyle- Related Diseases

Growth in Online Retail

6.5. Competition Scenario in Indonesia Pharmacy Retail Market

6.6. Competitive Landscape of Major Organized Pharmacy Chains in Indonesia

6.6.1. Guardian Pharmacy

6.6.2. Kimia Farma

6.6.3. Apotek K-24

6.6.4. A S Watsons group

6.6.5. Other Major players (Century Healthcare)

6.7. Indonesia Pharmacy Retail Market Future Outlook and Projections, 2018-2022

6.7.1. By Pharmacies and Drugstores

6.8. Analyst Recommendation

7. Indonesia Clinical Laboratory Market Introduction

7.1. Indonesia Clinical Laboratory Market Size, 2012-2017

7.2. Indonesia Clinical Laboratory Market Segmentation

7.2.1. By Type of Laboratory (Public Clinical Lab, Private Hospital Labs and Private Independent Labs), 2012-2017

7.2.2. Indonesia Private Independent Laboratory Market Segmentation

By Type of Private Independent Laboratory (Laboratory Chains and Single Independent Laboratory), 2015 & 2016

By Type of Customer (Doctor Referrals, Walk-Ins, Corporate Clients and External Referrals), 2016

By Payer (Private Health Insurance, Corporates, Out of Pocket and BPJS), 2016

By Type of Test (Routine, Non Laboratory and Esoteric), 2016

By Region, 2016

7.3. Value Chain of Clinical Labs Market

7.4. Trends, Developments, Issues and Challenges in Indonesia Clinical Laboratory Market

Universal Health Coverage (UHC) Increases The Demand For Clinical Laboratory Testing

Rising Prevalence of Non-Communicable Diseases (NCDs) and Communicable Diseases (CDs)

Increasing Demand For Health Check-Ups

Introduction of New Specialized Tests

Shortage of Skilled Human Resource Limits Growth

Limitations in Reimbursement per Case Load by BPJS May Limit the Extent of Tests Performed

Failure of Hub-and-Spoke Model

7.5. Government Regulations for Indonesia Clinical Laboratories Market

Classification And Licenses Of Clinical Laboratories

License Application Process

Regulation for Setting up Clinical Laboratory in Indonesia

Regulations on Transport of Tests and Quality Control Management

Regulation for Transporting Samples Abroad

Specimen Collection Point / Hospital Laboratory

Relevant Regulations On The Medical Personnel Law

Foreign Investment Restrictions

7.6. Competition Scenario for Indonesia Clinical Laboratories Market

7.7. Market Share of Major Organized Clinical Laboratories in Indonesia, 2016

7.8. Competitive Landscape of Major Organized Diagnostics Labs in Indonesia

7.8.1. Prodia

7.8.2. Kimia Farma Diagnostika

7.8.3. Pramita

7.8.4. Cito

7.8.5. BioMedika

7.8.6. Parahita

7.9. Indonesia Clinical Laboratory Market Future Outlook and Projections, 2018-2022

7.9.1. By Type of Private Independent Laboratory (Laboratory Chains and Single Independent Laboratory), 2022

7.9.2. By Type of Test (Routine, Non Laboratory and Esoteric), 2022

7.10. Analyst Recommendation

8. Indonesia Medical Device Market Introduction

8.1. Indonesia Medical Devices Market Size, 2012-2017

8.2. Indonesia Medical Devices Market Segmentation

8.2.1. By Type of Medical Devices (Medical consumable Products, Diagnostic Imaging Products, Auxiliary Devices, Orthopedic Implants, Dental Products, Aesthetic Devices and Others), 2014 and 2017

By Type of Medical Consumables (Syringes, Needles, Catheters, Bandages, Dressings, Suturing materials, Ostomy Products and Others), 2014 and 2017

8.2.2. By End Users (Hospitals, Clinics and Others), 2017

8.2.3. By Procurement (Imports and Domestic Production), 2014 and 2017

8.3. Regulatory Environment for Indonesia Medical Devices Market

Classification System for Medical Devices in Indonesia

Document Requirements for Medical Device Registration in Indonesia (MOH RI)

Other Special Requirements

Foreign Medical Devices Registration

Product Certification: SNI ISO 13485:2003

Electronic System to Control Medical Devices

Government Procurement

Import taxes and Duties

STandard Selling Requirement

8.4. Trends, Developments, Issues and Challenges in Indonesia Medical Devices Market

International manufacturers Register in e-catalogue

Rising Demand For More Sophisticated And Modern Medical Products

Challenges In Indonesia Medical Device Market

8.5. Competitive Scenario for Major Players in Indonesia Medical Devices Market

Decision Making Process to Shortlist Medical Device

8.6. Competitive Landscape of Major Players in Indonesia Medical Devices Market

8.6.1. Major Local Manufacturers

8.6.2. Major International Companies

GE Healthcare, Indonesia

Siemens, Indonesia

Philips, Indonesia

8.6.3. Major Local Distributors

PT Mensa Binasukses, Indonesia

PT Transmedic Indonesia

8.6.4. Overview for Other Major Local Distributors (PT Surgika Alkesindo, PT Daya Inti Kurnia Abadi)

8.7. Indonesia Medical Devices Market Future Outlook and Projections, 2018-2022

8.7.1. By Type of Medical Devices (Medical consumable Products, Diagnostic Imaging Products, Auxiliary Devices, Orthopedic Implants, Dental Products, Aesthetic Devices and Others), 2022

8.7.2. By Procurement (Imports and Domestic Production), 2022

9. Indonesia Polyclinic and Health Care Centers Market Snapshot, 2017

Public Health Services

Private Health Services

10. Indonesia Healthcare Industry Market Future Outlook and Projections, 2018-2022

11. Macro Economic Factors Affecting Indonesia Healthcare Market

11.1. Population, 2012-2022

11.2. Number of Primary Health Centers (Puskesmas), 2012-2022

11.3. Budget Allocation on Healthcare, 2012-2022

11.4. Obese Population, 2012-2022

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.