Indonesia Healthcare Providers Market Outlook to 2030

Region:Asia

Author(s):Sanjeev

Product Code:KROD3632

November 2024

83

About the Report

Indonesia Healthcare Providers Market Overview

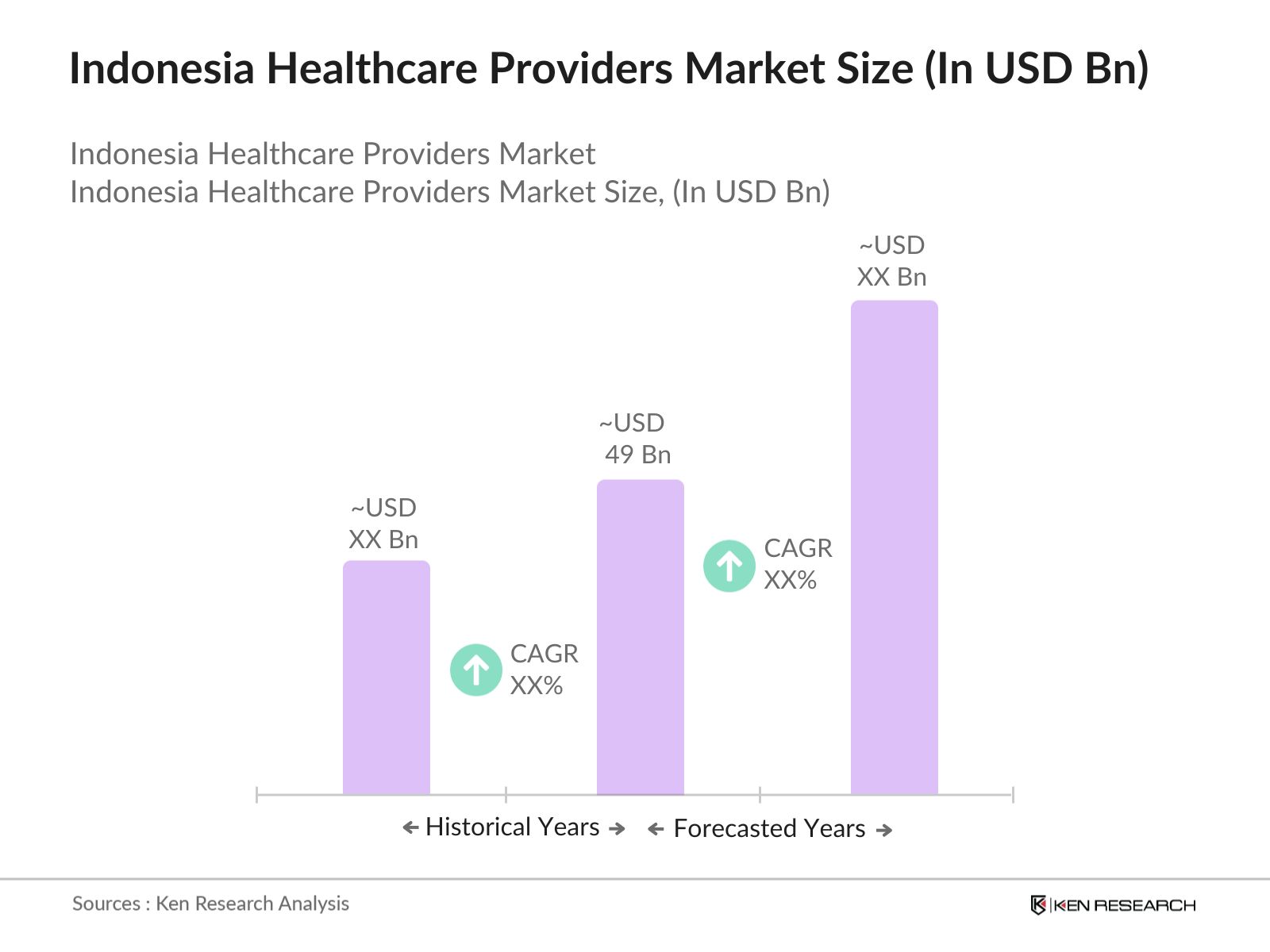

- The Indonesia Healthcare Providers Market is valued at USD 49 billion, driven by a combination of factors, including rising healthcare spending, the introduction of universal health coverage under the Jaminan Kesehatan Nasional (JKN) scheme, and increasing demand for specialized healthcare services. The rapid growth of the private healthcare sector, coupled with the government's focus on improving healthcare infrastructure, has further propelled the market. The expansion of healthcare facilities and the growing number of insured individuals are key factors driving the market forward.

- The market is dominated by cities like Jakarta and Surabaya, owing to their robust healthcare infrastructure, higher concentration of private hospitals, and large populations. Jakarta, as the capital city, boasts a significant number of leading healthcare providers, medical institutions, and specialized care centers. Surabaya follows closely due to its status as an economic hub, attracting investment in healthcare and offering advanced medical services. These cities continue to lead the market due to their urbanization and healthcare accessibility.

- The BPJS framework, which oversees the National Health Insurance program (JKN), covers 235 million Indonesians as of 2024. The government continues to expand the benefits under this framework, aiming to include more specialized treatments and cover more complex medical procedures. BPJS is critical for ensuring equitable access to healthcare and reducing the financial burden on households. However, challenges remain in managing costs and ensuring the sustainability of the program amid rising healthcare demands.

Indonesia Healthcare Providers Market Segmentation

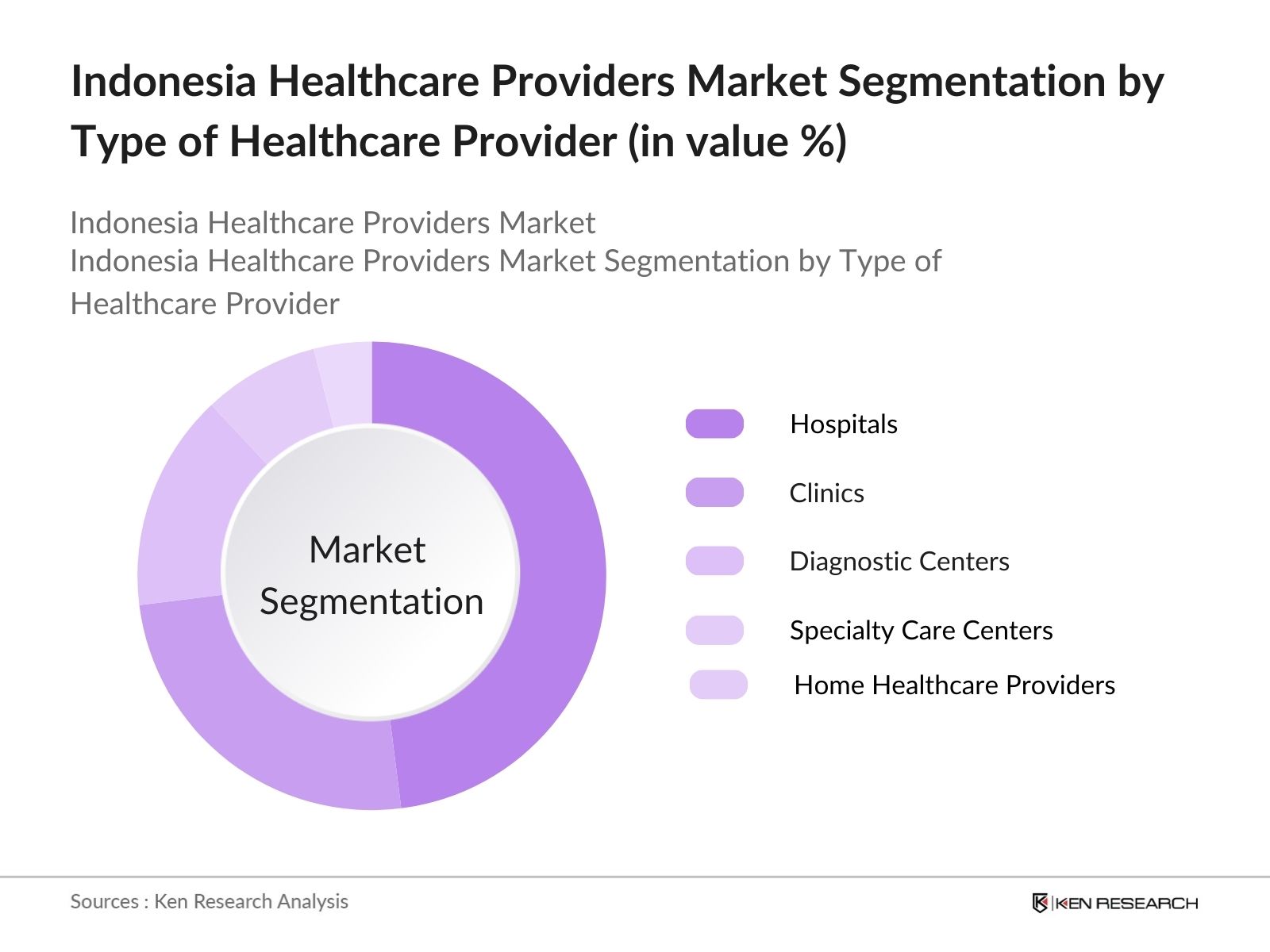

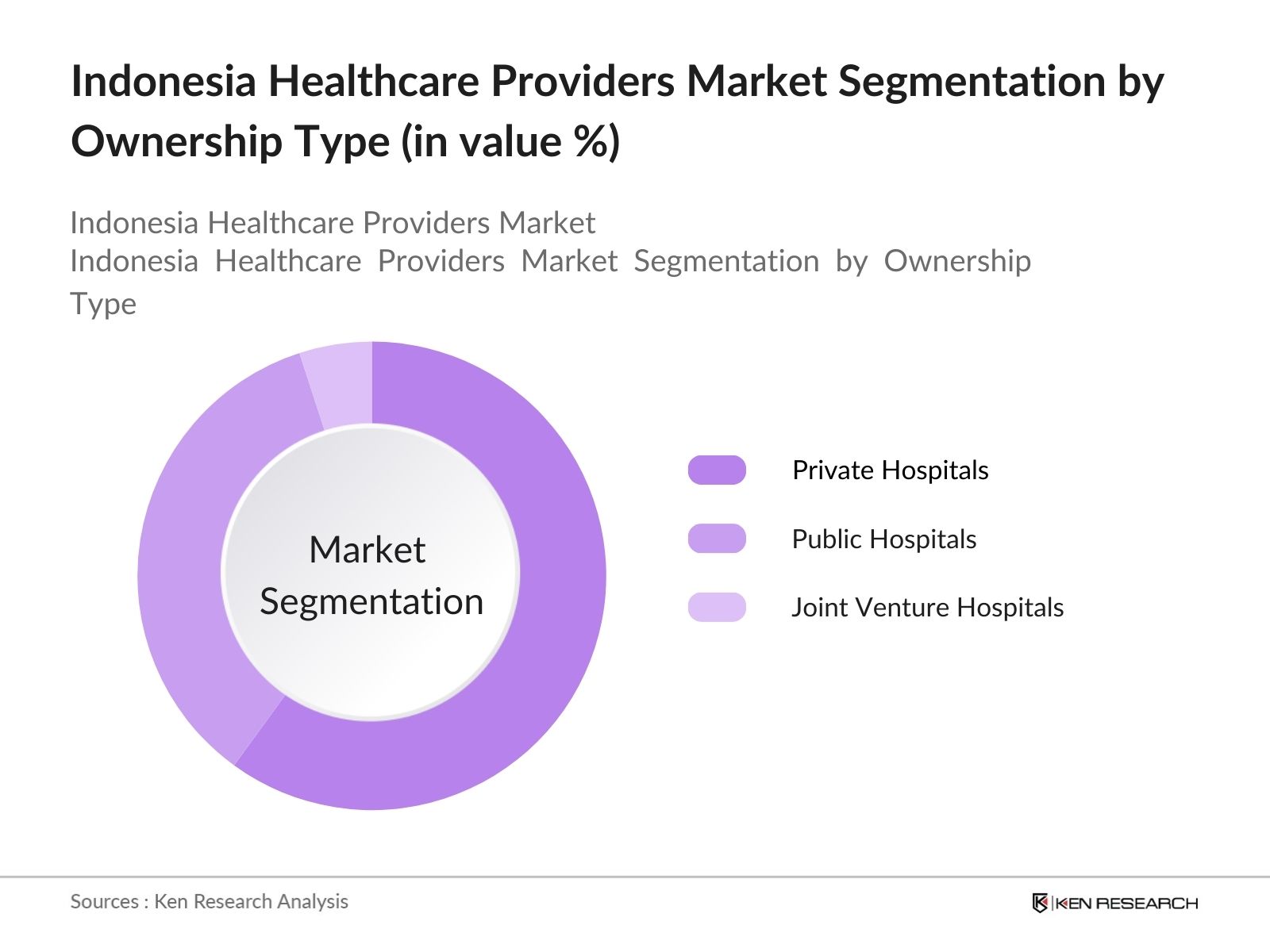

The Indonesia Healthcare Providers Market is segmented by healthcare provider and by ownership type.

- By Type of Healthcare Provider: The Indonesia Healthcare Providers Market is segmented by healthcare provider types, which include hospitals, clinics, diagnostic centers, specialty care centers, and home healthcare providers. Among these, hospitals hold the largest market share due to their ability to offer comprehensive healthcare services and their crucial role in tertiary care. In particular, private hospitals have gained a dominant position, driven by high demand for specialized treatments and better service quality. The increased adoption of advanced medical technology and international collaborations with foreign healthcare providers further boosts the prominence of hospitals in the market.

- By Ownership Type: The market is also segmented by ownership type into public hospitals, private hospitals, and joint venture hospitals. Private hospitals dominate this segment, holding the highest market share. Their dominance is due to higher investment in healthcare technology, better patient care services, and the ability to attract skilled professionals. Additionally, private hospitals are typically more flexible and responsive to market needs compared to public facilities, making them the preferred choice for middle- and upper-income segments of the population.

Indonesia Healthcare Providers Market Competitive Landscape

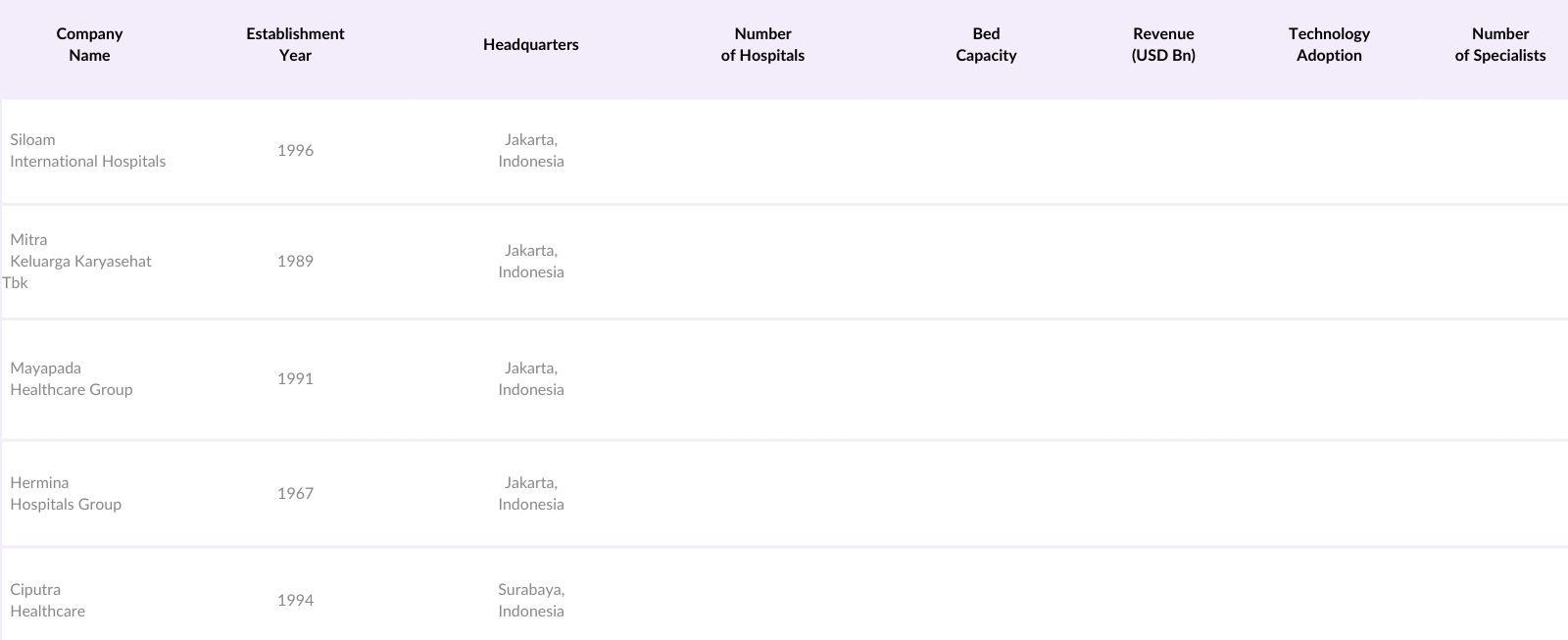

The Indonesia Healthcare Providers Market is highly competitive, with a mix of local and international healthcare providers. The market is dominated by private hospital groups such as Siloam International Hospitals and Mitra Keluarga. These players continue to expand their footprint, driven by increasing demand for specialized healthcare services and advancements in medical technology. Smaller, regional healthcare providers also hold significant market shares, especially in less urbanized regions. Strategic partnerships with foreign healthcare providers, the introduction of advanced healthcare infrastructure, and a focus on patient-centric care are some of the key strategies used by leading players.

Indonesia Healthcare Providers Market Analysis

Growth Drivers

- Population Growth and Aging: Indonesia, with a population of 273 million people in 2024, is witnessing a significant demographic shift. The elderly population, individuals aged 65 and older, has reached over 19 million, representing a growing need for specialized healthcare services like geriatric care and chronic disease management. The countrys life expectancy has risen to 73 years, adding pressure on the healthcare system to meet the demands of an aging population. As a result, Indonesia's healthcare providers are being required to increase capacity and capabilities in treating age-related diseases, which includes increased hospitalization rates.

- Rising Prevalence of Chronic Diseases: Chronic diseases like cardiovascular conditions, diabetes, and respiratory diseases are on the rise in Indonesia. In 2023, over 19 million adults were reported to have hypertension, and diabetes affected more than 10 million individuals. This increase in chronic disease prevalence is directly linked to lifestyle changes, urbanization, and dietary habits. Healthcare providers face heightened demand for long-term management and treatments, particularly for non-communicable diseases, driving growth in hospitals and specialized care facilities.

- Increasing Medical Tourism: Indonesia has positioned itself as a growing hub for medical tourism, attracting patients from neighboring countries like Malaysia and Singapore. In 2023, over 500,000 medical tourists visited Indonesia, seeking affordable healthcare services, particularly in areas like cosmetic surgery, dental procedures, and fertility treatments. Cities like Jakarta and Bali have become key destinations due to competitive pricing and the availability of advanced medical technology. Medical tourism contributes significantly to the healthcare providers market, enhancing the countrys reputation for quality care.

Market Challenges

High Out-of-Pocket Expenditure: Despite the JKN program, out-of-pocket expenditure remains high in Indonesia, with 2024 estimates showing that 32% of healthcare payments are made directly by individuals. This is due to gaps in insurance coverage and limitations on the types of services covered under JKN. Such high out-of-pocket costs hinder access to necessary care for many Indonesians, especially for specialized treatments, and put pressure on healthcare providers to balance affordability with service quality.

Infrastructure Gaps in Rural Areas: Indonesia's healthcare infrastructure remains unevenly distributed, particularly in rural and remote areas where 45% of the population resides. In 2023, there were only 1.2 hospital beds per 1,000 people, with rural regions significantly underserved. Healthcare providers face challenges in expanding services to these regions due to inadequate infrastructure, a shortage of medical equipment, and logistical difficulties. The government has announced plans to invest in rural healthcare, but significant gaps remain, impacting accessibility and quality of care.

Indonesia Healthcare Providers Market Future Outlook

Over the next five years, the Indonesia Healthcare Providers Market is expected to witness strong growth, driven by continuous government investment in healthcare infrastructure, expansion of the JKN scheme, and a rising demand for specialized healthcare services. The growing middle-class population, coupled with increasing awareness of healthcare options, is expected to fuel market expansion. Furthermore, advancements in digital healthcare technologies, such as telemedicine and electronic health records, will play a significant role in shaping the future of the healthcare market.

Market Opportunities

- Digital Healthcare and Telemedicine Expansion: Digital healthcare, including telemedicine, is rapidly expanding in Indonesia. In 2023, there were over 5 million telemedicine consultations, driven by both government initiatives and private sector investment in digital platforms. The adoption of telemedicine helps address the healthcare access gap, particularly in rural areas where traditional healthcare facilities are scarce. Companies are capitalizing on this by developing innovative solutions that connect patients with doctors remotely, enhancing access to care and reducing travel times. Source: Indonesian Ministry of Health

- Private Sector Investment Opportunities: Private sector involvement in Indonesias healthcare industry is growing, with foreign direct investment (FDI) in healthcare reaching IDR 35 trillion in 2023. Private hospitals and clinics are expanding, particularly in urban centers like Jakarta and Surabaya, where demand for premium healthcare services is increasing. Investors are focusing on building specialized care centers and upgrading medical technology. The governments push for public-private partnerships further boosts opportunities for private investment in the healthcare sector.

Scope of the Report

|

Hospitals, Clinics, Diagnostic Centers Specialty Care Centers Home Healthcare Providers |

|

|

By Ownership Type |

Public Hospitals Private Hospitals Joint Venture Hospitals |

|

By Service Type |

Outpatient Services Inpatient Services Emergency Care Rehabilitation Services |

|

By Payment Method |

Out-of-Pocket BPJS (Universal Healthcare) Private Insurance Employer-Sponsored |

|

By Region |

North East West South |

Products

Key Target Audience

Private Hospital Chains

Diagnostic Center Operators

Specialty Care Centers

Home Healthcare Providers

Medical Technology Providers

Insurance Companies

Investors and Venture Capitalist Firms

Government and Regulatory Bodies (e.g., Ministry of Health, BPJS Kesehatan)

Companies

Players mention in the Report:

Siloam International Hospitals

Mitra Keluarga Karyasehat Tbk

Mayapada Healthcare Group

Hermina Hospitals Group

Ciputra Healthcare

Rumah Sakit Premier Bintaro

Medistra Hospitals

Pondok Indah Healthcare Group

Omni Hospitals Group

RS Bunda Group

RSIA Harapan Kita

Pertamedika Indonesia Healthcare Corporation

Awal Bros Hospital Group

Kasih Ibu Hospital Group

Bhakti Timah Hospital

Table of Contents

1. Indonesia Healthcare Providers Market Overview

1.1. Definition and Scope

1.2. Market Taxonomy

1.3. Market Growth Rate

1.4. Market Segmentation Overview

2. Indonesia Healthcare Providers Market Size (In USD Mn)

2.1. Historical Market Size

2.2. Year-On-Year Growth Analysis

2.3. Key Market Developments and Milestones

3. Indonesia Healthcare Providers Market Analysis

3.1. Growth Drivers

3.1.1. Population Growth and Aging

3.1.2. Rising Prevalence of Chronic Diseases

3.1.3. Increasing Medical Tourism

3.1.4. Government Initiatives (e.g., JKN - Jaminan Kesehatan Nasional)

3.2. Market Challenges

3.2.1. High Out-of-Pocket Expenditure

3.2.2. Infrastructure Gaps in Rural Areas

3.2.3. Shortage of Skilled Medical Professionals

3.3. Opportunities

3.3.1. Digital Healthcare and Telemedicine Expansion

3.3.2. Private Sector Investment Opportunities

3.3.3. Partnerships with International Healthcare Providers

3.4. Trends

3.4.1. Adoption of Electronic Health Records (EHR)

3.4.2. Integration of Artificial Intelligence in Diagnosis

3.4.3. Increasing Focus on Specialized Care Centers

3.5. Government Regulation

3.5.1. National Health Insurance (BPJS) Framework

3.5.2. Hospital Accreditation Standards

3.5.3. Medical Licensing and Certifications

3.5.4. Healthcare Data Privacy Laws

3.6. SWOT Analysis

3.7. Stakeholder Ecosystem

3.8. Porters Five Forces Analysis

3.9. Competition Ecosystem

4. Indonesia Healthcare Providers Market Segmentation

4.1. By Type of Healthcare Provider (In Value %)

4.1.1. Hospitals

4.1.2. Clinics

4.1.3. Diagnostic Centers

4.1.4. Specialty Care Centers

4.1.5. Home Healthcare Providers

4.2. By Ownership Type (In Value %)

4.2.1. Public Hospitals

4.2.2. Private Hospitals

4.2.3. Joint Venture Hospitals

4.3. By Service Type (In Value %)

4.3.1. Outpatient Services

4.3.2. Inpatient Services

4.3.3. Emergency Care

4.3.4. Rehabilitation Services

4.4. By Region (In Value %)

4.4.1. North

4.4.2. East

4.4.3. West

4.4.4. South

4.5. By Payment Method (In Value %)

4.5.1. Out-of-Pocket

4.5.2. BPJS (Universal Healthcare)

4.5.3. Private Insurance

4.5.4. Employer-Sponsored

5. Indonesia Healthcare Providers Market Competitive Analysis

5.1. Detailed Profiles of Major Companies

5.1.1. Siloam International Hospitals

5.1.2. PT Mitra Keluarga Karyasehat Tbk

5.1.3. Mayapada Healthcare Group

5.1.4. RS Bunda Group

5.1.5. Medistra Hospitals

5.1.6. Hermina Hospitals Group

5.1.7. Ciputra Healthcare

5.1.8. Pondok Indah Healthcare Group

5.1.9. Omni Hospitals Group

5.1.10. Rumah Sakit Premier Bintaro

5.1.11. Pertamedika Indonesia Healthcare Corporation

5.1.12. Awal Bros Hospital Group

5.1.13. RSIA Harapan Kita

5.1.14. Kasih Ibu Hospital Group

5.1.15. Bhakti Timah Hospital

5.2. Cross Comparison Parameters (Inception Year, Headquarters, No. of Hospitals, Bed Capacity, Revenue, Market Share, Patient Satisfaction Ratings, Technology Integration Level)

5.3. Market Share Analysis

5.4. Strategic Initiatives

5.5. Mergers and Acquisitions

5.6. Investment Analysis

5.7. Venture Capital Funding

5.8. Private Equity Investments

6. Indonesia Healthcare Providers Market Regulatory Framework

6.1. Healthcare Licensing Regulations

6.2. National Health Insurance (BPJS) Compliance

6.3. Medical Equipment Standards

6.4. Patient Data Protection Guidelines

7. Indonesia Healthcare Providers Future Market Size (In USD Mn)

7.1. Future Market Size Projections

7.2. Key Factors Driving Future Market Growth

8. Indonesia Healthcare Providers Future Market Segmentation

8.1. By Type of Healthcare Provider (In Value %)

8.2. By Ownership Type (In Value %)

8.3. By Service Type (In Value %)

8.4. By Region (In Value %)

8.5. By Payment Method (In Value %)

9. Indonesia Healthcare Providers Market Analysts Recommendations

9.1. TAM/SAM/SOM Analysis

9.2. Customer Cohort Analysis

9.3. Marketing Initiatives

9.4. White Space Opportunity Analysis

Research Methodology

Step 1: Identification of Key Variables

The first phase involves identifying and analyzing all the major stakeholders within the Indonesia Healthcare Providers Market. Extensive desk research is conducted using secondary data from proprietary databases and credible industry reports. The aim is to understand the key variables that drive market growth, such as healthcare infrastructure and patient demographics.

Step 2: Market Analysis and Construction

In this phase, historical data is collected to assess the performance of the Indonesia Healthcare Providers Market. This includes the number of healthcare providers, hospital bed capacities, and healthcare spending patterns. Revenue estimates are constructed based on service offerings, and key performance indicators are evaluated for accuracy.

Step 3: Hypothesis Validation and Expert Consultation

Market hypotheses are validated through direct interviews and consultations with healthcare providers and industry experts. The insights gathered from these professionals ensure that the market estimates reflect actual industry performance and growth potential.

Step 4: Research Synthesis and Final Output

Finally, a comprehensive report is developed that synthesizes all the gathered data, ensuring that the analysis is both detailed and accurate. This report provides insights into healthcare provider services, market segmentation, and competitive strategies, validated through a bottom-up approach.

Frequently Asked Questions

How big is the Indonesia Healthcare Providers Market?

The Indonesia Healthcare Providers Market is valued at USD 49 billion, driven by factors such as the JKN scheme, increasing demand for specialized healthcare, and significant private investment in healthcare facilities.

What are the key challenges in the Indonesia Healthcare Providers Market?

Key challenges in Indonesia Healthcare Providers Market include high out-of-pocket expenses for patients, limited healthcare infrastructure in rural areas, and a shortage of skilled medical professionals, especially in specialized fields.

Who are the major players in the Indonesia Healthcare Providers Market?

Key players in Indonesia Healthcare Providers Market include Siloam International Hospitals, Mitra Keluarga Karyasehat Tbk, Mayapada Healthcare Group, and Hermina Hospitals Group, which dominate the market due to their extensive networks and superior healthcare services.

What are the growth drivers of the Indonesia Healthcare Providers Market?

Indonesia Healthcare Providers Market Growth is driven by the expanding middle-class population, rising healthcare awareness, the government's JKN initiative, and increased private sector investments in medical technology and hospital infrastructure.

What are the trends in the Indonesia Healthcare Providers Market?

The Indonesia Healthcare Providers Market is witnessing trends such as the adoption of telemedicine, integration of artificial intelligence in diagnostics, and increasing investment in private healthcare facilities focused on specialized care.

Why Buy From Us?

What makes us stand out is that our consultants follows Robust, Refine and Result (RRR) methodology. i.e. Robust for clear definitions, approaches and sanity checking, Refine for differentiating respondents facts and opinions and Result for presenting data with story

We have set a benchmark in the industry by offering our clients with syndicated and customized market research reports featuring coverage of entire market as well as meticulous research and analyst insights.

While we don't replace traditional research, we flip the method upside down. Our dual approach of Top Bottom & Bottom Top ensures quality deliverable by not just verifying company fundamentals but also looking at the sector and macroeconomic factors.

With one step in the future, our research team constantly tries to show you the bigger picture. We help with some of the tough questions you may encounter along the way: How is the industry positioned? Best marketing channel? KPI's of competitors? By aligning every element, we help maximize success.

Our report gives you instant access to the answers and sources that other companies might choose to hide. We elaborate each steps of research methodology we have used and showcase you the sample size to earn your trust.

If you need any support, we are here! We pride ourselves on universe strength, data quality, and quick, friendly, and professional service.